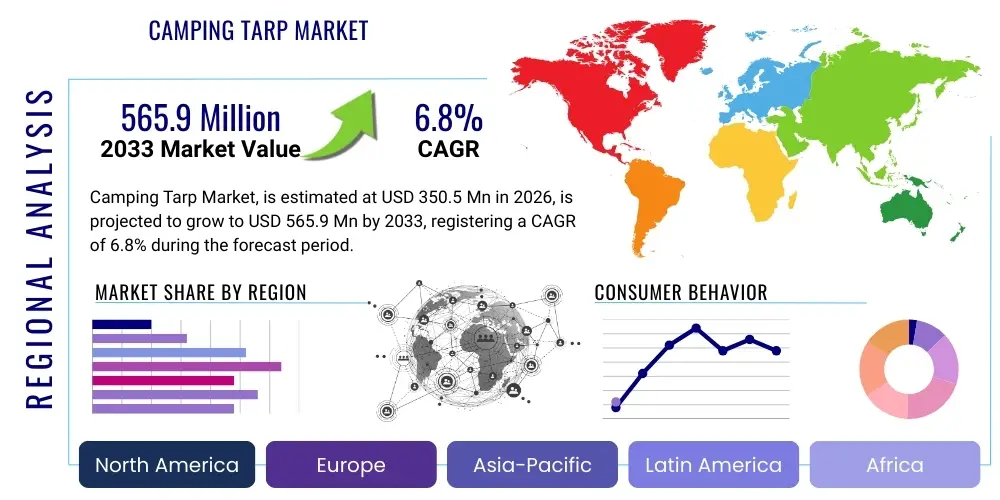

Camping Tarp Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437236 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Camping Tarp Market Size

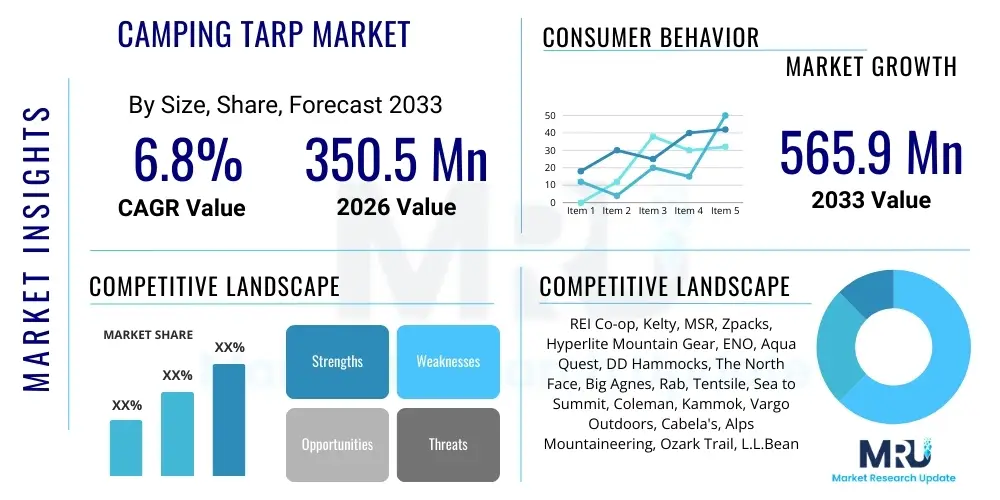

The Camping Tarp Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 350.5 million in 2026 and is projected to reach USD 565.9 million by the end of the forecast period in 2033. This consistent expansion is underpinned by the increasing global participation in outdoor recreational activities, driven particularly by millennials and Gen Z seeking experiential travel and lightweight, versatile shelter solutions. The market exhibits robust demand, moving beyond traditional polyethylene tarps to premium, technical materials like silicone-impregnated nylon (silnylon) and Dyneema Composite Fabrics (DCF), which offer superior performance in terms of weight, durability, and weather resistance, justifying higher average selling prices and contributing significantly to market value growth.

Camping Tarp Market introduction

The Camping Tarp Market encompasses the global trade of lightweight, portable, and weather-resistant sheets primarily designed to provide overhead shelter, ground cover, or windbreak protection for outdoor enthusiasts. Camping tarps serve as crucial elements in minimalist camping, backpacking, hammock setups, and overlanding applications, offering flexibility and reduced weight compared to traditional tents. These products vary widely in material, size, shape (e.g., flat, hexagonal, cat-cut), and waterproofing capabilities, catering to diverse environmental conditions and user requirements. Major applications include extended wilderness expeditions where weight saving is critical, emergency shelters, and enhancing existing tent setups by providing an ancillary covered area for cooking or gear storage. Key benefits include superior portability, quick setup times, multi-functionality, and significant cost savings relative to full-scale shelter systems, driving increased adoption across all segments of outdoor recreation globally. The market growth is substantially driven by the rising popularity of dispersed camping, sustainable tourism initiatives, and the constant technological advancements in polymer and fiber engineering leading to the creation of ultra-durable and highly packable products that appeal to the discerning modern camper.

Camping Tarp Market Executive Summary

The global Camping Tarp Market is experiencing sustained upward momentum, characterized by significant shifts towards high-performance materials and specialized product designs that cater to niche activities like ultralight backpacking and tactical outdoor operations. Business trends highlight intense competition focusing on innovation in fabric technology—specifically increasing the adoption of DCF and high-denier polyester with advanced polyurethane (PU) or silicone coatings—to achieve market differentiation. Sustainability is emerging as a critical competitive factor, with brands emphasizing recycled materials and ethical manufacturing practices to appeal to environmentally conscious consumers. Regionally, North America and Europe remain the dominant revenue generators due to established outdoor recreation cultures and high disposable income allocated to quality outdoor gear. However, the Asia Pacific region is forecast to exhibit the fastest Compound Annual Growth Rate (CAGR), fueled by expanding middle classes, government investment in ecotourism, and the rapid urbanization leading to increased weekend outdoor escapism. Segment trends indicate that the Nylon-based segment holds a leading market share due to its balance of cost and performance, while the Application segment sees the highest growth in the Hammock Setup category, paralleling the explosion in popularity of portable hammock systems. Distribution channels are increasingly dominated by specialized online retail platforms, which offer extensive product comparisons and detailed user reviews, enhancing consumer confidence and facilitating direct-to-consumer strategies for smaller, niche manufacturers.

AI Impact Analysis on Camping Tarp Market

Common user questions regarding AI's influence in this domain typically revolve around personalized product selection, predictive durability, optimized supply chain logistics, and the future integration of 'smart' features into outdoor gear. Users are keen to know if AI can recommend the perfect tarp shape and material based on their specific trip variables (location, expected weather, duration, user height/pack size) and how AI can ensure faster delivery and lower costs. Furthermore, there is interest in how machine learning models can predict the lifespan and potential failure points of high-tech fabrics under various stress tests, ensuring quality control and reducing manufacturing waste. Users also anticipate AI-driven interfaces for customizing tarp designs, particularly for specialized applications like overlanding or large group shelters. The core themes center on leveraging AI for hyper-personalization, achieving enhanced operational efficiency in manufacturing and distribution, and innovating product design through data-driven performance analysis, ultimately aiming for a more reliable and streamlined consumer experience in selecting durable outdoor shelters.

- AI algorithms optimize inventory management and demand forecasting for seasonal fluctuations in outdoor gear sales.

- Machine learning enhances materials science, predicting the optimal fabric blend (e.g., UV resistance, tear strength) for specific environmental specifications, leading to faster product development cycles.

- Predictive analytics models are utilized to analyze consumer reviews and social media trends, informing manufacturers about desired features (e.g., reinforced tie-out points, specific color palettes).

- AI-powered chatbots and recommendation engines provide personalized purchasing advice, suggesting the ideal tarp size and material based on intended application (e.g., ultralight backpacking vs. family car camping).

- Automation and robotic systems integrated through AI streamline manufacturing, reducing fabric wastage and improving precision cutting of complex tarp geometries (e.g., catenary curves).

DRO & Impact Forces Of Camping Tarp Market

The dynamics of the Camping Tarp Market are shaped by a powerful interplay of motivating drivers, significant market constraints, and emerging strategic opportunities, collectively defining the impact forces influencing industry growth and direction. The primary drivers include the global surge in interest in outdoor recreational activities, accelerated by post-pandemic trends emphasizing nature-based activities and mental wellness, which directly translates to higher demand for reliable, portable shelter solutions. Concurrently, technological advancements in material science, particularly the development of high strength-to-weight ratio fabrics, allow manufacturers to offer products that are both lighter and more durable, appealing directly to the highly influential ultralight backpacking community. This convergence of demand-side growth and supply-side innovation forms a strong foundation for sustained market expansion. However, the market faces inherent restraints, most notably the intense price sensitivity among recreational campers who often view tarps as non-essential or ancillary gear compared to primary shelter like tents, leading to fierce competition and margin pressure in the low-end segment. Moreover, the cyclical nature of outdoor equipment purchases, coupled with growing environmental concerns regarding the longevity and recyclability of synthetic polymers (nylon, polyester), necessitate substantial R&D investments to maintain competitive edge and align with regulatory compliance.

Opportunities for significant market penetration lie primarily in the emerging economies of Asia Pacific and Latin America, where disposable incomes are rising and infrastructure supporting ecotourism is rapidly developing, creating millions of new potential customers. Furthermore, strategic opportunities exist in diversification, specifically integrating tarps into modular shelter systems (e.g., specialized hammock tarps with integrated bug nets or customizable multi-panel systems) that offer enhanced utility and versatility. Brands can capitalize on the growing overlanding and van-life movements by developing robust, vehicle-integrated awning tarps that blend ease of use with maximum coverage. The effective management of these drivers and restraints dictates success, compelling companies to focus on continuous material innovation—seeking bio-based or fully recyclable polymers—while simultaneously streamlining supply chains to mitigate cost pressures. Strategic marketing focusing on the versatility and emergency preparedness utility of tarps can help overcome the perception of them being merely supplementary gear, thereby increasing market penetration and average transaction value.

The cumulative effect of these factors creates significant impact forces. Positive forces include urbanization leading to demand for quick, accessible escapes, and the viral success of outdoor content on social media, normalizing and promoting minimalist camping practices. Negative forces involve supply chain vulnerabilities exposed by global crises and the challenge of communicating the value proposition of premium, expensive materials (like DCF) to the broader mass market accustomed to inexpensive plastic alternatives. Ultimately, the market trajectory is highly dependent on manufacturers’ ability to effectively balance innovation in lightweight design against the imperative for sustainable and cost-effective production, ensuring that product offerings meet both the performance expectations of experienced adventurers and the budgetary constraints of casual campers across diverse geographic and climatic zones.

- Drivers:

- Rising global participation in outdoor recreation and adventure tourism.

- Increasing consumer demand for lightweight, high-performance, and multi-functional shelter solutions.

- Technological advancements in polymer and fiber engineering (e.g., ultralight, high-denier fabrics).

- Growth in minimalist camping, ultralight backpacking, and hammock camping cultures.

- Growing adoption of overlanding and vehicle-supported camping, requiring specialized awning tarps.

- Restraints:

- Intense price competition, particularly in the low-end commodity tarp segment.

- High manufacturing costs associated with premium materials like Dyneema Composite Fabrics (DCF) and high-quality silnylon.

- Substitution threat from sophisticated, multipurpose lightweight tents and bivouac sacks.

- Environmental concerns regarding the disposal and non-biodegradability of synthetic tarp materials.

- Market vulnerability to economic downturns impacting discretionary consumer spending on outdoor gear.

- Opportunities:

- Expansion into untapped emerging markets, particularly in South America and parts of Asia Pacific with growing tourism sectors.

- Development and commercialization of sustainable and recycled fabric alternatives (e.g., recycled PET polyester).

- Integration of smart technology (e.g., integrated LED lighting systems, UV protective sensors).

- Focus on specialized markets, such as tactical military use, disaster relief applications, and custom/bespoke manufacturing.

- Leveraging e-commerce and direct-to-consumer models to offer customized product specifications and enhanced customer engagement.

- Impact Forces:

- Force of Innovation (High): Driving material performance and reducing weight significantly.

- Force of Substitution (Moderate to High): Constant competition from advanced shelter systems.

- Force of Sustainability (Growing): Influencing consumer choice and demanding greener manufacturing processes.

- Force of Distribution Efficiency (High): E-commerce platforms dictating market reach and speed of delivery.

Segmentation Analysis

The Camping Tarp Market is structurally segmented based on Material, Product Type, Application, and Distribution Channel, each segment reflecting distinct consumer preferences and end-use requirements. This structured analysis allows manufacturers to tailor product development and marketing strategies precisely to the needs of different user groups, ranging from the budget-conscious car camper to the performance-driven ultralight backpacker. The segmentation by material is crucial as it directly determines the product's weight, packability, durability, and cost, with high-tech polymers gaining traction over traditional polyethylene and canvas options, although the latter retains relevance for heavy-duty applications. Furthermore, the segmentation by product shape reflects functional diversity, where cat-cut or shaped tarps are preferred for their superior wind shedding characteristics and ease of tensioning, contrasting with flat tarps that offer maximum flexibility in pitching configuration but require greater skill to set up effectively.

Application-based segmentation provides insights into consumer behavior, showing that backpacking and hammock camping drive demand for premium, lightweight materials, whereas car camping and base camps prioritize size, coverage, and robust tear resistance, often favoring heavier but more affordable polyester. The evolving nature of outdoor activities, such as the rise of van life and overlanding, continues to carve out new niche application segments requiring specialized product designs, such as integrated modular systems that attach directly to vehicles or provide expanded weatherproof living space adjacent to the primary shelter. Analyzing these segments is essential for understanding market saturation levels and identifying high-growth opportunities, particularly in catering to the experiential economy where consumers seek personalized and highly reliable gear.

Finally, the distribution channel segmentation underscores the transition towards digital platforms. While traditional sporting goods stores remain vital for physical examination and expert advice, online retail, including major e-commerce platforms and specialized brand websites, now dominates the market due to its ability to offer vast inventories, detailed specifications, and competitive pricing. This digital shift supports niche and specialized manufacturers in reaching global audiences without needing extensive physical retail footprints, thereby fostering innovation and market fragmentation. Strategic focus remains on optimizing the digital experience, leveraging high-quality photography, 3D models, and integrated customer service to emulate the in-store consultation process and build consumer trust in technically complex products.

- By Material:

- Polyethylene (PE)

- Polyester

- Nylon (Silnylon, Silpoly)

- Canvas/Cotton

- Dyneema Composite Fabric (DCF)

- By Product Type:

- Flat Tarps

- Shaped Tarps (Hexagonal, Cat-Cut, Asymmetrical)

- Specialty Tarps (Bivvy Tarp, Wing Tarp)

- By Application:

- Backpacking/Trekking

- Car Camping/Base Camp

- Hammock Setup

- Overlanding/Vehicle Shelter

- Emergency/Survival

- By Distribution Channel:

- Offline Channels (Specialty Sporting Goods Stores, Hypermarkets/Supermarkets)

- Online Channels (E-commerce Portals, Direct-to-Consumer Websites)

Value Chain Analysis For Camping Tarp Market

The value chain for the Camping Tarp Market begins with upstream activities involving the sourcing and processing of raw materials, primarily synthetic polymers like nylon and polyester, along with specialized coatings such as silicone, polyurethane, and UV inhibitors. Upstream suppliers are typically large chemical companies and textile manufacturers focused on technical fabric production, where efficiency and consistency in material specification (denier, thread count, ripstop capabilities) are paramount. Material innovation, such as the refinement of Silpoly (silicone-coated polyester) or the costly production of DCF, dictates the final product quality and cost structure. Manufacturers must maintain strong relationships with these suppliers to ensure a steady, high-quality input stream, especially for specialized materials that may face supply constraints or significant lead times.

The manufacturing process itself forms the core value-add, involving precise cutting using laser or CNC technology to maintain complex geometrical shapes (especially for cat-cut tarps), meticulous seam sealing (critical for waterproofing integrity), and the attachment of high-stress components like grommets and tie-out points. Effective manufacturing operations focus heavily on quality control, as seam failure or poor waterproofing can severely compromise the product's functionality in the field. Companies increasingly utilize lean manufacturing principles to reduce waste and optimize labor costs, particularly in regions like Southeast Asia, which offer competitive manufacturing environments. Branding, performance assurance through rigorous testing, and compliance with international standards for fire resistance and environmental safety are crucial activities at this stage.

Downstream activities center on distribution and retail. The distribution channel is bifurcated into direct and indirect routes. Direct distribution involves manufacturers selling directly to consumers (D2C) via their own e-commerce platforms, offering higher margins and direct feedback loops but requiring substantial investment in logistics and fulfillment infrastructure. Indirect distribution relies on partnerships with large sporting goods retailers (e.g., REI, Decathlon), major online marketplaces (Amazon), and regional wholesalers. Specialty outdoor retailers play a vital role in providing informed sales consultations, particularly for higher-end, technical tarps. The final stage involves marketing and after-sales service, where brand reputation, warranty support, and community engagement are crucial for building long-term customer loyalty and driving repeat purchases in a highly competitive consumer goods market.

Camping Tarp Market Potential Customers

The primary end-users and potential customers of the Camping Tarp Market span a broad demographic spectrum within the outdoor recreation domain, unified by a need for portable, versatile, and weatherproof shelter solutions. These customers can be broadly categorized into several distinct groups, including the Adventure Enthusiasts, the Casual Campers, and Institutional Buyers. Adventure Enthusiasts, comprising ultralight backpackers, long-distance hikers (thru-hikers), and mountaineers, prioritize minimum weight and maximum performance, making them the target market for premium, expensive materials like DCF and specialized cat-cut tarps. This segment values technical specifications, durability, and reliability under extreme conditions and is highly influenced by expert reviews and trail community recommendations, representing the most profitable niche for high-margin products.

The Casual Campers segment includes family campers, weekend warriors engaging in car camping, and users of general recreational gear. These customers prioritize ease of use, generous coverage area, and affordability, typically opting for larger, durable polyester or PE tarps. Their purchase decisions are less driven by minor weight differences and more by overall cost, size versatility, and general weather protection for cooking areas or gear storage near a vehicle. This segment is highly sensitive to pricing and often purchases through large retail chains and general e-commerce platforms, representing the largest volume opportunity but often lower margins per unit. Effective marketing to this group emphasizes multi-purpose utility and value for money.

Institutional Buyers constitute a smaller but highly stable demand stream, encompassing government agencies (such as forestry services and emergency management), military and tactical groups, and large commercial outfitters or rental companies. These organizations require highly standardized, durable, and sometimes flame-retardant products purchased in bulk. Their requirements often mandate specific certifications and robust specifications, leading to long-term contracts for standardized polyester or heavy-duty vinyl tarps designed for extreme longevity and reliability in emergency or prolonged field use. Engaging this segment requires specialized B2B sales expertise, compliance assurance, and the capacity to fulfill large, recurring orders consistently. Additionally, customers engaged in niche activities like hammock camping form a high-growth buyer segment, demanding specialized asymmetrical or hexagonal tarps perfectly matched to their suspension systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.5 million |

| Market Forecast in 2033 | USD 565.9 million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | REI Co-op, Kelty, MSR, Zpacks, Hyperlite Mountain Gear, ENO, Aqua Quest, DD Hammocks, The North Face, Big Agnes, Rab, Tentsile, Sea to Summit, Coleman, Kammok, Vargo Outdoors, Cabela's, Alps Mountaineering, Ozark Trail, L.L.Bean |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Camping Tarp Market Key Technology Landscape

The technological evolution within the Camping Tarp Market is focused predominantly on advanced material science and specialized manufacturing techniques designed to maximize the strength-to-weight ratio while ensuring absolute waterproofing and extended UV resistance. The primary innovation has shifted away from simple lamination towards highly specialized fabric treatments. Silicone impregnation of nylon (Silnylon) and, more recently, polyester (Silpoly) remains the industry standard for lightweight performance, offering excellent water repellency and tear resistance without significantly increasing weight or bulk. Furthermore, advancements in specialized polyurethane (PU) coatings now include higher hydrostatic head ratings (e.g., 5000mm+) with improved flexibility and resistance to hydrolysis, addressing one of the major failure points of earlier PU-coated fabrics. The precision required for these coatings demands sophisticated machinery and quality control to ensure uniform application and long-term performance.

A second major technological trend is the increasing dominance of high-modulus polyethylene fiber materials, commercially marketed as Dyneema Composite Fabrics (DCF), which represent the pinnacle of ultralight shelter technology. DCF, though significantly more expensive, offers unparalleled strength-to-weight performance, utilizing laminated non-woven fibers rather than traditional woven fabrics, eliminating the need for bulky seam sealing tapes through proprietary bonding techniques. The adoption of DCF requires specialized manufacturing tools and expertise, as the material cannot be conventionally sewn or taped, thereby differentiating the high-end manufacturers capable of working with it. Moreover, the design of the tarps themselves is increasingly reliant on computational geometry, using catenary cuts (cat-cuts) and complex hexagonal or diamond shapes calculated via CAD software to ensure perfect tensioning, superior wind shedding, and reduced fabric flutter without compromising internal space, making the structure inherently more stable and aerodynamic.

Looking ahead, emerging technologies are focused on sustainability and smart integration. Manufacturers are investing in R&D for bio-based polymers and fully recyclable alternatives to conventional synthetic fabrics, driven by consumer demand for eco-friendly products. Additionally, technologies enabling improved UV protection—critical for extending the lifespan of tarps in high-altitude or sunny environments—are being developed through advanced chemical stabilizers embedded directly into the fiber structure. Though nascent, the integration of very low-power electronics, such as thin-film solar charging patches or embedded light strips, represents a future avenue for ‘smart’ tarps that enhance user convenience, though the core technological priority remains maximizing material performance and manufacturing efficiency to deliver reliable, packable, and long-lasting elemental protection for the outdoor enthusiast.

Regional Highlights

- North America: North America, particularly the United States and Canada, represents the largest and most mature market for camping tarps globally. This dominance is driven by a deep-rooted culture of outdoor recreation, extensive national park systems, and high levels of disposable income dedicated to premium outdoor gear. The region exhibits high demand for both ultralight technical tarps (driven by thru-hiking communities on trails like the Appalachian Trail and Pacific Crest Trail) and robust, large-format tarps for car camping and overlanding. Manufacturers here prioritize innovation in materials like DCF and focus heavily on direct-to-consumer (D2C) sales models, often backed by strong brand communities and warranty programs.

- Europe: Europe is characterized by diverse outdoor activities, ranging from alpine trekking in the Alps to backpacking across Scandinavia. The market demands high quality, often favoring Silnylon and Silpoly due to a strong preference for durable, mid-weight solutions. Regulatory standards, particularly those concerning flame retardancy and environmental impact (e.g., REACH compliance), heavily influence product development. Germany, the UK, and the Nordic countries are major hubs, with a strong emphasis on ethically produced and sustainable gear, pushing manufacturers toward recycled and PFC-free coatings.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rising middle-class disposable income, increasing participation in domestic tourism, and significant governmental investment in outdoor and eco-tourism infrastructure, especially in China, Japan, and Australia. While price sensitivity remains a factor, the demand for high-quality, international brands is accelerating, particularly in urban centers where outdoor activities are seen as a status symbol. This region provides a huge opportunity for mass-market polyester and polyethylene tarps, alongside specialized growth in high-end mountaineering tarps catering to the Himalayan and other major Asian mountain ranges.

- Latin America: The Latin American market is characterized by a high demand for affordable, functional tarps primarily for general camping and utility purposes, reflecting a greater emphasis on cost-effectiveness. Brazil and Mexico are key growth markets, benefiting from favorable climates and increasing adventure travel. While the ultralight segment is smaller, there is substantial untapped potential for mid-range, durable polyester tarps, often distributed through local wholesalers and general merchandise stores.

- Middle East and Africa (MEA): This region is the smallest contributor to the global market but presents unique demands, particularly for high-durability, UV-resistant, and sand-proof tarps suitable for desert camping and arid environments. Institutional procurement for disaster relief and military applications constitutes a significant portion of the market volume. Growth is contingent upon stabilization in key tourism markets and increased investment in high-end safari and adventure tourism infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Camping Tarp Market.- REI Co-op

- Kelty

- MSR (Mountain Safety Research)

- Zpacks

- Hyperlite Mountain Gear

- ENO (Eagles Nest Outfitters)

- Aqua Quest

- DD Hammocks

- The North Face

- Big Agnes

- Rab

- Tentsile

- Sea to Summit

- Coleman

- Kammok

- Vargo Outdoors

- Cabela's (now owned by Bass Pro Shops)

- Alps Mountaineering

- Ozark Trail (Walmart Brand)

- L.L.Bean

Frequently Asked Questions

Analyze common user questions about the Camping Tarp market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the best material for an ultralight backpacking tarp?

The optimal material for ultralight backpacking is Dyneema Composite Fabric (DCF) due to its extremely high strength-to-weight ratio and superior waterproof capabilities. While expensive, DCF offers the lowest packed weight and highest performance for long-distance hikers. High-quality silicone-impregnated nylon (Silnylon) or polyester (Silpoly) are excellent, more affordable alternatives that provide a great balance of durability and low weight.

How is the Camping Tarp Market addressing sustainability and environmental concerns?

The market is addressing sustainability by increasingly adopting recycled materials, particularly post-consumer recycled polyester (rPET), for mainstream products. Furthermore, manufacturers are transitioning away from environmentally harmful coatings like per- and polyfluoroalkyl substances (PFCs) to more eco-friendly, durable water repellent (DWR) alternatives, and focusing on product longevity to reduce replacement cycles.

What factors should influence the choice between a flat tarp and a shaped (cat-cut) tarp?

The choice depends on versatility versus ease of setup. Flat tarps offer maximum versatility, allowing for numerous pitching configurations (A-frame, lean-to, diamond) but require more skill and external cordage. Shaped or cat-cut tarps (often hexagonal) are pre-tensioned with curved edges, making them exceptionally stable in high winds and easier to set up quickly, though their configuration options are limited.

Which distribution channel dominates the sales of premium camping tarps?

Online channels, specifically specialized e-commerce platforms and direct-to-consumer (D2C) brand websites, dominate the sales of premium camping tarps. These platforms allow manufacturers of high-tech gear (like DCF products) to educate consumers effectively on technical specifications, manage brand image, and achieve higher margins by bypassing traditional brick-and-mortar retail markups.

How is the growth of hammock camping influencing the Tarp Market segmentation?

The significant growth in hammock camping has created a specialized, high-growth sub-segment for asymmetrical and hexagonal tarps, designed specifically to provide full-coverage weather protection for suspended hammock systems. These tarps often feature multiple tie-out points and precise geometry to maximize coverage without excess weight, meeting the specific needs of the hammock enthusiast community.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager