Calcium Chloride Powder Anhydrous Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431395 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Calcium Chloride Powder Anhydrous Market Size

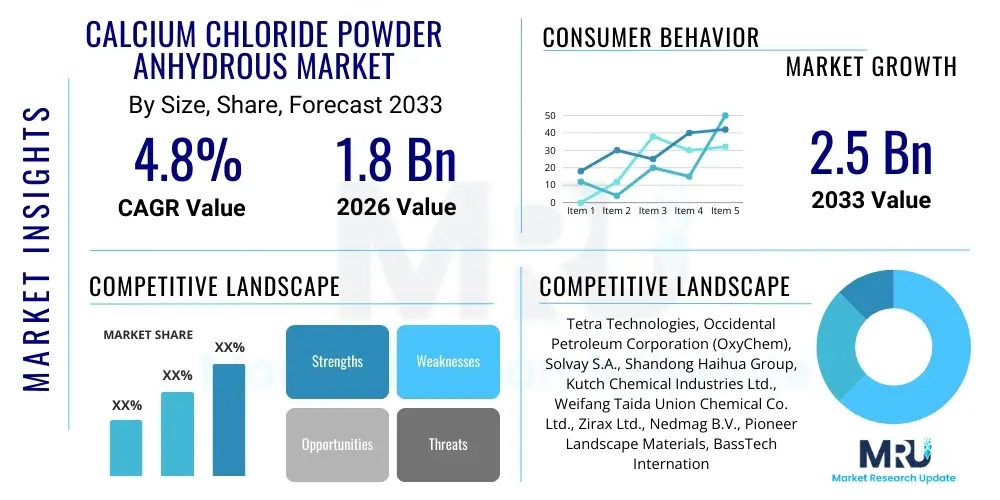

The Calcium Chloride Powder Anhydrous Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.5 Billion by the end of the forecast period in 2033.

Calcium Chloride Powder Anhydrous Market introduction

Calcium chloride powder anhydrous (CaCl₂) is a high-purity, granular, or powdered form of calcium chloride, known for its extreme hygroscopic properties and high solubility in water. This chemical compound is essential across numerous industrial sectors due to its strong ability to absorb moisture and lower the freezing point of water, which makes it indispensable in cold climates and moisture-sensitive processes. Its primary manufacturing methods involve purification from natural brines or as a co-product of the Solvay process (sodium carbonate production), ensuring varied supply streams tailored for different purity requirements. The anhydrous form is preferred in applications requiring minimal water content or high concentration, offering superior performance in deicing, desiccation, and chemical synthesis compared to its dihydrate or liquid counterparts.

Major applications of anhydrous calcium chloride span civil engineering, food processing, oil and gas drilling, and chemical manufacturing. In civil infrastructure, it is critically utilized for road deicing and dust suppression, improving road safety and maintaining pavement integrity during harsh weather conditions. Furthermore, the oil and gas industry employs it extensively as a brine component in drilling fluids to control hydrostatic pressure, stabilize shale formations, and prevent hydration swelling. Its function as a powerful desiccant is leveraged in packaging and storage to protect moisture-sensitive goods, while in the food industry, high-purity grades serve as firming agents, electrolytes, and preservatives, regulated by strict food safety standards globally.

The market growth is primarily propelled by increasing infrastructure development globally, particularly in developing economies, which drives demand for concrete accelerators and road maintenance chemicals. Concurrently, the rising global frequency of extreme cold weather events necessitates reliable and efficient deicing agents, maintaining the core demand trajectory. Moreover, expansion in the packaged food and beverage sector requires greater volumes of high-purity calcium chloride for preservation and quality enhancement, providing a strong diversification factor for market consumption away from seasonal dependence on deicing needs. Technological advancements focusing on sustainable sourcing and reduced corrosivity are further enhancing its market acceptance and environmental compatibility.

Calcium Chloride Powder Anhydrous Market Executive Summary

The Calcium Chloride Powder Anhydrous Market exhibits robust growth driven by non-seasonal industrial applications and sustained demand from municipal deicing operations across North America and Europe. Business trends indicate a strategic focus among major producers on securing stable and cost-effective raw material supplies, primarily natural brines, to mitigate volatility associated with Solvay process co-product pricing. Furthermore, there is an increasing trend toward specialized, low-corrosion formulations tailored for infrastructure protection, responding to growing regulatory pressure concerning the degradation of bridges and road surfaces caused by traditional chloride salts. Manufacturers are also investing in advanced packaging solutions to maintain the anhydrous state and prevent premature hydration during storage and transport, optimizing product integrity for end-users.

Regional trends highlight the accelerated market expansion in the Asia Pacific (APAC) region, fueled by rapid industrialization, burgeoning oil and gas exploration activities, and expanding cold chain logistics and food preservation sectors, especially in China and India. While North America remains the dominant market segment due to extensive road networks and stringent winter maintenance policies, APAC is emerging as the fastest-growing consumer base, creating significant investment opportunities for global players. Conversely, European markets demonstrate stable, albeit slower, growth, characterized by strong regulatory compliance favoring environmentally safer dust suppressants and corrosion-inhibited deicing alternatives, pressuring manufacturers towards higher-value specialty grades.

Segmentation trends reveal that the Deicing application segment maintains the largest volume share, benefiting from climate variability and governmental mandates for winter road safety. However, the Food and Beverage segment is projected to register the highest Compound Annual Growth Rate (CAGR), reflecting the stringent requirements for high-purity, food-grade anhydrous calcium chloride in processed foods and beverages, especially for calcium fortification and texture control. The Industrial Processing segment, encompassing desiccants, concrete setting accelerators, and chemical intermediates, provides critical underlying stability to the market, shielding it from the seasonal cyclicality inherent in the deicing business, ensuring year-round operational capacity utilization for producers.

AI Impact Analysis on Calcium Chloride Powder Anhydrous Market

User inquiries concerning AI's influence on the Calcium Chloride Powder Anhydrous Market often revolve around supply chain optimization, efficiency gains in manufacturing, and precision application technologies. Key themes frequently analyzed include how machine learning algorithms can predict optimal production yields based on brine composition fluctuations, forecast demand peaks for deicing materials correlated with specific weather models, and enhance quality control during the crystallization process. Users are particularly concerned with AI's potential to reduce energy consumption in the highly energy-intensive purification and drying stages, minimizing operational costs and environmental footprint, leading to expectations of smarter inventory management that mitigates risks associated with seasonal demand swings.

The impact of Artificial Intelligence is primarily centered on refining the supply chain and enhancing operational efficiency rather than radically altering the chemical production process itself. AI-driven predictive maintenance utilizes sensor data from drying equipment and crystallizers to anticipate failures, minimizing downtime and ensuring consistent output quality, which is crucial for meeting stringent purity specifications required by the food and pharmaceutical industries. Furthermore, logistics modeling employs AI to optimize transportation routes and storage locations for highly sensitive anhydrous powder, reducing transit times and inventory holding costs while dynamically responding to real-time weather changes that trigger sudden demand spikes for deicing agents in specific geographic zones.

In the application phase, AI and machine learning are pivotal in developing smarter deicing and dust suppression strategies. Predictive analytics models integrate data from road sensors, atmospheric conditions, and traffic flow to determine the minimum effective dosage of calcium chloride required, preventing overuse, minimizing corrosive impact on infrastructure, and achieving significant cost savings for municipal agencies. This precision application contributes to the market's sustainability profile and ensures that the product is utilized most efficiently, shifting the industry toward data-driven consumption patterns and away from historical, generalized application rates, thereby improving overall environmental stewardship.

- AI optimizes manufacturing parameters, predicting optimal energy usage during crystallization and drying processes.

- Machine learning models enhance demand forecasting, accurately linking deicing material requirements to granular, localized weather patterns.

- Predictive maintenance schedules for production equipment reduce unplanned downtime and maintain high-purity production capacity.

- AI-driven logistics systems optimize inventory placement and distribution networks for rapid response to severe weather events.

- Road weather information systems utilize AI to determine minimum effective application rates for deicing, reducing material waste and infrastructure corrosion.

DRO & Impact Forces Of Calcium Chloride Powder Anhydrous Market

The Calcium Chloride Powder Anhydrous Market is significantly influenced by a delicate balance of Drivers, Restraints, and Opportunities (DRO). The primary driving forces include the non-discretionary necessity for winter road safety and the continuous global investment in infrastructure, which requires efficient concrete setting accelerators and dust control agents. However, the market faces strong restraints stemming from environmental and infrastructure concerns, primarily the known corrosive nature of chloride salts on steel and concrete, necessitating regulatory oversight and the search for less damaging alternatives. Opportunities arise from the rapidly expanding specialized applications in industries like energy storage (brines for thermal management) and pharmaceutical excipients, along with geographical expansion into rapidly industrializing regions where the need for reliable chemical desiccants and industrial processing aids is increasing rapidly.

Impact forces shape the competitive landscape and technological direction of the market. Regulatory pressure, especially in mature markets like North America and Europe, acts as a pivotal force, mandating the adoption of corrosion inhibitors or shift toward lower-chloride alternatives, forcing manufacturers to innovate. Economic cycles significantly impact demand, as large-scale infrastructure projects and municipal road budgets (which dictate deicing expenditure) are highly sensitive to governmental fiscal policies. Furthermore, environmental advocacy groups and the resulting focus on sustainable raw material sourcing (favoring natural brine extraction over energy-intensive synthesis) influence public perception and corporate social responsibility strategies among major market players, demanding transparency in production processes.

The interplay between these forces dictates market pricing and supply dynamics. For instance, cold winter seasons exert a high positive impact force, leading to price spikes and inventory depletion, whereas mild winters result in market stagnation. Conversely, advancements in material science offering superior corrosion protection for end-users, such as specialized coatings or blending with non-chloride deicers, moderate the negative impact of the corrosivity restraint. Ultimately, the market trajectory is determined by the industry's capacity to deliver cost-effective, high-purity anhydrous calcium chloride while simultaneously addressing the environmental and infrastructure sustainability challenges posed by its intrinsic chemical properties, ensuring continued acceptance across diverse application segments.

Segmentation Analysis

The Calcium Chloride Powder Anhydrous Market is strategically segmented based on its application, purity grade, and source, reflecting the diverse industrial requirements and stringent quality standards demanded by various end-use sectors. Application segmentation is crucial as it dictates the required volume, seasonality, and pricing power of the product, with bulk applications like deicing commanding high volume but lower margins, while specialized uses like food processing require lower volumes but command significantly higher purity-driven margins. Purity grade is a pivotal segmentation criterion, differentiating technical grades used in industrial settings from highly refined food or pharmaceutical grades, which require additional investment in purification and quality assurance processes to comply with global regulatory bodies such as the FDA and EFSA. This multi-dimensional segmentation allows market players to tailor their production capabilities and distribution channels to target the most profitable niches effectively.

The primary application segments underscore the functional versatility of anhydrous calcium chloride, ranging from moisture control to chemical reaction facilitation. The Deicing segment dominates consumption volume, directly correlated with winter weather severity, driving significant logistical challenges related to seasonal stockpiling and rapid distribution. Contrastingly, the Dust Control segment offers more stable, non-seasonal demand, especially in mining, construction, and agricultural sectors requiring effective soil stabilization on unpaved roads. The Food and Pharmaceutical segments, though smaller in volume, represent critical growth areas due to increasing global standards for food additives (E509) and the necessity for ultra-pure desiccants in drug manufacturing and packaging, emphasizing traceability and certified quality.

Further segmentation by Source, differentiating between natural brine (solution mining) and synthetic (Solvay process co-product), impacts production cost structures, environmental footprint, and potentially the impurity profile of the final product. Brine-based production typically enjoys lower energy costs and a better sustainability narrative, attracting large-scale investment, especially in North America. Conversely, Solvay process co-products offer a stable, continuous supply linked directly to sodium carbonate manufacturing, providing diversification but sometimes requiring more extensive purification for high-grade applications. Understanding these interdependencies is vital for comprehensive market analysis and strategic planning, ensuring supply chain resilience against potential disruptions in either brine extraction or soda ash production.

- Application

- Deicing and Anti-Icing

- Dust Control and Road Stabilization

- Industrial Processing (Refrigeration Brine, Accelerators for Concrete)

- Oil and Gas Drilling Fluids

- Food and Beverage Processing (Firming Agents, Electrolytes)

- Chemical Intermediates and Desiccants

- Purity Grade

- Technical Grade

- Food Grade (FCC)

- Pharmaceutical Grade

- Source

- Natural Brine

- Synthetic (Solvay Process)

- Form

- Powder/Granules (Anhydrous)

- Flakes

Value Chain Analysis For Calcium Chloride Powder Anhydrous Market

The value chain for Calcium Chloride Powder Anhydrous is complex, starting with the sourcing of raw materials, moving through energy-intensive manufacturing, and concluding with highly specialized distribution to diverse end-use markets. The upstream analysis focuses primarily on raw material acquisition, which involves either mining limestone and salt (for synthetic production via the Solvay process) or, more commonly, extracting mineral-rich brines (calcium chloride-rich subterranean reservoirs). The viability and cost-effectiveness of production are heavily dictated by the accessibility and purity of these natural brine sources, which minimize the need for the energy-intensive evaporation and purification steps characteristic of synthetic methods, providing a cost advantage to brine-based producers. Stable access to inexpensive, high-quality brine is a fundamental determinant of profitability in this market, establishing a significant entry barrier for new competitors.

The midstream focuses on manufacturing and processing, converting the raw brine or co-product solution into the final anhydrous powder form, which requires multiple purification, concentration, crystallization, and drying stages. Achieving the high purity demanded by food or pharmaceutical grades necessitates sophisticated filtering and separation technologies, increasing operational complexity and capital investment. Distribution channels are highly varied; direct sales often dominate the bulk segments (deicing, O&G) where large volumes are sold directly to municipal governments, road contractors, or large oilfield service companies. This direct approach minimizes intermediary costs and allows for greater control over supply logistics, which is crucial during peak demand seasons.

Downstream analysis involves the penetration into diverse end-user sectors. Indirect distribution, leveraging a network of specialized chemical distributors, is common for smaller volume, high-value segments like food processing and desiccant applications, where technical support and niche inventory management are required. These distributors ensure prompt availability of specific purity grades and provide regional coverage that manufacturers might not maintain internally. The challenge in downstream logistics is maintaining the anhydrous state of the powder throughout storage and transport, requiring specialized packaging and climate control to prevent moisture absorption, which degrades the product’s effectiveness and purity specifications before it reaches the ultimate consumer.

Calcium Chloride Powder Anhydrous Market Potential Customers

The potential customer base for Calcium Chloride Powder Anhydrous is extremely broad, spanning governmental entities, heavy industry, construction, and specialized consumer goods sectors, unified by the need for desiccation, freezing point depression, or chemical enhancement. Governmental and municipal agencies represent the largest volume buyers, utilizing the product for mission-critical applications such as deicing major road networks and suppressing dust on rural roads to comply with safety and environmental mandates. These purchases are often characterized by high volume tender processes, where price, immediate availability, and proven efficacy are paramount purchasing criteria, typically favoring technical or commercial grade products.

Industrial users, particularly within the oil and gas (O&G) and construction industries, constitute a significant stable customer segment. O&G companies utilize calcium chloride brines extensively as completion fluids, workover fluids, and drilling mud additives to manage downhole pressures and densities, demanding consistent supply and highly reliable product specifications. In construction, the use of anhydrous calcium chloride as an accelerator in concrete mix ensures faster setting times in cold weather or rapid project requirements, providing a year-round demand source linked to global construction expenditure trends and major infrastructure projects. These customers require robust technical support and certified documentation regarding product origin and purity.

The high-purity customer segment includes the Food and Beverage (F&B) and Pharmaceutical sectors. F&B manufacturers purchase food-grade anhydrous calcium chloride for use in brining, canning, dairy production (as a coagulant), and beverage formulation (as a source of calcium ions), adhering strictly to food safety regulations like FCC (Food Chemicals Codex) standards. Pharmaceutical companies utilize ultra-pure grades as desiccants in packaging or as minor components in specific drug formulations, necessitating rigorous quality audits and exceptional product traceability. This segment, while smaller in volume, offers the highest margin potential and requires manufacturers to adhere to global Current Good Manufacturing Practice (cGMP) guidelines, ensuring sustained high-level investment in quality control.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2023 | USD 2.5 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tetra Technologies, Occidental Petroleum Corporation (OxyChem), Solvay S.A., Shandong Haihua Group, Kutch Chemical Industries Ltd., Weifang Taida Union Chemical Co. Ltd., Zirax Ltd., Nedmag B.V., Pioneer Landscape Materials, BassTech International, Tiger Calcium Services, Barmer Chemicals, Shouguang Zhongyi Chemical Co., AkzoNobel (KEMIRA), Junyu Chemical Co., Lianyungang Zesheng Chemical Co., Ward Chemical Ltd., China Chemical Additive Co. Ltd., AGC Inc., Weifang Yuze Chemical Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Calcium Chloride Powder Anhydrous Market Key Technology Landscape

The technology landscape for the Calcium Chloride Powder Anhydrous Market is primarily focused on enhancing production efficiency, improving product purity, and mitigating the environmental impact associated with its use and manufacture. A critical area of technological innovation revolves around the crystallization and drying stages, which are the most energy-intensive parts of the process. Advanced membrane filtration and multi-effect evaporation techniques are being adopted to concentrate the brine solution more efficiently before crystallization, significantly reducing the overall energy consumption per unit of finished product. Furthermore, flash drying technologies and rotary kiln dryers are being optimized using real-time sensors and computerized controls to ensure that the moisture content is precisely minimized, guaranteeing the stability and efficacy of the anhydrous form while minimizing the risk of product degradation during the heating process.

In terms of product quality, the technology landscape emphasizes purification methods necessary to meet stringent food and pharmaceutical grade specifications. Ion-exchange resins and selective chemical precipitation methods are utilized to remove trace heavy metals and undesired impurities (such as magnesium and potassium salts) that could compromise the safety or performance of high-end applications. The development of advanced anti-caking additives, specifically tailored polymer coatings or silica-based flow agents, is also crucial, particularly for the anhydrous powder form. These additives prevent the highly hygroscopic powder from agglomerating during prolonged storage or transportation, ensuring easy handling and precise metering for end-users like municipalities operating automated deicing spreaders, thereby extending the effective shelf life of the product.

Furthermore, technology related to sustainable application and corrosion mitigation is gaining prominence. This includes the development of integrated corrosion inhibitors (often phosphate or organic compound-based) that can be co-formulated with the calcium chloride powder. The goal is to reduce the material's corrosive impact on vehicles and infrastructure without compromising its effectiveness as a deicer or dust palliative. The implementation of smart application equipment that uses GPS and variable rate technology, often connected to a cloud-based system (as described in the AI impact analysis), ensures optimized usage, leading to material savings and environmental protection by limiting runoff. These technological advancements collectively aim to future-proof calcium chloride against regulatory scrutiny and competition from more environmentally benign, yet often costlier, alternatives.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand, supply, and regulatory environment of the Calcium Chloride Powder Anhydrous Market, reflecting variances in climate, industrial maturity, and infrastructure investment cycles across the globe. North America, encompassing the United States and Canada, remains the largest and most established market, primarily dominated by the deicing application segment. The extensive network of public roads, coupled with mandatory winter road maintenance policies across high-latitude states and provinces, ensures a consistently high-volume demand, regardless of minor fluctuations in seasonal severity. Furthermore, the region is a major producer of calcium chloride derived from natural brines (especially in the Mid-West US and Western Canada), leading to competitive pricing and robust local supply chains capable of meeting peak winter season demand efficiently.

Europe represents a mature market characterized by strict environmental regulations and a strong emphasis on infrastructure preservation. While deicing remains a significant application, European countries are actively exploring corrosion-inhibited or blended deicing solutions to mitigate the damage caused to historical structures and bridges. The region also hosts a sophisticated food and pharmaceutical industry, driving a steady demand for high-purity, certified food-grade and pharmaceutical-grade anhydrous calcium chloride. Regulatory frameworks such as REACH compliance significantly influence manufacturing processes and import requirements, favoring producers who demonstrate superior environmental stewardship and product traceability across the supply chain, often prioritizing quality over absolute cost minimization.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally, driven by rapid urbanization, massive infrastructure development projects, and explosive growth in the oil and gas exploration sector, particularly in countries like China, India, and Southeast Asia. The demand in APAC is predominantly non-seasonal, focused heavily on industrial applications, including concrete acceleration, use in oilfield brines, and as an essential chemical desiccant in manufacturing and logistics. While local production capacity is expanding, particularly in China (often synthetic source), the region also represents a major destination for bulk imports from established brine producers in North America and the Middle East, reflecting a dynamic interplay between domestic supply creation and import fulfillment to meet soaring industrial requirements.

- North America (US and Canada): Dominant market share due to extensive winter road maintenance needs (deicing) and major brine production centers, leading to competitive supply and advanced logistics for bulk delivery.

- Europe: Stable growth driven by high-purity demand (food/pharma) and industrial processing; characterized by stringent environmental regulations and focus on corrosion-mitigation technologies in deicing.

- Asia Pacific (APAC): Fastest growing region; demand is primarily industrial (construction, O&G, manufacturing) fueled by rapid economic and infrastructure expansion, leading to increased focus on localized production capacity.

- Latin America (LATAM): Emerging market, with demand primarily centered on oil and gas drilling activities (Brazil, Argentina) and regional construction projects; less reliant on deicing applications.

- Middle East and Africa (MEA): Significant demand from the oil and gas industry for drilling fluids and completion brines; regional suppliers benefit from strategic location and access to feedstock, supporting regional energy sector growth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Calcium Chloride Powder Anhydrous Market.- Tetra Technologies

- Occidental Petroleum Corporation (OxyChem)

- Solvay S.A.

- Shandong Haihua Group

- Kutch Chemical Industries Ltd.

- Weifang Taida Union Chemical Co. Ltd.

- Zirax Ltd.

- Nedmag B.V.

- Pioneer Landscape Materials

- BassTech International

- Tiger Calcium Services

- Barmer Chemicals

- Shouguang Zhongyi Chemical Co.

- AkzoNobel (KEMIRA)

- Junyu Chemical Co.

- Lianyungang Zesheng Chemical Co.

- Ward Chemical Ltd.

- China Chemical Additive Co. Ltd.

- AGC Inc.

- Weifang Yuze Chemical Co.

Frequently Asked Questions

Analyze common user questions about the Calcium Chloride Powder Anhydrous market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between anhydrous and dihydrate calcium chloride?

Anhydrous calcium chloride (CaCl₂) is essentially water-free, containing less than 0.5% moisture, offering a higher concentration of calcium chloride by weight and superior heat generation upon dissolution. Dihydrate (CaCl₂·2H₂O) contains about 20% crystal water, making the anhydrous form preferred for applications requiring maximum purity, higher thermal output, and minimum weight, such as high-performance desiccants and oilfield brines.

Which application segment drives the highest demand volume in the Calcium Chloride Powder Anhydrous Market?

The Deicing and Anti-Icing application segment is the largest consumer by volume, particularly in North America and Europe. Its high volume demand is driven by governmental mandates for winter road safety and the high efficacy of calcium chloride in lowering the freezing point of water compared to common salt (sodium chloride).

How do environmental regulations affect the market for calcium chloride powder?

Environmental regulations, especially concerning runoff and chloride content in waterways, act as a key restraint. This pressure encourages the development and adoption of corrosion-inhibited grades, the use of precision application techniques (smart spreading), and increased scrutiny on sustainable sourcing methods, particularly favoring natural brine extraction over energy-intensive synthetic production.

Where are the major global production centers for natural brine-based calcium chloride?

Major production centers utilizing natural brine sources are concentrated primarily in North America, notably in Michigan, Ohio, and Utah (USA), and parts of Western Canada. These regions benefit from geologically rich underground reservoirs, allowing for cost-effective extraction and processing compared to the co-product synthetic processes prevalent in parts of Asia and Europe.

Is food-grade anhydrous calcium chloride (E509) expected to see strong growth?

Yes, the food-grade segment (E509) is anticipated to exhibit the highest CAGR. This growth is driven by the global expansion of the processed food and beverage industry, increasing demand for calcium fortification, and the utilization of E509 as a safe and effective firming agent, particularly in vegetable canning and dairy coagulation processes worldwide.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager