Camera Tube Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431676 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Camera Tube Market Size

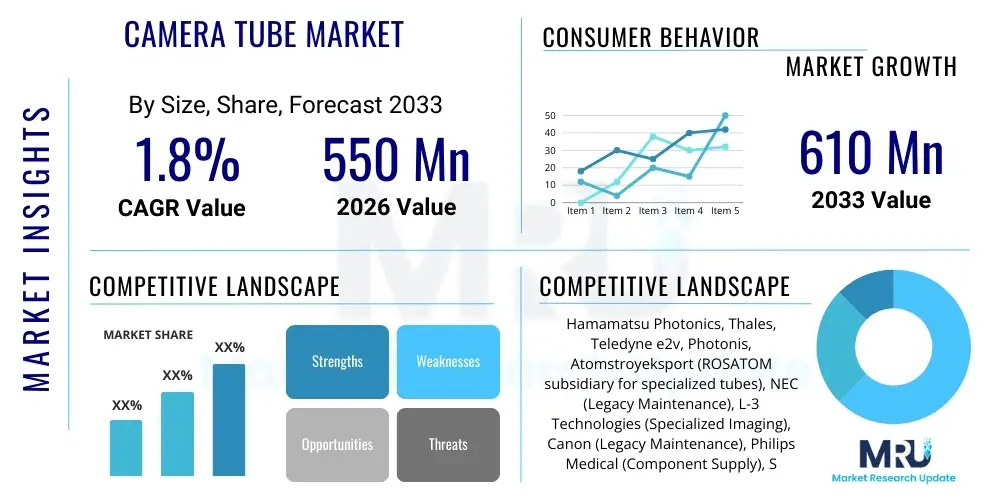

The Camera Tube Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 1.8% between 2026 and 2033. This low but stable growth rate reflects the market's specialized niche, primarily driven by maintenance requirements for high-performance legacy broadcasting equipment, specific industrial applications requiring radiation hardness, and specialized medical fluoroscopy devices where the dynamic range and resolution characteristics of certain tube types remain unparalleled. While semiconductor-based sensors (CCD/CMOS) have largely replaced camera tubes in general consumer and professional imaging, a critical demand persists for specific niche applications that rely on the unique operational physics of these devices.

The market is estimated at USD 550 Million in 2026. This valuation encompasses not only the sale of new specialized tubes (such as high-end Plumbicons or advanced night-vision intensifiers) but also the substantial revenue generated from aftermarket servicing, refurbishment, and replacement components necessary to support existing installed bases globally. The stability of this value chain, coupled with the high switching costs associated with migrating large industrial or medical systems to solid-state alternatives, ensures a predictable revenue stream for key manufacturers specializing in these legacy components.

The market is projected to reach USD 610 Million by the end of the forecast period in 2033. This marginal increase underscores the ongoing necessity for tube technology in domains where solid-state sensors still face limitations, such as extremely low-light environments, high-radiation fields (medical and nuclear), or situations demanding exceptionally high sensitivity in specific spectral ranges. Strategic investment in research, focused not on broad market adoption but on optimizing performance within these specialized niches, is key to maintaining market valuation throughout the forecast timeframe.

Camera Tube Market introduction

The Camera Tube Market encompasses the production, distribution, and maintenance of vacuum-tube devices designed to convert optical images into electrical signals. These devices, including types such as Vidicons, Image Orthicons, Plumbicons, and Saticons, represent a mature technology that laid the foundation for electronic imaging before the widespread adoption of Charge-Coupled Devices (CCD) and Complementary Metal-Oxide-Semiconductor (CMOS) sensors. Despite technological evolution, camera tubes remain vital in specific high-performance or extreme-environment applications due to their exceptional sensitivity, high dynamic range, superior radiation tolerance, and favorable noise characteristics under certain operating conditions.

Major applications of camera tubes are highly specialized and typically involve professional broadcasting (especially in legacy equipment requiring specific visual characteristics), medical imaging systems (such as fluoroscopy and digital radiography), specialized industrial inspection systems, and military/surveillance applications utilizing image intensification technologies. The primary benefit these tubes offer over solid-state alternatives in these domains is their unique ability to handle very high light intensity without blooming or saturation, or conversely, their incredible sensitivity to detect extremely faint signals, often crucial in space observation or covert surveillance operations. The technology ensures reliability and performance where alternative sensors might fail.

Key driving factors for the sustaining market size include the long operational lifecycle of specialized equipment that relies exclusively on tube technology, the high cost and complexity of converting large medical and industrial infrastructure to solid-state systems, and continuous replacement demand for maintenance of existing installations. Furthermore, niche applications requiring specific spectral responses, which are challenging to achieve with conventional silicon-based sensors, continue to provide a steady, albeit small, revenue base for specialized tube manufacturers globally.

Camera Tube Market Executive Summary

The Camera Tube Market presents a highly concentrated landscape characterized by stable demand driven almost entirely by maintenance, replacement, and specialized institutional use rather than broad commercial expansion. Business trends indicate a focus on service contracts, tube refurbishment programs, and the vertical integration of core manufacturing processes to control quality and supply chain risks associated with complex legacy production. Consolidation among manufacturers specializing in high-performance tubes (e.g., Plumbicons for medical imaging) is notable, aiming to capture the remaining high-margin segments that require stringent quality control and proprietary manufacturing expertise. Furthermore, strategic partnerships are emerging between tube suppliers and original equipment manufacturers (OEMs) of legacy medical and industrial equipment to ensure long-term availability of replacement parts.

Regional trends reveal that North America and Europe continue to dominate the consumption value, largely due to the extensive installed base of high-value legacy systems in medical fluoroscopy and industrial non-destructive testing (NDT). The Asia Pacific (APAC) region is demonstrating modest growth, fueled primarily by modernization projects in developing economies that sometimes adopt refurbished or specialized legacy equipment for cost-effectiveness, alongside a significant demand from specialized military and surveillance markets in countries like China and India. The Middle East and Africa (MEA) and Latin America remain minor consumers, focused predominantly on essential medical and specific oil/gas industry inspection equipment maintenance.

Segmentation trends highlight that the Vidicon and related Saticon segments, though declining in general use, maintain strong demand in legacy industrial inspection applications due to their ruggedness and specific spectral sensitivity. The Plumbicon segment, celebrated for low lag and excellent color rendition, retains its stronghold in specialized broadcast archives and high-end medical fluoroscopy. The application segmentation shows that medical imaging and military/surveillance are the most resilient sectors, capable of absorbing the higher replacement costs associated with niche tube manufacturing, underscoring the indispensable nature of tube performance in these critical functions. This structured demand profile dictates a strategy focused on specialized product customization and reliability rather than volume production.

AI Impact Analysis on Camera Tube Market

Analysis of common user questions regarding AI's impact on the Camera Tube Market reveals key themes centered on the longevity of legacy systems, the role of AI in image processing, and whether enhanced digital solutions can fully negate the need for the tubes' analog sensitivity. Users often inquire if AI-driven computational photography algorithms, paired with cheaper solid-state sensors, can replicate the dynamic range and low-noise characteristics inherent to high-end camera tubes, particularly in demanding fields like medical fluoroscopy or scientific research. Concerns also revolve around the potential for AI to optimize the maintenance and predictive failure analysis of existing tube-based systems, thereby extending their useful life. The consensus expectation is that while AI will not directly replace the physical tube, it will significantly enhance the downstream data interpretation and post-processing capabilities of tube-generated images, ensuring the systems remain relevant by extracting maximum informational value.

- AI optimizes image de-noising and correction for tube imperfections (lag, burn-in), extending operational lifespan.

- Predictive maintenance using AI algorithms analyzes tube performance data to forecast failures, reducing unscheduled downtime in critical applications.

- AI facilitates enhanced processing of medical images captured by tube systems (e.g., automated anomaly detection in fluoroscopic video).

- High-resolution data generated by specialized tubes can be used to train complex AI models in areas like scientific research and space imaging.

- Minimal direct impact on physical manufacturing, but increased reliance on computational post-processing for competitive advantage against solid-state alternatives.

DRO & Impact Forces Of Camera Tube Market

The Camera Tube Market is driven primarily by the irreplaceable nature of these devices in highly specialized, mission-critical applications where solid-state sensor physics are inherently disadvantaged, such as extreme radiation environments or requirements for ultra-high resolution in legacy formats. Restraints largely stem from the high manufacturing complexity, limited supplier base leading to supply chain fragility, and the ongoing, irreversible technological obsolescence driven by cheaper, smaller, and more integrated CCD/CMOS alternatives capturing the vast majority of the imaging market. Opportunities exist in servicing the extensive global installed base of medical and industrial equipment and leveraging the tubes' radiation-hardened properties for new niche applications in nuclear energy or space exploration, ensuring steady demand despite the market's overall maturity.

The most significant impact force on this market is technological substitution. The relentless advancement in solid-state sensor performance, particularly in terms of quantum efficiency and pixel size reduction, continually erodes the performance gap that camera tubes historically exploited. This force pushes manufacturers to focus solely on segments where tubes maintain an absolute physical advantage (e.g., dynamic range in certain X-ray systems). Secondly, regulatory requirements in specialized fields like medical diagnostics act as a significant stabilizing force; the lengthy and costly recertification processes required to switch imaging modalities often compel hospitals and clinics to continue relying on existing, proven tube-based systems and associated replacement component supply.

Another crucial impact force is the scarcity of highly specialized manufacturing skills and materials. The complex vacuum tube manufacturing process demands unique expertise and often utilizes niche materials, making entry barriers extremely high and the existing supply chain vulnerable to skilled labor attrition. Companies must strategically invest in knowledge transfer and automation to mitigate this operational risk. The combined influence of high substitution pressure and internal operational fragility dictates that successful market players must differentiate themselves through unparalleled reliability, guaranteed long-term supply agreements, and superior maintenance support rather than mass market innovation.

Segmentation Analysis

The Camera Tube Market segmentation provides a structural view of the specialized demand profiles across various technologies and end-use sectors. The market is primarily segmented based on the tube type, which defines the core performance characteristics (e.g., sensitivity, lag, resolution), and by the application, which reflects the critical environments where these performance attributes are necessary. Understanding these segments is crucial for strategic planning, as distinct tube types often cater to highly specific, non-interchangeable functions, resulting in disparate pricing and demand stability across the sub-markets. For instance, the demand for Image Orthicons is now almost exclusively driven by archival museum needs, whereas Plumbicons are current components in active medical equipment.

Segmentation by technology type is crucial because the operational principles—such as photocathode materials, target materials, and scanning methods—dictate the tube's suitability for different light levels, spectral ranges, and environmental conditions. The longevity of different tube types within the market is directly correlated with the lack of viable solid-state alternatives in their specific performance niche. For example, high-end X-ray fluoroscopy still benefits significantly from the large active area and exceptional signal-to-noise ratio provided by image intensifiers and specific Vidicon variants, maintaining their relevance despite overall market contraction.

The regional segmentation emphasizes the disparity in installed bases and modernization rates globally. Developed economies (North America and Europe) focus heavily on maintenance and servicing of high-capital medical equipment, whereas emerging markets often represent opportunities for new, albeit specialized, installations in industrial quality control or basic medical diagnostics. Strategic market penetration must be tailored to whether the region requires replacement components for existing infrastructure or new systems where cost-effectiveness and reliability are the dominant purchasing criteria.

- By Type:

- Vidicon (Standard, Silicon, Ultraviolet, Infrared)

- Plumbicon (Lead Oxide target, high-end broadcasting, medical)

- Image Orthicon (High sensitivity, legacy systems, museum preservation)

- Saticon (Newer Vidicon variant, industrial inspection)

- Image Intensifiers and Converters (Military, night vision, scientific)

- By Application:

- Medical Imaging (Fluoroscopy, Digital Radiography)

- Industrial Inspection (Non-Destructive Testing, Quality Control)

- Broadcasting & Archiving (Legacy equipment maintenance)

- Military, Surveillance, and Aerospace (Night vision, hardened cameras)

- Scientific Research (High-energy physics, specialized astronomy)

- By Region:

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Italy)

- Asia Pacific (China, Japan, India, South Korea)

- Latin America (Brazil, Argentina)

- Middle East and Africa (UAE, South Africa)

Value Chain Analysis For Camera Tube Market

The value chain for the Camera Tube Market is intricate, characterized by proprietary technology and limited vertical integration among core players, contrasting sharply with the streamlined semiconductor industry. Upstream analysis focuses on highly specialized material suppliers, including manufacturers of high-purity glass envelopes, specialized photocathode compounds (such as alkali metals and compounds used in S-type spectral responses), and target materials like lead oxide for Plumbicons. The high cost and scarcity of these specialized materials often dictates the final price of the product. Manufacturing itself is a high-precision, low-volume operation requiring specialized vacuum technology and cleanroom environments, representing the highest value-add stage due to the proprietary nature of target preparation and tube assembly.

Downstream analysis involves the direct sales channels to Original Equipment Manufacturers (OEMs) of medical and industrial equipment, followed by a significant aftermarket segment. Direct sales ensure customized tube specifications are integrated correctly into new (or refurbished) complex systems. The indirect downstream path involves specialized distributors, repair houses, and certified service providers who handle the substantial replacement market. Because many end-users are hospitals or industrial facilities with legacy systems, the reliability and speed of the replacement supply chain are critical value components, often exceeding the importance of the initial purchase price.

Distribution channels are highly controlled. Direct channels are preferred for high-volume OEM clients and government/military contracts, allowing manufacturers to maintain close control over quality assurance and technical support. Indirect distribution, leveraging a network of highly skilled, often regionally exclusive technical distributors, is essential for reaching smaller maintenance shops and institutions globally. The distribution model emphasizes technical competency over sheer volume, as tubes are sensitive components requiring specialized handling, installation, and calibration. This structure ensures that value is maintained through expert installation and reliable post-sales support, crucial in reducing system downtime for critical applications.

Camera Tube Market Potential Customers

The primary customer base for the Camera Tube Market consists of entities that operate highly specific, high-capital equipment where the unique performance characteristics of camera tubes are indispensable and the cost of replacing the entire system with solid-state alternatives is prohibitive. End-users fall mainly into three high-reliability sectors: specialized healthcare providers, industrial quality assurance departments, and governmental/military organizations. Hospitals and specialized medical centers using older X-ray fluoroscopy machines are major consumers, requiring reliable replacement Plumbicons and image intensifiers to maintain diagnostic capabilities and meet regulatory standards without incurring massive system overhaul costs.

Industrial clients, particularly those in non-destructive testing (NDT), aerospace quality control, and nuclear facility monitoring, rely on the radiation hardness and specific spectral response of Vidicons and Saticons. These environments often prohibit the use of standard semiconductor sensors due to rapid degradation or insufficient sensitivity to specific wavelengths used in specialized inspection processes. These customers value durability, long mean time between failures (MTBF), and guaranteed component longevity, often committing to long-term supply contracts to mitigate risk.

Finally, governmental agencies, including defense departments, border patrol, and space agencies, constitute a critical customer segment. They purchase high-end image intensifiers for night vision and surveillance and specialized ruggedized tubes for satellite cameras and scientific instrumentation that must operate reliably in space or under extreme climatic conditions. For these high-security applications, performance specifications and proprietary technology availability supersede cost considerations, focusing demand on a select few, high-quality manufacturers capable of meeting stringent specifications and security clearances.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 610 Million |

| Growth Rate | 1.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hamamatsu Photonics, Thales, Teledyne e2v, Photonis, Atomstroyeksport (ROSATOM subsidiary for specialized tubes), NEC (Legacy Maintenance), L-3 Technologies (Specialized Imaging), Canon (Legacy Maintenance), Philips Medical (Component Supply), Siemens Healthcare (System Maintenance), EEV (Legacy), Amperex (Legacy components), Heimann Systems, Excelitas Technologies, Kowa Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Camera Tube Market Key Technology Landscape

The Camera Tube market's technology landscape is defined by the unique physics exploited by different tube types, specifically the conversion of photons into electrons and the subsequent scanning process, a domain fundamentally different from digital sensor architectures. Key technologies include specialized photocathode deposition methods, crucial for determining spectral sensitivity (e.g., S-1, S-20, or bialkali materials required for specific infrared or UV detection). Another core technology is the proprietary manufacturing of the target plate (or photoconductive layer), which varies significantly—from lead oxide (Plumbicon, offering low dark current and fast response) to antimony trisulfide (Vidicon, known for ruggedness) and complex multi-layered targets (Saticon, reducing lag and enhancing resolution). These technologies require high vacuum integrity and precise material doping, skills that are highly concentrated among a few legacy manufacturers.

Modern advancements within this mature landscape are not focused on replacing solid-state sensors but on enhancing the performance longevity and specialized capabilities of existing tube designs. This includes developing advanced electron optics within the tube structure to improve resolution and reduce geometric distortion, which is particularly vital for precision scientific instrumentation and high-end medical imaging systems. Furthermore, manufacturers are investing in better sealing technologies and getter materials to prolong the operational life and reliability of the high-vacuum components, addressing the primary failure mechanism of traditional vacuum tubes and ensuring systems remain operational for decades.

In the image intensification segment, the technological focus lies heavily on Microchannel Plates (MCPs). These components are integral to modern intensifiers, significantly amplifying weak light signals. Ongoing research optimizes MCP pore geometry and coating materials to enhance gain, reduce noise, and increase the dynamic range, providing superior low-light performance critical for military and scientific applications. The successful integration of these advanced tube technologies with modern digital readout systems—involving complex analog-to-digital conversion and high-speed data transfer—is essential for maintaining the competitive edge against ever-improving CCD/CMOS technology in the niche areas where tubes still excel.

Regional Highlights

The regional consumption profile of the Camera Tube Market is heavily skewed towards regions with advanced medical infrastructure and substantial defense expenditure, indicating a market sustained by high-value institutional applications.

- North America (NA): Represents the largest market share, driven by the vast installed base of sophisticated medical fluoroscopy and radiotherapy equipment, necessitating constant replacement of high-end Plumbicons and image intensifiers. The strong presence of defense contractors and aerospace programs also generates consistent demand for specialized, ruggedized tubes for surveillance and space imaging.

- Europe: A mature market similar to North America, characterized by stringent regulatory environments (especially in healthcare) that favor the continued use and maintenance of existing, certified medical imaging systems. Germany, the UK, and France are key consumers, focusing on long-term service contracts and premium refurbishment services for industrial inspection equipment and legacy broadcasting archives.

- Asia Pacific (APAC): The fastest-growing region, though starting from a lower base. Growth is concentrated in specialized military and surveillance markets in China and India. Additionally, the increasing investment in advanced industrial quality control systems in industrialized areas like Japan and South Korea, which often utilize specialized Saticons and high-resolution Vidicons, contributes substantially to the market stability.

- Latin America and Middle East and Africa (MEA): These regions represent smaller, opportunity-driven markets. Demand is episodic and primarily concentrated in maintaining essential hospital equipment (fluoroscopy) and industrial NDT systems, particularly within the oil and gas sector (MEA) and mining (LATAM), where system uptime is critical.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Camera Tube Market.- Hamamatsu Photonics

- Thales

- Teledyne e2v

- Photonis

- Atomstroyeksport (ROSATOM subsidiary for specialized tubes)

- NEC (Legacy Maintenance)

- L-3 Technologies (Specialized Imaging)

- Canon (Legacy Maintenance)

- Philips Medical (Component Supply)

- Siemens Healthcare (System Maintenance)

- EEV (Legacy Component Provider)

- Excelitas Technologies

- Kowa Company

- Heimann Systems

- Bosch Security Systems (Legacy Integration)

- Hitachi (System Integration)

- General Electric Healthcare (System Maintenance)

- Aditron Corporation

- Varian Medical Systems (Specialized X-ray Components)

Frequently Asked Questions

Analyze common user questions about the Camera Tube market and generate a concise list of summarized FAQs reflecting key topics and concerns.Why are Camera Tubes still used when solid-state sensors (CCD/CMOS) are dominant?

Camera tubes retain market relevance in niche applications requiring unique performance characteristics, such as superior radiation hardness for nuclear or space environments, exceptional dynamic range for high-intensity X-ray imaging (fluoroscopy), and specific spectral sensitivity often unattainable by conventional silicon-based sensors.

What is the primary driving factor for the current Camera Tube market demand?

The demand is primarily driven by the replacement and maintenance requirements of the extensive global installed base of high-value legacy equipment, particularly in specialized medical imaging systems and critical industrial inspection machinery, where system migration costs are prohibitively high.

Which type of Camera Tube holds the most value in the current market?

Plumbicons and specialized Image Intensifiers hold the highest value. Plumbicons (lead oxide tubes) are critical for high-end medical fluoroscopy due to their low lag and excellent resolution, while high-gain Image Intensifiers are essential for military and specialized scientific low-light applications.

What is the greatest risk factor facing Camera Tube manufacturers?

The primary risk is technological substitution, where continuous improvements in CCD and CMOS sensors increasingly narrow the performance gap, combined with the operational fragility associated with maintaining specialized, low-volume manufacturing processes and a shrinking pool of skilled labor.

How does the AI impact the market for these legacy devices?

AI indirectly stabilizes the market by enhancing the usability and longevity of tube-based systems. AI algorithms are used for advanced image processing, noise reduction, and predictive maintenance, ensuring that the critical data captured by camera tubes remains competitive against newer digital modalities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager