Camera Module Assembly Adhesives Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434851 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Camera Module Assembly Adhesives Market Size

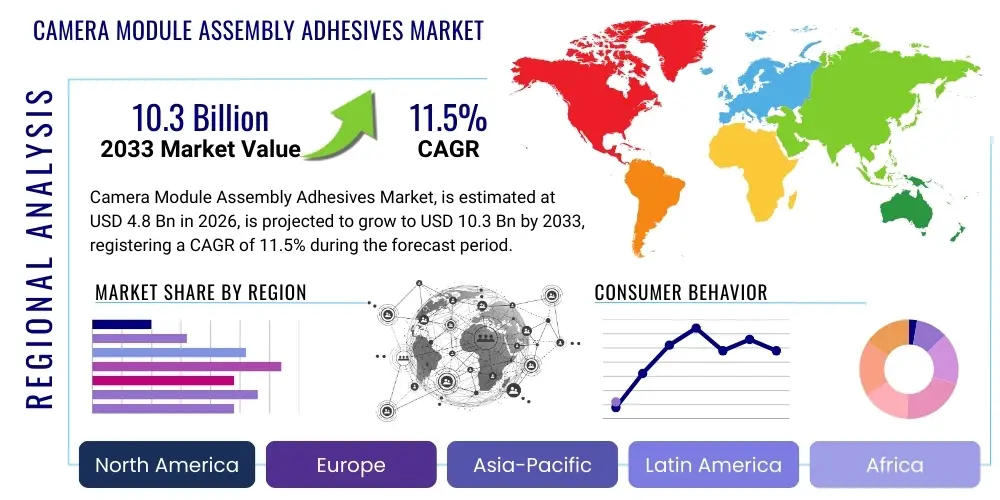

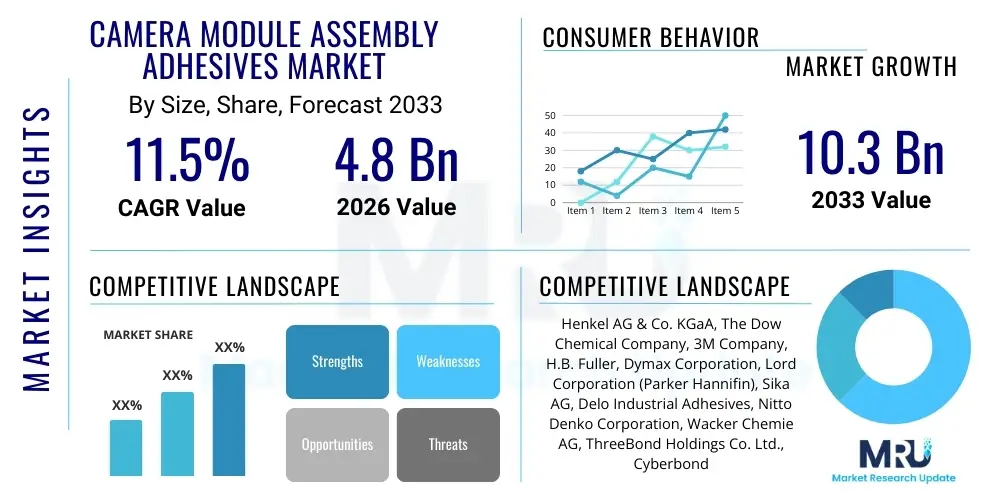

The Camera Module Assembly Adhesives Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 10.3 Billion by the end of the forecast period in 2033.

Camera Module Assembly Adhesives Market introduction

The Camera Module Assembly Adhesives Market encompasses specialized chemical formulations crucial for bonding and integrating various components within compact camera modules (CCMs), which are fundamental elements in modern electronic devices. These components include the lens barrel, image sensor, housing, and active alignment mechanisms. The performance of these adhesives directly impacts the optical stability, reliability, and imaging quality of the final product. Given the increasingly stringent requirements for smaller form factors, higher resolution, and integration into harsh environments, particularly in automotive and industrial applications, the demand for high-performance adhesives that offer superior temperature resistance, minimal outgassing, and rapid curing mechanisms is escalating globally. This technological shift is driving innovation toward UV-curing and thermal-curing epoxy and acrylic systems that facilitate high-throughput automated assembly processes.

Product description highlights adhesives engineered specifically for micro-assembly precision. Key adhesive types often include specialized epoxies, acrylics, and silicones, each tailored for different assembly steps such as lens fixation, sensor bonding (die attach), and structural sealing. Modern camera modules, particularly those used in multi-camera arrays in smartphones or sophisticated ADAS systems in vehicles, require adhesives that maintain stability under rapid thermal cycling and mechanical stress. The critical benefit provided by these advanced adhesives is the assurance of optical precision and long-term device reliability, preventing lens shift (decentering) or sensor misalignment over the device’s lifespan. These materials must also exhibit low volatile organic content (VOC) and high purity to prevent contamination of the delicate optical surfaces, which can degrade image quality.

Major applications of camera module assembly adhesives span across consumer electronics, primarily smartphones and tablets, where miniaturization and performance are paramount. Furthermore, the automotive sector represents a rapidly expanding application area, fueled by the proliferation of ADAS (Advanced Driver-Assistance Systems), rearview cameras, and interior monitoring systems, all requiring stringent automotive-grade reliability. Driving factors for market growth include the global surge in smartphone adoption, the transition to multi-camera setups in mobile devices, the mandate for automotive safety systems, and the increasing deployment of smart surveillance and drone technology. These drivers collectively necessitate higher volumes of precise, durable, and highly reliable adhesive solutions capable of meeting automated manufacturing demands.

Camera Module Assembly Adhesives Market Executive Summary

The Camera Module Assembly Adhesives Market is experiencing robust expansion, primarily driven by concurrent technological advancements in consumer electronics and automotive safety systems. Business trends are characterized by fierce competition among chemical specialty manufacturers focusing on developing highly customized, rapid-curing adhesive systems, such as advanced UV-curing epoxies and hybrid materials, designed specifically for active alignment processes where sub-micron precision is required. Furthermore, there is a strong emphasis on sustainability, leading manufacturers to explore solvent-free formulations and improved dispensing efficiency to minimize waste and operational costs for module assemblers. Strategic collaborations between adhesive suppliers and major camera module manufacturers (CCM vendors) are pivotal, allowing for early-stage material qualification and optimization necessary to meet escalating production volumes and quality standards.

Regional trends clearly indicate that the Asia Pacific (APAC) region dominates the market, serving as the epicenter for both camera module manufacturing and the assembly of end-user devices, notably smartphones and laptops, in countries like China, South Korea, Taiwan, and Japan. This dominance is further reinforced by the concentration of image sensor and optical component suppliers in the region. North America and Europe, while smaller in volume manufacturing, exhibit higher demand for high-reliability, premium adhesives driven by stringent regulatory requirements in the high-end automotive (ADAS/autonomous driving) and specialized medical device sectors. Future growth will be significantly influenced by the rapid industrialization and urbanization in emerging APAC countries, increasing the uptake of security and surveillance systems utilizing high-resolution cameras.

Segment trends highlight the significant growth trajectory in the epoxy adhesive segment due to its superior bonding strength, low shrinkage characteristics, and excellent thermal stability, making it ideal for structural and lens bonding applications. Application-wise, the mobile phones segment maintains the largest market share owing to massive annual production volumes and the complexity introduced by dual and triple camera systems, which require multiple adhesive joints per device. However, the automotive segment is poised to record the highest Compound Annual Growth Rate (CAGR), reflecting the irreversible shift towards semi-autonomous and fully autonomous vehicles, which rely heavily on multiple external and internal camera modules requiring the highest levels of performance reliability under extreme operating conditions. Technological advancements favor the UV curing method due to its speed, energy efficiency, and suitability for high-speed automated assembly lines.

AI Impact Analysis on Camera Module Assembly Adhesives Market

User queries regarding the impact of Artificial Intelligence (AI) on the Camera Module Assembly Adhesives Market frequently revolve around how AI-enhanced imaging systems and autonomous technology drive adhesive specifications, particularly concerning longevity, thermal management, and production quality control. Users are keen to understand if AI-driven machine vision in manufacturing lines will necessitate changes in adhesive optical properties (e.g., clarity, refractive index) or if the adhesives themselves need enhanced thermal performance to support AI processors operating near the camera module. Key themes emerging from these questions center on the shift towards higher data processing requirements in devices, such as autonomous vehicles and advanced robotics, demanding camera modules that operate reliably at higher temperatures and with greater precision over extended lifecycles. Users also express interest in how AI can optimize the adhesive dispensing and curing processes during active alignment assembly.

The integration of AI, especially in applications like Advanced Driver-Assistance Systems (ADAS) and high-end consumer photography, directly translates to increased sensor resolution and computational load. This elevated performance mandates camera modules that are thermally robust and mechanically precise. The heat generated by embedded AI processors or dedicated neural network accelerators requires adhesives with superior thermal dissipation properties, pushing manufacturers toward thermally conductive (but electrically insulating) adhesive compounds. This focus on thermal management is critical to prevent thermal drift that could compromise the accuracy of optical alignment, which is essential for successful AI vision processing. Furthermore, AI-driven quality assurance systems on assembly lines, utilizing machine vision, demand adhesives that cure rapidly and consistently, reducing process variability and facilitating immediate, non-destructive optical inspection.

The increasing complexity of AI-driven camera systems, such as LiDAR/camera fusion arrays or highly integrated stereoscopic systems, requires new adhesive formulations that can bond dissimilar materials (e.g., metal, plastic, glass) while maintaining hermetic seals against moisture and environmental contaminants. The need for sub-micron precision in active alignment, driven by the demands of complex AI algorithms requiring perfect focal planes and minimum distortion, is intensifying the adoption of photocurable adhesives with extremely low shrinkage and high modulus after curing. In essence, AI does not directly consume adhesives, but its proliferation in advanced imaging applications acts as a powerful downstream driver, pushing material science boundaries toward adhesives offering higher reliability, better thermal stability, and ultra-precise dimensional control.

- AI enhances demand for thermally conductive adhesives due to increased processor heat near camera modules (e.g., in ADAS).

- AI-driven active alignment systems mandate ultra-low shrinkage adhesives for sub-micron precision bonding.

- Advanced machine vision QA systems require consistent and rapid curing profiles to maintain high throughput.

- Increased complexity of AI camera arrays (e.g., multi-lens, LiDAR integration) drives demand for specialized adhesion to dissimilar substrates.

- AI applications in automotive and security heighten requirements for long-term mechanical and thermal reliability of adhesive bonds.

DRO & Impact Forces Of Camera Module Assembly Adhesives Market

The Camera Module Assembly Adhesives Market is significantly influenced by a dynamic interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces shaping its evolution. Key drivers propelling market growth include the relentless expansion of the mobile phone market, specifically the global trend towards adopting multi-camera configurations (dual, triple, or quad lenses) in mid-range and premium smartphones, necessitating more adhesive joints per device. The mandatory integration of camera systems into automotive safety and infotainment systems, particularly in regions enforcing stricter ADAS standards, provides a high-reliability, high-value growth engine. Concurrently, the increasing automation of assembly processes, such as active alignment, favors high-speed, UV-curable adhesives, thereby driving material innovation and consumption.

Despite these strong drivers, the market faces notable restraints. The primary challenge is the requirement for ultra-high precision and low outgassing properties, which significantly increases the complexity and cost of adhesive formulation and qualification. Failures due to outgassing can contaminate the image sensor or lens surfaces, leading to image degradation and high warranty costs for manufacturers. Moreover, the intensely competitive nature of the consumer electronics market constantly pressures adhesive suppliers to lower material costs while simultaneously improving performance, creating a margin squeeze. Regulatory hurdles, particularly the adoption of halogen-free and low-VOC (volatile organic compound) standards globally, impose costly reformulation and testing requirements on adhesive manufacturers, potentially slowing product cycles.

Opportunities for market players lie predominantly in developing next-generation adhesive technologies tailored for emerging high-growth applications. The transition towards high-resolution Time-of-Flight (ToF) sensors and advanced micro-optics in augmented reality (AR) and virtual reality (VR) devices presents a new frontier for specialized adhesive applications. Furthermore, the burgeoning drone and industrial robotics sectors, which demand rugged, weather-resistant, and vibration-dampening adhesive solutions for their imaging modules, offer lucrative niche opportunities. Strategic investment in dual-curing adhesives (e.g., UV and thermal cure) that offer both rapid fixturing and robust final bonding is a key area for capturing market share, particularly in high-volume, precision manufacturing environments. These impact forces necessitate a continuous focus on R&D to maintain technical superiority and competitive advantage in the highly specialized adhesives sector.

Segmentation Analysis

The Camera Module Assembly Adhesives Market is systematically segmented based on adhesive type, technology utilized for curing, and the end-use application, providing a granular view of market dynamics and growth potential across various product categories and user industries. The structural integrity and operational lifespan of a camera module are highly dependent on selecting the correct adhesive type, leading to distinct market shares for epoxy, acrylic, silicone, and polyurethane segments. The market landscape is further differentiated by the curing technology, reflecting the manufacturing efficiency needs of diverse end-users, from high-throughput mobile phone assembly lines demanding UV curing to automotive applications requiring robust thermal stability offered by thermal curing or dual-curing systems. Understanding these segmentation nuances is crucial for strategic market positioning.

The Application segment is particularly vital, reflecting the enormous volume of demand generated by mobile devices versus the high-reliability, high-specification demand from the automotive industry. While mobile phones dominate the revenue share due to sheer volume, the automotive segment offers premium pricing and faster growth rates fueled by regulatory mandates and the complexity of ADAS systems. Other application areas, such as security and surveillance, medical devices (e.g., endoscopic cameras), and industrial inspection cameras, constitute significant niche markets that require adhesives meeting specialized criteria like biocompatibility or extreme temperature resilience. The ongoing trend of miniaturization across all applications ensures sustained demand for high-viscosity, precision-dispensable adhesives capable of meeting tight tolerance requirements in increasingly smaller camera footprints.

- Adhesive Type: Epoxy, Polyurethane, Silicone, Acrylic, Others

- Curing Technology: UV Curing, Thermal Curing, Dual Curing (UV + Thermal/Moisture), Room Temperature Curing

- Application: Mobile Phones, Automotive (ADAS, In-Cabin), Medical Devices, Laptops/PCs, Security & Surveillance, Industrial/Robotics

Value Chain Analysis For Camera Module Assembly Adhesives Market

The value chain for the Camera Module Assembly Adhesives Market begins with the upstream sourcing of highly specialized raw materials, including oligomers, monomers, photoinitiators, fillers (e.g., silica, alumina for thermal conductivity), and performance additives. Suppliers in this stage are typically large chemical companies focused on petrochemical derivatives and advanced material science. A key challenge upstream is ensuring the ultra-high purity of components, especially for optical applications, where impurities can lead to outgassing and sensor contamination. The integration between raw material providers and adhesive formulators is high, focusing on developing custom chemical building blocks that meet specific optical, thermal, and mechanical properties required for precision camera module assembly.

The core of the value chain involves the adhesive manufacturing process, where formulation expertise is paramount. Adhesive manufacturers refine these raw materials into highly viscous, dispensable products, often incorporating advanced processes like vacuum mixing to minimize air bubbles and ensure product uniformity and stability. Quality control is rigorous, ensuring consistency in viscosity, cure speed, and adhesion strength across batches. Distribution channels involve both direct sales to major Tier 1 camera module manufacturers (CCM vendors) and indirect sales through specialized chemical distributors, particularly for smaller assembly houses or specific regional markets. Direct sales are often preferred for highly customized, proprietary formulations used in flagship product assembly, enabling close technical collaboration.

Downstream, the camera module assemblers are the direct users, utilizing sophisticated equipment for automated dispensing, active alignment, and precise curing. The efficiency and yield of the final product are highly dependent on the performance and consistency of the adhesive. The finished camera modules are then sold to major Original Equipment Manufacturers (OEMs) in the mobile phone, automotive, and industrial sectors. This downstream segment dictates the specifications for the entire chain, driving demand for materials that enable faster assembly throughput and higher optical performance. The value chain is characterized by a strong feedback loop, where issues identified during downstream assembly or end-user failure analysis lead directly to upstream reformulation efforts, underscoring the technical intimacy required across all stages.

Camera Module Assembly Adhesives Market Potential Customers

Potential customers for Camera Module Assembly Adhesives are primarily high-volume manufacturers and integrators of imaging components and end devices where precision optics are critical. The largest customer segment comprises Camera Module Manufacturers (CCM Vendors) like Sunny Optical, Largan Precision, and Semco, who procure vast quantities of adhesives for bonding lenses, sensors, and housing elements. These Tier 1 vendors demand adhesives optimized for automated, high-speed active alignment systems, favoring UV-curing or dual-curing epoxies with specific viscosity and cure characteristics to maximize production yield and optical precision.

Another major segment includes Original Equipment Manufacturers (OEMs) in the automotive industry, specifically those specializing in ADAS modules, LiDAR systems, and interior monitoring cameras. These customers, including automotive Tier 1 suppliers like Bosch, Continental, and Magna, require adhesives certified to meet stringent automotive standards (e.g., AEC-Q100 for electronics, and specific thermal cycling and vibration resistance tests). The adhesives must guarantee reliability over a 15-year vehicle lifespan, necessitating superior thermal stability and moisture resistance compared to consumer-grade materials.

Furthermore, specialized industrial and medical device manufacturers represent lucrative niche segments. For example, producers of high-resolution industrial inspection cameras, robotics vision systems, and miniature surgical endoscopes require adhesives with exceptional optical clarity, biocompatibility (for medical use), and resistance to harsh cleaning agents. These end-users prioritize customized, high-performance formulations over material cost, making them valuable targets for specialized adhesive suppliers focusing on advanced R&D capabilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 10.3 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Henkel AG & Co. KGaA, The Dow Chemical Company, 3M Company, H.B. Fuller, Dymax Corporation, Lord Corporation (Parker Hannifin), Sika AG, Delo Industrial Adhesives, Nitto Denko Corporation, Wacker Chemie AG, ThreeBond Holdings Co. Ltd., Cyberbond LLC, Kyoritsu Chemical, Master Bond Inc., Avery Dennison Corporation, Bostik (Arkema), Momentive Performance Materials, Shin-Etsu Chemical Co. Ltd., Cemedine Co. Ltd., Permabond Engineering Adhesives. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Camera Module Assembly Adhesives Market Key Technology Landscape

The technology landscape of the Camera Module Assembly Adhesives Market is characterized by continuous innovation focused on optimizing production speed, precision, and long-term durability. A central technological pillar is active alignment, a manufacturing process where the lens and image sensor are mechanically aligned in six degrees of freedom while monitoring the live image quality, and then permanently fixed using a fast-curing adhesive. This process necessitates specialized adhesives, primarily UV-curing epoxies or acrylics, that can be dispensed with sub-micron accuracy, offer quick "snap cure" upon UV exposure to freeze the alignment, and exhibit minimal post-cure shrinkage or movement (creep), ensuring the optical system remains stable throughout its operational life. The performance limitations of traditional passive alignment methods are driving the mass adoption of active alignment, thereby amplifying the demand for high-modulus, low-shrinkage photocurable materials.

Another crucial technological development involves dual-curing systems. These adhesives typically combine a primary UV cure mechanism for initial rapid fixturing during the active alignment process, followed by a secondary thermal or moisture cure to achieve the final, robust mechanical properties and high glass transition temperature (Tg). Dual-curing is especially vital for camera modules subjected to harsh environments, such as those in automotive or industrial applications, as the secondary cure significantly enhances resistance to thermal cycling, humidity, and vibration. Furthermore, the push towards miniaturization necessitates advancements in dispensing technology and corresponding adhesive rheology. Adhesives must be formulated to maintain a stable viscosity profile under high-speed dispensing pressures and across varying temperatures, preventing tailing or stringing that could contaminate adjacent optical surfaces.

The integration of advanced filler technology represents a key area of technical differentiation. To address the thermal challenges posed by high-resolution sensors and proximity to heat-generating processors (especially in ADAS and multi-camera phone modules), formulators are incorporating fine-grade, electrically non-conductive fillers like specialized alumina or boron nitride to impart thermal conductivity to the adhesive. Simultaneously, the market is seeing increased utilization of advanced light-filtering pigments and dyes within the adhesive formulations to block stray light or reduce crosstalk between sensors in adjacent camera modules, a critical requirement for complex multi-array systems. The technology focus remains on achieving the trifecta of ultra-precision, high-speed manufacturability, and superior long-term environmental reliability.

Regional Highlights

The market dynamics of camera module assembly adhesives show distinct regional characteristics driven by manufacturing concentration, technological adoption, and regulatory frameworks.

- Asia Pacific (APAC): APAC is the global manufacturing powerhouse for consumer electronics, dominating both production volume and consumption of assembly adhesives. Countries like China, South Korea, Taiwan, and Japan host the world’s largest camera module assembly houses and smartphone OEMs. The market here is characterized by extremely high volumes, competitive pricing, and rapid technological turnover, demanding fast-curing, cost-effective, yet highly precise adhesives suitable for billions of smartphone camera units annually. This region will maintain its leadership due to sustained growth in domestic electronics consumption and the expansion of automotive manufacturing bases.

- North America: North America is defined by high technological innovation and significant demand from the automotive sector, particularly in the development and early adoption of autonomous vehicle technology (L4 and L5). The adhesive requirements here are centered on high reliability, thermal stability, and adherence to rigorous standards for military, aerospace, and high-end industrial vision systems. The region drives the demand for premium, custom-formulated adhesives, often pioneering the use of advanced dual-curing and low-outgassing formulations.

- Europe: Similar to North America, the European market is heavily influenced by the robust automotive industry and stringent safety regulations (e.g., Euro NCAP mandates for ADAS), leading to high demand for specialized, certified adhesives. Germany, France, and the UK are key markets. Furthermore, Europe has a strong presence in industrial automation and advanced medical device manufacturing, requiring biocompatible and specialized adhesives for demanding, low-volume applications.

- Latin America & Middle East and Africa (MEA): These regions represent emerging markets characterized primarily by the import of finished consumer electronics and, increasingly, localized assembly operations. While smaller in immediate market size, growth is driven by rising smartphone penetration and the nascent development of local automotive and security infrastructure. The focus often remains on standard, reliable adhesive products used in licensed manufacturing and assembly.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Camera Module Assembly Adhesives Market.- Henkel AG & Co. KGaA

- The Dow Chemical Company

- 3M Company

- H.B. Fuller

- Dymax Corporation

- Lord Corporation (Parker Hannifin)

- Sika AG

- Delo Industrial Adhesives

- Nitto Denko Corporation

- Wacker Chemie AG

- ThreeBond Holdings Co. Ltd.

- Cyberbond LLC

- Kyoritsu Chemical

- Master Bond Inc.

- Avery Dennison Corporation

- Bostik (Arkema)

- Momentive Performance Materials

- Shin-Etsu Chemical Co. Ltd.

- Cemedine Co. Ltd.

- Permabond Engineering Adhesives

Frequently Asked Questions

Analyze common user questions about the Camera Module Assembly Adhesives market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary adhesive technologies used in active alignment for camera modules?

The primary technologies are UV-curable adhesives, predominantly specialized epoxies and acrylics. These materials offer rapid curing (snap cure) upon UV exposure, enabling sub-micron precision alignment to be instantly locked in place, crucial for high-speed manufacturing lines in consumer electronics.

Why is low outgassing capacity critical for camera module adhesives?

Low outgassing is critical because volatile organic compounds (VOCs) released by the adhesive during or after curing can condense on the image sensor or lens surfaces. This contamination degrades optical clarity, leading to image hazing, poor performance, and eventual product failure, making low-VOC/outgassing formulations mandatory.

How does the automotive sector drive specific adhesive requirements?

The automotive sector demands adhesives with superior thermal stability (resistance to -40°C to 125°C+ extremes), high vibration dampening, and moisture resistance, typically requiring specialized dual-curing or high-reliability epoxy systems that are often certified to AEC-Q100 standards for long-term operational reliability in ADAS components.

Which type of adhesive holds the largest market share by volume?

Epoxy-based adhesives, particularly those tailored for UV curing, generally hold the largest market share by volume due to their versatility, excellent mechanical strength, low shrinkage profile, and suitability for the massive production volumes required by the mobile phone industry.

What are dual-curing adhesives and why are they gaining prominence?

Dual-curing adhesives use two curing mechanisms (e.g., UV for rapid initial fixturing and thermal/moisture for final cure). They are gaining prominence because they combine the manufacturing speed necessary for high-throughput assembly with the robust mechanical and thermal performance required for high-reliability applications like automotive and security surveillance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager