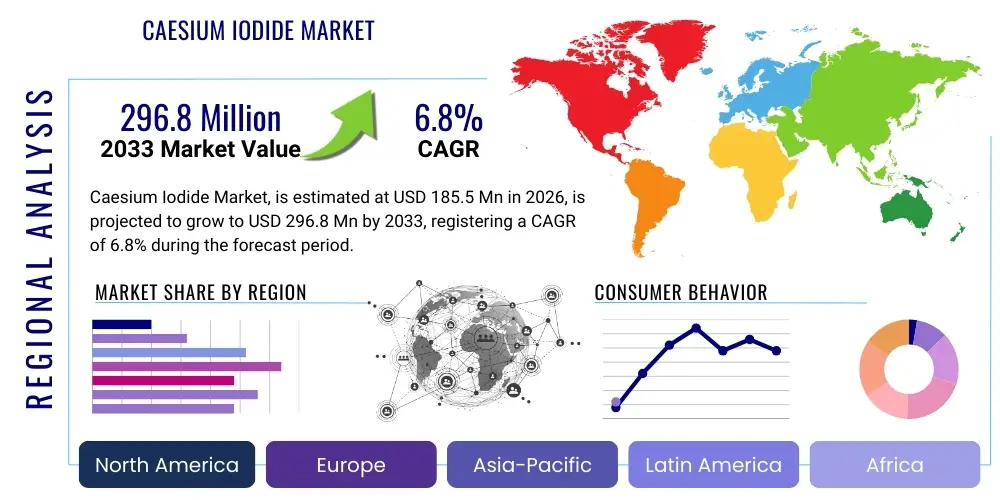

Caesium Iodide Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436342 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Caesium Iodide Market Size

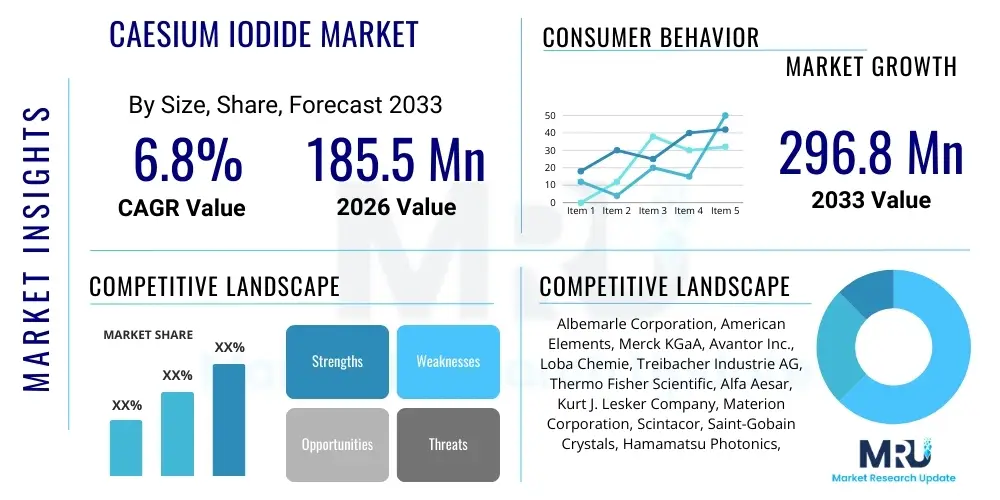

The Caesium Iodide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $185.5 million in 2026 and is projected to reach $296.8 million by the end of the forecast period in 2033.

Caesium Iodide Market introduction

Caesium Iodide (CsI) is a hygroscopic, colorless crystalline salt, prized primarily for its applications in scintillation detection and infrared optics. Its high density and atomic number make it exceptionally effective at absorbing high-energy radiation, such as X-rays and gamma rays, converting this energy into detectable light photons. This unique property positions CsI as a critical material in environments ranging from medical diagnostics, where it enhances imaging quality in digital radiography, to high-security contexts for nuclear material detection. The material exists typically as either pure CsI or doped with Thallium (CsI(Tl)), Sodium (CsI(Na)), or other activators to optimize light output and spectral characteristics for specific detector designs. The versatility of CsI across various sectors underpins its sustained demand within the high-performance materials market. The chemical stability and structural integrity of CsI crystals, despite its hygroscopicity requiring careful handling and packaging, are fundamental to its adoption in critical applications like space instrumentation and military surveillance systems where reliability is paramount.

The core applications of Caesium Iodide revolve around its function as a scintillator, specifically in forming large, stable crystals used in gamma spectroscopy and particle physics research, or as thin films essential for flat-panel digital X-ray detectors (DR panels). In medical imaging, the shift from traditional film-based systems to digital radiography is a major market driver, as CsI offers superior resolution and dose efficiency compared to older phosphors. Furthermore, its transparency across a wide spectrum, particularly in the infrared region, qualifies pure CsI for use in optical windows, prisms, and beam splitters, capitalizing on its relatively low refractive index and high transmittance. This dual functionality across radiation detection and specialized optics ensures a diversified demand profile, insulating the market against reliance on any single application segment.

Key market benefits driving adoption include high light yield, excellent stopping power, and the ability to grow large, uniform crystals necessary for highly sensitive detectors. The market is also heavily influenced by regulatory standards regarding radiation safety in nuclear facilities and medical practices, which continuously push the need for more efficient and accurate detection materials. The increasing global investment in national security infrastructure, specifically concerning monitoring nuclear materials and controlling illicit trafficking, further amplifies the demand for high-performance CsI detectors. Challenges, such as the volatility of raw material prices and the complex, energy-intensive crystal growth process, necessitate continuous technological improvements to maintain cost competitiveness and supply chain stability. These factors collectively contribute to a complex yet growing market landscape.

Caesium Iodide Market Executive Summary

The Caesium Iodide market is currently characterized by significant growth momentum, fueled primarily by the accelerated digitalization of medical imaging technologies globally and heightened defense and homeland security expenditures focused on radiation detection. Geographically, the Asia Pacific region is emerging as the dominant market force, driven by massive infrastructure expansion in healthcare and the proliferation of sophisticated electronics manufacturing capabilities, particularly in China and South Korea, which are major producers and consumers of DR panels. Business trends indicate a strong vertical integration strategy among leading players, aiming to control the highly technical crystal growth process and secure the supply of high-purity caesium compounds. This strategic control mitigates the risks associated with raw material sourcing and ensures consistent quality necessary for stringent end-user requirements in aerospace and high-energy physics. The consolidation of supply chains and investment in advanced purification techniques are central to sustaining market leadership.

Segment trends highlight the scintillation application segment as the largest revenue generator, primarily due to robust demand from portable security devices and advanced SPECT/PET scanners in clinical settings. Within this segment, thallium-doped Caesium Iodide (CsI(Tl)) remains the material of choice for large-volume detectors due to its superior mechanical stability and light emission properties. Concurrently, the high-purity grade segment is witnessing accelerated demand, mandated by the strict performance parameters of high-resolution X-ray imagers and advanced nuclear spectroscopy systems where trace impurities can severely degrade performance. The push for miniaturization and enhanced portability in detection equipment is compelling manufacturers to invest heavily in thin-film deposition techniques and flexible substrate technologies, indicating a future market shift towards compact, high-efficiency sensor arrays.

The technological landscape is increasingly focused on automated crystal growth systems utilizing the Bridgman or Czochralski methods to improve yield and reduce operational costs, addressing the historical challenge of expensive manufacturing. Furthermore, environmental regulations concerning the handling of hazardous materials and nuclear waste are indirectly shaping the demand for highly durable and sensitive detection equipment, ensuring that CsI-based solutions remain integral to safety protocols. The market exhibits characteristics typical of a specialized material sector: high barriers to entry due to capital intensity and intellectual property surrounding crystal growth, resulting in a competitive but concentrated market structure where quality and technical expertise are paramount differentiators. Overall, favorable regulatory environments supporting nuclear medicine and tightening global security measures guarantee sustained positive market dynamics throughout the forecast period.

AI Impact Analysis on Caesium Iodide Market

Common user inquiries regarding AI's influence on the Caesium Iodide market often center on three key areas: optimizing the complex crystal growth process, enhancing the performance and efficiency of CsI-based detectors, and accelerating new material discovery. Users frequently ask how machine learning algorithms can predict and control temperature gradients and pull rates in Czochralski and Bridgman furnaces to maximize crystal quality and minimize defect density, thereby reducing waste and cost—a significant concern given the high price of CsI. Another major theme involves AI's role in improving data interpretation, specifically in sophisticated medical imaging and nuclear spectroscopy. AI is expected to enable faster and more accurate discrimination between background noise and specific radiation signatures, effectively increasing the practical sensitivity and reliability of CsI detectors without requiring physical hardware modifications. Finally, users are keen on understanding how AI-driven material informatics can identify novel dopants or composite materials that might overcome CsI’s inherent vulnerability to moisture (hygroscopicity) or offer even higher light yield, potentially leading to next-generation scintillators.

The integration of Artificial Intelligence and machine learning models provides a substantial technological leverage point for manufacturers dealing with the highly specialized production of Caesium Iodide crystals. AI algorithms can process vast amounts of real-time sensor data collected during the crystal growth cycle—including thermal profiles, pressure variations, and melt composition—to identify optimal operating parameters that yield large, defect-free monocrystals consistently. This predictive modeling capability reduces the dependence on empirical trials and human expertise, dramatically improving material quality suitable for high-end applications like space exploration instruments and high-resolution medical detectors, thus accelerating the time-to-market for optimized CsI products. The utilization of these smart manufacturing techniques directly addresses the market restraint related to high production costs and complexity.

Beyond manufacturing, AI significantly enhances the utility of CsI detectors in end-user environments. In digital radiography, deep learning models analyze the scintillation patterns captured by CsI thin films, allowing for advanced noise reduction, artifact suppression, and contrast enhancement, which translates directly into lower required radiation doses for patients while maintaining diagnostic clarity. In security and nuclear applications, AI enables automated classification and identification of isotopes, drastically reducing false positives and improving the speed of threat assessment in real-time monitoring systems such as port scanners and handheld radiation identifiers. This enhancement in data fidelity and processing speed elevates the overall value proposition of CsI-based systems, ensuring they remain competitive against alternative detection technologies.

- AI optimizes Caesium Iodide crystal growth parameters (temperature, pressure) to minimize defects and increase yield.

- Machine learning enhances real-time radiation signature classification in security and nuclear detection, improving accuracy.

- Deep learning algorithms reduce noise and enhance image quality in digital radiography, enabling lower radiation doses.

- AI accelerates the discovery and testing of new CsI dopants or protective coatings to address hygroscopicity challenges.

- Predictive maintenance driven by AI minimizes downtime for expensive crystal growing equipment.

- Automated quality control systems using computer vision ensure the structural integrity of finished CsI components.

DRO & Impact Forces Of Caesium Iodide Market

The Caesium Iodide market is driven by robust growth in nuclear medicine, increasing global security concerns necessitating advanced radiation detection equipment, and the irreversible technological transition towards digital radiography in healthcare globally. These drivers create substantial impact forces, particularly in areas like high-resolution imaging and homeland security applications. However, significant restraints impede growth, primarily revolving around the material's inherent hygroscopicity, which mandates complex and costly encapsulation processes, and the high capital investment required for high-purity crystal manufacturing. Opportunities exist in the development of flexible and transparent CsI thin-films for wearable detectors and the exploration of novel composite scintillators that integrate CsI properties while mitigating its moisture sensitivity, offering pathways for sustained long-term market expansion and addressing current technological limitations. These intertwined dynamics define the competitive landscape and strategic imperatives for market participants.

Key drivers include the global aging population, which heightens the demand for diagnostic imaging procedures (CT, SPECT, PET) where CsI scintillators are integral components for precise detection of radiotracers. Furthermore, geopolitical instability and the resulting increase in defense spending globally contribute directly to the need for advanced, ruggedized radiation monitoring devices utilized by military and customs agencies for nuclear material safeguards. The superior stopping power and high light output of CsI(Tl) make it indispensable in these highly sensitive applications. Technological advancements enabling the production of large-area CsI detectors also facilitate the manufacturing of advanced digital detectors used in industrial non-destructive testing, expanding the market scope beyond traditional medical and nuclear sectors.

Conversely, the high cost and scarcity of high-purity Caesium raw materials present a continuous supply chain challenge, leading to price volatility that can affect manufacturing margins. The technical difficulty in growing large, homogenous, single CsI crystals without internal stress or defects limits production capacity and constitutes a major restraint. The high sensitivity of CsI to environmental moisture requires manufacturers to maintain stringent control over humidity during processing, packaging, and integration into final products, adding substantial complexity and cost. Despite these hurdles, emerging applications in personalized medicine and high-energy physics research, coupled with advancements in protective coating technologies, offer substantial commercial opportunities for specialized material producers capable of solving the hygroscopicity problem and achieving scalable, cost-effective production.

Segmentation Analysis

The Caesium Iodide market is segmented based on several critical parameters, including Application, Grade, and End-Use, reflecting the diversity of technical requirements across sectors. The primary segmentation revolves around the distinct physical forms and chemical compositions required by different applications; for instance, high-purity, undoped CsI is essential for specialized optical components due to its superior infrared transmission, while CsI doped with Thallium or Sodium is optimized specifically for scintillation detection, maximizing light yield for gamma and X-ray interaction. Understanding these segmentation nuances is vital for manufacturers to tailor production processes—ranging from bulk crystal growth for scintillators to precise vacuum deposition for thin-film detectors—to meet the exacting standards of aerospace and medical imaging end-users.

The Grade segmentation is crucial, differentiating between standard industrial grades and ultra-high-purity grades required for advanced detection systems where background noise must be minimized. High-purity CsI demands intensive purification techniques, such as zone refining, to remove trace elements that act as quenching centers, reducing light output. This technical requirement translates directly into higher costs and specialized manufacturing expertise, creating a natural distinction in the market offering. The End-Use segmentation highlights the economic weight of the medical sector, which dominates demand due to the pervasive adoption of digital radiography, followed by the robust and mission-critical needs of the Nuclear Detection and Homeland Security sectors that prioritize detector reliability and longevity in harsh environments. The continuous evolution of these segments is driven by technological advances in sensor design and increasing regulatory pressure for improved safety and diagnostic accuracy.

- By Application:

- Scintillators (Thallium-doped CsI(Tl), Sodium-doped CsI(Na), Undoped CsI)

- Optical Components (Prisms, Windows, Beam Splitters)

- X-ray Image Intensifiers and Detectors (Flat Panel Detectors)

- By Grade:

- High Purity Grade (99.999% and above)

- Standard Grade (99.9% to 99.99%)

- By End-Use Industry:

- Medical Imaging (Digital Radiography, CT Scanners, Nuclear Medicine)

- Nuclear Detection and Safety (SPECT, PET, Environmental Monitoring)

- Homeland Security and Defense (Portal Monitors, Handheld Identifiers)

- Aerospace and Scientific Research (Space Instrumentation, High Energy Physics)

Value Chain Analysis For Caesium Iodide Market

The value chain for the Caesium Iodide market is intricate, beginning with the highly specialized and globally concentrated sourcing of critical raw materials, primarily Caesium minerals and high-purity Iodine. Upstream activities are dominated by a limited number of specialized chemical companies focusing on extracting and refining these elements to the extreme purity levels required for crystal growth. Caesium extraction, often from pollucite ores, is capital-intensive and geographically constrained, leading to high bargaining power for upstream suppliers. Midstream processing involves the technically challenging synthesis of CsI powder and the subsequent growth of single crystals, requiring highly controlled environments utilizing complex techniques like the Bridgman and Czochralski methods, which represents the highest value-addition step in the chain due to the intellectual property and capital required.

Downstream activities involve the fabrication and integration of the finished CsI components into detection systems. This includes cutting, polishing, and encapsulation of the hygroscopic crystals, often performed by specialized crystal manufacturers or vertically integrated detector producers. The distribution channel is characterized by direct sales to Original Equipment Manufacturers (OEMs) in the medical (e.g., Siemens, GE Healthcare) and defense sectors, who integrate the components into final products like digital X-ray machines or radiation portal monitors. Indirect distribution involves specialized third-party integrators and distributors who supply smaller research institutions, academic labs, and niche industrial clients, ensuring market reach across diverse, smaller volume end-users.

The efficiency of the value chain is heavily dependent on minimizing material waste during the crystal growth phase, as raw material costs are substantial. Direct distribution channels are prevalent for large volume, long-term contracts with major medical and defense contractors, facilitating customized product specifications and detailed quality control. Conversely, indirect distribution often serves the research and academic community, supplying standard-grade CsI crystals and powders. The critical nexus in the chain is the transition from raw CsI crystal to encapsulated, functional detector component; technological leadership in protective coating and mounting is essential for downstream success, mitigating the material’s moisture vulnerability and enhancing operational lifespan in real-world deployment.

Caesium Iodide Market Potential Customers

The primary consumers and end-users of Caesium Iodide are high-technology manufacturers specializing in radiation detection and specialized optical instrumentation. The largest customer segment encompasses Original Equipment Manufacturers (OEMs) within the Medical Imaging sector, specifically those producing Digital Radiography (DR) flat panel detectors, Computed Tomography (CT) systems, and specialized nuclear medicine modalities like SPECT and PET scanners. These manufacturers require large volumes of high-purity, often thallium-doped, CsI scintillators or thin-film arrays to achieve the high resolution and rapid image acquisition demanded by modern clinical practice. The decision-making unit in this segment focuses intensely on material quality, consistency, and long-term supply agreements to ensure product reliability and regulatory compliance.

Another crucial customer segment is government agencies and defense contractors involved in Homeland Security and Nuclear Safeguards. These entities procure CsI detectors for use in handheld radiation identifiers, portal monitors at border crossings, and environmental monitoring stations. Customers in this high-reliability sector prioritize ruggedness, long operational life, and extreme sensitivity to detect low levels of illicit nuclear materials. The stringent performance specifications often mandate the highest grades of CsI, making these customers premium buyers, often through complex procurement processes involving detailed technical tenders and long lead times for certification.

Finally, scientific research institutions, universities, and aerospace agencies constitute a vital, albeit lower volume, customer base. These organizations utilize both doped and undoped CsI for fundamental physics research, high-energy particle detection experiments, and space-based instruments requiring radiation-hardened components capable of operating in extreme vacuum and thermal cycling environments. These specialized buyers seek customized geometries, ultra-high-purity grades, and often partner directly with material scientists for bespoke product development, focusing on performance metrics that surpass typical commercial standards. This segment drives innovation in exotic crystal growth and specialized encapsulation techniques.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185.5 Million |

| Market Forecast in 2033 | $296.8 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Albemarle Corporation, American Elements, Merck KGaA, Avantor Inc., Loba Chemie, Treibacher Industrie AG, Thermo Fisher Scientific, Alfa Aesar, Kurt J. Lesker Company, Materion Corporation, Scintacor, Saint-Gobain Crystals, Hamamatsu Photonics, RMD Inc., ZK&A Corporation, Crytur spol. s r.o., Beijing Opto-Electronics Technology Co. Ltd., Sigma-Aldrich (a part of Merck KGaA), T-Materials, Atom Trace s.r.o. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Caesium Iodide Market Key Technology Landscape

The technological landscape of the Caesium Iodide market is primarily defined by highly specialized crystal growth, material purification, and advanced thin-film deposition techniques. Crystal growth methods, notably the vertical Bridgman technique and the Czochralski method, are paramount, as they determine the final physical properties, size, and uniformity of the CsI scintillators. Continuous innovation focuses on automating these processes and controlling the thermal environment with precision to achieve large-diameter, high-quality monocrystals with minimal internal stress. The success of these techniques directly impacts the light yield and energy resolution of the final detector, making them a significant competitive differentiator. Furthermore, advancements in doping control—such as precisely regulating Thallium concentration—are critical to optimize the scintillation emission spectrum for coupling with specific photodetectors (e.g., photodiodes or photomultiplier tubes).

Material purification is an equally essential technological domain. Given the demanding requirements of nuclear detection, trace metallic impurities must be reduced to parts per billion levels, as these can severely quench the scintillation light. Technologies like zone refining and sophisticated fractional crystallization are employed to purify the raw Caesium and Iodine precursors before synthesis. The technological capability to manage these ultra-clean processing environments is a high barrier to entry. Moreover, the shift toward digital X-ray detectors necessitates expertise in vacuum thermal evaporation (VTE) techniques, where CsI is deposited as a highly structured thin-film onto large-area substrates. Achieving optimal columnar growth in these films is crucial for efficient light transmission and resolution in flat panel detectors, representing a complex material science challenge.

A critical emerging area involves encapsulation and surface treatment technologies designed to counteract CsI’s inherent hygroscopicity. Novel, moisture-resistant polymers, atomic layer deposition (ALD) coatings, and hermetic sealing techniques are being researched and implemented to ensure the longevity and stability of CsI crystals in non-laboratory settings, particularly in defense and field-deployed medical equipment. Furthermore, the development of flexible electronics is driving research into flexible CsI thin-film sensors grown on plastic or polymer substrates, promising the next generation of wearable radiation dosimeters and large, conformal imaging arrays. Intellectual property surrounding these deposition and encapsulation methodologies holds significant commercial value and drives strategic partnerships between material suppliers and detector system integrators.

Regional Highlights

The global Caesium Iodide market exhibits distinct regional dynamics driven by varying levels of healthcare investment, defense spending, and technological manufacturing prowess. Asia Pacific (APAC) stands out as the fastest-growing and largest regional market, attributed primarily to massive governmental investments in modernizing healthcare infrastructure, especially in rapidly expanding economies like China and India, leading to widespread adoption of digital radiography. APAC is also a major manufacturing hub for electronic components, including flat panel detectors, which leverages local supply chain advantages. North America and Europe, while growing at a more moderate pace, maintain leadership in high-end research applications, nuclear safety, and aerospace instrumentation, focusing heavily on ultra-high-purity grades and complex custom detector assemblies.

- Asia Pacific (APAC): Dominant market share fueled by rapid healthcare digitization (Digital Radiography adoption), expanding electronics manufacturing base (especially for DR panels), and increasing R&D activities in nuclear physics. Key consumers include China, South Korea, and Japan.

- North America: High demand stems from substantial defense and homeland security expenditures, rigorous nuclear regulatory frameworks, and advanced medical research. Focuses heavily on high-purity CsI for SPECT/PET systems and specialized space instrumentation (NASA, DoD contracts).

- Europe: Strong market driven by the modernization of nuclear power plants, stringent environmental radiation monitoring requirements, and a robust medical device industry (Germany, France). Significant R&D activity in fundamental physics (CERN) demanding large CsI crystals.

- Latin America (LATAM): Emerging market characterized by increasing investment in medical infrastructure upgrades and the slow but steady adoption of digital imaging technologies in major economies like Brazil and Mexico, creating a growing need for standard-grade CsI components.

- Middle East and Africa (MEA): Growth potential tied to infrastructure projects, increasing oil and gas exploration (requiring radiation safety monitoring), and defense spending, though adoption remains constrained by high cost and logistical challenges. Focus on essential medical diagnostics equipment upgrades.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Caesium Iodide Market.- Albemarle Corporation

- American Elements

- Merck KGaA

- Avantor Inc.

- Loba Chemie

- Treibacher Industrie AG

- Thermo Fisher Scientific

- Alfa Aesar

- Kurt J. Lesker Company

- Materion Corporation

- Scintacor

- Saint-Gobain Crystals

- Hamamatsu Photonics

- RMD Inc.

- ZK&A Corporation

- Crytur spol. s r.o.

- Beijing Opto-Electronics Technology Co. Ltd.

- Sigma-Aldrich (a part of Merck KGaA)

- T-Materials

- Atom Trace s.r.o.

Frequently Asked Questions

Analyze common user questions about the Caesium Iodide market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of Caesium Iodide in the medical field?

Caesium Iodide is critically used in medical imaging, particularly as the primary scintillator material in Digital Radiography (DR) flat panel detectors, enabling high-resolution X-ray imaging with reduced patient radiation dose. It is also essential in nuclear medicine modalities like SPECT and PET scanners.

Why is high purity essential for Caesium Iodide in detection applications?

High purity (often 99.999% or higher) is crucial because trace metallic impurities can act as quenching centers, significantly reducing the scintillation light output and consequently degrading the energy resolution and sensitivity required for accurate radiation detection in nuclear safety and high-energy physics.

What is the main challenge associated with handling and using Caesium Iodide?

The main challenge is its high hygroscopicity, meaning CsI readily absorbs moisture from the atmosphere. This necessitates complex and costly hermetic sealing or protective coatings to prevent crystal degradation and maintain optical performance, particularly in humid or harsh operating environments.

Which geographical region dominates the consumption and manufacturing of CsI components?

The Asia Pacific (APAC) region currently dominates the market, driven by its expansive manufacturing capacity for flat panel detectors and significant governmental investment in upgrading medical imaging technology across countries like China, South Korea, and Japan.

How do the Thallium-doped and undoped forms of Caesium Iodide differ in application?

Thallium-doped CsI (CsI(Tl)) is the leading scintillator material, optimized for high light output when interacting with radiation. Undoped, high-purity CsI is primarily utilized for specialized infrared optical components, such as windows and prisms, due to its excellent transparency across a broad spectrum.

The extensive application potential of Caesium Iodide (CsI) across critical sectors necessitates a deep understanding of its material science and manufacturing processes. The market's complexity stems from the need to manage its hygroscopic nature while consistently achieving ultra-high purity required for high-performance scintillation. The ongoing transition towards digital imaging, coupled with escalating global security mandates, guarantees robust demand for CsI-based components, particularly those integrated into advanced detector arrays and portable security devices. The industry is responding through focused technological investments in automated crystal growth systems, which leverage precise thermal control and predictive modeling to improve yield and reduce defects—a crucial strategy given the high cost of raw Caesium materials. This manufacturing efficiency is key to expanding market accessibility beyond high-budget defense and nuclear research sectors into broader medical and industrial applications. Furthermore, the integration of advanced data processing techniques, specifically Artificial Intelligence (AI) and machine learning, is beginning to fundamentally alter the performance envelope of CsI detectors. AI enhances the ability of these systems to interpret complex scintillation signals, improving signal-to-noise ratios and enabling faster, more accurate classification of radiation sources in security applications, thereby increasing the effective utility of existing hardware. This digital transformation is setting a new standard for sensor efficacy and reliability in demanding environments.

Future growth trajectories are heavily reliant on overcoming the inherent material constraint of moisture sensitivity. Significant R&D efforts are concentrated on developing highly durable protective coatings, including multilayer polymer films and specialized hermetic seals, which allow CsI detectors to be reliably deployed in non-controlled environments without compromising performance integrity. These advancements are opening up new market segments, such as flexible and wearable radiation monitoring devices, which require CsI deposited as thin films on flexible substrates. The strategic focus on integrating CsI components into miniaturized, robust, and highly efficient sensor arrays ensures its continued relevance in a market that demands greater portability and reliability. The supply chain, currently concentrated in upstream sourcing of Caesium, remains a point of vulnerability, driving major players toward vertical integration to secure consistent access to high-purity precursors. This ensures quality control from raw material to final integrated component, safeguarding high-end applications like aerospace and mission-critical defense systems. The continuous interplay between material science innovation, advanced manufacturing, and strategic supply chain management will define the competitive dynamics of the Caesium Iodide market through 2033.

The global outlook for the Caesium Iodide market remains highly positive, underpinned by non-cyclical demand from the healthcare sector and sustained government investment in security and defense technology. Regional disparities in growth rates reflect differing stages of technological adoption and infrastructure maturity; while APAC leads in volume manufacturing and overall market size due to digital health transitions, North America and Europe maintain dominance in high-value, research-intensive applications demanding the highest purity grades. Investment in high-throughput automated crystal growth, combined with novel encapsulation techniques, will be crucial for companies seeking market share expansion. The strategic importance of CsI as an enabling material for critical national infrastructure—ranging from early cancer detection to global nuclear safeguards—ensures its long-term viability and projected growth well above the average for specialized chemical materials. Manufacturers must prioritize quality assurance and technological differentiation, especially concerning light yield and uniformity, to maintain a competitive edge in serving demanding OEMs across the medical and security spheres.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager