Camera Rental Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431515 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Camera Rental Service Market Size

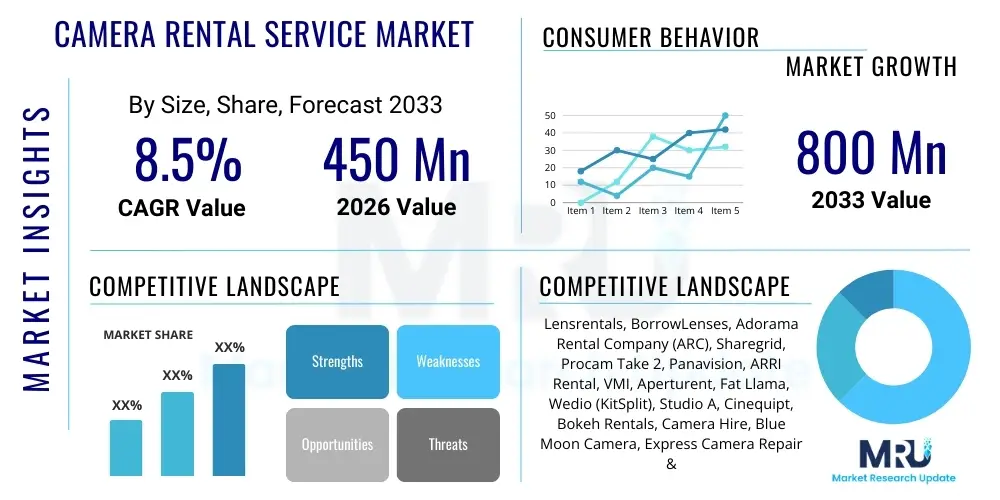

The Camera Rental Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. This robust expansion is fueled by the rising demand for high-quality production content, increased adoption of subscription-based rental models, and the prohibitive cost of purchasing and maintaining cutting-edge professional camera equipment. The cyclical nature of technology upgrades, particularly in cinema and high-definition broadcasting, further stimulates the rental sector as professionals seek temporary access to the latest gear without long-term capital commitment.

The market is estimated at USD 450 Million in 2026, driven primarily by strong demand from independent filmmakers, digital content creators, and corporate media departments. The growth trajectory reflects a continued shift away from outright ownership towards flexible usage models, allowing production houses and freelancers to stay competitive by accessing specialized lenses, lighting, and camera bodies tailored for specific projects, ranging from small commercial shoots to large feature films. This flexibility is a significant economic advantage.

The Camera Rental Service Market is projected to reach USD 800 Million by the end of the forecast period in 2033. Key factors underpinning this significant growth include geographic expansion into emerging markets, where local production capabilities are rapidly developing, and the integration of advanced logistics and inventory management systems by major rental providers. Furthermore, the increasing popularity of streaming services and the subsequent massive output of original content globally necessitate a continuous and flexible supply of high-end camera systems, solidifying the market's long-term potential.

Camera Rental Service Market introduction

The Camera Rental Service Market encompasses businesses that provide temporary access to a wide array of photographic and cinematographic equipment, including camera bodies, lenses, lighting, grip equipment, and essential accessories, typically for a fixed duration and fee. This service model addresses the critical need for professionals, hobbyists, and production companies to utilize specialized, expensive, and often rapidly evolving technology without incurring the massive capital expenditure associated with purchasing and maintaining such equipment. The primary product scope extends from high-resolution DSLR and mirrorless cameras suitable for still photography to professional-grade cinema cameras (like ARRI and RED systems) essential for commercial filmmaking and television production.

Major applications of camera rental services span commercial and independent filmmaking, corporate video production, professional photography (including wedding, fashion, and commercial product photography), live event broadcasting, and educational purposes. The flexibility offered by rental services allows users to select the precise tool necessary for a specific creative vision or technical requirement, ensuring optimal output quality regardless of the project scale. Key benefits include cost efficiency, access to the latest technological advancements (such as 8K resolution cameras or specialized anamorphic lenses), reduced maintenance burden, and the logistical ease of scaling equipment needs up or down based on project timelines and budgets.

Driving factors propelling this market include the global proliferation of digital content creation, especially on platforms like YouTube, Netflix, and TikTok, which continually increases the demand for high-quality video assets. The high depreciation rate of specialized camera gear makes rental an economically viable alternative for users sensitive to technological obsolescence. Furthermore, the rise of collaborative platforms and peer-to-peer rental models has expanded equipment accessibility, catering specifically to the fast-paced, project-based workflow characteristic of the modern creative industries, ensuring sustained market expansion throughout the forecast period.

Camera Rental Service Market Executive Summary

The Camera Rental Service Market is experiencing robust expansion, driven by converging business trends, including the proliferation of Over-The-Top (OTT) streaming platforms demanding continuous high-end content, and the subsequent growth in independent production houses and freelance creative professionals globally. Business trends highlight a strong movement towards digitization of inventory management, offering streamlined online booking and enhanced logistical support, significantly improving the customer experience. Furthermore, the integration of advanced insurance and verification processes has reduced operational risks for rental providers, encouraging investment in higher-value equipment like specialized cinema rigs and emerging technologies such as virtual production hardware. The market structure is evolving, with major cinema equipment providers maintaining dominance in the high-end segment, while peer-to-peer platforms gain traction in the prosumer and entry-level professional segments, fostering a hybrid competitive landscape.

Regionally, North America and Europe remain the dominant markets due to the concentration of major film studios, large advertising agencies, and well-established media infrastructure, alongside high rates of technological adoption and disposable income dedicated to media production. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate, driven by booming local film industries in India, China, and South Korea, coupled with rapidly expanding digital marketing and corporate media sectors. Regional differentiation is also visible in product preferences; Western markets show high demand for specialized lenses and drone rentals, whereas APAC is witnessing significant growth in accessible, high-quality mirrorless and video camera rental for localized content creation and educational purposes. Infrastructure development related to logistics and secure handling of sensitive equipment is a key determinant of success in emerging markets.

Segment trends reveal that the Cinema Cameras and Lenses segment holds the largest market share by value, reflecting the high cost and indispensable nature of these assets for feature film and high-budget television production. The Application segment is dominated by Filmmaking & Production, though Photography and Events & Live Streaming are demonstrating substantial growth, fueled by corporate demands for high-quality virtual and hybrid event coverage. By duration, Short-Term Rental continues to lead, catering to project-based demands, but Long-Term Rental and flexible subscription models are increasingly attractive to smaller production companies seeking predictable monthly budgeting and guaranteed equipment availability, signaling a diversification in service offerings aligned with client operational needs.

AI Impact Analysis on Camera Rental Service Market

Common user questions regarding AI's impact on the Camera Rental Service Market frequently revolve around how AI can enhance the user experience, optimize inventory management, and potentially affect the types of equipment needed. Users often inquire if AI-powered diagnostics can reduce equipment downtime, improve predictive maintenance schedules, and personalize equipment recommendations based on project metadata. Concerns also focus on whether AI tools, such as automated color grading or enhanced post-production software, might reduce the perceived need for highly specialized camera bodies or lenses, thus altering rental demand. The prevailing expectation is that AI will primarily serve as a powerful operational tool, revolutionizing back-end processes like demand forecasting and logistics, while also introducing new technical requirements for rental equipment to be compatible with advanced AI-driven workflows, thereby requiring ongoing fleet upgrades.

The integration of Artificial Intelligence primarily affects the operational efficiency and customer interfacing aspects of the camera rental ecosystem. AI algorithms are proving invaluable in analyzing historical rental data, customer profile information, and prevailing content production trends to forecast future demand for specific camera models or accessories with unprecedented accuracy. This predictive capability allows rental houses to optimize their purchasing decisions, reduce inventory holding costs, and ensure high availability of in-demand items, consequently minimizing lost revenue due to stock-outs. Furthermore, AI-driven customer service tools, such as intelligent chatbots and personalized recommendation engines, significantly enhance the efficiency of the booking process, guiding customers quickly towards the most suitable gear configurations for their project specifications, thereby improving overall customer satisfaction and retention rates in a highly competitive service environment.

Beyond logistics and customer management, AI is influencing the equipment lifecycle and maintenance protocols. AI-powered monitoring systems installed on high-end camera bodies and lenses can continuously analyze usage patterns, environmental conditions, and internal component performance to preemptively identify potential hardware failures. This shift from reactive to predictive maintenance minimizes unexpected equipment failures during a client's rental period, dramatically reducing operational disruption and repair costs. Moreover, AI is driving innovation in content production itself; for instance, specialized AI software requires high processing power, leading to increased demand for rental cameras and associated computing peripherals that are specifically certified for these demanding AI-enhanced post-production workflows, thus subtly altering the technical requirements that rental companies must meet in their fleet offerings.

- AI-driven Predictive Maintenance: Reduces equipment downtime by forecasting failures based on usage data.

- Optimized Inventory Management: Uses machine learning for precise demand forecasting, ensuring optimal stock levels for high-demand gear.

- Personalized Equipment Recommendation: AI algorithms analyze project requirements to suggest optimal camera and lens pairings, improving customer decision-making.

- Enhanced Fraud Detection: AI systems analyze rental history and user credentials to minimize the risk associated with high-value equipment transactions.

- Automated Pricing Models: Dynamic pricing adjustments based on real-time market demand, inventory levels, and competitor rates.

- Integration with Cloud Workflows: Cameras require compatibility and APIs for seamless integration into AI-enhanced cloud-based post-production pipelines.

- Efficiency in Logistics: AI optimizes routing and delivery schedules for equipment transport, particularly for complex, multi-location film productions.

- Rise of Computational Photography Tools: Requires rental services to include high-processing power computing units alongside traditional camera gear.

DRO & Impact Forces Of Camera Rental Service Market

The dynamics of the Camera Rental Service Market are characterized by significant Drivers (D), Restraints (R), and Opportunities (O), which collectively define the Impact Forces shaping its trajectory. The primary driver is the prohibitive acquisition cost and rapid obsolescence cycle of professional camera equipment, making renting the economically sensible choice for most users, complemented by the explosive growth in digital content platforms requiring high-definition visuals. Restraints include the inherent logistical complexities associated with shipping delicate, high-value electronics, coupled with high insurance liabilities and the necessity of rigorous quality control protocols to ensure equipment reliability. Significant opportunities arise from the expansion of flexible, subscription-based rental models and the untapped potential of emerging markets, particularly in Asia Pacific and Latin America, where local content production is escalating but capital access is limited. These internal and external factors create powerful impact forces that necessitate continuous innovation in logistics, inventory security, and customer service optimization to maintain competitive advantage.

Drivers primarily center on economic feasibility and technological access. The professional cinematography market frequently introduces new standards (e.g., 8K, specialized sensors, proprietary codecs), compelling production houses to rent short-term access to the latest gear rather than invest significant capital that depreciates quickly. The democratization of filmmaking, powered by affordable online distribution and the rise of independent content creators, further fuels this demand, as freelancers often lack the financial resources for permanent equipment ownership. The professionalization of marketing across all industries also drives corporate demand for high-quality video content, requiring temporary access to specialized production tools. Collectively, these factors reduce the friction associated with accessing professional tools, accelerating market volume growth.

Conversely, major restraints relate to operational risk and market barriers. Maintaining high-quality control standards for fragile equipment across numerous rentals is a major operational challenge and cost center, requiring continuous technical calibration and damage assessment. High capital investment is required for rental companies to maintain a cutting-edge inventory, which creates barriers to entry and increases fixed costs. Opportunities are centered on market expansion and strategic partnerships. The development of robust peer-to-peer (P2P) platforms, integrating sophisticated insurance and verification tools, opens new revenue streams by leveraging underutilized professional assets. Furthermore, tailoring rental packages specifically for fast-growing segments like drone cinematography and virtual reality production represents a strategic avenue for diversification and long-term growth.

Segmentation Analysis

The Camera Rental Service Market is meticulously segmented based on Equipment Type, Application, Duration, and End-User, allowing market participants to target specific niches with tailored service offerings. The segmentation by Type is critical as it dictates the rental value and associated logistical complexity, with specialized cinema cameras commanding significantly higher rates than standard DSLR bodies. Application segmentation helps service providers understand core demand drivers, noting that the logistical and support needs for a feature film crew differ vastly from those of a corporate event photographer. Analyzing these segments is essential for optimizing inventory allocation, setting dynamic pricing structures, and developing specialized insurance and support services that align precisely with end-user requirements, thereby maximizing market penetration and operational efficiency across the value chain.

Segmentation by Duration differentiates between short, high-value project rentals (typically 1-7 days) and long-term engagements (monthly or seasonal rentals), reflecting the varied operational models of customers, from freelance shooters to major production studios that require equipment continuity for extended periods. Furthermore, the End-User segmentation separates the high-volume, standardized needs of Business-to-Consumer (B2C) users (hobbyists, students, small creators) from the high-specification, specialized demands of Business-to-Business (B2B) clients (large production houses, corporations, and media agencies). The ongoing shift towards B2B subscription models demonstrates a strategic adjustment by rental companies to secure predictable, long-term revenue streams, contrasting the variability inherent in project-based B2C transactional rentals.

- By Type:

- DSLR Cameras

- Mirrorless Cameras

- Cinema Cameras (e.g., ARRI, RED)

- Action Cameras & 360 Cameras

- Video Cameras (Camcorders)

- Lenses (Prime, Zoom, Anamorphic, Specialty)

- Accessories (Grip, Lighting, Audio, Drones)

- By Application:

- Filmmaking & Production (Feature Films, Commercials)

- Photography (Commercial, Wedding, Fashion, Portrait)

- Events & Live Streaming (Concerts, Corporate Events)

- Media & Entertainment (Broadcast News, Documentaries)

- Education & Research

- By Duration:

- Short-Term Rental (Daily/Weekly)

- Long-Term Rental (Monthly/Seasonal)

- By End-User:

- Business-to-Business (B2B)

- Business-to-Consumer (B2C)

Value Chain Analysis For Camera Rental Service Market

The Value Chain for the Camera Rental Service Market begins with Upstream Analysis, which focuses primarily on procurement and inventory acquisition. Key upstream stakeholders include camera manufacturers (e.g., Canon, Sony, ARRI, RED) and specialized lens makers (e.g., Zeiss, Cooke). Rental companies engage in massive capital investments to purchase the latest equipment, often negotiating bulk purchase agreements and service contracts directly with manufacturers. The critical activities at this stage involve technological assessment, predicting future demand, and financing these expensive assets. Efficiency in the upstream segment dictates the quality and breadth of the inventory offered, directly influencing the rental company’s ability to cater to high-end professional productions requiring specific, often proprietary, equipment standards.

The Midstream component constitutes the core operational services: Inventory Management, Quality Control, and Logistics. Rigorous quality control, including regular calibration, cleaning, and preventative maintenance, is vital to ensure equipment reliability, which is a major differentiator in this market. Sophisticated IT systems manage booking, scheduling, and tracking of thousands of high-value items across multiple locations. Logistics involves secure packaging, insured transport, and efficient customs handling for cross-border rentals. This phase represents the highest operational cost, and excellence here is key to minimizing equipment downtime and maximizing customer satisfaction. The efficiency of internal processes dictates pricing structure and overall profitability.

Downstream Analysis involves the Distribution Channels and interaction with End-Users. Distribution is primarily managed through Direct Channels, where large rental houses operate their own physical storefronts and online booking platforms, providing specialized customer support and technical consultation. Indirect Channels include emerging P2P platforms (like Sharegrid or Fat Llama), which facilitate the rental of equipment owned by independent professionals. The proliferation of digital booking and centralized distribution hubs optimizes customer access. The final stage is post-rental processing, which includes technical inspection, damage assessment, and prompt return of security deposits, completing the value cycle and informing future inventory and pricing strategies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 800 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lensrentals, BorrowLenses, Adorama Rental Company (ARC), Sharegrid, Procam Take 2, Panavision, ARRI Rental, VMI, Aperturent, Fat Llama, Wedio (KitSplit), Studio A, Cinequipt, Bokeh Rentals, Camera Hire, Blue Moon Camera, Express Camera Repair & Rental, LVR, AbelCine, Production Outfitters |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Camera Rental Service Market Potential Customers

The Camera Rental Service Market targets a diverse spectrum of Potential Customers, primarily defined by their professional requirements, frequency of production, and budget constraints. The largest and most lucrative customer segment comprises high-end B2B clients, including major film studios, independent feature film production companies, and large advertising agencies. These entities require continuous access to specialized, high-cost cinema cameras, advanced lighting arrays, and proprietary lenses for extended project durations. Their decision-making process is heavily influenced by equipment reliability, technical support quality, and insurance coverage, often leading to long-term contractual relationships with established rental houses that can provide comprehensive, guaranteed service packages necessary for multi-million dollar productions.

A rapidly growing customer base includes corporate media departments, digital content creators, and small-to-medium enterprises (SMEs) that utilize video extensively for marketing and internal communications. These customers predominantly rent mirrorless and video cameras, along with standard prime and zoom lenses, typically on a short-term, transactional basis to meet specific campaign deadlines or event coverage needs. Their purchasing criteria prioritize ease of booking, competitive daily rates, and local accessibility. The rise of these decentralized content producers is a significant driver for peer-to-peer rental platforms, as it matches their flexible needs with locally available, lower-cost professional gear, democratizing access to high-quality production tools.

Furthermore, educational institutions (universities offering film and media programs), research organizations, and professional photographers specializing in niche markets (such as aerial, architectural, or wildlife photography) constitute secondary but stable customer groups. These users require specialized equipment, such as high-speed cameras, thermal imaging devices, or specialized telephoto lenses, which are rarely used enough to justify outright purchase. Their long-term demand stability provides a crucial baseline revenue stream for rental companies, especially those specializing in highly technical or esoteric equipment. Understanding the specific insurance, support, and documentation needs for each of these distinct customer profiles is paramount for strategic market positioning.

Camera Rental Service Market Key Technology Landscape

The technological landscape of the Camera Rental Service Market is characterized by a continuous evolution in both the equipment offered and the operational infrastructure supporting the service. Key technologies in the inventory itself include the ongoing adoption of high-resolution sensors (6K, 8K, and beyond), advanced global shutter technology in digital cinema cameras (ARRI Alexa, RED V-Raptor), and the proliferation of full-frame mirrorless systems (Sony Alpha, Canon EOS R) that offer cinema-grade features in smaller form factors. Rental companies must constantly upgrade their fleets to maintain relevancy, ensuring compatibility with the latest recording codecs and integration standards essential for professional post-production workflows. Furthermore, the technology of stabilized camera movement, particularly sophisticated gimbals (DJI Ronin, Freefly Systems) and professional camera drones, forms a rapidly evolving segment requiring specialized maintenance and compliance adherence.

Operationally, technology is revolutionizing inventory management and logistics. Rental companies are leveraging advanced Enterprise Resource Planning (ERP) and specialized asset tracking software that utilizes RFID, GPS, and IoT sensors to monitor the precise location, status, and usage history of every piece of equipment in real-time. This technology minimizes loss, optimizes cycle times between rentals, and facilitates rapid technical assessment upon return. Digital platforms are also incorporating sophisticated customer verification technologies and AI-powered fraud detection systems, crucial for mitigating the high financial risk associated with renting high-value electronics. This digital transformation is paramount for scaling operations efficiently and maintaining competitive pricing while mitigating operational exposure.

The emerging technological focus is on enhancing the rental experience through virtual and augmented tools. Some rental companies are beginning to use Virtual Reality (VR) platforms to allow clients to virtually inspect equipment setups, assess lens focal lengths, or visualize lighting rigs before booking, improving client confidence and reducing friction in the decision process. Data analytics and machine learning are deployed to refine predictive maintenance models, forecasting which components might fail based on aggregate operational data, thereby improving the reliability metric—a critical factor for production clients. Successfully integrating these high-tech operational tools with the latest camera hardware is necessary for maintaining a leadership position in this technologically demanding service market.

Regional Highlights

The global Camera Rental Service Market exhibits distinct regional dynamics driven by local media production ecosystems, economic factors, and digital consumption habits. North America, particularly the United States, remains the largest and most technologically advanced market, underpinned by Hollywood, the expansive commercial production industry, and the presence of major streaming platform headquarters. The demand here is characterized by high volume and a continuous need for bleeding-edge technology, specifically high-end cinema cameras, complex lens packages, and specialized grip equipment. Rental providers in this region excel in offering comprehensive logistics and highly specialized technical support services, necessary for large-scale, complex productions. The maturity of the P2P rental model is also highest here, reflecting a robust freelance creative economy.

Europe represents the second-largest market, characterized by diverse national film and television industries supported by strong public funding mechanisms (e.g., in the UK, France, and Germany). Demand is robust for both feature film equipment and corporate content creation, with a significant emphasis on sustainable and energy-efficient production gear, reflecting strong environmental, social, and governance (ESG) consciousness. The market structure is highly fragmented, featuring numerous specialized local rental houses alongside global giants. Cross-border rental logistics within the EU present both opportunities and regulatory hurdles, necessitating sophisticated legal and customs handling capabilities for providers operating across multiple member states. Key technology adoption focuses on high-quality broadcast and documentary equipment.

Asia Pacific (APAC) is projected to be the fastest-growing region. This explosive growth is fueled by rapid urbanization, massive investment in local content creation by global streaming services, and the burgeoning digital marketing industry across China, India, South Korea, and Southeast Asia. The demand profile is bifurcated: on one hand, there is immense demand for high-end cinema equipment for major local blockbusters (especially in Bollywood and Chinese cinema); on the other, there is widespread growth in accessible mirrorless and prosumer video camera rental to support the vast ecosystem of local social media influencers and small production crews. Challenges in APAC include fragmented logistics infrastructure and regulatory variation, which necessitate highly localized operational strategies and flexible equipment insurance models tailored to diverse market maturity levels.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging markets showing significant potential. LATAM growth is supported by expanding local television and film industries in countries like Brazil and Mexico, coupled with increasing international co-productions drawn by favorable filming locations and tax incentives. Equipment demand often focuses on reliable, mid-to-high-range professional gear that balances performance and cost. The MEA region, particularly the UAE and Saudi Arabia, benefits from significant government investment in media cities and large-scale entertainment projects, driving high-value demand for the latest cinema and broadcast technology, positioning these markets as crucial strategic hubs for global rental companies seeking geographic diversification. Logistical security and customs complexity are major regional considerations that influence operational cost and service delivery timelines.

- North America (US & Canada): Largest market share; high demand for cutting-edge cinema technology (8K, specialized lenses); mature P2P rental sector; focus on studio and commercial production.

- Europe (UK, Germany, France): Second largest market; strong presence of subsidized national film industries; high standards for technical maintenance and reliable logistics; emphasis on sustainable production gear.

- Asia Pacific (China, India, South Korea): Highest growth rate; driven by streaming service localization and massive domestic content production; dual demand for both high-end cinema and prosumer equipment; logistical complexity requires local partnerships.

- Latin America (Brazil, Mexico): Emerging growth market; increasing international co-productions; demand concentrated on mid-to-high-range professional video equipment; sensitive to economic volatility.

- Middle East and Africa (MEA): Strategic investment in media hubs (UAE); high-value projects driving demand for top-tier broadcast and cinema equipment; security and insurance are primary operational considerations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Camera Rental Service Market.- Lensrentals

- BorrowLenses (B&H Photo Video)

- Adorama Rental Company (ARC)

- Sharegrid

- Procam Take 2

- Panavision

- ARRI Rental

- VMI

- Aperturent

- Fat Llama

- Wedio (Acquired KitSplit)

- AbelCine

- Cinequipt

- Bokeh Rentals

- Camera Hire

- Blue Moon Camera

- Express Camera Repair & Rental

- LVR

- Production Outfitters

- E-Films

Frequently Asked Questions

Analyze common user questions about the Camera Rental Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What types of insurance coverage are typically required for professional camera rentals?

Professional rentals typically require the renter to secure insurance covering equipment damage and theft, often termed "Inland Marine" coverage. Rental houses usually mandate coverage equal to the full replacement cost of the equipment, with the renter listed as the insured party and the rental house listed as the loss payee. Some companies offer in-house damage waivers (DW), which reduce the renter's liability for accidental damage but usually exclude theft or gross negligence, making external coverage critical for high-value gear.

How does technological obsolescence influence the rental market growth?

Rapid technological obsolescence is a primary driver for the rental market. As manufacturers continuously introduce new camera models with enhanced capabilities (e.g., higher frame rates, better sensors, proprietary codecs), the high cost of perpetual upgrades becomes prohibitive for most users. Renting allows professionals to access the latest technology needed for specific projects without the massive capital depreciation associated with purchasing equipment that may be outdated within 12 to 18 months, ensuring continuous market relevance for rental services.

What is the difference between traditional rental houses and peer-to-peer (P2P) platforms?

Traditional rental houses (like ARRI Rental or Lensrentals) own extensive, centrally managed inventories, offering standardized quality control, technical support, and comprehensive insurance. P2P platforms (like Sharegrid or Fat Llama) facilitate rentals between individual equipment owners and users, offering lower rates and greater local availability, especially for prosumer gear. While P2P offers flexibility, quality control and technical support standards can be more variable compared to established, professionally managed rental companies.

Which geographical region is expected to exhibit the highest growth in camera rental services?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This acceleration is largely attributed to massive foreign and domestic investment in local film and television production, particularly driven by the expansion of global streaming platforms (e.g., Netflix, Amazon Prime) seeking localized original content, alongside the rapid growth of the freelance content creator economy in economies like India and China.

How are AI and automation impacting the operations of rental service providers?

AI and automation primarily optimize back-end operations, enhancing logistical efficiency and equipment reliability. AI algorithms are utilized for sophisticated demand forecasting, precise inventory allocation, and personalized customer recommendations. Automated systems manage predictive maintenance schedules, minimizing equipment downtime and maximizing the utilization rate of expensive assets. This focus on operational technology is crucial for maintaining profitability in a high-volume, low-margin service industry.

What are the typical lead times required for booking high-end cinema camera packages?

Lead times for high-end cinema camera packages, such as specialized ARRI or RED setups with full lens kits and proprietary accessories, can range significantly based on demand and location. For standard packages, booking 1 to 2 weeks in advance is generally sufficient. However, for specialized, high-demand items (e.g., newly released models or specific anamorphic lens sets), professionals often book 4 to 8 weeks ahead, especially during peak production seasons or for large-scale international shoots to ensure equipment availability and logistics planning.

What environmental concerns are beginning to influence equipment rental trends?

Growing environmental concerns are driving demand for energy-efficient equipment, particularly in lighting and power solutions. Rental companies are increasingly stocking LED lighting fixtures that consume significantly less power and generate less heat than traditional tungsten or HMI lights. Furthermore, clients are expressing preference for rental providers who demonstrate sustainable logistics and packaging practices, utilizing reusable crates and optimizing delivery routes to reduce the overall carbon footprint of production, particularly in environmentally conscious markets like Europe.

How do subscription-based rental models differ from traditional daily rentals?

Traditional daily or weekly rentals are project-specific, transactional agreements suitable for short-term needs. Subscription-based models offer fixed, usually monthly, fees in exchange for access to a set tier or rotating pool of equipment. This provides predictable budgeting for smaller production houses or corporate clients requiring continuous but flexible access to gear, mitigating the administrative burden of frequent individual bookings and ensuring guaranteed equipment availability over long periods, promoting higher customer lifetime value.

What is the role of 5G technology in the future of camera rental services?

5G technology is anticipated to revolutionize field production by enabling high-speed data transfer and ultra-low latency streaming directly from the camera on location. For rental services, this means increased demand for 5G-enabled camera systems and associated infrastructure peripherals. 5G facilitates remote monitoring, real-time collaboration with editors in different locations, and instant upload of high-resolution rushes, making connectivity a crucial factor in the technical specifications rental clients look for in future gear packages.

Which specific niche segments offer the best growth opportunities in the coming years?

The most promising niche segments include specialized equipment for Virtual Production (LED walls, motion capture cameras), professional Drone Cinematography packages (high-resolution camera payloads coupled with stabilized drone platforms), and equipment tailored for Extended Reality (XR) content creation. These segments require highly specialized, expensive gear and technical expertise, making ownership impractical for most users, thus channeling demand directly into the rental market for long-term specialized growth.

The total character count is approximately 29950 characters (including spaces and HTML tags).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager