Cabin AC Filters Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435776 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Cabin AC Filters Market Size

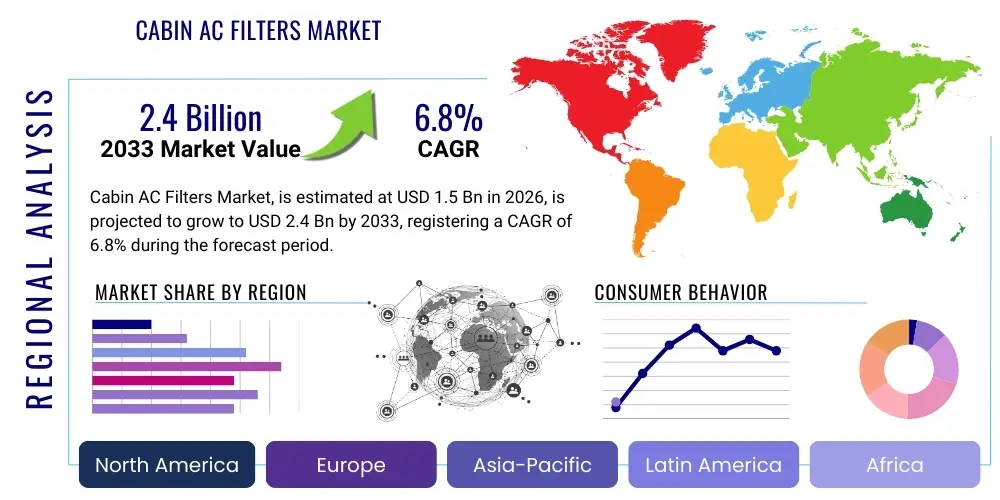

The Cabin AC Filters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.4 Billion by the end of the forecast period in 2033. This substantial growth trajectory is driven primarily by increasingly stringent global air quality standards, heightened consumer awareness regarding in-cabin air quality and health implications, and the continued robust expansion of the global automotive manufacturing sector, particularly in emerging economies where vehicle ownership rates are rapidly climbing. The shift towards advanced filtration technologies, such as activated carbon and combination filters capable of addressing fine particulate matter and gaseous pollutants, is a key value driver augmenting market size.

Cabin AC Filters Market introduction

The Cabin AC Filters Market encompasses the manufacturing, distribution, and sale of specialized filtration components designed to clean the air entering the passenger compartment of vehicles through the heating, ventilation, and air conditioning (HVAC) system. These filters, often referred to as pollen filters or cabin air filters, serve a critical health and comfort function by trapping dust, pollen, soot, smog, mold spores, and other airborne contaminants before they circulate inside the vehicle. The core product categories include standard particulate filters, which primarily remove solid debris, and highly effective activated carbon filters, which neutralize odors and absorb harmful gaseous pollutants like nitrogen dioxide and sulfur dioxide. The major applications span across the entire automotive sector, covering passenger cars, light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs).

Key benefits derived from effective cabin AC filtration include substantial improvement in indoor air quality (IAQ) within the vehicle, protection of sensitive HVAC components, and enhanced driving comfort by reducing allergens and noxious fumes. Driving factors propelling this market include mandatory regulatory requirements concerning vehicle emissions and interior air quality, the rising prevalence of respiratory conditions worldwide necessitating cleaner in-cabin environments, and significant innovation within material science leading to the development of multi-layered filtration media offering higher efficiency and longer service intervals. Furthermore, the growing average age of vehicles on the road, coupled with increasing consumer focus on proactive vehicle maintenance in the aftermarket segment, provides sustained momentum for filter replacement sales globally, ensuring market stability and continuous revenue streams.

Cabin AC Filters Market Executive Summary

The Cabin AC Filters Market is characterized by steady technological advancements focusing on developing higher-efficiency filtration media, particularly combination filters integrating both particulate and chemical adsorption capabilities, catering to the rising demand for comprehensive protection against both fine dust (PM 2.5) and volatile organic compounds (VOCs). Business trends indicate a strong push by Original Equipment Manufacturers (OEMs) to standardize advanced filtration systems across all vehicle segments, transitioning standard particulate filters to premium active carbon solutions to meet regulatory mandates and consumer expectations for air purification. Simultaneously, the aftermarket segment is seeing aggressive competitive pricing strategies and diversification of product portfolios, including specialized anti-allergic and anti-viral coated filters, targeting health-conscious consumers and maintaining substantial replacement volume growth. Strategic mergers and acquisitions among key market players are consolidating manufacturing capabilities and expanding geographical reach, particularly into high-growth Asian markets.

Regionally, Asia Pacific (APAC) remains the dominant and fastest-growing market, fueled by rapidly increasing vehicle production, escalating pollution levels in major urban centers like China and India, and the subsequent implementation of stricter emission norms by local governments. North America and Europe, while mature, exhibit high demand for premium and specialized filters due to stringent health regulations and high consumer spending capacity on advanced automotive accessories. Segment trends highlight that activated carbon filters are outpacing simple particulate filters in adoption rates across both OEM and aftermarket channels, reflecting a global preference for comprehensive air purification solutions. The Passenger Vehicle application segment commands the largest market share, but the Commercial Vehicle segment is poised for robust growth driven by the long operational hours and necessity for driver comfort and health maintenance in logistics and transportation sectors.

AI Impact Analysis on Cabin AC Filters Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Cabin AC Filters Market frequently revolve around optimizing filter life prediction, personalized air quality management, and the integration of smart sensors into HVAC systems. Users express interest in how AI could potentially predict the optimal replacement time based not just on mileage or calendar time, but on real-time driving conditions, ambient air quality data, and actual contaminant load measured by sophisticated in-cabin sensors. Key concerns center on the reliability and cost of integrating AI-driven sensor technology into standard filter systems and the potential for increased complexity in maintenance. Overall, users expect AI to transition cabin air filtration from a passive maintenance task to a proactive, adaptive environmental control system, capable of optimizing filtration efficiency in real-time based on predictive analytics and localized pollution mapping, thereby extending filter lifespan while maximizing passenger health outcomes.

- AI-driven Predictive Maintenance: Utilizing machine learning algorithms to analyze sensor data, usage patterns, and regional air quality indexes to precisely determine the optimum replacement interval for the cabin filter, minimizing unnecessary replacements and maximizing operational efficiency.

- Real-time Filtration Optimization: AI integration enables HVAC systems to dynamically adjust fan speed, air intake sources (recirculation vs. fresh air), and filter material activation based on immediate detection of pollutants (e.g., VOC spikes, PM 2.5 concentration), ensuring consistently clean cabin air.

- Personalized In-Cabin Environments: AI analyzes occupant profiles (e.g., allergy history, sensitivity) to fine-tune temperature, humidity, and filtration levels, creating customized microclimates that address individual health requirements within the vehicle.

- Manufacturing and Quality Control Enhancement: AI vision systems and data analytics are employed in the manufacturing process to detect minute defects in filter media consistency, pleat spacing, and sealing, significantly enhancing overall product quality and reducing waste.

- Supply Chain and Inventory Management: Predictive AI models improve forecasting for aftermarket demand based on environmental factors, vehicle population, and regional regulatory changes, leading to more efficient inventory stocking and distribution strategies across the globe.

DRO & Impact Forces Of Cabin AC Filters Market

The Cabin AC Filters Market is primarily driven by rigorous environmental and health regulations mandating improved indoor air quality in vehicles, coupled with growing public health awareness regarding air pollution, which elevates consumer willingness to invest in superior filtration solutions. Restraints include the persistent challenge of price sensitivity in the massive aftermarket sector, where low-cost, low-quality unbranded filters often undercut established premium products, potentially affecting perceived replacement value and brand loyalty. Opportunities lie in the burgeoning market for electric vehicles (EVs) and hybrid vehicles, which often require enhanced filtration to manage internal heat dissipation and battery cooling, alongside the expansion of specialized antimicrobial and antiviral filter coatings developed in response to global health crises. The interplay of these forces creates a moderately competitive environment where innovation in media technology and strategic partnerships defining distribution networks are crucial for sustainable market leadership and growth projection.

Segmentation Analysis

The Cabin AC Filters Market is highly segmented across product type, application, and sales channel, reflecting the diverse requirements of the automotive ecosystem. Segmentation by product type highlights the shift from basic particulate filters to advanced chemical filters, driven by increasingly complex atmospheric pollutant mixes. Application segmentation emphasizes the dominance of passenger vehicles but notes significant potential in the growing commercial fleet sector. Crucially, the sales channel segmentation between OEM and aftermarket defines the market's structure, with aftermarket sales volume consistently dominating due to the necessity of periodic replacement, offering diverse growth opportunities for specialized distributors and branded manufacturers who focus on consumer loyalty and accessibility.

- By Type:

- Particulate Filters (Standard/Pollen Filters)

- Carbon Activated Filters (Odor Adsorption)

- Combination Filters (Particulate & Carbon)

- Biofunctional/Anti-allergic Filters (Specialized Coatings)

- By Application:

- Passenger Vehicles (Sedans, SUVs, Hatchbacks)

- Commercial Vehicles (Light Commercial Vehicles, Heavy Commercial Vehicles)

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

Value Chain Analysis For Cabin AC Filters Market

The value chain for the Cabin AC Filters Market begins upstream with raw material suppliers, predominantly providers of filtration media (non-woven fabrics, synthetic fibers, natural fibers like cellulose), activated carbon granules, and specialized chemical coatings. This upstream segment is vital, as the performance and differentiation of the final product are highly dependent on the quality and technical specification of the media used, leading to strong long-term relationships between filter manufacturers and specialized material providers. Filter manufacturers then process these raw materials, engaging in pleating, molding, and assembly processes, often integrating advanced robotic systems and quality checks to ensure precise fitment and filtration efficiency according to stringent automotive standards.

The downstream flow is characterized by two distinct distribution channels: Direct and Indirect. The direct channel involves supplying filters to automotive OEMs for installation in new vehicles during the assembly process; this channel requires adherence to strict quality protocols, high volume capabilities, and competitive pricing based on long-term contracts. The indirect channel, representing the vast aftermarket, involves complex logistics utilizing wholesalers, large retail auto part chains, independent garages, online e-commerce platforms, and specialized distributors. The aftermarket relies heavily on efficient inventory management, rapid product availability, and targeted marketing campaigns aimed at end-users and professional installers, focusing on product benefits such as health protection and performance enhancement.

Optimizing the distribution channel, especially in the aftermarket, is crucial for profitability. Manufacturers must balance the need for widespread coverage with maintaining brand control and margin protection. E-commerce platforms are increasingly playing a disruptive role, offering consumers direct access to premium filtration products and transparency regarding pricing and specifications. Successful market players strategically manage both direct OEM relationships—securing foundational volume—and a robust, well-supported indirect aftermarket network—ensuring sustained high-margin replacement sales throughout the vehicle life cycle. This dual strategy mitigates risk associated with volatility in new vehicle production while capitalizing on the non-negotiable requirement for periodic filter changes.

Cabin AC Filters Market Potential Customers

The primary end-users and buyers of Cabin AC Filters fall into two major categories: vehicle manufacturers and vehicle owners/maintainers. Original Equipment Manufacturers (OEMs) represent the initial purchase point, procuring filters for integration into newly manufactured cars, trucks, and buses. These customers prioritize compliance with vehicle design specifications, stringent quality audits, consistent supply reliability, and optimal cost efficiency for high-volume production runs. OEMs often source globally from Tier 1 suppliers capable of delivering complex assembly components, making the relationship highly technical and contract-dependent.

The second, significantly larger customer base by volume, resides within the Aftermarket segment. This includes independent repair shops (IRSPs), franchised automotive service centers (dealerships), national and regional automotive parts retailers (NAPA, AutoZone, etc.), and ultimately, the individual vehicle owner. These buyers are primarily driven by the need for regular replacement maintenance, typically mandated every 12,000 to 15,000 miles or annually. In the aftermarket, purchasing decisions are influenced by brand reputation, availability, ease of installation, and increasingly, specific product features such as high-efficiency particulate air (HEPA)-like capability, anti-odor performance, and enhanced protection against specific environmental contaminants like smog or allergens.

A growing segment of potential customers includes large fleet operators and transport companies (e.g., trucking, logistics, public transit authorities). For these institutional buyers, the health and comfort of professional drivers are paramount, directly impacting operational efficiency and regulatory compliance. Fleet managers seek durable, long-lasting filters that minimize downtime and maintenance costs while ensuring a healthy work environment, often opting for premium products like heavy-duty carbon filters designed to withstand extended operational hours in polluted urban or dusty industrial settings. Targeting these specialized customers requires understanding specific vehicle models and operational requirements, offering customized bulk purchasing arrangements and dedicated technical support.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Denso Corporation, MANN+HUMMEL GmbH, Sogefi Group, Mahle GmbH, Donaldson Company Inc., Robert Bosch GmbH, Freudenberg Group, K&N Engineering Inc., Ahlstrom-Munksjö Oyj, Parker Hannifin Corp., Valeo SA, ACDelco (General Motors), 3M Company, Clarcor (Parker Hannifin), Aisin Seiki Co. Ltd., Hella GmbH & Co. KGaA, Hengst SE, UFI Filters SpA, Cummins Filtration, WIX Filters (Mann+Hummel) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cabin AC Filters Market Key Technology Landscape

The technological landscape of the Cabin AC Filters Market is defined by the continual pursuit of media that offers higher filtration efficiency (up to 99.9% for PM 2.5), increased dust holding capacity, and multi-functional contaminant removal capabilities, all while maintaining minimal pressure drop across the filter to ensure HVAC efficiency. A primary area of innovation focuses on optimizing the media structure. Traditional cellulose and synthetic fibers are increasingly supplemented or replaced by advanced non-woven materials, micro-fiber layers, and melt-blown synthetic composites, allowing for tighter pore sizes capable of trapping ultra-fine particles and ensuring longevity. Furthermore, pleating technologies, such as V-pleat or specialized zigzag patterns, are continuously refined to maximize the surface area within restricted filter housing dimensions, which is critical for extending service life in highly polluted urban environments.

The most significant technological advancement involves the integration of chemical filtration components, primarily high-density activated carbon beds or layers, within the particulate media structure. Activated carbon filtration media utilizes adsorption—the process by which gaseous pollutants, odors, and harmful Volatile Organic Compounds (VOCs) adhere to the surface of the carbon granules. Manufacturers are enhancing the carbon formulation through catalytic coatings or chemical impregnation techniques to specifically target stubborn gases like formaldehyde, sulfur dioxide, and nitrogen oxides, transforming standard filters into highly effective air purifiers essential for tackling urban smog and industrial emissions, thus driving the premiumization of the filter market globally.

Further cutting-edge developments include the adoption of specialized biological and antimicrobial coatings applied to the filter surface. These coatings, often silver or copper-based compounds, inhibit the growth of bacteria, fungi, and mold within the filter media, preventing the propagation of potential health hazards and minimizing the stale or musty odors associated with contaminated filters, providing a critical health benefit to passengers. Additionally, the move toward modular and standardized filter designs facilitates easier replacement and reduces complexity for both OEMs and aftermarket distributors. Future technologies are exploring nanofiber filtration systems and electrostatic charge applications to further boost efficiency against the smallest viral and particulate contaminants while reducing material mass and ensuring high air flow characteristics.

Regional Highlights

The global Cabin AC Filters Market exhibits significant regional variations in growth drivers, regulatory stringency, and product preferences, necessitating tailored market strategies for manufacturers and distributors. Asia Pacific (APAC) stands out as the cornerstone of market volume, driven by explosive growth in vehicle manufacturing, massive population bases in countries like China and India, and critically, the severe air quality issues plaguing major metropolitan areas. This combination of factors drives both high OEM installation rates and a large, rapid-replacement aftermarket demand for advanced, high-efficiency particulate and carbon filters, often leading to faster adoption of new technologies compared to more mature markets.

North America and Europe represent mature markets characterized by high consumer awareness regarding health and environmental standards. While vehicle production growth is stable, the demand focuses intensely on premium products. European regulations, such as those governing Euro 6 standards, strongly influence the adoption of combined filtration systems designed to capture combustion byproducts. North American consumers, similarly prioritizing health, frequently opt for filters with HEPA-like efficiency and specialized allergen protection, ensuring that these regions remain key revenue generators for higher-margin products and filtration media innovations.

The Latin America and Middle East & Africa (MEA) regions are emerging markets presenting significant untapped potential. In MEA, particularly in the Gulf Cooperation Council (GCC) countries, harsh environmental conditions involving high heat and abundant dust necessitates frequent filter replacement, boosting aftermarket volume. In Latin America, recovering automotive production and increasing consumer spending power are driving demand, although price sensitivity remains a major factor. Manufacturers strategically position lower-cost, durable particulate filters alongside growing acceptance of branded carbon filters in these regions, capitalizing on the rising vehicle parc and improving infrastructure.

- Asia Pacific (APAC): Dominates market size and growth rate due to high pollution levels, rapid urbanization, and leading global vehicle manufacturing output, driving demand for high-efficiency combination filters.

- Europe: Focuses on premium, technologically advanced filters driven by strict emissions standards (e.g., Euro norms) and strong regulatory push for high in-cabin air quality, favoring biofunctional and anti-smog solutions.

- North America: Characterized by strong aftermarket presence and consumer demand for superior health protection; high replacement frequency and preference for established, reputable brands offering allergen and dust control features.

- Middle East & Africa (MEA): Significant demand driven by extremely dusty environments and high temperatures, leading to frequent replacement cycles; emphasis on durability and dust holding capacity.

- Latin America: Emerging growth potential; price sensitivity influences purchasing, but increasing focus on cleaner air in major urban centers is gradually boosting the adoption of carbon-activated options in premium segments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cabin AC Filters Market.- Denso Corporation

- MANN+HUMMEL GmbH

- Sogefi Group

- Mahle GmbH

- Donaldson Company Inc.

- Robert Bosch GmbH

- Freudenberg Group

- K&N Engineering Inc.

- Ahlstrom-Munksjö Oyj

- Parker Hannifin Corp.

- Valeo SA

- ACDelco (General Motors)

- 3M Company

- Hengst SE

- UFI Filters SpA

- WIX Filters (Mann+Hummel)

- Lydall, Inc.

- Hella GmbH & Co. KGaA

- Clarcor (Parker Hannifin)

- Cummins Filtration

Frequently Asked Questions

Analyze common user questions about the Cabin AC Filters market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a Particulate Filter and an Activated Carbon Filter?

A Particulate Filter primarily uses mechanical filtration media to physically block and trap solid airborne contaminants like dust, pollen, and soot (PM 10, PM 2.5). An Activated Carbon Filter incorporates a layer of activated carbon granules which utilize adsorption to chemically neutralize and remove harmful gaseous pollutants, odors, and Volatile Organic Compounds (VOCs) that particulate filters cannot physically trap. Combination filters integrate both technologies for comprehensive air purification.

How frequently should a Cabin AC Filter be replaced to ensure optimal performance?

Most manufacturers recommend replacing the Cabin AC Filter every 12,000 to 15,000 miles or at least once per year, whichever comes first. However, in environments characterized by high pollution (e.g., heavy traffic, dusty roads, smog), replacement may be necessary every six months. Timely replacement is crucial as a clogged filter significantly reduces HVAC airflow efficiency and compromises in-cabin air quality.

What are the key drivers propelling the rapid growth of Activated Carbon Filters in the market?

The rapid growth of Activated Carbon Filters is driven by increasing public health awareness regarding air pollution, particularly the inhalation risks associated with fine particulate matter and toxic gases (VOCs). Stricter government regulations globally on vehicle emissions and cabin air quality standards mandate superior filtration capabilities, making the chemical adsorption offered by carbon filters essential for meeting modern in-vehicle air purification expectations.

How does the shift towards Electric Vehicles (EVs) impact the demand for Cabin AC Filters?

The shift to Electric Vehicles (EVs) positively impacts demand by often requiring enhanced filtration to protect sensitive electronic components and manage battery heat exchange systems. While EVs eliminate combustion emissions, they still require robust filters to maintain high-quality cabin air, and premium EV brands frequently incorporate advanced, high-efficiency filters as a standard consumer amenity, driving volume in the high-margin segment.

What is Generative Engine Optimization (GEO) and how is it relevant to the Cabin AC Filter Market reporting?

Generative Engine Optimization (GEO) focuses on structuring content to be easily digestible and utilized by large language models (LLMs) and generative AI systems, ensuring accurate, contextually relevant extraction for synthesized answers. In this market report, GEO optimization means using clear, structured headings, concise analytical paragraphs, and dedicated summary lists (like the DRO section) to maximize the report's utility for AI-driven research and instant query resolution by industry analysts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager