Camera Equipment Rental Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432878 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Camera Equipment Rental Market Size

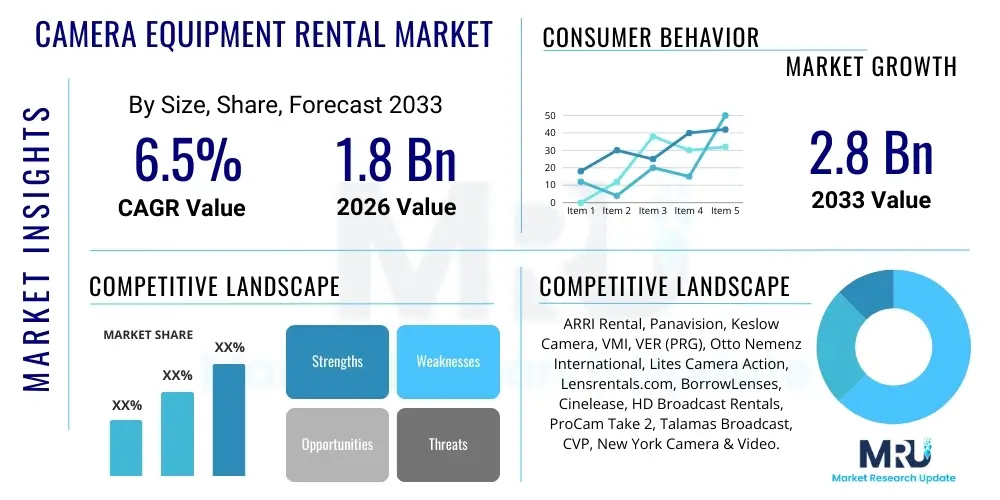

The Camera Equipment Rental Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.8 Billion by the end of the forecast period in 2033.

Camera Equipment Rental Market introduction

The Camera Equipment Rental Market encompasses the provisioning of professional-grade photographic and videographic gear, including high-end cameras, lenses, lighting kits, stabilization systems, and associated accessories, on a short-term basis for commercial and artistic production purposes. This specialized market caters primarily to film studios, independent filmmakers, marketing agencies, production houses, and burgeoning independent content creators who require access to expensive, specialized gear without the burden of capital expenditure, maintenance, or rapid obsolescence. The core offering is flexibility and access to cutting-edge technology crucial for achieving high production value across diverse media projects.

The product description spans a comprehensive range of equipment, categorized broadly into digital cinema cameras (e.g., ARRI, RED, Sony Venice), DSLR/mirrorless systems suitable for high-resolution stills and video (e.g., Canon, Nikon, Sony Alpha series), specialized optics (prime and zoom lenses), and essential support infrastructure such as gimbals, drones, professional audio recording devices, and advanced monitoring tools. Major applications include feature film production, episodic television series, commercial advertising campaigns, documentary filmmaking, music videos, and high-stakes corporate videography. The necessity of using specific, proprietary equipment for certain looks or technical specifications drives the demand for specialized rentals rather than outright purchasing.

The principal benefits driving market expansion include substantial cost savings for production companies, ensuring immediate access to the latest technological upgrades without large depreciating assets, and the ability to scale equipment needs rapidly based on project scope. Key driving factors involve the exponential growth in streaming content (Netflix, Amazon Prime, Disney+), the increasing demand for high-definition and 4K/8K resolution content across all platforms, and the democratization of content creation, which has expanded the client base from large studios to thousands of smaller, agile production teams globally. The continuous innovation cycles in camera technology, rendering purchased equipment obsolete within a few years, further reinforces the economic rationale for renting.

Camera Equipment Rental Market Executive Summary

The Camera Equipment Rental Market is characterized by robust growth underpinned by significant shifts in content consumption and production methodologies. Business trends highlight a strong emphasis on digital workflow integration, inventory management leveraging cloud solutions, and strategic mergers and acquisitions among regional rental houses to achieve broader geographical reach and specialized inventory pools. The market is increasingly polarizing, with high-end cinema rentals catering to large studio productions demanding the absolute latest technology, and a distinct, growing segment focusing on mid-range mirrorless systems and simplified rental processes serving the influencer and corporate video market. Supply chain stability, particularly concerning high-demand lenses and specialty lighting, remains a critical operational consideration for leading rental providers globally.

Regionally, North America and Europe maintain dominance, driven by mature film industries and established global production hubs (Hollywood, Pinewood, etc.). However, Asia Pacific (APAC) is emerging as the fastest-growing region, fueled by massive domestic film industries in China and India, coupled with increasing investments by global streaming platforms expanding their original content libraries specifically for the Asian audience. This rapid APAC expansion is necessitating significant infrastructure investment by international rental firms establishing local bases, often focusing on localization of technical support and logistics to navigate complex import/export regulations for specialized equipment.

In terms of segmentation, the digital cinema camera segment remains the dominant revenue generator due to the high per-day rental cost and the requirement for extensive accompanying support gear. However, the lenses and specialty optics segment exhibits exceptional growth, driven by the need for unique cinematic aesthetics and the highly specialized, costly nature of professional prime lens sets. The end-user segment is evolving, shifting slightly from traditional film and television production towards the burgeoning corporate, commercial, and independent web content creation segments. Furthermore, the rising adoption of virtual production and LED wall technology is creating new demands for specialized camera synchronization and lens calibration services within the rental ecosystem.

AI Impact Analysis on Camera Equipment Rental Market

User inquiries regarding AI's influence on the Camera Equipment Rental Market frequently center on automation, decision support for equipment selection, and the potential displacement of certain human roles in production. Key themes include the role of AI in predictive maintenance for complex camera systems, optimizing inventory allocation across multiple projects based on deep learning models of demand spikes, and the integration of AI-powered post-production tools that might alter on-set shooting requirements. Concerns are often raised about whether generative AI (GAI) could eventually reduce the overall need for live-action filming, thereby decreasing rental demand, contrasted with expectations that AI tools will primarily serve to streamline high-end virtual production workflows, increasing the complexity and specialization of rented gear.

The immediate impact of AI is focused on operational efficiency for rental houses. AI algorithms can analyze historical rental patterns, maintenance logs, and geographic data to forecast equipment breakdowns and optimize servicing schedules, significantly reducing downtime for expensive assets. Furthermore, AI-driven recommendation engines are becoming vital for helping less experienced clients choose the optimal camera body, lens, and accessory package tailored specifically to their project's technical requirements (e.g., frame rate, resolution, specific sensor characteristics) and budget constraints. This enhanced advisory capability improves customer experience and minimizes incorrect rentals.

Looking ahead, AI will fundamentally alter production requirements, indirectly affecting rental demand. AI-assisted cinematography, such as automated framing, subject tracking, and depth mapping, will require camera systems and gimbals capable of seamless, real-time data integration, driving demand towards rental-only specialized AI-ready hardware. While generative AI might replace some background or stock footage needs, the demand for primary, high-quality, unique cinematic content remains robust, requiring the best sensor technology and optics—equipment too costly for most producers to own, thus ensuring the foundational need for rental services persists, shifting the focus towards renting highly integrated, data-capable systems rather than purely mechanical tools.

- AI enhances predictive maintenance and reduces equipment downtime for rental houses.

- AI-powered recommendation systems optimize equipment selection for clients based on project needs.

- Generative AI may shift demand towards highly specialized camera systems for virtual production.

- Automation of workflow and inventory management improves operational efficiency for rental firms.

- AI integration drives demand for data-logging and AI-ready hardware systems.

DRO & Impact Forces Of Camera Equipment Rental Market

The market is dynamically shaped by the constant interplay of Drivers (D), Restraints (R), Opportunities (O), and potent Impact Forces (IF). Key drivers include the global proliferation of streaming services necessitating massive volumes of high-quality content, alongside the financial imperative for production companies to minimize capital expenditure by renting specialized, high-cost equipment. Restraints largely center on the intense logistical complexity of managing sensitive, high-value assets across international borders, the necessity for robust, specialized insurance coverage, and the high barriers to entry for new rental firms due to the steep initial investment required for competitive inventory. Opportunities arise predominantly from technological advancements, specifically the shift toward 8K resolution and Virtual Production technologies, requiring new tiers of highly complex, integrated rental packages. These elements collectively generate powerful Impact Forces, including intense price sensitivity in the mid-range segment and rapid technological obsolescence forcing continuous inventory upgrades.

Drivers are primarily economic and content-driven. The rise of OTT platforms has triggered a content arms race, where quality cinematic visuals are non-negotiable, requiring professional digital cinema cameras that cost hundreds of thousands of dollars. The economic model of renting provides crucial financial flexibility for both large and small production houses, allowing them to allocate resources directly to project execution rather than asset ownership. Furthermore, the rapid pace of sensor and lens technology advancement means that professional camera bodies often become outdated within 3-5 years, making ownership economically disadvantageous compared to renting the latest generation equipment when needed. This cyclical technological churn consistently feeds the rental demand.

Restraints pose persistent operational challenges. The highly specialized nature of the equipment mandates expert technical staff for maintenance, calibration, and support, elevating labor costs. Equipment theft and damage represent significant financial risks, necessitating comprehensive, high-premium insurance policies. Moreover, smaller production markets outside major metropolitan hubs often lack the robust local rental infrastructure, requiring expensive cross-country or international shipping, which adds logistical complexity and risk. Regulatory restraints, especially cross-border customs procedures for temporary importation of high-value equipment, can severely impede production schedules and logistics for global projects.

Opportunities are largely tied to emerging production methods and geographic expansion. The rapid adoption of Virtual Production (VP) using large LED stages demands highly specialized, synchronized camera equipment, offering premium pricing opportunities for firms that can integrate these complex packages. Geographical expansion, particularly into the high-growth markets of Asia Pacific and Latin America, represents untapped revenue potential. Additionally, the development of subscription-based rental models or specialized long-term leasing options for specific market segments (like documentary filmmaking or corporate studios) offers avenues for diversifying revenue streams and increasing client retention. The impact forces are thus dominated by the need for continuous technological investment to stay competitive, and the pressure to maintain operational excellence in asset management.

Segmentation Analysis

The Camera Equipment Rental Market is broadly segmented based on Equipment Type, End-User, and Rental Duration, each segment reflecting distinct demand patterns and pricing strategies. Equipment type segmentation is crucial as it defines the technology tier, ranging from high-cost, highly specialized digital cinema cameras to more affordable DSLR/mirrorless systems and supplementary equipment. The end-user segment distinguishes between the needs of large traditional studios, agile independent filmmakers, and corporate/commercial entities, reflecting differences in volume and technical complexity requirements. Rental duration segmentation is vital for pricing and inventory allocation, classifying leases into short-term (daily/weekly) and long-term (monthly/project-based) contracts, offering different profitability margins based on asset utilization rates.

The Equipment Type segment is further detailed by the high concentration of revenue derived from Digital Cinema Cameras, such as ARRI, RED, and high-end Sony models. These units command the highest daily rates due to their complex technology, high resolution capabilities, and specialized features required for feature films and premium streaming content. Lenses, especially high-speed prime sets and specialty vintage optics, represent the second major revenue stream, often costing more to rent than the camera body itself, reflecting the importance of glass quality in cinematic aesthetics. The Accessories segment, encompassing tripods, gimbals, follow focus systems, and monitoring tools, constitutes a necessary but lower-margin component of the rental package, often bundled with the primary camera rental.

The End-User categorization highlights the diversity of the client base. Film and Television Production remains the core segment, utilizing the most advanced and extensive equipment packages. However, the Commercial and Advertising sector provides consistent, high-volume demand for short, intense shoots, often requiring fast turnaround and specialized lighting alongside the camera gear. The Independent Filmmaking and Content Creation segment, while individually smaller, is rapidly expanding due to the accessibility of professional tools and the global demand for unique digital content. Rental houses are increasingly customizing inventory and pricing structures to serve these niche end-users effectively, often offering training and simplified logistical support tailored to smaller crews.

- By Equipment Type:

- Digital Cinema Cameras (e.g., ARRI, RED, Sony)

- DSLR/Mirrorless Cameras

- Lenses (Prime, Zoom, Specialty Optics)

- Support Equipment (Tripods, Gimbals, Cranes)

- Lighting and Grip Equipment

- Audio Equipment

- By Rental Duration:

- Short-Term Rental (Daily/Weekly)

- Long-Term Rental (Monthly/Project-Based)

- By End-User:

- Film and Television Production

- Commercial and Advertising

- Independent Filmmaking and Content Creation

- Corporate and Events

- News and Documentary

- By Technology:

- Conventional Equipment

- Virtual Production Equipment (LED Walls, Specialized Synchronized Cameras)

Value Chain Analysis For Camera Equipment Rental Market

The value chain for the Camera Equipment Rental Market starts with upstream manufacturing of high-end camera bodies, lenses, and specialized accessories by OEMs, followed by procurement and financing by the rental houses. The core value addition occurs at the midstream phase, where rental firms manage logistics, rigorous quality control, technical support, maintenance, and strategic inventory management. Downstream activities involve direct distribution to end-users (production companies, studios) through physical rental locations and increasingly sophisticated online booking platforms. The chain is characterized by high asset value, significant technical expertise required at the midstream level, and direct consumer interaction at the downstream point, ensuring seamless integration of the equipment into complex production workflows.

Upstream analysis highlights the oligopolistic structure of high-end camera manufacturing, dominated by a few key players (e.g., ARRI, RED, Sony) whose product release cycles dictate the obsolescence and investment strategies of rental houses. Procurement involves substantial capital investment and strategic forecasting to acquire the most demanded gear immediately upon release. Strong relationships between rental firms and manufacturers are essential, often securing bulk purchasing discounts or early access to proprietary technology, which acts as a competitive advantage. The quality and reliability built into the manufacturing phase directly influence the maintenance burden and lifespan of the rented asset.

Downstream distribution channels are multifaceted. Direct rental via specialized physical locations (brick-and-mortar stores near production hubs) remains the primary method for high-end cinema gear, facilitating necessary hands-on technical checkouts and consultation. However, indirect channels, primarily through advanced e-commerce platforms and aggregated industry marketplaces, are growing rapidly, especially for standardized, mid-range equipment needed by independent content creators and smaller commercial agencies. The shift toward hybrid models, integrating digital booking with personalized technical support, is crucial for maintaining market share and improving client satisfaction, especially when dealing with complex, integrated camera systems.

The inherent value proposition of the rental model rests on efficient asset utilization and expert technical support. Unlike retail, rental firms monetize assets through time, making preventative maintenance and rapid repair capabilities non-negotiable. Direct engagement through expert technicians providing pre-and post-rental checks and on-set support forms a significant part of the service value. The efficiency of the distribution channel (logistics, packaging, and insurance management) directly impacts the asset’s profitability and the end-user’s production schedule adherence.

Camera Equipment Rental Market Potential Customers

The primary consumers and end-users of camera equipment rental services are diverse professional entities requiring access to specialized, high-cost cinematic tools for temporary production cycles. The market's largest revenue drivers are major Film and Television Production studios, including global entities like Disney, Warner Bros., and streaming giants such as Netflix and Amazon Studios, which undertake continuous, large-scale projects demanding multiple camera bodies, vast lens inventories, and extensive support gear for long durations. These clients prioritize reliability, access to cutting-edge technology, and comprehensive technical support packages.

A rapidly expanding customer base includes independent production houses and commercial advertising agencies. These firms rely heavily on rentals to maintain flexibility and optimize project budgets. Commercials require high-resolution, specific camera setups for short, intensive shooting periods, making ownership uneconomical. Similarly, independent filmmakers utilize rental services to afford professional equipment that elevates their project quality beyond what they could purchase, often preferring flexible weekly rates and tailored packages. This segment is highly sensitive to price and requires user-friendly, accessible rental processes.

Furthermore, specialized end-users include corporate media departments, news organizations, and large event production companies. Corporate clients frequently rent high-quality video equipment for internal communications, training videos, and live streams, demanding reliability and ease of use. News and documentary crews require robust, portable, and often rapidly deployable equipment. The common thread among all potential customers is the financial necessity of avoiding large depreciating capital investments and the functional need to access specialized, professionally maintained tools only when a specific production demands them, allowing them to scale their technical capabilities on demand.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ARRI Rental, Panavision, Keslow Camera, VMI, VER (PRG), Otto Nemenz International, Lites Camera Action, Lensrentals.com, BorrowLenses, Cinelease, HD Broadcast Rentals, ProCam Take 2, Talamas Broadcast, CVP, New York Camera & Video. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Camera Equipment Rental Market Key Technology Landscape

The technology landscape in the Camera Equipment Rental Market is defined by high-resolution imaging, specialized optics, and the integration of data-centric workflows. The critical technological driver is the continuous push towards higher resolutions, primarily 4K, 6K, and 8K, which necessitates regular investment in the latest sensor technologies, driving perpetual upgrade cycles for rental inventory. Furthermore, the specialized optics segment, including large-format lenses and customized anamorphic glass, represents high-value technology that filmmakers rely on for distinct cinematic looks, making ownership impractical for most. Rental firms must maintain expertise in calibrating and certifying these highly sensitive technological instruments.

A significant technological development is the convergence of professional camera systems with data management and networking capabilities. Modern digital cinema cameras are essentially sophisticated computing devices that generate vast amounts of data (metadata, sensor readings, high-resolution files) that must be securely managed and transferred. Rental houses are increasingly investing in proprietary software solutions for asset tracking, remote diagnostics, firmware management, and secure data storage options for clients. This technological layer of service transforms the rental offering from merely equipment provision to a crucial data-chain partner in the production process.

The rise of Virtual Production (VP) using LED walls and real-time rendering engines (like Unreal Engine) has introduced new technological complexity. VP requires highly specialized camera systems capable of perfect synchronization, precise lens calibration for distortion correction, and integration with motion capture technology. Rental firms must now stock specialized cameras (often smaller, lighter versions optimized for VP stages) and offer integration services to ensure seamless operation within the virtual environment. This requires a shift in technical expertise from traditional camera operation to highly specialized data and integration engineering, significantly raising the barriers to entry for new rental providers.

Regional Highlights

- North America (NA): North America, encompassing the United States and Canada, stands as the largest and most mature market segment for camera equipment rentals, primarily due to the dominance of Hollywood and numerous major streaming platform headquarters. The region benefits from a highly sophisticated infrastructure, including deeply established, vertically integrated rental giants and a high concentration of professional technical talent. Demand is characterized by the need for cutting-edge, large-format digital cinema cameras (e.g., ARRI Alexa LF, RED V-Raptor) and extensive use of specialized Virtual Production technologies. The market is highly competitive, focusing heavily on value-added services such as on-set technical support and expedited logistics, often driven by intense production schedules.

- Europe: Europe represents the second-largest market, fragmented but highly influential, with major hubs in the UK (Pinewood), Germany (Babelsberg), and France. Growth is consistently fueled by government subsidies and tax incentives for film production, attracting international projects. The European market shows a strong appreciation for high-quality specialized lenses and is generally more focused on sustainability in production practices, leading to a demand for energy-efficient lighting and power solutions alongside camera gear. The logistics are complex due to numerous national borders, requiring rental firms to maintain a robust pan-European operational network or rely on reliable cross-border partnerships to serve clients effectively.

- Asia Pacific (APAC): APAC is the fastest-growing region, driven by exponential increases in content consumption and production volume, notably in China, India, South Korea, and Japan. While traditional production houses remain important, the rapid expansion of localized streaming content by global and domestic platforms (e.g., Tencent Video, Hotstar) is dramatically boosting demand for high-end cinematic tools. Rental infrastructure is rapidly developing, often characterized by strong local partnerships to navigate diverse regulatory environments and ensure product availability. The market growth rate is expected to outpace mature markets, focusing on both high-end film production and high-volume commercial video creation.

- Latin America (LATAM): LATAM is an emerging market with significant localized production activity, particularly in Mexico and Brazil. The region faces challenges related to economic volatility and import complexities, making the rental model particularly attractive as local production companies struggle to justify large, stable capital investments. Demand is concentrated in mid-to-high-range professional systems, often favoring durability and versatility. International rental firms are entering through strategic acquisitions and joint ventures to mitigate operational risks and establish reliable supply chains.

- Middle East and Africa (MEA): The MEA region is developing, primarily driven by investments in high-profile events, national branding films, and nascent film initiatives, particularly in the UAE and Saudi Arabia. Infrastructure development is concentrated in key urban centers. The equipment rental demand is highly seasonal and project-based, often requiring specialized logistics to transport equipment into remote or less-developed production locations. The region relies heavily on international rental partners to supply the latest technology and specialized support services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Camera Equipment Rental Market.- ARRI Rental

- Panavision

- Keslow Camera

- VMI

- VER (PRG)

- Otto Nemenz International

- Lites Camera Action

- Lensrentals.com

- BorrowLenses

- Cinelease

- HD Broadcast Rentals

- ProCam Take 2

- Talamas Broadcast

- CVP

- New York Camera & Video

- Adorama Rental Company (ARC)

- Fujifilm (Fujinon Rental Services)

- Kodak Film Lab and Rental Services

- Grip & Lighting Rental Company

- Location Camera Rental

Frequently Asked Questions

Analyze common user questions about the Camera Equipment Rental market and generate a concise list of summarized FAQs reflecting key topics and concerns.What major factors are driving the growth of the Camera Equipment Rental Market globally?

The primary drivers include the escalating global demand for original, high-definition content fueled by streaming platforms (OTT services), the prohibitive cost of owning and maintaining specialized digital cinema cameras and optics, and the rapid technological obsolescence cycle that makes renting the most economically viable strategy for production houses of all sizes. The democratization of content creation also broadens the customer base requiring professional gear.

How does Virtual Production technology impact the demand for camera equipment rental services?

Virtual Production (VP) significantly increases the demand for highly specialized rental packages. VP workflows necessitate multiple, synchronized camera bodies, unique lens sets optimized for LED wall environments, and advanced, data-integrated support systems. Rental firms specializing in VP integration services can command premium rates for these complex technological solutions, expanding the market's high-end niche.

Which equipment segments are generating the highest revenue within the rental market?

Digital Cinema Cameras, such as those manufactured by ARRI and RED, consistently generate the highest revenue due to their extremely high per-day rental rates and essential nature for professional features and series. Closely following are specialized Lenses (prime and anamorphic optics), which often represent a greater technical and financial investment for the rental house than the camera bodies themselves.

What are the main operational challenges faced by camera equipment rental companies?

Key operational challenges include managing the intense logistical complexity of high-value assets (shipping, tracking, customs clearance), mitigating the financial risks associated with equipment damage, theft, and insurance costs, and the substantial necessity of continually reinvesting capital to acquire the latest technology required to meet client demands and stay competitive against technological obsolescence.

Is the Camera Equipment Rental Market expected to consolidate, or will regional specialization prevail?

The market shows dual trends. High-end cinema rental is experiencing increasing consolidation globally (e.g., major players acquiring regional specialists) to achieve global inventory scale and standardized logistics. Simultaneously, regional specialization will persist, particularly in catering to localized independent filmmakers and corporate segments that prioritize local technical support, specialized regional optics, and fast turnaround times over international access, ensuring a healthy balance between global scale and local responsiveness.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager