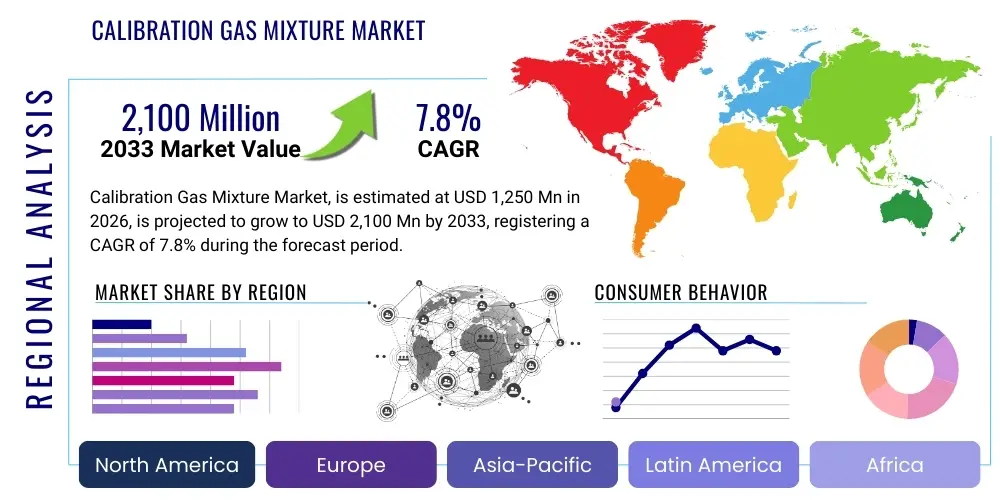

Calibration Gas Mixture Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436171 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Calibration Gas Mixture Market Size

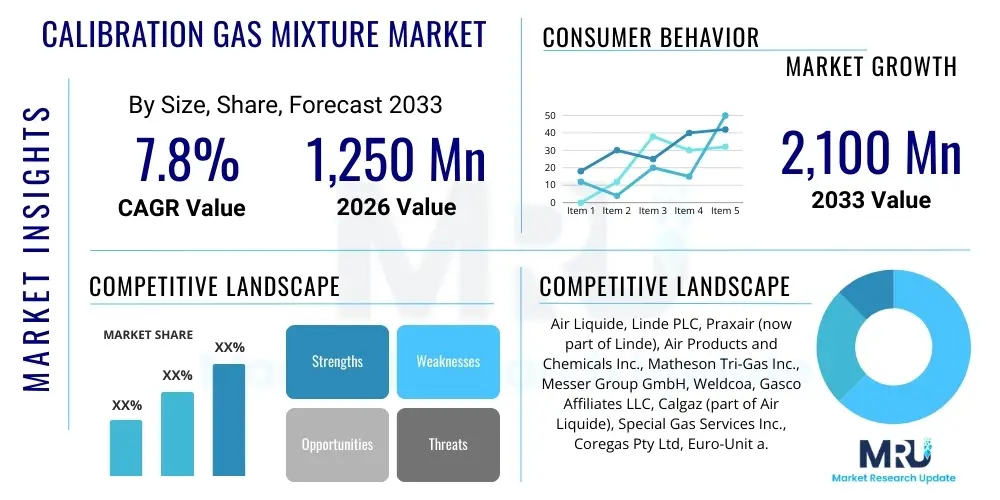

The Calibration Gas Mixture Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $1,250 Million in 2026 and is projected to reach $2,100 Million by the end of the forecast period in 2033.

Calibration Gas Mixture Market introduction

The Calibration Gas Mixture Market encompasses specialty gases and precise gas blends utilized across various industries to ensure the accurate operation and measurement capabilities of analytical instruments, gas detectors, and environmental monitoring equipment. These mixtures are critical standards against which sensors and analyzers are tested and adjusted, guaranteeing regulatory compliance, operational safety, and process efficiency. The composition of these mixtures is highly specific, often involving inert carriers mixed with trace amounts of target analytes, formulated according to stringent ISO or governmental standards.

Major applications of calibration gas mixtures span environmental compliance, industrial hygiene, process control in chemical and petrochemical facilities, medical diagnostics, and the burgeoning semiconductor manufacturing sector. Key benefits derived from the use of certified calibration gases include enhanced instrument reliability, prevention of costly operational errors, assurance of worker safety by accurately detecting toxic or explosive gases, and facilitating international trade through standardized measurement protocols. These mixtures act as the fundamental truth source for all gas analysis operations.

Driving factors contributing to the market's robust growth include the increasing global emphasis on environmental protection, leading to stricter emission monitoring mandates, particularly in developed and rapidly industrializing economies. Furthermore, the proliferation of complex gas sensors, especially in the oil and gas sector for leak detection and safety monitoring, coupled with advancements in medical gas therapy and diagnostics requiring ultra-high purity gas standards, fuels demand for specialized calibration products.

Calibration Gas Mixture Market Executive Summary

The Calibration Gas Mixture market is characterized by stable demand driven by mandatory safety and environmental regulations across heavy industries. Current business trends indicate a shift towards multi-component, complex gas mixtures capable of calibrating sophisticated sensor arrays used in continuous emission monitoring systems (CEMS) and advanced industrial hygiene devices. Suppliers are increasingly focusing on developing non-refillable cylinders that offer enhanced portability and reduced lifecycle costs, appealing particularly to field service technicians and smaller-scale industrial users. Furthermore, sustainability is becoming a key differentiator, pushing manufacturers to optimize cylinder logistics and minimize waste associated with gas handling.

Regionally, Asia Pacific is anticipated to exhibit the fastest growth, largely due to rapid industrialization in countries like China and India, escalating concerns over air quality, and consequent governmental implementation of stringent emission control policies in manufacturing and power generation sectors. North America and Europe, while mature, maintain dominance in terms of value, driven by high safety standards in the oil and gas and chemical processing industries, along and continuous technological upgrades in analytical instrumentation. Geopolitical shifts impacting energy production and trade routes also influence demand for specific calibration standards used in natural gas processing and LNG transport.

Segment trends highlight strong growth in the application segment related to environmental monitoring, primarily propelled by global climate change mitigation efforts requiring precise greenhouse gas (GHG) measurement. By component, multi-component mixtures are gaining traction, reflecting the market need for efficiency in calibrating instruments designed to detect numerous analytes simultaneously. The purity and certification level remain paramount across all segments, dictating pricing power and market access for specialized producers.

AI Impact Analysis on Calibration Gas Mixture Market

Users frequently inquire about how AI can optimize the calibration process, reduce the reliance on costly physical standards, and predict the optimal calibration frequency for instruments. Key themes revolve around the potential for AI-driven predictive maintenance models to minimize downtime caused by analyzer drift and the integration of machine learning algorithms for real-time validation of sensor data, potentially reducing the required physical gas volume used for routine checks. Concerns often surface regarding the initial investment in integrating AI systems and the reliability of virtual calibration standards compared to certified physical mixtures. Users expect AI to streamline compliance reporting and improve the logistical planning for calibration gas replenishment, thereby increasing efficiency in field operations, but they remain cautious about fully replacing traditional, certified methods.

- AI enables predictive maintenance, forecasting sensor drift and optimizing calibration cycles, thereby reducing unnecessary gas consumption.

- Machine learning algorithms enhance quality control by analyzing historical data and certifying batch consistency during manufacturing processes.

- Integration of smart sensors and AI permits real-time virtual calibration verification, acting as a preliminary check before utilizing expensive physical mixtures.

- AI-powered logistics and inventory management systems optimize the supply chain for specialty gases, ensuring timely delivery of critical standards.

- Automated reporting and data integrity checks, driven by AI, streamline regulatory compliance and audit trails for environmental monitoring data.

DRO & Impact Forces Of Calibration Gas Mixture Market

The Calibration Gas Mixture Market is primarily influenced by stringent regulatory frameworks mandating accurate gas detection and emission monitoring, acting as the fundamental driver for sustained demand. Restraints include the high cost associated with producing, certifying, and distributing ultra-high purity, multi-component mixtures, coupled with logistical challenges related to cylinder handling, pressure vessel safety, and managing short shelf lives of reactive gas mixtures. Significant opportunities arise from the rapid deployment of 5G infrastructure and semiconductor manufacturing, which necessitate new categories of high-purity process and calibration gases, as well as the expansion of the natural gas and hydrogen energy economies requiring new calibration standards.

Impact forces currently shaping the market include the accelerating pace of environmental regulation, such as global efforts to cap methane and CO2 emissions, which directly increases the demand for certified CEMS calibration gases. Technological advancements in sensor miniaturization and the development of IoT-enabled gas detection systems are simultaneously driving the need for smaller, more portable calibration solutions. The market structure, dominated by a few large industrial gas companies, exerts considerable influence over pricing and distribution networks, while safety regulations concerning compressed gas storage significantly impact end-user adoption and handling protocols.

The inherent technical complexity in manufacturing and certifying stable, reactive gas mixtures, such as those containing nitric oxide or sulfur dioxide, acts as a barrier to entry for smaller players, solidifying the market position of established suppliers with robust R&D and quality control infrastructures. Furthermore, global supply chain volatility, affecting the availability of specialized raw materials and cylinder components, can sporadically impact production timelines and costs, requiring strategic inventory management by market leaders to maintain stable supply.

Segmentation Analysis

The Calibration Gas Mixture market is highly segmented, reflecting the diverse application requirements across multiple industries, each demanding unique compositions, concentrations, and purity levels. Segmentation primarily revolves around the type of gas mixture (pure or mixed), the concentration level (PPM or percentage), the components included (single, dual, or multi-component), and the end-use application (such as environmental, industrial hygiene, or medical). This structural complexity necessitates specialized manufacturing and distribution capabilities tailored to niche regulatory demands and technical specifications, making standardization challenging but essential for large-scale adoption.

Analyzing the segmentation reveals that the multi-component mixture segment is experiencing accelerated growth, driven by the increasing deployment of sophisticated, multi-gas analyzers capable of simultaneous detection of several toxic or flammable gases. The oil and gas and chemical sectors represent the largest consumer base, due to mandatory safety regulations concerning flammable and toxic gases like H2S and CO. Conversely, the growth in the medical segment, particularly for lung function testing and specialized anesthetic mixtures, demands the highest purity standards and often smaller, non-refillable formats for ease of clinical use.

The distribution of calibration gases is also segmented by cylinder size and type, ranging from small, non-refillable cylinders favored for field work and portability to large, high-pressure cylinders used for continuous, high-volume calibration processes in laboratory settings or continuous emission monitoring stations. Understanding these distinct segment needs allows manufacturers to optimize product packaging, shelf life extension technologies, and certification documentation, thereby maximizing market penetration and complying with varying regional transportation and safety requirements.

- By Type:

- PPM Calibration Gas Mixtures

- Percentage Calibration Gas Mixtures

- Pure Gases (Used as Calibration Standards)

- By Component:

- Single-Component Gas Mixtures

- Dual-Component Gas Mixtures

- Multi-Component Gas Mixtures

- By Application:

- Oil & Gas

- Chemical & Petrochemical

- Environmental Monitoring (CEMS, Ambient Air Quality)

- Industrial Hygiene & Safety

- Automotive & Transportation

- Medical & Healthcare

- Food & Beverages

- Research & Laboratory

- By Cylinder Type:

- Non-Refillable Cylinders

- Refillable Cylinders

Value Chain Analysis For Calibration Gas Mixture Market

The value chain for the Calibration Gas Mixture market begins with the upstream sourcing and purification of raw materials, which are typically high-purity industrial and specialty gases such as nitrogen, argon, methane, and reactive gases like sulfur dioxide or carbon monoxide. This initial stage requires significant technological expertise and capital investment to ensure the base components meet ultra-high purity specifications. Key upstream activities involve separation techniques like cryogenic distillation or membrane separation, followed by meticulous quality checks to eliminate trace contaminants that could destabilize the final blend or compromise calibration accuracy. Major industrial gas producers often vertically integrate this raw material sourcing step.

The midstream phase involves the core activity of gas blending, which is highly specialized and knowledge-intensive. Manufacturers must precisely mix components at low concentrations (often in the parts per million or parts per billion range) and certify the stability and homogeneity of the blend over time and under various storage conditions. This stage is heavily regulated, requiring advanced analytical instrumentation (such as mass spectrometers and gas chromatographs) for certification under global standards like ISO 17025. Packaging, which includes selecting appropriate cylinder materials (e.g., aluminum or treated steel) and valve types, is critical to maintaining the mixture's integrity and shelf life.

Downstream activities focus on distribution and end-user engagement. Distribution channels are bifurcated: direct sales to major industrial users and research labs, and indirect sales through specialized distributors and retailers who handle localized logistics, safety training, and cylinder exchange programs. Since calibration gases are consumable supplies requiring frequent replenishment and specific safety handling, the efficiency of the distribution network and the provision of technical support significantly influence customer satisfaction and retention. Direct and indirect channels both require robust inventory management systems due to the shelf-life constraints of certain reactive mixtures.

Calibration Gas Mixture Market Potential Customers

Potential customers for calibration gas mixtures are widespread across virtually all industrial and institutional sectors where safety, environmental compliance, and process accuracy are critical. The primary end-users are entities operating gas analyzers and detection equipment that require regular verification to maintain operational integrity and meet legal mandates. High-volume buyers typically include large industrial organizations that manage extensive safety monitoring programs or continuous emission reporting requirements, often procuring multi-component mixtures in refillable, high-capacity cylinders.

The most lucrative customer segments include oil and gas exploration, refining, and pipeline operations, where continuous monitoring for flammable gases (like methane) and toxic gases (like H2S) is mandatory for worker safety. Another significant segment is the chemical and petrochemical manufacturing industry, which utilizes these gases for process control, quality assurance, and hazardous leak detection. Environmental agencies and companies operating Continuous Emission Monitoring Systems (CEMS) in power plants and waste incinerators are also major, regulated purchasers, focusing on certified mixtures for pollutants like NOx and SO2.

Beyond heavy industry, customers also encompass various specialized fields. Medical facilities use calibration gases for testing respiratory equipment and diagnostic analyzers. The automotive industry utilizes them for exhaust emission testing and catalytic converter calibration. Furthermore, independent testing laboratories, governmental safety inspectorates (e.g., OSHA equivalents), and equipment rental companies that supply gas detectors constitute a consistent, diverse customer base, preferring smaller, portable, non-refillable cylinder formats for on-site verification.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1,250 Million |

| Market Forecast in 2033 | $2,100 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Air Liquide, Linde PLC, Praxair (now part of Linde), Air Products and Chemicals Inc., Matheson Tri-Gas Inc., Messer Group GmbH, Weldcoa, Gasco Affiliates LLC, Calgaz (part of Air Liquide), Special Gas Services Inc., Coregas Pty Ltd, Euro-Unit a.s., Scientific and Technical Gases Ltd., Advanced Specialty Gas Equipment, PCT Gas Solutions, Buzwair Industrial Gases, GfG Instrumentation Inc., Scott Specialty Gases (part of Air Liquide). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Calibration Gas Mixture Market Key Technology Landscape

The technology landscape of the Calibration Gas Mixture market is dominated by advancements in gas blending accuracy and cylinder passivation techniques crucial for maintaining the stability and integrity of reactive gas standards. Core technology lies in volumetric, manometric, and gravimetric blending methods, with gravimetric techniques (weighing components precisely) being the gold standard for high-accuracy primary standards used in regulatory contexts. Continuous refinement of these processes, often leveraging automated systems and sophisticated control software, is vital to meet the ultra-low uncertainty requirements of modern analytical instrumentation, which are sensitive to trace impurities or concentration drifts over time.

A major technological focus is on enhancing the shelf life of reactive mixtures, particularly those containing challenging components like hydrogen sulfide (H2S), ammonia (NH3), or nitrogen dioxide (NO2). This is achieved through advanced cylinder interior treatments, known as passivation technologies. These proprietary surface treatments (such as specialized coatings or thermal processes) minimize the reaction between the reactive gas components and the inner walls of the cylinder, preventing adsorption or decomposition. Successful passivation technology directly translates into a competitive advantage by allowing manufacturers to offer longer guarantees on product stability, reducing replacement frequency for end-users.

Furthermore, technology is rapidly evolving in the area of traceability and certification. The increasing demand for low-concentration mixtures necessitates highly precise analytical instruments, such as high-resolution mass spectrometers and cavity ring-down spectrometers (CRDS), to verify the blend composition down to parts per billion levels. Integration of digital technologies, including QR codes and blockchain for enhanced documentation and traceability of certification reports (AEO and GEO optimization focus), ensures that customers can instantly verify the source and accuracy of their calibration standards, streamlining audit procedures and complying with global measurement traceability requirements.

Regional Highlights

- North America: This region is a mature market characterized by stringent safety regulations imposed by bodies like OSHA and the EPA, particularly driving demand in the oil and gas, chemical, and environmental sectors. The United States accounts for the largest share due to high industrial activity and early adoption of continuous emission monitoring systems (CEMS). Innovation is focused on advanced sensor technologies and the deployment of field-portable calibration solutions.

- Europe: Driven by the European Union's ambitious climate targets (Green Deal) and high industrial safety standards, Europe represents a high-value market segment. Germany, the UK, and France are key consumers, with significant demand stemming from the automotive industry (emission testing) and advanced manufacturing. Strict adherence to ISO standards and a strong preference for certified, traceable standards define this regional market.

- Asia Pacific (APAC): Expected to be the fastest-growing region, APAC’s growth is fueled by rapid industrialization, massive infrastructure development, and increasing public awareness regarding air pollution. Countries like China, India, and South Korea are significantly investing in environmental monitoring infrastructure. The rising demand for calibration gases in semiconductor manufacturing and electric vehicle battery production is a major growth accelerator.

- Latin America: This region presents considerable opportunity, particularly in Brazil and Mexico, driven by expanding oil and gas exploration and processing activities. Market growth is closely linked to economic stability and the adoption of international safety and environmental standards, which are gradually being enforced across key industrial hubs.

- Middle East and Africa (MEA): Dominated by the massive oil, gas, and petrochemical sectors, the MEA region requires large volumes of calibration mixtures for safety monitoring (H2S, flammables) and process control. Investment in new refinery projects and LNG facilities across Saudi Arabia and Qatar ensures steady, high-volume demand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Calibration Gas Mixture Market.- Air Liquide

- Linde PLC

- Air Products and Chemicals Inc.

- Matheson Tri-Gas Inc.

- Messer Group GmbH

- Weldcoa

- Gasco Affiliates LLC

- Calgaz (a brand of Air Liquide)

- Special Gas Services Inc.

- Coregas Pty Ltd

- Euro-Unit a.s.

- Scientific and Technical Gases Ltd.

- Advanced Specialty Gas Equipment

- PCT Gas Solutions

- Buzwair Industrial Gases

- GfG Instrumentation Inc.

- Praxair (now part of Linde)

- Scott Specialty Gases (part of Air Liquide)

- Spectra Gases

- CK Special Gases

Frequently Asked Questions

Analyze common user questions about the Calibration Gas Mixture market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the demand for multi-component calibration gas mixtures?

Demand is driven by the increasing deployment of advanced multi-gas analyzers and CEMS (Continuous Emission Monitoring Systems) that require a single, efficient standard to calibrate multiple sensors simultaneously, enhancing operational efficiency and reducing calibration time.

How is cylinder passivation technology critical for highly reactive calibration gas mixtures?

Cylinder passivation involves proprietary internal coatings or treatments that prevent reactive gases, such as H2S or NO2, from adsorbing onto or reacting with the cylinder walls, thereby maximizing the gas mixture's shelf life and ensuring concentration stability for accurate calibration.

Which application segment holds the largest market share in the Calibration Gas Mixture Market?

The Environmental Monitoring and Industrial Hygiene/Safety segments collectively hold the largest market share, mandated by strict global regulations (EPA, OSHA) requiring routine, verifiable calibration of gas detectors used for pollutant tracking and worker safety in industrial environments.

What role does digitalization play in the future of calibration gas certification and traceability?

Digitalization, including the use of blockchain and advanced QR code systems, is being adopted to provide instant, verifiable, and immutable traceability for certified calibration standards, simplifying regulatory audits and guaranteeing measurement confidence for end-users worldwide.

What is the projected growth rate (CAGR) for the Calibration Gas Mixture Market through 2033?

The Calibration Gas Mixture Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033, driven by regulatory compliance and technological expansion in APAC and high-purity industrial sectors.

The extensive application scope of calibration gas mixtures across critical infrastructure sectors ensures robust and continuous demand, insulating the market somewhat from short-term economic fluctuations. These gases are not merely consumables but essential quality assurance tools, underpinning the credibility of all environmental, safety, and process data generated by gas analysis instrumentation. The complexity of manufacturing these certified reference materials requires specialized infrastructure, cementing the dominance of large, technologically advanced industrial gas companies.

Future market evolution will likely be defined by the convergence of digital technologies, such as advanced data analytics and IoT integration, with traditional gas delivery systems. This integration will lead to "smart cylinders" capable of communicating usage data, shelf life predictions, and automated reorder triggers directly to the end-user's asset management system. This shift enhances the overall value proposition, transforming the supply of calibration gases from a transactional commodity into a managed service focused on guaranteed regulatory compliance and optimized operational uptime.

Furthermore, global efforts to transition towards sustainable energy sources, particularly the increasing focus on hydrogen production and utilization, are creating an entirely new category of calibration standards. Precise measurement and control of hydrogen purity and handling explosive mixtures require unique, highly stable gas standards, presenting significant opportunities for manufacturers capable of rapidly developing and certifying these novel mixtures under emerging international energy standards.

The competitive landscape remains intense, primarily centered on securing long-term contracts with major industrial clients and maintaining an impeccable reputation for product purity and certification reliability. Mergers and acquisitions remain a strategy for market leaders to consolidate technological capabilities, particularly in niche areas like reactive gas handling and ultra-low concentration mixtures, and to expand geographical reach into rapidly growing industrial regions like Southeast Asia and Latin America.

Pricing strategies in the calibration gas market reflect the high production costs associated with gravimetric blending, specialized cylinder treatment, and stringent analytical verification. While standard mixtures might be highly competitive, customized, multi-component mixtures, especially those requiring low uncertainty levels and containing corrosive components, command premium pricing due to the required expertise and limited number of suppliers capable of guaranteed performance. This pricing differentiation further reinforces the specialized nature of the market, distinguishing it from bulk industrial gas sales.

Compliance and regulatory adherence are non-negotiable determinants of market success. Suppliers must navigate a complex web of national and international standards (e.g., NIST, ISO 6142, ISO 17025) which dictate acceptable uncertainty levels, documentation requirements, and shelf life testing protocols. Continuous investment in certified laboratories and quality management systems is thus paramount, acting both as a cost factor and a critical entry barrier for new entrants.

The environmental segment's growth is particularly resilient due to global legislative cycles that consistently tighten acceptable emission limits. This sustained regulatory pressure ensures that even during economic downturns, industrial operators must continue purchasing certified calibration standards to maintain legal operating licenses and avoid heavy fines, solidifying the essential nature of these products across the manufacturing value chain.

Geographically, while North America and Europe possess the established regulatory infrastructure and large installed base of analytical equipment, the substantial new investment in petrochemical and heavy manufacturing facilities in the Middle East and APAC represents the strongest vectors for volume growth. Market players are strategically expanding their local distribution and technical support infrastructure in these regions to capitalize on localized rapid industrial growth and satisfy complex logistics requirements.

In summary, the Calibration Gas Mixture Market is poised for stable, technology-driven growth, underpinned by mandatory safety and environmental compliance. Key strategic imperatives for market participants include enhancing product stability through material science advancements, leveraging AI and digitalization for supply chain optimization and certification traceability, and focusing on specialized mixtures tailored for the burgeoning clean energy and high-tech manufacturing sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager