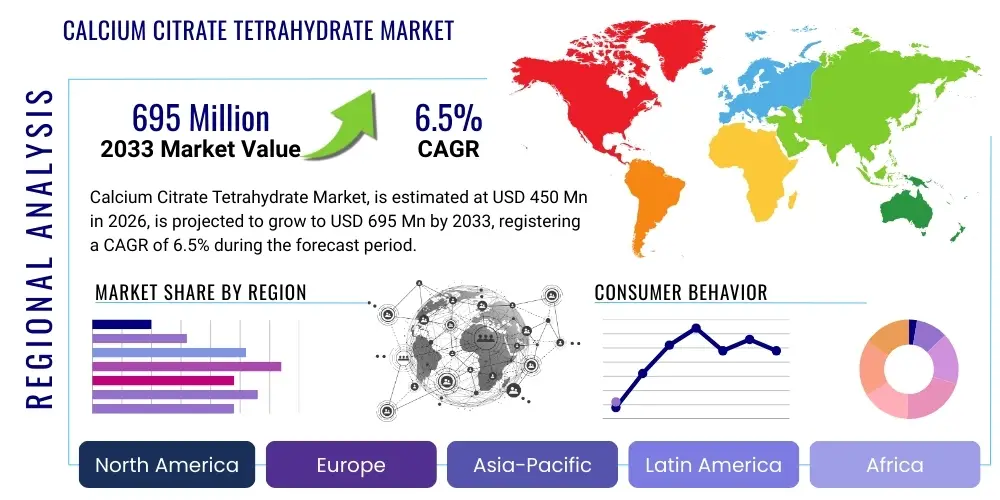

Calcium Citrate Tetrahydrate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437447 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Calcium Citrate Tetrahydrate Market Size

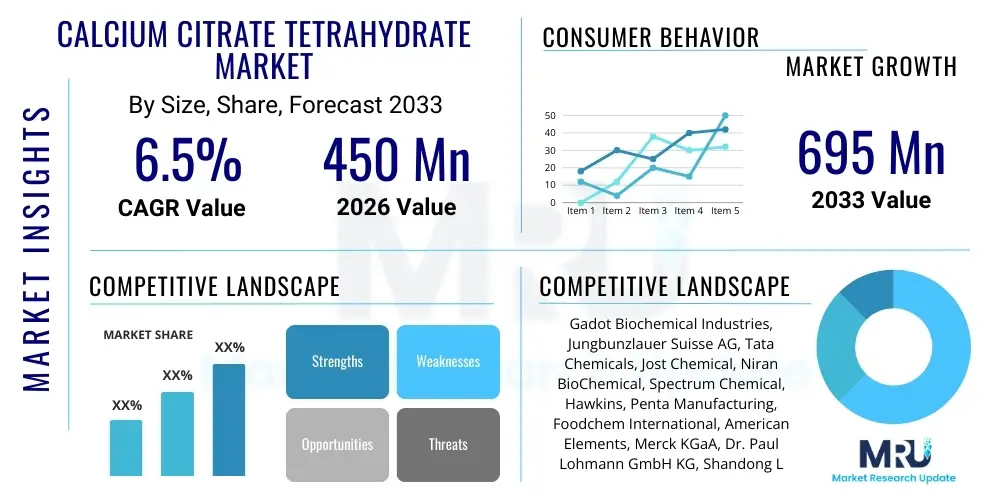

The Calcium Citrate Tetrahydrate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 695 Million by the end of the forecast period in 2033.

Calcium Citrate Tetrahydrate Market introduction

Calcium Citrate Tetrahydrate is a vital inorganic salt widely recognized for its superior bioavailability compared to other calcium forms, such as calcium carbonate. This chemical compound, often represented by the formula Ca₃(C₆H₅O₇)₂·4H₂O, serves primarily as a highly effective dietary supplement to combat calcium deficiencies, particularly in populations susceptible to osteoporosis and rickets. Its excellent solubility, particularly at neutral pH levels, makes it ideal for fortification in various food and beverage matrices, ensuring enhanced absorption in the digestive tract. The increasing global awareness regarding bone health and the rising prevalence of lifestyle-related nutritional disorders are key propellers for the sustained demand within this specialized market segment.

The product is synthesized through the neutralization of citric acid with calcium hydroxide or calcium carbonate, followed by controlled crystallization processes to yield the tetrahydrate form, ensuring high purity, which is critical for pharmaceutical and nutraceutical applications. Major applications span across functional foods, dietary supplements (including chewable tablets and liquid formulations), clinical nutrition products, and, to a lesser extent, industrial applications such as water treatment and chemical buffering agents. The market growth is intricately linked to demographic shifts, specifically the aging global population requiring regular calcium intake, and stringent regulatory environments in developed economies promoting nutritional standards.

Driving factors for the Calcium Citrate Tetrahydrate market include strong scientific evidence supporting its efficacy in bone mineral density maintenance, consumer preference for highly bioavailable mineral sources, and technological advancements enabling cost-effective, high-purity production. Furthermore, the expansion of the functional beverage sector and the increasing use of calcium citrates in fortified dairy alternatives and plant-based foods contribute significantly to market expansion. The versatility and safety profile of Calcium Citrate Tetrahydrate position it as a foundational ingredient in the rapidly evolving global health and wellness industry, ensuring consistent demand across established and emerging economies.

Calcium Citrate Tetrahydrate Market Executive Summary

The Calcium Citrate Tetrahydrate market exhibits robust growth driven by converging trends in health consciousness, technological refinement in synthesis, and strategic market expansion into emerging geographical regions. Business trends indicate a strong move toward vertical integration among key manufacturers, aimed at securing raw material supply chains (citric acid and calcium sources) and maintaining stringent quality controls necessary for pharmaceutical-grade production. Furthermore, companies are investing heavily in research and development to create microencapsulated or specialized dosage forms that improve taste masking and stability, particularly in liquid suspension products. Strategic mergers and acquisitions targeting niche nutraceutical formulation companies are also becoming prevalent, allowing established chemical suppliers to gain direct access to end-user markets and customized product requirements.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, primarily fueled by rising disposable incomes, expanding middle-class populations, and government initiatives aimed at reducing malnutrition and promoting healthy aging. North America and Europe remain mature markets, characterized by high per capita consumption of dietary supplements and sophisticated regulatory frameworks that favor high-quality, traceable ingredients. Within these developed regions, the emphasis is shifting towards clean label products and non-GMO certifications, compelling manufacturers to adapt their sourcing and processing methodologies. Infrastructure development related to cold chain logistics and specialized warehousing for sensitive food and pharmaceutical ingredients is crucial for sustaining growth across all major regions.

Segment trends underscore the dominance of the Pharmaceuticals and Nutraceuticals application segment, attributed to the high dosage required for therapeutic calcium replacement therapies and the increasing use of preventive supplements. The Food & Beverages segment, particularly functional foods and infant formula, is demonstrating accelerated growth due to fortification mandates and consumer demand for added health benefits in daily consumed products. The technical grade segment, while smaller, maintains a steady demand from specialized industrial processes, including as a chelating agent or pH regulator. Innovation in the Tetrahydrate form itself, focusing on enhanced flowability and reduced dusting properties, continues to provide competitive advantages to leading suppliers globally.

AI Impact Analysis on Calcium Citrate Tetrahydrate Market

User inquiries regarding AI's influence in the Calcium Citrate Tetrahydrate sector frequently revolve around optimization of synthesis processes, predictive demand modeling, and enhanced quality control mechanisms. Key themes center on leveraging machine learning algorithms to fine-tune crystallization parameters, thereby ensuring highly uniform particle size and purity, which are crucial for pharmaceutical stability and bioavailability. Users are also keen on understanding how AI can predict regional demand fluctuations based on health trends, demographic data, and regulatory changes, allowing manufacturers to optimize inventory and production schedules. Concerns often touch upon the initial investment required for integrating AI systems into traditional chemical manufacturing setups and the need for specialized data scientists within these industrial environments.

The primary expectations users have for AI implementation involve reducing manufacturing variability and improving yield efficiencies, particularly in large-scale production facilities where minor deviations can result in substantial losses. AI-powered image recognition and spectroscopic analysis are anticipated to revolutionize inline quality checks, moving beyond traditional batch testing to continuous monitoring for impurities or structural anomalies in the crystalline structure. Furthermore, Generative AI models are being explored for accelerating formulation development by simulating the interaction of Calcium Citrate Tetrahydrate with various excipients and active pharmaceutical ingredients (APIs), reducing the time and cost associated with traditional trial-and-error R&D processes. This computational approach significantly enhances market responsiveness and product innovation.

- AI-driven optimization of crystallization temperatures and pH levels for maximum purity and yield.

- Predictive maintenance analytics for synthesis reactors and filtration equipment, minimizing downtime.

- Machine learning models for forecasting global and regional demand based on public health indices and seasonality.

- Enhanced quality control using computer vision for real-time particle size and morphology analysis.

- Robotics and automation, guided by AI, improving precision in packaging and logistics handling.

- Accelerated discovery of novel formulations by simulating ingredient interactions and stability profiles.

- Supply chain risk management optimization through AI-powered tracking of raw material provenance and supplier performance.

DRO & Impact Forces Of Calcium Citrate Tetrahydrate Market

The dynamics of the Calcium Citrate Tetrahydrate market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces dictating market trajectory. Major drivers include the irrefutable evidence supporting the superior absorption rate of calcium citrate over cheaper alternatives like calcium carbonate, making it the preferred choice among clinically advised populations and premium nutraceutical brands. This preference is strongly reinforced by the global demographic shift towards an aging population, inherently requiring higher calcium supplementation to mitigate age-related bone loss conditions such as osteoporosis. Furthermore, increasing consumer acceptance and awareness regarding preventive healthcare, spurred by widespread media attention and educational campaigns, consistently fuels demand across key global regions.

Despite strong underlying demand, the market faces significant restraints. The high cost of production, primarily linked to the necessity of high-purity citric acid (a core raw material), and the energy-intensive crystallization and drying processes, acts as a primary barrier, potentially limiting its adoption in highly price-sensitive markets. Regulatory hurdles, particularly those governing pharmaceutical-grade ingredient sourcing and manufacturing facility compliance (e.g., cGMP requirements), impose substantial operational and capital expenditure burdens on market participants. Moreover, the complexity of managing intellectual property rights related to specialized formulation technologies, such as sustained-release or chelated versions, can slow down widespread market adoption of innovative products, particularly in emerging economies where enforcement might be lax.

Opportunities for expansion are abundant, chiefly residing in the untapped potential of emerging markets, specifically in Sub-Saharan Africa and parts of Southeast Asia, where calcium deficiency rates are high and economic development is improving accessibility to supplements. Significant growth opportunities also exist in developing novel, application-specific products, such as incorporating calcium citrate tetrahydrate into specialized medical nutrition products designed for renal patients or individuals with gastrointestinal absorption issues. The accelerating trend of functional food fortification, especially in plant-based dairy alternatives (soy milk, oat milk), presents a scalable avenue for manufacturers to integrate their products into staple diets, moving beyond traditional pill-based supplementation. Successful navigation of these Impact Forces necessitates robust quality assurance, cost optimization strategies, and agility in regulatory compliance across diverse international markets.

Segmentation Analysis

The Calcium Citrate Tetrahydrate market is strategically segmented based on factors such as Purity Grade, Application, and Form, allowing market participants to target specific consumer needs and regulatory requirements across different industries. Understanding these segmentations is critical for effective market strategy, production scheduling, and inventory management, as the specifications for pharmaceutical use are vastly different from those required for standard food fortification. The inherent chemical properties of the tetrahydrate form, particularly its stability and bioavailability, ensure its widespread acceptance across all segments, although the production scale and quality testing protocols vary significantly based on the intended end-use industry. This layered segmentation reflects the diverse regulatory landscape and consumer expectations encountered globally.

The purity grade segmentation dictates pricing and market access, with USP/EP Grade (Pharmaceutical Grade) commanding the highest premium due to stringent testing for heavy metals and microbial contaminants, necessary for direct human therapeutic consumption. Food Grade materials, while maintaining high standards, are produced at higher volumes and lower costs, catering to mass-market fortification needs in beverages, cereals, and bakery products. Application segmentation confirms the market's reliance on health and wellness sectors, with Nutraceuticals dominating volume and value, followed closely by the rapidly evolving Functional Food segment which emphasizes convenience and holistic dietary incorporation. Analysis of these segments reveals shifts in consumer behavior towards preventive health measures.

Furthermore, geographic segmentation is paramount, as consumption patterns and regulatory preferences for calcium sourcing differ widely. For instance, European and North American markets prioritize transparency and sustainability in sourcing, influencing the choice of raw materials for citric acid synthesis, whereas high population density and rising incomes drive the exponential growth in the Asia Pacific region. Deep diving into these segments allows for tailored product offerings, such as developing specific fine-mesh powders optimized for tablet pressing in the pharmaceutical segment, or granular forms better suited for blending in large-scale food manufacturing operations, thereby capturing maximum value across the entire market spectrum.

- Purity Grade:

- USP/EP Grade (Pharmaceutical Grade)

- Food Grade (FCC Grade)

- Technical Grade

- Application:

- Pharmaceuticals and Nutraceuticals

- Dietary Supplements (Tablets, Capsules, Powders)

- Liquid Suspensions

- Therapeutic Formulations

- Food and Beverages

- Functional Drinks

- Dairy Alternatives (Plant-based milks)

- Cereals and Baked Goods

- Infant Formula

- Cosmetics and Personal Care

- Industrial Applications (Buffering, Chelating)

- Pharmaceuticals and Nutraceuticals

- Form:

- Powder

- Granular

- Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain)

- Asia Pacific (China, India, Japan, South Korea)

- Latin America (Brazil, Argentina)

- Middle East and Africa (MEA)

Value Chain Analysis For Calcium Citrate Tetrahydrate Market

The value chain for Calcium Citrate Tetrahydrate is initiated with the upstream procurement of essential raw materials, primarily high-quality citric acid (often produced via microbial fermentation of sugars) and calcium sources, typically calcium hydroxide or carbonate, derived from limestone. This upstream phase is crucial as the purity and availability of these raw materials directly impact the final product quality and manufacturing costs. Suppliers of citric acid, being a highly standardized commodity, possess moderate bargaining power, compelling calcium citrate producers to maintain efficient synthesis and crystallization processes to ensure cost competitiveness. Investment in sustainable and non-GMO citric acid sourcing is increasingly defining the upstream competitive landscape, particularly for manufacturers targeting premium European and North American nutraceutical markets seeking clean label compliance.

The midstream phase encompasses the core manufacturing process, involving reaction, filtration, crystallization, drying, milling, and rigorous quality assurance testing to meet specific purity grades (USP, FCC). Manufacturers must adhere to Good Manufacturing Practices (GMP) or Current Good Manufacturing Practices (cGMP) standards, particularly when producing pharmaceutical grade material, which significantly adds to the operational complexity and capital expenditure. The efficiency of the crystallization step, specifically controlled temperature and pressure management to ensure the correct formation of the tetrahydrate crystal structure, is a key determinant of final product attributes such as flowability and density. Technological differentiation in this phase allows leading players to minimize moisture content and prevent caking during storage and transport.

The downstream distribution channels are diverse, segmented into direct sales to large pharmaceutical and functional food manufacturers (B2B), and indirect distribution through specialized chemical and ingredient distributors. Direct sales are prevalent for high-volume, custom-specification orders, enabling closer technical collaboration between the producer and the end-user. Indirect channels, utilizing regional distributors, are essential for reaching smaller nutraceutical formulators and diverse industrial users. The final stage involves the product reaching the end-consumer through pharmacies, retail stores, e-commerce platforms, and specialized health food outlets. E-commerce has emerged as a critical driver for the supplement sector, necessitating strong brand positioning and efficient last-mile logistics for packaged goods containing Calcium Citrate Tetrahydrate.

Calcium Citrate Tetrahydrate Market Potential Customers

The primary end-users and buyers of Calcium Citrate Tetrahydrate are concentrated within the global health and nutrition ecosystem, demonstrating a profound reliance on high-quality, bioavailable calcium sources. The largest customer base is comprised of pharmaceutical companies specializing in prescription and over-the-counter (OTC) calcium supplements, particularly those targeting conditions like hypocalcemia, postmenopausal bone loss, and specific malabsorption disorders. These customers demand extremely high purity levels (USP/EP Grade), rigorous documentation, and consistent supply, often engaging in long-term procurement contracts to ensure supply chain stability for their regulated therapeutic products. Clinical nutrition firms developing specialized formulas for tube feeding or intravenous use also constitute a high-value customer segment requiring stringent quality controls.

Another crucial customer segment consists of nutraceutical and dietary supplement manufacturers, ranging from large multinational corporations producing mass-market vitamin brands to smaller, specialized firms focusing on targeted functional health products (e.g., prenatal vitamins, sports nutrition). These buyers value high bioavailability and stability, often seeking granular or customized powder forms that integrate seamlessly into complex multivitamin blends or chewable formats. The growing functional food and beverage industry represents a rapidly expanding customer base, including large dairy alternative producers, juice manufacturers, and cereal companies seeking to fortify their products to meet consumer demand for added health benefits, primarily sourcing Food Grade material at competitive volumes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 695 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Gadot Biochemical Industries, Jungbunzlauer Suisse AG, Tata Chemicals, Jost Chemical, Niran BioChemical, Spectrum Chemical, Hawkins, Penta Manufacturing, Foodchem International, American Elements, Merck KGaA, Dr. Paul Lohmann GmbH KG, Shandong Longlive Bio-Technology Co., Ltd., Zibo Xinglu Chemical Co., Ltd., Henan Jindan Lactic Acid Technology Co., Ltd., Weifang Ensign Industry Co., Ltd., Bartek Ingredients Inc., Corbion N.V., Compass Minerals International Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Calcium Citrate Tetrahydrate Market Key Technology Landscape

The manufacturing of Calcium Citrate Tetrahydrate relies on advanced chemical synthesis and crystallization engineering to achieve the necessary high-purity and specific physical characteristics mandated by end-use industries. Key technological advancements center around optimizing the reaction kinetics between citric acid and calcium compounds, focusing on precise pH and temperature control during the precipitation phase. Modern manufacturing facilities utilize continuous flow reactors rather than traditional batch processing, which allows for superior consistency, reduced cycle times, and enhanced energy efficiency. This continuous crystallization technology ensures the uniform crystal habit necessary for the tetrahydrate form, preventing the formation of undesired byproducts or alternative hydration states that could compromise stability and bioavailability. Furthermore, specialized filtration and washing techniques, often involving membrane technologies, are crucial for removing trace impurities and ensuring compliance with stringent heavy metal limits required for USP certification.

Post-synthesis technology focuses heavily on particle engineering and processing. Techniques such as spray drying, fluidized bed granulation, and micronization are employed to achieve specific particle size distributions (PSDs). A precise PSD is vital for applications like tableting, where flowability and compressibility directly impact manufacturing speed, or for liquid suspensions, where ultra-fine particles are needed to prevent sedimentation and ensure consistent dosage. Manufacturers are increasingly adopting advanced spectroscopic methods, such as Near-Infrared (NIR) or Raman spectroscopy, for real-time, non-destructive quality analysis of the powder. This move towards Process Analytical Technology (PAT) enhances control over moisture content and polymorphism, significantly improving product reliability and reducing the need for costly post-production batch testing, aligning the industry with modern pharmaceutical manufacturing standards.

Sustainability and resource efficiency are also major technological drivers. Innovations in waste management, specifically the recycling of solvents and water used in the washing processes, contribute to a reduced environmental footprint. Additionally, research into bio-based calcium sources and improved fermentation techniques for higher yield citric acid production offer long-term cost reduction potential and improved supply chain resilience. The integration of robust automation and data analytics platforms (Industry 4.0 principles) is transforming operations by collecting extensive process data, enabling predictive maintenance, and facilitating closed-loop control systems. These sophisticated technologies ensure that the Calcium Citrate Tetrahydrate produced meets the increasingly demanding specifications of the global nutraceutical and pharmaceutical sectors while maintaining competitive production costs and high standards of traceability.

Regional Highlights

- North America: North America, comprising the United States and Canada, represents a cornerstone of the global Calcium Citrate Tetrahydrate market, characterized by high per capita spending on dietary supplements and a well-established regulatory environment. The strong presence of major pharmaceutical and nutraceutical companies drives consistent demand for high-grade material. Consumers in this region are highly aware of preventative health measures and bone density concerns, fueling the consumption of calcium-fortified foods and specialized supplements. The market here is highly segmented, with a pronounced preference for clean label, non-GMO, and clinically validated ingredients, pushing manufacturers towards stringent sourcing and processing standards. Regulatory bodies like the FDA maintain tight oversight, ensuring that ingredient claims and purity levels are rigorously met, thereby favoring established, quality-focused suppliers. This maturity necessitates continuous innovation in delivery formats and combination supplements to maintain competitive edge.

- Europe: Europe is a key market, reflecting robust demand across pharmaceuticals, especially in countries like Germany, France, and the UK, due to aging populations and well-developed healthcare systems that prioritize nutritional intervention. The European Union's regulatory framework, particularly regarding novel foods and supplement claims (EFSA guidelines), significantly shapes product development and market accessibility. There is a strong, growing trend towards functional beverages and plant-based foods fortified with highly bioavailable minerals like calcium citrate tetrahydrate, driven by vegetarianism and veganism trends. Sustainability and traceability are crucial purchasing criteria for European buyers, often leading to a premium price for ingredients manufactured using environmentally responsible practices. Eastern European markets offer significant, though price-sensitive, growth opportunities as health spending increases and dietary supplement culture develops.

- Asia Pacific (APAC): The APAC region is poised for the most rapid market expansion, driven by massive population growth, rapidly increasing disposable incomes, and improving access to modern healthcare and supplements, particularly in economic powerhouses like China and India. The sheer scale of demand for basic nutrition and fortification ingredients, including in infant formula and mass-market food products, makes APAC a high-volume market. Regulatory harmonization remains a challenge across the diverse nations in this region, requiring manufacturers to adapt labeling and purity standards country-by-country. Investment in local manufacturing and distribution infrastructure is accelerating to meet domestic demand and reduce reliance on expensive imports. The rising prevalence of osteoporosis awareness campaigns and government support for nutritional supplementation programs further catalyzes market growth, positioning APAC as the primary focus for future market capacity expansion.

- Latin America (LATAM): The LATAM market, while smaller in absolute terms than APAC or North America, presents moderate to high growth potential, especially in Brazil and Mexico. Economic volatility and currency fluctuations can intermittently restrain growth, yet the fundamental demand for nutritional products is strengthening due to urbanization and the increasing availability of processed and fortified foods. Calcium Citrate Tetrahydrate is valued here for its ability to stabilize formulations in varied climatic conditions. Market penetration relies heavily on effective distribution networks and overcoming logistical challenges in diverse geographies. Price competition is intense, necessitating a focus on efficient production and optimized supply chain logistics to compete against lower-cost calcium sources, though demand for high-quality imported supplements is rising among the affluent consumer base.

- Middle East and Africa (MEA): The MEA region is segmented, with high growth potential concentrated in the Gulf Cooperation Council (GCC) nations due to high disposable income and advanced healthcare systems. The demand for specialized dietary supplements and imported nutraceuticals is robust in these oil-rich countries. Conversely, the African continent presents significant challenges related to infrastructural deficits and lower per capita health spending, although initiatives focused on combating widespread micronutrient deficiencies offer long-term opportunities for affordable fortification programs. Political instability and complex import tariffs are key barriers. However, increasing awareness campaigns and government efforts to improve maternal and child nutrition are expected to gradually increase the regional uptake of high-quality calcium supplements, including Calcium Citrate Tetrahydrate.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Calcium Citrate Tetrahydrate Market.- Gadot Biochemical Industries

- Jungbunzlauer Suisse AG

- Tata Chemicals

- Jost Chemical

- Niran BioChemical

- Spectrum Chemical

- Hawkins

- Penta Manufacturing

- Foodchem International

- American Elements

- Merck KGaA

- Dr. Paul Lohmann GmbH KG

- Shandong Longlive Bio-Technology Co., Ltd.

- Zibo Xinglu Chemical Co., Ltd.

- Henan Jindan Lactic Acid Technology Co., Ltd.

- Weifang Ensign Industry Co., Ltd.

- Bartek Ingredients Inc.

- Corbion N.V.

- Compass Minerals International Inc.

Frequently Asked Questions

Analyze common user questions about the Calcium Citrate Tetrahydrate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of Calcium Citrate Tetrahydrate over Calcium Carbonate in supplements?

Calcium Citrate Tetrahydrate offers significantly superior bioavailability and absorption, particularly for individuals with low stomach acid (achlorhydria) or those taking acid blockers. Unlike calcium carbonate, which requires gastric acid for proper dissolution, calcium citrate can be absorbed effectively without food, making it the preferred clinical and nutraceutical choice for efficacy and convenience.

Which application segment holds the largest share in the Calcium Citrate Tetrahydrate Market?

The Pharmaceuticals and Nutraceuticals segment maintains the largest market share. This dominance is driven by the high volume demand for dietary supplements aimed at preventing and treating bone density loss (like osteoporosis) and the use of the ingredient in clinical therapeutic formulations where high purity and predictable absorption are critical requirements.

How do regulatory standards influence the pricing of Calcium Citrate Tetrahydrate?

Regulatory standards, particularly those requiring USP, EP, or cGMP compliance for pharmaceutical grade material, significantly increase production costs. Compliance necessitates enhanced quality testing, validation of synthesis processes, specialized equipment, and documentation, leading to higher pricing for regulated grades compared to standard Food Grade or Technical Grade calcium citrate.

Is the Asia Pacific region projected to be the fastest-growing market for Calcium Citrate Tetrahydrate?

Yes, the Asia Pacific (APAC) region is projected to experience the fastest growth due to rapidly rising disposable incomes, expanding healthcare access, increasing awareness of preventive health, and substantial demand for fortified foods and infant nutrition products across high-population countries like China and India.

What role does technology play in optimizing the synthesis process of Calcium Citrate Tetrahydrate?

Technology, specifically advanced crystallization engineering (continuous flow reactors) and Process Analytical Technology (PAT), ensures uniform particle size and high crystal purity (tetrahydrate form). This optimization minimizes impurities, maximizes yield, reduces manufacturing time, and ensures that the final product meets stringent pharmaceutical standards for stability and efficacy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager