Camellia Oil Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433245 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Camellia Oil Market Size

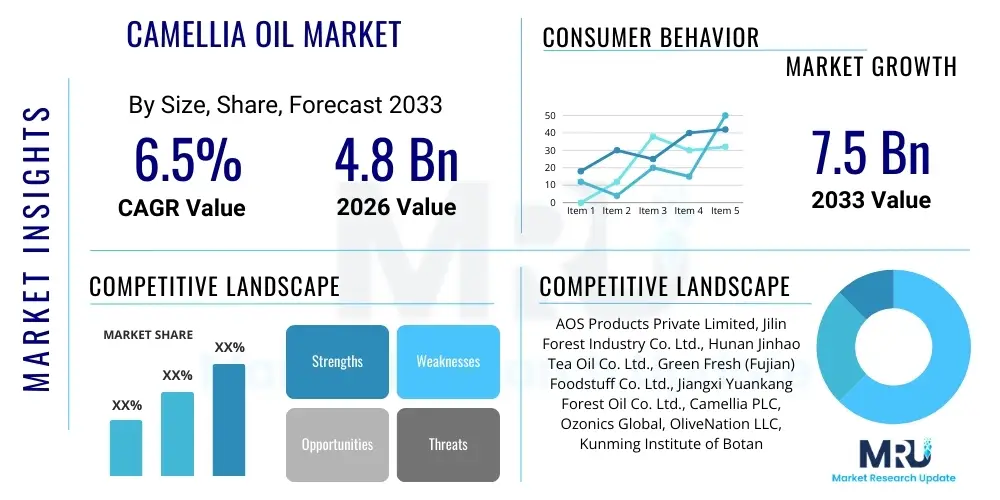

The Camellia Oil Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033.

Camellia Oil Market introduction

Camellia oil, often derived from the seeds of Camellia oleifera (known as tea seed oil) or Camellia japonica (tsubaki oil), is a premium vegetable oil recognized globally for its high monounsaturated fat content, particularly oleic acid (omega-9). This composition makes it highly stable, resistant to oxidation, and exceptionally beneficial for health, beauty, and culinary applications. Originating primarily in East Asia, the oil is increasingly sought after by Western markets due to its natural, chemical-free profile and efficacy in skincare formulations, challenging conventional oils in high-end segments.

The product is characterized by its light texture, mild flavor, and high smoke point, allowing its usage across diverse industrial sectors. Major applications include its use as a cooking oil, offering a healthier alternative to saturated fats, and its deep penetration into the cosmetics industry where it serves as a moisturizing, anti-aging, and skin-barrier enhancing ingredient. Furthermore, camellia oil finds application in traditional medicines and, increasingly, as an industrial lubricant substitute in specialized high-heat applications, driven by sustainability pressures and a demand for biodegradable materials.

Driving factors fueling market expansion include a heightened global consumer awareness regarding the health benefits of unsaturated fats, rapid expansion in the organic and natural cosmetics sector, and favorable governmental policies supporting sustainable agricultural practices, particularly in major producing countries like China and Japan. The transition of camellia oil from a niche, regional product to a global ingredient staple underscores its versatility and premium positioning within the global oils and fats industry, necessitating continuous innovation in extraction techniques to maximize yield and purity.

Camellia Oil Market Executive Summary

The global Camellia Oil market exhibits robust growth, primarily driven by shifting consumer preferences towards clean label products and functional foods rich in antioxidants and healthy fatty acids. Business trends indicate significant investment in research and development aimed at improving extraction efficiency and exploring novel applications in pharmaceutical delivery systems. Key market participants are focusing on vertical integration, controlling the supply chain from cultivation to final packaging, to ensure product quality and traceability, which is a crucial differentiator in premium consumer segments. The market structure remains fragmented but is trending towards consolidation as larger beauty and food conglomerates acquire specialized producers to secure reliable supply lines.

Regionally, Asia Pacific maintains its dominance in both production and consumption, with China and Japan being central to the market ecosystem. However, North America and Europe are rapidly emerging as high-growth regions, propelled by the surge in demand for natural ingredients in premium skincare and the increasing acceptance of camellia oil as a gourmet cooking oil. These Western regions are characterized by higher pricing power and strong regulatory frameworks governing organic certifications, influencing global quality standards. The expansion of e-commerce platforms has played a pivotal role in democratizing access to these specialized oils, overcoming traditional distribution hurdles.

Segmentation trends highlight the commercial grade and food grade segments as the largest contributors to market revenue, although the therapeutic/pharmaceutical grade segment is poised for the highest CAGR due to rising investment in nutraceuticals. Furthermore, the market is undergoing diversification by source (C. oleifera vs. C. japonica), catering to distinct application needs, where C. japonica oil commands higher prices in the cosmetic sector. Distribution channel analysis shows that specialized retail and direct-to-consumer (D2C) models are gaining traction, reflecting consumers’ desire for transparency and expert advice regarding premium oil purchases.

AI Impact Analysis on Camellia Oil Market

Users frequently inquire how Artificial Intelligence (AI) and Machine Learning (ML) can optimize the notoriously complex and varied agricultural production cycle of camellia seeds, focusing on yield prediction, disease identification, and automated quality assessment during pressing. Key concerns revolve around the integration cost of high-tech solutions versus the potential return on investment for historically traditional farming communities. Users also expect AI to revolutionize supply chain transparency, using blockchain-linked AI models to verify origin and organic status, thereby combating fraudulent labeling which erodes consumer trust in premium oils. The overriding theme is the expectation that AI will standardize quality and increase efficiency from farm to factory, reducing waste and ultimately stabilizing the price for high-grade camellia oil.

- AI-driven optimization of camellia cultivation processes, including precision agriculture for irrigation and nutrient management.

- Machine learning models for predicting optimal harvest times based on weather patterns and seed maturity data, maximizing oil yield.

- Implementation of visual recognition AI systems for automated inspection and grading of camellia oil quality (color, purity, turbidity).

- Enhanced supply chain traceability and anti-counterfeiting measures through blockchain supported by AI verification systems.

- Predictive maintenance analytics for extraction machinery, minimizing downtime and ensuring continuous processing efficiency in oil mills.

- AI-powered market analysis predicting demand fluctuations in specialized cosmetic and food sectors, aiding inventory management.

DRO & Impact Forces Of Camellia Oil Market

The market for Camellia Oil is fundamentally shaped by powerful synergistic forces—health-conscious consumerism acts as the primary driver, contrasted by production constraints related to climate sensitivity and complex cultivation cycles. Opportunities are abundant in penetrating high-value markets, particularly in pharmaceuticals and advanced cosmetology, where premium pricing justifies significant R&D investment. These forces create an inherently volatile but high-potential market environment where sustainable sourcing and technological innovation in extraction methods determine competitive advantage and long-term viability. The delicate balance between fulfilling escalating global demand and maintaining strict quality standards essential for premium positioning is the core challenge defining market trajectory.

Drivers: Significant growth is spurred by the escalating demand for natural and organic ingredients, particularly within the lucrative anti-aging and moisturizing segment of the global beauty market, where camellia oil’s rapid absorption and high oleic acid content offer superior performance compared to mass-market alternatives. Furthermore, the rising awareness of the negative health impacts associated with highly refined seed oils and trans fats drives consumers toward healthier, plant-based cooking oils with high smoke points like camellia oil, supporting its uptake in modern culinary practices. Government initiatives in major producing regions promoting sustainable forestry and value-added agricultural products also provide infrastructural and financial support for cultivation expansion.

Restraints: The market faces considerable restraints, including the lengthy maturation period of camellia trees, which limits the speed at which supply can respond to sudden increases in global demand, leading to supply-side bottlenecks and price volatility. High production costs associated with manual harvesting and advanced cold-pressing techniques needed to maintain oil purity pose a barrier to entry, particularly for smaller producers. Moreover, the lack of widespread consumer awareness outside traditional Asian markets requires substantial marketing and educational investment to position the oil effectively against well-established global competitors like olive oil or avocado oil.

Opportunities: Key opportunities lie in the diversification of product offerings, such as developing refined camellia oil derivatives for specialized industrial applications, including high-performance lubricants and biofuels, leveraging its oxidation stability. There is substantial scope for strategic expansion into the rapidly growing nutraceutical and pharmaceutical industries, focusing on formulating supplements that capitalize on its documented anti-inflammatory and cardiovascular benefits. Establishing globally recognized organic and fair-trade certifications will significantly enhance market premiumization and penetration into ethical consumer segments in North America and Europe.

Impact Forces: The combined impact of these forces results in a market characterized by high premiumization potential but necessitating robust supply chain management. The strong driver of consumer health preference ensures sustained demand, but the inherent agricultural restraints necessitate continuous technological investment in yield improvement and efficient processing. The industry’s future success hinges on capitalizing on opportunities in high-margin sectors while mitigating external risks posed by climate change affecting traditional growing regions and managing competitive pressures from other specialty oils.

Segmentation Analysis

The Camellia Oil market is segmented based on the specific source of the oil, the purification grade which determines its end-use suitability, the diverse applications across multiple industries, and the primary distribution channels through which it reaches consumers. Analyzing these segments is crucial as the value proposition and pricing structure vary dramatically—for instance, cold-pressed, organic Camellia japonica oil sold through specialized retailers commands a premium far exceeding that of refined Camellia oleifera used in bulk food service or industrial formulations. The increasing complexity of the end-use spectrum necessitates precise segmentation strategies for effective market targeting and product positioning.

The primary segmentation by source distinguishes between Tea Seed Oil (C. oleifera), which dominates the food and bulk commercial markets due to its higher yield and cost-effectiveness, and Tsubaki Oil (C. japonica), valued highly in the cosmetic industry for its superior skin compatibility and traditional association with high-end beauty rituals. Further segmentation by grade—virgin/cold-pressed versus refined—reflects processing methods and residual nutrient levels, directly impacting consumer health perception and market price. Cold-pressed oils appeal to the discerning natural food and cosmetic consumer seeking maximal nutrient retention, while refined oils satisfy industrial and high-heat cooking requirements where stability is paramount over specific nutrient composition.

Application-wise, the market is broadly segmented into Food & Beverages, Cosmetics & Personal Care, and Industrial uses, with the first two sectors collectively representing the dominant share of revenue. Within distribution, the bifurcation between Business-to-Business (B2B) sales, crucial for bulk industrial and food processing clients, and Business-to-Consumer (B2C) sales, covering retail and e-commerce channels, demonstrates the varied distribution logistics required. The rapid expansion of specialized e-commerce channels has significantly altered the B2C landscape, providing niche brands with global reach and facilitating detailed consumer education regarding product quality and benefits.

- By Source:

- Camellia Oleifera (Tea Seed Oil)

- Camellia Japonica (Tsubaki Oil)

- Other Camellia Varieties

- By Grade:

- Virgin/Cold-Pressed Oil

- Refined Oil

- By Application:

- Food & Beverages (Cooking, Salad Dressings, Health Supplements)

- Cosmetics & Personal Care (Skincare, Haircare, Massage Oils)

- Pharmaceuticals & Nutraceuticals

- Industrial Applications (Lubricants, Biofuels)

- By Distribution Channel:

- B2B (Direct Sales to Manufacturers)

- B2C (Retail, Supermarkets, Online Stores)

Value Chain Analysis For Camellia Oil Market

The Camellia Oil value chain is complex, starting with agricultural activities in dedicated camellia plantations, often concentrated in specific geographical pockets of East Asia. The upstream activities are characterized by intensive manual labor during harvesting and a significant dependence on favorable weather conditions, which inherently introduces supply volatility. Effective upstream management requires long-term planning, sustainable forestry practices, and genetic research to develop high-yield, disease-resistant camellia varieties. Transparency and ethical sourcing in this stage are paramount, particularly for brands targeting the premium organic segment, necessitating close partnerships with local farming cooperatives.

Midstream processing involves critical steps such as seed drying, cleaning, and oil extraction. The choice of extraction method—cold pressing versus solvent extraction—is pivotal, defining the final product grade and its market value. Cold-pressing maximizes the retention of beneficial nutrients (antioxidants, vitamins) but typically yields less oil, commanding a higher price point for cosmetic and virgin food grades. Downstream activities involve rigorous refining, filtration, standardization, and packaging, tailored to specific end-user requirements (e.g., specific viscosity for cosmetic formulations or high stability for industrial lubricants). This stage is heavily influenced by quality assurance standards and regulatory compliance related to food safety and cosmetic ingredients.

Distribution channels for camellia oil are bifurcated into direct and indirect routes. Direct distribution (B2B) involves large volume sales directly from processors to major cosmetic or food manufacturers who use the oil as a raw ingredient. Indirect distribution (B2C) leverages distributors, wholesalers, and retail chains (including specialized organic food stores and online platforms) to reach individual consumers. E-commerce channels have proven particularly effective for specialized camellia oil brands, offering detailed product narratives and enhancing global market reach without significant physical retail investment. The efficiency of the distribution network, particularly cold chain logistics where applicable, directly impacts the oil’s shelf life and market acceptance.

Camellia Oil Market Potential Customers

Potential customers for camellia oil are highly segmented, ranging from multinational cosmetic giants seeking high-performance, natural emollients to health-conscious individual consumers replacing conventional cooking fats. The primary consumer base resides in the personal care industry, where camellia oil is highly prized as a non-greasy, deeply moisturizing ingredient in premium anti-aging creams, serums, and hair treatments (especially for damaged or color-treated hair). These B2B customers prioritize certifications, consistency, and a guaranteed supply of high-purity, often organic, oil, necessitating rigorous supplier vetting and long-term contracts based on quality specifications.

In the Food & Beverage sector, potential customers include gourmet food manufacturers producing high-end salad dressings, specialized cooking oils, and high-quality condiments, alongside the expansive nutraceutical industry formulating dietary supplements focused on cardiovascular health and antioxidant intake. These customers demand food-grade certification, verifiable nutritional profiles, and stability against oxidation. Furthermore, the individual consumer who practices gourmet cooking or adheres to health-centric diets, particularly those seeking monounsaturated fats as an olive oil alternative, represents a significant and rapidly growing B2C customer segment, usually purchasing through specialized health food stores or online marketplaces.

Finally, a niche but emerging customer segment is the industrial and manufacturing sector, specifically companies developing environmentally friendly products. These include manufacturers of bio-lubricants, hydraulic fluids, and specialized technical oils requiring high thermal stability and biodegradability. This B2B segment is primarily driven by regulatory pressures encouraging sustainable industrial practices and requires camellia oil derivatives that meet stringent technical specifications for viscosity, flash point, and lubricity performance, often demanding bulk, refined grade oil tailored for specific machinery requirements rather than aesthetic quality.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AOS Products Private Limited, Jilin Forest Industry Co. Ltd., Hunan Jinhao Tea Oil Co. Ltd., Green Fresh (Fujian) Foodstuff Co. Ltd., Jiangxi Yuankang Forest Oil Co. Ltd., Camellia PLC, Ozonics Global, OliveNation LLC, Kunming Institute of Botany (CAS), Camellia Grove Oil Company, Wuyi Shan Xinghua Tea Oil Co., LTD, Shaanxi Huike Botanical Development Co., Ltd., Shenzhen Camellia Oleifera Technology Co., Ltd., JAF Tea, Kanto Tea Seed Oil Co. Ltd., The Hain Celestial Group, Inc. (Through subsidiaries), Flora & Fauna, Essential Depot, Inc., Mountain Rose Herbs, Purify Organic Foods. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Camellia Oil Market Key Technology Landscape

The technological landscape in the Camellia Oil market is characterized by a push towards sophisticated extraction methods that maximize both yield and preservation of therapeutic compounds, moving beyond conventional hot pressing. The most crucial technology remains cold-pressing, which uses mechanical force without external heat to extract oil, thereby maintaining the integrity of delicate antioxidants, vitamins, and the desired light color and flavor profile. Innovations within cold-pressing focus on optimized pressure control and filtration systems, such as advanced membrane filtration, to remove impurities efficiently while avoiding chemical solvents, which is critical for meeting stringent organic and food-grade standards demanded by premium end-users.

Furthermore, solvent-free supercritical fluid extraction (SFE) using carbon dioxide is gaining traction, particularly for extracting specialized high-purity fractions destined for pharmaceutical or high-end cosmetic applications. SFE allows for precise control over extraction parameters, resulting in a cleaner, residue-free oil with superior purity compared to traditional methods. On the upstream side, agricultural technology plays an increasing role; this includes the use of drones and satellite imagery for monitoring tree health across large plantations, coupled with genetic selection techniques aimed at cultivating camellia varieties that offer significantly higher oil content and improved disease resistance, shortening the time required for tree maturity.

The integration of digital traceability solutions is another key technological trend. Implementing Internet of Things (IoT) sensors and blockchain technology ensures transparent monitoring of the oil throughout the value chain, from monitoring soil conditions and microclimate factors during cultivation to tracking temperature and packaging conditions during transit. This addresses the critical need for verifiable origin and quality assurance in a market prone to adulteration, offering consumers and manufacturers undeniable proof of the oil's purity, thereby protecting brand equity and justifying premium pricing.

Regional Highlights

The global consumption and production map of Camellia Oil reveals significant regional disparity, with Asia Pacific acting as the global epicenter, while North America and Europe emerge as crucial, high-growth consumer markets focusing predominantly on premium, imported products. The market dynamics in each region are dictated by varying consumer preferences, regulatory environments, and indigenous production capabilities, leading to distinct marketing and distribution strategies tailored for local demand profiles.

Asia Pacific (APAC) holds the dominant market share, primarily driven by China, which is the world's largest producer of tea seed oil (C. oleifera), utilizing it extensively in traditional cooking and medicine. Japan, focusing on C. japonica (tsubaki oil), sets the global benchmark for high-end cosmetic application due to its centuries-old use in traditional beauty rituals. The robust growth in APAC is underpinned by deep cultural acceptance, established domestic supply chains, and strong government investment in agricultural modernization and processing technology aimed at improving yield and international export quality.

North America and Europe represent highly lucrative growth frontiers, fueled almost entirely by import demand. These regions prioritize organic, cold-pressed, and ethically sourced camellia oil, driven by the clean beauty movement and the rise of specialty food culture. European Union regulations regarding novel foods and cosmetic ingredients necessitate strict compliance, influencing supplier selection and fostering a preference for highly certified, premium brands. The strong purchasing power and willingness to pay a premium for verified quality make these regions strategically vital for exporters focusing on high-margin product lines like cosmetic-grade tsubaki oil and specialized nutraceutical formulations.

- Asia Pacific (APAC): Dominates production and consumption; driven by China (food use) and Japan (cosmetic use); focus on traditional medicinal applications and volume production.

- North America: High-growth consumption region; strong demand for organic, cold-pressed camellia oil in premium skincare and gourmet food; strict focus on import quality and certification.

- Europe: Rapidly expanding market, particularly in Germany, France, and the UK; emphasis on natural and clean-label cosmetics ingredients; stringent regulatory framework shapes market access.

- Latin America (LATAM): Emerging market with increasing interest in natural health products; gradual incorporation of camellia oil in local cosmetic formulations, often relying on global distributors.

- Middle East & Africa (MEA): Niche market demand currently concentrated in affluent Gulf Cooperation Council (GCC) countries for luxury cosmetics; supply heavily dependent on imports from Asia.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Camellia Oil Market.- AOS Products Private Limited

- Jilin Forest Industry Co. Ltd.

- Hunan Jinhao Tea Oil Co. Ltd.

- Green Fresh (Fujian) Foodstuff Co. Ltd.

- Jiangxi Yuankang Forest Oil Co. Ltd.

- Camellia PLC

- Ozonics Global

- OliveNation LLC

- Kunming Institute of Botany (CAS)

- Camellia Grove Oil Company

- Wuyi Shan Xinghua Tea Oil Co., LTD

- Shaanxi Huike Botanical Development Co., Ltd.

- Shenzhen Camellia Oleifera Technology Co., Ltd.

- JAF Tea

- Kanto Tea Seed Oil Co. Ltd.

- The Hain Celestial Group, Inc. (Through subsidiaries)

- Flora & Fauna

- Essential Depot, Inc.

- Mountain Rose Herbs

- Purify Organic Foods

Frequently Asked Questions

Analyze common user questions about the Camellia Oil market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Camellia Oleifera and Camellia Japonica oil?

Camellia Oleifera (Tea Seed Oil) is primarily sourced for food use due to its high yield and suitability as a cooking oil. Camellia Japonica (Tsubaki Oil) is predominantly used in high-end cosmetic applications, valued for its superior moisturizing properties and light texture in skincare.

What major factors are driving the growth of the Camellia Oil market?

Market growth is chiefly propelled by the accelerating global demand for natural, clean-label ingredients in the cosmetics industry and the increasing consumer shift towards healthier, monounsaturated fats as cooking alternatives, driven by health and wellness trends.

Which region dominates the global production and consumption of Camellia Oil?

Asia Pacific (APAC), particularly China, dominates the market in terms of both cultivation volume and consumption, historically using the oil for culinary purposes and traditional medicine, with Japan leading high-value cosmetic consumption.

What are the key challenges hindering the global supply of high-grade Camellia Oil?

Key challenges include the long maturation period required for camellia trees to yield optimal seeds, high costs associated with premium cold-pressing extraction, and persistent supply chain volatility influenced by climate sensitivity in growing regions.

How is technology impacting the quality and traceability of Camellia Oil?

Advanced technologies, including optimized cold-pressing techniques, supercritical fluid extraction, and the implementation of blockchain and IoT for supply chain monitoring, are crucial in ensuring high purity, preventing adulteration, and providing verified origin traceability to meet premium market demands.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager