Call Centre Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438004 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Call Centre Market Size

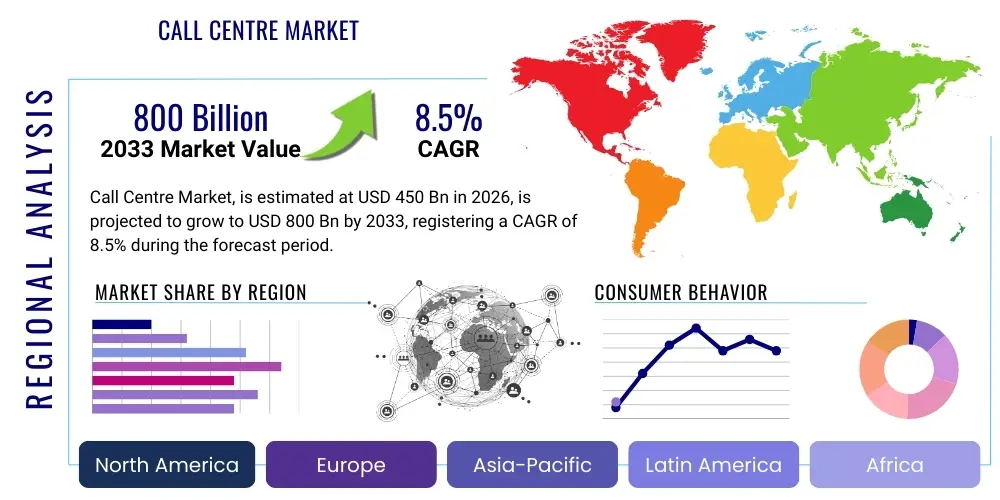

The Call Centre Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450 Billion in 2026 and is projected to reach USD 800 Billion by the end of the forecast period in 2033. This substantial growth trajectory is primarily fueled by the accelerating global trend toward digital transformation, requiring sophisticated customer engagement strategies across diverse industries, including Banking, Financial Services, and Insurance (BFSI), telecommunications, and retail.

Market expansion is significantly driven by the increasing complexity of customer interactions and the imperative for businesses to achieve high first-call resolution (FCR) rates and superior Customer Experience (CX). The shift from traditional premises-based call center infrastructure to cloud-based Contact Center as a Service (CCaaS) models is a major underlying factor contributing to market valuation, offering enhanced scalability, flexibility, and reduced operational expenditures for enterprises worldwide.

Call Centre Market introduction

The Call Centre Market encompasses the infrastructure, technologies, services, and human capital utilized by organizations to manage inbound and outbound customer communications across various channels. Key products and services include Automated Call Distribution (ACD), Interactive Voice Response (IVR) systems, workforce management (WFM) solutions, Customer Relationship Management (CRM) integration, and comprehensive Business Process Outsourcing (BPO) services. Major applications span customer support, technical helpdesks, telesales, debt collection, and complex case management across sectors like healthcare, travel, and e-commerce. The primary benefits derived from these systems are optimized operational efficiency, reduced customer churn, enhanced customer loyalty, and valuable data generation through interaction analytics. The market is predominantly driven by the pervasive need for omnichannel customer engagement, the maturation of cloud-based contact center solutions, and the strategic adoption of Artificial Intelligence (AI) and machine learning (ML) to automate routine tasks and provide predictive insights for agents.

Modern call centers are transforming into advanced contact centers, prioritizing unified customer journeys rather than fragmented channel interactions. This evolution necessitates the deployment of sophisticated software platforms capable of integrating voice, email, chat, social media, and mobile app interactions seamlessly. Furthermore, the market is characterized by intense competition among technology vendors offering advanced features such as predictive dialers, advanced routing algorithms based on agent proficiency, and robust security protocols (e.g., PCI compliance) essential for handling sensitive customer data.

The fundamental structural components of the market include technology providers (hardware and software), service providers (BPOs), and internal captive centers maintained by large enterprises. Driving factors are deeply tied to global consumer behavior, specifically the demand for instant gratification and 24/7 availability, forcing companies to invest heavily in resilient and scalable call center operations. Geographically, emerging economies present significant opportunities for outsourcing activities due to cost advantages and growing digital infrastructure, while developed regions focus on implementing AI-driven automation to enhance quality and complexity handling capabilities.

Call Centre Market Executive Summary

The Call Centre Market is experiencing robust acceleration driven by strategic pivots toward digital transformation and Customer Experience (CX) optimization. Business trends indicate a definitive shift toward hybrid and remote work models for agents, catalyzed by recent global events, making Cloud Contact Center as a Service (CCaaS) the preferred deployment method over traditional on-premise systems. Furthermore, market competition is intensifying around the integration of AI tools, particularly conversational AI (chatbots and voice assistants) and Robotic Process Automation (RPA), which are fundamentally altering the cost structure and efficiency metrics of call center operations, enabling greater focus on complex, high-value interactions.

Regional trends highlight North America’s dominance in technological adoption, particularly in leveraging advanced analytics and proprietary AI solutions, while the Asia Pacific region emerges as the fastest-growing market, largely due to extensive Business Process Outsourcing (BPO) activities and increasing domestic digital consumption in countries like India, the Philippines, and China. Europe maintains strong growth, primarily driven by stringent regulatory requirements (such as GDPR) necessitating advanced data handling and compliance solutions within contact center technologies. Latin America and the Middle East and Africa (MEA) are also exhibiting increasing investment, driven by infrastructure improvements and the growth of multinational corporate presence requiring localized customer support.

Segment trends underscore the accelerated adoption within the BFSI and Telecommunications sectors, where customer volume and regulatory compliance demands are highest. Based on deployment, the cloud segment is overwhelmingly leading growth, displacing older infrastructure models. Service-wise, outsourcing services continue to hold a significant market share, though internal captive centers are increasingly investing in sophisticated software solutions to retain core capabilities. The emphasis across all segments is now placed on achieving true omnichannel integration, moving beyond multi-channel presence to deliver a cohesive, personalized customer journey across all touchpoints, regardless of whether the interaction is handled by a human agent or an AI bot.

AI Impact Analysis on Call Centre Market

Users frequently inquire about AI's role in displacing human jobs, the effectiveness of chatbots versus live agents, the return on investment (ROI) of implementing AI solutions like voice biometrics and predictive analytics, and how AI can genuinely improve customer satisfaction (CSAT) scores rather than merely cutting costs. The analysis indicates a high level of user concern regarding the ethical implications of AI deployment, including data privacy and the potential for algorithmic bias in customer treatment. Key expectations center around AI's ability to automate Level 1 and Level 2 support tickets, provide real-time agent assistance through augmented intelligence (AI Augmentation), and enable hyper-personalization of customer service interactions, thereby transitioning the call center from a cost center to a strategic revenue driver.

The integration of Artificial Intelligence and Machine Learning (ML) is fundamentally redefining the operating model of the Call Centre Market, shifting focus from pure volume handling to complex problem resolution and proactive customer engagement. Conversational AI, encompassing sophisticated chatbots and natural language processing (NLP) enabled voice bots, handles a rapidly increasing share of routine inquiries, reducing average handle time (AHT) and allowing human agents to concentrate on emotionally complex or highly customized service requests. Furthermore, AI-driven predictive analytics utilize historical data and real-time cues to anticipate customer needs, enabling personalized outreach and preemptive issue resolution before customers even initiate contact, leading to significantly improved Net Promoter Scores (NPS).

This technological transformation is leading to a necessary re-skilling of the workforce, moving agents from simple transaction processors to high-level customer relationship managers supported by AI tools like real-time sentiment analysis and guided workflows. The primary impact is not job elimination, but rather job evolution, emphasizing emotional intelligence and problem-solving skills. The strategic implementation of AI is also driving increased regulatory scrutiny regarding consumer data usage and transparency in automated interactions, making explainability and fairness crucial technological considerations for vendors and operators alike.

- Automated Task Handling: Significant reduction in handling common inquiries (e.g., password resets, order tracking) via conversational AI and IVR enhancements.

- Agent Augmentation: Real-time sentiment analysis, knowledge base retrieval, and next-best-action guidance provided directly to human agents.

- Predictive Routing: Utilizing ML algorithms to route customers to the most suitable agent based on skill, temperament, and likelihood of resolution.

- Data Analytics and Insights: Processing vast quantities of interaction data (voice and text) to derive actionable insights into customer behavior and process inefficiencies.

- Workforce Optimization (WFO): Improved scheduling, forecasting, and quality assurance through automated monitoring and performance scoring.

- Bias Mitigation: Developing ethical AI frameworks to ensure fair and equitable treatment across diverse customer demographics.

- Voice Biometrics: Enhancing security and reducing friction during identity verification processes, cutting down on validation time.

- RPA Implementation: Automating backend processes triggered by customer interactions, such as data entry or service provisioning.

DRO & Impact Forces Of Call Centre Market

The Call Centre Market is subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO) which collectively determine its growth trajectory and competitive landscape. Key drivers include the overwhelming global demand for superior Customer Experience (CX), the accelerated adoption of digital channels necessitating centralized contact management, and the cost efficiency derived from migrating to cloud-based solutions (CCaaS). Conversely, market growth is often restrained by significant initial capital investment required for advanced AI and omnichannel platforms, persistent data security and privacy concerns (especially regarding regulations like GDPR and CCPA), and the complexity of integrating legacy systems with modern cloud infrastructure. Opportunities are abundant in the expansion of niche vertical-specific solutions (e.g., highly compliant healthcare contact centers), the proliferation of sophisticated Generative AI applications for content creation and dialogue management, and leveraging offshore locations for specialized multilingual support services.

The primary impact forces shaping this market include technological innovation speed, regulatory compliance mandates, shifting labor market dynamics, and evolving customer expectations. The rapid development cycle of AI and ML technologies continuously pressures call center operators to upgrade capabilities to remain competitive. Regulatory mandates impose strict controls on data handling, influencing architectural choices and operational protocols. Furthermore, the global shortage of skilled agents capable of handling complex digital and AI-augmented interactions presents a strategic constraint, driving up wages and increasing training expenditures. Finally, the customer's expectation for instantaneous, personalized, and effortless service across every touchpoint compels continuous process redesign and technology investment.

A crucial factor influencing the market is the total cost of ownership (TCO) associated with sophisticated contact center platforms. While CCaaS reduces CapEx, the OpEx for customization, integration, and continuous software updates remains significant. Businesses must constantly weigh the potential benefits of automation—such as reduced labor costs and improved quality—against the implementation complexity and the risk of alienating customers through overly robotic interactions. The market success hinges on the strategic balance between human empathy and technological efficiency, ensuring that automation complements, rather than compromises, the customer relationship.

- Drivers:

- Escalating Demand for Omnichannel Customer Engagement.

- Rapid Adoption of Cloud Contact Center as a Service (CCaaS).

- Increasing Complexity of Customer Interactions Requiring Specialized Support.

- Mandate for Cost Optimization and Operational Efficiency through Automation.

- Expansion of E-commerce and Digital Services Globally.

- Restraints:

- High Initial Investment Costs Associated with AI and Advanced Analytics Platforms.

- Persistent Data Security Risks and Compliance Complexity (e.g., HIPAA, PCI DSS).

- Difficulty Integrating Modern CCaaS Solutions with Existing Legacy Enterprise Resource Planning (ERP) Systems.

- Shortage of Highly Skilled Agents Trained in Digital and Augmented Technologies.

- Opportunities:

- Emergence of Generative AI for Dynamic Content Creation and Summarization.

- Growth Potential in Vertical-Specific and Highly Specialized Contact Centers (e.g., telehealth).

- Expansion into Underserved Geographic Regions with Growing Digital Penetration.

- Development of Advanced Predictive Customer Journey Mapping Tools.

- Impact Forces:

- Technological Disruption (AI/ML) forcing rapid infrastructure upgrades.

- Regulatory Environment (Data Privacy and Consumer Protection Laws).

- Shifting Customer Expectations for Personalized and Instant Service.

- Global Labor Market Dynamics and Remote Work Trends.

Segmentation Analysis

The Call Centre Market is comprehensively segmented based on various critical parameters, including Component, Deployment Mode, Organization Size, Application, and Industry Vertical. This detailed segmentation allows for a nuanced understanding of market dynamics, revealing where investment is accelerating and which operational models are gaining prominence. The components segmentation divides the market into solutions (software and platforms) and services (managed and professional), reflecting the duality of technology procurement and operational outsourcing. Deployment analysis clearly shows the migration from on-premise solutions to cloud-based architectures, driven by scalability and resilience needs. Furthermore, the segmentation by organization size differentiates the complex, multi-site needs of large enterprises from the flexible, subscription-based requirements of Small and Medium Enterprises (SMEs).

Application-based segmentation emphasizes the diverse roles call centers play, ranging from critical customer interaction management (CIM) to strategic telesales and specialized collections activities. Each application area has distinct technology needs, such as high-volume automated dialers for sales or secure recording and retrieval systems for financial compliance. The industry vertical perspective is essential, as sectors like BFSI and Telecommunications typically demand the highest levels of security, redundancy, and regulatory adherence, driving innovation in those specific niches. Conversely, sectors like healthcare and retail are rapidly adopting omnichannel solutions to manage complex patient or supply chain interactions efficiently.

Understanding these segments is crucial for technology vendors and BPO providers to tailor their offerings effectively. For instance, an SME in the retail sector is highly likely to seek an affordable, scalable CCaaS solution integrated with basic CRM, while a large banking institution requires custom, secure premises-based or private cloud solutions with robust AI integration for fraud detection and compliance monitoring. The growth rates within these segments vary significantly, with Cloud deployment and AI-enabled software solutions consistently exhibiting the highest Compound Annual Growth Rates across the forecast period, reflecting the market's trajectory toward agility and intelligence.

- By Component:

- Solutions (Software/Platforms)

- Automated Call Distribution (ACD)

- Interactive Voice Response (IVR)

- Workforce Management (WFM)

- Workforce Optimization (WFO)

- Customer Collaboration and Monitoring

- Reporting and Analytics

- Outbound Campaign Management

- Services

- Managed Services

- Professional Services (Consulting, Integration, Maintenance)

- Outsourcing Services (BPO)

- By Deployment Mode:

- On-Premise

- Cloud-Based (Contact Center as a Service - CCaaS)

- By Organization Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- By Application:

- Customer Interaction Management (CIM)

- Telesales and Marketing

- Collections and Billing

- Technical Support and Helpdesk

- Inbound and Outbound Services

- By Industry Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- Telecommunications and IT

- Healthcare and Life Sciences

- Government and Public Sector

- Consumer Goods and Retail

- Travel and Hospitality

- Media and Entertainment

Value Chain Analysis For Call Centre Market

The value chain of the Call Centre Market begins with upstream activities focused on technology development and infrastructure provision. This segment includes hardware manufacturers providing servers and networking gear, software developers specializing in contact center applications (ACD, IVR, CRM connectors), and cloud infrastructure providers (AWS, Azure, Google Cloud) offering scalable computing resources for CCaaS. Efficiency in the upstream segment relies heavily on continuous R&D investment, especially in advanced areas like conversational AI and predictive analytics, aiming to create highly integrated and user-friendly platforms that reduce setup complexity and improve reliability for downstream operators. Strategic partnerships between CRM giants and contact center platform vendors are crucial here to ensure seamless data flow and process integration.

Midstream operations involve the core service provision, primarily executed by BPO firms and internal captive centers. This stage focuses on talent acquisition, training, quality assurance, and managing the technological stack purchased upstream. BPOs add significant value by scaling operations rapidly, offering multilingual support, and managing regulatory compliance burdens on behalf of their clients. Their profit margins are optimized through efficient workforce management (WFM) and the skillful deployment of automation technologies to handle routine tasks, thereby enhancing the productivity of human agents. The strategic choice between direct employment and outsourcing (downstream) heavily influences the composition and complexity of this middle layer.

Downstream activities center on distribution channels and end-user engagement. Technology solutions reach end-users either directly through vendor sales teams or indirectly via system integrators, value-added resellers (VARs), and strategic channel partners who customize and implement complex multi-channel systems. The final output is the delivery of customer service and sales support to the end consumer, which dictates customer satisfaction and retention rates for the client company. The effectiveness of the distribution channel determines the speed of market penetration for new technologies, especially in geographically diverse regions. Direct channels often serve large enterprises requiring deep customization, while indirect channels efficiently serve the SME segment with standardized, scalable CCaaS solutions.

Call Centre Market Potential Customers

Potential customers for the Call Centre Market span virtually every large enterprise and a growing number of digitally active Small and Medium Enterprises (SMEs) across diverse industry verticals globally. The core buyers are organizations seeking to manage and optimize customer interactions across digital and traditional channels, aiming to improve customer lifetime value (CLV) and operational efficiency. Primary end-users include Chief Operating Officers (COOs), Chief Information Officers (CIOs), Customer Service Directors, and IT Procurement Managers who are responsible for implementing technology platforms and ensuring service delivery quality. The most significant customer segments, due to transaction volume and complexity, remain the Banking, Financial Services, and Insurance (BFSI) sector, requiring secure, compliant platforms for banking support, claims processing, and fraud management; and the Telecommunications industry, which mandates massive scalability for billing inquiries, technical support, and service provisioning.

Furthermore, the rapid expansion of e-commerce has made the Retail and Consumer Goods sector a critical customer base, requiring sophisticated omnichannel solutions to manage returns, inventory inquiries, and personalized sales experiences across web, social media, and traditional voice channels. Healthcare providers, particularly those moving toward telehealth models, are emerging high-growth customers, needing highly secure, HIPAA-compliant contact centers for appointment scheduling, patient data inquiries, and remote monitoring support. Government agencies also constitute a substantial customer base, needing scalable systems for managing high-volume public inquiries, disaster response communications, and general citizen services, often prioritizing data sovereignty and security within their procurement criteria.

In essence, any organization that relies on frequent, complex, or high-stakes interactions with its user base is a potential customer. The segmentation of customers by size is crucial; large enterprises typically procure comprehensive, custom-built solutions (often hybrid or on-premise), whereas SMEs are increasingly focused on accessible, subscription-based, pure CCaaS models that offer quick deployment and low initial capital expenditure. The evolution toward proactive and predictive customer service means that organizations previously focused solely on reactive support are now proactively investing in outbound capabilities and data analytics, expanding the total addressable market significantly.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Billion |

| Market Forecast in 2033 | USD 800 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Genesys, NICE Ltd., Cisco Systems, Five9, Talkdesk, 8x8, AWS (Amazon Connect), Microsoft (Dynamics 365), Avaya, IBM, Oracle, PegaSystems, Zendesk, Salesforce (Service Cloud), SAP, TTEC Holdings, Teleperformance, Concentrix, Alorica, Atos |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Call Centre Market Key Technology Landscape

The Call Centre Market technology landscape is characterized by high rates of innovation, centering on three core pillars: cloud architecture, intelligent automation, and comprehensive data integration. Cloud-based technologies, particularly Contact Center as a Service (CCaaS), represent the foundational shift, offering pay-as-you-go models, rapid deployment, and unmatched scalability necessary for modern business volatility. Leading platforms provide unified APIs for seamless integration with enterprise applications (ERP, CRM) and leverage microservices architecture for enhanced resilience and quicker feature deployment. This shift has democratized access to advanced contact center capabilities, making high-level features previously reserved for large enterprises accessible to SMEs, thereby flattening the competitive landscape and driving innovation from niche SaaS providers.

Intelligent automation is perhaps the most transformative technological area, incorporating advanced Natural Language Processing (NLP) and Machine Learning (ML). Key technologies here include conversational AI (chatbots, voice bots) capable of human-like interactions, Robotic Process Automation (RPA) for automating back-office tasks initiated by customer interactions, and predictive behavioral analytics. These tools work synergistically to reduce human workload, improve data accuracy, and allow for real-time customer intent recognition. Furthermore, AI-driven Workforce Optimization (WFO) tools use predictive modeling to optimize agent scheduling, training needs, and quality monitoring, moving beyond simple historical reporting to proactive operational management.

Data integration and security form the third critical pillar. Omnichannel routing systems rely on sophisticated data lakes and real-time synchronization across channels (voice, chat, social) to maintain context, ensuring the customer does not have to repeat information. Security technologies such as biometric authentication (voice/facial recognition), tokenization for payment processing, and advanced encryption protocols are mandatory, particularly in highly regulated industries. Furthermore, the rise of WebRTC (Web Real-Time Communication) technology allows for browser-based, high-quality communications without proprietary software, simplifying access and connectivity for both agents and customers, further accelerating the adoption of geographically distributed and remote contact center models.

Regional Highlights

- North America: This region holds the largest market share, driven by early and rapid adoption of advanced technologies like AI, ML, and predictive analytics. The presence of major technology vendors and high consumer expectation for seamless digital service drives continuous high investment in sophisticated cloud-based CCaaS platforms and robust data compliance solutions. Key markets include the United States and Canada, characterized by a focus on quality assurance, security, and innovative agent augmentation technologies.

- Asia Pacific (APAC): Expected to register the highest CAGR during the forecast period. This growth is fueled by massive urbanization, increasing digital penetration, and the continued dominance of countries like India and the Philippines as global hubs for Business Process Outsourcing (BPO) due to cost advantages and large skilled labor pools. Domestic growth in markets like China and Southeast Asia is driven by burgeoning e-commerce industries and the need for localized multilingual customer support solutions.

- Europe: The market is mature, exhibiting stable growth influenced heavily by stringent regulatory frameworks, particularly the General Data Protection Regulation (GDPR). Investment is concentrated on compliant CCaaS solutions, data residency requirements, and technologies that enable high-quality multilingual service across diverse national markets. Western European countries prioritize security and human-agent expertise, while Eastern Europe is emerging as a critical nearshore outsourcing destination.

- Latin America (LATAM): Showing strong potential driven by improving digital infrastructure and a growing middle class demanding better services. Key growth drivers include investments in local data centers and CCaaS implementations to serve multinational corporations expanding their operations in countries like Brazil and Mexico, focusing on bilingual support and reducing latency.

- Middle East and Africa (MEA): Growth is gradual but accelerating, largely dependent on government investment in smart city projects and digitalization initiatives in the UAE, Saudi Arabia, and South Africa. Market adoption is focused on leveraging contact centers for managing citizen services and supporting rapid expansion in the financial and telecommunications sectors. Challenges remain concerning infrastructure variability and political stability in some sub-regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Call Centre Market, encompassing technology providers, BPO specialists, and cloud infrastructure leaders.- Genesys

- NICE Ltd.

- Cisco Systems

- Five9

- Talkdesk

- 8x8

- AWS (Amazon Connect)

- Microsoft (Dynamics 365)

- Avaya

- IBM

- Oracle

- PegaSystems

- Zendesk

- Salesforce (Service Cloud)

- SAP

- TTEC Holdings

- Teleperformance

- Concentrix

- Alorica

- Atos

- Sitel Group

- Capita

- Cognizant

Frequently Asked Questions

Analyze common user questions about the Call Centre market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of CCaaS solutions?

The primary driver for Contact Center as a Service (CCaaS) adoption is the need for increased operational agility, scalability, and reduced capital expenditure (CapEx). CCaaS enables businesses to deploy advanced omnichannel capabilities quickly, support remote work models, and leverage continuous software updates without managing complex on-premise infrastructure.

How is AI fundamentally changing the role of a human call center agent?

AI is transforming the agent's role from transactional processors to strategic relationship managers. Routine tasks are automated by bots, allowing human agents to focus on complex, emotionally sensitive interactions, supported by AI tools providing real-time sentiment analysis and guided resolutions.

Which industry vertical demonstrates the highest investment in advanced call center technologies?

The Banking, Financial Services, and Insurance (BFSI) sector demonstrates the highest investment in advanced contact center technologies, driven by stringent regulatory compliance needs, high transaction volumes, security requirements (e.g., voice biometrics), and the strategic need to enhance customer retention.

What are the key security concerns for modern call center operations?

Key security concerns include protecting sensitive customer data (like PII and payment information) from breaches, ensuring compliance with global data privacy regulations (GDPR, CCPA), and mitigating risks associated with remote agent access and sophisticated social engineering fraud attempts.

What distinguishes Omnichannel from traditional Multi-channel contact center systems?

Multi-channel systems offer various communication options (phone, email, chat) that operate in silos, losing context between transitions. Omnichannel systems provide a unified, seamless customer journey where the context and history of interaction are retained across all communication channels, ensuring a cohesive and personalized experience.

The imperative for continuous improvement in customer service metrics, coupled with the rising capabilities of generative AI for synthesizing customer summaries and automating complex dialogue flows, ensures that the call center market will remain highly dynamic and ripe for technological investment throughout the forecast period. Companies prioritizing strategic deployment of cloud infrastructure alongside sophisticated AI tools are best positioned to capture market share and achieve significant differentiation in Customer Experience management. The global market is transitioning into an era where the contact center acts as a crucial data intelligence hub, informing overall business strategy and product development, rather than merely serving as a cost center for transaction processing.

Future growth will be significantly shaped by the successful integration of emerging technologies such as Web3 capabilities, further decentralizing customer data management while enhancing transparency. Furthermore, specialized contact centers focusing on niche areas, such as regulatory compliance consulting, environmental, social, and governance (ESG) reporting inquiries, and specialized technical support for highly complex industrial IoT deployments, will see accelerated demand. The trend toward hyper-personalization, driven by the ability to aggregate data across internal and external sources, will require contact center platforms to offer robust, highly configurable data integration layers, moving beyond standard CRM hooks to include predictive, proactive engagement mechanisms.

In summary, the Call Centre Market represents a vital sector undergoing massive technological overhaul. The shift to CCaaS provides the necessary infrastructure agility, while the adoption of AI provides the operational intelligence required to meet escalating global customer expectations. Navigating regulatory complexity and ensuring robust cybersecurity will remain paramount for all market participants, driving demand for highly secure, compliant, and innovative solutions throughout the 2026–2033 forecast period, cementing its role as a key contributor to global digital economic transformation.

The competitive landscape is increasingly defined by ecosystems rather than isolated products. Major players are strategically acquiring or partnering with specialized AI startups and BPO firms to offer end-to-end integrated solutions. This consolidation aims to provide a single, unified platform covering everything from workforce management and quality assurance to advanced analytics and automated self-service, simplifying procurement and deployment for large global enterprises. This ecosystem approach, bolstered by standardized API integration capabilities, ensures that organizations can seamlessly scale their operations and adapt to rapidly changing consumer communication preferences, guaranteeing resilience and competitive advantage in the digital service delivery space.

Moreover, the focus on Environmental, Social, and Governance (ESG) criteria is subtly beginning to influence procurement decisions in the call center sector. Customers are increasingly interested in vendors who can demonstrate sustainable practices, such as reducing the carbon footprint associated with large data centers (for on-premise solutions) or utilizing energy-efficient cloud infrastructure. Socially, the emphasis on ensuring fair labor practices for agents, whether captive or outsourced, and promoting diversity and inclusion within the contact center workforce, is becoming a strategic imperative, adding another layer of complexity to the operational management component of the market.

The market for specialized consulting services related to AI implementation and digital transformation within contact centers is also experiencing strong growth. Companies require expert guidance not only on selecting the right technology but also on redesigning core business processes to maximize the benefits of automation. This includes developing new agent training programs focused on empathy and high-level problem-solving, as well as establishing clear governance structures for AI-driven decision-making, ensuring ethical and compliant customer interactions globally.

Finally, the proliferation of specialized vertical solutions is a key trend. While generalist CCaaS platforms serve broad needs, there is increasing demand for solutions pre-configured and optimized for specific regulatory and operational requirements of industries like pharmaceuticals, utilities, and logistics. These solutions often integrate industry-specific databases and compliance workflows directly into the contact center platform, reducing deployment time and enhancing regulatory adherence, thus commanding a premium in the highly competitive solutions segment of the market.

The integration capabilities of core platforms are undergoing severe testing as enterprises seek to unify data from marketing automation, sales pipelines, and customer service ticketing systems. The future success of any call center solution will hinge on its ability to act as a central hub, orchestrating data flow and ensuring that every agent or bot possesses a complete, real-time 360-degree view of the customer. This level of integration supports proactive service, reduces customer frustration from repetitive inquiries, and provides crucial business intelligence that transcends the traditional boundaries of customer service operations.

The ongoing development of 5G infrastructure is also playing a secondary but important role, particularly in mobile-centric markets and for remote agent connectivity. Improved bandwidth and reduced latency enhance the quality and reliability of cloud-based communications, supporting sophisticated voice and video interactions, crucial for high-value services like financial advisory or specialized technical diagnostics delivered remotely. This technological layer supports the flexible and geographically diverse deployment models that are characterizing the modern call center environment.

In conclusion, the market's trajectory is defined by a race towards intelligent, unified, and compliant customer engagement. The substantial projected growth confirms the continued strategic importance of contact centers as the primary interface between enterprises and their customers, driving massive investment in next-generation platforms and outsourcing expertise to manage this critical corporate function effectively and profitably in the digital age.

The need for real-time performance monitoring across globally distributed call center operations has catalyzed the demand for advanced analytics dashboards that utilize machine learning to predict staffing needs and potential service degradations. These sophisticated WFM (Workforce Management) and WFO (Workforce Optimization) tools are essential for maintaining service level agreements (SLAs) and managing the complexities introduced by hybrid and remote work models. The ability to monitor agent performance, identify coaching opportunities, and manage compliance obligations automatically across diverse geographies provides a significant competitive edge to BPO providers and large captive centers.

Furthermore, the evolution of regulatory standards worldwide, particularly those related to consumer data handling and consent, mandates continuous technological adaptation. Call center platforms must incorporate features such as advanced encryption, secure data masking during live calls, and comprehensive audit trails to demonstrate adherence to requirements like PCI DSS for payment handling and various regional consumer protection acts. Non-compliance poses severe financial and reputational risks, making compliance features non-negotiable aspects of platform selection and operational management, further cementing security technology as a high-growth segment within the market.

In the competitive arena, price sensitivity remains a factor, particularly among SMEs and in emerging markets. This maintains pressure on CCaaS providers to continuously innovate and streamline their platform offerings, reducing the total cost of ownership (TCO) while expanding functionality. Modular subscription models, where customers only pay for the specific AI and analytics features they utilize, are becoming standard practice, allowing businesses to incrementally adopt advanced capabilities aligned with their specific budgetary and strategic goals, thereby promoting wider market penetration.

The ongoing challenge of agent retention and managing high turnover rates is indirectly fueling technology adoption. By implementing AI to automate tedious tasks and providing agents with superior tools (Agent Desktop), organizations aim to reduce stress, improve job satisfaction, and elevate the agent experience (AX). A focus on AX is now recognized as intrinsically linked to customer experience (CX), driving investment in sophisticated knowledge management systems and streamlined user interfaces to empower the human workforce. This human-centric technology approach is essential for sustaining long-term service quality and market competitive advantage.

Finally, the movement towards self-service solutions, while seemingly reducing call volumes, actually drives demand for more complex, integrated call center systems. The calls that do reach human agents are typically highly technical or emotionally charged, requiring a level of expertise and data access that older systems cannot support. Therefore, the market growth is not solely about increasing agent numbers, but about increasing the technological sophistication and efficacy of every interaction handled, whether automated or human-assisted.

The technological synergy between core CCaaS platforms and adjacent enterprise solutions like Enterprise Resource Planning (ERP) and Supply Chain Management (SCM) systems is deepening. For instance, integration allows a contact center agent to instantly verify inventory levels or initiate a complex refund process directly from their desktop interface without switching applications, drastically improving first-call resolution (FCR) rates and enhancing operational speed. This cross-functional integration strategy is increasingly defining the competitive differentiation among leading technology vendors in the Call Centre Market.

This market analysis strongly indicates that sustained investment in technological infrastructure and BPO partnerships focused on quality and regulatory adherence will be necessary to capitalize on the 8.5% CAGR projected for the forecast period, positioning the Call Centre Market as a key barometer of global service economy health and digital transformation maturity.

The transition from traditional voice-only contact centers to digital-first engagement hubs necessitates specialized training and tooling. Training programs must now encompass complex digital channel management, including advanced social media crisis handling and asynchronous communication methodologies inherent in email and messaging platforms. The technology must support this by offering unified queuing and priority management across disparate channels, ensuring that service standards are met regardless of the communication method chosen by the customer.

Furthermore, the competitive landscape is shifting as large technology players like Amazon (AWS Connect) and Microsoft (Dynamics 365) heavily invest in embedded contact center capabilities within their broader cloud ecosystems. This integration simplifies procurement for existing cloud customers, putting pressure on pure-play contact center vendors to innovate rapidly and maintain specialization in complex feature sets like advanced routing, WFM, and proprietary AI algorithms that offer superior performance and customization beyond standard cloud offerings.

The long-term viability of market players hinges on their ability to offer truly composable architectures. Enterprises are moving away from monolithic platforms towards flexible systems where components (IVR, ACD, WFM, AI modules) can be selected and deployed independently, allowing businesses to mix and match best-of-breed solutions. This trend places a high value on open APIs, developer ecosystems, and robust technical support for complex multi-vendor deployments, thereby driving innovation towards highly flexible, interconnected cloud-native platforms.

Ultimately, the Call Centre Market's expansion is intrinsically linked to global economic growth and the relentless pressure on businesses to cultivate strong, proactive customer relationships. As digital touchpoints multiply and consumer expectations for personalized service continue to rise, the call center, reimagined as the intelligent contact center, remains essential for competitive advantage and sustained profitability across every major industry vertical analyzed in this comprehensive report.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Contact and Call Centre Outsourcing Market Statistics 2025 Analysis By Application (BFSI, Retail, Government and Public Sector, IT & Telecommunication, Healthcare and Life Sciences, Manufacturing, Others), By Type (On-Premise Type, Cloud-based Type), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Contact and Call Centre Outsourcing Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Outbound call center services, Inbound call center services, Outsource date entry services, Man-power outsourcing, Outsource web enabled services, Outsource market reasearch services), By Application (Internet industry, Insurance, Finance and banking, Service industry, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager