Cabinet and Enclosure Filter Fan Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437585 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Cabinet and Enclosure Filter Fan Market Size

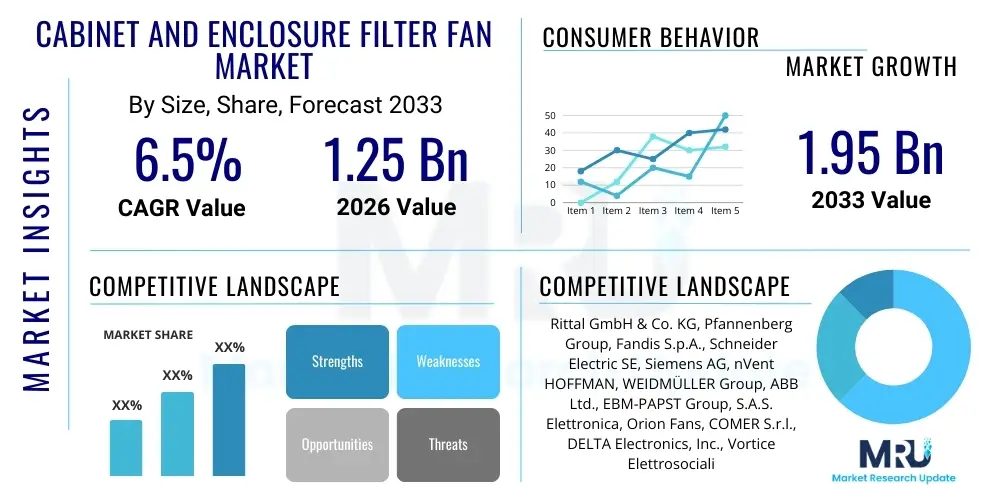

The Cabinet and Enclosure Filter Fan Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.95 Billion by the end of the forecast period in 2033.

Cabinet and Enclosure Filter Fan Market introduction

The Cabinet and Enclosure Filter Fan Market encompasses essential thermal management solutions designed to regulate the internal temperature of electrical, electronic, and industrial control enclosures, ensuring optimal performance and longevity of sensitive components. These systems are crucial in environments where dust, moisture, and high ambient temperatures pose significant threats to operational reliability. Filter fans operate by drawing clean, cooler air into the enclosure while exhausting heated internal air, thereby maintaining temperatures within acceptable operational limits. This preventative thermal management minimizes the risk of component degradation, premature failure, and system downtime, which are critical considerations across manufacturing, telecommunications, and infrastructure sectors. The fundamental product description involves an external fan unit paired with a protective grille and a specialized filter mat, typically rated for specific ingress protection (IP) levels.

Major applications for cabinet and enclosure filter fans span a wide array of industrial and commercial settings, particularly within automated production lines, data communication infrastructure, power distribution systems, and complex machinery. In industrial automation, control cabinets housing Programmable Logic Controllers (PLCs), Variable Frequency Drives (VFDs), and Human-Machine Interfaces (HMIs) require continuous cooling to dissipate heat generated by active electronic components. Similarly, in the telecommunications sector, network cabinets and server racks rely heavily on these fans to prevent overheating, which is exacerbated by increasingly miniaturized and high-density electronic assemblies. The ongoing global trend toward Industry 4.0, characterized by heightened digitization and interconnectedness of machinery, fundamentally drives the necessity for robust and reliable thermal control solutions.

The core benefits derived from utilizing high-quality filter fans include enhanced equipment lifespan, reduced maintenance costs through effective dust filtration, and increased operational safety by preventing thermal runaway. Key driving factors propelling market growth involve the stringent regulatory requirements for equipment performance and safety, particularly concerning electromagnetic compatibility (EMC) and thermal stability. Furthermore, the rising demand for energy-efficient cooling solutions, such as those utilizing EC (Electronically Commutated) motor technology, influences procurement decisions. EC fans offer substantial energy savings and precise speed control compared to traditional AC or DC variants, aligning with corporate sustainability goals and operating cost reduction strategies. The expansion of infrastructure projects globally, especially in emerging economies focusing on smart cities and modernized power grids, further solidifies the foundational demand for reliable enclosure climate control.

Cabinet and Enclosure Filter Fan Market Executive Summary

The Cabinet and Enclosure Filter Fan Market is positioned for steady expansion, fueled primarily by the global surge in industrial automation adoption, the continuous expansion of data center infrastructure, and the necessity for robust thermal management in harsh operating environments. Business trends highlight a strong shift toward integrated, intelligent cooling solutions, with manufacturers increasingly incorporating monitoring sensors, IoT connectivity, and predictive maintenance capabilities directly into fan units. This integration supports the broader Industry 4.0 movement, enabling real-time diagnostics and optimized energy consumption. The market is experiencing competitive pressure centered on developing high-performance, energy-efficient products, specifically focusing on slimmer profiles and higher airflow capacities per unit volume, responding to the miniaturization trends in control systems and machinery.

Regionally, the Asia Pacific (APAC) stands out as the most dominant and rapidly growing market, driven by massive investments in manufacturing, automotive production, and telecommunication infrastructure, particularly in China, India, and Southeast Asia. The region benefits from lower manufacturing costs and booming industrialization, which translate into high demand for enclosure cooling components. North America and Europe, while mature, exhibit strong demand for advanced, premium filter fans featuring EC motor technology and comprehensive regulatory compliance (UL, CE), driven by strict energy efficiency standards and high operational costs. Regional trends underscore the importance of local supply chain resilience and customization capabilities to meet diverse industrial standards across different geographical areas.

Segmentation trends reveal significant growth in the AC and EC fan motor segments. While AC fans maintain a large installed base due to their cost-effectiveness and reliability, the EC segment is rapidly gaining market share due to its superior efficiency, reduced noise levels, and variable speed operation, crucial for precision cooling in sensitive electronic racks. In terms of application, the machine tools and industrial automation sectors remain the primary revenue generators, although the renewable energy segment, particularly solar and wind power installations requiring ruggedized control enclosures, is demonstrating accelerating demand. Furthermore, the adoption of specialized filter media offering enhanced particle filtration (e.g., fine dust filters) and resistance to oil mist contamination is becoming a key differentiator in highly polluted industrial settings, influencing purchasing behavior among sophisticated end-users seeking extended maintenance intervals.

AI Impact Analysis on Cabinet and Enclosure Filter Fan Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can transform passive thermal management components like filter fans into active, predictive systems. Common user questions revolve around the feasibility of optimizing cooling cycles to reduce energy bills, preventing unexpected thermal failures before they occur, and integrating fan performance data seamlessly into broader Industrial Internet of Things (IIoT) platforms. Users are concerned about the complexity and cost of implementing AI-driven thermal solutions, seeking assurance that these advanced systems will offer a tangible return on investment through extended equipment life and minimized downtime. The expectation is that AI will move filter fan operation beyond simple on/off temperature thresholds to dynamic, load-aware cooling profiles, thereby enhancing overall operational efficiency and sustainability.

The impact of AI on the Cabinet and Enclosure Filter Fan Market is transitioning from theoretical optimization to practical application, primarily focused on predictive maintenance and energy consumption modulation. AI algorithms, when fed data streams from embedded fan sensors (such as vibration, airflow rate, motor current, and internal/external temperature readings), can establish baseline operational norms and detect subtle anomalies indicative of impending fan failure or filter clogging. This predictive capability allows maintenance teams to schedule replacements or cleaning proactively, eliminating the costly consequence of reactive maintenance caused by sudden thermal shutdowns. Furthermore, in large installations like server farms or extensive manufacturing facilities, AI models can learn complex thermal patterns related to varying production loads or environmental conditions, enabling dynamic adjustment of fan speed and flow direction to maintain optimal component temperature with minimal energy expenditure, significantly reducing the carbon footprint associated with auxiliary industrial equipment.

Moreover, AI integration facilitates the development of self-regulating climate control ecosystems within enclosures. Instead of relying solely on fixed thermostat settings, AI leverages data analysis to anticipate cooling needs based on historical operational data and immediate system load fluctuations (e.g., anticipating a peak load event based on a specific process step). This ability to anticipate thermal load rather than react to it optimizes the fan’s operational profile, extends the life of the fan itself by reducing unnecessary high-speed operation, and ensures stricter temperature stability for sensitive components like high-power processors or intricate wiring harnesses. Manufacturers are responding by developing ‘smart’ fan controllers that are natively compatible with standardized communication protocols (like Modbus or EtherNet/IP) and capable of running lightweight ML models locally, paving the way for truly intelligent thermal management solutions that are scalable and relatively simple to deploy within existing industrial frameworks.

- AI enables predictive failure detection based on analyzing fan vibration and current draw signatures.

- Machine learning optimizes fan speed dynamically, minimizing energy consumption based on real-time and predicted thermal load.

- Integration with IIoT platforms allows centralized AI management of thermal conditions across hundreds of remote enclosures.

- AI facilitates the creation of adaptive cooling profiles, moving beyond fixed temperature setpoints for enhanced component longevity.

- Improved maintenance scheduling through AI-driven warnings regarding filter clogging severity and motor degradation.

DRO & Impact Forces Of Cabinet and Enclosure Filter Fan Market

The dynamics of the Cabinet and Enclosure Filter Fan Market are significantly shaped by a confluence of escalating industrial digitalization (Drivers), high initial costs associated with advanced solutions (Restraints), the untapped potential of integrated IIoT features (Opportunities), and the stringent mandates for efficiency and compliance (Impact Forces). The global push towards smart manufacturing and automated processes mandates reliable and sustained equipment operation, thereby creating intrinsic demand for robust thermal management. Conversely, achieving the highest levels of ingress protection and energy efficiency often requires specialized materials and advanced motor technologies (EC), leading to higher upfront investment costs that can deter smaller enterprises, especially in highly price-sensitive developing markets. Successfully navigating these market pressures requires manufacturers to continuously innovate on both cost-effectiveness and technological sophistication, ensuring compliance while maximizing system uptime for the end-user.

Key drivers include the pervasive trend of component miniaturization and increasing power density in control systems. As modern electronics shrink and pack more computational power into confined spaces, the heat generated per cubic inch rises exponentially, making active cooling indispensable. Furthermore, the rapid global expansion of 5G infrastructure and associated telecommunications cabinets—often located outdoors or in harsh environments—demands ruggedized filter fans with high IP ratings (typically IP54 or IP55) that can withstand dust, temperature extremes, and moisture intrusion while maintaining consistent airflow. The necessity for reliable, fail-safe operation in critical infrastructure sectors, such as transportation signaling and medical device manufacturing, further underpins the market's stability and growth trajectory. Regulatory drivers, particularly those related to energy efficiency mandates (e.g., minimum efficiency standards for motors), also force a market migration toward higher-performing products.

Restraints primarily revolve around the operational complexity and required maintenance. Although filter fans are critical, they rely on periodic filter media replacement or cleaning, and if neglected, this can lead to catastrophic system failure due to overheating, creating reluctance among some operators to rely solely on filter fan solutions in extremely dusty environments. The market also faces competition from alternative cooling technologies, such as air-to-air heat exchangers or passive cooling (heat pipes), which may be preferred in ultra-high IP environments where airflow exchange is undesirable. Opportunities are substantial, centered on integrating advanced sensor technology for real-time monitoring of filter pressure drop, temperature gradients, and fan health status. Developing self-cleaning or low-maintenance filter technologies represents a significant avenue for manufacturers to capture premium market share. Impact forces are dominated by the need to comply with global safety standards (UL, CE) and environmental regulations (RoHS), coupled with intense market pressure to reduce the Total Cost of Ownership (TCO) through enhanced energy efficiency and longevity.

Segmentation Analysis

The Cabinet and Enclosure Filter Fan Market is extensively segmented based on factors including product type, motor technology, mounting configuration, ingress protection (IP) rating, and application industry. Analyzing these segments provides a granular view of market demands, highlighting where technological innovation and investment are most concentrated. Segmentation by product type typically divides the market into standard filter fans, slim-fit versions designed for shallow enclosures, and roof-mounted exhaust units utilized when wall space is constrained. Each variant caters to specific spatial requirements and heat load characteristics of the industrial application. The ongoing trend toward higher performance within smaller footprints drives innovation within the slim-fit segment.

Segmentation by motor technology is crucial, defining the fan's efficiency and control capabilities. The market is primarily split between AC (Alternating Current), DC (Direct Current), and EC (Electronically Commutated) fans. AC fans remain prevalent due to simplicity and lower initial cost, whereas DC fans are common in low-voltage applications like telecom. EC motor fans, however, represent the premium segment, offering superior energy efficiency, extended service life, and advanced speed modulation capabilities via analog or digital signals, making them highly desirable in energy-sensitive environments like data centers and remote monitoring stations. The increasing adoption of EC technology is directly correlated with rising energy costs and stricter governmental efficiency mandates across developed regions.

Application-based segmentation reveals the core consumption centers, with industrial automation machinery, power generation and distribution, telecommunications, and automotive manufacturing leading demand. The required IP rating often differentiates the fans utilized in these sectors; for instance, fans used in food processing (requiring frequent washdowns) need higher IP ratings (e.g., IP66) than those used in clean indoor control rooms (IP54). Strategic investment often targets the fastest-growing application sectors, such as e-mobility infrastructure (EV charging stations) and renewable energy systems, both requiring highly durable and reliable external enclosure cooling solutions to manage significant heat loads under demanding environmental conditions.

- By Motor Type:

- AC Filter Fans

- DC Filter Fans

- EC Filter Fans (Electronically Commutated)

- By Product Type/Design:

- Standard Filter Fans

- Slim Line Filter Fans

- Roof-Mounted Exhaust Fans

- Exhaust Grilles and Inlet Filters

- By Ingress Protection (IP) Rating:

- IP 54

- IP 55

- IP 65/66

- By Application/End-User Industry:

- Industrial Automation and Machinery

- Power Generation and Distribution (Switchgear/Transformers)

- Telecommunications (Outdoor Cabinets, 5G Infrastructure)

- Data Centers and Server Rooms

- Automotive Manufacturing

- Food and Beverage Processing

- Renewable Energy Systems (Solar/Wind Inverters)

Value Chain Analysis For Cabinet and Enclosure Filter Fan Market

The value chain for the Cabinet and Enclosure Filter Fan Market is characterized by specialized manufacturing and a highly defined distribution network focusing on technical expertise and just-in-time delivery. The upstream segment involves the sourcing of critical raw materials, including high-grade engineering plastics (ABS, polycarbonate) for fan housings and grilles, specialized filter media (non-woven fibers, polypropylene), and high-efficiency motor components (stators, rotors, electronics for EC fans). Manufacturers often rely on established relationships with motor and electronics suppliers to maintain quality consistency and benefit from economies of scale. Challenges in the upstream segment include volatile raw material prices and ensuring the sustained supply of advanced electronic components necessary for intelligent, connected fan systems. Quality control at this stage, particularly regarding thermal stability and UL compliance of plastics, is paramount for the final product's reliability.

The core manufacturing and assembly stage involves precision molding, motor integration, and final testing, often requiring automated assembly lines to ensure consistency and meet high production volumes. Differentiation at this stage is achieved through proprietary fan blade designs that maximize airflow while minimizing noise and energy consumption, and through specialized assembly processes that guarantee specific IP ratings. The distribution channel is multifaceted, relying heavily on both direct sales to major Original Equipment Manufacturers (OEMs) and indirect sales through a network of specialized industrial distributors, electrical wholesalers, and Maintenance, Repair, and Operations (MRO) suppliers. Direct sales dominate when dealing with large-scale panel builders or system integrators who require custom solutions or significant technical support, enabling tighter control over pricing and specifications.

The downstream analysis focuses on the installation, operation, and aftermarket support. End-users, who are primarily system builders and plant maintenance managers, require products that are easy to install, operate reliably for extended periods, and have readily available replacement filter mats. The aftermarket segment, comprising replacement filters and spare fan units, generates a substantial recurring revenue stream for distributors and manufacturers. The increasing complexity of modern fans (EC motors, integrated sensors) necessitates enhanced technical training for distributors and installers. Success in the downstream market is increasingly linked to providing comprehensive technical documentation, rapid spare parts availability, and offering value-added services such as thermal assessment consultancy and predictive maintenance software integrations. Effective logistics and warehousing capabilities are essential to service the MRO segment efficiently, minimizing customer downtime.

Cabinet and Enclosure Filter Fan Market Potential Customers

Potential customers for Cabinet and Enclosure Filter Fans are predominantly business-to-business (B2B) entities operating in sectors where electronic control systems are critical to production or infrastructure management. The primary end-users are large industrial OEMs, including machine builders (e.g., manufacturers of CNC machines, robotics, packaging equipment), who integrate these fans directly into the control cabinets of their machinery before deployment. These customers prioritize compatibility, durability, and compliance with global safety standards, seeking robust solutions that contribute positively to the overall reliability rating of their finished industrial product. The selection criteria for OEMs are highly technical, focusing on airflow capacity, noise levels, lifespan (L10 rating), and certified ingress protection levels, often demanding customized sizes or proprietary features that fit specific machine designs.

Another significant customer segment includes large infrastructure operators and utility companies, encompassing organizations involved in power generation, grid distribution, water treatment plants, and public transportation systems. These customers require filter fans for protecting external control panels, distribution switchgear, and remote monitoring units, often exposed to severe environmental elements like high humidity, extreme temperatures, and corrosive agents. Reliability and minimal maintenance are paramount for this segment, driving demand for high-efficiency EC fans and robust, high IP-rated housing. Their purchasing decisions are often influenced by long-term operating costs and the vendor's ability to provide products with certified compliance for high-stakes, regulated environments.

Furthermore, telecommunications providers, especially those rolling out 5G networks, represent a rapidly expanding customer base. The outdoor telecom cabinets housing critical network hardware must maintain tightly controlled internal temperatures, regardless of weather conditions. These buyers seek energy-efficient cooling solutions that can operate autonomously and reliably in remote locations, integrating well with existing network monitoring systems for predictive thermal alerts. Finally, specialized system integrators and panel builders, who assemble custom control cabinets for diverse projects, constitute a continuous and vital customer segment, purchasing a wide variety of fan types and accessories to meet the heterogeneous demands of their project portfolios. Providing these integrators with streamlined procurement processes, modular design options, and rapid delivery schedules is essential for market penetration.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.95 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rittal GmbH & Co. KG, Pfannenberg Group, Fandis S.p.A., Schneider Electric SE, Siemens AG, nVent HOFFMAN, WEIDMÜLLER Group, ABB Ltd., EBM-PAPST Group, S.A.S. Elettronica, Orion Fans, COMER S.r.l., DELTA Electronics, Inc., Vortice Elettrosociali S.p.A., DEGSON Electronics Co., Ltd., Hammond Manufacturing, Micronel AG, Phoenix Contact GmbH & Co. KG, Sanyo Denki Co., Ltd., Rosenberg Ventilatoren GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cabinet and Enclosure Filter Fan Market Key Technology Landscape

The technological evolution within the Cabinet and Enclosure Filter Fan Market is overwhelmingly centered on achieving superior energy efficiency, increased lifespan, and enhanced connectivity, driven by global sustainability goals and the demands of IIoT environments. The dominant shift is the rapid adoption of Electronically Commutated (EC) motor technology, which is superior to traditional AC or DC motors in terms of efficiency, typically converting over 90% of electrical energy into mechanical energy, resulting in significantly lower operating costs. EC fans allow for precise, variable speed control, enabling the cooling system to match the exact thermal load requirements, thereby reducing noise, vibration, and component stress. This capability is foundational for integrating fans into smart factory ecosystems where dynamic thermal management is required, moving beyond simple binary operation.

Another crucial technological development lies in the advancement of monitoring and diagnostics. Modern filter fans are increasingly equipped with integrated sensors capable of measuring internal and external temperatures, monitoring motor health (vibration and current consumption), and critically, assessing the pressure drop across the filter media. The pressure drop measurement alerts maintenance staff when a filter is nearing saturation, preventing dangerous reductions in airflow before overheating occurs. Manufacturers are incorporating standardized communication interfaces, such as Modbus TCP or Ethernet/IP, directly into the fan controllers, allowing seamless integration with central Supervisory Control and Data Acquisition (SCADA) systems and cloud-based predictive maintenance platforms. This connectivity transforms the fan from a passive component into an active data node within the industrial network, crucial for AEO strategy focused on reliability.

Furthermore, innovations in filter media and fan design are constantly optimizing performance. New filter materials are being developed to offer higher filtration efficiency (up to G4 standard or higher) while maintaining low airflow resistance, extending the time between necessary filter changes. Designs are focusing on quick-change mechanisms and tool-less installation to reduce maintenance downtime significantly. Advances in computational fluid dynamics (CFD) simulation are enabling manufacturers to refine fan blade geometries, optimizing airflow patterns within confined enclosures, eliminating harmful hot spots, and ensuring uniform cooling distribution. The push toward slimline and recessed designs allows for increased component density within the enclosure while maximizing usable internal space, catering directly to the miniaturization trends seen across industrial machinery and telecom infrastructure deployment.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market, primarily fueled by heavy government investment in manufacturing infrastructure, rapid adoption of Industry 4.0 standards, and exponential growth in data centers and 5G network rollouts across China, India, and South Korea. The region serves as a global manufacturing hub, necessitating massive volumes of enclosure cooling for factory automation equipment. Local manufacturers are intensely competitive, often focusing on cost-effective, high-volume solutions, though there is a growing demand for premium, energy-efficient EC fans due to increasing regulatory focus on sustainable industrial practices.

- North America: This region is characterized by high demand for technologically advanced, high-efficiency cooling solutions, particularly driven by the stringent energy conservation standards in the United States and Canada. Growth is concentrated in data center expansion (hyperscale facilities) and advanced industrial sectors like aerospace, defense, and high-tech manufacturing. North American buyers prioritize UL and CSA certifications, extended warranty periods, and integration capabilities with sophisticated building management systems (BMS) and IIoT platforms.

- Europe: Europe represents a mature market defined by strict regulatory adherence (CE marking, RoHS compliance) and a strong commitment to energy efficiency, leading to the early and widespread adoption of EC motor technology. Germany, Italy, and the UK are major consumption centers due to their large and diversified manufacturing bases (machinery, automotive, pharmaceuticals). The market emphasizes aesthetic integration, low-noise operation, and long product lifespan, often favoring premium European brands known for their engineering and robust IP ratings.

- Latin America (LATAM): This region is exhibiting moderate growth, driven by modernization projects in mining, oil and gas, and infrastructure development. The demand is particularly sensitive to initial cost, often favoring reliable, standard AC filter fan models. Brazil and Mexico are the primary market contributors, focusing on localized manufacturing and addressing challenging environmental conditions, which demand durable housings and effective moisture protection.

- Middle East and Africa (MEA): Growth in MEA is primarily supported by large-scale public investment in smart city projects, utility infrastructure (power and water), and expansion of telecom networks. The extreme ambient temperatures in the Middle East necessitate highly robust cooling solutions, driving demand for heavy-duty components and specialized air-to-air cooling options in conjunction with filter fans. Reliability under continuous high thermal stress is the key purchasing determinant.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cabinet and Enclosure Filter Fan Market.- Rittal GmbH & Co. KG

- Pfannenberg Group

- Fandis S.p.A.

- Schneider Electric SE

- Siemens AG

- nVent HOFFMAN

- WEIDMÜLLER Group

- ABB Ltd.

- EBM-PAPST Group

- S.A.S. Elettronica

- Orion Fans

- COMER S.r.l.

- DELTA Electronics, Inc.

- Vortice Elettrosociali S.p.A.

- DEGSON Electronics Co., Ltd.

- Hammond Manufacturing

- Micronel AG

- Phoenix Contact GmbH & Co. KG

- Sanyo Denki Co., Ltd.

- Rosenberg Ventilatoren GmbH

Frequently Asked Questions

Analyze common user questions about the Cabinet and Enclosure Filter Fan market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of EC technology in cabinet filter fans?

The primary factor driving EC (Electronically Commutated) technology adoption is superior energy efficiency, which significantly reduces operational costs and aligns with global sustainability mandates. EC fans offer precise speed control and longer service life compared to traditional AC or DC motors, essential for optimizing thermal management in sensitive industrial electronics and high-density enclosures.

How does the IP rating affect the choice of a cabinet filter fan?

The Ingress Protection (IP) rating defines the level of protection a filter fan provides against solids (dust) and liquids (water). Higher IP ratings (e.g., IP55 or IP66) are mandatory for fans operating in harsh outdoor or washdown industrial environments, such as food and beverage processing or telecom outdoor cabinets, ensuring component longevity and preventing system failure due to environmental ingress.

What role does predictive maintenance play in the filter fan market?

Predictive maintenance, often leveraging integrated sensors and AI analysis, transforms fan operation by monitoring parameters like motor vibration and filter pressure drop. This allows maintenance teams to anticipate and schedule filter cleaning or fan replacement before thermal runaway occurs, minimizing costly unplanned downtime and maximizing the operational lifespan of the enclosed equipment, thereby reducing the Total Cost of Ownership (TCO).

Which industry segment represents the largest demand for enclosure filter fans globally?

The Industrial Automation and Machinery segment consistently represents the largest demand for enclosure filter fans. The complexity and heat generation of control cabinets housing PLCs, VFDs, and drive components in automated production lines necessitate continuous and reliable thermal management to ensure continuous manufacturing operations, making this sector a foundational consumption center.

What are the typical maintenance requirements for industrial filter fans?

The primary maintenance requirement for industrial filter fans is the periodic inspection and replacement or cleaning of the filter media. Neglecting filter maintenance leads to reduced airflow, increased static pressure, and eventually, inadequate cooling and subsequent overheating of critical electronic components. Advanced fans incorporate filter status indicators or pressure sensors to optimize maintenance schedules.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager