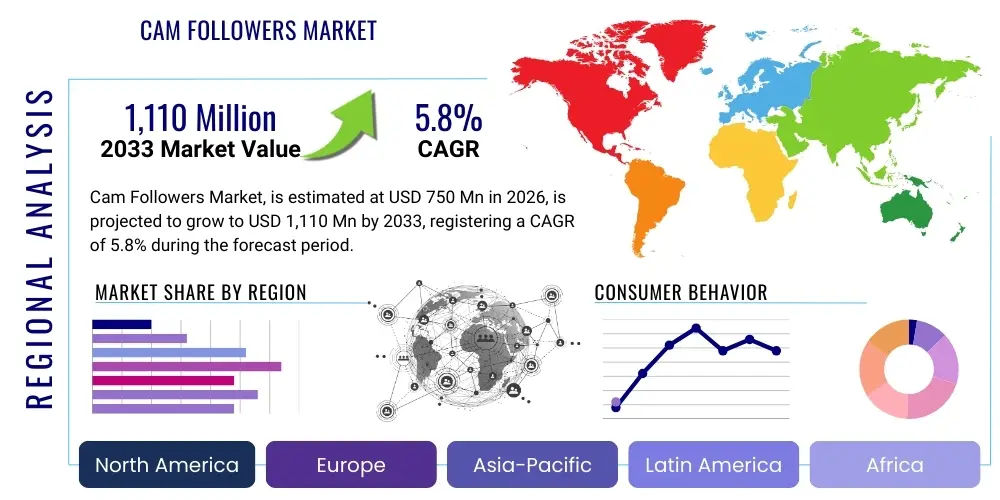

Cam Followers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438721 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Cam Followers Market Size

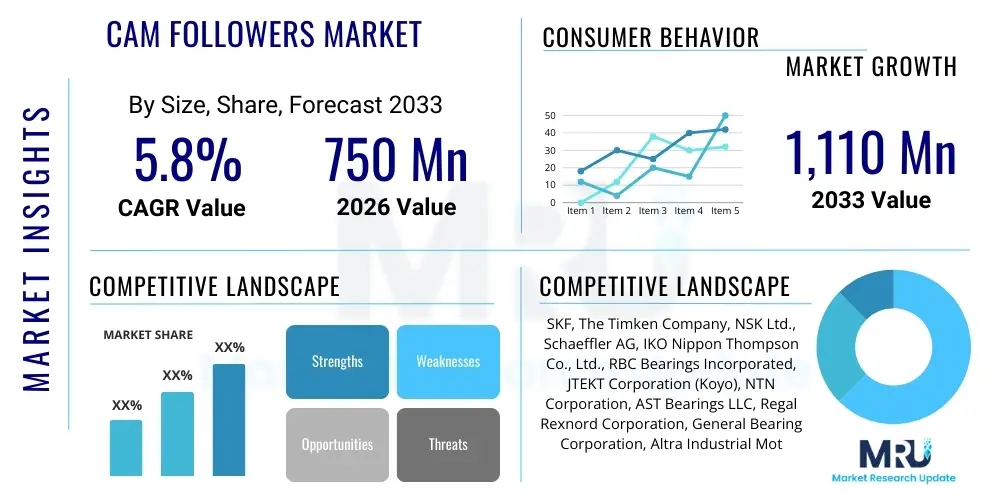

The Cam Followers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $750 Million in 2026 and is projected to reach $1,110 Million by the end of the forecast period in 2033.

Cam Followers Market introduction

The Cam Followers market encompasses specialized rolling element bearings designed to follow the profile of a cam or track, facilitating precise, low-friction linear or oscillating motion transfer. These components are integral to automated machinery, providing critical support in converting rotary motion into specific, timed linear movement or vice versa. Essential characteristics of cam followers include their thick-walled outer rings, which enable them to withstand high static and dynamic loads, misalignment, and intermittent shock loading typical in industrial environments. They are utilized extensively across highly demanding sectors, including printing presses, textile machinery, material handling systems, and complex CNC equipment.

Product descriptions typically differentiate between stud-type cam followers, which feature a threaded stud for quick mounting, and yoke-type cam followers, which require mounting via a shaft or bolt through an inner ring bore. Major applications span industrial automation, where precision indexing and smooth motion are paramount; packaging machinery, requiring rapid and reliable operation cycles; and the automotive manufacturing sector, particularly within stamping and assembly lines. The intrinsic benefits of utilizing cam followers include enhanced operational efficiency due to reduced friction, improved load distribution, and extended machinery lifespan owing to their robust design and internal bearing configurations, which often include full complement rollers or caged roller sets.

Driving factors propelling market expansion are fundamentally linked to the global acceleration of industrial automation and the push toward implementing Industry 4.0 standards. The increasing adoption of advanced robotics and automated guided vehicles (AGVs) in logistics and manufacturing necessitates high-precision components capable of enduring continuous heavy-duty cycles. Furthermore, the rising demand for specialized machinery in emerging economies, coupled with stricter regulatory requirements for energy efficiency and operational reliability in developed markets, solidifies the foundational demand for high-quality, durable cam followers. Technological advancements, particularly in sealing technologies and specialized coatings, also contribute significantly to the market growth trajectory by enhancing performance in corrosive or contaminant-heavy settings.

Cam Followers Market Executive Summary

The global Cam Followers market is characterized by robust business trends driven primarily by the rapid modernization of manufacturing infrastructure worldwide and a pronounced shift toward high-speed automation systems. Key market players are heavily investing in product innovation, focusing on integrating smart features such as condition monitoring sensors into bearing assemblies to predict failures and minimize downtime, aligning with predictive maintenance paradigms. Mergers, acquisitions, and strategic partnerships are defining the competitive landscape, as leading manufacturers seek to consolidate market share, optimize supply chains, and gain access to proprietary sealing and material technologies, especially those offering superior performance in extreme temperature or high-contamination environments. The fundamental business strategy revolves around offering customized solutions that meet the stringent precision requirements of specialized applications like semiconductor manufacturing and high-speed packaging.

Regional trends indicate that the Asia Pacific (APAC) region continues to dominate market growth, primarily fueled by massive government investments in infrastructure development, establishing APAC as the world's primary manufacturing hub. Countries such as China, India, and South Korea are witnessing accelerated adoption of automated production lines across automotive and electronics sectors, demanding large volumes of standard and specialized cam followers. North America and Europe, while mature, exhibit high demand for premium, high-performance cam followers utilized in aerospace, defense, and advanced robotics, emphasizing quality and longevity over cost. Regulatory harmonization and emphasis on environmental, social, and governance (ESG) standards are influencing procurement decisions globally, favoring manufacturers who utilize sustainable materials and energy-efficient production processes.

Segment trends highlight the dominance of the Stud Type Cam Followers segment due to their ease of installation and widespread applicability across general machinery. However, the Yoke Type segment is projected to exhibit faster growth, particularly in heavy-duty applications requiring greater axial stiffness and higher dynamic load capacity, often integrated into large indexing tables and heavy material transfer systems. Application-wise, the Industrial Machinery segment maintains the largest market share, but the Automotive and Aerospace sectors are emerging as high-value segments, driven by increased production complexities and the critical need for absolute precision in their automated tooling. Material advancements, specifically the use of ceramic hybrids and specialized polymers in outer rings, are carving out niche segments demanding lightweight solutions and superior corrosion resistance.

AI Impact Analysis on Cam Followers Market

User queries regarding the impact of Artificial Intelligence (AI) on the Cam Followers market primarily center on how AI-driven predictive maintenance (PdM) systems utilize sensor data from machinery to optimize bearing lifecycles and schedule necessary replacements before catastrophic failures occur. Users are keen to understand the integration costs and efficacy of embedding smart sensors (IoT integration) into standard cam follower assemblies and how AI algorithms analyze vibration, temperature, and acoustic signatures specific to rolling element performance. Key themes summarize user concerns about data security, the accuracy of failure prediction models in highly variable industrial settings, and the potential for AI-optimized operational strategies to reduce the overall replacement volume but increase demand for premium, sensor-ready smart components. Expectations are high regarding significant reductions in unplanned downtime and a shift from traditional time-based maintenance to condition-based servicing, fundamentally altering the after-market dynamics for these essential machine components.

- AI algorithms facilitate sophisticated predictive maintenance by analyzing vibration and temperature data from surrounding machinery, forecasting cam follower failure probability with high accuracy.

- Implementation of digital twins leverages AI to simulate operational stresses, allowing manufacturers and end-users to select the optimal cam follower specification for demanding duty cycles, minimizing premature wear.

- AI-enhanced quality control systems utilize machine vision and deep learning to inspect manufacturing tolerances, ensuring components meet strict geometrical precision standards required for high-speed automation.

- Optimized inventory management in supply chains is achieved using AI to predict demand fluctuations based on industry activity and historical usage patterns, reducing lead times for high-volume parts.

- The development of smart cam followers, integrating miniature sensors and transceivers, allows real-time health monitoring, generating data inputs crucial for AI-driven anomaly detection and operational optimization.

- Generative AI tools are increasingly used in the design phase to rapidly iterate complex cam profiles and follower geometries, improving motion control efficiency and reducing design-to-production cycles.

DRO & Impact Forces Of Cam Followers Market

The market dynamics for Cam Followers are shaped by a complex interplay of growth drivers (D), constraining factors (R), strategic opportunities (O), and pervasive impact forces. A primary driver is the accelerating global investment in industrial automation, particularly in emerging economies, which necessitates high volumes of precision motion components for new manufacturing facilities and machine upgrades. Furthermore, the stringent demand for increased machine uptime and operational reliability across sectors like aerospace and heavy industry forces end-users to adopt premium, heavy-duty cam followers with extended life cycles, positively influencing market value. These drivers are fundamentally supported by advancements in material science, leading to bearings capable of handling higher loads and speeds.

However, the market faces significant restraints, notably the intense price competition, particularly in the standard segment, where cheaper substitutes from non-certified regional players can undercut established premium brands. The technical complexity involved in selecting the precise cam follower for highly specialized applications also poses a barrier, requiring sophisticated engineering consultancy and leading to protracted sales cycles. Moreover, the long replacement cycles inherent to high-quality industrial components mean that revenue streams are often reliant on new machine sales rather than frequent aftermarket replacement, creating volatility in demand driven by capital expenditure cycles in the manufacturing sector.

Strategic opportunities emerge primarily from the integration of IoT and AI into traditional mechanical components, allowing manufacturers to transition from component suppliers to integrated service providers offering predictive maintenance solutions. Expansion into niche, high-growth sectors such as robotics, additive manufacturing equipment, and renewable energy infrastructure (e.g., concentrated solar power tracking systems) provides avenues for premium pricing and technological differentiation. The impact forces are characterized by stringent quality standards (ISO 9001, aerospace specifications) which favor market leaders, and the constant pressure to develop superior sealing technology to prevent lubricant contamination, which is the single most common cause of premature bearing failure across all industrial applications.

Segmentation Analysis

The Cam Followers market exhibits extensive segmentation based on product characteristics, application diversity, and geographical footprint, reflecting the component's ubiquitous nature across various industrial machinery types. Analyzing the market through segmentation provides critical insights into dominant demand patterns, technological preferences, and regional consumption dynamics. Key segmentation parameters include the type of mounting mechanism (stud vs. yoke), the design configuration (caged vs. full complement), the material composition (steel vs. stainless steel), and the specific end-use industry (such as packaging, textile, or automation), each influencing the selection criteria regarding load capacity, speed, and environmental resistance.

The segmentation by design configuration is crucial, differentiating between caged cam followers, which offer high-speed capabilities and lower friction, making them suitable for rapid indexing machinery, and full complement cam followers, which maximize load-carrying capacity, essential for heavy lifting and high-impact applications like forging equipment. Furthermore, the market is differentiated by sealing type—standard seals, heavy-duty seals, and specialized labyrinth seals—which are critical performance factors in environments characterized by dust, moisture, or chemical exposure. This granularity in segmentation allows manufacturers to tailor product portfolios to meet precise performance specifications demanded by advanced manufacturing standards, ensuring optimized operational longevity and efficiency for the end-user.

Geographical segmentation reveals stark contrasts in demand drivers: mature markets prioritize technical compliance, customization, and longevity, fostering demand for premium, specialized variants; conversely, developing markets prioritize volume, standardization, and cost-effectiveness. The overall trend indicates a strong shift toward maintenance-free and permanently lubricated units across all segments, reducing the total cost of ownership (TCO) for automated systems. This movement pushes manufacturers to innovate in lubricant technology and sealing robustness, creating a competitive advantage in the high-performance segment which is critical for long-term market sustainability and growth across specialized industrial application areas.

- By Type:

- Stud Type (Standard Stud, Heavy Stud, Eccentric Stud)

- Yoke Type (With Inner Ring, Without Inner Ring)

- Track Rollers (Flanged, V-Groove, U-Groove)

- By Design Configuration:

- Caged Rollers

- Full Complement Rollers

- Needle Roller Bearings

- By Application/End-Use Industry:

- Industrial Machinery and Automation (Textile, Printing, CNC)

- Packaging and Material Handling Systems

- Automotive Manufacturing and Stamping

- Aerospace and Defense Equipment

- Construction and Mining Equipment

- Medical and Pharmaceutical Machinery

- By Material:

- Carbon Steel

- Stainless Steel (Corrosion Resistant)

- Special Alloy Steel

Value Chain Analysis For Cam Followers Market

The value chain of the Cam Followers market begins with upstream activities focused on the procurement and processing of high-grade raw materials, primarily specialized bearing steel (high-carbon chromium steel) and materials for sealing and lubrication (synthetic rubbers and high-performance greases). Upstream analysis is critical as the quality of the raw materials directly determines the lifespan and load capacity of the final product. Key upstream challenges involve maintaining consistent quality standards for steel alloys and managing volatility in commodity prices. Strategic supplier relationships, focusing on long-term contracts with specialized steel mills, are essential to ensure a reliable supply of materials that meet stringent industry specifications for hardness and fatigue resistance required in heavy-duty applications.

Midstream activities encompass the precise manufacturing processes, including forging, turning, grinding, heat treatment, and specialized surface finishing (such as black oxide coating for corrosion protection). Manufacturing complexity is high due to the demanding tolerances required for the outer ring, which functions as the running surface, and the precision required for the internal roller assembly. Direct manufacturing involves in-house production by major integrated bearing manufacturers who control the entire process, ensuring quality consistency. Indirect manufacturing involves outsourcing specific stages, such as forging or heat treatment, to specialized vendors, allowing market players to focus on core assembly and quality assurance. Efficiency in midstream operations, driven by automation and sophisticated metrology, is crucial for maintaining cost competitiveness and quality control.

Downstream analysis focuses on distribution channels and end-user engagement. Distribution is multifaceted, involving both direct sales to large Original Equipment Manufacturers (OEMs) who integrate cam followers into their machinery, and indirect sales through extensive networks of authorized industrial distributors, stockists, and maintenance, repair, and operations (MRO) suppliers. Direct channels facilitate deep technical collaboration between manufacturer and OEM during the design phase, crucial for customized solutions. Indirect channels provide broad market penetration and logistical support for aftermarket demand, especially for standardized replacement parts. The effectiveness of the distribution network, particularly the availability of local inventory and specialized technical support, significantly impacts the customer purchasing experience and speed of maintenance response globally.

Cam Followers Market Potential Customers

Potential customers for Cam Followers are predominantly concentrated within the industrial manufacturing and automation ecosystem, categorized primarily as Original Equipment Manufacturers (OEMs) and Maintenance, Repair, and Operations (MRO) entities. OEMs represent the primary segment, integrating cam followers into newly designed machinery across various industries, including robotics, printing presses, packaging machines, and construction vehicles. These buyers prioritize technical specifications such as load rating, precision tracking capabilities, and compatibility with proprietary mounting systems. Their purchasing decisions are highly influenced by performance guarantees, material certifications, and the ability of suppliers to provide technical consultation during the product development lifecycle, ensuring seamless integration and optimal machine performance from the outset.

The second major segment, MRO buyers, includes manufacturing plants, industrial repair shops, and maintenance contractors who purchase cam followers for replacing worn-out components in existing machinery. For MRO customers, availability, standardization (cross-referencing capabilities), and timely delivery are paramount, as unexpected component failure translates directly into costly production downtime. Demand from the MRO segment is typically stable, driven by the size of the installed machinery base globally, and is less sensitive to economic cycles than the OEM segment. Specialized end-users, such as defense contractors and aerospace manufacturers, represent a high-value niche segment, demanding ultra-high precision, specialized coatings, and compliance with rigorous industry-specific quality and documentation standards (e.g., AS9100). These buyers are often less price-sensitive and focus instead on long-term reliability and supplier trust.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $750 Million |

| Market Forecast in 2033 | $1,110 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SKF, The Timken Company, NSK Ltd., Schaeffler AG, IKO Nippon Thompson Co., Ltd., RBC Bearings Incorporated, JTEKT Corporation (Koyo), NTN Corporation, AST Bearings LLC, Regal Rexnord Corporation, General Bearing Corporation, Altra Industrial Motion Corp., Carter Manufacturing Limited, THK Co., Ltd., CCTY Bearing, BDI Bearing, KMF Group, GGB Bearing Technology, QTC Metric Gears, Del-Tron Precision Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cam Followers Market Key Technology Landscape

The technological landscape of the Cam Followers market is defined by continuous innovation aimed at enhancing wear resistance, increasing load-carrying capacity, and extending the service life under harsh operating conditions, moving beyond standard bearing steel formulations. A primary technological focus is on advanced materials science, including the development of ceramic hybrid cam followers, which utilize ceramic rolling elements (such as silicon nitride) combined with steel rings. These hybrids offer superior performance in terms of higher speed capabilities, reduced friction, and excellent resistance to corrosion and electrical erosion, making them indispensable in highly demanding applications like semiconductor manufacturing equipment and high-speed CNC machines where environmental contamination must be strictly minimized.

Another pivotal technological area is specialized coatings and surface treatments. Manufacturers are employing black oxide, zinc-nickel plating, and thin dense chromium (TDC) coatings to significantly improve the corrosion resistance of the outer ring and stud, particularly crucial for applications in the food and beverage industry, pharmaceutical processing, and outdoor construction equipment exposed to high humidity or chemical washdowns. Furthermore, advancements in bearing internal geometry, such as modified roller end designs and optimized raceway profiles, are implemented to improve lubrication film formation, reduce edge stress, and accommodate higher levels of axial misalignment without compromising dynamic load performance. These geometric optimizations are computationally intensive and rely on sophisticated finite element analysis (FEA) during the design stage.

The adoption of advanced sealing technology represents a critical competitive differentiator. Modern cam followers increasingly feature multi-lip contact seals, labyrinth seals, and shield combinations constructed from robust materials like Viton or specialized polymers, designed to exclude fine contaminants (dust, swarf) while effectively retaining the internal lubrication for the entire service life. The ultimate goal is achieving "lubricated-for-life" performance, thereby eliminating maintenance routines and reducing the environmental footprint associated with frequent re-lubrication. Finally, the incorporation of integrated sensor technology (IoT readiness), embedding miniature accelerometers or temperature probes directly into the stud or outer ring structure, allows for proactive condition monitoring, creating a pathway toward intelligent machine components that communicate their health status in real-time to centralized maintenance systems.

Regional Highlights

Asia Pacific (APAC) is the dominant and fastest-growing region in the Cam Followers market, primarily fueled by massive industrial expansion and government initiatives promoting advanced manufacturing (e.g., Made in China 2025, Make in India). The region serves as the global epicenter for the automotive, electronics, and textile industries, leading to substantial demand for cam followers in automated assembly lines, high-speed sorting, and precision tooling. China and India are the largest consumers due to their rapidly expanding manufacturing bases and increasing adoption of automation to boost productivity and quality standards. The regional focus often balances between high-volume, cost-effective standard products and increasingly complex, specialized units required by the burgeoning semiconductor and high-precision electronics sectors in countries like South Korea and Taiwan.

North America holds a significant market share, characterized by high demand for premium, high-reliability cam followers used in technologically advanced sectors such as aerospace, defense, and high-speed packaging machinery. The market here emphasizes stringent quality control, customized engineering solutions, and long-term durability, often exceeding standard performance requirements. Investments in advanced robotics and the modernization of existing industrial infrastructure in the United States and Canada, coupled with regulatory pressure favoring high-efficiency equipment, drive the consumption of high-specification, sensor-ready cam followers. The competitive landscape is defined by established global players and specialized domestic manufacturers focusing on niche, high-tolerance applications critical for national defense and safety standards.

Europe constitutes a mature but highly technologically demanding market. Consumption is concentrated in Germany (known for its robust machine tool industry), Italy (specialized machinery), and the Scandinavian countries (pulp and paper, heavy mining). European manufacturers are pioneers in Industry 4.0 integration, driving demand for intelligent, digitally-integrated cam followers that support sophisticated condition monitoring and predictive maintenance protocols. The region’s strict environmental regulations encourage the adoption of sealed, maintenance-free units that minimize lubricant waste. While growth rates are moderate compared to APAC, the value generated per unit is high, reflecting the preference for high-precision, highly durable products compliant with rigorous EU safety and environmental standards.

Latin America (LATAM) and the Middle East and Africa (MEA) regions represent emerging markets with substantial long-term growth potential. LATAM demand is largely influenced by the automotive assembly and mining sectors in Brazil and Mexico, requiring durable cam followers capable of withstanding rough operating conditions. The MEA market, particularly the Gulf Cooperation Council (GCC) nations, sees growth driven by large-scale infrastructure projects, oil and gas exploration, and investments in logistics and material handling automation. While these regions currently rely heavily on imports and focus on cost-effectiveness, increasing domestic manufacturing capabilities are expected to drive demand for localized technical support and standardized component stocking in the coming years, gradually shifting procurement dynamics toward long-term supplier partnerships.

- Asia Pacific (APAC): Leads market size and growth due to manufacturing expansion in China, India, and Southeast Asia; high demand in automotive, electronics, and textile sectors; strong adoption of automation technologies.

- North America: Focuses on high-performance, premium cam followers for aerospace, defense, and robotics; characterized by stringent quality requirements and early adoption of integrated smart bearing technology.

- Europe: Mature market driven by sophisticated machine tool manufacturing (Germany); high demand for intelligent, maintenance-free units aligning with Industry 4.0 and strict environmental standards.

- Latin America (LATAM): Growth tied to automotive manufacturing and commodity extraction sectors (mining, construction); preference for rugged and cost-efficient components.

- Middle East & Africa (MEA): Emerging demand fueled by infrastructure development, oil and gas sector automation, and logistics investment; market highly dependent on imported premium components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cam Followers Market.- SKF

- The Timken Company

- NSK Ltd.

- Schaeffler AG

- IKO Nippon Thompson Co., Ltd.

- RBC Bearings Incorporated

- JTEKT Corporation (Koyo)

- NTN Corporation

- AST Bearings LLC

- Regal Rexnord Corporation

- General Bearing Corporation

- Altra Industrial Motion Corp.

- Carter Manufacturing Limited

- THK Co., Ltd.

- CCTY Bearing

- BDI Bearing

- KMF Group

- GGB Bearing Technology

- QTC Metric Gears

- Del-Tron Precision Inc.

Frequently Asked Questions

Analyze common user questions about the Cam Followers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between Stud Type and Yoke Type Cam Followers?

Stud Type Cam Followers feature a built-in threaded stud for cantilever mounting, offering ease of installation in standard applications. Yoke Type Cam Followers require a separate pin or shaft for mounting, providing greater structural support and enhanced load distribution, making them suitable for high-load or complex tracking mechanisms requiring greater axial rigidity.

How does Industry 4.0 affect the demand for Cam Followers?

Industry 4.0 significantly boosts demand for high-precision, durable, and sensor-ready Cam Followers. Integration with automated systems requires components with zero maintenance and high reliability, driving innovation toward smart bearings equipped with IoT capabilities for real-time condition monitoring and predictive maintenance algorithms.

Which industry accounts for the largest market share in Cam Followers consumption?

The Industrial Machinery and Automation sector maintains the largest share of the Cam Followers market. This segment includes textile machinery, printing equipment, CNC machine tools, and general factory automation systems that rely heavily on cam mechanisms for indexing, positioning, and controlled motion sequences.

What materials and coatings are trending for enhanced corrosion resistance?

The market is seeing a strong trend toward stainless steel construction for wet or food-grade applications, often coupled with specialized surface treatments like black oxide or thin dense chromium (TDC) coatings. These materials and coatings significantly resist corrosion, extending operational life in chemical or washdown environments, reducing total cost of ownership.

What factors determine the lifespan and necessary replacement frequency of a Cam Follower?

The lifespan is primarily determined by the dynamic load applied, operating speed, environmental contamination levels, and lubrication quality. Misalignment, shock loads, and insufficient or contaminated lubrication are the most common factors accelerating fatigue and premature failure, necessitating replacement schedules based on condition monitoring rather than fixed time intervals.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager