Camera Module Adhesives Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439401 | Date : Jan, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Camera Module Adhesives Market Size

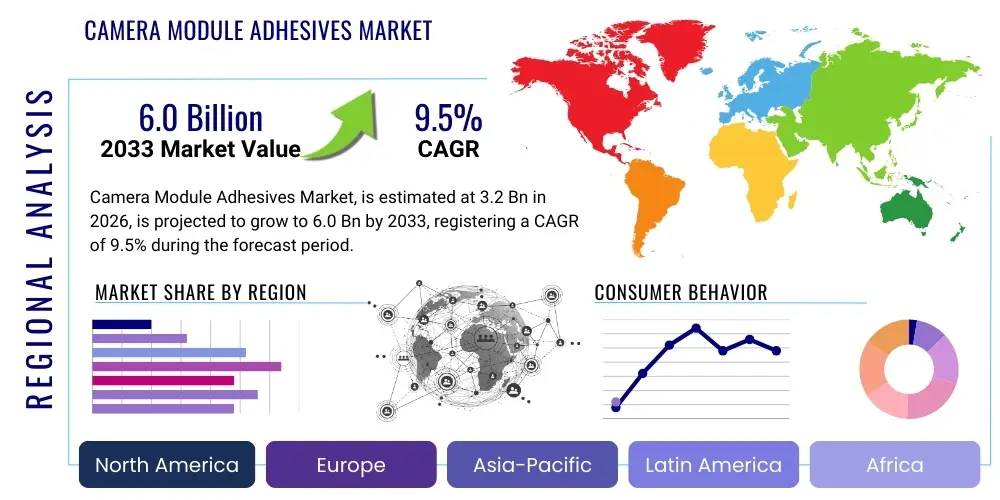

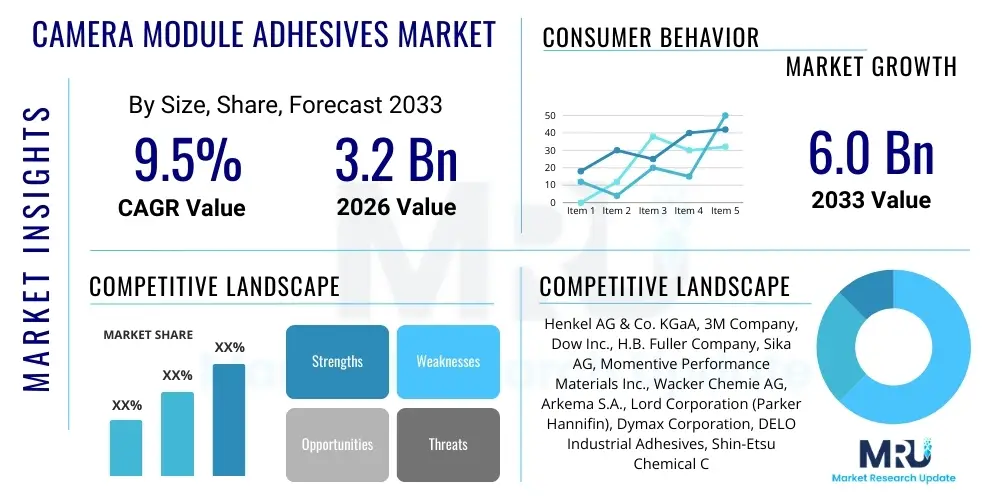

The Camera Module Adhesives Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 3.2 Billion in 2026 and is projected to reach USD 6.0 Billion by the end of the forecast period in 2033.

Camera Module Adhesives Market introduction

The Camera Module Adhesives Market encompasses specialized adhesive formulations crucial for the assembly and performance of compact camera modules utilized across various electronic devices. These sophisticated adhesives are engineered to meet stringent requirements, including precise bonding, thermal stability, resistance to environmental factors, and compatibility with sensitive optical components and electronic circuitry. The primary products in this market include epoxy-based, acrylic-based, silicone-based, and polyurethane-based adhesives, each offering unique properties tailored to specific applications such as lens bonding, sensor attachment, housing sealing, and flex circuit connections within the camera module.

Major applications driving this market span a broad spectrum of industries, most notably smartphones, where the demand for ever-improving camera quality and miniaturization is relentless. Beyond mobile devices, camera module adhesives are vital in the burgeoning automotive sector for advanced driver-assistance systems (ADAS) and autonomous vehicles, medical imaging equipment, security and surveillance systems, and industrial inspection cameras. The benefits of these adhesives include enhanced optical performance by ensuring precise alignment and stability of lenses, improved durability and reliability of camera modules in harsh conditions, and enabling the miniaturization necessary for compact device designs without compromising structural integrity or functionality.

Key driving factors for the market's robust growth include the continuous technological advancements in camera sensor resolution and optical complexity, the rapid expansion of the smartphone industry in emerging economies, and the increasing integration of vision systems in automotive, industrial automation, and consumer electronics. The proliferation of IoT devices and smart infrastructure also contributes significantly to the demand for reliable and high-performance camera modules, consequently boosting the need for advanced adhesive solutions that can withstand diverse operational environments and demanding assembly processes.

Camera Module Adhesives Market Executive Summary

The Camera Module Adhesives Market is experiencing dynamic growth, propelled by several overarching business trends. A significant trend is the relentless pursuit of miniaturization and enhanced performance in camera modules, particularly in the smartphone and automotive sectors. This drives adhesive manufacturers to innovate with materials that offer superior bonding strength, low outgassing, high thermal stability, and UV curability for rapid, precise assembly. Furthermore, there is a growing demand for environmentally friendly and sustainable adhesive solutions, prompting research into solvent-free and bio-based formulations to meet evolving regulatory standards and consumer preferences for eco-conscious products. Strategic partnerships and collaborations between adhesive suppliers, camera module manufacturers, and original equipment manufacturers (OEMs) are also becoming more prevalent to co-develop custom solutions for next-generation devices.

Regionally, Asia Pacific continues to dominate the market, largely due to its concentration of leading electronics manufacturing hubs, particularly in China, South Korea, Japan, and Taiwan. The rapid adoption of smartphones and the burgeoning automotive industry in these countries are key contributors. North America and Europe are also significant markets, driven by innovation in automotive ADAS, medical devices, and high-end consumer electronics, along with stringent quality and reliability requirements. Latin America and the Middle East & Africa regions are emerging as high-growth areas, fueled by increasing digitalization, smartphone penetration, and developing automotive infrastructure, although they currently represent smaller market shares.

From a segmentation perspective, the market sees robust growth across various adhesive types, with epoxy-based and acrylic-based adhesives maintaining strong positions due to their versatile properties and cost-effectiveness. Silicone-based adhesives are gaining traction for applications requiring extreme temperature resistance and flexibility, especially in automotive environments. Application-wise, lens bonding remains a critical segment, demanding ultra-precise and optically clear adhesives, while sensor bonding and housing sealing are also significant, driven by the need for hermetic seals and robust device protection. The end-use industry segment is largely dominated by smartphones, but automotive applications are projected to exhibit the highest growth rates over the forecast period, reflecting the increasing sophistication and ubiquity of vehicle cameras.

AI Impact Analysis on Camera Module Adhesives Market

The pervasive integration of Artificial Intelligence (AI) across various industries significantly influences the Camera Module Adhesives Market by imposing new and heightened demands on camera performance and reliability. User questions often revolve around how AI-driven applications, such as advanced computer vision in autonomous vehicles, sophisticated facial recognition in smart devices, or complex medical imaging, necessitate superior optical precision and durability from camera modules. Concerns frequently emerge regarding the long-term stability of adhesives in thermally challenging environments, especially as AI processing units generate more heat within compact devices, alongside questions about the ability of adhesives to support modules operating continuously for AI tasks without degradation. Expectations are high for adhesives that can ensure optical alignment stability over extended periods and in diverse operational conditions, directly impacting the accuracy and reliability of AI algorithms that rely on high-fidelity visual data.

The demand for more robust, precise, and durable camera modules, driven by AI’s requirement for high-quality, consistent data input, directly translates into a need for advanced adhesive solutions. AI applications often push the boundaries of camera performance, requiring modules that can operate flawlessly under extreme conditions, for longer durations, and with greater sensitivity. This impacts adhesive formulation by demanding materials that exhibit exceptional dimensional stability, minimal outgassing to prevent lens fogging, and superior resistance to vibrations and temperature fluctuations. The precision required for optical alignment, which is paramount for AI algorithms to accurately interpret visual information, places an even greater emphasis on the non-migratory and stable properties of the adhesives used in lens and sensor bonding.

Furthermore, the miniaturization trend, coupled with the integration of more powerful AI chips, leads to increasingly dense packaging within electronic devices. This intensifies thermal management challenges, necessitating adhesives that can dissipate heat efficiently or withstand higher operating temperatures without compromising structural integrity or optical clarity. The continuous evolution of AI algorithms, requiring faster data acquisition and processing, means camera modules must deliver consistent performance over their entire lifespan, making the long-term reliability of adhesive bonds a critical consideration. This confluence of factors drives adhesive manufacturers to innovate continually, developing next-generation solutions that can meet the rigorous demands of an AI-powered future, from autonomous vehicle vision systems to advanced robotics and smart consumer electronics.

- Enhanced precision requirements for optical alignment due to AI-driven image processing algorithms.

- Increased demand for thermal resistance and stability in adhesives to cope with heat generated by AI processors.

- Need for ultra-low outgassing adhesives to prevent contamination and maintain optical clarity for AI vision systems.

- Development of adhesives with superior shock and vibration resistance for AI-enabled devices in demanding environments (e.g., automotive, industrial).

- Requirement for faster curing and automated dispensing solutions to support high-volume manufacturing of AI-enabled camera modules.

- Greater emphasis on long-term reliability and durability of adhesive bonds to ensure consistent performance for AI applications.

- Innovation in optically clear adhesives for augmented reality (AR) and virtual reality (VR) systems powered by AI.

DRO & Impact Forces Of Camera Module Adhesives Market

The Camera Module Adhesives Market is significantly influenced by a complex interplay of drivers, restraints, and opportunities, collectively shaping its trajectory. The primary drivers include the escalating demand for high-resolution cameras in smartphones and consumer electronics, the pervasive adoption of advanced driver-assistance systems (ADAS) in the automotive sector, and the expansion of surveillance and security systems globally. Miniaturization trends across all electronic devices compel manufacturers to develop smaller, yet more powerful camera modules, which critically depend on advanced adhesives for precise component assembly and structural integrity. Rapid technological advancements in camera sensor technology and optical components also necessitate sophisticated adhesive solutions capable of meeting evolving performance requirements, further propelling market growth.

However, the market also faces notable restraints. The increasing complexity of camera module designs and the stringent performance requirements demand highly specialized and often costly adhesive formulations, which can impact overall manufacturing costs. Technical challenges such as achieving ultra-precise alignment, ensuring long-term thermal stability, and preventing outgassing in confined spaces present significant hurdles for adhesive manufacturers. Furthermore, intense competition among adhesive suppliers, coupled with fluctuating raw material prices, can exert pressure on profit margins. The relatively long qualification cycles for new adhesive materials in critical applications like automotive and medical devices can also slow down market adoption and innovation.

Despite these challenges, substantial opportunities exist for market expansion. The emergence of new applications in augmented reality (AR) and virtual reality (VR) devices, drones, and robotics offers fresh avenues for advanced camera modules and, consequently, their specialized adhesives. The ongoing development of IoT devices and smart infrastructure solutions will continue to integrate cameras, creating a sustained demand for reliable bonding agents. Moreover, advancements in adhesive technology, such as UV-curable, low-temperature curable, and electrically conductive adhesives, present opportunities for enhanced manufacturing efficiency and broader application scope. Focusing on sustainable and environmentally friendly adhesive solutions also presents a lucrative opportunity for companies to differentiate themselves and capture market share in an increasingly eco-conscious industrial landscape, fostering innovation that addresses both performance and environmental responsibility.

Segmentation Analysis

The Camera Module Adhesives Market is comprehensively segmented to provide granular insights into its diverse components and evolving dynamics. This segmentation helps in understanding the specific demands and growth drivers within various product types, application areas, and end-use industries, allowing for more targeted market strategies and product development. Each segment addresses distinct technical requirements and market needs, reflecting the broad range of camera module designs and functionalities prevalent across different electronic devices and systems. The market's structure is influenced by material science innovations in adhesives, manufacturing process advancements, and the specific performance criteria mandated by various end-user applications.

- By Type

- Epoxy-based Adhesives

- Acrylic-based Adhesives

- Silicone-based Adhesives

- Polyurethane-based Adhesives

- Cyanoacrylate Adhesives

- Other Types (e.g., UV-curable, Hot Melt)

- By Application

- Lens Bonding

- Sensor Bonding (CMOS/CCD)

- Housing Sealing

- Substrate Attachment

- Flex Circuit Bonding

- Other Applications (e.g., EMI Shielding)

- By End-Use Industry

- Smartphones & Tablets

- Automotive (ADAS, In-Cabin Monitoring)

- Medical Devices (Endoscopes, Surgical Cameras)

- Security & Surveillance (CCTV, IP Cameras)

- Industrial (Robotics, Machine Vision)

- Consumer Electronics (Laptops, Drones, Wearables)

- Other Industries (e.g., AR/VR, Aerospace)

- By Form

- Liquid Adhesives

- Paste Adhesives

- Film Adhesives

Value Chain Analysis For Camera Module Adhesives Market

The value chain for the Camera Module Adhesives Market begins with upstream activities involving raw material suppliers, who provide the foundational chemical components such as resins, curing agents, fillers, and other additives essential for adhesive formulation. Key suppliers in this stage include petrochemical companies, specialty chemical producers, and polymer manufacturers. Research and development activities also form a crucial part of the upstream segment, where adhesive manufacturers innovate new formulations to meet evolving performance requirements for optical clarity, thermal stability, and bonding strength. Quality control and cost efficiency at this initial stage significantly impact the final product's performance and competitiveness.

Moving downstream, the value chain progresses to the core adhesive manufacturers who process these raw materials into specialized camera module adhesives. These manufacturers undertake complex formulation, mixing, and packaging processes, often developing proprietary technologies for UV curing, low-temperature curing, or specific rheological properties. Their direct customers are typically camera module integrators and component manufacturers who assemble the various parts of the camera, including lenses, sensors, and housing units. These integrators then supply the completed camera modules to original equipment manufacturers (OEMs) in various end-use industries such as consumer electronics, automotive, medical, and industrial sectors.

The distribution channel for camera module adhesives primarily involves both direct and indirect approaches. Direct sales often occur for large-volume orders or for highly specialized custom formulations, where adhesive manufacturers work closely with major camera module integrators or OEMs. Indirect distribution channels include a network of authorized distributors, regional agents, and online marketplaces that cater to smaller manufacturers or provide a broader reach to diverse geographic markets. These distributors often offer technical support and logistics services, bridging the gap between adhesive producers and their widespread customer base. The efficiency and reliability of these distribution networks are critical for timely delivery and ensuring market access for advanced adhesive solutions.

Camera Module Adhesives Market Potential Customers

The potential customers for camera module adhesives represent a diverse and expanding ecosystem of manufacturers across various high-growth industries. Primarily, these customers are the companies involved in the design and assembly of camera modules themselves. This includes specialist camera module integrators who source individual components like lenses, sensors, and flex circuits, and then meticulously bond them together using precision adhesives. These integrators are highly focused on achieving optimal optical performance, miniaturization, and long-term reliability, making them critical buyers of advanced adhesive solutions. Their demands often drive innovation in adhesive properties, such as curing speed, bond strength, and environmental resistance, directly impacting product development cycles.

Beyond the direct integrators, original equipment manufacturers (OEMs) in end-use industries form a significant segment of potential customers, often influencing adhesive selection through their stringent product specifications. For instance, smartphone manufacturers are constantly seeking adhesives that enable thinner phones with multiple high-performance cameras, while automotive OEMs require adhesives that can withstand extreme temperatures, vibrations, and moisture for ADAS cameras. Medical device manufacturers, on the other hand, prioritize biocompatibility, sterilization resistance, and precision for endoscopic cameras and diagnostic equipment. Each end-use industry imposes a unique set of requirements that the adhesive must fulfill, making these OEMs instrumental in shaping market demand.

Furthermore, contract manufacturers and electronic manufacturing service (EMS) providers, who handle the assembly of electronic devices for various brands, also represent a substantial customer base. These entities require a consistent supply of reliable and high-performance camera module adhesives that can be integrated seamlessly into their automated assembly lines. Their purchasing decisions are often driven by factors such as cost-effectiveness, ease of application, and the ability of the adhesive to meet specific quality and regulatory standards across different client projects. The continuous evolution of these industries, coupled with the increasing integration of camera technology, ensures a sustained and growing demand for specialized camera module adhesives, highlighting the broad spectrum of end-users and buyers in this dynamic market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.2 Billion |

| Market Forecast in 2033 | USD 6.0 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Henkel AG & Co. KGaA, 3M Company, Dow Inc., H.B. Fuller Company, Sika AG, Momentive Performance Materials Inc., Wacker Chemie AG, Arkema S.A., Lord Corporation (Parker Hannifin), Dymax Corporation, DELO Industrial Adhesives, Shin-Etsu Chemical Co., Ltd., Elkem ASA, DIC Corporation, Cyberbond LLC, KCC Corporation, Panacol-Elosol GmbH, Master Bond Inc., Bostik (Arkema), Intertronics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Camera Module Adhesives Market Key Technology Landscape

The Camera Module Adhesives Market is characterized by a rapidly evolving technological landscape, driven by the increasing demands for miniaturization, higher performance, and enhanced durability in camera modules. A significant technological advancement is the widespread adoption of UV-curable adhesives. These adhesives offer rapid curing times, often within seconds under UV light exposure, which significantly accelerates production cycles and improves manufacturing efficiency. Their ability to cure on demand provides precise control over the bonding process, crucial for maintaining critical optical alignment and preventing component shift during assembly. Moreover, UV-curable formulations often exhibit excellent optical clarity, low shrinkage, and strong adhesion to a variety of substrates, making them ideal for lens and sensor bonding applications.

Another critical technological trend involves the development of low-temperature curable adhesives, including those that cure at room temperature or with minimal heat. This technology is particularly valuable for bonding heat-sensitive components, such as advanced image sensors and delicate flex circuits, preventing potential damage or degradation that could occur with high-temperature curing processes. These adhesives often rely on novel chemistry, such as dual-cure mechanisms (e.g., UV and moisture, or UV and heat), to achieve robust bonds while protecting sensitive electronics. The ongoing research focuses on enhancing their shelf life, improving dispensing accuracy, and ensuring long-term reliability in demanding operational environments, further broadening their applicability in compact and high-performance camera modules.

Furthermore, advancements in materials science are leading to the introduction of specialty adhesives with enhanced properties tailored for specific challenges. This includes high-performance epoxy and silicone formulations that offer superior thermal stability, crucial for camera modules exposed to extreme temperatures, such as those in automotive ADAS systems or industrial machine vision. Electrically conductive adhesives are also gaining traction for applications requiring both structural bonding and electrical interconnection, reducing the need for separate soldering processes. Additionally, the industry is witnessing innovation in optically clear adhesives (OCAs) for display-integrated camera modules and advanced light management, alongside the development of adhesives with ultra-low outgassing properties to prevent lens fogging and maintain pristine optical surfaces over the device's lifespan. These technological innovations collectively enable the manufacturing of increasingly sophisticated and reliable camera modules essential for the next generation of electronic devices.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market due to the presence of major electronics manufacturing hubs (China, South Korea, Japan, Taiwan), high smartphone penetration, and rapid growth in the automotive sector, driving significant demand for camera module adhesives.

- North America: A robust market driven by technological innovation in automotive ADAS, advanced medical devices, and high-end consumer electronics. Strong R&D investments and stringent quality standards fuel demand for high-performance adhesives.

- Europe: Characterized by a strong automotive industry and growing industrial automation sector. Emphasis on quality, environmental regulations, and advanced manufacturing processes drives the adoption of specialized and sustainable adhesive solutions.

- Latin America: Emerging market with increasing smartphone adoption and a developing automotive manufacturing base. Growth is steady, offering opportunities for adhesive suppliers as industrialization progresses.

- Middle East & Africa (MEA): Growing market influenced by increasing urbanization, infrastructure development, and rising demand for consumer electronics. Investment in smart cities and surveillance systems also contributes to market expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Camera Module Adhesives Market.- Henkel AG & Co. KGaA

- 3M Company

- Dow Inc.

- H.B. Fuller Company

- Sika AG

- Momentive Performance Materials Inc.

- Wacker Chemie AG

- Arkema S.A.

- Lord Corporation (Parker Hannifin)

- Dymax Corporation

- DELO Industrial Adhesives

- Shin-Etsu Chemical Co., Ltd.

- Elkem ASA

- DIC Corporation

- Cyberbond LLC

- KCC Corporation

- Panacol-Elosol GmbH

- Master Bond Inc.

- Bostik (Arkema)

- Intertronics

Frequently Asked Questions

Analyze common user questions about the Camera Module Adhesives market and generate a concise list of summarized FAQs reflecting key topics and concerns.What types of adhesives are commonly used in camera modules?

The camera module adhesives market primarily utilizes epoxy-based, acrylic-based, silicone-based, and polyurethane-based formulations. Each type offers distinct properties tailored for specific bonding requirements, such as optical clarity, thermal stability, or flexibility, across various components like lenses and sensors.

What are the primary applications driving the demand for camera module adhesives?

Key applications include lens bonding, sensor attachment (CMOS/CCD), housing sealing, and flex circuit bonding within camera modules. The market is largely driven by the smartphone, automotive (ADAS), medical devices, and security & surveillance industries, all requiring high-performance and reliable camera systems.

How does AI impact the Camera Module Adhesives Market?

AI significantly impacts the market by demanding higher precision, durability, and thermal stability from camera modules. AI-driven applications like autonomous driving and facial recognition require superior optical alignment, low outgassing, and resistance to environmental stress, pushing for advanced adhesive innovations.

What are the main challenges faced by adhesive manufacturers in this market?

Manufacturers face challenges such as achieving ultra-precise optical alignment, ensuring long-term thermal stability in compact devices, minimizing outgassing to prevent lens fogging, and navigating stringent material qualification processes, especially for automotive and medical applications.

Which regions are key contributors to the Camera Module Adhesives Market growth?

Asia Pacific is the dominant region due to its extensive electronics manufacturing base and high demand for smartphones. North America and Europe also contribute significantly, driven by innovation in automotive ADAS and high-tech consumer and industrial applications, while Latin America and MEA are emerging growth regions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager