Camping Gear and Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433212 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Camping Gear and Equipment Market Size

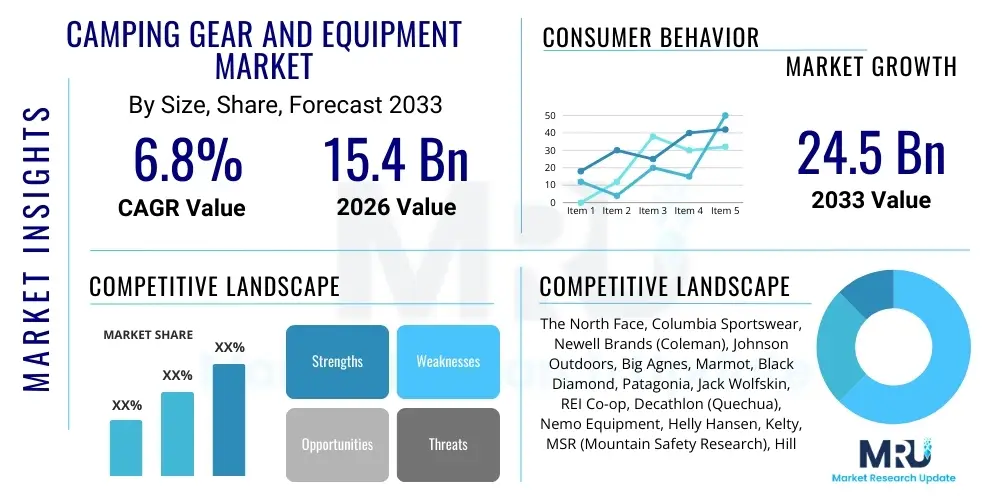

The Camping Gear and Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 15.4 Billion in 2026 and is projected to reach USD 24.5 Billion by the end of the forecast period in 2033.

Camping Gear and Equipment Market introduction

The Camping Gear and Equipment Market encompasses a wide array of products designed to facilitate and enhance outdoor living experiences, ranging from basic necessities like tents and sleeping bags to advanced portable electronics and specialized cooking apparatus. This market is fundamentally driven by the global increase in leisure time, growing awareness regarding the physical and mental benefits of spending time outdoors, and the subsequent rise in participation rates for activities such as hiking, backpacking, general camping, and "glamping." The industry is characterized by significant innovation, particularly in materials science focused on developing lightweight, durable, and sustainable products that meet the demanding needs of outdoor enthusiasts.

Product offerings in this sector are highly diverse, segmented by functionality, durability, and intended application. Core products include robust shelter solutions such as family tents, specialized backpacking tents, and hammocks, alongside essential sleeping systems like insulated sleeping bags and sleeping pads optimized for thermal efficiency and comfort. Major applications span from rugged, multi-day wilderness expeditions requiring ultra-lightweight and compact gear to car camping and recreational vehicle (RV) excursions where comfort and convenience take precedence. The versatility of modern camping equipment allows manufacturers to cater to both the budget-conscious consumer and the high-end adventure seeker, thereby expanding the overall market reach.

The primary benefits associated with market growth include increased accessibility to outdoor recreation, improved safety standards through advanced equipment design, and greater environmental stewardship fostered by companies focusing on eco-friendly manufacturing processes and durable goods. Driving factors include socio-economic trends such as the rise of experiential travel over material purchases, aggressive marketing by outdoor lifestyle brands promoting wellness and adventure, and the integration of smart technology into gear, offering features like portable solar power solutions and app-controlled lighting systems, which significantly enhance the modern camping experience.

Camping Gear and Equipment Market Executive Summary

The Camping Gear and Equipment Market is positioned for robust expansion, primarily fueled by shifting consumer preferences toward experiential leisure and the sustained growth of outdoor tourism globally. Key business trends indicate a strong focus on sustainable sourcing, circular economy models, and digital transformation in retail, with specialty outdoor retailers and direct-to-consumer (DTC) brands dominating the competitive landscape by offering highly specialized and premium products. Strategic alliances and mergers among large consumer goods conglomerates and niche outdoor brands are shaping market consolidation, while technological advancements, particularly in smart gear and material innovation (e.g., bio-based fabrics, ultralight alloys), are critical differentiators for achieving market share growth and customer loyalty.

Regional trends highlight North America and Europe as established revenue centers, characterized by mature outdoor recreation cultures and high per capita spending on quality equipment. However, the Asia Pacific (APAC) region is projected to be the fastest-growing market segment, driven by increasing disposable incomes in countries like China and India, expanding middle classes adopting Western leisure activities, and substantial government investments in developing national parks and outdoor recreational infrastructure. Latin America and the Middle East and Africa (MEA) present nascent but highly opportunistic markets, particularly for mid-range, versatile camping products that cater to family and local tourism segments, suggesting significant untapped potential subject to infrastructure development.

Segmentation trends reveal that the Tents and Shelters category continues to hold the largest market share by value, though the Sleeping Gear segment is exhibiting accelerated growth due to continuous innovation in insulation technology and comfort maximization, addressing consumer demand for high-performance four-season systems. Distribution channel dynamics show a decisive shift toward online retail, which offers convenience, comprehensive product comparisons, and targeted brand engagement. Furthermore, the application segment analysis underscores the explosive popularity of 'Glamping' and 'Family Camping,' which demands higher-end furniture, cooking systems, and power solutions, moving beyond traditional, minimalist backpacking gear, thereby driving up the average selling price of specialized equipment.

AI Impact Analysis on Camping Gear and Equipment Market

User inquiries regarding the influence of Artificial Intelligence (AI) in the Camping Gear and Equipment Market frequently revolve around personalization, inventory management, and the enhancement of safety and convenience during outdoor expeditions. Common questions address how AI can optimize supply chains to ensure gear availability during peak seasons, the potential for AI-driven recommendations systems to match complex user needs (e.g., altitude, temperature, trip length) with appropriate gear configurations, and the development of 'smart' camping devices. Users are particularly keen on predictive maintenance alerts for high-value equipment, AI-powered emergency communication systems, and how machine learning can accelerate the development of innovative materials by simulating performance under extreme conditions. The central theme emerging from user interest is the expectation that AI will transform camping from a gear-intensive, planning-heavy activity into a more intuitive, safer, and highly personalized experience.

The strategic incorporation of AI extends across the entire product lifecycle, from design and manufacturing to retail and consumer use. In manufacturing, generative design tools use AI to optimize product geometry, creating tents and backpacks that are lighter and stronger with less material waste. On the consumer side, AI facilitates predictive analytics for weather patterns and route difficulty, feeding into smart compasses or integrated apparel systems. The implementation of AI in retail is optimizing merchandising and forecasting demand for seasonal items, minimizing stockouts and overstocking. Ultimately, AI is poised to elevate the performance, safety, and operational efficiency of the camping gear ecosystem, moving the market toward highly customized and digitally integrated solutions, ensuring that the right gear is available for the right environment.

- Supply Chain Optimization: AI-driven demand forecasting models enhance inventory management, minimizing lead times and reducing capital tied up in seasonal stock, crucial for managing the highly cyclical nature of camping gear demand.

- Personalized Product Recommendations: Machine learning algorithms analyze historical purchase data, intended trip characteristics, and geographical location to suggest highly specific gear setups (e.g., tent models, insulation ratings) tailored to individual user needs, improving conversion rates.

- Smart Gear Development: AI integrated into devices such as portable power stations and safety beacons enables real-time environmental monitoring, battery life optimization, and automated distress signaling, significantly enhancing safety during remote trips.

- Material Innovation Acceleration: Generative AI and simulation tools expedite the research and development process for new textiles and alloys, allowing manufacturers to rapidly test parameters for weight, durability, and thermal performance.

- Retail Experience Enhancement: AI-powered chatbots and virtual assistants provide 24/7 customer support and guided selling experiences, helping consumers navigate complex product specifications and warranty claims effectively.

- Dynamic Pricing Strategy: Algorithms analyze competitor pricing, demand elasticity, and localized events (e.g., major holidays, weather forecasts) to dynamically adjust pricing, maximizing revenue while maintaining competitiveness.

- Design Optimization: AI tools aid engineers in topology optimization for frames and structures (e.g., backpack frames, tent poles), resulting in lighter, more efficient designs that use material resources optimally.

DRO & Impact Forces Of Camping Gear and Equipment Market

The trajectory of the Camping Gear and Equipment Market is governed by a confluence of accelerating drivers, persistent restraints, and significant emerging opportunities, collectively shaping the competitive and innovative environment. Key drivers include a burgeoning societal focus on health and wellness, prompting increased engagement in outdoor recreational activities, often accelerated by events such as global pandemics that pushed leisure activities outdoors. Alongside this, the pervasive influence of social media and outdoor influencers actively promotes an adventure lifestyle, driving demand for high-quality, aesthetically pleasing gear. These forces are amplified by demographic shifts, particularly the rising interest in 'Van Life' and experiential tourism among younger generations, which necessitates investment in durable, multifunctional, and portable living solutions. The cumulative effect of these drivers is a consistent upward pressure on market volume and value.

However, the market faces inherent restraints that temper growth rates. The high initial capital investment required for premium, durable camping equipment acts as a significant barrier to entry for casual or first-time campers. Furthermore, the industry is highly susceptible to seasonal fluctuations, with peak sales concentrated in the spring and summer months across most major markets, necessitating complex inventory management. Supply chain volatility, particularly concerning the sourcing of specialized materials (e.g., down insulation, technical fabrics, lightweight metals), and geopolitical trade tensions continue to pose logistical challenges and drive up input costs. Consumer perceptions regarding product lifespan, leading some buyers to invest less frequently in high-durability items, also present a restraint on recurring sales outside of product upgrades.

Opportunities for expansion are abundant, centered primarily on technological integration and geographical diversification. The development of 'Smart Camping' equipment, incorporating Internet of Things (IoT) sensors, integrated power solutions, and satellite communication capabilities, offers premium price points and differentiation. Furthermore, the massive potential within emerging economies, particularly in APAC and Latin America, represents a fertile ground for market penetration, provided that localized distribution networks can be established effectively. The industry is also capitalizing on the growing trend toward sustainability and eco-friendly products; companies that successfully implement circular economy models (rental programs, repair services) and utilize recycled or bio-based materials stand to gain a competitive edge and appeal to environmentally conscious millennials and Generation Z consumers. Strategic focus on the burgeoning 'Glamping' segment also provides an avenue for selling luxury, high-margin items.

Segmentation Analysis

The Camping Gear and Equipment Market is meticulously segmented based on product type, distribution channel, and primary application, allowing manufacturers to target specific consumer needs with specialized product lines. Product type segmentation is critical as it reflects the varying degrees of necessity and technological complexity, from essential shelter items to advanced portable electronics. The dominance of physical and online retail channels dictates sales strategy, while the application segment highlights the shifting preferences from minimalist backpacking to comfort-focused family and luxury camping experiences. This granular segmentation is essential for accurate market forecasting and strategic resource allocation across different product categories and geographical regions, optimizing market reach and promotional efforts.

- By Product Type:

- Tents and Shelters (Backpacking Tents, Family Tents, Pop-up Tents, Tarps and Hammocks)

- Sleeping Gear (Sleeping Bags, Sleeping Pads and Air Mattresses, Pillows and Blankets)

- Cooking Gear (Stoves and Grills, Cookware and Utensils, Coolers and Refrigeration)

- Camp Furniture (Chairs and Stools, Tables, Cots)

- Lighting & Power (Lanterns and Flashlights, Portable Power Stations, Solar Chargers)

- Backpacks (Daypacks, Multi-day Backpacks, Technical Packs)

- Accessories and Other Gear (Navigation Tools, Safety & First Aid, Water Filters)

- By Distribution Channel:

- Online Retail (E-commerce Platforms, Brand Websites)

- Specialty Stores (Outdoor Equipment Retailers)

- Supermarkets and Hypermarkets

- Direct-to-Consumer (DTC)

- By Application:

- Backpacking and Trekking

- RV and Car Camping

- Glamping (Luxury Camping)

- General Recreational and Family Camping

Value Chain Analysis For Camping Gear and Equipment Market

The value chain for the Camping Gear and Equipment Market is complex, beginning with raw material sourcing and culminating in consumer purchase and post-sale services. The upstream analysis is dominated by the sourcing of specialized raw materials, including high-performance textiles (nylon, polyester, specialized membranes), aluminum alloys for frames, durable plastics, and insulation materials (down, synthetic fills). Manufacturers must establish robust, often global, supply networks to secure cost-effective and certified sustainable materials, necessitating strict quality control and ethical sourcing practices. Innovation in this stage is driven by R&D focused on lighter weight, increased thermal efficiency, and water resistance, often in collaboration with material science companies to create proprietary technologies that provide a competitive advantage.

The manufacturing and assembly stages involve converting raw materials into finished products through sophisticated processes such as computer-aided design, precision cutting, and specialized stitching techniques, particularly for technical apparel and tents. Operational efficiency and scale are paramount here, leading many major brands to utilize large-scale contract manufacturing facilities, predominantly in Southeast Asia, to minimize labor costs while adhering to stringent quality and safety standards. Effective logistics management is crucial to handle the bulky and seasonally variant nature of inventory, moving products efficiently from production centers to regional distribution hubs, often involving cross-border transportation and complex tariff negotiations.

Downstream analysis highlights the vital role of diverse distribution channels. Direct and indirect sales channels each serve specific customer bases. Indirect channels, primarily encompassing specialty outdoor stores and online marketplaces, provide broad reach and expert advice to consumers. Specialty stores thrive on offering experiential shopping, allowing customers to interact physically with tents and gear, complemented by knowledgeable staff. Direct channels, through brand-owned retail locations and DTC e-commerce sites, allow companies maximum control over branding, pricing, and customer data, fostering loyalty programs and personalized marketing. Post-sale services, including extensive warranties, repair centers, and emerging gear rental or buy-back programs, are increasingly important differentiators, reinforcing product quality and supporting the market's shift toward circularity and sustainability.

Camping Gear and Equipment Market Potential Customers

Potential customers for the Camping Gear and Equipment Market are broadly segmented into several key demographic and psychographic profiles, ranging from minimalist backpackers focused on extreme performance to families prioritizing comfort and convenience. The largest consumer base is the General Recreational Camping segment, comprising families and casual campers who typically engage in car camping or short trips to established campgrounds. These buyers prioritize durability, ease of setup, moderate pricing, and multi-functional items such as large family tents, comfortable air mattresses, and integrated cooking systems, often making purchases through mass retailers and large online marketplaces.

A high-value potential customer segment includes the Technical Outdoor Enthusiasts, such as backpackers, mountaineers, and thru-hikers. This group represents consumers willing to pay a significant premium for ultra-lightweight, high-performance, and technologically advanced gear, valuing low weight-to-performance ratios and superior resilience in extreme conditions. Their purchasing decisions are heavily influenced by specific product specifications, professional reviews, and brand reputation for technical excellence. They predominantly shop at specialized outdoor retailers and directly from high-end technical brands, seeking cutting-edge innovations in insulation, material science, and navigation tools.

The rapidly growing segment of 'Glampers' and Experiential Tourists represents another crucial customer base. These consumers seek luxury, comfort, and aesthetics in their outdoor experiences, driving demand for high-end, specialized products like sophisticated canvas tents, portable high-fidelity audio systems, premium camp furniture, and efficient portable refrigerators. This group is less constrained by weight or size, focusing instead on optimizing the outdoor living environment. Marketers target this segment through lifestyle branding and partnerships with travel and hospitality companies that specialize in luxury outdoor retreats, emphasizing convenience and the elevated nature of the camping experience.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.4 Billion |

| Market Forecast in 2033 | USD 24.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The North Face, Columbia Sportswear, Newell Brands (Coleman), Johnson Outdoors, Big Agnes, Marmot, Black Diamond, Patagonia, Jack Wolfskin, REI Co-op, Decathlon (Quechua), Nemo Equipment, Helly Hansen, Kelty, MSR (Mountain Safety Research), Hilleberg, Vango, Tentsile, Klymit, Snow Peak |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Camping Gear and Equipment Market Key Technology Landscape

The technological landscape of the Camping Gear and Equipment market is characterized by a rapid evolution aimed at maximizing performance, minimizing environmental impact, and integrating smart functionalities. Advanced materials science stands at the forefront of innovation, particularly in the development of proprietary, highly durable, and lightweight fabrics. Companies are investing heavily in technologies such as Gore-Tex substitutes, high-denier nylons treated with sophisticated polyurethane or silicone coatings for enhanced water and UV resistance, and the application of aerospace-grade aluminum and carbon fiber in structural components like tent poles and backpack frames. This focus directly addresses the consumer demand for products that can withstand harsh environments while significantly reducing pack weight for trekkers and backpackers, thereby driving premium price realization.

Another critical area of technological advancement is thermal regulation and insulation. Modern sleeping gear utilizes highly efficient synthetic insulation materials that retain warmth even when wet, rivaling the performance of high-fill-power down while offering anti-microbial treatments. Furthermore, the development of sophisticated air-chamber designs in sleeping pads and air mattresses, coupled with specialized reflective coatings, dramatically increases the R-value (a measure of thermal resistance) without increasing bulk. Beyond passive insulation, active temperature regulation through battery-powered heating elements integrated into apparel and sleeping bags is emerging as a niche, high-tech offering, utilizing miniature, flexible circuitry that offers user-controlled comfort in variable conditions, addressing a key pain point for four-season campers.

The integration of connectivity and power solutions represents the shift toward 'Smart Camping.' This includes highly efficient portable solar panels that can charge small electronics quickly, miniaturized power stations (lithium-ion based) capable of running cooking appliances or medical devices, and navigation tools incorporating GPS, satellite communication, and IoT sensors. These smart devices enable campers to maintain connectivity, enhance safety through real-time location sharing and emergency alerts, and manage power consumption efficiently. Manufacturers are increasingly embedding near-field communication (NFC) chips or QR codes onto gear to facilitate repair tracking, warranty claims, and access to digital instruction manuals, streamlining the user experience and supporting the growing emphasis on product longevity and sustainability within the market.

Regional Highlights

- North America (United States, Canada, Mexico): North America dominates the camping gear market in terms of value, driven by a deeply ingrained outdoor culture, high levels of disposable income, and extensive national park systems that facilitate outdoor tourism. The United States, in particular, showcases high consumer demand for both high-end technical gear (driven by activities like thru-hiking and mountaineering) and specialized recreational products (driven by the popularity of RV and car camping). Manufacturers focus heavily on product innovation, durability, and brand loyalty. The region is a key hub for e-commerce penetration and DTC strategies, with consumers being early adopters of smart camping technology and sustainable product lines. The maturity of the market necessitates continuous differentiation through specialized materials and niche offerings, such as luxury glamping gear.

- Europe (Germany, UK, France, Scandinavia): Europe represents a mature market characterized by stringent environmental regulations and a high appreciation for sustainable, durable products. Countries like Germany and the Scandinavian nations exhibit strong participation rates in hiking and backpacking, driving demand for technical apparel and lightweight, robust tents. The UK and France maintain strong markets for family and recreational camping. European consumers prioritize ethical sourcing and the longevity of equipment, leading to high sales of premium brands that offer extensive warranties and repair services. Regulatory alignment, particularly within the EU, influences product standards related to chemicals and fire safety, subtly shaping the product development cycles across the continent.

- Asia Pacific (APAC) (China, Japan, South Korea, Australia): APAC is anticipated to be the fastest-growing region, driven by rapid urbanization, rising middle-class disposable income, and increased interest in leisure activities. While countries like Japan and South Korea have long-established outdoor cultures and a preference for highly specialized, innovative gear (exemplified by brands like Snow Peak), China’s burgeoning interest in leisure camping and domestic tourism is transforming the market. Governments in the region are investing in ecotourism infrastructure, further stimulating demand for entry-level and mid-range equipment. The primary challenge remains navigating complex distribution channels and adapting product specifications to diverse climates and cultural preferences across the vast region.

- Latin America (Brazil, Argentina, Chile): Latin America represents an opportunistic but developing market. Market growth is primarily concentrated in urban centers and regions with established adventure tourism (e.g., Patagonia in Chile and Argentina). Consumers are generally price-sensitive, leading to higher demand for value-oriented and locally produced gear, though affluent consumers in major metropolitan areas drive demand for international premium brands. Infrastructure development related to campgrounds and accessible natural areas remains a significant factor influencing the rate of market expansion, with current growth primarily driven by domestic adventure travel and eco-tourism initiatives.

- Middle East and Africa (MEA): The MEA market is highly diversified, with specific areas like the UAE and Saudi Arabia showing growing interest in luxury desert camping ('glamping') and high-end outdoor leisure, driven by governmental tourism diversification efforts. Conversely, parts of Africa focus on safari tourism, driving demand for specialized, heavy-duty expedition gear and rugged power solutions. The market size is smaller and highly fragmented, often dependent on the influx of international tourists and expatriates. Extreme climatic conditions necessitate specialized product attributes such as enhanced UV protection and robust cooling solutions for prolonged outdoor use in high temperatures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Camping Gear and Equipment Market.- The North Face (a subsidiary of VF Corporation)

- Columbia Sportswear Company

- Newell Brands (Coleman)

- Johnson Outdoors Inc.

- Big Agnes

- Marmot (a subsidiary of Newell Brands)

- Black Diamond Equipment

- Patagonia, Inc.

- Jack Wolfskin

- REI Co-op (Recreational Equipment, Inc.)

- Decathlon (Quechua brand)

- Nemo Equipment

- Helly Hansen

- Kelty (a subsidiary of Exxel Outdoors)

- MSR (Mountain Safety Research - a subsidiary of Cascade Designs)

- Hilleberg the Tentmaker

- Vango (a brand of AMG Group)

- Tentsile

- Klymit

- Snow Peak

Frequently Asked Questions

Analyze common user questions about the Camping Gear and Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Camping Gear and Equipment Market?

The Camping Gear and Equipment Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of 6.8% over the forecast period spanning from 2026 to 2033. This growth is primarily attributed to sustained global interest in outdoor recreational activities, driven by health and wellness trends, coupled with rapid innovations in lightweight and smart camping technology, enhancing user experience and product performance across various segments.

Which product segment holds the highest growth potential in the next five years?

While the Tents and Shelters segment maintains the largest market share by value, the Sleeping Gear category, encompassing high-performance sleeping bags, insulated pads, and advanced hammocks, is anticipated to demonstrate the highest growth potential. This acceleration is fueled by continuous technological breakthroughs in insulation science (synthetic and down alternatives) and thermal optimization, directly addressing consumer demands for maximum comfort and reduced weight for extended trips.

How is the trend of 'glamping' influencing market demand and product design?

The 'glamping' (glamorous camping) trend significantly influences market dynamics by creating robust demand for high-margin, comfort-focused, and aesthetically pleasing equipment. This application segment drives the sales of large, multi-room tents, premium portable furniture, advanced cooling and cooking systems, and solar-powered amenities. Manufacturers are responding by focusing product design on luxury, ease of setup, and enhanced durability rather than strict weight limitations, thereby increasing the average selling price of specialized gear.

What are the primary challenges faced by manufacturers in the Camping Gear and Equipment industry?

Manufacturers face key challenges including managing intense seasonality, which necessitates sophisticated inventory management and risk mitigation strategies to avoid overstocking and obsolescence. Furthermore, the reliance on complex, global supply chains for specialized technical fabrics and materials creates vulnerability to geopolitical instability and transportation disruptions. Finally, the high initial cost of sustainable and premium equipment poses a price barrier for entry-level and casual consumers, limiting market penetration in certain demographic segments.

Which geographical region is expected to show the strongest market expansion through 2033?

The Asia Pacific (APAC) region, particularly driven by large consumer bases in China and India, is forecast to achieve the strongest market expansion rate through 2033. This growth is underpinned by rising disposable incomes, rapid urbanization leading to increased interest in nature escapes, and government investments supporting domestic eco-tourism and outdoor recreational infrastructure. This region represents the largest untapped potential for both established international brands and local manufacturers focusing on mid-range and entry-level products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager