Camping Sleeper Pad Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437836 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Camping Sleeper Pad Market Size

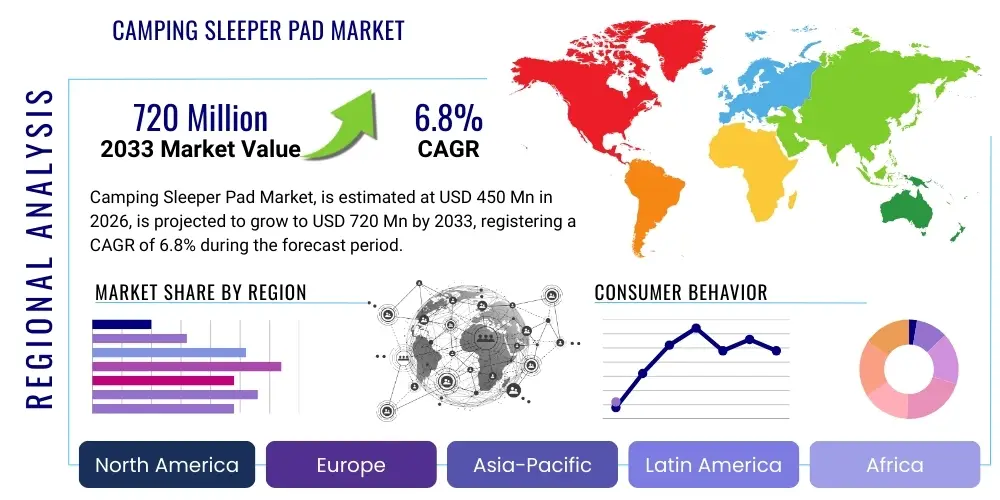

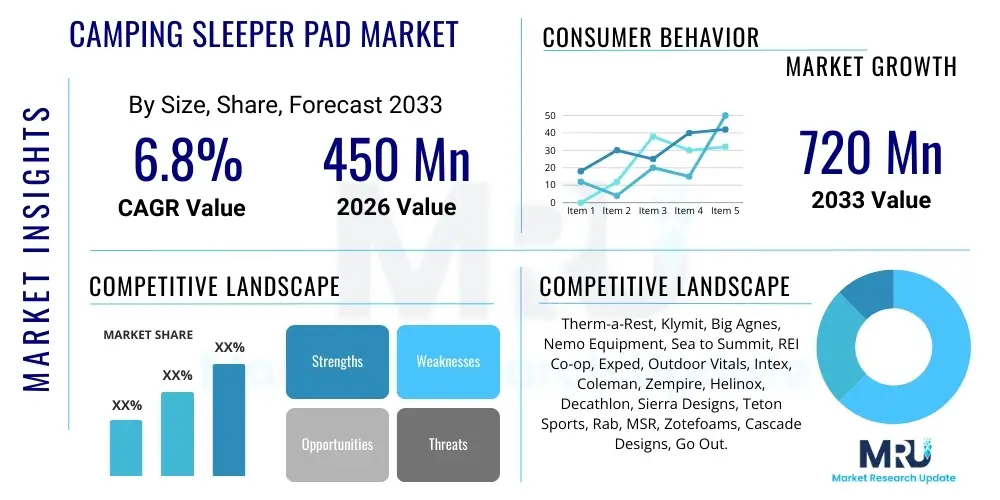

The Camping Sleeper Pad Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 720 Million by the end of the forecast period in 2033.

Camping Sleeper Pad Market introduction

The Camping Sleeper Pad Market encompasses the manufacturing, distribution, and sale of specialized portable bedding designed to provide insulation and cushioning for outdoor enthusiasts. These pads are essential components of modern camping gear, significantly enhancing comfort and protecting users from cold ground temperatures, thereby preventing heat loss crucial for restful sleep in variable outdoor environments. The core product categories include self-inflating pads, air pads requiring manual or pump inflation, and closed-cell foam pads. Product differentiation is primarily driven by R-value (a measure of thermal resistance), weight, packed size, and durability, catering to diverse consumer needs ranging from ultra-lightweight backpacking to heavy-duty car camping.

Major applications for camping sleeper pads span recreational activities such as weekend camping trips, long-distance backpacking expeditions, mountaineering, and general outdoor pursuits. The primary benefits include superior thermal regulation, improved ergonomic support compared to sleeping directly on the ground, and enhanced portability, which is critical for trekkers and hikers. Technological advancements in material science, such as the adoption of high-denier ripstop nylon and Thermoplastic Polyurethane (TPU) lamination, are driving innovation toward lighter, more robust, and better-insulated products, improving the overall consumer experience and longevity of the equipment.

The market growth is fundamentally driven by the escalating global interest in outdoor recreation and adventure tourism, particularly among younger demographics who prioritize experiential travel. Furthermore, increasing disposable income in emerging economies, coupled with growing awareness regarding the health benefits of disconnecting and spending time outdoors, substantially fuels demand for high-quality, specialized camping equipment. The COVID-19 pandemic further accelerated this trend by pushing consumers toward localized outdoor activities, establishing new customer bases that continue to invest in durable outdoor gear, making comfort and performance crucial purchasing factors.

Camping Sleeper Pad Market Executive Summary

The Camping Sleeper Pad Market exhibits robust growth, underpinned by evolving consumer preferences favoring lightweight, high-performance gear optimized for varied climatic conditions. Business trends indicate a strong shift towards sustainability, with key players integrating recycled materials and minimizing the environmental footprint of their manufacturing processes, responding to environmentally conscious consumer demand. Innovations focused on ergonomic design, such as body-mapped baffles and integrated pillow systems, are creating premium market segments, driving up the average selling price (ASP) for advanced air pads with high R-values (R-5 and above). Strategic mergers, acquisitions, and partnerships between gear manufacturers and technology firms are commonplace, aiming to secure supply chains for advanced materials and broaden distribution reach, particularly through direct-to-consumer (D2C) online channels, which provide manufacturers greater control over branding and pricing strategies.

Regionally, North America and Europe maintain dominance, characterized by high rates of outdoor participation and established infrastructure for camping and hiking. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market, driven by rising outdoor leisure adoption in countries like China, Japan, and Australia, coupled with increasing disposable incomes facilitating investment in specialized recreational equipment. Regional competition is intense, requiring manufacturers to tailor product specifications—such as prioritizing three-season versus four-season insulation—to local climate needs. Furthermore, organized retail expansion in these regions, including specialized outdoor stores and large format sporting goods retailers, significantly improves product accessibility and consumer education regarding technical gear specifications.

Segment-wise, the air pads category currently leads in terms of revenue, primarily due to their superior packability and comfort customization capabilities through adjustable inflation levels. However, the foam pad segment is experiencing resurgence, particularly among ultra-light backpackers and budget-conscious consumers who value reliability, puncture resistance, and low cost. The online distribution channel is rapidly gaining market share, capitalizing on detailed product comparisons, customer reviews, and effective digital marketing campaigns that target specific outdoor activity niches (e.g., mountaineering versus family camping). Trend analysis suggests a future where segmentation relies heavily on integrated technology, such as smart inflation pumps and connectivity features, providing valuable data on sleep patterns and microclimate management to enhance user experience.

AI Impact Analysis on Camping Sleeper Pad Market

Common user questions regarding AI's impact on the Camping Sleeper Pad Market frequently center on how machine learning can optimize product design, streamline supply chains, and enhance the overall user experience through personalized recommendations. Users are keen to understand if AI can contribute to creating smarter sleeping solutions, such as predictive insulation adjustment or automated microclimate control within the pad. Concerns often revolve around the necessity and cost of integrating complex electronics into traditionally minimalist outdoor gear. The prevailing expectations point toward AI primarily improving manufacturing efficiency, leveraging algorithms to identify material defects, forecast localized demand fluctuations based on weather patterns and travel trends, and personalize insulation specifications based on user biometrics and typical camping environments, moving beyond generic thermal ratings.

- AI-driven Predictive Maintenance: Analyzing material stress points and usage patterns to inform design iterations, extending product life and reducing failure rates.

- Optimized R-Value Calculation: Using machine learning models to simulate thermal performance across varied temperatures and weights, leading to more accurate and personalized insulation ratings.

- Supply Chain Resilience: Employing AI to monitor global commodity prices, predict logistics bottlenecks, and optimize inventory levels based on granular geographical demand forecasting (e.g., anticipating high demand for cold-weather pads in specific regions based on climate forecasts).

- Personalized Product Recommendations: Utilizing user-reported data (sleep style, body type, preferred activity, and usual camping environment) to recommend the optimal pad type, R-value, and dimension.

- Automated Manufacturing Quality Control: Implementing computer vision and AI inspection systems on the assembly line to instantly detect lamination flaws, air leaks, or inconsistent foam density.

- Smart Pad Integration (Future): Developing embedded sensors linked to AI algorithms to dynamically adjust pressure or airflow, optimizing comfort based on real-time body temperature and movement during sleep.

DRO & Impact Forces Of Camping Sleeper Pad Market

The market dynamics of camping sleeper pads are shaped by a complex interplay of drivers, restraints, opportunities, and their collective impact forces. Primary drivers include the massive surge in global adventure tourism, a renewed focus on holistic well-being encouraging outdoor activities, and continuous innovation in lightweight, high R-value materials that address the stringent demands of serious backpackers and mountaineers. Conversely, the market faces restraints such as the high cost associated with premium, technical gear, which limits accessibility for budget consumers, coupled with market saturation in developed economies where replacement cycles become the primary source of revenue rather than new consumer adoption. Furthermore, the volatility in raw material prices, particularly petrochemical-derived plastics used in TPU and nylon, introduces manufacturing cost pressures that can restrict profit margins, especially for mid-tier brands.

Significant opportunities arise from the increasing adoption of eco-friendly and sustainably sourced pads, appealing to a consumer base that values corporate social responsibility. The penetration of e-commerce platforms provides a crucial avenue for direct interaction, customization, and efficient global distribution, minimizing reliance on traditional retail bottlenecks. Moreover, market expansion in developing regions, especially in Southeast Asia and Latin America, driven by rising middle-class disposable incomes and government initiatives promoting domestic tourism, presents untapped growth potential. Specialized market niches, such as pads tailored specifically for winter camping, hammock camping, or ultra-marathon runners seeking minimal weight solutions, offer avenues for premium pricing and brand differentiation, utilizing technological superiority as a competitive edge.

The impact forces driving this market are predominantly concentrated on consumer health and technological advancement. Improved sleep quality resulting from advanced pad designs is a major purchasing motivator, creating strong emotional links to product investment. Technology impacts manifest through radical improvements in the insulation-to-weight ratio (R-value per gram), making previously impossible long-haul, minimalist expeditions feasible. These forces ensure that consumers are consistently willing to upgrade to newer models that offer marginal, but critical, improvements in performance. The collective impact of these forces fosters a highly competitive environment where manufacturers must perpetually invest in R&D to maintain market relevance, simultaneously managing the cost implications of high-performance material procurement and sustainable manufacturing standards required by modern consumers.

Segmentation Analysis

The Camping Sleeper Pad Market is comprehensively segmented based on product Type, Application, Distribution Channel, and Material, providing a granular view of consumer behavior and specialized demand niches. Understanding these segments is vital for strategic planning, allowing manufacturers to optimize product portfolios and marketing efforts toward the highest-growth areas. The overall segmentation reflects a mature market where consumer choice is highly specialized; for instance, backpackers prioritize weight and R-value efficiency, while car campers prioritize plush comfort and size, driving distinct segment performance.

- By Type:

- Self-inflating Pads

- Air Pads/Inflatable Pads

- Foam/Closed-Cell Pads

- By Application:

- Backpacking & Hiking

- Car Camping

- Mountaineering & High Altitude Expeditions

- General Recreational Use

- By Distribution Channel:

- Online Retail (E-commerce Platforms, Brand Websites)

- Offline Retail (Specialty Stores, Department Stores, Mass Merchandisers)

- By Material:

- Nylon

- Polyester

- TPU (Thermoplastic Polyurethane)

- PVC (Polyvinyl Chloride)

Value Chain Analysis For Camping Sleeper Pad Market

The value chain for the Camping Sleeper Pad Market begins with upstream activities focused heavily on raw material sourcing. This involves the procurement of highly specialized technical textiles (high-denier nylon and polyester), foam components (polyurethane and EVA), and synthetic insulation materials, which are often petrochemical derivatives. Crucially, suppliers of TPU lamination film and specialized valve components dictate product durability and inflation efficiency. Manufacturers must manage complex global supply chains to secure cost-effective and high-quality inputs, particularly for achieving the precise R-values and weight metrics demanded by premium consumers. R&D and design—focusing on baffle structure, body mapping, and valve technology—form a crucial intermediate step that generates intellectual property and competitive advantage.

The core manufacturing process involves lamination, welding, insulation insertion, and assembly. Quality control is paramount during this stage to prevent micro-leaks or delamination, which are the primary causes of product failure. The downstream segment involves robust distribution channels. These channels are categorized into direct and indirect models. Direct channels include the brand's own e-commerce website and flagship stores, offering higher margins and direct consumer data access. Indirect channels involve wholesalers, large-scale sporting goods retailers (e.g., REI, Decathlon), and specialized independent outdoor gear shops, which provide necessary market reach and localized service, especially in regions requiring technical guidance for product selection.

The final stage involves marketing and sales, where digital content, influencer endorsements, and detailed educational resources play a crucial role in conveying the technical features, such as R-value and packed volume, to the end-user. Effective logistics and after-sales service, including warranty support for leaks and manufacturing defects, solidify brand reputation. The transition towards omnichannel distribution necessitates tight integration between inventory management and online order fulfillment. Profitability across the value chain is highly dependent on effective inventory management to prevent overstocking of seasonal items and leveraging direct sales to bypass intermediary markups, thereby capturing a greater share of the final retail price.

Camping Sleeper Pad Market Potential Customers

Potential customers for camping sleeper pads represent a diverse spectrum of outdoor enthusiasts, categorized primarily by their activity type, frequency of use, and budget constraints. The core buying segments include serious backpackers and mountaineers who require ultra-lightweight, high-insulation (R-5+) pads that maximize warmth-to-weight efficiency and packability, willing to pay a premium for minimal bulk. A second major segment is the family or casual car camper, who prioritizes comfort, durability, and size, often opting for thicker, wider, and sometimes double-sized pads, where weight is a lesser concern but ease of inflation is highly valued.

A rapidly growing customer base includes millennials and Gen Z individuals engaging in weekend glamping or festival camping, focusing on moderately priced, durable, and stylish options. These consumers often utilize online research extensively and are influenced by social media trends. Additionally, institutional buyers such as wilderness programs, rental agencies, outdoor education centers, and military/emergency response organizations represent consistent, bulk buyers focused on durability, standardization, and long-term cost of ownership, often preferring robust, repairable models or closed-cell foam pads known for their reliability in harsh conditions.

Understanding the needs of these varied end-users is crucial for product design. For instance, backpackers are sensitive to the noise (crinkling sound) associated with certain insulation materials, driving demand for silent-sleep technologies. Conversely, car campers seek integrated comfort features like plush surfaces and raised side rails. Manufacturers must align their product development—whether focusing on ultra-light nylon for the enthusiast segment or heavy-duty polyester for the rental market—with the specific performance and budgetary criteria of these key end-user/buyer groups to maximize market penetration and brand loyalty, ensuring the correct balance between thermal performance and ergonomic design.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 720 Million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Therm-a-Rest, Klymit, Big Agnes, Nemo Equipment, Sea to Summit, REI Co-op, Exped, Outdoor Vitals, Intex, Coleman, Zempire, Helinox, Decathlon, Sierra Designs, Teton Sports, Rab, MSR, Zotefoams, Cascade Designs, Go Out. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Camping Sleeper Pad Market Key Technology Landscape

The technology landscape of the Camping Sleeper Pad Market is dominated by advancements in thermal efficiency and weight reduction, focusing heavily on insulation technology and material engineering. A critical technological innovation is the continued refinement of the R-value, achieved through sophisticated internal structures such as horizontal or vertical baffling systems, reflective barriers (like aluminized film), and specialized synthetic fill materials designed to trap air effectively. For instance, sophisticated air pad designs now incorporate multiple internal chambers and proprietary heat-reflective coatings to achieve high R-values (R-7+) suitable for extreme cold without significant weight penalty. Furthermore, advancements in lamination techniques, primarily utilizing durable TPU coatings over lightweight nylon fabrics, ensure air retention and improve puncture resistance, addressing the long-standing durability concerns associated with inflatable pads.

Another pivotal area of technological innovation is inflation and deflation mechanisms. Manual pump sacks and integrated foot pumps are becoming standard accessories, eliminating the need for battery-powered pumps while preventing moisture from entering the pad, which degrades insulation performance. High-flow, multi-function valves, such as flat valves or wing valves, significantly reduce the time required for setup and packing, offering a considerable convenience factor, especially in cold environments. This focus on ease-of-use technology caters directly to consumer demand for minimal effort and rapid deployment in the field, making the entire camping experience smoother and more reliable.

Emerging technologies include the integration of biodegradable or recycled materials (such as recycled PET bottles used in synthetic insulation) to meet sustainability targets, and advanced fabric treatments to enhance abrasion and UV resistance. Although still niche, smart technology integration, featuring minor electronic components for auto-inflation to a user-defined firmness level or embedded sensors that monitor ambient temperature and alert the user to potential thermal challenges, represents the next generation of high-end sleeping systems. Brands are actively filing patents related to noise reduction in internal insulation layers, aiming to mitigate the loud crinkling sounds that often disrupt sleep when pads are weighted by a moving user, further enhancing the overall user experience through nuanced technological refinement.

Regional Highlights

- North America (Dominant Market Share): North America, led by the United States and Canada, represents the largest and most mature market for camping sleeper pads. This dominance is attributed to a deeply ingrained culture of outdoor recreation, extensive national park systems, high disposable income, and a strong presence of leading outdoor gear brands. Demand here is characterized by a strong preference for high-performance, four-season pads (R-value 4+) due to varied climates, and a rapid adoption rate for technology-driven, ultra-light backpacking equipment. The competitive landscape is fierce, driven by continuous product innovation and aggressive marketing by both established giants and niche D2C brands.

- Europe (Strong Growth and Sustainability Focus): The European market, encompassing the UK, Germany, France, and Scandinavia, shows robust demand, particularly for environmentally conscious and sustainably sourced products. European consumers often prioritize product longevity and repairability, influencing manufacturers to adopt modular designs and utilize recycled materials. Demand is diversified, with alpine regions driving sales of specialized mountaineering pads, while coastal areas favor general recreational and foam pad alternatives. Regulations regarding chemical use and manufacturing safety standards also shape product development in this region, pushing innovation towards greener alternatives.

- Asia Pacific (Fastest Growing Region): The APAC region is projected to exhibit the highest CAGR during the forecast period. This growth is spurred by the rapidly increasing middle class in countries like China, India, and Southeast Asian nations, leading to greater participation in domestic tourism and camping. While budget-friendly options currently hold significant market share, there is a burgeoning segment demanding high-quality, international-standard gear, particularly for technical trekking in regions like the Himalayas or New Zealand. The expansion of organized retail and e-commerce platforms is crucial for market penetration in this geographically vast and diverse area.

- Latin America (Emerging Potential): The Latin American market remains relatively fragmented but holds substantial potential, driven by rising interest in ecotourism and regional natural attractions (e.g., Patagonia, Andean regions). Market penetration is currently hampered by economic instability and reliance on imported goods, making price sensitivity a major factor. However, as local manufacturing capabilities improve and distribution networks mature, particularly in Brazil and Mexico, the demand for accessible, durable camping gear is expected to rise steadily, often focusing initially on entry-level and mid-range pads suitable for short-term recreational use.

- Middle East and Africa (Niche Market Development): The MEA region is a niche market, with demand concentrated in specific areas like South Africa and the UAE, often linked to luxury safari tourism or expat communities engaging in regional travel. Climate conditions dictate demand for low R-value pads (or pads focused on comfort rather than extreme cold insulation) in many parts of the Middle East, while South Africa exhibits more conventional demand patterns. Growth here is slow but steady, dependent primarily on the development of outdoor leisure infrastructure and tourism stability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Camping Sleeper Pad Market.- Therm-a-Rest (Cascade Designs)

- Klymit

- Big Agnes

- Nemo Equipment

- Sea to Summit

- REI Co-op

- Exped

- Outdoor Vitals

- Intex

- Coleman

- Zempire

- Helinox

- Decathlon (Quechua)

- Sierra Designs

- Teton Sports

- Rab

- MSR (Mountain Safety Research)

- Zotefoams

- Go Out

- Luxe Camping

Frequently Asked Questions

Analyze common user questions about the Camping Sleeper Pad market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most critical factor when selecting a camping sleeper pad?

The most critical factor is the R-value, which measures the pad's resistance to heat flow and indicates its insulating capacity. A higher R-value (R-5 and above) is essential for cold weather or four-season use, while lower values suffice for summer or indoor camping, ensuring thermal comfort and preventing conductive heat loss to the ground.

Are foam pads or inflatable pads better for serious backpacking?

Inflatable air pads are generally preferred for serious backpacking due to their superior combination of low weight, minimal packed volume, and high R-value capability. However, closed-cell foam pads remain popular for their absolute reliability, puncture resistance, and lower cost, often used as a protective layer beneath an air pad.

How are sustainable practices influencing the Camping Sleeper Pad Market?

Sustainability is driving innovation toward using recycled materials, such as post-consumer plastic in insulation and fabric coatings, and employing manufacturing processes that reduce volatile organic compounds (VOCs). Consumers increasingly seek pads with reduced environmental impact and brands committed to lifecycle assessment and repair programs.

What is the expected growth driver for the Camping Sleeper Pad Market in the Asia Pacific region?

The primary growth driver in APAC is the rapid expansion of the middle-class population, leading to increased leisure spending on outdoor activities and adventure tourism. This demographic shift, coupled with improved retail infrastructure and digitalization, boosts demand for international-standard, specialized camping equipment.

What is TPU lamination and why is it important in sleeping pad technology?

TPU (Thermoplastic Polyurethane) lamination is a critical manufacturing process used to seal the fabric of inflatable pads, ensuring air-tightness and enhancing durability. It is favored over traditional PVC because it is lighter, more flexible, and generally perceived as a more environmentally friendly material, offering superior resistance to delamination and punctures under stress.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager