Calcium Phytate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434093 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Calcium Phytate Market Size

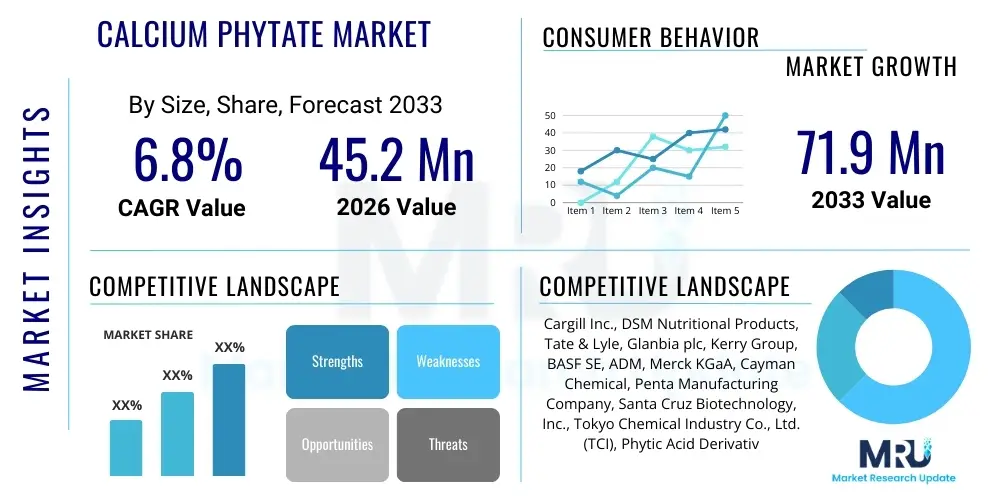

The Calcium Phytate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 45.2 million in 2026 and is projected to reach USD 71.9 million by the end of the forecast period in 2033.

Calcium Phytate Market introduction

Calcium Phytate, chemically known as calcium inositol hexakisphosphate, is a mineral salt derived from phytic acid (inositol hexakisphosphate), which is abundantly found in seeds, grains, and nuts. This compound serves crucial roles primarily in the food, pharmaceutical, and cosmetic industries due to its unique chemical properties, especially its function as a chelating agent and a source of readily available calcium and phosphorus. Historically, phytic acid was viewed negatively in nutrition due to its anti-nutrient properties, inhibiting mineral absorption. However, Calcium Phytate is increasingly being utilized in controlled applications to leverage its beneficial functionalities, such as antioxidant activity and stabilization capabilities, particularly when formulated appropriately.

The core applications of Calcium Phytate are centered on its ability to stabilize formulations and act as a calcium supplement. In the food industry, it is employed as a food additive, primarily as a mineral fortifier, though its use is regulated based on regional safety standards. Its ability to chelate metal ions makes it invaluable in stabilizing fats and oils, preventing oxidative degradation and extending shelf life in processed foods and beverages. Furthermore, in the pharmaceutical sector, it is investigated for use in drug delivery systems and as a supportive ingredient in oral supplements aimed at bone health, capitalizing on its high calcium content.

Driving factors for the market expansion include the burgeoning demand for natural and bio-derived ingredients across various sectors, coupled with increased consumer awareness regarding dietary supplementation and mineral deficiencies. The global shift toward preventative healthcare and the incorporation of functional ingredients in fortified foods further stimulate demand. However, the market must navigate regulatory complexities concerning its safety profile, especially in high concentrations, which necessitates ongoing research and development into optimized production methods and application dosages to maximize benefits while mitigating any perceived risks associated with phytic acid derivatives.

Calcium Phytate Market Executive Summary

The Calcium Phytate market is characterized by moderate growth, primarily fueled by its growing adoption as a functional food additive and a key ingredient in nutraceuticals targeting mineral supplementation. Business trends indicate a strong focus among manufacturers on enhancing purity levels and developing highly stable, granular forms of Calcium Phytate to meet stringent quality requirements in the pharmaceutical grade segment. Strategic collaborations between raw material suppliers (phytic acid extractors) and end-product formulators are becoming essential to secure stable supply chains and ensure cost-effectiveness, particularly in the rapidly expanding Asia Pacific consumer markets. Furthermore, sustainability in sourcing phytic acid, often derived from rice bran or corn steep liquor, is emerging as a critical competitive differentiator.

Regionally, Asia Pacific is anticipated to exhibit the fastest growth, largely driven by increasing consumption of fortified foods, rapid urbanization, and rising disposable incomes that support higher expenditure on health supplements. North America and Europe, representing mature markets, maintain significant market share, characterized by high regulatory standards and a strong demand from established cosmetic and specialized chemical manufacturers utilizing Calcium Phytate’s chelating and anti-aging properties. These regions prioritize high-purity grades and specialized delivery formats, pushing innovation in encapsulation and formulation science. The Middle East and Africa and Latin America are nascent markets with significant potential, especially in food fortification programs aimed at public health improvement.

Segment trends highlight the dominance of the Food and Beverages segment, where Calcium Phytate is used extensively for stabilization and mineral fortification. However, the Nutraceuticals segment, encompassing dietary supplements, is projecting the highest growth rate, reflecting the global trend towards preventive medicine and personalized nutrition. In terms of grade, the food grade segment holds the largest volume share, while the pharmaceutical grade, demanding greater rigor in purity and testing, commands a higher price point and is expected to drive value growth. Key industry players are increasingly investing in research to unlock novel applications beyond traditional uses, focusing on areas like bone density improvement and specialized anti-inflammatory formulations.

AI Impact Analysis on Calcium Phytate Market

User inquiries regarding AI's impact on the Calcium Phytate market predominantly revolve around three critical themes: optimizing extraction and purification processes, predicting formulation stability, and accelerating novel application discovery. Users are highly interested in how machine learning can enhance the efficiency and yield of phytic acid extraction from agricultural by-products, a process that is currently energy-intensive and variable. There is also significant concern regarding supply chain optimization, where AI-driven predictive analytics could forecast demand fluctuations for key derivatives and manage raw material inventory, especially given the global variability in agricultural yields. Furthermore, advanced AI modeling is expected to drastically reduce the time and cost associated with formulating new nutritional supplements or food stabilization systems by predicting the interaction of Calcium Phytate with other complex ingredients, ensuring optimal bioavailability and shelf life.

The implementation of AI and Big Data analytics is poised to revolutionize quality control and regulatory compliance within the Calcium Phytate production ecosystem. AI-powered image processing and sensor data analysis can monitor production batches in real-time, instantly detecting impurities or deviations in crystal structure, thereby ensuring pharmaceutical and food-grade standards are consistently met, significantly lowering recall risks. In research and development, generative AI models can simulate thousands of molecular interactions, identifying optimal dosages and synergistic ingredient combinations for enhanced bioavailability, thereby addressing the long-standing challenge of reducing phytic acid’s potential anti-nutrient effect while maximizing the benefits of the delivered calcium. This technological leap will enable manufacturers to customize Calcium Phytate formulations for highly specific dietary or medical needs.

AI's strategic role extends into market analysis and personalized health recommendations. AI algorithms analyzing vast consumer data and clinical trial outcomes can identify emerging market needs for calcium supplements and functional foods, guiding manufacturers toward high-potential product development areas, such as targeted bone health supplements for specific demographic groups. Moreover, in the future, personalized nutrition platforms utilizing AI could recommend specific Calcium Phytate dosages based on an individual's genetic profile and existing diet, driving demand for specialized, high-purity products. This shift ensures production aligns precisely with verified consumer demand, reducing wastage and increasing overall market responsiveness and efficiency.

- AI-driven optimization of phytic acid extraction yield and purity using predictive modeling.

- Machine learning algorithms enhancing quality control by detecting impurities in real-time processing.

- Predictive analytics improving supply chain resilience and raw material inventory management.

- Generative AI accelerating formulation R&D by simulating ingredient interactions for optimal bioavailability.

- AI facilitating personalized nutrition recommendations, customizing dosage based on consumer health data.

- Automation and robotics integration improving manufacturing scale and reducing labor costs in downstream processing.

DRO & Impact Forces Of Calcium Phytate Market

The dynamics of the Calcium Phytate market are primarily governed by the increasing global focus on mineral deficiencies and the subsequent governmental and industrial push for food fortification (Driver). However, this growth is significantly restrained by the persistent perception of phytic acid as an anti-nutrient, which requires substantial consumer and regulatory education, alongside strict dosage limits (Restraint). The opportunity lies in leveraging its potent chelating properties beyond nutrition, particularly in advanced material science, water purification, and niche cosmetics, positioning it as a multifunctional bio-based chemical. The combined impact of these forces—high demand for natural fortifiers counterbalanced by stringent anti-nutrient perceptions—necessitates innovation in delivery systems to unlock the market’s full potential, demanding higher investment in technological improvements.

The key driving forces include the rapid growth of the global nutraceutical industry, driven by aging populations and increased health consciousness, where Calcium Phytate is prized for providing both calcium and phosphorus in a stable, bio-available form (though bioavailability remains a focus area for research). Furthermore, the regulatory environment in several developing nations is becoming more supportive of food fortification to combat widespread nutritional deficiencies, particularly in staple foods like flour and cereals, creating massive volume demand. Conversely, the market faces restraints related to the high complexity and cost associated with achieving pharmaceutical-grade purity, which involves multiple crystallization and drying steps. Supply instability, often tied to fluctuating agricultural by-product availability (like rice bran), also poses a logistical challenge, affecting pricing volatility.

The primary opportunities stem from technological advancements in microbial fermentation and enzymatic hydrolysis, which offer pathways to modify phytic acid structure, potentially mitigating its anti-nutrient effects and enhancing its acceptance. The development of microencapsulation techniques provides a critical avenue for protecting the compound during processing and improving targeted delivery within the human body or industrial processes. Impact forces, therefore, include increasing R&D investment (positive force), the continuous pressure from competitive, cheaper mineral alternatives like calcium carbonate (negative force), and evolving consumer preferences towards natural, plant-derived ingredients (positive force). The market’s future trajectory hinges on successful technological mitigation of the anti-nutrient image while scaling up production sustainably.

- Drivers:

- Growing prevalence of calcium and phosphorus deficiencies globally.

- Increasing consumer demand for functional and fortified foods and beverages.

- Rising adoption in the cosmetic industry for its chelating and stabilizing properties.

- Expansion of the global nutraceutical and dietary supplement market.

- Restraints:

- Regulatory constraints and dosage limits due to phytic acid's anti-nutrient characteristics.

- Complexity and high cost involved in manufacturing high-purity pharmaceutical grade Calcium Phytate.

- Availability and price volatility of key raw materials derived from agricultural waste.

- Competition from established, cost-effective synthetic calcium sources.

- Opportunities:

- Technological advancements in enzymatic modification to enhance bioavailability.

- Emerging applications in specialized industrial sectors, such as precision cleaning and wastewater treatment.

- Development of novel microencapsulation technologies for targeted delivery.

- Untapped potential in pediatric nutrition and geriatric care formulations.

- Impact Forces:

- High Impact: R&D investment in formulation science to overcome bioavailability hurdles.

- Medium Impact: Stringent global food safety and pharmaceutical regulatory harmonization.

- Low Impact: Fluctuations in agricultural commodity prices affecting raw material costs.

Segmentation Analysis

The Calcium Phytate market is segmented primarily based on application, grade, and form, providing a granular view of demand patterns across different end-use industries. The application segmentation reveals the dual-utility of Calcium Phytate as both a nutritional enhancer and a technical stabilizer, with the largest volume consumed in food processing and the highest value growth stemming from specialized nutraceutical and pharmaceutical uses. Manufacturers strategically tailor purity, particle size, and hydration levels to meet the specific requirements of each segment, optimizing the product for solubility in beverages or stability in tablet formulations. Understanding these segment dynamics is crucial for producers aiming to maximize market penetration and pricing power.

Grade segmentation—Food Grade, Pharmaceutical Grade, and Others (including Cosmetic and Technical)—dictates production complexity and average selling price. Pharmaceutical Grade necessitates the highest level of quality assurance, including strict heavy metal limits and microbial testing, making it the most profitable segment per unit. Conversely, Food Grade constitutes the bulk of production, catering to high-volume fortification and preservation needs. The increasing convergence of food and health standards globally, particularly in developed economies, is blurring the lines between these grades, pushing the minimum quality expectation higher even for standard food applications.

Further analysis of the form segment, including Powder and Granular, highlights preferences based on handling and manufacturing processes. The powdered form is dominant due to its easy integration into liquid suspensions and blended food mixes, while the granular form is preferred in tablet compression and certain industrial applications where reduced dust and enhanced flowability are necessary. The overall segmentation landscape confirms that growth will be concentrated in high-value, specialized segments driven by health and regulatory compliance, demanding continuous innovation in purification and standardization protocols.

- By Application:

- Food and Beverages

- Nutraceuticals and Dietary Supplements

- Pharmaceuticals

- Cosmetics and Personal Care

- Chemical and Technical Applications

- By Grade:

- Food Grade

- Pharmaceutical Grade

- Technical/Industrial Grade

- By Form:

- Powder

- Granular

- Liquid Suspension (Niche)

Value Chain Analysis For Calcium Phytate Market

The Calcium Phytate value chain commences with the upstream extraction and sourcing of phytic acid, the primary raw material, which is typically obtained from agricultural by-products such as rice bran, corn steep liquor, or defatted oilseeds. This stage involves complex chemical or enzymatic processes to isolate the phytic acid, requiring specialized knowledge and efficient waste management. Suppliers in the upstream segment face constant pressure regarding the seasonality and price volatility of agricultural commodities. Efficiency in this stage significantly impacts the final cost structure, as transportation and storage of these voluminous raw materials must be managed carefully before the chemical conversion into calcium salt.

The midstream segment involves the core manufacturing process: the reaction of phytic acid with calcium sources, purification, crystallization, and subsequent drying and milling to achieve the desired grade (Food, Pharma, or Technical) and form (Powder or Granular). High capital investment in purification technologies, particularly chromatography or multiple precipitation steps, is essential to meet stringent pharmaceutical specifications regarding heavy metals and solvent residues. Direct distribution involves manufacturers selling high-volume, standard-grade products directly to large food processors or chemical companies. Indirect distribution utilizes specialized distributors and agents, particularly for pharmaceutical and niche cosmetic ingredients, where regulatory expertise, small batch sizes, and just-in-time delivery are critical services provided by the intermediary.

Downstream analysis focuses on the integration of Calcium Phytate into end-user products, such as fortified cereals, mineral supplements, and specialty cosmetic formulations. The effectiveness of the product in these applications depends heavily on formulation science—ensuring stability, solubility, and bioavailability. The distribution channel selection is often based on the end-user industry; high-security, traceable channels are mandatory for pharmaceuticals, while established food ingredient supply networks handle the high-volume food grade material. The value addition is maximized at the downstream stage through branding, clinical validation, and the development of proprietary formulations that enhance the ingredient's functionality and consumer appeal.

Calcium Phytate Market Potential Customers

The primary consumers of Calcium Phytate are large-scale food manufacturers and ingredient blenders who utilize the compound for its fortification and stabilization capabilities. Within the food sector, staple food producers, particularly those involved in breakfast cereals, infant formulas, and bakery products, represent a major demand pool seeking to boost the mineral content of their offerings to meet public health standards and consumer expectations for functional foods. Beverage manufacturers also constitute a significant customer base, employing Calcium Phytate to chelate trace metals that can cause cloudiness or off-flavors, thereby ensuring product clarity and shelf stability.

Nutraceutical companies form the second critical tier of potential customers. These firms specialize in developing dietary supplements aimed at specific health outcomes, such as bone density maintenance, geriatric health, and prenatal care. They require pharmaceutical or high-quality food grade Calcium Phytate, emphasizing purity, particle size control, and clinical evidence supporting bioavailability. This segment demands specialized service from suppliers, including regulatory documentation and formulation support, driving the premium pricing in this end-use category. The sustained global rise in self-medication and proactive health management ensures consistent high-growth demand from this segment.

Additionally, the cosmetic and specialty chemical industries represent niche but growing customer segments. Cosmetic companies use Calcium Phytate in anti-aging creams, toothpastes, and personal care products for its metal ion-chelating properties, which counteract the degrading effects of hard water and trace metal contamination, ensuring product integrity and efficacy. Technical grade applications include specialized industrial processes such as metal surface treatment, corrosion inhibition, and small-scale water treatment, where its chelating power is leveraged to control mineral buildup or remove contaminants. These diverse applications necessitate tailored product specifications, making the customer base highly segmented by technical requirement.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 Million |

| Market Forecast in 2033 | USD 71.9 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cargill Inc., DSM Nutritional Products, Tate & Lyle, Glanbia plc, Kerry Group, BASF SE, ADM, Merck KGaA, Cayman Chemical, Penta Manufacturing Company, Santa Cruz Biotechnology, Inc., Tokyo Chemical Industry Co., Ltd. (TCI), Phytic Acid Derivatives Co., Ltd., Wuxi Chunhui Biotechnology Co., Ltd., Spectrum Chemical Manufacturing Corp., Haihang Industry Co., Ltd., Loba Chemie Pvt. Ltd., Hangzhou Fanda Chemical Co., Ltd., Shaanxi Top Pharm Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Calcium Phytate Market Key Technology Landscape

The technology landscape for the Calcium Phytate market is primarily focused on improving the efficiency of phytic acid extraction and enhancing the compound's functional characteristics, particularly its bioavailability. Traditional extraction methods involve acid or alkaline treatments of agricultural by-products, which are often inefficient and lead to product heterogeneity. Modern technological advancements are increasingly centered on environmentally friendly and higher-yield methods. Enzyme-assisted extraction (EAE) utilizing specific phytase enzymes is gaining traction, offering higher purity outputs and reduced harsh chemical usage, aligning with clean label trends and sustainability goals.

A second crucial area of technological innovation involves purification and particle engineering. To meet the stringent requirements of pharmaceutical and advanced nutraceutical applications, manufacturers are employing supercritical fluid extraction (SFE) and specialized chromatography techniques to remove residual heavy metals and organic solvents effectively. Furthermore, nanotechnology and microencapsulation are pivotal for developing enhanced delivery systems. Microencapsulation involves coating Calcium Phytate particles in polymeric materials or liposomes, which protects the compound from degradation in the digestive tract and enhances targeted release, thereby significantly improving calcium absorption and mitigating the anti-nutrient effect associated with raw phytic acid.

The market also benefits from advanced analytical technologies that ensure quality control and batch consistency. High-Performance Liquid Chromatography (HPLC) and Mass Spectrometry are standard tools for verifying purity and ensuring compliance with regulatory bodies like the FDA and EFSA. Future technology adoption includes continuous manufacturing processes utilizing flow chemistry, which promises to reduce batch variability, lower energy consumption, and enable more flexible production scale-up. The successful integration of these technologies determines a manufacturer's ability to compete in high-value, quality-sensitive segments such as pharmaceuticals and high-end dietary supplements.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by the expanding middle class, increasing government initiatives for mandatory food fortification (especially in countries like India and China), and a rapidly growing domestic nutraceutical industry. High consumption of rice bran, a primary source of phytic acid, also supports localized production capacity.

- North America: North America holds a substantial market share, characterized by a highly mature supplement industry and stringent quality standards. Demand is concentrated in high-purity pharmaceutical grades and advanced functional food additives, emphasizing clean sourcing and clinical efficacy.

- Europe: The European market is highly regulated by EFSA, focusing heavily on safety and validated health claims. Growth is steady, primarily driven by the cosmetic sector and the demand for natural chelating agents, alongside strong regulatory pressure towards sustainable sourcing and bio-based ingredients.

- Latin America (LATAM): LATAM shows promising growth, spurred by economic development and rising health awareness, leading to greater adoption of fortified foods and mineral supplements to address common dietary deficiencies. Market penetration is accelerating through multinational food conglomerates operating in the region.

- Middle East and Africa (MEA): This region is currently a smaller contributor but possesses high potential, particularly due to public health programs aimed at combatting malnutrition and mineral deficiencies, often necessitating large-scale food fortification projects backed by government funding and international aid organizations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Calcium Phytate Market.- Cargill Inc.

- DSM Nutritional Products

- Tate & Lyle

- Glanbia plc

- Kerry Group

- BASF SE

- Archer Daniels Midland Company (ADM)

- Merck KGaA

- Cayman Chemical

- Penta Manufacturing Company

- Santa Cruz Biotechnology, Inc.

- Tokyo Chemical Industry Co., Ltd. (TCI)

- Phytic Acid Derivatives Co., Ltd.

- Wuxi Chunhui Biotechnology Co., Ltd.

- Spectrum Chemical Manufacturing Corp.

- Haihang Industry Co., Ltd.

- Loba Chemie Pvt. Ltd.

- Hangzhou Fanda Chemical Co., Ltd.

- Shaanxi Top Pharm Co., Ltd.

- Charkit Chemical Corporation

Frequently Asked Questions

Analyze common user questions about the Calcium Phytate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Calcium Phytate and its primary function in the food industry?

Calcium Phytate is the calcium salt of phytic acid, derived from grains and seeds. In the food industry, its primary function is dual: it serves as a mineral fortifier, providing calcium and phosphorus, and acts as a powerful chelating agent, stabilizing foods and beverages by binding trace metals, thereby preventing oxidation, rancidity, and discoloration.

How does the anti-nutrient property of phytic acid affect the Calcium Phytate market?

The historical anti-nutrient label of phytic acid, which inhibits mineral absorption, acts as a restraint on the market. Manufacturers mitigate this by utilizing highly purified Calcium Phytate in controlled dosages and investing in enzymatic modification or microencapsulation technologies to enhance its bioavailability and acceptance in nutraceutical and food fortification applications.

Which application segment is expected to show the highest growth rate in the forecast period?

The Nutraceuticals and Dietary Supplements segment is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This growth is driven by the global aging population, increased consumer focus on preventative health, and the demand for high-ppurity calcium supplements with stable, plant-derived ingredients.

What are the key technological advancements driving production efficiency for Calcium Phytate?

Key technological advancements include enzyme-assisted extraction (EAE) for higher purity and yield, and microencapsulation techniques. EAE improves sourcing sustainability, while microencapsulation enhances the compound's targeted delivery and absorption profile, addressing critical formulation challenges for end-users.

Which region dominates the Calcium Phytate market in terms of volume and value?

While North America and Europe hold high value due to demand for pharmaceutical grade and premium supplements, the Asia Pacific (APAC) region is expected to dominate in terms of future volume growth. This is attributed to massive governmental food fortification programs, rapid urbanization, and expansion of local food and nutraceutical production capacity in populous nations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager