Camelina Cooking Oil Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432382 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Camelina Cooking Oil Market Size

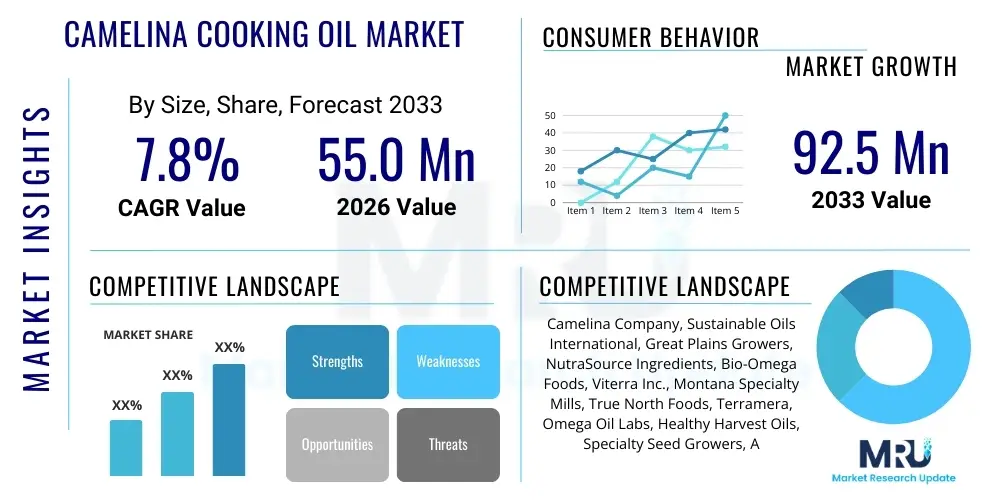

The Camelina Cooking Oil Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 55.0 million in 2026 and is projected to reach USD 92.5 million by the end of the forecast period in 2033.

Camelina Cooking Oil Market introduction

The Camelina Cooking Oil Market centers around the culinary utilization of oil derived from the seeds of Camelina sativa, an ancient oilseed crop gaining prominence due to its exceptional nutritional profile and sustainable cultivation characteristics. Often referred to as "gold-of-pleasure," camelina oil is characterized by a high smoke point, making it suitable for various cooking methods, including frying and high-heat sautéing, which provides a significant competitive advantage over other high-omega content oils like flaxseed. The primary driving factor for its increasing adoption lies in its polyunsaturated fatty acid composition, particularly the superior ratio of Omega-3 (alpha-linolenic acid, ALA) to Omega-6 fatty acids, typically around 2:1, which is highly desirable for heart health and anti-inflammatory diets. Furthermore, camelina oil contains high levels of tocopherols (Vitamin E), which contribute to its inherent oxidative stability, extending shelf life naturally without extensive processing or chemical additives. This natural stability appeals strongly to both manufacturers seeking clean-label ingredients and health-conscious consumers.

The product description encompasses both refined and unrefined varieties, with unrefined camelina oil retaining a distinct, mildly nutty, and slightly herbaceous flavor profile, preferred in salad dressings and finishing oils. Refined camelina oil, characterized by a neutral flavor and higher smoke point, is primarily targeted towards the packaged food industry and institutional cooking sectors where flavor neutrality is paramount. Major applications span direct consumer use in home cooking, integration into functional foods such as baked goods and nutritional bars for omega enhancement, and utilization in the foodservice industry as a healthier alternative to conventional vegetable oils. The increasing awareness regarding the detrimental effects of high saturated and trans-fats is compelling consumers globally to seek out healthier fat sources, positioning camelina oil advantageously in the premium edible oils segment.

Driving factors propelling market growth include expanding scientific research validating the cardiovascular benefits of ALA, coupled with a robust global trend favoring plant-based and sustainable food systems. Camelina is resilient, drought-tolerant, and requires fewer inputs compared to major oilseeds, making it an economically and environmentally sound crop choice for farmers, thereby securing a stable supply chain. The governmental push in several key regions, particularly North America and Europe, to support the cultivation of low-input crops and novel foods further accelerates market entry. However, achieving mainstream visibility and overcoming the cost barrier compared to established commodity oils like canola and soy remains a persistent challenge that market players are actively addressing through strategic marketing and scaling up production efficiencies.

Camelina Cooking Oil Market Executive Summary

The Camelina Cooking Oil Market is experiencing dynamic growth, fundamentally underpinned by shifting consumer preference toward functional ingredients and sustainable sourcing practices, positioning it as a key contender in the specialty oils segment. Business trends indicate a strong focus on vertical integration, where key industry players are controlling the supply chain from seed genetics and farming (ensuring non-GMO status) through processing and final distribution. This strategy aims to stabilize raw material costs and guarantee quality consistency, crucial factors for securing large contracts within the functional food manufacturing and B2B segments. Furthermore, product innovation is accelerating, primarily focusing on creating high-stability omega oil blends and specialized culinary products, alongside investing in advanced extraction technologies like cold pressing to maximize nutritional retention and appeal to the high-end, organic consumer base. Strategic alliances between camelina producers and established retail distributors are becoming vital to enhance market penetration and consumer education.

Regionally, North America, particularly the United States and Canada, currently holds the dominant share, driven by proactive agricultural support for new crops and a large, affluent population keenly focused on dietary supplements and cardiovascular health. Europe is the fastest-growing region, stimulated by the European Union’s Novel Food Regulation, which has streamlined the approval process for camelina oil, allowing its integration into a wider array of food products. Key trends in Europe include the adoption of camelina oil in Mediterranean diet variations and the strong consumer demand in countries like Germany and the UK for domestically and sustainably sourced vegetable oils. Asia Pacific is emerging as a critical future growth area, although currently smaller, driven by the expanding middle class in countries like Japan and South Korea, which increasingly seeks Western health food trends and high-value functional oils, provided supply chain logistics and pricing can be optimized for the region.

Segment trends reveal that the Unrefined Camelina Oil segment is witnessing robust growth, propelled by the raw food and clean-label movement, where the retained flavor and maximum nutrient density are prioritized, particularly in the direct-to-consumer channel. The Functional Food Application segment is projected to show the highest CAGR, as manufacturers rapidly substitute less stable omega sources with camelina oil in products requiring heat processing, such as fortified breads, pasta, and ready-to-eat meals, leveraging its high oxidative stability. Distribution channel analysis shows that e-commerce platforms and specialty health stores are currently the primary drivers of B2C sales, offering specialized product information and targeting niche health communities effectively, while bulk sales to B2B food processors remain the largest volume segment, reflecting the industrial adoption of the oil as a functional ingredient.

AI Impact Analysis on Camelina Cooking Oil Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Camelina Cooking Oil Market generally revolve around optimizing agricultural practices, ensuring supply chain transparency, and leveraging personalized nutrition marketing. Common user concerns include how AI can enhance the yield and quality consistency of camelina crops under varying climate conditions, whether AI-driven predictive analytics can mitigate commodity price volatility, and how machine learning can be used to analyze complex consumer data to tailor product offerings. There is significant interest in utilizing AI for advanced quality control, specifically detecting and quantifying key nutritional components like omega-3 content and tocopherol levels rapidly during processing. The consensus expectation is that AI will primarily drive operational efficiencies, reduce waste, and facilitate the scaling of sustainable farming practices necessary to transition camelina oil from a niche product to a mainstream cooking oil alternative. AI adoption is viewed as essential for minimizing risks associated with novel crop introduction and maximizing traceability for environmentally conscious consumers.

- AI optimizes camelina crop rotation and irrigation schedules through predictive modeling based on hyper-local climate data, enhancing yield consistency.

- Machine learning algorithms analyze genomic data of Camelina sativa strains to accelerate selective breeding for higher oil content and improved disease resistance.

- AI-powered sensor technology monitors seed quality and oil extraction efficiency in real-time, reducing processing waste and ensuring standardized nutritional profiles.

- Predictive analytics tools forecast global commodity price fluctuations, enabling better inventory management and procurement strategies for raw camelina seed supply.

- AI-driven consumer behavioral analysis facilitates personalized marketing of camelina oil, linking its health benefits directly to individual dietary requirements and purchasing patterns.

- Automated quality control systems utilize computer vision to detect impurities and inconsistencies in the finished oil product, improving overall safety and compliance.

- Blockchain integration, managed by AI, provides full farm-to-shelf traceability, satisfying consumer demand for transparent and ethically sourced ingredients.

DRO & Impact Forces Of Camelina Cooking Oil Market

The market for Camelina Cooking Oil is significantly influenced by a complex interplay of internal drivers that create demand, external restraints that limit accessibility, and strategic opportunities that pave the way for future expansion. The central driver is the scientifically backed nutritional superiority of camelina oil, particularly its high Omega-3 content and balanced Omega-6 ratio, addressing the global health crisis associated with excessive Omega-6 consumption in Western diets. Coupled with this is the environmental sustainability advantage; camelina is a highly resilient, low-input crop that thrives on marginal lands, minimizing the ecological footprint and appealing to the rapidly growing segment of environmentally conscious consumers and food manufacturers committed to sustainable supply chains. These two primary forces—health benefits and sustainability—act in tandem to generate a strong intrinsic pull for the product, moving it beyond specialized markets into the general functional food category. Furthermore, favorable regulatory shifts, particularly in Europe and North America where camelina is now recognized as a safe and novel food ingredient, serve to reduce market entry barriers for new product formulations.

Conversely, significant restraints impede the rapid mainstream adoption of camelina oil. The most notable constraint is the relatively high production cost compared to established commodity oils like soybean, sunflower, and canola oil, leading to a higher retail price point that restricts mass-market appeal, particularly in price-sensitive developing economies. Secondly, a critical lack of widespread consumer awareness remains a major hurdle; unlike olive or coconut oil, camelina oil lacks a recognizable consumer identity, necessitating substantial investment in educational marketing by industry stakeholders. Supply chain fragmentation, characteristic of a nascent agricultural sector, presents operational challenges, often resulting in inconsistent supply volumes and quality, which deters large multinational food corporations accustomed to reliable, massive-scale inputs. The third major restraint involves scaling cultivation; while the crop is resilient, transitioning large swathes of traditional farmland requires investment in new farming infrastructure, seed varieties, and dedicated processing facilities, which represents a substantial capital expenditure barrier.

Opportunities for market expansion are vast, largely centering on product diversification and strategic integration. A key opportunity lies in developing camelina-based functional food ingredients, such as omega-fortified butter substitutes, baking shortenings, and encapsulated omega supplements, moving beyond basic cooking oil. The rise of the personalized nutrition trend offers another significant opportunity, where camelina oil can be marketed directly to consumers based on genetic predispositions or specific dietary needs, leveraging its unique fatty acid profile. Strategically, forging partnerships with major functional food manufacturers and pet food companies (where camelina's stability and omega content are highly valued) allows for substantial volume growth and market legitimacy. The impact forces—competitive pressure from established specialty oils (e.g., avocado, flaxseed) and fluctuating global oilseed prices—necessitate continuous innovation in processing efficiency and dedicated brand building to maintain market share and pricing power. The environmental imperative, driven by global climate goals, provides a powerful underlying force that strongly favors camelina's sustainable profile over conventional options, acting as a long-term structural tailwind for the market.

Segmentation Analysis

The Camelina Cooking Oil Market is comprehensively segmented based on Type, Application, and Distribution Channel, reflecting the diverse routes to market and varying consumer demands concerning processing, intended use, and purchasing method. Analyzing these segments provides crucial insights into market dynamics, helping stakeholders prioritize investments in high-growth areas such as the unrefined variety and the functional food application segment. The segmentation reflects a dual market approach: high-volume sales targeted at industrial food processing (B2B) utilizing refined oil for stability, and high-value sales targeted at health-conscious consumers (B2C) seeking the maximal nutritional and flavor profile of the unrefined product. Understanding the interplay between these segments is vital for developing effective product positioning and distribution strategies across different geographical regions.

- By Type

- Refined Camelina Oil

- Unrefined (Cold-Pressed) Camelina Oil

- By Application

- Culinary Use (Home Cooking, Food Service)

- Functional Food & Beverages

- Nutraceuticals and Dietary Supplements

- By Distribution Channel

- Business-to-Business (B2B) Sales (Food Processing, Ingredients Suppliers)

- Business-to-Consumer (B2C) Sales

- Online Retail (E-commerce Platforms)

- Offline Retail (Supermarkets, Health Food Stores, Specialty Grocers)

Value Chain Analysis For Camelina Cooking Oil Market

The value chain of the Camelina Cooking Oil Market begins with the upstream segment, primarily involving agricultural R&D, seed production, and large-scale cultivation. Upstream activities are critical as the quality and yield of camelina seed directly dictate the final oil characteristics. This stage is dominated by seed genetic companies and agricultural cooperatives that focus on developing high-oleic, high-yielding, and disease-resistant camelina varieties suitable for different climate zones. Efficiency in cultivation is paramount, given the need to compete on cost with major conventional oilseeds. Processing facilities, which involve either cold-pressing for premium unrefined oil or solvent extraction followed by refining for neutral oil, form the core manufacturing element, ensuring quality control and adherence to food safety standards before the product moves downstream.

The downstream analysis focuses on the transformation of bulk oil into final consumer or industrial products, encompassing bottling, branding, and marketing. Companies in this segment invest heavily in traceability technology and transparent labeling to highlight the health and sustainability attributes of camelina oil, which are key selling points. Downstream activities involve creating specialized product lines, such as organic certifications, omega-fortified blends, or private-label solutions for major retailers. Effective branding is necessary to overcome the lack of inherent consumer recognition associated with novel oils, requiring targeted educational campaigns emphasizing the oil's high smoke point and superior nutritional balance. Manufacturers must also strategically manage relationships with functional food formulators who utilize camelina oil as a high-stability ingredient in processed goods, representing a major portion of industrial demand.

The distribution channel plays a pivotal role in market penetration. Direct channels primarily involve B2B sales where large volumes of bulk refined oil are sold directly to major food manufacturers and nutraceutical companies. Indirect channels dominate the B2C segment, utilizing specialty health food stores and, most importantly, e-commerce platforms. E-commerce facilitates targeted outreach to health-conscious early adopters and allows for the detailed communication of product benefits necessary for specialty items. Traditional supermarkets and mass retailers, while offering the potential for high volume, require substantial promotional support due to camelina oil’s niche status. Optimizing the blend of direct industrial supply and indirect specialty retail distribution is crucial for balancing profit margins and achieving sustained market growth while slowly building mainstream visibility for the product.

Camelina Cooking Oil Market Potential Customers

The potential customer base for the Camelina Cooking Oil Market is diverse but primarily segmented into high-value B2C consumers driven by dietary health concerns and B2B industrial buyers seeking functional and sustainable ingredients. In the direct consumer segment, the primary end-users are health-conscious millennials and older adults suffering from or seeking preventative measures against cardiovascular diseases and chronic inflammation, actively looking for superior sources of Omega-3 fatty acids beyond fish oil and flaxseed. These buyers value the culinary flexibility of camelina oil (high heat stability) combined with its nutritional profile, often purchasing the premium, unrefined, organic varieties through specialty and online retailers. Furthermore, consumers who adhere to specific dietary niches, such as vegan, ketogenic, and paleo diets, represent a growing cohort seeking plant-based, clean-label fat sources.

On the industrial side, the major potential customers are manufacturers in the functional food and beverage sector. These B2B buyers integrate camelina oil into products like nutritional bars, fortified dairy alternatives, high-protein snacks, and specialized infant formulas due to its exceptional oxidative stability, which helps prevent rancidity and extends the shelf life of the final product without relying on synthetic preservatives. The stability factor makes camelina oil particularly attractive to manufacturers facing challenges with incorporating highly perishable omega-3 sources. Additionally, the nutraceutical industry is a vital end-user, utilizing refined camelina oil for encapsulation into soft-gel supplements, capitalizing on its balanced fatty acid composition as a sustainable, non-marine-based source of ALA. The cosmetics and personal care industry also presents a significant B2B opportunity, using camelina oil for its skin health benefits and moisturizing properties.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 55.0 Million |

| Market Forecast in 2033 | USD 92.5 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Camelina Company, Sustainable Oils International, Great Plains Growers, NutraSource Ingredients, Bio-Omega Foods, Viterra Inc., Montana Specialty Mills, True North Foods, Terramera, Omega Oil Labs, Healthy Harvest Oils, Specialty Seed Growers, Avena Foods, Prairie Pride, OLEO-X, Smart Earth Seeds, Coronet Seeds, Kadiant, Inc., Meadowland Seed, Calyx Bio-Ventures. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Camelina Cooking Oil Market Key Technology Landscape

The technological landscape driving the Camelina Cooking Oil Market is focused intensely on two main objectives: enhancing oil quality and nutritional retention, and optimizing agricultural yields for sustainable scaling. Advanced seed breeding techniques, including marker-assisted selection and genomic editing (though highly regulated), are crucial for developing new Camelina sativa varieties with higher concentrations of beneficial fatty acids, particularly ALA, and improved oxidative stability traits. These agricultural innovations are essential for ensuring a stable, high-quality raw material supply capable of meeting stringent food manufacturing standards. Furthermore, precision agriculture technologies, integrated with AI and IoT sensors, are being utilized to monitor soil health, optimize fertilizer and water usage, and predict pest outbreaks, drastically reducing input costs and reinforcing the crop's sustainability credentials. The successful implementation of these upstream technologies is fundamental to reducing the cost gap between camelina and conventional oils.

In the processing segment, cold-pressing technology is a primary focus, particularly for the premium unrefined market. Modern cold-pressing equipment is designed to operate at extremely low temperatures and high efficiency to maximize the extraction rate while preserving heat-sensitive nutrients like tocopherols and the oil’s natural flavor profile. This technology allows producers to market oils with minimal processing, satisfying the demand for clean-label products. For high-volume industrial applications requiring refined, flavor-neutral oil, advancements in physical refining techniques are gaining prominence over traditional chemical solvent extraction. Physical refining minimizes the use of harsh chemicals, leading to a cleaner final product that retains the high smoke point but removes undesirable flavor compounds, making it suitable for high-heat industrial frying and baking applications.

Additionally, packaging technology plays a vital stabilizing role. Due to the polyunsaturated nature of camelina oil, preventing oxidation during storage and transit is essential. Manufacturers are increasingly adopting inert gas flushing, UV-protective dark glass or PET bottling, and specialized capping systems that minimize oxygen exposure. Emerging technologies, such as microencapsulation, are being explored to deliver camelina oil as a shelf-stable powdered ingredient for inclusion in dry mixes, snacks, and supplements, broadening its application potential significantly beyond liquid oil formats. These processing and preservation innovations are critical for mitigating the inherent instability risks associated with high omega-3 content oils, thereby securing longer shelf life and better functionality in complex food matrixes.

Regional Highlights

- North America (United States & Canada): Dominates the market share due to substantial governmental support for camelina as a rotational crop, high consumer awareness regarding omega-3 benefits, and rapid adoption in the functional food manufacturing sector. Canada, in particular, has strong research infrastructure supporting camelina cultivation and processing.

- Europe (Germany, UK, France): Exhibits the highest CAGR, primarily driven by the favorable regulatory framework established by the EU Novel Food Regulation, which simplifies market access. Strong consumer demand for locally sourced, traceable, and sustainable vegetable oils fuels growth in the B2C segment, especially in health food stores.

- Asia Pacific (Japan, South Korea, Australia): Emerging as a high-potential market. Growth is catalyzed by rising health expenditures, Westernization of diets, and increasing demand for high-value functional ingredients in nutraceuticals. However, market penetration requires overcoming high import tariffs and establishing dedicated supply chains.

- Latin America (Brazil, Argentina): Characterized by initial stage market penetration, focused mainly on export potential of camelina seed rather than oil consumption. Domestic market growth is slow, constrained by lower consumer spending power and preference for conventional, locally sourced commodity oils like soy.

- Middle East and Africa (MEA): Remains a nascent market. Potential exists in affluent Gulf Cooperation Council (GCC) countries for premium health products, driven by expatriate populations and high disposable incomes. Challenges include complex logistics, lack of local cultivation, and lower priority for non-essential specialty oils.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Camelina Cooking Oil Market.- Camelina Company

- Sustainable Oils International

- Great Plains Growers

- NutraSource Ingredients

- Bio-Omega Foods

- Viterra Inc.

- Montana Specialty Mills

- True North Foods

- Terramera

- Omega Oil Labs

- Healthy Harvest Oils

- Specialty Seed Growers

- Avena Foods

- Prairie Pride

- OLEO-X

- Smart Earth Seeds

- Coronet Seeds

- Kadiant, Inc.

- Meadowland Seed

- Calyx Bio-Ventures

Frequently Asked Questions

Analyze common user questions about the Camelina Cooking Oil market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary health benefits of using camelina cooking oil?

Camelina oil is highly valued for its exceptional nutritional profile, featuring a superior ratio of Omega-3 to Omega-6 fatty acids (typically 2:1), which supports cardiovascular health, reduces chronic inflammation, and aids in cognitive function. It is also rich in natural Vitamin E (tocopherols), providing strong antioxidant protection.

How does camelina oil compare to other popular cooking oils like olive or canola oil?

Camelina oil offers a much higher smoke point (around 475°F or 246°C) than standard olive oil, making it highly suitable for high-heat cooking methods such as frying. Nutritionally, it surpasses both olive and canola oils in Omega-3 content and provides better oxidative stability due to its high Vitamin E levels, appealing to health-conscious users.

Is Camelina sativa crop cultivation sustainable and environmentally friendly?

Yes, Camelina is considered an environmentally sustainable crop. It is highly drought-tolerant, requires significantly less water and fertilizer inputs than traditional oilseeds, and can thrive on marginal land. It is also often used as a rotational or cover crop, enhancing soil health and reducing erosion, contributing to sustainable farming practices.

What is the difference between refined and unrefined (cold-pressed) camelina oil?

Unrefined (cold-pressed) camelina oil is minimally processed, retaining its distinct, slightly nutty flavor, maximum nutrient density, and lower smoke point, ideal for dressings and low-heat applications. Refined camelina oil undergoes further processing to achieve a neutral flavor and a higher smoke point, making it preferred for industrial frying and baking where flavor neutrality is necessary.

Which geographical region leads the global market for camelina cooking oil?

North America, particularly the United States and Canada, currently holds the dominant market share due to established agricultural infrastructure supporting the crop, significant consumer awareness regarding specialized health oils, and high industrial adoption in the functional food sector. Europe is the fastest-growing region, however, driven by favorable novel food regulations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager