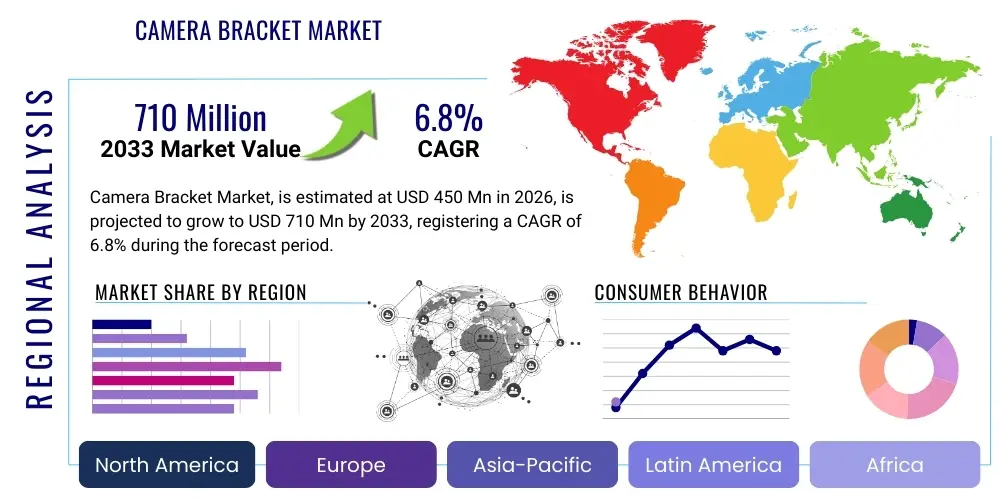

Camera Bracket Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435612 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Camera Bracket Market Size

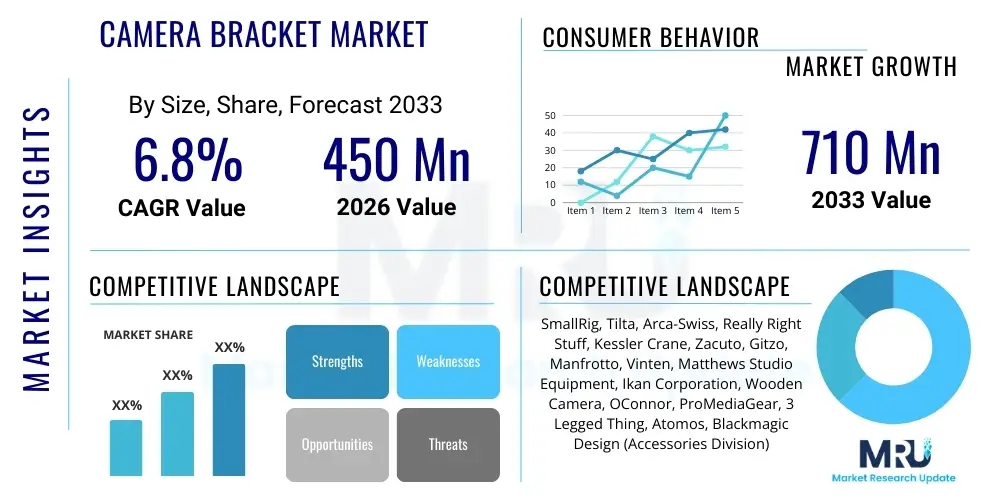

The Camera Bracket Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 710 Million by the end of the forecast period in 2033.

Camera Bracket Market introduction

The Camera Bracket Market encompasses a diverse range of mechanical stabilizing and mounting solutions designed to securely position cameras and associated photographic or video equipment, ranging from simple L-brackets to complex professional camera cages and rigging systems. These essential accessories provide stability, flexibility in angle adjustment, and connectivity points for peripheral gear such as monitors, microphones, lights, and follow focus systems. The core function of a camera bracket is to enhance the versatility and operational performance of imaging devices across various demanding environments, ensuring professional-grade content capture characterized by minimized shake and precise composition. Technological advancements in both camera bodies and accessories, coupled with the increasing professionalization of content creation, drive demand for specialized bracket solutions tailored for specific formats, including DSLRs, mirrorless cameras, cinema cameras, and action cameras.

Major applications of camera brackets span multiple sectors, including professional cinematography, broadcast journalism, high-end photography (particularly real estate and sports), and the rapidly expanding field of commercial content creation and vlogging. The benefits derived from utilizing high-quality camera brackets are significant, primarily centering on improved ergonomics, enhanced equipment protection, and the standardization of mounting interfaces (e.g., Arca-Swiss, NATO rails) which allows for rapid assembly and reconfiguration in fast-paced production environments. Furthermore, specialized brackets, such as gimbal mounts and drone payload connectors, are crucial for integrating cameras into complex stabilization and mobility systems, broadening the creative possibilities available to modern videographers.

Driving factors fueling the growth of this market include the relentless expansion of the digital content ecosystem, marked by soaring demand for high-resolution video across social media, streaming platforms, and corporate communications. The proliferation of affordable, high-specification cameras has democratized professional video production, necessitating corresponding investments in stabilization and rigging equipment. Moreover, the robust growth in security and surveillance infrastructure, where durable, precise mounting hardware is critical for fixed installations and long-term reliability, contributes significantly to market expansion. Innovation in materials, specifically the shift toward lightweight yet strong materials like carbon fiber and aerospace-grade aluminum alloys, enhances product portability and durability, further stimulating consumer adoption across professional and prosumer segments.

Camera Bracket Market Executive Summary

The Camera Bracket Market is experiencing dynamic growth driven by converging trends in digital media consumption and advanced imaging technology. Business trends indicate a strong move toward modular and quick-release systems, emphasizing cross-compatibility between different camera brands and accessory ecosystems. Key manufacturers are focusing on integrating features that cater specifically to hybrid shooters—professionals who alternate rapidly between high-end still photography and cinematic video production—leading to the development of highly adaptable camera cages and modular support structures. Furthermore, sustainability and material innovation are emerging as critical competitive differentiators, with some companies exploring recycled or more durable material compositions to appeal to environmentally conscious professional users, ensuring long product life cycles and reducing replacement frequency. The competitive landscape is characterized by both established photography equipment giants and specialized accessory firms, with innovation centered on lightweighting and ergonomic efficiency.

Regionally, the Asia Pacific (APAC) market is projected to demonstrate the fastest growth rate, fueled by robust local content creation industries in countries like China, India, and South Korea, coupled with significant growth in manufacturing capabilities that drive down production costs and increase local accessibility of sophisticated rigging equipment. North America and Europe remain dominant in terms of revenue contribution, largely due to the concentration of major film studios, broadcast networks, and high-value professional content producers who invest heavily in premium, specialized camera support systems. Regional regulatory differences concerning drone usage and surveillance infrastructure also subtly influence the demand for specific bracket types, especially those designed for outdoor, weather-resistant applications and remotely operated vehicles (ROVs).

Segment trends reveal a rapid expansion in the market for specialized mirrorless camera cages, which offer form-fitting protection and extensive mounting points required for professional setups using smaller, modern camera bodies. The shift away from bulky DSLRs necessitates redesigned bracket geometry. Concurrently, the surveillance and industrial inspection segment exhibits consistent, stable growth, demanding high-load capacity and extremely durable mounting solutions for fixed positions or harsh industrial environments. The consumer segment, while contributing less revenue per unit, is growing substantially in volume, driven by demand for simple, affordable cold shoe mounts and mobile phone brackets that facilitate professional-looking vlogging and social media content capture, underscoring the market's reliance on the democratization of high-quality visual storytelling tools.

AI Impact Analysis on Camera Bracket Market

User queries regarding the impact of Artificial Intelligence (AI) on the Camera Bracket Market frequently revolve around two main themes: how AI might eliminate the need for physical stabilization, and how AI-powered cameras or accessories might require new types of mounting solutions. Users often ask if advanced electronic image stabilization (EIS) combined with AI computational photography will render mechanical stabilization redundant. They also inquire about the integration requirements for new intelligent monitoring systems, such as AI-driven surveillance cameras or automated tracking systems, which often require precise, motorized, yet rigidly mounted brackets. The core concern centers on whether AI capabilities will necessitate smarter, perhaps motorized or actively compensating brackets, or if they will simply make the market for traditional, passive brackets smaller. Expectations are leaning towards AI driving the need for more complex, data-transmitting mounting solutions rather than replacing the fundamental mechanical structure.

The primary influence of AI on the camera bracket domain is indirect, focusing on optimization and integration rather than replacement. While AI enhances electronic stabilization, eliminating camera shake entirely in dynamic, professional environments (e.g., handheld cinema shots, vehicle mounts) remains largely dependent on mechanical rigidity and precise mounting geometry provided by brackets and cages. AI processing capabilities in cameras, particularly for real-time tracking and scene recognition, necessitate robust thermal management. Camera cages often serve the dual purpose of mounting points and passive heat sinks, a role reinforced by the heat generated by intensive AI computing tasks. Therefore, future bracket designs must incorporate features that facilitate heat dissipation while maintaining structural integrity and supporting the necessary peripheral equipment required for AI-enhanced workflows, such as external computation modules or specialized sensors.

Furthermore, the growth of automated visual inspection and high-precision robotics, heavily relying on AI for analysis, demands customized camera brackets that offer micron-level positional accuracy. These applications move beyond standard film production needs, requiring industrial-grade mounting hardware that can withstand vibrations and maintain alignment over extended periods. AI's push towards smart surveillance and smart cities necessitates brackets that can house complex arrays of sensors, communication antennae, and power solutions alongside the camera module. This shifts the bracket from a simple mechanical support to an integrated utility hub, requiring closer collaboration between bracket manufacturers and developers of AI-driven imaging systems to ensure seamless form factor compliance and functional integration, thereby broadening the engineering requirements for market participants.

- AI enhances Electronic Image Stabilization (EIS) but does not replace the need for mechanical rigidity in professional setups.

- AI computing requires enhanced thermal management, positioning camera cages as crucial passive heat dissipation solutions.

- Growth in AI-driven automated inspection necessitates high-precision, industrial-grade mounting brackets.

- AI-enabled smart surveillance systems require integrated utility hub brackets to house sensors and communication equipment.

- Brackets must evolve to accommodate new AI peripherals and computational modules attached to camera bodies.

DRO & Impact Forces Of Camera Bracket Market

The Camera Bracket Market is shaped by a robust interplay of driving forces centered on the escalating global demand for visual content, tempered by specific design constraints and abundant opportunities for technological differentiation. Key drivers include the exponential growth of streaming platforms and social media, which continuously elevates the technical standards required for user-generated and professional content, compelling creators to invest in professional-grade stabilization gear. Restraints primarily involve the inherent commoditization of basic bracket models, leading to intense price competition, and the challenge of balancing lightweight construction with uncompromising load-bearing capacity and rigidity. Opportunities are heavily concentrated in the development of modular ecosystems that offer universal compatibility across major camera systems and the integration of smart features, such as integrated power distribution or data pass-through capabilities within the bracket structure itself.

The impact forces within this market are significant, revolving around material science innovations and shifts in camera body design. The continuous reduction in the physical size of professional mirrorless cameras (e.g., Sony Alpha, Canon R Series) forces manufacturers to perpetually redesign form-fitting cages and brackets, necessitating rapid product development cycles. This continuous evolution acts as a potent driving force for innovation among specialized accessory providers. Conversely, the high cost associated with certified, aerospace-grade materials used to ensure maximum strength with minimal weight can restrain adoption in cost-sensitive segments. The pervasive nature of intellectual property related to proprietary quick-release systems (e.g., Arca-Swiss derivatives, proprietary rail standards) creates market friction, yet also drives firms to establish their own proprietary ecosystems, reinforcing brand loyalty among professional users who prioritize seamless system integration and robustness over simple affordability.

The major long-term impact force is the convergence of professional imaging with industrial and governmental applications, particularly drone cinematography and specialized military surveillance. These high-specification sectors demand extreme reliability and durability under harsh conditions, pulling the entire market towards higher standards of material testing and certification. This trend elevates the barrier to entry for lower-quality manufacturers. Additionally, the increasing focus on ergonomics and ease of use—driven by the long shooting hours common in film production—compels bracket designers to incorporate human-centric design principles, ensuring tools are not only structurally sound but also comfortable and intuitive for rapid field deployment. This focus on operational efficiency translates directly into market advantage for manufacturers prioritizing design patents and user experience over basic functionality.

Segmentation Analysis

The Camera Bracket Market is comprehensively segmented based on product type, material composition, application, and end-user vertical, reflecting the highly specialized nature of imaging equipment needs. Segmentation by product type highlights the difference between static support structures (cages, mounting plates) and specialized functional brackets (gimbal adapters, flash brackets). Material segmentation underscores the trade-off between cost, durability, and weight, primarily differentiating between metal alloys, carbon composites, and engineering plastics. Application and end-user categories distinguish between the high-demand technical requirements of professional cinematography versus the standardized durability needed for surveillance installations or the portability necessary for consumer vlogging, providing manufacturers clear targets for product differentiation and pricing strategies across diverse market landscapes.

- By Product Type:

- Camera Cages and Rigs

- L-Brackets and Plates (Quick Release)

- Flash/Accessory Brackets (Hot Shoe/Cold Shoe)

- Specialized Mounts (Gimbal Adapters, Drone Brackets, Vehicle Mounts)

- Surveillance and Fixed Installation Brackets

- By Material:

- Aluminum Alloys (6061, Aircraft Grade)

- Carbon Fiber Composites

- Engineering Plastics (ABS, Nylon)

- Steel and Other Metals (primarily for industrial applications)

- By Application:

- Professional Cinematography and Film Production

- Commercial Photography (Studio and On-Location)

- Broadcast and News Gathering

- Security and Surveillance

- Industrial Inspection and Machine Vision

- Consumer Content Creation (Vlogging, Streaming)

- By Sales Channel:

- Online Retail (E-commerce Platforms)

- Specialty Camera Stores and Distributors

- Direct Sales (OEM and Industrial Supply)

Value Chain Analysis For Camera Bracket Market

The value chain for the Camera Bracket Market begins with upstream activities, predominantly involving raw material procurement, focusing heavily on specialized, lightweight aluminum billets (such as 6061-T6 or 7075 aluminum alloys) and high-modulus carbon fiber sheets. These materials are selected not only for their strength-to-weight ratio but also for their machining compatibility and resistance to corrosion, which are critical performance indicators for professional-grade gear. Upstream suppliers must maintain rigorous quality control standards, as material defects directly impact the safety and stability of expensive camera equipment. The core manufacturing phase involves precision CNC machining, forging, casting, and advanced surface finishing (anodizing) to achieve the required tolerances and aesthetic quality, often undertaken by specialized component manufacturers in regions with advanced manufacturing capabilities, such as parts of Asia Pacific and Germany.

The midstream section involves the design, assembly, and testing of the final bracket products. Leading camera bracket companies heavily invest in R&D to develop proprietary designs, focusing on ergonomics, quick-release mechanisms, and compatibility standards (e.g., NATO rails, Arca-Swiss standards, specific camera body molds). This stage also includes integrating electronic components in more advanced brackets, such as power distribution boards or data synchronization ports. Downstream activities focus on distribution and customer interaction. The market utilizes both direct sales channels, particularly for large industrial contracts (surveillance systems, broadcast equipment packages), and indirect channels, predominantly through specialized photographic equipment distributors, major e-commerce platforms (Amazon, B&H Photo), and dedicated specialty camera retail stores, ensuring global accessibility to the diverse range of end-users.

The distribution network is bifurcated between high-volume consumer goods sold via online retail, emphasizing logistics efficiency and competitive pricing, and high-value professional gear requiring expert advice and potentially direct technical support. Direct channels are crucial for maintaining brand control, capturing valuable end-user feedback for product iteration, and supplying specialized industries that require tailored solutions and volume discounts. Indirect channels leverage the established reach and technical expertise of authorized dealers, who often bundle brackets and accessories with camera bodies and lenses, serving as crucial points of technical education and customer service for complex rigging systems. The efficiency of the downstream logistics, including inventory management of varied SKU dimensions, heavily influences market responsiveness and overall customer satisfaction in this accessory-driven sector.

Camera Bracket Market Potential Customers

Potential customers for the Camera Bracket Market span a wide spectrum, ranging from individual professional content creators requiring versatile, portable solutions to large organizational entities needing fixed, robust mounting systems. The primary segment comprises professional videographers, cinematographers, and documentary filmmakers who necessitate comprehensive camera cages and modular rigging systems to support heavy payloads, external monitoring, and specialized lenses. These buyers prioritize rigidity, durability, quick setup times, and extensive accessory mounting points, often leading to substantial investments in integrated, proprietary ecosystems from leading accessory manufacturers like SmallRig, Tilta, or Arca-Swiss.

A second major customer category is the institutional sector, which includes broadcasters, news organizations, educational filmmaking departments, and military/governmental agencies. These end-users demand standardized, high-reliability brackets suitable for long-term deployment, often focusing on features like weatherproofing, anti-tamper mechanisms, and compatibility with vehicle or specialized platform mounts (e.g., specialized brackets for mounting broadcast cameras in helicopters or high-speed chase vehicles). Their purchasing decisions are heavily influenced by quality certifications, guaranteed supply chains, and adherence to specific industry standards for environmental endurance and load capacity, often procuring via bulk tenders or long-term supply agreements.

The third, and fastest-growing, customer base consists of prosumers, hobbyist photographers, and the large community of social media content creators (vloggers, streamers). This segment seeks affordable, user-friendly solutions, focusing primarily on smartphone brackets, lightweight cold shoe mounts for lighting/microphones, and simplified L-brackets for quick horizontal-to-vertical switching. Their purchasing behavior is highly sensitive to price, influenced by online reviews and trending ergonomic designs. Finally, industrial users in machine vision, quality control, and automated surveillance represent a niche but high-value segment demanding specialized, high-precision brackets optimized for minimal vibration and thermal stability, crucial for maintaining calibration in critical industrial inspection tasks.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 710 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SmallRig, Tilta, Arca-Swiss, Really Right Stuff, Kessler Crane, Zacuto, Gitzo, Manfrotto, Vinten, Matthews Studio Equipment, Ikan Corporation, Wooden Camera, OConnor, ProMediaGear, 3 Legged Thing, Atomos, Blackmagic Design (Accessories Division), Bright Tangerine, Shape, Edelkrone |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Camera Bracket Market Key Technology Landscape

The technological landscape of the Camera Bracket Market is characterized by advancements in precision engineering, material science, and the development of standardized mounting interfaces designed for rapid deployment and high reliability. The dominant technological trend is the pervasive adoption of Computer Numerical Control (CNC) machining for manufacturing high-precision camera cages and quick-release plates. CNC technology ensures dimensional accuracy and repeatability, which are critical for maintaining the tight tolerances required when mounting expensive camera bodies and ensuring compatibility with standardized rail systems like 15mm rods or NATO rails. Furthermore, the use of aerospace-grade aluminum alloys and the increasing incorporation of carbon fiber composites represent significant material technologies, driving down overall weight while enhancing structural rigidity, a crucial requirement for stabilizing modern, high-resolution cinema packages, particularly those involving advanced gimbal systems.

A second major technological area involves the evolution of quick-release mechanisms and modularity. Key technologies here include patented lever-release systems, ratchet-style locking mechanisms, and the refinement of dovetail standards (e.g., Arca-Swiss compatible systems) that allow users to switch equipment between tripods, sliders, and handheld rigs in seconds. Manufacturers are increasingly integrating power and data pass-through technology directly into the bracket structure itself. This involves incorporating internal wiring or specialized contact points within the bracket or cage, allowing the transmission of battery power or control signals from an external source (such as a V-mount battery attached to the cage) to the camera or monitor without requiring bulky external cabling, streamlining the overall workflow and reducing clutter on the camera rig.

Finally, the rise of specialized mounting solutions for drones and robotic platforms dictates unique technological demands, focusing on vibration dampening and shock absorption. Technologies in this segment include specialized elastomer inserts, tuned mass dampers, and proprietary mounting interfaces that integrate seamlessly with specific drone payloads (like DJI’s Ronin series). For surveillance and industrial applications, technology focuses on long-term reliability, often involving corrosion-resistant coatings, highly secure anti-vibration locking screws, and passive cooling technologies built into the metallic structure of the bracket to manage the heat generated by continuously running sensors and processing units, ensuring optimal performance across varied climate conditions and operational loads.

Regional Highlights

Regional dynamics within the Camera Bracket Market reflect the geographic concentration of film production, broadcasting infrastructure, and advanced manufacturing capabilities.

- North America: This region holds a dominant market share, driven by Hollywood, major broadcast networks, and a high concentration of professional content creators and high-budget film studios. Demand here is characterized by investment in premium, specialized rigging systems, often demanding custom or highly certified equipment that integrates seamlessly with high-end cinema cameras (ARRI, RED). The strong presence of key industry accessory players and a large prosumer market further solidify its leading position, emphasizing innovation in ergonomic design and swift workflow accessories.

- Europe: A significant market focusing on both high-end artistic cinema and robust industrial applications, particularly in Germany and the UK. Europe exhibits strong demand for durable, standardized mounting hardware, influenced by rigorous safety and quality standards (e.g., CE marking). The region shows substantial growth in the use of camera brackets in automated industrial inspection and high-precision surveillance systems, requiring stable, long-lasting products capable of operating in diverse European climates.

- Asia Pacific (APAC): Expected to be the fastest-growing region due to the rapid expansion of local film industries (especially in India and China), the proliferation of streaming content, and the high volume of manufacturing bases. The demand in APAC is bifurcated: high-volume, cost-effective generic brackets for the enormous consumer and emerging professional segment, and specialized, technology-driven mounts for the sophisticated surveillance and advanced drone cinematography markets, particularly in major tech hubs.

- Latin America (LATAM): A growing market, characterized by increasing investment in local broadcasting and independent film production. The market tends to prioritize cost-effectiveness but is increasingly adopting modular and standardized professional systems as the quality standards for local productions rise. Imports of professional-grade brackets primarily serve the core production centers in Brazil and Mexico.

- Middle East and Africa (MEA): Emerging markets with significant, targeted growth, primarily driven by large government infrastructure projects (requiring surveillance brackets) and burgeoning regional media hubs (e.g., Dubai, Abu Dhabi). High-value projects often demand premium, robust equipment capable of handling extreme temperatures and desert conditions, favoring highly durable metallic alloy brackets and specialized weather-sealed systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Camera Bracket Market.- SmallRig

- Tilta

- Arca-Swiss International

- Really Right Stuff (RRS)

- Kessler Crane

- Zacuto

- Gitzo

- Manfrotto (Vitec Group)

- Vinten (Vitec Group)

- Matthews Studio Equipment

- Ikan Corporation

- Wooden Camera

- OConnor (Vitec Group)

- ProMediaGear

- 3 Legged Thing

- Atomos (Accessories Division)

- Blackmagic Design (Accessories)

- Bright Tangerine

- Shape

- Edelkrone

Frequently Asked Questions

Analyze common user questions about the Camera Bracket market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most critical factor when selecting a professional camera cage?

The most critical factor is form-fitting compatibility with the specific camera body model, ensuring full access to ports, buttons, and battery doors. Secondary critical factors include material (lightweight aluminum or carbon fiber for rigidity) and the abundance and standardization of mounting points (such as NATO rails, 1/4-20 threads, and ARRI Anti-Twist mounts) to facilitate complex rigging and accessory attachment without rotation.

How does the shift to mirrorless cameras impact camera bracket design?

The shift to smaller, lighter mirrorless bodies necessitates smaller, lighter, and more precisely machined cages. These brackets often incorporate integrated handles and specialized battery grips to maintain a balanced, ergonomic feel lost with the smaller camera form factor. Furthermore, the heat dissipation requirements for high-resolution mirrorless video recording mean cages are increasingly designed to act as passive heat sinks for optimal thermal management.

Are quick-release systems standardized across different bracket manufacturers?

While proprietary quick-release systems exist, the industry has widely standardized around the Arca-Swiss dovetail system for general photography plates and mounting heads due to its universality and ease of use. However, advanced professional rigging often uses proprietary standards like NATO rails (for sliding attachment of handles/monitors) or Vinten/OConnor plates for heavy-duty fluid heads, requiring users to remain mindful of system cross-compatibility.

What is the primary difference between aluminum and carbon fiber camera brackets?

Aluminum alloy brackets (typically aerospace-grade) offer excellent strength, high durability, and are generally more cost-effective, making them standard for most professional cages. Carbon fiber brackets offer superior vibration dampening properties and significantly lower weight for the same rigidity, making them ideal for high-end aerial or extreme mobility setups where minimizing payload weight is paramount, though they come at a higher cost.

How significant is the surveillance sector's contribution to the Camera Bracket Market?

The surveillance and security sector provides a stable, high-volume demand stream, primarily for fixed, weather-resistant, and high-load capacity mounting solutions. While the revenue per unit is often lower than specialized cinema gear, the continuous global expansion of smart city initiatives and corporate security infrastructure ensures that this segment contributes significantly to volume growth and drives innovation in durable, long-term outdoor mounting hardware.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager