Cable Entry Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436942 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Cable Entry Systems Market Size

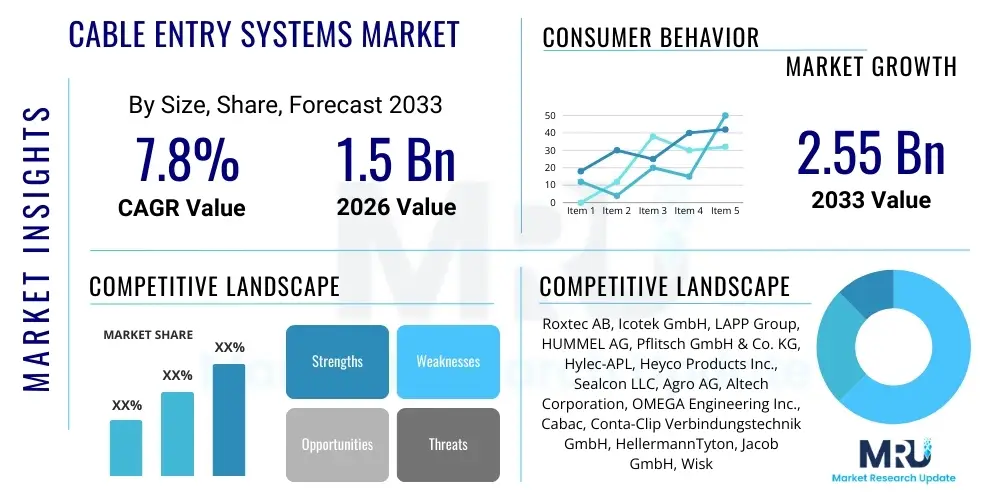

The Cable Entry Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.55 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the accelerated growth in industrial automation, the proliferation of complex machinery requiring high-density wiring solutions, and increasingly stringent safety and environmental regulations demanding certified sealing and strain relief mechanisms. Market stability is underpinned by consistent demand from traditional sectors like manufacturing and construction, while emerging sectors such as renewable energy infrastructure and advanced data centers provide significant growth impetus.

Cable Entry Systems Market introduction

The Cable Entry Systems Market encompasses specialized components and assemblies designed to facilitate the safe, efficient, and secure routing of cables into enclosures, machines, or electrical cabinets while maintaining crucial environmental integrity (such as ingress protection, typically measured by IP ratings) and providing mechanical protection, including strain relief. These systems are essential for ensuring operational safety, longevity of equipment, and compliance with various international industrial standards, particularly those concerning electromagnetic compatibility (EMC) and explosion protection (ATEX/IECEx). Products range from basic cable glands and metric fittings to highly sophisticated modular entry plates and multi-cable entry frames capable of handling hundreds of cables within a confined space.

The primary applications of cable entry systems span across numerous critical infrastructure and industrial sectors. They are indispensable in high-vibration environments like railway and maritime transport, demanding applications in robotics and automated production lines, and crucial safety installations in oil and gas refineries and chemical processing plants. Beyond mere cable penetration, modern cable entry solutions offer features such as high-temperature resistance, corrosion immunity, and quick assembly capabilities, significantly reducing installation time and overall maintenance costs. The continuous push toward Industry 4.0 and smart factories necessitates robust, reliable, and standardized cable management, thereby solidifying the market's foundational growth trajectory.

Major benefits derived from utilizing specialized cable entry systems include enhanced operational reliability through superior ingress protection against dust, dirt, and moisture (IP69K), prevention of cable strain and subsequent damage, and effective electromagnetic shielding, which is vital for sensitive electronic components. Key driving factors include the global shift toward automation in manufacturing, massive investments in renewable energy infrastructure (solar and wind farms), the expansion of data centers globally, and the consistent need for retrofitting aging industrial equipment with modern, compliant sealing solutions. Furthermore, regulatory bodies worldwide are consistently tightening standards for electrical installations, directly boosting the demand for certified, high-performance cable entry solutions.

Cable Entry Systems Market Executive Summary

The Cable Entry Systems Market is currently experiencing robust business trends characterized by a strong emphasis on modularity, digitalization, and integration capabilities. Manufacturers are focusing on developing tool-less assembly systems and flexible entry solutions that can adapt quickly to changes in cable configurations, a requirement driven by the dynamic nature of automated production lines. A significant trend involves the increasing utilization of plastic-based systems (polyamide) in less demanding environments to reduce cost and weight, contrasting with the sustained premium demand for stainless steel and specialized metal systems in harsh environments, such as marine and offshore applications, where corrosion resistance is paramount. Furthermore, the convergence of power and data transmission within single enclosures is fueling demand for hybrid entry systems that manage varying cable diameters and types simultaneously, streamlining complex industrial wiring architecture.

Regional analysis indicates that Asia Pacific (APAC) holds the largest market share and exhibits the fastest growth trajectory, predominantly fueled by rapid industrialization, massive infrastructure development, and substantial government investments in smart city projects in countries like China, India, and South Korea. Europe remains a significant market, distinguished by stringent safety regulations and high adoption rates of advanced automation technologies, necessitating high-specification, certified cable entry products. North America’s growth is stable, driven by the expansion of the telecommunications sector, the build-out of large-scale data center facilities, and modernization initiatives across the automotive and aerospace industries. Developed regions show a preference for highly engineered solutions that minimize installation downtime, while developing regions prioritize scalable and cost-effective modular solutions.

In terms of segment trends, the Cable Glands segment continues to dominate the market due to their universal application across nearly all industrial machinery and electrical installations, offering basic sealing and strain relief. However, the Cable Entry Frames and Plates segment is poised for the highest CAGR, propelled by their ability to handle high cable densities in confined spaces, facilitating maintenance and future expansion without compromising IP integrity—a critical feature for cabinet manufacturers and system integrators. The End-User segment shows substantial momentum within the Automation & Robotics and Renewable Energy sectors, where complex wiring schemes and environmental resilience are essential requirements, mandating the use of highly specialized, durable, and reliable cable entry solutions designed for continuous operational stress.

AI Impact Analysis on Cable Entry Systems Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Cable Entry Systems Market often center around two main areas: how AI influences the manufacturing and supply chain efficiency of cable entry products, and, more critically, how the increasing demand for high-speed data transfer within AI-driven systems (like robotics and autonomous vehicles) necessitates new features in cable management. Users frequently inquire about the integration of smart sensors into cable systems for predictive maintenance, the standardization of AI-specific cabling (e.g., high-throughput fiber optics within existing metal enclosures), and the role of AI-optimized design software in reducing material waste and improving installation blueprints. Key themes emerging from these concerns highlight the need for ultra-reliable, noise-resistant, and easily diagnosable cable management solutions to support the immense computational loads and stringent uptime requirements of AI-enabled industrial ecosystems.

The secondary area of concern revolves around using AI/Machine Learning (ML) in the actual production of cable entry components. Users are keen to know if AI can optimize complex injection molding processes for plastic glands or improve the precision machining of metal components, thereby ensuring consistent quality and lowering per-unit costs. Furthermore, the complexity introduced by AI hardware necessitates far more sophisticated thermal management and electromagnetic compatibility (EMC) requirements within enclosures. This drives the demand for cable entry systems that can seamlessly integrate specialized shielding materials and provide verified, continuous grounding, ensuring that sensitive AI processing hardware operates without interference. The expectation is that AI will not fundamentally change the components themselves, but rather raise the quality, reliability, and precision standards required from them.

- AI drives increased demand for high-density, modular cable entry frames to manage complex, proprietary AI cabling bundles.

- AI-optimized design software facilitates rapid prototyping and customization of entry plates, aligning with specific industrial robot or machine learning server requirements.

- Increased implementation of predictive maintenance (AI/ML powered) requires cable entry systems that are easy to inspect and integrate smart monitoring capabilities for temperature or vibration.

- Enhanced focus on Electromagnetic Compatibility (EMC) in cable entry design to prevent interference with sensitive AI processing units and high-speed data links.

- AI/ML tools are utilized in manufacturing processes to minimize material defects and optimize throughput in producing high-volume plastic and metal cable glands.

- Autonomous systems and robotics (driven by AI) necessitate highly ruggedized and vibration-resistant cable conduits and entries to ensure cable integrity during rapid movement.

DRO & Impact Forces Of Cable Entry Systems Market

The market dynamics for Cable Entry Systems are shaped by a powerful interplay of drivers, restraints, and opportunities, collectively categorized as DRO & Impact Forces. The primary drivers include the accelerating global trend towards industrial automation, particularly Industry 4.0 adoption, which necessitates vast arrays of interconnected machinery requiring robust and reliable wiring seals. Furthermore, increasingly stringent international safety and environmental regulations (e.g., ATEX, IP standards, UL certifications) mandate the use of certified, high-performance sealing solutions, thereby expanding the mandatory application scope for these systems. Opportunities largely stem from the burgeoning renewable energy sector, especially offshore wind and large-scale solar farms, and significant infrastructure investments in data centers and electric vehicle (EV) charging infrastructure, all demanding specialized, environmentally resilient cable management.

Conversely, the market faces significant restraints. Price sensitivity, especially in developing economies, often leads to the adoption of low-cost, uncertified alternatives, which impacts the market share of premium solution providers. Additionally, the complexity associated with integrating specialized sealing technologies (such as those for EMC or explosion protection) requires high levels of technical expertise, creating challenges for standardization and adoption among smaller enterprises. The overall economic volatility, particularly in capital expenditure across heavy industries, can temporarily restrict large-scale equipment procurement and, consequently, demand for new cable entry installations. Addressing these restraints requires manufacturers to focus on simplified, standardized, yet high-performance modular solutions that offer long-term value.

The major impact forces governing the market include technological advancements focused on quick-connect and modular systems, shifting the market toward faster installation and lower total cost of ownership (TCO). Regulatory pressure is another high-impact force, continuously pushing the industry toward safer, more durable, and environmentally compliant products. The sustained growth of the electronics and telecommunications industries ensures persistent demand for miniaturized and high-density solutions. Successfully navigating these impact forces requires continuous investment in research and development, particularly in advanced materials science, to meet the dual demands of high performance and competitive pricing while maintaining critical safety certifications mandated by global regulatory bodies.

Segmentation Analysis

The Cable Entry Systems Market is extensively segmented based on the product type, material composition, and the diverse applications across various end-user industries. This structured segmentation is critical for understanding market penetration and identifying high-growth niches. Product type analysis distinguishes between traditional components like cable glands and conduits, and more advanced, integrated solutions such as cable entry frames and plates. This distinction reflects the evolution from simple sealing applications to complex, high-density cable routing requirements typical in modern automated systems. The choice of material—whether metal or plastic—is dictated by the required level of mechanical strength, environmental resistance (corrosion, temperature), and shielding properties necessary for the specific industrial environment.

Further granular segmentation is achieved through end-user categorization, which highlights the highly specialized needs of sectors like Automotive/Transportation, which demands vibration resistance and adherence to strict fire safety standards, versus the Energy sector, which requires specialized ingress protection for harsh outdoor or explosive environments (Oil & Gas). The increasing sophistication of industrial automation dictates that segmented product offerings must cater to extremely specific parameters, including pressure equalization, temperature ranges, and certification standards. For market participants, understanding these fine-grained segments is key to developing targeted product portfolios and effective distribution strategies, maximizing resonance with distinct industrial procurement needs.

- By Product Type:

- Cable Glands (Standard, Metric, NPT, EMC)

- Cable Entry Frames and Plates (Modular Entry Systems)

- Cable Conduits and Fittings (Flexible and Rigid)

- Strain Relief Plates

- Sealing Components (Grommets, Inserts)

- By Material:

- Metal (Stainless Steel, Nickel-Plated Brass, Aluminum)

- Plastic (Polyamide (PA), Polypropylene (PP), Polyvinylidene Fluoride (PVDF))

- Elastomer/Rubber (TPE, Silicone)

- By End-User Industry:

- Machinery & Equipment Manufacturing

- Automation & Robotics

- Energy (Oil & Gas, Wind, Solar)

- Automotive & Transportation (Rail, Marine)

- Telecommunications & Data Centers

- Building & Construction

- Chemical and Pharmaceutical

- By Ingress Protection (IP Rating):

- IP65/IP66

- IP67/IP68

- IP69K (High Pressure/Steam Cleaning)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Cable Entry Systems Market

The value chain for the Cable Entry Systems Market begins with the upstream suppliers of raw materials, primarily specialized metals (stainless steel, brass) and engineering plastics (polyamide, polycarbonate). The performance and compliance of the final product are heavily dependent on the quality and certification of these input materials, especially concerning fire ratings, chemical resistance, and UV stability. Manufacturers often engage in strategic, long-term relationships with material suppliers to ensure a consistent supply of certified, high-grade polymers and alloys. The core value addition occurs in the manufacturing stage, involving precision injection molding, casting, machining, and assembly, where Intellectual Property (IP) relating to sealing technologies, strain relief mechanisms, and modular design is crucial for market differentiation.

The downstream segment of the value chain is characterized by a complex distribution network catering to Original Equipment Manufacturers (OEMs), electrical contractors, system integrators, and maintenance, repair, and operations (MRO) service providers. Distribution channels are typically segmented into direct sales to large, strategic OEMs (like major industrial cabinet producers or automation integrators) and indirect sales through specialized industrial distributors, electrical wholesalers, and e-commerce platforms for smaller volume and aftermarket sales. Effective inventory management and technical support capabilities are vital downstream activities, as customers often require immediate availability of specific components and expert guidance on installation and regulatory compliance.

Direct distribution provides manufacturers with greater control over branding and pricing, ensuring that complex, custom-engineered solutions are correctly specified and implemented. Indirect channels, through specialized distributors, offer essential market reach, particularly into regional industrial hubs and the MRO segment. The success of the overall value chain relies on streamlined logistics, stringent quality control at the manufacturing level, and robust technical training provided downstream to ensure proper installation, which directly impacts the safety and sealing integrity of the end system. Customer feedback loops are also critical for informing R&D regarding emerging cable standards and application challenges.

Cable Entry Systems Market Potential Customers

Potential customers and end-users of Cable Entry Systems are diverse, encompassing virtually every industrial, commercial, and utility sector that utilizes electrical power and data transmission within protective enclosures. The largest customer group consists of Original Equipment Manufacturers (OEMs) who integrate these systems into their standard products, such as control panels, junction boxes, machinery, and robotics. System integrators and panel builders constitute another critical segment, as they require reliable, standardized, and often modular solutions to quickly assemble and certify complex control systems tailored for specific industrial applications across various sectors, ranging from food processing to material handling.

High-value customers include companies involved in capital-intensive industries characterized by harsh or regulated environments. This includes global energy companies (oil & gas drilling, petrochemical processing) needing ATEX/IECEx certified glands and conduits for explosive zones, and operators of critical infrastructure like data centers and telecommunications facilities, which prioritize high-density entry frames with superior EMC shielding capabilities to ensure data integrity. Furthermore, governmental and municipal entities involved in transportation (railway signaling, street lighting) and utility management are consistent buyers, prioritizing long-term durability, UV resistance, and minimal maintenance requirements for outdoor installations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.55 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Roxtec AB, Icotek GmbH, LAPP Group, HUMMEL AG, Pflitsch GmbH & Co. KG, Hylec-APL, Heyco Products Inc., Sealcon LLC, Agro AG, Altech Corporation, OMEGA Engineering Inc., Cabac, Conta-Clip Verbindungstechnik GmbH, HellermannTyton, Jacob GmbH, Wiska Hoppmann GmbH, Cortem Group, Amphenol Corporation, Phoenix Contact, Major Electronix. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cable Entry Systems Market Key Technology Landscape

The technological landscape of the Cable Entry Systems Market is driven by the need for simplified installation, enhanced sealing performance, and high-level compliance in demanding industrial settings. A major technological advancement is the proliferation of modular cable entry frames and split sealing technology. These systems allow pre-assembled cables (often with connectors already attached) to be routed through an enclosure wall, and then the sealing elements are separated and reassembled around the cable, significantly reducing installation time and eliminating the need to cut and re-terminate connectors. This modularity also facilitates easier expansion and maintenance, making them highly attractive to OEMs specializing in highly configurable machinery and industrial cabinets.

Another crucial technological focus is on materials science, particularly in developing advanced elastomers and plastics that offer superior performance characteristics. This includes Fire Retardant Low Smoke and Halogen Free (FR/LSZH) materials for use in public transport and sensitive environments, as well as specialized compounds offering high resistance to aggressive chemicals, oils, and extreme temperatures (both high and low). Simultaneously, significant effort is dedicated to improving Electromagnetic Compatibility (EMC) solutions. Modern EMC cable glands incorporate conductive inserts or integrated shielding techniques to ensure effective, 360-degree grounding of cable shields as they pass through the enclosure wall, which is essential for protecting complex electronic systems from electromagnetic interference.

Furthermore, digital integration and smart technologies are slowly entering the market. While cable entry systems are fundamentally passive components, technology is being applied to the installation and maintenance process. This includes QR codes or RFID tags on complex entry plates for easy identification, detailed digital instruction sets, and, in some nascent applications, integrated pressure equalization plugs that utilize membrane technology to prevent condensation buildup while maintaining the enclosure’s IP rating. The overall technological direction favors solutions that reduce human error during installation, maximize operational uptime, and comply effortlessly with the increasingly strict global standards governing electrical installations in automated and critical infrastructure environments.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand for Cable Entry Systems, reflecting differing levels of industrial maturity, regulatory stringency, and infrastructure investment priorities across the globe. Asia Pacific (APAC) dominates the market, primarily due to unprecedented rates of urbanization and industrialization across manufacturing powerhouses like China, India, and Southeast Asia. The region’s focus on establishing world-class manufacturing bases, combined with massive governmental expenditure on smart cities, railway networks, and telecommunications infrastructure, drives volume demand for both basic cable glands and advanced modular entry systems. The key challenge in APAC is balancing cost competitiveness with rising demands for international safety compliance.

Europe represents the second largest market, characterized by mature industrial sectors, stringent regulatory frameworks (e.g., machinery directives, ATEX), and a strong focus on high-quality, certified solutions. Countries like Germany, known for its expertise in high-end automation and mechanical engineering, demand premium, specialized products with superior IP and EMC performance. European demand is heavily influenced by the push towards renewable energy infrastructure (offshore wind farms) and strict requirements for safety and reliability in critical public transportation systems, leading to high adoption rates of fire-rated and environmentally robust entry solutions.

North America maintains a robust market position, driven largely by significant investments in the data center industry, the modernization of oil and gas infrastructure, and the resurgence of the manufacturing sector bolstered by governmental incentives. The region shows a high willingness to adopt innovative, quick-assembly technologies that minimize labor costs and improve installation efficiency. The demand here is often concentrated on NEMA-rated enclosures and systems compatible with established U.S. standards, focusing on durability and compliance in hazardous locations, particularly within the petrochemical and conventional energy sectors.

- Asia Pacific (APAC): Key growth engine fueled by mass industrial automation and infrastructure build-out; high volume demand from China, India, and ASEAN nations. Focus on balancing cost efficiency with emerging compliance needs.

- Europe: High-value market dominated by stringent regulatory demands and advanced manufacturing sectors (Germany, Italy). Strong adoption of premium, modular, and specialized EMC/ATEX certified systems.

- North America: Stable growth driven by telecommunications, hyperscale data center construction, and revitalization of the manufacturing base. Preference for quick-connect solutions and compliance with NEMA standards for hazardous environments.

- Latin America (LATAM): Emerging market primarily driven by infrastructure projects, mining, and oil & gas investments (Brazil, Mexico). Market growth is reliant on foreign direct investment and commodity price stability.

- Middle East & Africa (MEA): Growth centered around large-scale energy projects (Oil & Gas, Solar) and infrastructure development (Saudi Arabia, UAE). High demand for corrosion-resistant and high-temperature performance materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cable Entry Systems Market.- Roxtec AB

- Icotek GmbH

- LAPP Group

- HUMMEL AG

- Pflitsch GmbH & Co. KG

- Hylec-APL

- Heyco Products Inc.

- Sealcon LLC

- Agro AG

- Altech Corporation

- OMEGA Engineering Inc.

- Cabac

- Conta-Clip Verbindungstechnik GmbH

- HellermannTyton

- Jacob GmbH

- Wiska Hoppmann GmbH

- Cortem Group

- Amphenol Corporation

- Phoenix Contact

- Major Electronix

Frequently Asked Questions

Analyze common user questions about the Cable Entry Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a cable gland and a modular cable entry frame?

A cable gland is typically a single component used for one or two cables, providing basic sealing and strain relief through a threaded hole. A modular cable entry frame allows multiple cables (often pre-terminated) to pass through a non-threaded panel cutout using segmented, split sealing inserts, offering high-density routing and maintenance flexibility while preserving IP integrity.

Which industrial sectors are driving the highest demand for advanced cable entry systems?

The highest demand is currently driven by the Automation and Robotics sector, requiring high-density, dynamically reliable systems, and the Renewable Energy sector (especially offshore wind and solar), which mandates extreme environmental resistance and high IP ratings (IP68/IP69K) due to harsh operating conditions.

Why is Electromagnetic Compatibility (EMC) essential for modern cable entry solutions?

EMC is essential because modern industrial environments contain sensitive electronic devices and high-speed data cables susceptible to electromagnetic interference (EMI). EMC cable entry systems provide a reliable 360-degree contact and grounding path for the cable shield to the enclosure, protecting internal components from external noise and preventing internal noise from radiating outwards.

How do global safety regulations impact market growth and product design?

Stringent regulations (such as IP ratings, UL standards, and ATEX/IECEx for hazardous locations) significantly drive market growth by necessitating the use of certified, high-quality products. These regulations force manufacturers to continuously innovate in material science and sealing technology to ensure compliance, effectively serving as a barrier to uncertified, low-quality solutions.

What material is preferred for cable entry systems in corrosive environments like marine or chemical processing?

For severely corrosive environments, Stainless Steel (typically 303, 304, or 316) cable glands and frames are preferred due to their superior chemical resistance and mechanical durability compared to brass or plastic alternatives. Specialized, high-performance plastics like PVDF may also be used where weight or specific chemical resistance is required.

The extensive analysis of the Cable Entry Systems Market highlights its foundational role within global industrial modernization and critical infrastructure development. The market is transitioning from simple, general-purpose components towards highly engineered, application-specific modular solutions. This shift is primarily driven by the escalating requirements for operational efficiency, absolute reliability, and strict compliance with global safety standards. Manufacturers successful in this environment are those who leverage advanced materials, invest heavily in simplified installation technologies (quick-connect, split sealing), and maintain rigorous certification processes to address the niche demands of high-growth sectors such as robotics, data centers, and renewable energy. The strong regional growth observed in APAC, coupled with the high-value demand in Europe and North America, ensures a stable and continuously expanding market trajectory throughout the forecast period. The integration of digital tools and AI in the design and manufacturing process promises further efficiencies, solidifying the market’s responsiveness to the dynamic needs of Industry 4.0 environments. Continuous regulatory pressure will remain the paramount non-market force dictating product specifications and driving innovation in sealing integrity and electromagnetic shielding capabilities.

The competitive landscape features a mix of multinational conglomerates and specialized regional manufacturers, all striving to achieve a competitive advantage through technological differentiation and supply chain optimization. Key strategic movements include mergers and acquisitions aimed at consolidating specialized expertise, and strategic partnerships focused on co-developing solutions for emerging technologies like high-voltage direct current (HVDC) transmission or autonomous vehicle infrastructure. Future market penetration strategies are expected to center around providing complete end-to-end cable management packages, rather than standalone components, encompassing pre-wired solutions, customized enclosure design support, and comprehensive regulatory consultation services. This holistic approach will be essential to capture large-scale OEM contracts and maximize long-term customer retention across diversified industrial platforms.

Detailed examination of the Value Chain reveals that material quality and manufacturing precision are non-negotiable value drivers, given the safety-critical nature of these products. Distribution efficiency, especially through specialized industrial channels capable of providing expert technical support, is equally vital for market success. The shift towards e-commerce platforms is providing new avenues for smaller purchasers (MRO) to access standardized products, but complex, certified systems still rely heavily on direct or technically supported sales channels. Ultimately, the sustained growth of the Cable Entry Systems Market is inextricably linked to global capital investment in industrial assets, automation technologies, and resilient infrastructure that demands guaranteed ingress protection and strain relief for mission-critical electrical and data cabling.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager