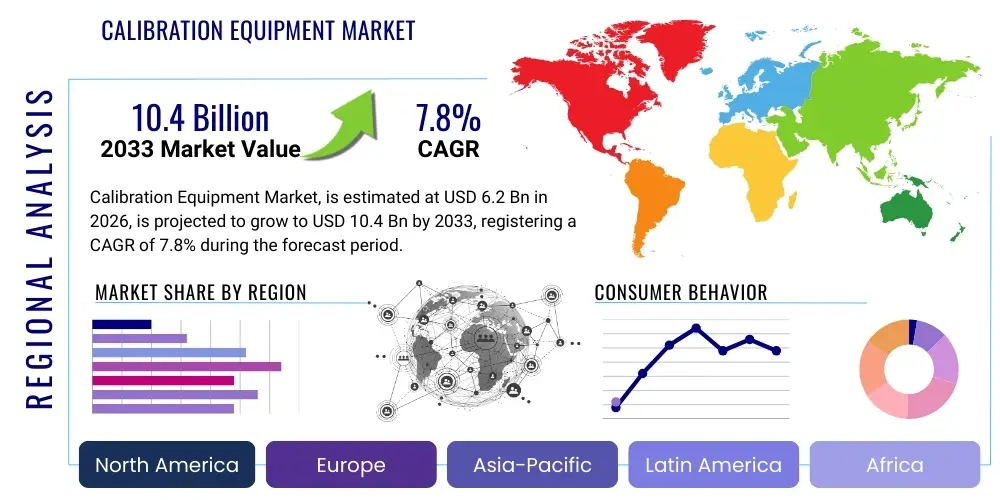

Calibration Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436097 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Calibration Equipment Market Size

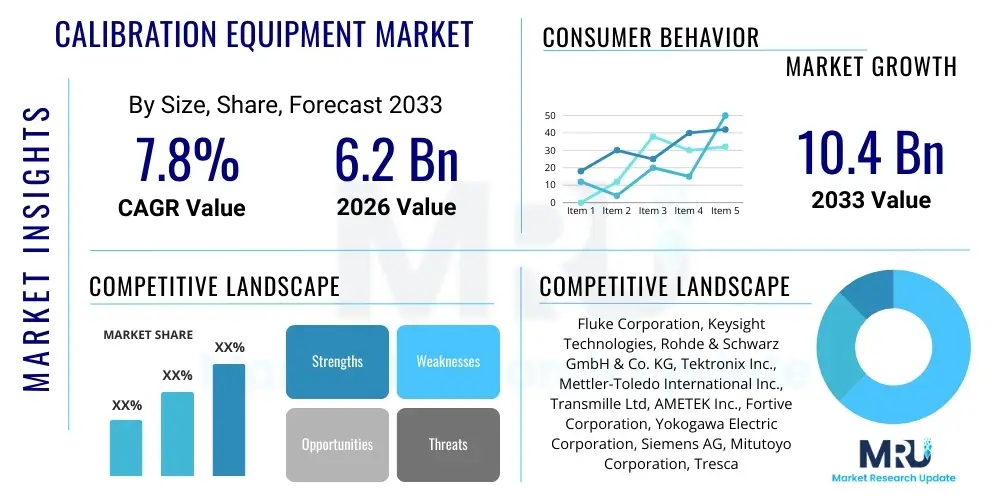

The Calibration Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 6.2 Billion in 2026 and is projected to reach USD 10.4 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily attributed to stringent regulatory requirements across critical industries such as pharmaceuticals, aerospace, and manufacturing, which necessitate accurate and traceable measurement standards. The expansion of industrial automation and the increasing complexity of measurement systems globally further solidify the demand for sophisticated calibration tools and services, driving substantial market expansion over the forecast period. The increasing focus on quality assurance (QA) and quality control (QC) in emerging economies is a significant underlying factor supporting this valuation increase.

The market expansion is also fundamentally influenced by the continuous technological advancements in sensor technologies and the integration of smart calibration systems. Modern calibration equipment now incorporates features such as Internet of Things (IoT) connectivity, cloud-based data storage, and advanced analytics, allowing for predictive maintenance and enhanced efficiency in calibration cycles. Furthermore, the rising need for high-precision calibration in sectors like automotive electronics and semiconductor fabrication, where dimensional and electrical accuracy is paramount, contributes significantly to the anticipated market value increase, establishing a firm base for the projected USD 10.4 Billion valuation by 2033. Manufacturers are focusing on developing portable, multi-functional calibration devices that reduce downtime and increase operational flexibility for end-users operating in dynamic environments.

Calibration Equipment Market introduction

The Calibration Equipment Market encompasses a wide array of instruments, standards, and accessories used to verify and adjust the accuracy of measuring devices against established international references. These sophisticated tools ensure that measurement instruments consistently deliver precise and reliable results, which is essential for quality control, safety compliance, and operational efficiency across virtually all industrial sectors. Product descriptions typically span electrical, dimensional, pressure, temperature, and mechanical calibration devices, ranging from primary standards used in national laboratories to portable field calibrators used on production floors. The fundamental objective of this equipment is maintaining measurement traceability, linking all measurements back to fundamental SI units, thereby standardizing global industrial processes.

Major applications of calibration equipment are pervasive, spanning highly regulated environments such as petrochemical refineries, power generation plants, clinical laboratories, and aerospace manufacturing facilities. In the pharmaceutical sector, precise temperature and pressure calibration are vital for drug stability and process validation, while the automotive industry relies heavily on dimensional and torque calibration for safety-critical components. The primary benefit derived from utilizing high-quality calibration equipment is risk mitigation, ensuring product quality meets regulatory standards, avoiding costly defects, and preventing equipment failure. Furthermore, accurate calibration optimizes resource consumption and improves operational throughput, offering a compelling return on investment for adopting entities.

Key driving factors fueling market growth include the escalating volume of complex manufacturing processes, particularly in Asia Pacific, demanding tighter tolerances and higher measurement accuracies. Regulatory bodies like the International Organization for Standardization (ISO), particularly ISO 9001 and ISO/IEC 17025, mandate periodic calibration, creating sustained demand. Moreover, the increasing adoption of automated inspection systems and digital manufacturing practices accelerates the need for equipment that can interface seamlessly with these modern industrial ecosystems. The trend towards industrial digitization necessitates robust data logging and certified measurement capabilities, placing calibration equipment at the core of modern industrial metrology strategies. Investment in advanced manufacturing techniques, such as additive manufacturing, which require new forms of dimensional metrology, is further stimulating innovation and growth in the specialized calibration segments.

Calibration Equipment Market Executive Summary

The Calibration Equipment Market is poised for substantial growth, driven primarily by favorable business trends emphasizing quality assurance, regulatory compliance, and industrial digitization. Current business trends show a significant pivot towards integrated, automated calibration solutions that minimize human error and calibration time. Key market participants are increasingly focusing on mergers and acquisitions to expand their geographical footprint and diversify their technological offerings, particularly in software-defined calibration platforms and cloud-based asset management systems. The demand for outsourced calibration services is also rising, particularly among small and medium enterprises (SMEs) that lack the specialized in-house metrology expertise, creating a dynamic service-oriented business model complementing equipment sales. This trend underscores a strategic shift towards holistic metrology management rather than just equipment procurement, favoring vendors who offer comprehensive service contracts and digital integration capabilities.

Regionally, the Asia Pacific (APAC) market is expected to exhibit the highest growth rate, fueled by rapid industrialization, massive investments in infrastructure development, and the establishment of stringent quality standards in emerging economies like China, India, and South Korea. North America and Europe, while mature markets, maintain dominance in terms of technological sophistication and demand for high-end, primary standard calibration equipment, particularly in the aerospace and advanced healthcare sectors. These regions are characterized by a high concentration of accredited calibration laboratories and early adoption of AEO and IoT-enabled calibration technologies. Latin America and the Middle East and Africa (MEA) are emerging regions, where increased investment in oil and gas, utilities, and pharmaceuticals is creating fresh opportunities for portable and robust field calibration units, although regulatory adoption may lag behind developed economies. The expansion of manufacturing bases relocating to Southeast Asia further catalyzes regional demand, necessitating standardized, globally recognized calibration protocols.

Segment trends indicate a strong preference for electrical calibration equipment, largely due to the pervasive nature of electronic components and power systems across all industries. However, the fastest-growing segment is projected to be dimensional calibration, driven by the increasing complexity and tight tolerance requirements of components manufactured using advanced technologies like CNC machining and 3D printing. Furthermore, the services segment, including both in-house and third-party laboratory calibration, is outpacing equipment sales growth, reflecting the recurring need for calibration and the complexity involved in maintaining sophisticated metrology systems. Within the end-user landscape, the automotive and aerospace industries remain the dominant consumers, but the life sciences sector is showing accelerating demand due to enhanced governmental scrutiny on manufacturing practices and cold chain logistics validation. The convergence of software and hardware solutions is a defining segmentation trend, where integrated data management platforms are becoming a mandatory feature for sophisticated calibration instruments.

AI Impact Analysis on Calibration Equipment Market

User queries regarding the impact of Artificial Intelligence (AI) on the Calibration Equipment Market frequently center on automation, predictive maintenance, and data integrity. Users are keen to understand how AI-driven algorithms can optimize calibration schedules, reducing unnecessary downtime while ensuring compliance. Common themes include the integration of machine learning (ML) for anomaly detection in measurement drift, the potential for autonomous calibration adjustments, and the role of AI in processing vast datasets generated by IoT-enabled calibration devices. There is significant interest regarding the enhancement of measurement uncertainty analysis using advanced computational models and the automation of complex decision-making processes currently performed by highly skilled metrologists. The overarching expectation is that AI will transform calibration from a reactive, time-based process into a proactive, condition-based necessity, thereby improving efficiency and reducing operational costs for large-scale industrial users.

The integration of AI into calibration equipment focuses primarily on transforming raw measurement data into actionable business intelligence. For example, machine learning models can analyze historical calibration data, environmental factors, and usage patterns to accurately predict when a specific instrument is likely to drift out of tolerance. This capability moves maintenance from fixed schedules to a dynamic, condition-based approach, ensuring instruments are only calibrated when truly necessary, thereby optimizing resource allocation. Furthermore, AI facilitates the rapid analysis of measurement uncertainty budgeting, a historically complex task, by evaluating numerous parameters simultaneously and suggesting optimal calibration procedures to meet specific quality requirements. This sophistication enhances the reliability and traceability of the entire measurement infrastructure, particularly in decentralized industrial environments.

AI also plays a critical role in augmenting the capabilities of calibration software and digital twinning of metrology assets. By creating digital replicas of calibration standards and instruments, AI algorithms can simulate various operational scenarios and potential failure modes, significantly improving the design and reliability of future equipment. For end-users, AI-powered diagnostic tools embedded within the calibration hardware can provide real-time feedback and troubleshoot common issues, reducing the reliance on specialized technician intervention. The ability of AI to categorize and validate calibration certificates and documentation automatically also addresses significant regulatory compliance burdens, ensuring that audit trails are flawless and instantly accessible, which is crucial for high-stakes industries like aerospace and pharmaceuticals.

- AI-driven Predictive Calibration: Utilizing machine learning algorithms to forecast instrument drift and optimize maintenance schedules based on condition rather than fixed time intervals.

- Automated Uncertainty Analysis: AI models enhance the accuracy and speed of calculating measurement uncertainties by processing large datasets and environmental variables.

- Intelligent Data Validation: Automation of the review and validation of calibration certificates and audit trails for stringent regulatory compliance.

- Enhanced Anomaly Detection: Machine learning identifies subtle deviations or failures in measurement processes faster than traditional statistical methods.

- Digital Twin Integration: Creation of virtual models of calibration standards for simulation, optimization, and remote diagnostics, improving overall system reliability.

- Autonomous Calibration Systems: Development of closed-loop systems where AI directs minor instrument adjustments without human intervention, ensuring continuous accuracy.

DRO & Impact Forces Of Calibration Equipment Market

The Calibration Equipment Market is propelled by several robust drivers, primarily the global adherence to stringent regulatory frameworks such as ISO 9001, which mandates the use of traceable measurement equipment in quality management systems. The rapid technological evolution across key sectors, including the expansion of 5G networks, electric vehicles (EVs), and advanced medical devices, requires extremely tight manufacturing tolerances, directly increasing the demand for high-precision dimensional and electrical calibration tools. Furthermore, the industrial shift towards Industry 4.0 principles, emphasizing automation, IoT connectivity, and real-time data monitoring, necessitates smart calibration equipment capable of seamless digital integration. These drivers collectively ensure a sustained and expanding demand base for sophisticated metrology solutions, irrespective of minor economic downturns, positioning calibration as a non-negotiable operational expenditure for quality-focused entities.

However, the market faces significant restraints. The high initial capital investment required for acquiring high-accuracy primary calibration standards, coupled with the recurring costs associated with maintenance and recalibration, can deter smaller enterprises from adopting premium solutions. The technical complexity associated with operating and maintaining advanced calibration laboratories requires highly specialized personnel, creating a significant skills gap challenge in many emerging markets. Furthermore, the inherent risk of measurement uncertainty and the complexities in achieving true traceability across diverse international standards pose constant challenges to equipment manufacturers and end-users alike. These technical and economic barriers necessitate innovative financing and training solutions to fully unlock market potential in smaller industrial ecosystems.

Opportunities for growth are abundant, particularly in the development of portable, user-friendly, and multi-functional field calibration equipment, catering to the growing need for on-site verification in remote locations and sprawling industrial complexes. The expansion of cloud-based calibration management services (CCMS) offers significant scalability, enabling centralized control over decentralized assets and opening lucrative avenues for subscription-based service models. Moreover, the transition to software-defined instruments and the adoption of virtual or remote calibration techniques, accelerated by global events, represent high-growth areas. The increasing demand for specialized calibration in novel fields, such as non-contact metrology for additive manufacturing and validation of autonomous vehicle sensor systems, offers unique market niches for specialized equipment providers. The impact forces acting on this market include the pervasive regulatory pressure, the technological push towards automation, and the accelerating need for robust global supply chain quality assurance, collectively creating a resilient demand structure. The necessity of maintaining operational safety and preventing catastrophic failures in critical infrastructure further amplifies the mandatory adoption rate of high-quality calibration practices.

Segmentation Analysis

The Calibration Equipment Market is broadly segmented based on equipment type, application, end-user industry, and service type. This comprehensive segmentation is vital for understanding the diverse needs of the industrial landscape, ranging from routine field testing to highly precise laboratory validation. The core segmentation by equipment type separates the market into electrical, mechanical, thermodynamic, and dimensional measurement categories, reflecting the fundamental parameters requiring standardization. The market exhibits heterogeneity, with high-volume demand originating from general manufacturing and critical, high-value demand stemming from specialized sectors like aerospace and nuclear energy, each demanding specific equipment characteristics, precision levels, and regulatory compliance features. Analyzing these segments helps stakeholders tailor product development and market entry strategies effectively.

The fastest growth is anticipated in the dimensional and thermodynamic segments, driven by advanced manufacturing techniques that require tighter geometric tolerances and the critical need for cold chain monitoring in pharmaceuticals and food logistics, respectively. The services segment, which includes recurring calibration and repair services, consistently accounts for a larger revenue share than equipment sales due to the mandatory nature of recertification and the increasing complexity of maintenance. Geographic segmentation highlights the disparity between mature, high-value markets (North America, Europe) prioritizing innovation and high-accuracy standards, and rapidly industrializing markets (APAC) prioritizing volume, cost-effectiveness, and robust field solutions. Understanding these sub-segments allows manufacturers to optimize their product portfolio, offering everything from cost-effective standard calibrators to complex, automated primary measurement benches tailored to regional economic maturity and industrial regulatory requirements.

- Equipment Type:

- Electrical Calibrators (Multifunction, Signal, Current, Voltage)

- Mechanical Calibrators (Torque, Force, Mass, Vibration)

- Dimensional Calibrators (Gauges, Optical, CMM)

- Thermodynamic Calibrators (Temperature, Humidity)

- Pressure Calibrators (Pneumatic, Hydraulic)

- End-User Industry:

- Aerospace and Defense

- Automotive and Transportation

- Pharmaceutical and Biotechnology

- Oil and Gas

- Electronics and Semiconductor

- Power Generation and Utilities

- Manufacturing (General)

- Service Type:

- In-House Calibration Services

- Third-Party Calibration Services (Commercial Labs)

- Repair and Maintenance Services

- Consulting and Training Services

- Application:

- Primary/Laboratory Calibration

- Secondary/Field Calibration

Value Chain Analysis For Calibration Equipment Market

The value chain for the Calibration Equipment Market commences with upstream activities involving the sourcing of specialized components, high-purity materials, and advanced electronic sensors essential for creating accurate measurement standards. Key upstream suppliers include specialized manufacturers of high-stability reference resistors, pressure transducers, temperature sensors (like PRTs), and sophisticated data acquisition electronics. The integrity and stability of these core components directly dictate the accuracy and reliability of the final calibration instrument, necessitating stringent quality control at the manufacturing stage. Research and development activities, which focus on reducing measurement uncertainty and improving connectivity features (IoT, wireless), are critical upstream investments that define the competitive advantage of equipment manufacturers, often involving collaborative research with national metrology institutes (NMIs) to maintain traceability and adhere to international standards.

Midstream activities revolve around the manufacturing and assembly of the calibration instruments, where high-precision machining, cleanroom assembly, and meticulous quality validation processes are employed. Manufacturers must invest heavily in sophisticated testing facilities to ensure their products meet or exceed specifications derived from organizations like ISO and NIST. Following manufacturing, the distribution channel is multifaceted, involving both direct sales models, especially for high-value or customized primary standards sold to national laboratories or large corporations, and indirect sales through a network of specialized distributors and value-added resellers (VARs). VARs often provide regional support, local expertise, and integration services, acting as a crucial link between manufacturers and diverse smaller industrial end-users. The choice between direct and indirect distribution depends heavily on the complexity of the equipment and the geographical reach required, with indirect channels dominating routine, portable equipment sales.

Downstream activities focus on the final sale, installation, training, and, most crucially, post-sale calibration and maintenance services. The service component forms a substantial part of the market value, as calibration equipment requires periodic recalibration (often annually) by an accredited laboratory (e.g., ISO/IEC 17025 accredited). Direct customer engagement in the downstream phase includes offering comprehensive service contracts, calibration asset management software, and mandatory technical support. The entire value chain is heavily regulated and driven by the need for certified traceability, meaning that robust documentation, accreditation status, and adherence to metrology standards are non-negotiable requirements that influence profitability and market access at every stage, particularly when catering to regulated industries like defense and pharmaceuticals. The emphasis is increasingly shifting downstream toward optimizing the total cost of ownership through efficient and timely service delivery.

Calibration Equipment Market Potential Customers

The primary customers for calibration equipment span a vast range of industrial and governmental entities whose operations critically depend on accurate, reliable measurements. End-users are predominantly categorized into high-stakes regulated industries, general manufacturing sectors, and specialized metrology service providers. High-stakes customers include the Aerospace and Defense industry, which demands extreme precision for flight control surfaces, engine components, and navigation systems; the Pharmaceutical and Biotechnology sector, which requires strict validation of temperature, pressure, and flow rates for process control and cold chain maintenance; and the Oil and Gas sector, relying on accurate pressure and flow calibration for safety and resource accountability in upstream and downstream operations. These sectors require the highest tier of accuracy, often demanding primary standards and accredited in-house laboratories, constituting the most significant revenue generators for high-end equipment manufacturers.

General manufacturing industries, encompassing automotive, consumer electronics, and machinery production, form a high-volume customer base, requiring a diverse portfolio of dimensional, torque, and electrical calibrators for production line quality control. These customers often balance precision requirements with portability and ease of use, leading to increased demand for robust field calibrators and automated test systems integrated directly into the manufacturing environment. Furthermore, the burgeoning electric vehicle (EV) market is creating a new segment of high-voltage electrical calibration requirements. The increasing complexity of modern supply chains means that quality checkpoints are required at numerous stages, driving demand for lower-tier, standardized calibration equipment across thousands of suppliers globally, expanding the base of potential high-volume customers significantly.

A crucial and rapidly expanding segment of potential customers is the third-party calibration services industry, consisting of commercial calibration laboratories that offer accredited services to small and medium-sized enterprises (SMEs) that cannot afford or justify an internal metrology department. These laboratories act as major bulk purchasers of primary and secondary calibration standards, requiring state-of-the-art, multi-functional equipment to service a diverse client base across multiple industries. Governmental bodies, including national metrology institutes (NMIs) like NIST (USA) and NPL (UK), remain essential customers, driving demand for the absolute highest precision equipment and participating actively in the development and dissemination of measurement standards. Educational and research institutions also form a niche customer segment, purchasing equipment for teaching metrology principles and conducting fundamental scientific research requiring high accuracy measurements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.2 Billion |

| Market Forecast in 2033 | USD 10.4 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fluke Corporation, Keysight Technologies, Rohde & Schwarz GmbH & Co. KG, Tektronix Inc., Mettler-Toledo International Inc., Transmille Ltd, AMETEK Inc., Fortive Corporation, Yokogawa Electric Corporation, Siemens AG, Mitutoyo Corporation, Trescal, Endress+Hauser Group Services AG, National Instruments (NI), Beamex Oy Ab, Testo SE & Co. KGaA, Anton Paar GmbH, Vaisala, PCE Instruments, Gagemaker. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Calibration Equipment Market Key Technology Landscape

The technological landscape of the Calibration Equipment Market is rapidly evolving, driven by the need for higher accuracy, increased automation, and seamless integration into digital industrial ecosystems. A major advancement is the widespread adoption of smart calibration technology, incorporating Internet of Things (IoT) sensors and wireless connectivity (e.g., Bluetooth, Wi-Fi) into calibration devices. This allows for real-time monitoring of measurement performance, automated data logging, and remote diagnostics, significantly enhancing operational efficiency and reducing manual transcription errors. Furthermore, the development of software-defined measurement instruments is transforming traditional hardware-centric models. These devices can update functionality via software, providing unprecedented flexibility and future-proofing against evolving measurement standards and protocols. The integration of advanced metrology algorithms, particularly those leveraging computational models to minimize uncertainty, represents a key differentiator among leading manufacturers.

Another crucial technological focus is on miniaturization and portability, enabling the development of robust, battery-powered multi-functional calibrators suitable for demanding field applications in the oil and gas or utilities sectors. This portability does not compromise accuracy; instead, it is often paired with advanced thermal stabilization techniques and ruggedized casings to maintain performance under harsh environmental conditions. In the dimensional metrology segment, the shift towards non-contact measurement techniques, such as laser trackers, structured light scanners, and advanced video measurement systems, is accelerating. These technologies are essential for rapidly and accurately inspecting complex geometries produced by additive manufacturing and large-scale structures, reducing measurement time significantly compared to traditional coordinate measuring machines (CMMs) and manual gauges, which is vital for high-throughput manufacturing environments. The precision required for high-frequency electrical measurements, particularly in 5G and radar technologies, necessitates continuous innovation in network analyzer calibration standards and high-stability reference oscillators.

Furthermore, the technology stack is increasingly emphasizing sophisticated data management solutions. Cloud-based Calibration Management Software (CCMS) provides centralized control over large inventories of measurement assets, automating scheduling, generating compliance reports, and storing historical calibration data securely. These platforms often incorporate Artificial Intelligence (AI) and Machine Learning (ML) features to provide predictive insights, moving beyond simple record-keeping to proactive asset health management. Traceability is being digitized through the use of blockchain technology in some pilot projects to create immutable, tamper-proof records of calibration lineage, addressing key regulatory requirements for industries where data integrity is paramount. This holistic approach, integrating connectivity, data analytics, and high-precision physical standards, defines the cutting edge of the modern calibration equipment market, positioning it as an essential component of the digitized factory floor and smart infrastructure management.

Regional Highlights

Geographic analysis reveals distinct consumption patterns and growth drivers across major global regions. North America and Europe represent mature markets characterized by stringent regulatory environments (FDA, FAA, European directives) and a high concentration of advanced manufacturing, aerospace, and pharmaceutical industries. These regions demonstrate a strong preference for automated, high-accuracy primary standards and are the leading adopters of IoT-enabled calibration solutions and advanced calibration management software. Technological innovation is rapid, with a focus on reducing measurement uncertainty in complex physical and electrical parameters. The demand in these regions is stable, driven primarily by maintenance, replacement cycles, and the continuous need for highly specialized calibration services mandated by established quality standards and high labor costs necessitating automation.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market globally, propelled by unparalleled industrial expansion, government initiatives promoting domestic manufacturing (e.g., Made in China 2025, Make in India), and massive foreign direct investment in electronics, automotive, and semiconductor fabrication. The rapid establishment of new production facilities requires substantial initial procurement of foundational calibration equipment. While cost sensitivity remains a factor, the increasing adoption of international quality standards by local manufacturers is driving demand for higher-accuracy instruments and accredited third-party calibration services. China and India, in particular, are seeing massive investment in infrastructure and utilities, creating significant volume demand for robust, reliable field calibration tools used in process control environments.

Latin America and the Middle East and Africa (MEA) are emerging markets offering untapped potential. In MEA, the dominant driver is the oil and gas industry, which requires intensive pressure, temperature, and flow calibration equipment for pipeline integrity and refinery operations. Investments in power generation and utilities also contribute significantly. Latin America, particularly Brazil and Mexico, benefits from expanding automotive assembly and agricultural processing sectors, requiring standardized mechanical and dimensional calibration. Growth in these regions is often influenced by global commodity prices and the stability of governmental regulatory oversight, although the necessity for certified equipment to export goods internationally acts as a strong underlying growth mechanism, ensuring continued procurement of quality measurement systems.

- North America: Dominant market share due to stringent quality regulations in aerospace, healthcare, and defense; high adoption of automated calibration systems and cloud solutions.

- Europe: High demand for precision dimensional and thermodynamic calibrators driven by the robust automotive and complex machinery manufacturing base; early adopter of ISO/IEC 17025 compliance.

- Asia Pacific (APAC): Fastest-growing region due to rapid industrialization, expansion of the semiconductor and electronics manufacturing hubs (China, South Korea, Taiwan), and increasing regulatory compliance efforts.

- Middle East and Africa (MEA): Growth primarily fueled by substantial investments in the oil and gas sector and infrastructure projects, driving demand for robust, field-serviceable pressure and flow calibrators.

- Latin America: Moderate growth driven by manufacturing expansion, particularly in automotive and processing industries; demand focuses on balancing cost-effectiveness with internationally acceptable measurement traceability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Calibration Equipment Market.- Fluke Corporation

- Keysight Technologies

- Rohde & Schwarz GmbH & Co. KG

- Tektronix Inc.

- Mettler-Toledo International Inc.

- Transmille Ltd

- AMETEK Inc.

- Fortive Corporation

- Yokogawa Electric Corporation

- Siemens AG

- Mitutoyo Corporation

- Trescal

- Endress+Hauser Group Services AG

- National Instruments (NI)

- Beamex Oy Ab

- Testo SE & Co. KGaA

- Anton Paar GmbH

- Vaisala

- PCE Instruments

- Gagemaker

Frequently Asked Questions

Analyze common user questions about the Calibration Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Calibration Equipment Market?

The primary factor driving market growth is the enforcement of global regulatory mandates, particularly ISO 9001 and industry-specific standards (e.g., FDA requirements in pharmaceuticals), which necessitate mandatory periodic calibration and traceability of all measurement equipment used in quality-critical processes, ensuring consistent product quality and safety worldwide.

Which technology trends are most significantly impacting modern calibration equipment?

The most significant technology trends involve the integration of IoT and wireless connectivity for smart calibration, enabling real-time monitoring and automated data logging. Additionally, the adoption of AI/ML for predictive maintenance and automated uncertainty analysis is transforming reactive calibration schedules into proactive, condition-based strategies, optimizing asset management.

Is the demand higher for calibration equipment or related calibration services?

While equipment sales generate substantial revenue, the demand for related calibration services (both in-house and third-party accredited laboratory services) is generally higher and exhibits faster growth. Services represent a recurring revenue stream, driven by the mandatory annual or biannual recalibration cycles required to maintain instrument certification and regulatory compliance.

How is the aerospace industry influencing the calibration market?

The aerospace industry significantly influences the market by demanding the highest levels of accuracy and measurement traceability, particularly for dimensional, force, and torque calibration equipment. Regulatory oversight (like FAA and EASA) drives continuous investment in advanced primary standards and specialized equipment tailored for safety-critical components and systems.

What challenges do SMEs face when adopting high-end calibration equipment?

SMEs primarily face challenges related to the high initial capital investment required for high-precision instruments and the difficulty in recruiting and retaining personnel with the necessary metrology expertise. This often leads SMEs to rely heavily on outsourced, third-party accredited calibration laboratories to meet compliance requirements without incurring massive internal overheads.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Calibration Equipment Market Size Report By Type (Mechanical Calibration Equipments, Electrical Calibration Equipments, Physical/Dimensional Calibration Equipments, Thermodynamic Calibration Equipments), By Application (Industrial, Laboratories), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Temperature Calibration Equipment Market Statistics 2025 Analysis By Application (Oil and Gas, Power and Energy, Pharmaceutical, Food & Beverage, Automotive, Aerospace & Defence, Others), By Type (Benchtop Type, Portable Type), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Laser Calibration Equipment Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Nano level, Micron level), By Application (Aerospace, Automobile industry, Energy, Electronic product, Heavy industry, Precision manufacturing, Medical insurance, Science, research and analysis), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager