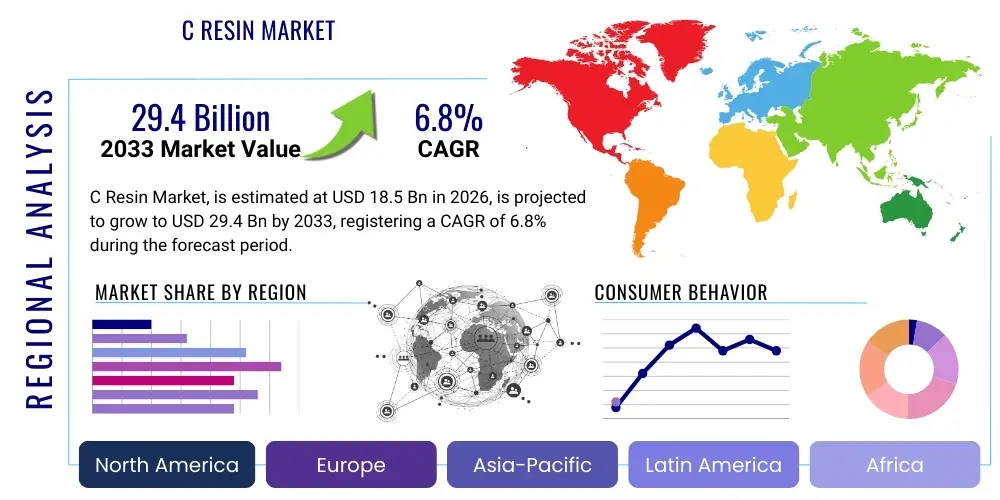

C Resin Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436406 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

C Resin Market Size

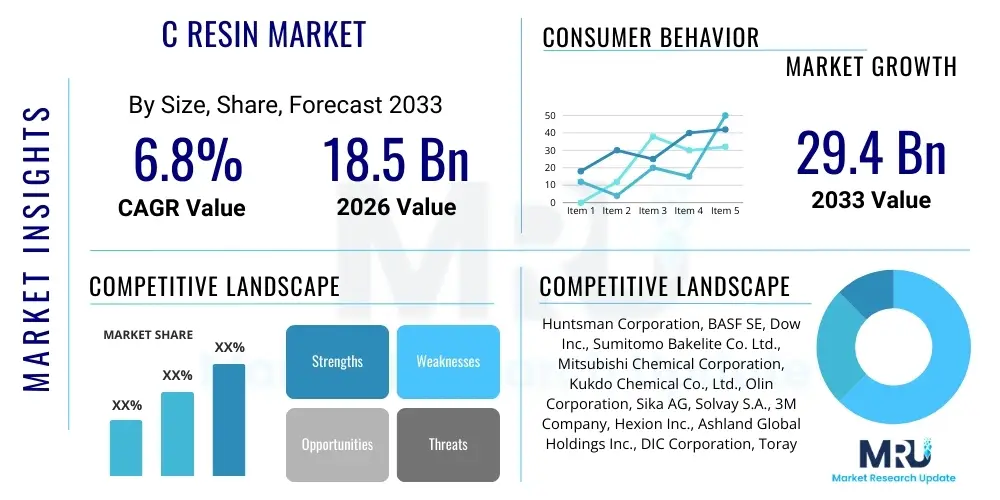

The C Resin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 29.4 Billion by the end of the forecast period in 2033. This consistent expansion is driven primarily by escalating demand from high-performance end-use sectors, including aerospace, automotive lightweighting, and specialized electronics manufacturing, where the unique thermal and chemical resistance properties of C Resins are indispensable for modern component durability and functional efficiency.

The valuation reflects robust investment across Asia Pacific manufacturing hubs, particularly in China and India, which are rapidly integrating advanced material solutions into their expanding industrial base. Furthermore, regulatory pressures in developed economies concerning product longevity and safety are favoring the adoption of high-grade polymeric materials like C Resin over conventional substitutes. This sustained demand trajectory underscores the critical role C Resins play in facilitating technological advancement across multiple high-value sectors globally, necessitating continuous innovation in polymerization processes and feedstock optimization to maintain supply chain resilience and cost competitiveness.

Market growth is also significantly influenced by emerging applications in renewable energy infrastructure, such as wind turbine blades and specialized protective coatings for solar components. The inherent ability of C Resins to withstand harsh environmental conditions—including extreme temperature fluctuations and UV exposure—positions them as a material of choice for sustainable infrastructure projects. Consequently, manufacturers are focusing heavily on developing bio-based or recycled C Resin variants to meet stringent sustainability criteria set by international governing bodies, ensuring the market's long-term viability and addressing evolving consumer and industrial expectations toward environmental responsibility.

C Resin Market introduction

The C Resin Market encompasses specialty synthetic polymers characterized by exceptional mechanical strength, superior thermal stability, and robust chemical resistance, making them essential materials across critical industrial applications. C Resins, often referring to highly specialized thermosetting or thermoplastic polymers (such as specific grades of phenolics, polyimides, or high-performance epoxies tailored for composite matrices), are typically derived from complex polymerization reactions involving specific organic precursors. The distinct molecular architecture of these resins provides performance attributes significantly exceeding those of commodity polymers, facilitating their deployment in demanding environments where failure is not permissible.

Major applications of C Resins span diverse sectors, prominently including aerospace for structural components, advanced composites in high-speed rail and automotive bodies for lightweighting and fuel efficiency, and specialized encapsulation materials in electronics to protect sensitive circuitry from heat and moisture. Furthermore, they are crucial in high-performance coatings, adhesives, and tooling applications requiring dimensional stability and resistance to corrosive agents. The inherent benefits derived from utilizing C Resins include enhanced component lifespan, reduced maintenance frequency, improved operational safety margins, and, critically, significant weight reduction in transportation sectors, directly contributing to lower operational costs and improved sustainability metrics.

Driving factors for this market are intrinsically linked to global industrial trends, notably the intensifying focus on vehicle electrification and the development of next-generation aircraft, both of which require materials capable of operating under higher stress and temperature regimes. Rapid urbanization in emerging economies fuels infrastructure and construction demands, requiring durable protective materials. Simultaneously, regulatory incentives promoting energy efficiency and material circularity are driving innovation towards optimizing C Resin formulations for faster cure times, lower volatile organic compound (VOC) emissions, and improved recyclability, ensuring their continued relevance as foundational materials for future high-tech manufacturing.

C Resin Market Executive Summary

The C Resin market trajectory is defined by a strategic shift toward performance optimization and sustainability across business, regional, and segment trends. Business trends highlight intense competitive differentiation focused on customized formulations and vertical integration by major players to secure critical feedstock supply chains and manage price volatility. Merger and acquisition activities are prominent, driven by the desire to acquire specialized technology portfolios, particularly in high-temperature composites and bio-based polymer chemistry, enhancing overall market consolidation and technological capability.

Regionally, the Asia Pacific (APAC) region maintains its dominance in terms of volume consumption, propelled by burgeoning industrial output, expansive infrastructure development, and a rapidly growing electronics manufacturing ecosystem, positioning it as the primary locus for capacity expansion. North America and Europe, while slower in volume growth, lead in value-added products, focusing on stringent quality controls, complex aerospace specifications, and pioneering the implementation of circular economy principles for polymeric materials. European markets, in particular, are setting global benchmarks for low-emission and sustainable resin systems, influencing technological investment patterns worldwide.

Segment trends underscore the burgeoning adoption of C Resins in the automotive and electrical/electronics sectors, reflecting the shift towards electric vehicles (EVs) and 5G communication infrastructure, both demanding high-dielectric strength and thermal management capabilities. By product type, thermosetting C Resins, valued for their irreversible cross-linking structure and superior stability, currently hold the largest market share, though specialized thermoplastic C Resins are gaining traction due to their enhanced processing efficiency and improved recyclability profiles, attracting significant R&D spending from leading material science corporations.

AI Impact Analysis on C Resin Market

User inquiries concerning the impact of Artificial Intelligence (AI) on the C Resin market frequently center on themes of R&D acceleration, supply chain resilience, and predictive quality control. Users consistently ask how machine learning models can optimize complex polymerization reactions, predict material performance under various stress conditions, and minimize costly batch failures. Key concerns revolve around the integration cost of AI systems and the required data infrastructure, especially for smaller manufacturers. Expectations are high regarding AI's ability to unlock new material combinations rapidly, personalize resin formulations for niche applications, and provide near real-time diagnostics for curing processes. The overarching theme is utilizing AI to transform the traditionally trial-and-error dependent field of specialty chemical synthesis into a data-driven, highly efficient, and predictable manufacturing ecosystem, ensuring materials meet increasingly tight specifications.

- AI-driven optimization of polymerization kinetics, reducing reaction time and energy consumption.

- Predictive material failure analysis using machine learning to forecast the lifespan of C Resin components in harsh environments.

- Enhanced quality control systems through computer vision and sensor data analysis, detecting microscopic defects in composite prepregs.

- Optimization of complex supply chain logistics and inventory management, forecasting raw material price volatility (feedstock inputs).

- Accelerated discovery of novel C Resin formulations, simulating molecular interactions and predicting performance properties without extensive laboratory synthesis.

- Implementation of smart curing cycles (Industry 4.0 integration) using AI algorithms to ensure optimal cross-linking and material integrity.

- Automated monitoring of environmental compliance metrics, ensuring production processes adhere to evolving sustainability standards.

DRO & Impact Forces Of C Resin Market

The market dynamics of C Resins are dictated by a sophisticated interplay between potent growth drivers, inherent operational restraints, and substantial innovation opportunities, collectively shaping the market's trajectory and defining critical impact forces. Primary drivers include the global mandate for vehicle lightweighting in the automotive and aerospace industries, necessitated by fuel efficiency regulations and the shift toward electric propulsion, demanding lighter yet stronger material matrices. Furthermore, increasing global infrastructure spending, particularly on bridges, pipelines, and industrial flooring, necessitates the use of high-durability coatings and repair materials, frequently based on C Resins. These macro-economic and regulatory drivers provide a sustained, high-volume baseline demand, particularly in sectors focused on longevity and high performance.

Conversely, the market faces significant restraints, chiefly related to the volatility and sourcing reliability of petrochemical-derived raw materials, which form the feedstock for most C Resins, leading to unstable production costs and pricing pressures. Stringent environmental regulations in North America and Europe concerning VOC emissions and the disposal of composite waste pose operational challenges, necessitating substantial investment in emission control technologies and material recyclability research. The requirement for specialized curing equipment, specific storage conditions, and skilled labor for handling and processing high-performance resins also acts as a barrier to entry, limiting widespread adoption in less specialized manufacturing settings, thereby moderating growth rates in certain application areas.

Opportunities for growth are concentrated in the development and commercialization of bio-based C Resins derived from renewable sources, addressing both sustainability concerns and raw material dependency. Advancements in nanotechnology integration offer opportunities to enhance resin properties, such as introducing self-healing capabilities or superior conductivity, opening avenues in smart materials and functional coatings. The dominant impact forces include the rapid pace of composite technology evolution, pushing material specification boundaries, and the accelerating integration of Industry 4.0 techniques (e.g., automated processing and digital twins) which enhance manufacturing efficiency and product consistency, fundamentally changing how these specialty materials are produced and applied across global industrial chains.

Segmentation Analysis

The C Resin market is highly differentiated, categorized predominantly by resin type, end-use industry, and application method, reflecting the diversity required to meet unique performance specifications across various sectors. Segmentation by type distinguishes between thermosetting resins (e.g., high-performance epoxies, phenolics, polyimides), known for permanent strength and thermal stability after curing, and thermoplastic resins (e.g., specialized PEEK, PEI grades), valued for their processability and recyclability. This categorization is crucial as it determines the final mechanical and thermal properties achievable in the finished component, directly influencing their suitability for critical applications like aerospace primaries versus automotive secondaries. Understanding the type breakdown provides essential insights into R&D focus and material innovation directions.

Segmentation by end-use industry is paramount for market sizing and strategy formulation, with key verticals including Aerospace & Defense, Automotive, Electrical & Electronics, Construction, and Marine. The specific performance demands of each sector—for example, flame retardancy in aerospace versus moisture resistance in construction—drive the volume and value consumption patterns for particular C Resin grades. The fastest-growing segment is typically Electrical & Electronics, propelled by miniaturization trends and the requirement for sophisticated dielectric materials in advanced microprocessors and telecommunication infrastructure. Analyzing this segmentation helps identify high-growth potential areas and tailor marketing efforts toward specific vertical demands and regulatory compliance needs globally.

Geographic segmentation is also critical, distinguishing mature markets (North America and Europe) which focus on high-value, niche applications and sustainability, from rapidly expanding markets (APAC) which are volume-driven by large-scale infrastructure and general manufacturing expansion. This diversity in regional requirements ensures that global C Resin manufacturers must maintain flexible production capacities and diversified product portfolios to effectively capture market share across differing economic and regulatory landscapes, necessitating a sophisticated segmentation approach for successful market penetration and sustained revenue growth over the forecast period.

- By Type:

- Thermosetting Resins (Epoxy, Phenolic, Polyimide)

- Thermoplastic Resins (PEEK, PEI, PSU)

- By Application:

- Coatings and Adhesives

- Composites (Prepregs, Laminated Structures)

- Molding and Tooling

- Encapsulation and Potting

- By End-Use Industry:

- Aerospace and Defense

- Automotive and Transportation

- Electrical and Electronics (E&E)

- Construction and Infrastructure

- Marine and Offshore

- Industrial and Manufacturing

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For C Resin Market

The C Resin value chain begins with the upstream procurement and processing of fundamental chemical feedstocks, primarily derived from petrochemical sources such as crude oil or natural gas derivatives (e.g., benzene, phenols, or specialized amines). This initial stage is characterized by significant capital expenditure and reliance on major chemical producers, making the C Resin market vulnerable to fluctuations in global oil and gas prices. Efficient upstream management involves strategic long-term sourcing contracts and, increasingly, investments in bio-based feedstock alternatives to mitigate risk and improve environmental profiles. The manufacturing process itself involves complex, often proprietary, polymerization and compounding techniques, requiring specialized reactors and precise temperature control to yield the high-performance resin intermediates.

The midstream involves the transformation of these intermediates into final C Resin products, which are then packaged and prepared for distribution. This segment includes formulation specialists who modify standard resins with fillers, catalysts, curing agents, and performance additives to achieve specific application properties, such as enhanced flame retardancy or improved adhesion. Distribution channels are highly specialized due to the technical nature and specific storage requirements of C Resins. Direct sales channels are frequently employed for large volume purchases and highly customized orders (e.g., aerospace prime contractors), facilitating detailed technical support and quality assurance throughout the supply process.

Conversely, indirect distribution utilizes a network of specialized chemical distributors and agents, particularly for smaller orders, regional market penetration, and providing localized inventory holding for end-users like smaller molders or specialized coating applicators. The downstream segment involves the end-use application by sectors such as composite manufacturers (who produce prepregs and laminated structures), electronic assemblers, and coating applicators. Success in the downstream market depends heavily on the integration of technical service and application support, ensuring that the sophisticated material is correctly processed, cured, and deployed to achieve the intended high-performance outcomes, thus linking the value chain back to the original feedstock quality and resin formulation precision.

C Resin Market Potential Customers

Potential customers for C Resins are concentrated within industries demanding materials with exceptional thermal, mechanical, or electrical performance attributes crucial for component reliability and safety. The primary end-users are large-scale manufacturers operating within regulated and high-stress environments, most notably in the Aerospace & Defense sector. These customers procure C Resins for structural composites in aircraft fuselages, wings, and interior components, requiring high strength-to-weight ratios and superior resistance to extreme temperatures and chemicals. The decision-making process in this segment is lengthy, driven by strict qualification standards (e.g., military or FAA specifications) and long-term contracts based on material longevity and reliability, prioritizing performance over upfront cost.

Another major customer cluster is the Automotive and Transportation industry, particularly original equipment manufacturers (OEMs) and Tier 1 suppliers engaged in electric vehicle (EV) production. These customers utilize C Resins for battery encapsulation, thermal management systems, and lightweight structural parts to offset the weight of heavy battery packs, improving range and efficiency. The procurement criteria here emphasize mass production compatibility, fast cycle times, and cost-effectiveness, alongside demanding performance metrics related to fire safety and electrical insulation. Furthermore, the Electrical and Electronics (E&E) sector, encompassing semiconductor manufacturers, PCB producers, and device assemblers, represents a growing customer base, utilizing C Resins for molding compounds, adhesives, and protective coatings that ensure the functional integrity of sensitive microcomponents against heat buildup and environmental ingress.

Secondary, yet substantial, customer groups include specialized construction firms involved in high-performance coatings for chemical processing plants, marine applications (yacht and boat manufacturing), and infrastructure repair projects requiring quick-curing, durable, and chemical-resistant materials. For these customers, factors such as ease of application, compliance with regional environmental standards, and long-term protective capabilities are key purchasing determinants. Ultimately, the market successfully targets any industrial buyer where component failure due to thermal stress, chemical attack, or insufficient mechanical integrity results in significant operational cost or safety hazards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 29.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Huntsman Corporation, BASF SE, Dow Inc., Sumitomo Bakelite Co. Ltd., Mitsubishi Chemical Corporation, Kukdo Chemical Co., Ltd., Olin Corporation, Sika AG, Solvay S.A., 3M Company, Hexion Inc., Ashland Global Holdings Inc., DIC Corporation, Toray Industries Inc., Gurit Holding AG, SABIC, Evonik Industries AG, AOC Resins, Reichhold LLC, and Momentive Specialty Chemicals Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

C Resin Market Key Technology Landscape

The technological landscape of the C Resin market is evolving rapidly, driven by the need for materials with enhanced functional properties, improved processing characteristics, and reduced environmental impact. A primary focus is on advanced polymerization techniques, moving beyond traditional batch processes toward continuous manufacturing methods that enhance purity, consistency, and scale-up efficiency, significantly reducing energy consumption and material waste. Specifically, researchers are investigating novel catalyst systems and controlled radical polymerization methods to tailor molecular weight distributions and architectural complexity, allowing for the precise tuning of final mechanical and thermal performance features, which is critical for meeting aerospace and medical standards.

Another pivotal technological area is the development of ultra-high performance resin systems, achieved through the incorporation of nanotechnology, such as carbon nanotubes (CNTs) or graphene, into the resin matrix. This integration significantly improves fracture toughness, electrical conductivity, and thermal dissipation properties without unduly compromising the material's weight. Furthermore, significant investment is being channeled into developing sustainable synthesis routes, particularly the utilization of bio-renewable monomers derived from agricultural waste or forest biomass. This shift addresses both feedstock vulnerability and regulatory mandates, positioning bio-based C Resins as a disruptive technology offering a viable path toward a lower carbon footprint for composite manufacturing.

In processing technology, the industry is witnessing the widespread adoption of automated deposition systems and out-of-autoclave (OOA) curing technologies. OOA resins, specifically formulated to cure reliably under vacuum pressure alone, drastically reduce the energy expenditure and size constraints associated with traditional high-pressure autoclave curing, making high-performance composite manufacturing more accessible and cost-efficient for automotive and general industrial applications. Additionally, advancements in digital twinning and simulation software allow manufacturers to predict curing kinetics and residual stress formation accurately, thereby optimizing manufacturing parameters before physical production begins, representing a significant leap in efficiency and quality control across the C Resin supply chain.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market for C Resins, primarily driven by massive infrastructure projects, burgeoning automotive production (especially EVs), and its status as the global manufacturing hub for electronics. Countries like China, Japan, and South Korea exhibit high consumption rates, fueled by intense industrialization and government focus on localizing advanced materials production. The region’s growth is characterized by high volume consumption and an increasing adoption of specialized C Resins in wind energy and composite manufacturing, requiring sustained capacity expansion.

- North America: This region is characterized by high-value applications, particularly in the Aerospace & Defense sectors and advanced medical devices. North American demand is driven by stringent material qualification standards and the need for cutting-edge thermal management solutions in high-performance computing and 5G infrastructure. Market growth here is focused on technological leadership, specializing in highly durable, low-flammability C Resins and rapid integration of automated manufacturing processes.

- Europe: Europe maintains a strong focus on sustainability and regulatory compliance (e.g., REACH), driving the demand for bio-based and low-VOC C Resins. The automotive sector, particularly in Germany and France, utilizes C Resins extensively for electric vehicle components and lightweight body structures. European market expansion is moderated by mature industrialization but bolstered by significant R&D investment in material circularity and advanced thermoset recycling techniques, ensuring qualitative rather than quantitative growth.

- Latin America (LATAM): Growth in LATAM is sporadic but promising, centered mainly on infrastructure development, energy pipelines, and local automotive assembly markets (Mexico and Brazil). Demand is primarily focused on corrosion-resistant coatings and standard-grade C Resins for general construction and industrial maintenance, often relying on imported specialty resins due to limited local high-end production capacity.

- Middle East and Africa (MEA): The MEA market is largely driven by investments in the oil and gas sector (pipelines, offshore structures requiring high chemical resistance), and rapid urbanization projects (UAE, Saudi Arabia). The adoption of C Resins is crucial for durable coatings and structural repairs in harsh desert and marine environments, requiring materials optimized for extreme temperature stability and UV resistance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the C Resin Market.- Huntsman Corporation

- BASF SE

- Dow Inc.

- Sumitomo Bakelite Co. Ltd.

- Mitsubishi Chemical Corporation

- Kukdo Chemical Co., Ltd.

- Olin Corporation

- Sika AG

- Solvay S.A.

- 3M Company

- Hexion Inc.

- Ashland Global Holdings Inc.

- DIC Corporation

- Toray Industries Inc.

- Gurit Holding AG

- SABIC

- Evonik Industries AG

- AOC Resins

- Reichhold LLC

- Momentive Specialty Chemicals Inc.

Frequently Asked Questions

Analyze common user questions about the C Resin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the demand for C Resins in the automotive sector?

Demand is primarily driven by the transition to electric vehicles (EVs), necessitating lightweight composite materials to enhance battery range and structural integrity, alongside the need for high-performance encapsulation and thermal management systems for sensitive electronic components.

How do environmental regulations impact the manufacturing and sales of C Resins?

Regulations, particularly in Europe (REACH) and North America, impose strict limits on Volatile Organic Compound (VOC) emissions, forcing manufacturers to invest heavily in developing low-VOC, waterborne, or solid C Resin formulations and increasing the demand for sustainable, bio-based alternatives.

Which application segment of C Resin is projected to experience the fastest growth rate?

The Electrical and Electronics (E&E) segment, specifically for advanced encapsulation and protective coatings in high-density semiconductors and 5G infrastructure components, is anticipated to record the highest growth due to rapid technological advancement and miniaturization trends.

What is the significance of the shift towards Out-of-Autoclave (OOA) curing technologies for C Resins?

OOA curing significantly reduces manufacturing complexity, energy consumption, and limits on part size compared to traditional autoclave processing. This technological shift lowers production costs and accelerates the adoption of high-performance C Resins in sectors like mass-market automotive and civil aviation structures.

How does raw material volatility affect the pricing structure of C Resin products?

C Resins rely heavily on petrochemical feedstocks; therefore, fluctuations in crude oil and natural gas prices directly translate into instability in C Resin production costs and final market pricing. This necessitates robust supply chain risk management and forward contracting strategies by major vendors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Synthetic Resin Teeth Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Hexamine for Industrial Uses Market Size Report By Type (Stabilized Grade, Unstabilized Grade, Other), By Application (Synthetic Resin Industry, Rubber Industry, Textile Industry, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Caprolactone Market Size Report By Type (99.5 % Purity, 99.9% Purity), By Application (Polycaprolactone, Acrylic Resin Modified, Polyesters Modified, Epoxy Resin Modified, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Phenolic Resin for Friction Materials Market Size Report By Type (Liquid Type (Phenolic Resol Resins), Powder Type (Phenolic Novolac Resins)), By Application (Automotive, Railway, Aeronautics, Industrial), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Phenolic Resin Grinding Wheel Market Size Report By Type (Al2O3 Phenolic Resin Grinding Wheel, SiC Phenolic Resin Grinding Wheel, MBD & CBN Phenolic Resin Grinding Wheel, Others), By Application (Metal, Stones, Steel, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager