Camera Module Assembly Glue Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431366 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Camera Module Assembly Glue Market Size

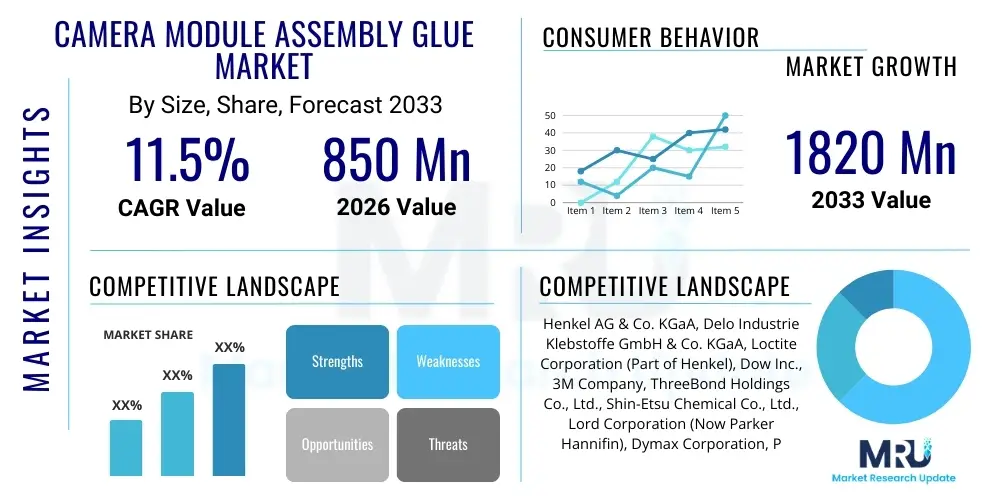

The Camera Module Assembly Glue Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $850 Million in 2026 and is projected to reach $1820 Million by the end of the forecast period in 2033.

Camera Module Assembly Glue Market introduction

The Camera Module Assembly Glue Market encompasses specialized adhesive materials crucial for the precise and durable integration of various components within compact camera modules, utilized predominantly in consumer electronics, automotive vision systems, and medical imaging devices. These adhesives, often UV-curing or thermal-curing epoxies, acrylics, and silicones, are designed to meet stringent optical, thermal, and mechanical stability requirements, ensuring optimal performance and longevity of sophisticated imaging systems. The primary function of these glues includes lens barrel fixation, sensor bonding, and overall module sealing against environmental factors such as moisture and dust, requiring materials that exhibit low volatile organic compounds (VOCs) and minimal shrinkage to maintain the high precision required for micron-level alignment.

Product descriptions within this market segment are highly technical, focusing on rheology, curing speed, coefficient of thermal expansion (CTE), and glass transition temperature (Tg). The evolution of mobile imaging, particularly the trend toward multi-lens systems and periscope camera designs in smartphones, has intensified the demand for advanced assembly glues that offer rapid processing speeds necessary for high-volume manufacturing while maintaining superior bonding strength and minimal outgassing. Furthermore, the adhesives must be capable of withstanding the rigorous reflow soldering processes common in electronics manufacturing without compromising structural integrity or optical clarity, which is paramount for high-resolution imaging quality.

Major applications driving market expansion include the smartphone sector, where camera specifications are a key differentiator; the burgeoning automotive industry, leveraging camera modules for Advanced Driver Assistance Systems (ADAS) and autonomous driving; and security and surveillance systems requiring robust, tamper-proof assemblies. The core benefits delivered by high-performance camera module assembly glues include enhanced optical alignment stability, superior shock and vibration resistance, miniaturization enablement, and improved manufacturing throughput. The market's growth is fundamentally driven by the escalating global demand for high-resolution imaging across various end-use industries, coupled with advancements in adhesive chemistry leading to products optimized for extremely thin and complex module geometries.

Camera Module Assembly Glue Market Executive Summary

The Camera Module Assembly Glue Market is positioned for robust expansion, primarily propelled by global technological shifts favoring embedded vision and high-fidelity imaging, evidenced by the proliferation of multi-camera arrays in consumer devices and the rapid adoption of LiDAR and vision systems in the automotive sector. Key business trends include aggressive vertical integration by adhesive manufacturers seeking to tailor solutions directly to leading Original Equipment Manufacturers (OEMs) specifications, focusing on ultra-low-shrinkage materials and specialized formulations compatible with next-generation sensing technologies, such as Time-of-Flight (ToF) sensors. Furthermore, sustainability and regulatory compliance, particularly concerning halogen-free and low-VOC formulations, are becoming critical competitive factors, shifting R&D investments toward greener chemistries.

Regional trends indicate that the Asia Pacific (APAC) region, dominated by major electronics manufacturing hubs in China, South Korea, Taiwan, and Japan, remains the epicenter of demand and innovation, accounting for the largest market share due to its massive smartphone production capacity and the concentration of leading component suppliers. North America and Europe, while smaller in volume, exhibit strong growth in high-value applications, specifically within the premium automotive ADAS segment and sophisticated industrial machine vision sectors, where reliability and extreme temperature performance are non-negotiable requirements. Manufacturers are strategically expanding their global footprint to optimize supply chain resilience and proximity to key assembly plants, particularly in emerging manufacturing geographies within Southeast Asia.

Segmentation trends highlight the dominance of UV-curing adhesives due to their rapid processing capabilities, aligning perfectly with high-volume production cycles. However, the thermal-curing segment is gaining traction in applications demanding exceptionally high heat resistance, particularly in under-the-hood automotive camera systems. From an application perspective, the smartphone segment commands the largest revenue share, though the automotive segment is projected to exhibit the highest Compound Annual Growth Rate (CAGR), driven by the transition from luxury-feature installation to standard safety equipment, requiring high-reliability adhesives certified for harsh operating conditions. The ongoing pursuit of smaller pixel sizes and increased lens elements necessitates continuous innovation in adhesive dispensing and curing technologies to ensure micron-level accuracy.

AI Impact Analysis on Camera Module Assembly Glue Market

User queries regarding the impact of Artificial Intelligence (AI) on the Camera Module Assembly Glue Market predominantly revolve around two central themes: how AI-driven image processing necessitates higher camera module integrity and how AI can optimize the adhesive manufacturing and application processes themselves. Users frequently ask about the correlation between advanced sensor data (used by AI algorithms in autonomous vehicles or smart manufacturing) and the physical stability requirements of the components, recognizing that any drift or misalignment, even minor, can drastically compromise AI effectiveness. Concerns also focus on whether AI-powered quality control systems during module assembly will mandate even tighter tolerances for adhesive performance, necessitating ultra-precise formulations and dispensing systems. Furthermore, there is significant interest in how machine learning could be applied to predict adhesive failure under various operational stresses (thermal cycling, vibration), thereby guiding material selection and product longevity guarantees.

- AI algorithms require extremely stable and distortion-free input data, driving demand for assembly glues with near-zero volumetric shrinkage to maintain lens alignment stability over the product lifecycle.

- Integration of AI-driven vision systems in high-end industrial automation increases the addressable market for industrial-grade, ruggedized camera module adhesives.

- Machine learning is being deployed by adhesive manufacturers to optimize formulation chemistry, predicting performance characteristics (e.g., UV-curing depth, adhesion strength, CTE) based on material composition inputs.

- AI-enabled quality inspection systems during camera module assembly enforce stricter adhesive application tolerances, reducing waste and demanding more consistent product rheology from suppliers.

- The rise of AI in edge computing for autonomous devices requires adhesives that are thermally stable to handle increased heat generated by onboard processing units adjacent to the camera module.

- Predictive maintenance models based on AI output necessitate highly durable adhesives capable of providing reliable performance guarantees over extended operational periods without optical degradation.

DRO & Impact Forces Of Camera Module Assembly Glue Market

The market is primarily driven by the exponential growth in multi-camera setups in smartphones and the mandated integration of high-reliability vision systems in automotive platforms (Drivers), while facing challenges related to the complexity of dispensing ultra-fine volumes with precision and the strict optical clarity requirements that limit material choice (Restraints). Opportunities abound in the development of hybrid curing mechanisms (UV and moisture/thermal) to speed up assembly lines and in tailoring specific solutions for emerging applications like Augmented Reality (AR) glasses and sophisticated medical endoscopy cameras. The key Impact Forces include the rapid pace of miniaturization, demanding smaller adhesive dots with higher bonding strength, and intense pricing pressure from Chinese manufacturers in the commodity segments, which necessitates product differentiation based on specialized performance characteristics and proprietary chemistries. The balance between faster production cycles and non-compromising optical quality remains the central dynamic shaping market competition and innovation trajectories.

Segmentation Analysis

The Camera Module Assembly Glue Market is segmented based on critical technical and application parameters, providing a detailed view of market structure and growth opportunities across diverse end-use sectors. Key technical segmentation is defined by the chemical composition and curing mechanism of the adhesive, which directly correlates with the required speed of assembly and the operational environment of the finished module. Application segmentation clearly delineates the massive volume consumption areas, such as consumer electronics, from the high-value, high-reliability sectors like automotive and industrial machine vision. Understanding these segments is crucial for strategic planning, as R&D investment must align with the specific performance requirements—optical clarity for consumer cameras versus thermal and vibration resistance for automotive applications. The convergence of these segments is increasingly evident as advanced features like OIS (Optical Image Stabilization) migrate from high-end smartphones to mid-range devices, driving volume demand for sophisticated, fast-curing adhesives across broader product lines.

- By Product Type:

- UV Curing Adhesives (Dominant segment due to fast processing)

- Thermal Curing Adhesives (Used for high heat resistance)

- Moisture Curing Adhesives

- Dual Curing Adhesives (Hybrid systems)

- By Application:

- Smartphones and Tablets

- Automotive (ADAS, Cabin Monitoring)

- Industrial and Machine Vision

- Security and Surveillance

- Medical Imaging

- Consumer Electronics (excluding phones, e.g., Drones, AR/VR)

- By Chemistry:

- Epoxies

- Acrylate/Acrylics

- Silicones

- Polyurethanes

Value Chain Analysis For Camera Module Assembly Glue Market

The value chain for the Camera Module Assembly Glue Market starts with Upstream Analysis, dominated by chemical and polymer raw material suppliers (such as specialized resin, photoinitiator, and monomer producers). These suppliers dictate the basic cost structure and the purity levels of the chemical inputs, which are critical for achieving the optical properties required by the final adhesive. Leading adhesive formulators (the manufacturers) then convert these raw materials into highly specialized, proprietary formulations, focusing heavily on R&D to optimize parameters like viscosity, thixotropy, and curing profiles, often working closely with dispensing equipment manufacturers to ensure application compatibility. The integration here is crucial, as the adhesive performance is inextricably linked to the dispensing technology used in high-speed assembly lines.

The Midstream component involves the distribution channels, which are bifurcated into Direct and Indirect sales. Direct sales are common when dealing with Tier 1 camera module manufacturers and major OEMs (like Samsung, LG Innotek, Foxconn) where highly customized formulations or technical support necessitate direct communication between the adhesive supplier and the end-user engineering team. Indirect channels involve authorized distributors and specialized chemical handlers who manage inventory and logistics for smaller assembly houses or companies requiring standard, off-the-shelf products. The technical expertise required to handle and store these specialized chemical products (often requiring temperature control) makes distributor selection a critical part of maintaining product quality through the supply chain.

Downstream analysis focuses on the end-users: the Camera Module Assemblers (CMAs), who are the immediate buyers, and the large OEMs (Apple, Tesla, Bosch) who specify the adhesive requirements for their product designs. The adhesives are integrated into the final camera module assembly, which is then sold to the final product manufacturers (e.g., smartphone companies, automotive Tier 1 suppliers). The complexity of the assembly process—which includes active alignment and precise UV exposure—means that the adhesive selection is heavily influenced by the manufacturing environment and quality control mandates of these downstream buyers. The market exhibits strong supplier-customer stickiness due to the lengthy and costly qualification process required for any adhesive change in high-reliability applications.

Camera Module Assembly Glue Market Potential Customers

The primary potential customers and end-users of Camera Module Assembly Glues are sophisticated manufacturing entities requiring precision bonding solutions for high-volume or high-reliability optical assemblies. The most significant customer base resides within the consumer electronics manufacturing ecosystem, particularly companies specializing in fabricating multi-lens camera modules for smartphones, tablets, and wearable technologies. These customers demand adhesives that facilitate rapid curing and possess superior optical properties while conforming to strict space and weight limitations. The continuous innovation cycle in consumer devices ensures persistent demand for next-generation, improved adhesive solutions capable of handling increasingly complex module designs, such as folding optics and ultra-thin form factors.

Another major customer segment is the automotive sector, encompassing Tier 1 suppliers like Continental, Aptiv, and Magna, as well as vehicle OEMs themselves (e.g., Tesla, BMW, Toyota). These customers utilize camera module assembly glues for ADAS systems (front-facing, surround-view, and driver monitoring cameras). The adhesive requirements here are stringent, focusing on resilience against extreme temperatures, high humidity, mechanical shock, and long-term durability (often exceeding 10 years). Qualification cycles are significantly longer in the automotive sector, leading to strong, established relationships between adhesive suppliers and qualified automotive component manufacturers.

Furthermore, the industrial and medical imaging sectors represent high-margin, albeit lower-volume, customer bases. Industrial customers, primarily in machine vision, require adhesives that can withstand industrial solvents and intense vibration. Medical device manufacturers, specializing in endoscopy and surgical imaging tools, prioritize biocompatibility, non-outgassing properties, and reliability for sterilization procedures. These customers often seek highly specialized, custom formulations that meet unique regulatory compliance standards (such as ISO 10993 for medical applications), presenting a distinct market opportunity for specialized adhesive providers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 Million |

| Market Forecast in 2033 | $1820 Million |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Henkel AG & Co. KGaA, Delo Industrie Klebstoffe GmbH & Co. KGaA, Loctite Corporation (Part of Henkel), Dow Inc., 3M Company, ThreeBond Holdings Co., Ltd., Shin-Etsu Chemical Co., Ltd., Lord Corporation (Now Parker Hannifin), Dymax Corporation, Permabond Engineering Adhesives, Sika AG, Cyberbond LLC, Kyoritsu Chemical Co., Ltd., Nitto Denko Corporation, Momentive Performance Materials Inc., Master Bond Inc., ITW Performance Polymers, Panacol-Elosol GmbH, Aremco Products Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Camera Module Assembly Glue Market Key Technology Landscape

The technology landscape in the Camera Module Assembly Glue Market is defined by the ongoing pursuit of non-contact dispensing accuracy, faster curing mechanisms, and advanced material chemistries tailored for optical precision. A cornerstone technology is the development of next-generation photoinitiators that enable ultra-fast, deep-curing of UV adhesives, crucial for maintaining high throughput in manufacturing lines without compromising the bond line integrity. This speed is vital as assembly lines process millions of modules monthly. Furthermore, the industry is increasingly adopting specialized single-component, thixotropic epoxies and acrylics formulated for minimal ionic contamination and extremely low shrinkage (often below 0.1%), addressing the stringent requirements of high-resolution sensors and ensuring micron-level alignment stability post-cure.

Significant technological advancements are also observed in Dual-Curing adhesives, which combine initial UV fixation (for rapid alignment stability) followed by secondary thermal or moisture curing (for maximizing long-term mechanical strength and ensuring cure in shadow areas). This hybrid approach is essential for complex camera modules featuring multiple overlapping components where UV light exposure is uneven. Dispensing technology forms a parallel critical landscape, with manufacturers increasingly relying on jetting systems and piezo-driven valves rather than traditional needle dispensing. Jetting allows for the precise, non-contact deposition of very small dots (micro-liter to nano-liter range) of highly viscous adhesive, minimizing material waste and enhancing assembly speed and accuracy, which is non-negotiable for ultra-miniaturized lens barrel fixation.

The integration of materials capable of passive alignment is also a key technological focus, utilizing thermally or chemically reactive fillers that help self-align components during the curing process, further reducing the reliance on costly and time-consuming active alignment machinery. Finally, addressing the thermal management challenges posed by densely packed electronic components is driving innovation in thermally conductive, yet electrically insulating, adhesives. These specialized materials dissipate heat generated by the image processor and sensor without interfering with the optical path, ensuring stable image quality even under heavy load, particularly relevant for ADAS and high-performance computing applications.

Regional Highlights

Asia Pacific (APAC): APAC stands as the dominant global market for Camera Module Assembly Glue, driven by the massive concentration of consumer electronics manufacturing hubs, particularly in China, South Korea, Taiwan, and Japan. This region is home to the world’s largest smartphone assemblers and camera module manufacturers (CMAs) like LG Innotek, Samsung Electro-Mechanics, and numerous Chinese module makers. The market demand here is characterized by high volume, rapid technological cycles, and intense cost competition, necessitating continuous innovation in high-speed, UV-curing adhesive formulations to maximize production throughput. Furthermore, the increasing adoption of electric vehicles (EVs) in China, coupled with local development of ADAS technology, is rapidly boosting the high-reliability segment of the adhesive market, moving beyond just consumer devices.

The technological ecosystem in APAC fosters strong collaboration between domestic adhesive suppliers and local CMAs, leading to fast iteration of product formulations customized for specific assembly equipment and module designs. South Korea and Japan continue to be leaders in advanced chemical research, contributing high-performance materials for optical stabilization and sensor bonding. The market is witnessing a shift towards dual-curing solutions to accommodate the shadow-area curing required by sophisticated multi-lens arrangements, solidifying APAC’s role as both the primary consumer and the key innovator in assembly glue technology.

North America: North America represents a mature yet high-value market segment, primarily driven by strong demand from specialized high-tech sectors, including advanced automotive R&D, military/defense applications, and high-performance industrial machine vision systems. While not a high-volume manufacturing center for consumer devices, the region hosts major automotive OEMs and Tier 1 suppliers that focus heavily on sensor fusion and autonomous vehicle development. Consequently, the demand here is concentrated on premium, highly regulated adhesives that offer validated reliability under extreme environmental conditions, often requiring compliance with ISO/TS 16949 standards and rigorous thermal cycling certifications.

The market growth in North America is less about unit volume and more about value, with a focus on custom formulations tailored for LiDAR systems, complex optical assemblies for aerospace, and specialized medical imaging equipment. Adhesive suppliers in this region emphasize R&D in novel materials with superior mechanical shock resistance and minimal outgassing, aligning with the quality-over-quantity ethos prevalent in these critical applications. The presence of leading technology companies involved in AR/VR and professional drone manufacturing also ensures a steady demand for cutting-edge, lightweight bonding solutions.

Europe: The European market is characterized by robust demand from the established premium and luxury automotive sector, particularly in Germany and France, where stringent safety regulations accelerate the adoption of ADAS features requiring multiple high-quality camera modules. European industrial automation and machine vision sectors are also significant consumers, demanding highly durable and chemically resistant adhesives for use in demanding factory environments. Sustainability regulations, such as REACH compliance, heavily influence material selection in Europe, driving adhesive manufacturers toward eco-friendly, low-VOC, and halogen-free formulations, often ahead of other regions.

Furthermore, European R&D centers focus on precision engineering, leading to a demand for advanced metering and dispensing equipment that complements the specialized glues. The market exhibits slow but steady growth, prioritized by product reliability and longevity over pure speed or lowest cost. Suppliers must navigate complex certification processes and often provide comprehensive technical support to meet the exacting quality standards set by major European manufacturers, such as Bosch, Continental, and major car makers, ensuring high barriers to entry for uncertified or lower-quality adhesive producers.

Latin America (LATAM): The LATAM market remains nascent in terms of camera module manufacturing, with demand primarily being satisfied through imports of finished electronic devices and components assembled elsewhere, mainly from APAC. However, the region is experiencing gradual growth in local vehicle assembly and increasing penetration of surveillance and security systems, creating localized pockets of demand for camera module glues. The market is highly price-sensitive, often preferring cost-effective, readily available adhesive solutions. Brazil and Mexico, due to their large domestic manufacturing bases for electronics assembly and automotive parts, represent the key growth opportunities within this region.

Adhesive distributors play a crucial role in the LATAM supply chain, providing localized inventory and technical support for smaller assembly houses that lack direct relationships with global adhesive manufacturers. Future growth is strongly linked to foreign direct investment in electronics manufacturing and the domestic regulatory push for vehicle safety features, which would require locally supplied and certified assembly materials. Currently, the market segment focuses heavily on standard UV and epoxy formulations used in mid-to-low-range consumer devices and simpler security cameras.

Middle East and Africa (MEA): The MEA market is the smallest in global terms, characterized by highly fragmented demand driven mainly by infrastructure development, security requirements, and slow domestic electronics assembly growth. Demand for camera module adhesives is predominantly linked to large-scale surveillance projects (smart cities, oil and gas facilities) and the burgeoning automotive repair and maintenance sector. Gulf Cooperation Council (GCC) countries exhibit high demand for advanced surveillance systems, necessitating adhesives optimized for extreme high-temperature performance due to the harsh desert climate conditions.

Market penetration relies heavily on international distributors and third-party system integrators who source and utilize high-reliability glues. While electronics assembly volume is low, the requirement for robust performance in challenging environmental conditions (heat, dust) drives the demand for specialized silicone and thermal-curing epoxies designed for ruggedization. The long-term growth prospects are tied to national strategies aimed at diversifying economies and establishing local high-tech assembly capabilities, though significant R&D investment in this region is currently minimal, relying heavily on products developed and qualified in North America and Europe.

- Asia Pacific (APAC): Dominant market, driven by smartphone volume and EV/ADAS growth; epicenter of manufacturing and rapid curing adhesive innovation.

- North America: High-value market focused on specialized ADAS, LiDAR, aerospace, and medical imaging applications; demand for ultra-reliable, certified adhesives.

- Europe: Strong demand from premium automotive and industrial machine vision; high emphasis on sustainability (REACH compliance) and highly durable materials.

- Latin America (LATAM): Emerging, price-sensitive market centered in Brazil and Mexico; growth tied to local vehicle assembly and imported component repair/assembly.

- Middle East and Africa (MEA): Smallest segment; demand focused on high-reliability, extreme-temperature resistant adhesives for security and industrial infrastructure projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Camera Module Assembly Glue Market.- Henkel AG & Co. KGaA

- Delo Industrie Klebstoffe GmbH & Co. KGaA

- Dow Inc.

- 3M Company

- ThreeBond Holdings Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Dymax Corporation

- Permabond Engineering Adhesives

- Sika AG

- Kyoritsu Chemical Co., Ltd.

- Nitto Denko Corporation

- Momentive Performance Materials Inc.

- Lord Corporation (Parker Hannifin)

- Master Bond Inc.

- Huntsman Corporation

- Cyberbond LLC

- Panacol-Elosol GmbH

- Bostik (Arkema Group)

- M.G. Chemicals

- Aremco Products Inc.

Frequently Asked Questions

Analyze common user questions about the Camera Module Assembly Glue market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of assembly glue in a camera module?

The primary function is achieving and maintaining precise micron-level alignment between optical components, such as the lens barrel and image sensor (CMOS/CCD), ensuring optimal image quality and structural integrity against shock, vibration, and thermal cycling throughout the device's operational life. It also provides hermetic sealing against contaminants.

Which adhesive chemistry dominates the Camera Module Assembly Glue Market?

UV Curing Acrylates and Epoxies currently dominate the market, primarily due to their ability to cure rapidly (in seconds) upon exposure to UV light. This rapid curing mechanism is essential for maintaining the high throughput and speed required by large-scale consumer electronics manufacturing lines, especially for smartphone camera modules.

How does miniaturization impact the demand for camera module adhesives?

Miniaturization drives demand for glues with ultra-low volumetric shrinkage (less than 0.1%) and the capability to be accurately dispensed in nano-liter volumes. These materials must maintain high bond strength even with extremely small bond lines, ensuring that the alignment of shrinking components remains stable despite tighter packing densities and increased thermal load.

What are the key differences between adhesive requirements for smartphones and automotive cameras?

Smartphone adhesives prioritize rapid cure speed and optical clarity, while automotive adhesives prioritize extreme thermal stability (withstanding temperatures from -40°C to 150°C), superior resistance to environmental contaminants (moisture, oil), and long-term reliability (10+ years), often necessitating specialized thermal-curing epoxies or high-performance silicones.

What role does dual curing technology play in camera module assembly?

Dual curing (e.g., UV followed by thermal or moisture curing) is crucial for complex modules where UV light cannot penetrate all bonding areas, particularly in multi-lens or stacked designs. The initial UV cure provides rapid fixturing for alignment, while the secondary cure ensures complete hardening of the adhesive in shadowed areas, guaranteeing long-term mechanical stability and reliability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager