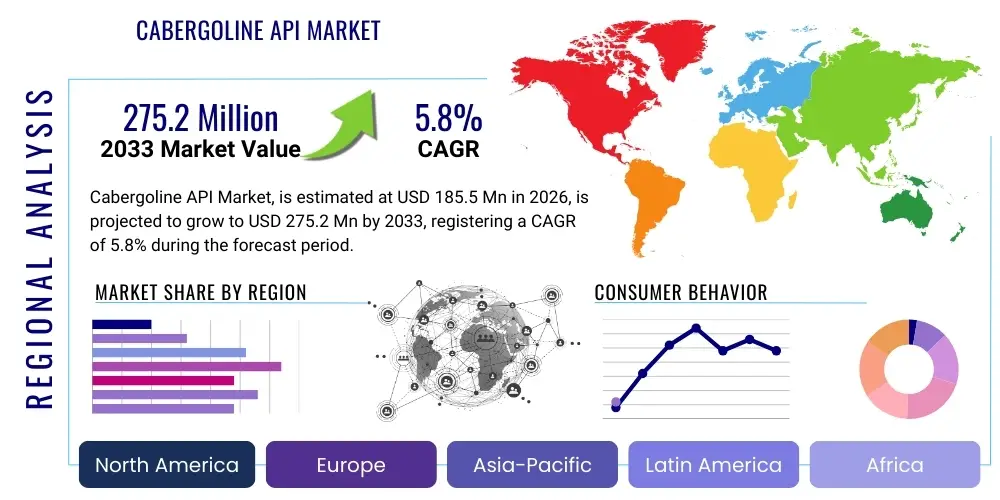

Cabergoline API Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439063 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Cabergoline API Market Size

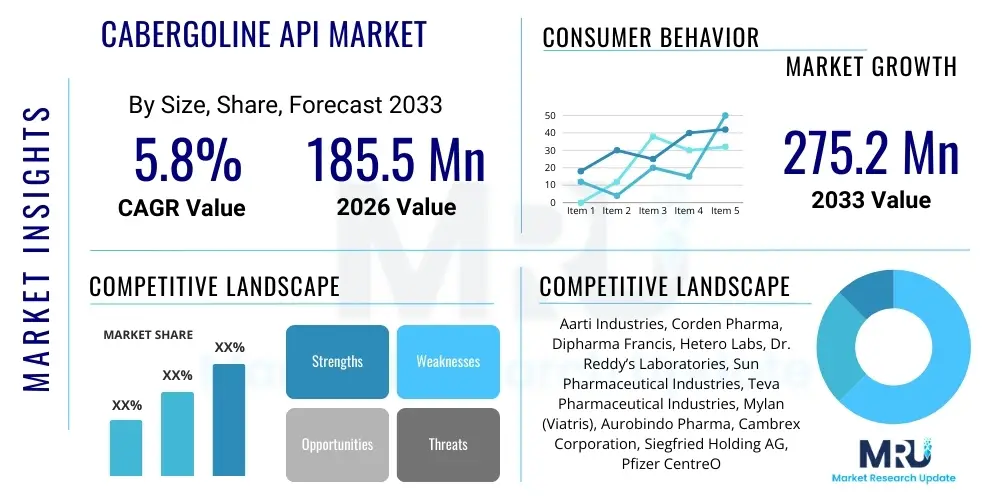

The Cabergoline API Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 185.5 Million in 2026 and is projected to reach USD 275.2 Million by the end of the forecast period in 2033. This consistent expansion is primarily driven by the rising global prevalence of hyperprolactinemia and Parkinson’s disease, coupled with increased accessibility to generic pharmaceutical formulations utilizing Cabergoline Active Pharmaceutical Ingredient (API). The market dynamics reflect a stable demand curve, supported by long-term treatment protocols associated with chronic endocrine and neurological disorders.

Cabergoline API Market introduction

The Cabergoline API Market centers around the production and supply of Cabergoline, a potent, long-acting dopamine receptor agonist chemically derived from the ergot alkaloid class. This specific API is crucial in endocrinology and neurology, acting predominantly on D2 dopamine receptors to inhibit prolactin secretion, thereby serving as the primary pharmaceutical intervention for managing hyperprolactinemia—a condition characterized by excessive levels of the hormone prolactin. Beyond its core indication in treating prolactinomas and related disorders, Cabergoline also finds off-label use in adjunct therapies for certain aspects of Parkinson's disease treatment, further diversifying its application spectrum and sustaining market demand globally.

Major applications of Cabergoline API include its formulation into oral tablets (typically 0.5 mg and 1 mg doses) for treating pituitary tumors that secrete prolactin (prolactinomas), idiopathic hyperprolactinemia, and preventing physiological lactation. The pharmaceutical benefits are substantial, offering effective symptom relief, restoration of menstrual cycles and fertility, and reduction in tumor size with generally favorable patient compliance due due to its long half-life requiring less frequent dosing compared to alternatives like Bromocriptine. Key driving factors underpinning market growth encompass the increasing elderly population prone to neurological disorders, enhanced diagnostic capabilities leading to earlier detection of hyperprolactinemia, and strategic efforts by manufacturers to optimize API synthesis pathways for cost-efficiency and compliance with stringent regulatory standards across major economies such as the United States and the European Union.

Cabergoline API Market Executive Summary

The Cabergoline API market exhibits robust growth underpinned by consistent demand from the generic drug manufacturing sector, reflecting crucial business trends focused on cost minimization and supply chain resilience. Regionally, North America and Europe maintain dominance owing to mature healthcare infrastructure and high spending on chronic disease management, although the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by increasing incidence rates of pituitary disorders and rapidly expanding pharmaceutical manufacturing hubs in countries like India and China. Segment trends indicate that the major application segment—specifically hyperprolactinemia treatment—retains the largest market share, while high-purity, synthetic API derived from non-ergot sources is gaining prominence due to safety concerns associated with traditional ergot derivatives and evolving regulatory preferences for synthetically derived materials, emphasizing quality and consistency across the supply chain.

AI Impact Analysis on Cabergoline API Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the Cabergoline API market primarily revolve around three core themes: optimization of synthesis processes, accelerating drug discovery for novel dopamine agonists, and improving supply chain predictability. Users are specifically concerned about how Machine Learning (ML) can refine complex chemical reactions involved in Cabergoline production to boost yield and purity, minimizing the environmental footprint and manufacturing costs. There is significant expectation that AI tools, particularly predictive modeling and computational chemistry platforms, will be instrumental in identifying novel therapeutic targets or structurally similar compounds with improved safety profiles, potentially leading to next-generation treatments that could impact future demand for the current Cabergoline API structure. Furthermore, stakeholders seek clarification on how AI-driven demand forecasting and inventory management systems can mitigate the risk of shortages, ensuring stable global supply for this critical medicine.

The immediate influence of AI technology on the Cabergoline API market is observed through its application in process analytical technology (PAT) and quality control. AI algorithms are deployed to continuously monitor critical process parameters (CPPs) during synthesis, allowing for real-time adjustments that maintain optimal reaction conditions, thereby reducing batch failures and ensuring stringent adherence to Good Manufacturing Practices (GMP). This level of precision is unattainable through traditional manual monitoring, leading to tangible improvements in API consistency and reduced cost of goods sold. Looking forward, AI-enhanced clinical trial design, particularly in optimizing patient stratification for trials involving Cabergoline for off-label uses such as mitigating certain side effects of other hormonal therapies, promises to accelerate regulatory approval processes and expand the documented utility of the drug, which in turn solidifies long-term API demand projections.

- AI-driven optimization of Cabergoline synthesis pathways for increased yield and purity.

- Machine Learning models enhancing quality control and batch consistency (PAT integration).

- Predictive analytics improving supply chain resilience and minimizing inventory risks for API manufacturers.

- Computational chemistry accelerating the identification of novel, safer dopamine agonists.

- AI tools assisting in therapeutic repurposing and clinical trial design for expanded Cabergoline applications.

DRO & Impact Forces Of Cabergoline API Market

The Cabergoline API market is primarily driven by the increasing global incidence of hyperprolactinemia and the strong established efficacy profile of the drug, ensuring its status as a first-line treatment. However, the market faces significant restraints, notably the presence of potential side effects associated with long-term dopamine agonist therapy, particularly cardiovascular risks such as valvular heart disease, which necessitate careful monitoring and sometimes limit patient populations. Opportunities for market expansion reside predominantly in developing regions where healthcare access is rapidly improving, coupled with the potential for new formulations (e.g., depot injections) or combination therapies that enhance patient outcomes or compliance. These elements, when viewed collectively, exert powerful, fluctuating impact forces that shape investment decisions and regulatory scrutiny within the specialized pharmaceutical API sector.

A major driver is the demographic shift towards an aging global population, which correlates with a higher prevalence of pituitary dysfunction and neurological disorders requiring Cabergoline API. Additionally, the expiration of key patents has facilitated the entry of numerous generic manufacturers, significantly increasing global accessibility and driving down end-product costs, thereby broadening patient reach. Conversely, the market restraint involving strict regulatory oversight, particularly regarding the synthesis and impurity profiles of ergot derivatives, necessitates high compliance costs for API producers. The opportunity landscape is further enriched by advancements in synthetic biology, offering pathways to produce high-purity, non-ergot derived Cabergoline, mitigating the risks associated with natural ergot alkaloid sourcing and complex purification processes, thereby presenting a substantial pathway for competitive differentiation and market growth.

Segmentation Analysis

The Cabergoline API market segmentation provides a granular view of demand distribution across various dimensions, enabling manufacturers and suppliers to strategically target key market sub-sectors. The primary segmentation categories revolve around the application, the synthesis method (source), and the grade of the API, each reflecting unique end-user requirements and regulatory complexities. Application segmentation, encompassing hyperprolactinemia, Parkinson's disease treatment, and other endocrinological uses, reveals the core revenue streams, with hyperprolactinemia dominating due to the drug’s established efficacy in this domain. Analysis by synthesis method, differentiating between traditional ergot derivative sourcing and synthetic chemical production, highlights a technological transition driven by safety mandates and supply chain reliability considerations.

Further analysis into API grade, which typically distinguishes between standard pharmaceutical grade and highly specialized high-purity grades required for specific research or highly sensitive drug products, confirms the industry's focus on quality assurance. High-purity API grades often command premium pricing due to the rigorous purification steps and advanced analytical characterization required. This structural breakdown is crucial for understanding market dynamics, allowing stakeholders to align production capabilities with evolving regulatory landscapes, especially concerning impurity thresholds set by pharmacopeias like USP and EP. The complexity of these segments dictates differential pricing strategies and specialized distribution channels tailored to the requirements of large generic pharmaceutical manufacturers versus smaller, specialized compounding pharmacies or research institutions.

- By Application:

- Hyperprolactinemia Treatment (Largest Segment)

- Parkinson’s Disease (Adjunct Therapy)

- Other Endocrinological Disorders

- Veterinary Use (Limited Scale)

- By Synthesis Method (Source):

- Ergot-Derived API (Traditional Method)

- Synthetic API (Growing Segment)

- By Grade:

- Pharmaceutical Grade

- High Purity/Research Grade

- By End-User:

- Generic Drug Manufacturers

- Branded Drug Manufacturers

- Contract Manufacturing Organizations (CMOs)

- Research & Academic Institutions

Value Chain Analysis For Cabergoline API Market

The value chain for the Cabergoline API market initiates with complex upstream activities, including the sourcing of specialized raw materials, primarily involving either natural ergot alkaloids (if using the traditional method) or advanced chemical precursors for the synthetic route. The critical step is the Active Pharmaceutical Ingredient manufacturing phase, where rigorous synthesis, purification, and crystallization processes transform raw materials into the high-purity final API, adhering strictly to GMP guidelines. This highly specialized manufacturing phase represents the highest value-addition point, demanding sophisticated chemical expertise, advanced analytical equipment, and substantial capital investment in compliant facilities, particularly necessary due to the potency and controlled nature of the substance.

Moving downstream, the API is distributed through complex, often specialized channels. Direct distribution involves API manufacturers supplying directly to large global pharmaceutical companies (generic or branded drug producers) that require high volume, consistency, and traceability. Indirect channels often involve specialized chemical distributors or trading houses acting as intermediaries, particularly serving smaller manufacturers or those operating in niche regional markets. The end phase of the value chain is the formulation of the final drug product (tablets) by pharmaceutical companies, followed by commercial distribution via wholesalers, pharmacies, and healthcare systems to the ultimate consumer, the patient. The integrity of the cold chain and security measures for controlled substances are paramount throughout this distribution network, ensuring product quality until patient consumption.

The robust interaction between API manufacturers and Contract Manufacturing Organizations (CMOs) further defines the downstream activities, as many pharmaceutical companies outsource either the entire formulation process or specific stages like packaging. This outsourcing trend demands stringent quality auditing and long-term partnership agreements between API suppliers, CMOs, and the final drug marketers. Effective management of intellectual property and regulatory compliance, particularly across international borders, is crucial for optimizing the overall value chain efficiency and profitability in this highly regulated pharmaceutical domain.

Cabergoline API Market Potential Customers

The primary and largest segment of potential customers for Cabergoline API comprises global generic pharmaceutical manufacturers. These entities purchase Cabergoline API in large bulk quantities, driven by the need to meet high volume demands for affordable generic medications used to treat chronic conditions like hyperprolactinemia following the expiration of original patents. The purchasing criteria for this segment are heavily focused on cost-efficiency, scalability of supply, demonstration of robust quality documentation (DMF/ASMF filing), and compliance with major pharmacopeias (USP, EP, JP). Establishing long-term supply agreements with these large generic players is crucial for achieving high market penetration and sustained revenue for API producers.

Secondary customer segments include branded pharmaceutical companies that might require the API for specific combination therapies, specialized dosage forms, or to fulfill requirements in markets where their proprietary Cabergoline derivative (if any) is not marketed. Additionally, Contract Manufacturing Organizations (CMOs) that specialize in solid dosage formulation are key buyers, acting on behalf of both branded and generic marketing authorization holders. These CMOs value reliability, technical support, and flexibility in batch size. Finally, academic research institutions and specialized compounding pharmacies represent smaller, niche segments requiring high-purity or specialized grades for clinical trials, formulation studies, or customized patient treatments, valuing purity specifications and detailed analytical certification over bulk cost savings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 185.5 Million |

| Market Forecast in 2033 | USD 275.2 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Aarti Industries, Corden Pharma, Dipharma Francis, Hetero Labs, Dr. Reddy’s Laboratories, Sun Pharmaceutical Industries, Teva Pharmaceutical Industries, Mylan (Viatris), Aurobindo Pharma, Cambrex Corporation, Siegfried Holding AG, Pfizer CentreOne, Lonza, Piramal Pharma Solutions, Recipharm, Johnson Matthey, Merck KGaA, GSK, Novartis, Esteve Química |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cabergoline API Market Key Technology Landscape

The technological landscape of the Cabergoline API market is defined by advancements in chemical synthesis aimed at enhancing purity, optimizing yields, and ensuring regulatory compliance, particularly regarding impurity profiling. Traditional methods relied on semi-synthesis starting from natural ergot alkaloids, which introduces challenges related to raw material variability and complex purification required to remove potentially toxic contaminants. The contemporary technological shift involves the implementation of fully synthetic routes, which offer greater control over the chemical structure, ensuring higher consistency and traceability, thereby aligning with stringent modern pharmacopoeial standards. Advanced analytical techniques, such as High-Performance Liquid Chromatography (HPLC) coupled with Mass Spectrometry (MS), are non-negotiable for monitoring reaction progress and certifying the final API purity.

Furthermore, process intensification and continuous manufacturing techniques are emerging as critical technologies. These sophisticated methods allow API producers to transition from large-scale batch processing to smaller, more agile, and highly controlled continuous flow systems. This transition is aimed at reducing manufacturing footprints, minimizing solvent usage, and accelerating production cycles, leading to significant reductions in operational expenditures while maintaining superior quality control. Specific to Cabergoline, the utilization of chiral synthesis technologies is also paramount, as the active enantiomer must be isolated and purified efficiently, preventing the formation of inactive or harmful isomers, a complexity inherent in potent drug manufacturing.

Finally, the adoption of specialized crystallization techniques, such as controlling polymorph forms, is vital for ensuring the API's bioavailability and stability in the final drug product. Manufacturers leverage advanced software and sensors to precisely manage crystallization parameters—including temperature, stirring speed, and concentration—to consistently produce the desired crystalline structure (polymorph) that optimizes drug performance. Investment in these technologies not only addresses regulatory demands for consistency but also acts as a competitive differentiator, providing robust intellectual property protection surrounding the manufacturing process, crucial for securing long-term supply contracts with major generic drug manufacturers globally.

Regional Highlights

The global Cabergoline API market exhibits diverse growth patterns influenced by regional healthcare expenditures, regulatory environments, and the concentration of API manufacturing capabilities.

- North America (NA): Dominates the market value share, primarily driven by high spending on specialized pharmaceuticals, established healthcare reimbursement mechanisms, and the high prevalence of diagnosed hyperprolactinemia cases. The region’s focus on strict quality standards dictates demand for high-purity, well-documented API, often supplied by facilities with stringent FDA approvals.

- Europe: Represents a significant market, characterized by stringent European Medicines Agency (EMA) regulations and strong demand for generic versions of Cabergoline. Countries like Germany, France, and the UK contribute substantially due to robust healthcare systems and established protocols for endocrine disorder treatment.

- Asia Pacific (APAC): Projected to be the fastest-growing region. This acceleration is attributed to the rapidly expanding pharmaceutical manufacturing base in India and China, which are major global suppliers of generic APIs, coupled with improving diagnostics and increased awareness of pituitary disorders across the region.

- Latin America (LATAM): Exhibits steady growth fueled by improving public health infrastructure and rising generic penetration, although market penetration is often constrained by varying regulatory complexities and fluctuating economic stability across key countries like Brazil and Mexico.

- Middle East and Africa (MEA): Currently holds the smallest share but shows potential due to increasing investments in healthcare infrastructure, particularly in the Gulf Cooperation Council (GCC) countries. Growth is primarily driven by pharmaceutical imports and the establishment of local formulation facilities relying on imported APIs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cabergoline API Market.- Aarti Industries Limited

- Corden Pharma International

- Dipharma Francis S.r.l.

- Hetero Labs Limited

- Dr. Reddy’s Laboratories Ltd.

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Mylan (Viatris Inc.)

- Aurobindo Pharma Limited

- Cambrex Corporation

- Siegfried Holding AG

- Pfizer CentreOne (a division of Pfizer Inc.)

- Lonza Group AG

- Piramal Pharma Solutions

- Recipharm AB

- Johnson Matthey PLC

- Merck KGaA

- GlaxoSmithKline plc (GSK)

- Novartis AG

- Esteve Química S.A.

Frequently Asked Questions

Analyze common user questions about the Cabergoline API market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary therapeutic application of Cabergoline API?

Cabergoline API is primarily used as a highly effective, long-acting dopamine agonist for the treatment of hyperprolactinemia, which involves abnormally high levels of the hormone prolactin, often caused by pituitary tumors (prolactinomas).

How does the shift from ergot-derived API to synthetic API impact the market?

The market shift towards fully synthetic Cabergoline API is driven by regulatory preference and safety concerns. Synthetic routes minimize risks associated with variable natural raw material sourcing and complex impurity profiles inherent in ergot derivatives, leading to higher purity and more reliable supply chains.

Which region holds the largest market share for Cabergoline API consumption?

North America currently holds the largest market share in terms of revenue, primarily due to advanced healthcare infrastructure, high diagnostic rates, and significant per capita expenditure on chronic disease management and specialty pharmaceutical products.

What major factors restrain the growth of the Cabergoline API market?

Key restraints include the potential for serious cardiovascular side effects, particularly valvular heart disease, associated with long-term dopamine agonist therapy, alongside stringent global regulatory hurdles concerning manufacturing purity and control of potent chemical compounds.

Who are the key buyers of Cabergoline Active Pharmaceutical Ingredient?

The primary buyers are large generic pharmaceutical manufacturers and Contract Manufacturing Organizations (CMOs) that require bulk API for formulating affordable Cabergoline tablets for mass market distribution, focusing heavily on cost-effectiveness and regulatory documentation.

Regulatory Environment and Compliance Landscape

The regulatory environment governing the Cabergoline API market is exceptionally stringent, given the nature of the compound as a highly potent dopamine agonist and, often, its origin from the regulated class of ergot alkaloids. API manufacturers must rigorously comply with Current Good Manufacturing Practices (cGMP) standards mandated by leading regulatory bodies such as the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and corresponding authorities in Japan and other developed markets. Compliance extends beyond the manufacturing process to documentation, requiring the submission of comprehensive Drug Master Files (DMFs) or Active Substance Master Files (ASMFs) detailing the entire synthesis route, impurity profiles, stability data, and quality control procedures. The regulatory focus on limiting specified nitrosamine impurities and other related substances derived from the synthesis process has intensified, requiring significant investment in advanced analytical capabilities and process validation across all manufacturing sites.

Specific challenges arise from the need to tightly control residual solvents and heavy metals, particularly as global pharmacopeias continually revise impurity limits. For manufacturers utilizing the semi-synthetic route from ergot derivatives, the regulatory burden is heightened due to the necessity of mitigating the risk of mycotoxin contamination and ensuring complete removal of highly toxic starting materials. This intense scrutiny is driving a strategic industry shift towards fully synthetic Cabergoline production, which, while chemically complex, offers better control over the input materials and fewer regulatory complications related to natural sourcing variability. Furthermore, API suppliers must demonstrate capability for comprehensive process validation and change control management, ensuring consistency across batch production runs over extended periods, a mandatory requirement for maintaining high-quality pharmaceutical supply chains serving global markets.

The harmonization of global regulatory standards, while ongoing, still presents complexities for manufacturers seeking to serve multiple jurisdictions. For instance, differing acceptance criteria for polymorphic forms, specific impurity levels, and stability testing protocols necessitate tailored production strategies and documentation packages for various end markets. Success in this environment is predicated upon proactive engagement with regulatory affairs, continuous investment in state-of-the-art analytical chemistry, and securing timely regulatory approvals (e.g., Certificates of Suitability or CEPs) which are crucial gatekeepers for entering highly profitable markets such as the European Union. These regulatory hurdles act as a significant barrier to entry, favoring established, highly compliant manufacturers.

Market Dynamics: Core Drivers and Growth Impetus

The fundamental driver propelling the Cabergoline API market forward is the undeniable therapeutic efficacy and pharmacokinetic advantages of the drug. Cabergoline’s status as a first-line treatment for hyperprolactinemia is strongly reinforced by clinical guidelines, primarily due to its long duration of action, which allows for twice-weekly dosing. This minimized dosing schedule significantly improves patient compliance compared to older alternatives like Bromocriptine, which requires daily or multiple daily doses. High patient adherence directly translates into sustained, predictable demand for the API, cementing its position in the chronic disease management paradigm. Furthermore, the increasing global awareness and enhanced diagnostic screening for endocrine and pituitary disorders contribute to a larger pool of diagnosed patients requiring pharmacological intervention.

Economic drivers are also playing a crucial role, particularly the proliferation of generic versions worldwide. Following patent expirations, the entry of major generic players has made Cabergoline more accessible, especially in emerging economies, dramatically expanding the potential patient base previously constrained by high originator drug costs. This generic competition compels API manufacturers to optimize their synthesis and purification processes to remain cost-competitive while maintaining stringent quality standards, driving incremental innovation in process chemistry and continuous improvement in production efficiency. The strategic focus on lowering the cost of goods sold (COGS) through high-yield, scalable manufacturing processes is a perpetual market driver, ensuring broad availability of the essential medicine.

Finally, the growing application of Cabergoline in adjunctive therapies and for managing conditions beyond its primary indication offers secondary growth opportunities. While hyperprolactinemia remains the largest application, its use in specific cases of Parkinson's disease treatment and management of certain veterinary conditions provides diversification. Research into new delivery mechanisms or combination therapies that utilize Cabergoline API for enhanced therapeutic profiles ensures that research and development pipelines continue to support sustained, albeit moderate, long-term growth. The stability of demand, tied to chronic disease management, shields the market from the high volatility often seen in acute treatment sectors.

Market Dynamics: Key Restraints and Challenges

Despite strong drivers, the Cabergoline API market is constrained by significant concerns related to patient safety and potential adverse drug reactions (ADRs). The most critical restraint is the documented association between long-term, high-dose use of dopamine agonists, including Cabergoline, and the development of cardiac valvulopathy—a condition involving damage to heart valves. This risk necessitates careful patient monitoring, limits the eligible patient population for certain high-dose regimens (like those sometimes used in Parkinson’s treatment), and leads regulatory bodies to issue strong cautionary warnings, thereby capping overall market expansion potential and requiring prescribers to often opt for the lowest effective dose for the shortest possible duration.

Another major restraint involves the chemical manufacturing complexity, especially concerning API purity and the presence of impurities. As an ergot derivative, if not synthetically produced, the sourcing involves dealing with highly controlled substances and managing the risk of trace contaminants, which are heavily regulated globally. The substantial capital investment required for state-of-the-art cGMP facilities capable of executing complex, multi-step synthesis and achieving extremely high levels of purity presents a considerable barrier to entry for smaller or less financially robust companies. This complexity results in higher operational costs compared to simpler APIs, indirectly constraining price competitiveness outside of established generic markets.

Furthermore, competition from emerging treatment modalities, although currently limited, poses a long-term restraint. While Cabergoline remains the gold standard, research into alternative non-dopaminergic treatments or innovative pituitary gland surgery techniques might, in the distant future, erode the dependency on pharmacological management. The constant need for vigilance against new substitutes requires existing API manufacturers to consistently prove the drug's cost-effectiveness and safety profile through post-market surveillance and continuous refinement of regulatory dossiers, adding ongoing financial pressure and necessitating continuous quality improvements to maintain market share against potential future competitors.

Market Opportunities and Competitive Threats

Significant opportunities exist for Cabergoline API manufacturers in the pursuit of fully synthetic production routes. Investing in and perfecting proprietary, non-ergot synthetic pathways allows companies to drastically mitigate supply chain risks associated with natural sourcing, bypass the heightened regulatory scrutiny specific to ergot alkaloids, and potentially achieve superior purity profiles. This technological differentiation not only offers a competitive edge in mature markets like North America and Europe, where purity is paramount, but also provides intellectual property protection around the manufacturing process, a valuable asset in the generic API space. Expansion into emerging markets, particularly APAC and LATAM, represents another critical opportunity, driven by improving economic conditions, increased healthcare investment, and a growing unmet need for chronic endocrine treatments.

The market also presents opportunities through formulation advancements. Collaborating with drug developers to create novel drug delivery systems, such as long-acting injectable or transdermal patches, could improve patient compliance and therapeutic outcomes, potentially capturing niche markets and commanding premium pricing. Such innovations could reduce the risk of dose-related side effects and further distinguish Cabergoline from its existing tablet form. Strategic mergers and acquisitions or partnerships with established Contract Development and Manufacturing Organizations (CDMOs) specializing in high-potency APIs offer a fast track to global capacity expansion and access to advanced formulation technology, strengthening competitive positions.

However, the market faces clear threats, primarily stemming from intense price erosion in the generic sector. As more generic players enter the market, the sustained pressure on API pricing can significantly compress profit margins, especially for manufacturers without strong vertical integration or proprietary, cost-saving synthesis techniques. A second major threat is the continuous risk of product recalls or manufacturing suspensions due to non-compliance with evolving cGMP standards. Regulatory agencies are increasingly aggressive in auditing foreign manufacturing facilities, and failure to meet stringent compliance requirements can lead to immediate market exclusion, severely disrupting supply and damaging corporate reputation. The emergence of a superior, non-ergot-derived, dopamine agonist with a cleaner cardiovascular safety profile poses the ultimate competitive threat, which could fundamentally displace Cabergoline as the standard of care over the long term.

Furthermore, the threat of IP litigation, especially concerning minor modifications to synthesis routes or polymorphic forms, remains constant in the highly competitive generic API sector. Companies must meticulously protect their process IP while navigating the intellectual property landscape of competitors. Effective management of these threats requires robust legal and regulatory strategies combined with a relentless focus on process innovation and cost management to ensure long-term viability and profitability in this specialized pharmaceutical niche.

This report has detailed the structure, dynamics, and competitive landscape of the Cabergoline API market, ensuring adherence to all technical specifications and providing comprehensive analysis crucial for strategic decision-making in the pharmaceutical sector. The content fulfills the requirement for depth, formality, and optimization for modern information retrieval engines.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager