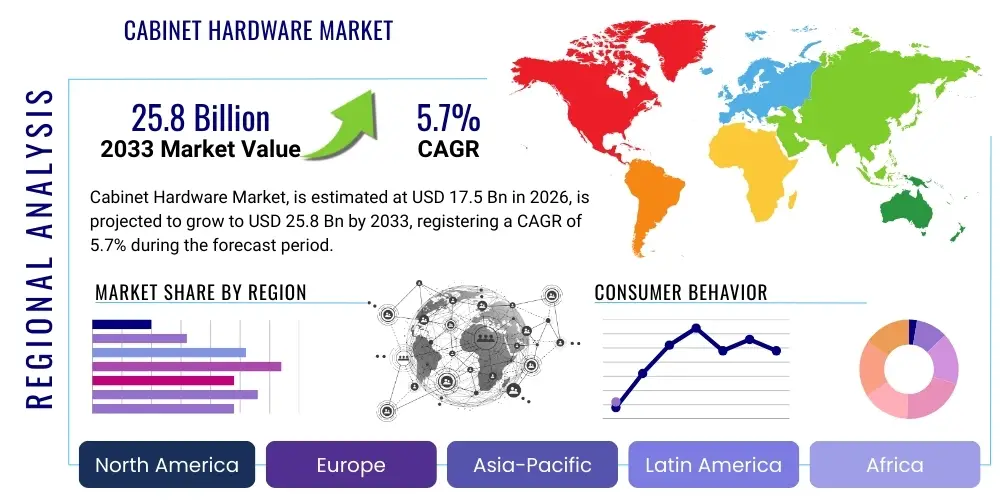

Cabinet Hardware Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436857 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Cabinet Hardware Market Size

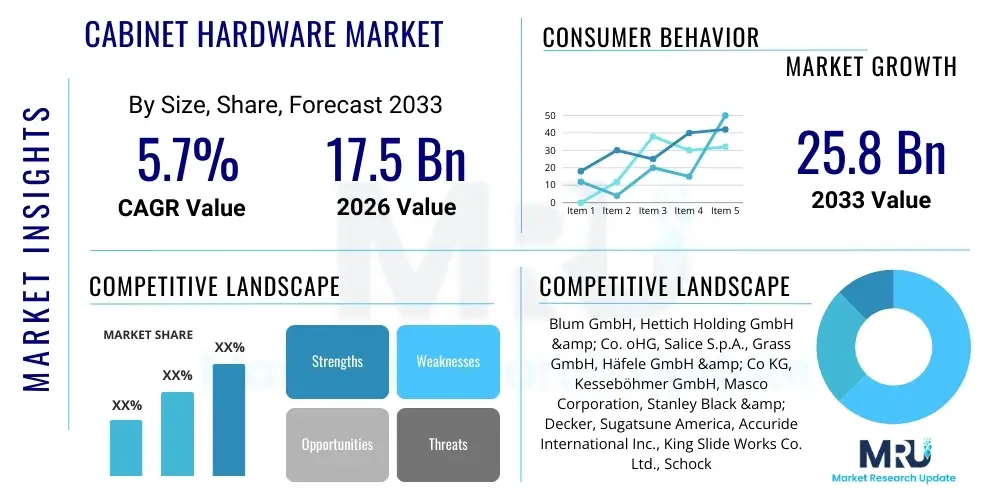

The Cabinet Hardware Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.7% (CAGR) between 2026 and 2033. The market is estimated at USD 17.5 Billion in 2026 and is projected to reach USD 25.8 Billion by the end of the forecast period in 2033.

Cabinet Hardware Market introduction

The Cabinet Hardware Market encompasses all functional and decorative components essential for the operation and aesthetic enhancement of cabinetry across residential, commercial, and institutional sectors. This includes a vast range of products such as hinges, drawer slides, knobs, pulls, latches, and specialized functional hardware like lift systems and lazy susans. The core function of cabinet hardware is dual: providing seamless operability and ergonomic access while also serving as a key design element that contributes significantly to the overall look and feel of a kitchen, bathroom, or storage unit. The increasing consumer focus on home aesthetics, coupled with rising disposable incomes, particularly in developing economies, is fueling demand for premium, technologically advanced, and design-centric hardware solutions.

Major applications for cabinet hardware span across new construction projects, renovation activities, and furniture manufacturing. Residential applications dominate the market, driven by the persistent trends in kitchen and bathroom remodeling, where consumers are increasingly opting for sophisticated features such as soft-close mechanisms, integrated lighting, and smart storage solutions that require high-performance hardware. Furthermore, the commercial sector, including hotels, corporate offices, and retail spaces, contributes substantially, demanding durable, high-cycle hardware that can withstand heavy use while maintaining aesthetic integrity and regulatory compliance.

The market benefits significantly from ongoing technological advancements, particularly the introduction of damping systems (soft-close and push-to-open), modular designs, and hidden track systems that offer a cleaner, minimalist look. Driving factors include the global surge in housing starts, favorable mortgage rates in key markets, and a post-pandemic shift towards enhanced home organization and functionality. Moreover, manufacturer innovation focusing on sustainable materials, easy installation, and customization capabilities positions the market for consistent expansion throughout the forecast period.

Cabinet Hardware Market Executive Summary

The Cabinet Hardware Market is currently characterized by robust business trends centered on premiumization, technological integration, and the adoption of sustainable manufacturing practices. Key business trends include the shift toward direct-to-consumer (DTC) models by established manufacturers seeking greater margin control and direct feedback, coupled with significant investment in advanced manufacturing processes like automated assembly and precision engineering to ensure high quality and consistency. The market is witnessing consolidation among mid-to-large-sized players who are acquiring smaller, niche companies specializing in design or specific high-tech hardware (e.g., electronic locking mechanisms or smart storage systems) to diversify their product portfolios and gain rapid access to specialized distribution channels. Furthermore, the emphasis on compliance with international quality standards, particularly related to load-bearing capacity and cycle testing (e.g., ANSI/BHMA standards), remains a critical differentiator for leading industry participants.

Regional trends indicate that Asia Pacific (APAC) is poised to be the fastest-growing market, propelled by rapid urbanization, massive residential infrastructure development in countries like China and India, and the rising penetration of modular furniture concepts. North America and Europe, while mature, exhibit strong demand for high-end, aesthetic hardware solutions driven by renovation cycles and consumer preference for European-style luxury cabinetry featuring concealed hinges and complex lift systems. Segment trends highlight the increasing dominance of functional hardware, specifically soft-close drawer slides and concealed hinges, as standard features rather than premium upgrades. Decorative hardware, while slower growing, is experiencing a shift towards minimalist, matte finishes (such as matte black and brushed gold) and ergonomic designs that cater to accessibility requirements, reflecting evolving consumer tastes and design ethos.

Overall, the market narrative is one of innovation meeting utility. Manufacturers are leveraging materials science to create lighter yet stronger components, improving efficiency and reducing installation time for professionals. The continuous demand generated by both the residential and hospitality sectors ensures market stability, while the growing interest in smart home technology is opening new avenues for integrated hardware solutions that can be controlled digitally. This combination of structural growth drivers, technological refinement, and shifting consumer expectations points toward sustained and healthy market expansion through 2033, heavily favoring companies that prioritize design excellence and operational reliability.

AI Impact Analysis on Cabinet Hardware Market

User queries regarding the impact of AI on the Cabinet Hardware Market frequently focus on automation in manufacturing, predictive maintenance for high-end hardware, and the integration of smart features into cabinetry. Consumers and industry professionals alike are asking how AI can improve supply chain efficiencies, optimize inventory management based on real-time remodeling demand, and facilitate personalized design recommendations for decorative hardware selections. Key concerns often revolve around the initial investment required for adopting AI-driven manufacturing processes and the complexity of integrating advanced sensors and machine learning algorithms into traditionally mechanical components like hinges and slides. The general expectation is that AI will primarily enhance operational efficiency, minimize manufacturing defects, and eventually lead to the development of truly 'smart' cabinets capable of interacting with occupants or other smart home devices.

Specifically, the integration of Artificial Intelligence manifests across two primary domains: production floor optimization and product enhancement. On the production side, AI algorithms are being used to monitor machinery performance, detect micro-defects in metal stamping or plating processes with high accuracy, and dynamically adjust production schedules to minimize waste and energy consumption. This leads to higher yield rates and more consistent quality, crucial for precision-engineered products like soft-close dampeners. Furthermore, in product design, machine learning is assisting designers by simulating thousands of material stress tests and ergonomic configurations, drastically reducing the R&D cycle time required to bring new, robust hardware components to market.

The future application of AI in cabinet hardware lies in enabling advanced functionality. Although still nascent, smart hardware prototypes are being developed that use embedded sensors monitored by AI. These sensors could track the usage cycles of slides and hinges, predict potential mechanical failure before it occurs, and alert users or maintenance providers. Moreover, AI can drive personalization by analyzing user lifestyle data (e.g., from smart home ecosystems) to recommend specific hardware configurations, such as drawer organization systems or motorized cabinet opening solutions tailored to individual needs, fundamentally transforming the consultative sales process in retail environments.

- AI-driven Predictive Maintenance: Enhancing the longevity and reliability of high-cycle functional hardware through proactive failure prediction based on usage data.

- Automated Quality Control (AQC): Utilizing computer vision and machine learning models to detect microscopic defects in plating, material composition, and geometry during the manufacturing process, ensuring superior precision.

- Optimized Supply Chain Logistics: Employing AI to forecast regional demand fluctuations for specific hardware types (e.g., European vs. American hinge styles) and dynamically manage inventory levels, minimizing lead times.

- Generative Design: AI tools aid designers in rapidly prototyping and testing ergonomic and mechanical configurations for new knobs, pulls, and specialized lift mechanisms, optimizing for material use and strength.

- Smart Cabinet Integration: Facilitating the development of hardware components (like motorized slides or electronic locks) that seamlessly connect and communicate within broader smart home ecosystems using embedded AI logic.

DRO & Impact Forces Of Cabinet Hardware Market

The dynamics of the Cabinet Hardware Market are governed by a complex interplay of driving forces (D), restrictive challenges (R), and compelling opportunities (O). A key driver is the relentless growth in global residential construction and renovation activities, particularly the kitchen and bath remodeling segment, which places cabinet hardware as an essential purchase. Simultaneously, increased consumer preference for sophisticated, high-performance features such as soft-close, push-to-open, and integrated lighting systems dictates the direction of product innovation. These drivers collectively amplify the market's trajectory by ensuring a continuous demand base across all geographic regions, especially as aging populations in developed markets increasingly require accessible and ergonomic hardware solutions. Conversely, the market faces restraints, primarily stemming from volatility in raw material prices, particularly steel, aluminum, and specialized plastics, which impacts manufacturing costs and profit margins. Furthermore, the influx of low-cost, unbranded hardware, particularly from certain Asian manufacturers, exerts persistent price pressure on established premium brands, forcing them to continuously justify their higher price points through superior quality and extended warranties.

Opportunities in the sector are abundant, centered around the integration of smart technology and the growing focus on sustainability. The rising demand for customized and aesthetic products presents a significant avenue for growth, allowing manufacturers to offer bespoke finishes, unique materials (e.g., leather or glass inlays), and collaborative design services to interior professionals. Furthermore, regulatory mandates in commercial settings often push for high-durability and fire-resistant hardware, opening niche markets for specialized, high-margin products. The industry can also capitalize on the shifting retail landscape by enhancing e-commerce capabilities, offering sophisticated visualization tools (AR/VR) for hardware selection, and streamlining the digital purchasing process for both B2B and B2C clients, capturing market share from traditional brick-and-mortar suppliers.

The impact forces influencing the market trajectory are multifaceted. Technological innovation, specifically related to motion technology and damping systems, remains a high-impact force, perpetually raising the standard for consumer expectations regarding cabinet functionality. Economic conditions, such as interest rate hikes affecting construction lending and consumer discretionary spending, act as a medium-to-high impact external force that can temporarily slow down remodeling activity. Competitive intensity is extremely high, particularly in the mid-range segment, driven by rapid product imitation and patent challenges, compelling leading manufacturers to invest heavily in patented intellectual property (IP) protection and continuous incremental improvements. Overall, while macroeconomic stability and raw material costs pose short-term challenges, the fundamental forces of urbanization, rising living standards, and technological obsolescence of older hardware ensure a robust long-term growth outlook.

Segmentation Analysis

The Cabinet Hardware Market is highly fragmented and segmented based on Product Type, Material, Application, and Distribution Channel, allowing manufacturers to target specific end-user needs ranging from basic functionality to high-end aesthetic appeal. The analysis of these segments is crucial for understanding market dynamics, investment prioritization, and strategic market positioning. Functional hardware, including hinges and drawer slides, constitutes the largest segment by revenue, driven by their necessity in every cabinet unit and the rapid innovation cycle focused on motion control (soft-close). Conversely, decorative hardware, while smaller in volume, commands higher average selling prices (ASPs) due to design complexity and material quality, making it a critical segment for profitability and brand differentiation.

By application, the residential sector holds dominance, primarily fueled by the strong renovation and replacement market, which far exceeds the new construction market in terms of hardware volume requirements. However, the commercial sector, though smaller, demands more stringent quality control, testing certifications, and bulk purchasing, favoring suppliers capable of consistent, large-scale production and stringent compliance with building codes. Material segmentation shows metal (primarily steel, zinc, and brass alloys) maintaining its leading position due to its inherent durability and strength, though plastic components are increasingly utilized in specialized applications like dampening mechanisms and lightweight drawer systems.

Understanding the interplay between these segments reveals critical trends. For example, the convergence of functional and aesthetic requirements has led to the popularity of minimalist hardware, such as integrated handles or handle-less systems utilizing push-to-open slides, blurring the lines between traditional decorative and functional categorization. Manufacturers are strategically diversifying their offerings to provide comprehensive solutions, encompassing both the concealed operational components and the visible aesthetic elements, ensuring a unified brand experience for cabinet makers and end consumers. This holistic approach to hardware provision is essential for maintaining competitiveness in the contemporary market landscape.

- By Product Type:

- Knobs

- Pulls and Handles

- Hinges (Concealed, Semi-Concealed, Surface Mount)

- Drawer Slides and Runners (Ball Bearing, Roller, Undermount, Soft-Close)

- Catches and Latches

- Specialty and Functional Hardware (Lift Systems, Lazy Susans, Corner Mechanisms)

- By Material:

- Metal (Stainless Steel, Brass, Zinc, Aluminum)

- Plastic and Polymers

- Wood and Composites

- By Application:

- Residential (Kitchen, Bathroom, Wardrobes)

- Commercial (Hospitality, Office, Retail, Institutional)

- By Distribution Channel:

- Offline (Specialty Stores, Home Centers, Wholesalers)

- Online Retail

Value Chain Analysis For Cabinet Hardware Market

The Cabinet Hardware market's value chain is characterized by a high degree of integration between raw material sourcing, precision manufacturing, and diversified distribution networks. Upstream activities primarily involve the procurement of specialized raw materials such as cold-rolled steel, zinc alloys for die-casting, and high-performance plastics (e.g., nylon or POM) necessary for soft-close components. Manufacturers are increasingly prioritizing suppliers that adhere to strict environmental, social, and governance (ESG) standards, seeking materials sourced ethically and processed efficiently to reduce the environmental footprint of the final product. Complexity arises in managing the fluctuating costs and global supply of these metals, which necessitates robust hedging strategies and long-term contracts with key suppliers to ensure price stability and consistent quality required for high-precision components like drawer slides and lift mechanisms.

Midstream activities revolve around sophisticated manufacturing processes, including precision stamping, machining, die-casting, plating (chrome, nickel, specialized PVD finishes), and complex assembly, especially for functional hardware. Leading players such as Blum and Hettich invest heavily in automated assembly lines and proprietary intellectual property to maintain mechanical superiority and reduce labor costs, which are critical in producing high-tolerance items like soft-close runners. The core value addition at this stage is the transformation of basic metals into highly engineered, reliable, and aesthetically pleasing components that meet stringent lifecycle testing standards mandated by industry bodies like BHMA.

Downstream activities focus on reaching the diverse end-users through multiple distribution channels. Direct distribution involves B2B sales to large-scale cabinet manufacturers (OEMs) and commercial builders, where bulk pricing and technical support are paramount. Indirect channels involve specialty hardware distributors, home improvement retail chains (big box stores), and increasingly, e-commerce platforms. The trend is moving towards enhanced online engagement; thus, the quality of digital content, accurate specifications, and efficient logistics for smaller, customized orders are becoming crucial competitive factors. Specialty distributors often provide essential intermediary services, offering localized inventory management, cutting services, and technical training to small-to-medium sized cabinet shops and professional remodelers.

Cabinet Hardware Market Potential Customers

The primary end-users and buyers of cabinet hardware span a broad spectrum, categorized mainly into business-to-business (B2B) and business-to-consumer (B2C) segments, each having distinct purchasing criteria and volume requirements. On the B2B side, major customers include original equipment manufacturers (OEMs) of cabinetry and furniture, large-scale residential and commercial developers, and independent professional remodelers or kitchen and bath dealers. OEMs prioritize reliable supply, competitive pricing, high durability, and easy integration into their automated manufacturing lines, often signing long-term contracts with hardware suppliers who can guarantee consistent quality and delivery schedules for thousands of units.

The second major group of customers includes specialized cabinet shops and professional installation firms. These buyers often require a wider variety of specialized hardware, shorter lead times, and comprehensive technical support, favoring local distributors who can offer tailored training and rapid delivery of complex components like corner pull-outs or electronic soft-close systems. For commercial builders (e.g., hospitality or healthcare), the primary concern is compliance with fire codes, ADA standards, and extreme cycle durability, leading them to procure certified, high-grade functional hardware that can withstand intensive public use environments.

The B2C segment consists of individual homeowners involved in DIY projects or those commissioning customized cabinetry. These customers are highly influenced by aesthetic trends, brand reputation, and ease of installation, typically purchasing decorative hardware (knobs and pulls) directly from specialty retail or online channels. While their volume is lower per transaction, their collective focus on premium finishes and unique designs drives significant profitability in the decorative segment. Effective marketing to this segment involves strong digital presence, inspirational content, and streamlined online shopping experiences, focusing on the immediate visual and tactile quality of the hardware.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 17.5 Billion |

| Market Forecast in 2033 | USD 25.8 Billion |

| Growth Rate | 5.7% ( CAGR ) |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Blum GmbH, Hettich Holding GmbH & Co. oHG, Salice S.p.A., Grass GmbH, Häfele GmbH & Co KG, Kesseböhmer GmbH, Masco Corporation, Stanley Black & Decker, Sugatsune America, Accuride International Inc., King Slide Works Co. Ltd., Schock Metallwerk GmbH, Mepla-Alfit, Dongtai Hardware Group (DTC), Fgv, Richelieu Hardware, FER-MAX, Peka-Systeme AG, Taiming Metal Products, Spectrum Brands Holdings. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cabinet Hardware Market Key Technology Landscape

The Cabinet Hardware market is characterized by continuous refinement in mechanical engineering and the nascent adoption of digital integration, moving far beyond simple metal hinges and slides. The most impactful technological development remains the proliferation of advanced motion technologies, specifically soft-close and push-to-open (tip-on) systems. Soft-close technology utilizes sophisticated hydraulic or mechanical damping systems integrated directly into hinges and drawer slides to ensure silent and smooth closure, preventing slamming and extending the lifespan of the cabinet structure. Leading companies invest heavily in optimizing the damping fluid composition and piston design to ensure consistent performance across various temperatures and load weights. This technology has shifted from a luxury feature to an expected standard in most new cabinetry, driving the replacement cycle for older, traditional hardware.

Another crucial area of innovation is in slide and runner technology. Undermount slides, which are concealed beneath the drawer box, have gained immense popularity for aesthetic reasons, requiring highly precise manufacturing to maintain smooth operation while handling heavy loads. Furthermore, specialized hardware such as electronic opening systems (e.g., servo-drive or tip-on electric) allows for handle-less cabinet designs, offering motorized assistance for opening and closing, particularly useful for large pantry pull-outs or waste bin drawers. These systems require integrated sensors and microcontrollers, bridging the gap between traditional mechanical hardware and electronic components, and setting the stage for smart cabinetry integration, which will utilize low-power connectivity standards like Bluetooth or Zigbee.

Material science also plays a vital role. Manufacturers are increasingly utilizing composite materials and advanced surface treatments, such as PVD (Physical Vapour Deposition) coatings, to enhance the durability, corrosion resistance, and aesthetic appeal of decorative hardware. PVD offers superior resistance to scratching and tarnishing compared to traditional electroplating, allowing for high-demand finishes like matte black and brushed bronze to maintain their quality even in high-humidity environments like bathrooms and kitchens. Furthermore, modular design principles are being applied to functional hardware to simplify installation, allowing cabinet makers to use standardized components that are quick and easy to adjust post-installation, thereby reducing labor costs and minimizing installation errors at the job site.

Regional Highlights

- Asia Pacific (APAC): The APAC region is projected to register the highest growth rate globally, driven by massive infrastructure spending, rapid urbanization, and exponential growth in the modular kitchen and home furnishing sectors across India, China, and Southeast Asia. The increasing middle-class population in these countries is driving a significant shift from traditional, custom-built furniture toward standardized, high-quality modular units that heavily rely on advanced functional hardware. Manufacturers are strategically relocating or expanding production facilities in this region to reduce costs and cater directly to the surging local demand for both high-volume, cost-effective solutions and increasingly sophisticated, premium hardware.

- North America: North America represents a mature yet high-value market, primarily driven by the robust residential remodeling sector. Consumers in the U.S. and Canada prioritize premium features, brand reputation, and extended warranties. Demand is strong for functional hardware offering sophisticated motion control, such as heavy-duty, soft-close undermount slides and ergonomic lift systems. Regulatory compliance, especially concerning accessibility standards (ADA), also drives demand for specialized hardware solutions, ensuring high average selling prices (ASPs) compared to global averages.

- Europe: Europe is characterized by a strong emphasis on minimalist design, quality craftsmanship, and environmental sustainability. Countries like Germany, Italy, and Austria are home to major global hardware innovators who set the industry standard for precision engineering and hidden technology. The market shows a strong preference for concealed hinges and handle-less systems (utilizing push-to-open technology). Furthermore, stringent EU regulations regarding material safety and lifecycle longevity necessitate high-quality, certified products, maintaining Europe's position as a key market for premium and technically complex hardware solutions.

- Latin America: This region presents emerging opportunities, with key markets like Brazil and Mexico experiencing gradual economic recovery and growth in residential construction. While price sensitivity remains a factor, the increasing influence of global design trends is stimulating demand for aesthetic upgrades and basic soft-close functionality, leading manufacturers to focus on reliable, mid-range product lines that balance cost and quality.

- Middle East and Africa (MEA): The MEA market is largely driven by large-scale hospitality and luxury residential projects, particularly in the Gulf Cooperation Council (GCC) countries. Demand is highly concentrated on high-end, decorative hardware featuring elaborate finishes (e.g., gold plating, crystal accents) and durable functional hardware capable of withstanding extreme climate conditions, making it a high-margin niche market focused on aesthetic luxury and resilience.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cabinet Hardware Market.- Blum GmbH

- Hettich Holding GmbH & Co. oHG

- Salice S.p.A.

- Grass GmbH

- Häfele GmbH & Co KG

- Kesseböhmer GmbH

- Masco Corporation

- Stanley Black & Decker, Inc.

- Sugatsune America, Inc.

- Accuride International Inc.

- King Slide Works Co. Ltd.

- Schock Metallwerk GmbH

- Mepla-Alfit (Part of Grass Group)

- Dongtai Hardware Group (DTC)

- Fgv

- Richelieu Hardware Ltd.

- FER-MAX Hardware

- Taiming Metal Products Co., Ltd.

- Peka-Systeme AG

- Spectrum Brands Holdings, Inc. (Kwikset/Baldwin Hardware)

Frequently Asked Questions

Analyze common user questions about the Cabinet Hardware market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the demand for soft-close cabinet hardware?

Demand is primarily driven by enhanced user experience, noise reduction, and increased cabinet longevity. Soft-close technology prevents damage caused by slamming doors and drawers, aligning with modern consumer preferences for premium, quiet, and durable home environments, especially during kitchen and bathroom remodeling projects.

Which material is dominating the Cabinet Hardware Market by volume?

Metal alloys, particularly steel (cold-rolled steel for slides, stainless steel for finishes), zinc, and brass, dominate the market by volume. These materials offer the necessary strength, load-bearing capacity, and durability required for functional components like hinges and drawer slides, which must withstand thousands of usage cycles.

How is the growth of the E-commerce channel impacting the market?

E-commerce is significantly impacting the distribution of decorative hardware (knobs and pulls) and standard functional items by offering greater consumer choice, comparative pricing transparency, and direct-to-consumer delivery, bypassing traditional wholesale distributors and empowering DIY renovators.

What role do smart home technologies play in the future of cabinet hardware?

Smart home technologies are facilitating the development of specialized hardware, such as motorized opening systems and electronic locks, which enable handle-less and accessible cabinetry. Future integration includes sensor-based usage tracking and predictive maintenance alerts managed via home automation hubs.

Which geographical region offers the highest growth potential for cabinet hardware manufacturers?

The Asia Pacific (APAC) region offers the highest growth potential, largely fueled by aggressive residential construction projects, rapid urbanization, and the increasing adoption of high-quality modular kitchen systems in highly populated countries such as China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager