Calcium Acetate Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434640 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Calcium Acetate Powder Market Size

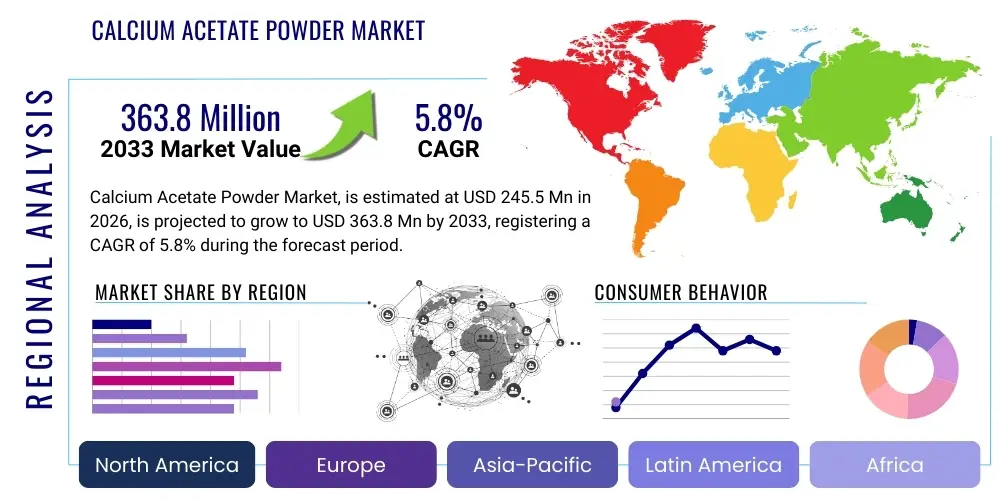

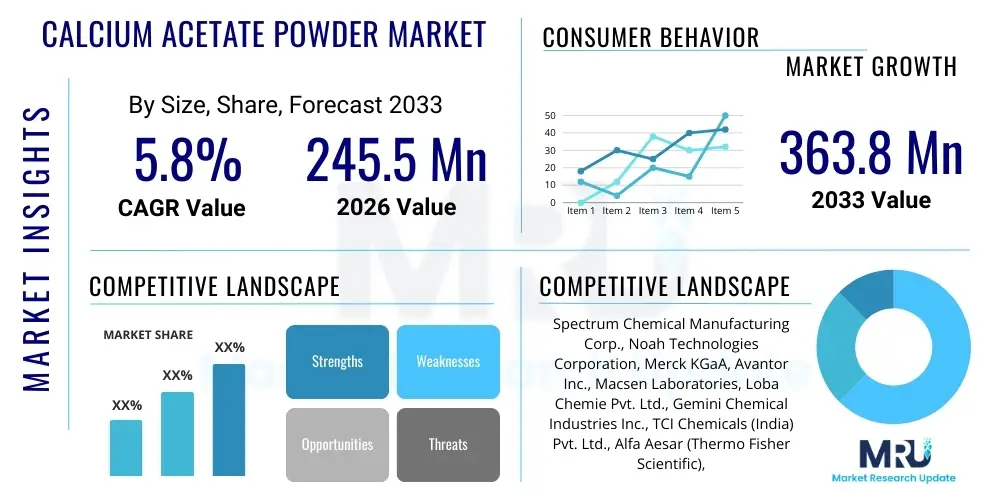

The Calcium Acetate Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 245.5 Million in 2026 and is projected to reach USD 363.8 Million by the end of the forecast period in 2033.

Calcium Acetate Powder Market introduction

The Calcium Acetate Powder market involves the production and distribution of the calcium salt of acetic acid, a versatile compound represented by the chemical formula Ca(C2H3O2)2. This white, odorless, crystalline powder is highly soluble in water and functions primarily as a source of calcium, a chelating agent, a buffering agent, and a potent preservative. Its major applications span critical sectors including pharmaceuticals, food and beverage, industrial chemicals, and wastewater treatment, driven by its efficacy in controlling phosphate levels in medical treatments and enhancing stability and preservation in food products. The compound’s non-toxic nature in regulated quantities and its regulatory approval across major economies contribute significantly to its expanding commercial utilization. A key driving factor for market growth is the rising global incidence of chronic kidney disease (CKD), necessitating increased demand for pharmaceutical- grade calcium acetate for hyperphosphatemia treatment.

Calcium Acetate Powder Market Executive Summary

The Calcium Acetate Powder Market is experiencing robust growth driven predominantly by escalating demand from the pharmaceutical sector, particularly for phosphate binding in renal failure patients, coupled with continuous expansion in the processed food industry, where it serves as a crucial additive. Business trends indicate a strong focus on capacity expansion among key manufacturers, prioritizing high-purity, USP/EP grade production to meet stringent healthcare regulations, leading to strategic partnerships between pharmaceutical formulation companies and specialized chemical suppliers. Regionally, the Asia Pacific (APAC) market is poised for the fastest expansion, fueled by rapid industrialization, increasing awareness regarding wastewater management, and growing healthcare infrastructure, while North America and Europe remain mature markets characterized by established regulatory frameworks and high consumption rates in advanced dialysis treatments. Segment trends show that the Pharmaceutical Grade segment maintains the highest value share due to premium pricing, whereas the Food Grade segment contributes significantly to volume, propelled by consumer demand for fortified and preserved food items, necessitating continuous innovation in granulation and packaging technologies to ensure product stability and ease of application across diverse end-use verticals.

AI Impact Analysis on Calcium Acetate Powder Market

Common user questions regarding AI's impact on the Calcium Acetate Powder market frequently revolve around how artificial intelligence can optimize synthesis processes, improve quality control for pharmaceutical grades, and enhance supply chain resilience. Users are particularly interested in the application of machine learning for predictive maintenance in manufacturing facilities, optimizing raw material input ratios (calcium carbonate and acetic acid) to maximize yield and purity, and utilizing AI-driven analytics to forecast demand fluctuations across diverse end-user sectors like healthcare and wastewater management. Concerns often center on the initial investment costs associated with integrating complex AI systems and ensuring the reliability of AI models in highly regulated environments like pharmaceutical production, where deviations in purity can have critical consequences. The overarching expectation is that AI will introduce unprecedented levels of efficiency and precision, leading to significant cost reductions and faster time-to-market for specialized powder grades.

- AI-driven optimization of chemical reaction parameters reduces waste and enhances the purity of pharmaceutical-grade output.

- Predictive maintenance algorithms minimize unplanned downtime in high-volume spray drying and crystallization equipment.

- Machine learning improves quality assurance by instantly analyzing spectral data for impurity detection, surpassing manual inspection capabilities.

- AI-powered demand forecasting enhances inventory management, reducing storage costs and preventing supply shortages in critical healthcare applications.

- Robotics and automation, guided by AI, streamline complex packaging and handling processes, particularly for moisture-sensitive powder forms.

- Simulation models utilizing AI help manufacturers design new, cost-effective synthesis routes for technical and industrial grades.

- Advanced supply chain tracking using AI provides real-time visibility, enhancing transparency and compliance for global distribution networks.

DRO & Impact Forces Of Calcium Acetate Powder Market

The Calcium Acetate Powder market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities, collectively forming the core Impact Forces. Key drivers include the increasing prevalence of Chronic Kidney Disease (CKD) globally, which mandates the use of pharmaceutical-grade calcium acetate as a primary phosphate binder, significantly stabilizing high-value demand. Furthermore, stricter environmental regulations concerning phosphate discharge in industrial and municipal wastewater accelerate the adoption of calcium acetate as an efficient, non-toxic flocculant and removal agent, particularly in rapidly urbanizing regions. These forces create a sustainable, bifurcated demand structure spanning both high-value medical applications and high-volume industrial uses.

However, the market faces significant restraints, primarily centered around the volatility of key raw material prices, particularly glacial acetic acid and high-purity calcium sources, which directly impacts production costs and profit margins. Additionally, the availability of substitute phosphate binders, such as sevelamer carbonate and lanthanum carbonate, especially in developed markets, poses a competitive challenge to the market share of pharmaceutical-grade calcium acetate. Strict regulatory requirements for pharmaceutical and food applications necessitate complex and costly certification processes, acting as a barrier to entry for smaller manufacturers and prolonging product development cycles, thereby slowing market expansion in specialized segments.

Opportunities for growth are concentrated in technological advancements focused on developing novel, customized powder forms, such as microencapsulated or highly granulated calcium acetate, which offer improved solubility and bioavailability for specific applications like dietary supplements and advanced concrete additives. Geographic expansion into emerging markets, particularly across Southeast Asia and Latin America, presents substantial opportunities due to underdeveloped wastewater infrastructure and rapidly growing pharmaceutical consumption. Strategic mergers and acquisitions aimed at consolidating raw material sourcing and optimizing distribution channels represent tactical opportunities to enhance cost-competitiveness and secure market dominance against competing products.

Segmentation Analysis

The Calcium Acetate Powder market is comprehensively segmented based on its Purity Grade, End-Use Application, and Physical Form, providing a granular view of market dynamics and catering to specific industry requirements. The purity grade segmentation is the most critical, dictating regulatory compliance and pricing, where pharmaceutical grade commands the highest value due to stringent purity standards required for medical use, while technical grade focuses on bulk industrial applications like construction and textile processing. End-use application segmentation highlights the diversification of demand, with pharmaceuticals, food preservation, and environmental applications being the major revenue contributors, reflecting the compound's versatile chemical properties. Understanding these segmentation nuances is vital for manufacturers to tailor their production processes and marketing strategies effectively to maximize revenue across distinct, highly regulated segments.

- By Purity Grade:

- Pharmaceutical Grade (USP/EP)

- Food Grade (FCC/E263)

- Technical Grade

- By End-Use Application:

- Pharmaceuticals (Hyperphosphatemia Treatment)

- Food & Beverage (Preservative, Stabilizer, Calcium Fortification)

- Wastewater Treatment (Phosphate Removal)

- Chemical Manufacturing

- Textiles

- Construction (Cement Additives)

- Animal Feed

- By Physical Form:

- Powder

- Granules

- Flakes

Value Chain Analysis For Calcium Acetate Powder Market

The value chain for Calcium Acetate Powder begins with the procurement of essential precursor chemicals, primarily high-purity calcium carbonate (or lime) and glacial acetic acid. This upstream segment is characterized by specialized chemical producers who supply consistent, quality raw materials. The cost and availability of these upstream components directly dictate the profitability and price stability of the finished product. Manufacturing processes involve sophisticated chemical synthesis, crystallization, and drying stages. For pharmaceutical and food grades, manufacturers invest heavily in advanced processing techniques such as cleanroom environments and meticulous quality control (QC) testing, ensuring compliance with global regulatory bodies like the FDA and EMA.

The midstream stage involves formulation and conversion into the final powder, granule, or flake form, often utilizing spray drying technology to achieve specific particle sizes and flow characteristics required by end-users. Distribution channels are highly varied; large-scale bulk purchasers, such as municipal water treatment plants and major pharmaceutical companies, frequently engage in direct purchase agreements to ensure stable supply and technical support. This direct model optimizes logistics and inventory management for both parties, securing long-term contractual relationships and minimizing intermediaries.

Conversely, indirect distribution utilizes specialized chemical distributors and regional wholesalers who maintain warehousing facilities and handle smaller-volume orders for diverse customers, including small food manufacturers, local textile mills, and compounding pharmacies. The downstream market sees the Calcium Acetate Powder integrated into final products. This end-use analysis reveals a crucial dependence on regulatory standards; for instance, the demand from dialysis centers is inelastic and driven solely by patient demographics and healthcare policy, while industrial demand fluctuates with construction activities and environmental enforcement measures. Efficient supply chain integration across these complex direct and indirect channels is paramount for maintaining market competitiveness and responsiveness to fluctuating sector-specific demands.

Calcium Acetate Powder Market Potential Customers

The Calcium Acetate Powder Market's potential customers are highly diversified across three major sectors: healthcare, food processing, and environmental management. In the healthcare sector, the most critical customers are pharmaceutical companies specializing in renal care, which formulate the powder into tablets or capsules for the management of hyperphosphatemia in Chronic Kidney Disease (CKD) patients undergoing dialysis. Dialysis centers and hospitals also serve as significant end-users, procuring the compound either as finished medication or in bulk for specialized compounding. These customers prioritize USP/EP grade purity, validated documentation, and reliable supply chains, as the product is essential for patient treatment outcomes.

In the food and beverage industry, major potential customers include large-scale commercial bakeries, dairy producers (for stabilizers in cheese and milk products), and companies manufacturing canned foods and snacks. Here, Calcium Acetate Powder (Food Grade, E263) acts as an effective preservative, mold inhibitor, and calcium fortifier. These customers require consistent quality, compliance with FCC standards, and often prefer granulated forms for ease of incorporation into processing lines. Market penetration efforts in this segment focus heavily on demonstrating cost-effectiveness and functional benefits, such as shelf-life extension and nutritional enhancement.

Industrial and municipal potential customers are predominantly wastewater treatment facilities and construction chemical manufacturers. Water treatment plants use technical-grade calcium acetate as a biodegradable and highly efficient agent for the removal of phosphate from effluent streams, addressing environmental mandates. Construction companies utilize it as a specialized additive in concrete to modify setting times and enhance specific performance characteristics. These industrial buyers are highly price-sensitive but require guaranteed consistency in bulk supply, often leading to long-term procurement contracts based on competitive pricing and proven logistical capabilities. Furthermore, emerging customers include large agricultural businesses using it in specialized animal feed formulations to optimize mineral intake.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 245.5 Million |

| Market Forecast in 2033 | USD 363.8 Million |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Spectrum Chemical Manufacturing Corp., Noah Technologies Corporation, Merck KGaA, Avantor Inc., Macsen Laboratories, Loba Chemie Pvt. Ltd., Gemini Chemical Industries Inc., TCI Chemicals (India) Pvt. Ltd., Alfa Aesar (Thermo Fisher Scientific), American Elements, Central Drug House (P) Ltd., Pure Chemical Co., Tixchem Pharma, Dr. Paul Lohmann GmbH KG, CellMark AB, Inner Mongolia Xingyi Chemical Co. Ltd., Shandong Xiwang Group, Nantong Guangji Chemical Co. Ltd., S. A. G. Pharma, ProChem Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Calcium Acetate Powder Market Key Technology Landscape

The manufacturing process for Calcium Acetate Powder relies on well-established chemical synthesis methods, primarily the reaction between calcium hydroxide (or carbonate) and acetic acid. However, the key technological advancements driving market differentiation are concentrated in purification, crystallization, and particle size control, crucial for pharmaceutical and food-grade applications. For high-purity pharmaceutical-grade material, advanced multi-stage crystallization techniques and chromatographic separation are employed to ensure the removal of heavy metals and organic impurities far below regulatory thresholds (USP/EP standards). Continuous flow processing technologies are increasingly being adopted to enhance reaction kinetics, improve yield consistency, and reduce batch-to-batch variability, which is critical for securing long-term supply contracts with major drug formulators.

Particle engineering represents another vital technological landscape. Manufacturers are leveraging advanced drying technologies, such as spray drying and vacuum shelf drying, to produce powders with specific bulk density, flowability, and dissolution characteristics. For instance, creating fine, uniform microparticles enhances the bioavailability and tablet compression properties for pharmaceutical applications, while granulated forms (larger, less dusty particles) are preferred in food processing and industrial applications for easier handling and minimized atmospheric moisture absorption. Innovation also includes developing stabilized formulations through microencapsulation techniques, particularly for use in humidity-prone environments or complex food matrices, ensuring that the calcium acetate retains its efficacy and shelf life.

Furthermore, automation and digitalization are becoming pivotal in maintaining competitive advantages. Integration of sensors and real-time monitoring systems throughout the production line allows for immediate adjustments to synthesis parameters, ensuring optimal energy consumption and product quality control (QC). This technological shift aids in complying with stricter global manufacturing practices (GMP) and enhances traceability across the supply chain. The ability to produce highly consistent, customized Calcium Acetate Powder, optimized for specific end-use requirements—be it ultra-low impurity levels for medicine or enhanced solubility for wastewater treatment—is the core technological driver differentiating leading manufacturers in this specialized chemical commodity market.

Regional Highlights

- North America: The North American market holds a significant share, driven by a well-established healthcare system and high expenditure on dialysis treatments. Stringent food safety standards and the robust demand for processed and fortified foods also contribute substantially. The US dominates regional consumption, characterized by a mature regulatory environment and advanced wastewater treatment infrastructure that consistently utilizes calcium acetate for phosphate control.

- Europe: Europe is a key market, characterized by strict environmental regulations (e.g., EU Water Framework Directive) necessitating effective phosphate removal in municipal and industrial effluents. Germany, France, and the UK are major consumers, particularly in the pharmaceutical and specialty chemical sectors. The focus on high-quality pharmaceutical raw materials and advanced food preservatives maintains steady, high-value demand.

- Asia Pacific (APAC): APAC is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This rapid expansion is attributed to fast industrialization, significant infrastructure development, and growing disposable incomes leading to increased access to healthcare services, particularly in China and India. The lack of developed wastewater treatment infrastructure in many emerging economies creates massive potential demand for cost-effective phosphate binding solutions. Increased population and the expansion of the regional processed food industry further fuel market growth.

- Latin America (LATAM): Growth in LATAM is moderate but accelerating, primarily driven by investments in public health infrastructure and expanding pharmaceutical manufacturing capabilities, particularly in Brazil and Mexico. The market is highly price-sensitive, leading to a strong demand for competitive technical and food grades, while the pharmaceutical segment grows in tandem with rising rates of diabetes and associated CKD cases.

- Middle East and Africa (MEA): The MEA market is developing, with growth focused on key regions like the UAE and Saudi Arabia due to infrastructure projects and increasing healthcare spending. Challenges include varied regulatory landscapes and reliance on imports for high-purity grades. Opportunities exist in petrochemical and industrial water management, where calcium acetate finds use in specific process treatments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Calcium Acetate Powder Market.- Spectrum Chemical Manufacturing Corp.

- Noah Technologies Corporation

- Merck KGaA

- Avantor Inc.

- Macsen Laboratories

- Loba Chemie Pvt. Ltd.

- Gemini Chemical Industries Inc.

- TCI Chemicals (India) Pvt. Ltd.

- Alfa Aesar (Thermo Fisher Scientific)

- American Elements

- Central Drug House (P) Ltd.

- Pure Chemical Co.

- Tixchem Pharma

- Dr. Paul Lohmann GmbH KG

- CellMark AB

- Inner Mongolia Xingyi Chemical Co. Ltd.

- Shandong Xiwang Group

- Nantong Guangji Chemical Co. Ltd.

- S. A. G. Pharma

- ProChem Inc.

Frequently Asked Questions

Analyze common user questions about the Calcium Acetate Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary application driving the demand for Pharmaceutical Grade Calcium Acetate Powder?

The primary application driving demand for Pharmaceutical Grade Calcium Acetate is the treatment of hyperphosphatemia, a common complication in patients with end-stage renal disease (ESRD) or chronic kidney disease (CKD), where it acts as an effective non-aluminum phosphate binder.

Which purity grades of Calcium Acetate are most valuable in the current market?

Pharmaceutical Grade (USP/EP) calcium acetate holds the highest market value due to the stringent regulatory requirements, complex purification processes, and the premium pricing associated with life-saving medications requiring validated, ultra-high purity active pharmaceutical ingredients (APIs).

How do volatile raw material prices impact the Calcium Acetate Powder market?

Volatility in the cost of precursor materials, primarily glacial acetic acid and high-purity calcium carbonate, directly impacts the profit margins of manufacturers, necessitating complex hedging strategies and efficient process optimization to maintain competitive pricing in the downstream markets.

Is the Asia Pacific region dominating market growth for Calcium Acetate Powder?

Yes, the Asia Pacific region, particularly countries like China and India, is projected to dominate market growth in terms of volume and CAGR, fueled by rapid industrialization, expanding healthcare services, and increasing environmental mandates for wastewater treatment.

What substitutes currently challenge the market share of Calcium Acetate in hyperphosphatemia treatment?

The main substitutes challenging pharmaceutical-grade calcium acetate are newer, non-calcium based phosphate binders such as sevelamer carbonate (Renvela) and lanthanum carbonate (Fosrenol), which are often preferred by clinicians to minimize the risk of calcium loading in certain dialysis patients.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager