Calcium Oxalate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434504 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Calcium Oxalate Market Size

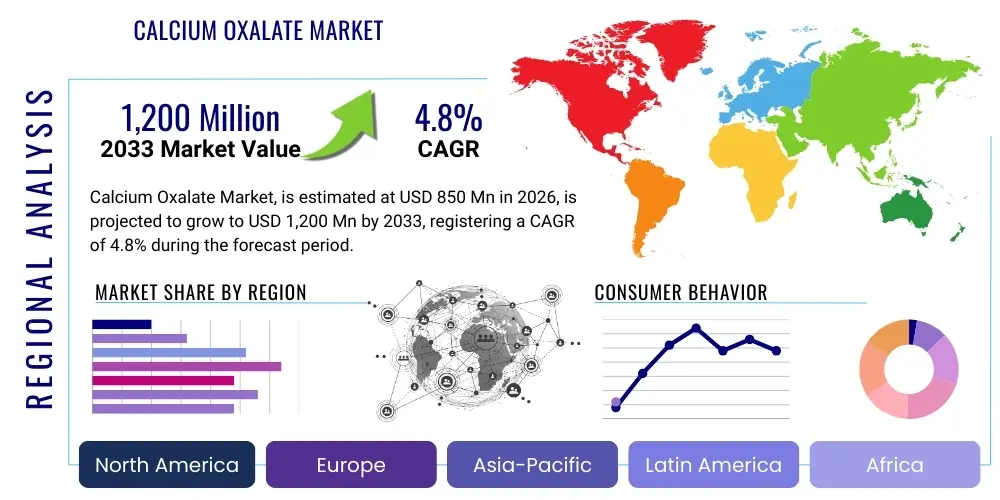

The Calcium Oxalate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,200 Million by the end of the forecast period in 2033.

Calcium Oxalate Market introduction

Calcium oxalate (CaC2O4) is a coordination polymer with significant industrial and biological relevance, primarily occurring as a white, crystalline substance that is insoluble in water. Industrially, it is used as a precursor in the production of specialized ceramics, particularly high-temperature ceramics and ferrites, due to its ability to decompose cleanly upon heating, leaving behind pure calcium oxide. Furthermore, its application extends into the metallurgical sector for the refinement of rare earth elements, where it aids in precipitation processes. The compound is also utilized in analytical chemistry as a primary standard and in certain pharmaceutical formulations, though its medical connotation is often linked to the formation of kidney stones (urolithiasis), which drives demand in diagnostic research and preventative medicine.

The core benefits driving market adoption include its high thermal stability, consistent crystalline structure, and reliability as a chemical standard. Its application in advanced materials synthesis provides manufacturers with precise control over stoichiometry and purity, essential for producing high-performance components used in aerospace and electronics. The increasing investment in materials science research globally, particularly in countries focusing on localized production of specialized chemicals and rare earth magnets, directly fuels the demand for high-purity calcium oxalate. This demand is segmented based on required purity levels, ranging from technical grade for bulk chemical operations to ultra-high purity grades necessary for sensitive electronic applications.

Major driving factors influencing market expansion encompass the rapid growth of the ceramics and refractory materials industry, particularly in Asia Pacific, coupled with the escalating need for specialized chemical intermediates in the pharmaceutical and fine chemicals sectors. The growing global burden of kidney stone disease also contributes indirectly to the market, increasing the funding and necessity for research-grade calcium oxalate for medical diagnostics and research institutions studying crystal growth inhibition and dissolution kinetics. Regulatory standards regarding chemical purity in end-use applications, particularly in Europe and North America, mandate the use of consistently high-quality raw materials, reinforcing market demand.

Calcium Oxalate Market Executive Summary

The Calcium Oxalate Market demonstrates robust growth driven primarily by advancements in specialized ceramics and the surging global demand for fine chemicals and precursors used in advanced manufacturing. Business trends indicate a strong focus on optimizing synthesis methods, moving towards environmentally cleaner and more energy-efficient production techniques, such as hydrothermal synthesis, to achieve higher purity levels suitable for electronics-grade applications. Key market players are investing heavily in capacity expansion, especially in emerging economies, to cater to the burgeoning industrial base. Furthermore, strategic collaborations between chemical producers and end-user industries (ceramics manufacturers and metallurgical plants) are becoming common to ensure stable supply chains and customized product specifications. Sustainability remains a crucial trend, pushing producers to minimize waste and optimize energy use in production.

Regionally, the Asia Pacific (APAC) region dominates the consumption and production landscape, led by China and India, due to their massive industrial bases in infrastructure development, electronics assembly, and rare earth processing. North America and Europe maintain steady demand, driven by specialized, high-value applications in medical research and advanced aerospace materials, where stringent quality control necessitates premium-priced, high-purity material. The competitive landscape is characterized by the presence of a few global leaders and numerous regional specialized manufacturers, leading to competitive pricing in technical-grade segments while high margins are maintained in ultra-high purity segments.

Segment trends reveal that the synthesis grade segment, used primarily as a chemical intermediate, accounts for the largest volume share, benefiting from bulk industrial applications. However, the research and diagnostics grade segment, though smaller in volume, is exhibiting the fastest growth rate, propelled by increasing global healthcare expenditure and biomedical research focusing on crystallization processes. By application, ceramics and refractory materials represent the predominant market segment due to the vast volumes consumed in high-temperature kilns and component manufacturing, while the metallurgical application segment shows significant promise related to rare earth element separation technologies.

AI Impact Analysis on Calcium Oxalate Market

User queries regarding AI's impact on the Calcium Oxalate market frequently revolve around process optimization, predictive quality control, and the acceleration of materials discovery related to oxalate compounds. Users are keenly interested in whether AI and machine learning (ML) algorithms can predict crystallization rates, optimize yield efficiency in synthesis reactors, and analyze complex reaction kinetics in real-time, thereby reducing material waste and energy consumption. Concerns are often raised about the high cost of implementing sophisticated AI-driven monitoring systems in traditional chemical plants and the necessity of high-quality sensor data to feed these advanced models. The expectation is that AI will primarily revolutionize upstream manufacturing processes, specifically improving the uniformity and purity of the resulting calcium oxalate crystals, which is crucial for high-end applications like electronics and medical standards.

The application of AI in the manufacturing segment allows producers to move beyond traditional batch processing and adopt highly optimized continuous production cycles. Machine learning models can analyze vast datasets concerning temperature fluctuations, pH levels, reactant concentrations, and stirring speeds to determine the optimal parameters for achieving specific crystal morphologies and size distributions—a critical factor for materials used in advanced ceramics. Predictive maintenance based on AI also minimizes unscheduled downtime in synthesis and drying equipment, further enhancing operational efficiency and lowering overall production costs, thereby impacting the market's supply dynamics and pricing structure.

Beyond manufacturing, AI-driven computational chemistry is accelerating research into calcium oxalate's biological implications, particularly urolithiasis. ML models are being trained to predict the efficacy of novel crystallization inhibitors, analyze patient dietary data correlation with stone formation, and even automate the analysis of complex microscopy images of crystal samples. This research acceleration, supported by AI, ensures a continuous stream of demand from pharmaceutical and clinical research sectors for standardized, high-purity calcium oxalate samples used in experimental controls and validation studies.

- AI-driven optimization of crystallization parameters leads to improved purity and yield efficiency in synthesis.

- Predictive quality control systems use ML to minimize batch variation, crucial for electronic and medical grades.

- AI enhances supply chain visibility and demand forecasting for key raw materials (calcium salts and oxalic acid).

- Machine learning accelerates computational chemistry research into novel therapeutic approaches for calcium oxalate-related diseases.

- Automated process monitoring reduces energy consumption and operational waste in production facilities.

DRO & Impact Forces Of Calcium Oxalate Market

The market dynamics are governed by a complex interplay of drivers, restraints, and opportunities. Key drivers include the exponential growth in the global ceramics sector, especially structural and advanced technical ceramics used in automotive and aerospace lightweighting initiatives. The increasing focus on rare earth element separation, particularly in Asian economies, provides sustained demand as calcium oxalate remains a reliable precipitating agent in these complex processes. However, the market faces significant restraints, notably the regulatory hurdles and occupational safety requirements related to handling oxalic acid precursors and the toxicity concerns associated with the end product. Furthermore, the availability of alternative, less hazardous chemical precursors in niche applications presents a competitive restraint. Opportunities arise from expanding applications in specialized high-purity chemical standards for environmental monitoring and the development of novel composites utilizing calcium oxalate nanomaterials for enhanced structural properties.

Impact forces, defined by the relative influence of these factors, demonstrate that demand pull from advanced materials manufacturing currently exerts the strongest positive pressure. The globalization of supply chains and the need for standardized material specifications across different regions amplify this demand pull. Conversely, environmental and health safety regulations represent a significant restraining force, increasing operational costs for manufacturers and requiring substantial investment in closed-loop handling systems and waste treatment. The threat of substitution, particularly from other inorganic precursors, remains moderate but is closely monitored in cost-sensitive bulk applications. Innovation opportunities focused on creating nano-grade calcium oxalate for biomedical delivery systems or advanced coating technologies offer promising avenues for premiumization and market diversification.

In summary, while the industrial demand remains robust, manufacturers must navigate strict health and environmental compliance frameworks. The market’s resilience depends heavily on continuous technological advancements in synthesis purity, enabling penetration into high-value markets where material quality cannot be compromised. The strategic alignment of production capacity with emerging centers of advanced manufacturing, such as Southeast Asia and certain parts of Eastern Europe, will be critical for long-term growth and capitalizing on the opportunities presented by specialized chemical applications.

Segmentation Analysis

The Calcium Oxalate market is comprehensively segmented based on its Purity Grade, which dictates suitability for end-use applications; the Application Area, reflecting the major consuming industries; and the regional presence. Purity is crucial, differentiating between technical grade (for bulk chemical processing), synthesis grade (intermediate quality for standard industrial uses), and high/ultra-high purity grade (essential for medical diagnostics, analytical standards, and specialized electronics). The application segmentation highlights the dominant role of the ceramics sector alongside growing demand from pharmaceutical research and metallurgical processes. This structured segmentation provides manufacturers and stakeholders with granular insights into market dynamics, pricing strategies, and regional consumption patterns, facilitating targeted market penetration.

- By Purity Grade:

- Technical Grade

- Synthesis Grade

- High Purity Grade (99% - 99.9%)

- Ultra-High Purity Grade (99.99%+ for Electronics/Medical)

- By Application:

- Ceramics and Refractory Materials

- Metallurgy (Rare Earth Processing)

- Chemical Synthesis and Precursors

- Analytical Chemistry and Laboratory Standards

- Pharmaceutical and Biomedical Research

- By Form:

- Powder

- Crystals

Value Chain Analysis For Calcium Oxalate Market

The Calcium Oxalate value chain begins with the upstream sourcing of primary raw materials: calcium salts (such as calcium chloride or calcium hydroxide) and oxalic acid (or oxalates). The quality and stability of these precursors significantly influence the final purity of the calcium oxalate product, demanding high supplier reliability and stringent quality control at the procurement stage. Manufacturing involves precise precipitation or hydrothermal synthesis processes, followed by crucial steps like washing, drying, and milling to achieve the required crystal morphology and size distribution. Efficiency in this stage, including energy optimization and waste byproduct management, is a key determinant of the final production cost. Integrated manufacturers often produce their own oxalic acid to control costs and supply stability, while non-integrated producers rely on long-term supply agreements.

The distribution channel is multifaceted. For high-volume technical and synthesis grades destined for ceramics or metallurgy, distribution often utilizes direct sales channels, bulk shipping, and specialized chemical distributors capable of handling hazardous materials compliant with global transport regulations. These direct channels prioritize cost efficiency and bulk logistics. Conversely, ultra-high purity grades intended for specialized electronics, pharmaceuticals, or research laboratories predominantly rely on indirect channels, utilizing specialized fine chemical distributors who offer smaller pack sizes, rigorous quality certification, and rapid delivery services across international borders. These specialized distributors provide crucial value-added services such as repackaging, quality documentation, and regulatory support, commanding higher margins.

Downstream analysis reveals that the product flows into various end-user industries. Ceramics manufacturers use it as a thermal decomposition precursor; metallurgical operations utilize it for selective precipitation; and research institutions require it as a highly specific chemical standard. The market's profitability is dictated by the ability of manufacturers to transition from supplying low-margin technical grades to high-margin, ultra-high purity products. Strategic positioning requires expertise in tailoring crystal structure and particle size distribution to meet demanding end-user performance specifications, particularly in advanced materials where impurity levels below parts per million are often required, necessitating advanced packaging and handling procedures.

Calcium Oxalate Market Potential Customers

The primary end-users and buyers of Calcium Oxalate span diverse industrial sectors requiring precise chemical precursors, analytical standards, or specialized precipitation agents. Ceramics manufacturers, particularly those focusing on technical ceramics like advanced insulators, grinding media, and structural components for aerospace and defense, represent the largest customer base. These entities purchase synthesis and technical grades in significant volumes for use in high-temperature processes where the compound acts as a precise source of calcium oxide. Their purchasing decisions are primarily influenced by consistent quality, bulk pricing, and reliable long-term supply contracts, emphasizing stability and scale.

Another crucial customer segment is the metallurgy and rare earth processing industry. Companies involved in the extraction, separation, and purification of rare earth elements (REEs) utilize calcium oxalate as a highly effective precipitant to isolate specific REE fractions. Given the strategic importance and complex nature of REE supply chains, these customers demand high-purity, reactive grades to ensure maximum separation efficiency and minimal contamination. Geographically, these buyers are heavily concentrated in regions like China, Southeast Asia, and increasingly, North America, where strategic domestic REE production is being incentivized.

Finally, the pharmaceutical, biomedical, and analytical chemistry sectors constitute a rapidly growing, albeit lower-volume, customer segment demanding ultra-high purity grades. Research institutions, diagnostic laboratories, and pharmaceutical companies studying kidney disease, or using calcium oxalate as a certified analytical standard, are willing to pay a substantial premium for materials with documented purity and traceability. For these buyers, quality certification (such as USP or reagent grade) and detailed documentation regarding trace elements and particle size distribution are paramount, often overriding cost considerations in purchasing decisions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,200 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sigma-Aldrich (Merck KGaA), Alfa Aesar (Thermo Fisher Scientific), American Elements, Central Drug House, TCI Chemicals, Lonza Group, Wako Pure Chemical Industries (Fujifilm), VWR International, Merck Millipore, Solvay S.A., Spectrum Chemical Mfg. Corp., Parchem Fine & Specialty Chemicals, Otto Chemie Pvt. Ltd., Nanjing Chemical Reagent Co., Santa Cruz Biotechnology, Inc., Gelest Inc., Sisco Research Laboratories Pvt. Ltd., Beantown Chemical, Evonik Industries AG, Noah Chemicals. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Calcium Oxalate Market Key Technology Landscape

The technological landscape in the Calcium Oxalate market is focused on achieving superior material purity, controlling particle size distribution (PSD), and enhancing synthesis efficiency to reduce operational costs. The primary synthesis method remains precipitation from solutions of calcium salts and oxalic acid; however, modern advancements center on optimizing reaction conditions, such as controlled cooling rates and surfactant addition, to tailor crystal morphology for specific applications. Hydrothermal synthesis is gaining traction, particularly for producing nano-sized calcium oxalate particles (often used in advanced composites and biomedical research), offering better control over stoichiometry and homogeneity compared to traditional methods. Furthermore, continuous flow chemistry techniques are being investigated as a means to move away from energy-intensive batch processing, promising enhanced yield consistency and reduced overall production time.

Technological innovations are also highly concentrated in downstream processing and quality assurance. Advanced filtration and drying technologies, including spray drying and freeze drying, are essential for preserving the morphology and purity of ultra-fine powders. For quality control, high-resolution analytical techniques such as X-ray Diffraction (XRD), Scanning Electron Microscopy (SEM), and Inductively Coupled Plasma Mass Spectrometry (ICP-MS) are indispensable for certifying the high purity and structural integrity demanded by high-end users in the electronics and medical sectors. Investment in automated, real-time spectroscopy and sensor technology integrated with AI systems (as mentioned previously) is becoming a competitive differentiator, enabling instant feedback loops to adjust synthesis parameters and ensure batch conformity.

Looking ahead, nanotechnology and surface modification technologies represent the next frontier. Researchers are exploring methods to synthesize calcium oxalate with specific surface functionalization to improve compatibility with polymer matrices in composite materials or to enhance dissolution characteristics for potential drug delivery systems. The move towards green chemistry principles is also a significant technological driver, pushing for the development of synthesis routes that minimize the use of harsh solvents and reduce the volume of waste byproducts, aligning with stricter global environmental regulations and consumer preference for sustainable chemical manufacturing practices.

Regional Highlights

- Asia Pacific (APAC) Dominance: APAC holds the largest market share and is projected to exhibit the highest growth rate, primarily driven by China and India. This dominance is attributed to the region's massive manufacturing capacity in technical ceramics, rapid urbanization boosting construction and refractory materials demand, and the concentration of rare earth element processing facilities. Investment in localizing advanced chemical production further solidifies the region's position.

- North American Stability and High Value: North America represents a mature, high-value market segment. Demand here is characterized by stringent quality requirements, focusing heavily on ultra-high purity grades for pharmaceutical research, medical diagnostics, and advanced aerospace and defense material applications. Regulatory oversight drives demand for certified analytical standards, ensuring stable, albeit slower, growth.

- European Focus on Regulation and Specialty Chemicals: Europe demonstrates consistent demand, driven by well-established chemical, automotive, and fine material sectors. The region is marked by rigorous environmental regulations (REACH), pushing manufacturers towards sustainable synthesis methods. Demand is strongly segmented toward high-end specialty chemicals and precursors, particularly in Germany and Switzerland, which are hubs for pharmaceutical and advanced materials R&D.

- Latin America (LATAM) Emerging Growth: LATAM is an emerging market, showing incremental growth linked to expanding industrialization, particularly in Brazil and Mexico. The demand is currently focused on technical and synthesis grades for localized manufacturing and infrastructure projects. Economic volatility remains a key challenge, but long-term industrialization efforts present significant opportunity.

- Middle East & Africa (MEA) Infrastructure Investment: MEA displays potential growth, specifically tied to large-scale infrastructure and industrial diversification projects, particularly in the Gulf Cooperation Council (GCC) countries. The demand is primarily focused on refractory materials for construction and petrochemical refining, requiring bulk technical grade materials. Limited local production capacity necessitates reliance on imports, making supply chain reliability a key factor.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Calcium Oxalate Market.- Sigma-Aldrich (Merck KGaA)

- Alfa Aesar (Thermo Fisher Scientific)

- American Elements

- Central Drug House

- TCI Chemicals

- Lonza Group

- Wako Pure Chemical Industries (Fujifilm)

- VWR International

- Merck Millipore

- Solvay S.A.

- Spectrum Chemical Mfg. Corp.

- Parchem Fine & Specialty Chemicals

- Otto Chemie Pvt. Ltd.

- Nanjing Chemical Reagent Co.

- Santa Cruz Biotechnology, Inc.

- Gelest Inc.

- Sisco Research Laboratories Pvt. Ltd.

- Beantown Chemical

- Evonik Industries AG

- Noah Chemicals

Frequently Asked Questions

Analyze common user questions about the Calcium Oxalate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of high-purity Calcium Oxalate?

High-purity Calcium Oxalate is predominantly used as a certified analytical standard in laboratory testing, as a precursor in the production of advanced technical ceramics and ferrites, and extensively in biomedical research related to crystallization processes and urolithiasis studies.

Which region dominates the global consumption of Calcium Oxalate, and why?

The Asia Pacific (APAC) region dominates the global market consumption, driven by its expansive industrial base in China and India, particularly due to high-volume usage in the manufacturing of refractory materials, structural ceramics, and extensive rare earth element processing operations.

What are the main purity grades available in the market?

The market is segmented into Technical Grade (industrial bulk use), Synthesis Grade (intermediate chemical processes), High Purity Grade (99%+), and Ultra-High Purity Grade (99.99%+), with the latter required for specialized electronics and certified medical standards.

How do regulatory factors impact the Calcium Oxalate market?

Regulatory factors, particularly concerning the handling and disposal of precursor materials like oxalic acid, increase operational complexity and costs for manufacturers. Furthermore, strict regulatory standards for purity in end-use applications (e.g., pharmaceuticals) create high barriers to entry for ultra-high purity material producers.

What key technological innovations are shaping the future production of Calcium Oxalate?

Key innovations include the adoption of hydrothermal synthesis for controlled nano-material production, continuous flow chemistry to enhance efficiency and consistency, and the integration of AI/ML for real-time process optimization and predictive quality control in large-scale synthesis reactors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager