Camphene Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434395 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Camphene Market Size

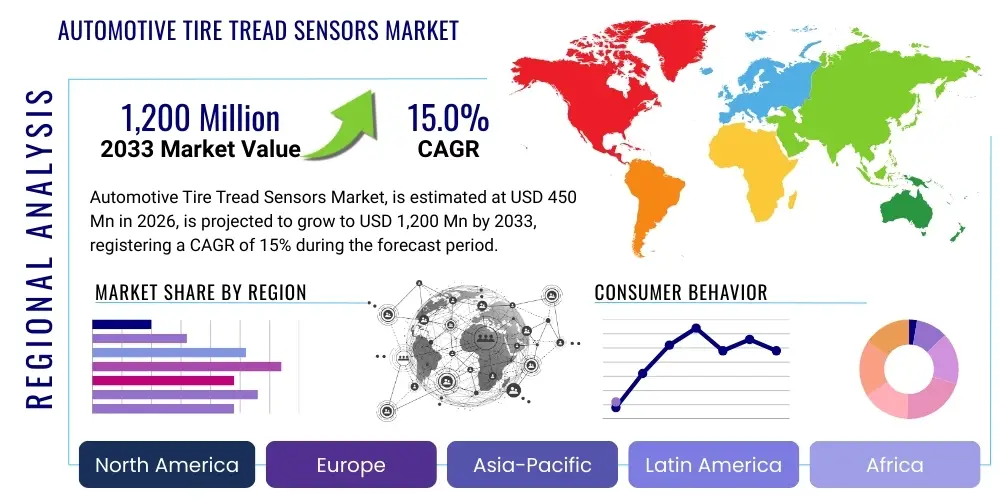

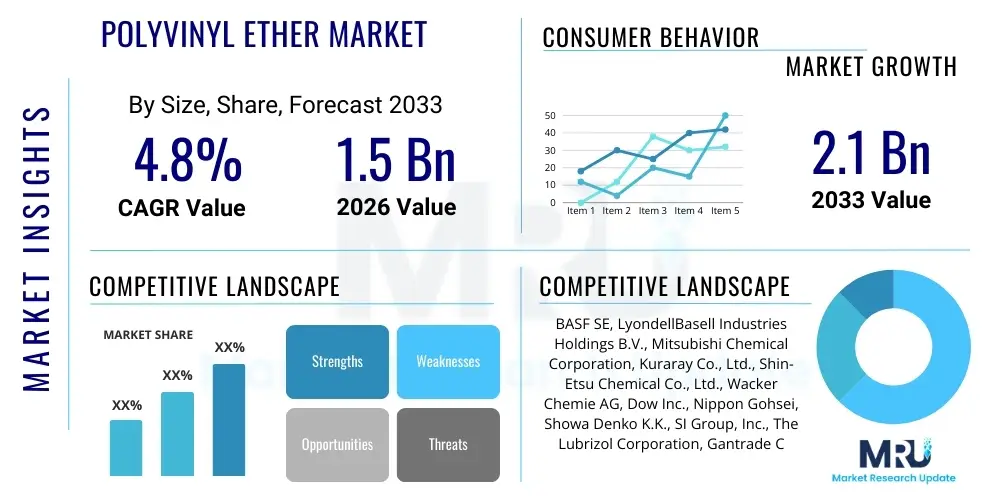

The Camphene Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 665 Million by the end of the forecast period in 2033.

Camphene Market introduction

Camphene, a bicyclic monoterpene, is a colorless, waxy solid known for its characteristic pungent odor, often described as similar to camphor. It is naturally derived primarily from turpentine oil, specifically alpha-pinene, through complex isomerization processes, although synthetic routes are also commercially viable. Historically significant in the chemical industry, Camphene serves as a versatile intermediate crucial for synthesizing a wide array of specialized chemicals, including fragrances, flavors, and camphor derivatives. Its molecular structure and reactivity make it highly valuable in organic synthesis, bridging the gap between basic petrochemical feedstocks and complex fine chemicals. The increasing consumer preference for natural or naturally-derived ingredients significantly underpins the demand trajectory for high-quality camphene across various sectors.

The major applications of Camphene span across the highly dynamic Fragrance and Flavor (F&F) industry, pharmaceutical synthesis, and the production of insecticides and specific resin monomers. In the F&F sector, it is integral to creating specific scent profiles and fixing volatile compounds, contributing depth and longevity to perfumes, cosmetics, and household products. Furthermore, its role as a precursor to camphor, a critical ingredient in medicinal balms, topical analgesics, and traditional remedies, solidifies its importance in the pharmaceutical and healthcare segments. The utility of Camphene extends into the agrochemical domain where it is utilized in certain formulations for its insecticidal properties, albeit subject to evolving environmental regulations.

The market expansion is robustly driven by several interconnected factors, predominantly the persistent global demand for sophisticated fragrance compositions and the burgeoning growth of the generics pharmaceutical market in emerging economies. Manufacturers are increasingly focused on leveraging Camphene as a sustainable, bio-based building block, aligning with global green chemistry initiatives. The volatility inherent in turpentine supply chains presents challenges, yet ongoing technological advancements in catalytic conversion and purification processes are enhancing yield and purity, thereby stabilizing the supply for high-end applications and sustaining market growth over the projected timeframe. Strategic investments in bio-based synthetic routes further mitigate raw material dependency risks.

Camphene Market Executive Summary

The Camphene market is characterized by moderate growth, heavily influenced by the oscillating availability and pricing of turpentine oil, the primary natural raw material. Current business trends indicate a strong bifurcation in the market: premium, high-purity camphene is witnessing increased demand from leading fragrance houses requiring stringent quality control, while standard-purity camphene continues to serve bulk chemical synthesis and agrochemical applications. Manufacturers are focusing on backward integration and developing highly efficient, proprietary catalytic processes to manage input costs and ensure supply stability, reflecting a strategic shift toward resilience against supply chain disruptions. Furthermore, sustainability requirements are driving research into novel bio-fermentation methods that could potentially bypass traditional extraction dependency, establishing a key competitive edge.

Regionally, the market dynamics are dominated by the Asia Pacific (APAC) region, which acts as the global manufacturing hub, particularly for mass-produced synthetic variants and camphor conversion. Countries like China and India benefit from competitive manufacturing landscapes and access to extensive turpentine resources or petrochemical derivatives. Conversely, North America and Europe remain the principal consumption centers, characterized by high-value applications in sophisticated perfumery and specialized pharmaceutical intermediates. These regions exhibit stringent regulatory oversight regarding volatile organic compounds (VOCs) and sourcing sustainability, compelling suppliers to adhere to higher environmental and ethical standards. The growth in Latin America and MEA is accelerated by rising disposable incomes and the subsequent expansion of local cosmetic and consumer goods industries.

Segmentation analysis reveals that the high-purity segment (Camphene >98%) is set to experience the fastest growth due to its indispensable requirement in high-end flavor and fragrance formulations where even minor impurities can significantly alter sensory profiles. Application-wise, the Fragrance and Flavor segment maintains the largest market share, consistently propelled by new product development in personal care and household cleaning products. Concurrently, the Pharmaceutical Intermediates segment shows significant potential, driven by the expanding synthesis of complex molecules and active pharmaceutical ingredients (APIs) utilizing bicyclic structures. The market is also seeing consolidation, with major players acquiring smaller specialized chemical manufacturers to integrate proprietary synthesis technology and expand their product portfolios across varied purity levels.

AI Impact Analysis on Camphene Market

Common user inquiries regarding AI's impact on the Camphene market primarily revolve around three interconnected themes: the optimization of chemical synthesis pathways, predictive modeling for volatile raw material pricing, and enhanced quality control systems for high-purity products. Users are keenly interested in how Artificial Intelligence and Machine Learning (ML) can be deployed to overcome the yield limitations inherent in current isomerization and purification processes, especially concerning the efficiency of converting alpha-pinene to camphene while minimizing by-products. Additionally, due to the high volatility of turpentine oil prices, there is significant interest in ML models that can accurately forecast supply chain disruptions and price fluctuations, enabling proactive procurement strategies. Finally, the need for instantaneous and ultra-precise purity verification, critical for pharmaceutical and premium fragrance grades, positions AI-driven spectroscopic analysis as a key area of market expectation and investment.

The implementation of AI/ML technologies is poised to revolutionize the operational efficiency and strategic decision-making within the Camphene market ecosystem. Machine learning algorithms can process vast amounts of data from reaction kinetics, catalyst performance, temperature, and pressure variables to identify optimal operating windows, leading to substantial improvements in production yield and energy efficiency. Predictive maintenance facilitated by AI will minimize unplanned downtime in specialized distillation and purification units. Strategically, AI tools are already assisting in demand forecasting across fragmented end-user markets and optimizing global logistics networks, ensuring timely delivery while minimizing transportation costs and inventory holding periods, directly impacting profitability in a highly competitive commodity market.

For research and development, computational chemistry powered by AI offers accelerated screening of novel catalysts and reaction conditions that are environmentally benign (green chemistry). This speeds up the discovery of alternative, non-turpentine-based production methods, such as engineered fermentation processes using microorganisms, potentially decoupling the industry from agricultural commodity volatility. The integration of AI into formulation science is equally critical, enabling fragrance chemists to rapidly assess the interaction of Camphene and its derivatives with hundreds of other ingredients, predicting stability, scent profile longevity, and potential regulatory conflicts long before lab trials begin, thereby significantly reducing time-to-market for new F&F products.

- AI-driven optimization of catalytic conversion processes, improving Camphene yield and reducing energy consumption.

- Machine learning models utilized for predictive analysis of volatile raw material (turpentine oil) pricing and supply stability.

- Enhanced quality control using AI-powered spectroscopy for rapid, ultra-precise detection of impurities in high-purity Camphene.

- Accelerated R&D through computational chemistry for screening novel, sustainable bio-based synthesis routes.

- Optimization of global logistics and supply chain networks using AI algorithms for demand forecasting and routing efficiency.

DRO & Impact Forces Of Camphene Market

The Camphene market is subject to dynamic interplay between robust demand drivers, persistent supply-side restraints, and significant opportunities arising from technological innovation and shifting consumer preferences. Key drivers include the escalating global demand for natural or nature-identical chemical building blocks in the F&F industry and the sustained expansion of the pharmaceutical sector, utilizing Camphene as a key intermediate for synthesizing complex APIs, including synthetic camphor and borneol derivatives. However, the market faces acute restraints, primarily the inherent volatility and price fluctuation of natural turpentine oil, which directly impacts production costs and profit margins, alongside increasingly strict environmental regulations governing the use and discharge of organic solvents associated with its synthesis and purification processes. Significant opportunities exist in developing sustainable, bio-based synthetic Camphene, expanding applications in specialty polymers, and capitalizing on advanced continuous flow synthesis technologies to enhance efficiency and scalability.

Drivers are strongly rooted in consumer trends favoring natural origins. The 'green label' premium dictates that ingredients sourced naturally or derived through sustainable processes gain significant market traction, making naturally sourced Camphene highly desirable despite its cost implications. The demand surge for fragrances in emerging economies, driven by rising middle-class consumption of luxury and personal care items, provides consistent underlying market momentum. Furthermore, Camphene’s versatility allows its utilization in synthesizing intermediates that cater to specific high-performance applications, such as high-thermal stability polymers and specialty chemical coatings, diversifying its industrial relevance beyond traditional uses. These synergistic demands across multiple high-growth industries anchor the market stability and forecast expansion.

Restraints necessitate strategic management and investment in alternative processes. The heavy dependence on agricultural commodities means that climatic events, geopolitical shifts affecting trade, and fluctuations in forestry yields directly translate into supply risk. Additionally, the complexity and hazardous nature of some traditional chemical processes used in Camphene production require substantial capital expenditure for compliance with stringent health, safety, and environmental (HSE) standards, especially in North America and Europe, raising the barrier to entry for new competitors. Opportunities, therefore, center on technological disruption. Investment in biocatalysis and metabolic engineering to produce Camphene via fermentation routes represents a paradigm shift that promises stable supply, potentially lower costs, and superior environmental performance, effectively mitigating the most significant existing restraints and opening up new competitive landscapes.

Segmentation Analysis

The Camphene market is systematically segmented based on Purity Level, Primary Application, and Source of Origin, providing granular insights into specific market dynamics and growth pockets. Segmentation by Purity Level—High Purity (>98%), Standard Purity (90-98%), and Technical/Low Purity (<90%)—is critical, as purity directly correlates with the end-user industry and acceptable impurity profiles. High Purity Camphene commands a significant premium and is essential for the sensitive F&F and pharmaceutical sectors, while lower purity grades are typically relegated to bulk chemical synthesis, polymerization, and certain agrochemical formulations. The rigorous quality standards imposed by regulatory bodies such as the FDA and EMA for APIs reinforce the growth of the high-purity segment, demanding sophisticated separation and testing technologies.

Application-based segmentation highlights the market's reliance on the Fragrance and Flavor sector, which consumes the largest volume due to Camphene's multifaceted roles in scent creation and modification. However, the Pharmaceutical Intermediates segment is demonstrating accelerated growth, driven by the increased global production of camphor and borneol derivatives, which are crucial for treating respiratory and musculoskeletal conditions. The growing focus on synthesizing environmentally friendly insecticides and personal insect repellents also contributes substantially to the overall market consumption. Specific demand within the Chemical Synthesis segment, particularly for the production of specialized resins and polymer additives that enhance material performance, provides a steady, cyclical demand curve, independent of direct consumer preferences.

Segmentation by Source differentiates between Natural Camphene (derived directly from turpentine oil through isomerization of alpha-pinene) and Synthetic Camphene (derived from petrochemical feedstocks or alternative chemical processes). While the natural segment appeals to consumers seeking 'natural origin' claims, the synthetic segment offers cost stability and volume predictability, crucial for large-scale industrial buyers. The future trajectory suggests a blurring of these lines as bio-based synthetic methods—utilizing sustainable non-petroleum feedstocks like biomass—emerge, bridging the gap between cost efficiency and natural sourcing ethos. This emerging 'bio-synthetic' segment represents a key innovation area poised to capture significant market share in the latter half of the forecast period.

- By Purity Level:

- High Purity (>98%)

- Standard Purity (90-98%)

- Technical/Low Purity (<90%)

- By Application:

- Fragrance and Flavor (F&F)

- Pharmaceutical Intermediates (Synthetic Camphor, Borneol)

- Chemical Synthesis (Specialty Polymers, Additives)

- Insecticides and Agrochemicals

- Others (Cleaning Agents, Solvents)

- By Source:

- Natural (Turpentine Oil Derived)

- Synthetic (Petrochemical or Bio-Synthetic Routes)

Value Chain Analysis For Camphene Market

The Camphene market value chain initiates with the upstream sourcing of raw materials, predominantly crude sulfate turpentine (CST) or wood turpentine oil, which are by-products of the pulping and forestry industries. This upstream segment is characterized by fragmented supply, subject to geopolitical and agricultural factors, necessitating robust procurement strategies from large chemical processors. Key upstream activities involve the initial fractionation of crude turpentine to isolate alpha-pinene, the direct precursor to camphene. Efficiency at this stage dictates the overall production cost structure and is highly dependent on effective collaboration between forestry companies, paper mills, and specialized chemical extractors. The volatility of this commodity market poses a persistent threat to stable profitability downstream.

The midstream process involves the complex chemical transformation, specifically the catalyzed isomerization of alpha-pinene into Camphene. This manufacturing stage requires high technical expertise, specialized reactor technology, and efficient purification methods, such as fractional distillation and crystallization, to achieve the required purity levels for end-use applications. Direct manufacturing typically occurs in large chemical complexes located in APAC and certain European hubs. Distribution channels are varied: direct sales dominate the high-volume supply to major fragrance houses and pharmaceutical corporations (indirect), while specialized chemical distributors handle smaller volumes and supply to regional manufacturers, ensuring penetration into diversified end-user segments.

The downstream analysis focuses on the final consumption and integration into end products. Major chemical producers often sell directly to large-scale industrial consumers (e.g., IFF, Givaudan, BASF). For consumers requiring high purity and specific quality certifications, the distribution chain is typically shorter and highly controlled. Indirect distribution relies on global chemical trading firms and regional agents who manage inventory, repackaging, and technical support for localized F&F houses and smaller pharmaceutical compounders. The efficacy of the downstream distribution network is critical for market penetration and hinges on adherence to stringent transportation and storage regulations governing chemical intermediates to maintain product quality until the point of use.

Camphene Market Potential Customers

The primary consumers of Camphene are multinational corporations and specialized manufacturers operating within the Fragrance and Flavor (F&F) industry, where Camphene is used extensively as a cost-effective, high-impact ingredient for establishing woody, earthy, or coniferous notes, and as a raw material for synthesizing advanced aroma chemicals like isobornyl acetate and camphor. Large F&F houses such as Symrise, Firmenich, and IFF are key high-volume buyers, requiring substantial, consistent supply of certified high-purity material, often under long-term supply contracts. Their purchasing decisions are critically influenced by regulatory compliance (e.g., IFRA standards), sustainability certification, and the sensory profile consistency provided by the supplier's material, demanding meticulous quality control.

A second major customer segment encompasses the pharmaceutical and nutraceutical sectors, where Camphene is a vital precursor in the synthesis of synthetic camphor, borneol, and other therapeutically active compounds used in over-the-counter (OTC) pain relievers, cold and cough remedies, and topical analgesics. Pharmaceutical companies and API manufacturers prioritize suppliers who can demonstrate impeccable adherence to Good Manufacturing Practices (GMP) and provide comprehensive traceability documentation, due to the critical nature of product safety and efficacy. The purchasing cycle in this segment is typically longer, involving rigorous vetting and qualification processes, but offers greater stability once a supplier is approved.

Tertiary customers include manufacturers of specialty chemicals, polymers, and agrochemicals. Specifically, companies involved in synthesizing specialized monomers, resins, and high-performance adhesives utilize Camphene due to its unique bicyclic structure, which imparts desirable physical properties like rigidity and resistance to heat. Agrochemical producers use Camphene derivatives in certain insect repellent and pesticide formulations. These industrial buyers generally focus on cost-efficiency and technical specifications, often utilizing standard or technical purity grades, with procurement strategies centered on securing large volumes at competitive pricing to maintain production cost advantages in highly competitive commodity markets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 665 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Symrise, Firmenich, Givaudan, BASF SE, International Flavors & Fragrances (IFF), Mane SA, Takasago International Corporation, Emerald Kalama Chemical, DRT (Firmenich), Gujarat Alkalies and Chemicals Ltd. (GACL), Saptagir Camphor Limited, Kemin Industries, Penta Manufacturing Company, Aarti Industries Ltd., Spectrum Chemical Manufacturing Corp., TCI Chemicals (India) Pvt. Ltd., Millennium Specialty Chemicals, Zhuhai Tairui Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Camphene Market Key Technology Landscape

The core technology underpinning the Camphene market revolves around highly efficient and selective catalytic isomerization processes of alpha-pinene, typically involving mineral acids or specialized solid-acid catalysts such as zeolites or modified clays. These processes must be finely tuned to maximize the conversion of the primary terpene to Camphene while minimizing the formation of undesirable by-products like tricyclene, limonene, or unwanted stereoisomers, which detrimentally affect purity and subsequent sensory profiles. Recent advancements focus heavily on green chemistry principles, exploring solvent-free reactions and continuous flow reactor technologies that offer better control over reaction kinetics, enhanced safety, and reduced waste generation compared to traditional batch processes, thereby improving operational expenditure (OPEX) significantly across the manufacturing base.

In addition to synthesis methods, advanced purification technology is crucial, particularly for meeting the exacting standards of the High Purity segment. Techniques employed include highly sophisticated fractional distillation under vacuum, often involving complex column designs to separate closely boiling isomers, and precision crystallization methods. Emerging technologies are centered on chromatographic separation and molecular sieves, which are being explored to achieve ultra-high purity levels required for trace element control in pharmaceutical-grade intermediates. Automation and integration of real-time monitoring systems, often incorporating AI for process optimization, are transforming these purification steps from manual, time-intensive operations into predictive, highly efficient industrial processes.

The future technology landscape is rapidly shifting toward sustainable sourcing via biotechnology. Research institutions and market leaders are heavily investing in metabolic engineering and synthetic biology to develop genetically modified microorganisms (e.g., yeasts or bacteria) capable of fermenting cost-effective feedstocks (like sugars or biomass) into high yields of the target terpene, Camphene, or its direct precursor, pinene. This bio-synthetic approach, while still developing in terms of industrial scalability, promises to stabilize raw material supply, offer superior sustainability credentials, and fundamentally decouple Camphene production from the volatile agricultural supply chain of turpentine oil, representing the most disruptive technological frontier in the market.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant region, primarily serving as the world's largest manufacturing and processing hub for Camphene, particularly for synthetic variants and subsequent camphor conversion. Countries like China and India leverage economies of scale, competitive labor costs, and robust access to either forestry resources or petrochemical derivatives. This region experiences strong internal demand driven by rapidly expanding domestic F&F and pharmaceutical sectors, making it both a massive producer and a growing consumer.

- North America: North America represents a mature, high-value consumption market. Demand here is strongly concentrated in the premium segments—high-purity Camphene for niche fragrance formulations and specialized pharmaceutical intermediates. The market is characterized by strict regulatory compliance and a strong emphasis on supplier sustainability and traceability, driving innovation toward bio-synthetic and certified natural sources.

- Europe: Europe maintains a significant market presence driven by its established chemical and cosmetic industries (Germany, France). European consumption is high, fueled by leading global fragrance houses and specialty chemical manufacturers. Regulations, particularly REACH mandates and eco-labeling requirements, significantly influence market dynamics, favoring suppliers who can demonstrate advanced environmental stewardship and superior product quality control.

- Latin America (LATAM): LATAM is characterized by emerging growth potential. Market expansion is correlated with increasing industrialization and rising consumer spending on personal care and hygiene products, particularly in Brazil and Mexico. The region acts as both a local production base (utilizing regional forestry resources) and a growing import market for specialized, high-pend ingredients.

- Middle East & Africa (MEA): The MEA region exhibits moderate but rapidly accelerating growth, largely concentrated in the Gulf Cooperation Council (GCC) countries due to significant investment in domestic fragrance manufacturing and increased healthcare expenditure. The market relies heavily on imports of high-grade Camphene, especially from European and Asian suppliers, to meet the demands of luxury perfumery and local pharmaceutical compounding.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Camphene Market.- Symrise AG

- Firmenich International SA (including DRT subsidiary)

- Givaudan SA

- BASF SE

- International Flavors & Fragrances (IFF)

- Mane SA

- Takasago International Corporation

- Emerald Kalama Chemical

- Gujarat Alkalies and Chemicals Ltd. (GACL)

- Saptagir Camphor Limited

- Kemin Industries

- Penta Manufacturing Company

- Aarti Industries Ltd.

- Spectrum Chemical Manufacturing Corp.

- TCI Chemicals (India) Pvt. Ltd.

- Millennium Specialty Chemicals

- Zhuhai Tairui Chemical Co., Ltd.

- Orchidee Fragrances

- Camphor & Allied Products Ltd.

- Suzhou Yalong Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Camphene market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Camphene primarily used for, and why is high purity necessary?

Camphene is primarily used as a chemical intermediate in the Fragrance and Flavor (F&F) industry for its distinct coniferous notes, and in pharmaceuticals for synthesizing synthetic camphor and borneol. High purity (typically >98%) is essential, particularly for F&F and pharmaceutical applications, because trace impurities can negatively alter the final product's sensory profile or fail to meet stringent regulatory standards (e.g., GMP).

What are the key drivers impacting the growth trajectory of the Camphene Market?

Key drivers include the global consumer shift toward natural and naturally-derived ingredients, increasing demand from the personal care and cosmetic sectors in emerging economies, and the continuous growth of the generics pharmaceutical market, which requires reliable supply of chemical intermediates like Camphene.

How does the volatility of turpentine oil affect the Camphene market?

Turpentine oil is the main natural raw material for Camphene production. Its price and supply are subject to agricultural and environmental factors, leading to high volatility. This instability directly translates into fluctuating production costs for Camphene manufacturers, acting as a major restraint on market profitability and stability.

Which region dominates the production of Camphene, and which dominates consumption?

The Asia Pacific (APAC) region, specifically China and India, dominates global Camphene production due to extensive manufacturing capacity and competitive operational costs. North America and Europe, however, dominate high-value consumption, driven by the presence of large multinational fragrance and pharmaceutical corporations.

What is the future technological direction for Camphene sourcing?

The future technological direction is focused on developing bio-based synthesis routes, utilizing metabolic engineering and engineered microorganisms to produce Camphene or its precursors (pinene) through fermentation of sustainable feedstocks like sugars. This aims to reduce reliance on volatile turpentine oil and improve sustainability credentials.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Camphene Market Size Report By Type (General Type, Other), By Application (Flavor & Fragrance, Synthetic Material, Pesticide, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Camphene Market Statistics 2025 Analysis By Application (Flavor & Fragrance, Synthetic Material, Pesticide), By Type (General Type, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Camphene Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (78%-79% Content, 45% Content, 82% Content, Others), By Application (Flavor Spices, Synthetic Materials, Pesticides), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager