Cancer Therapeutics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432606 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Cancer Therapeutics Market Size

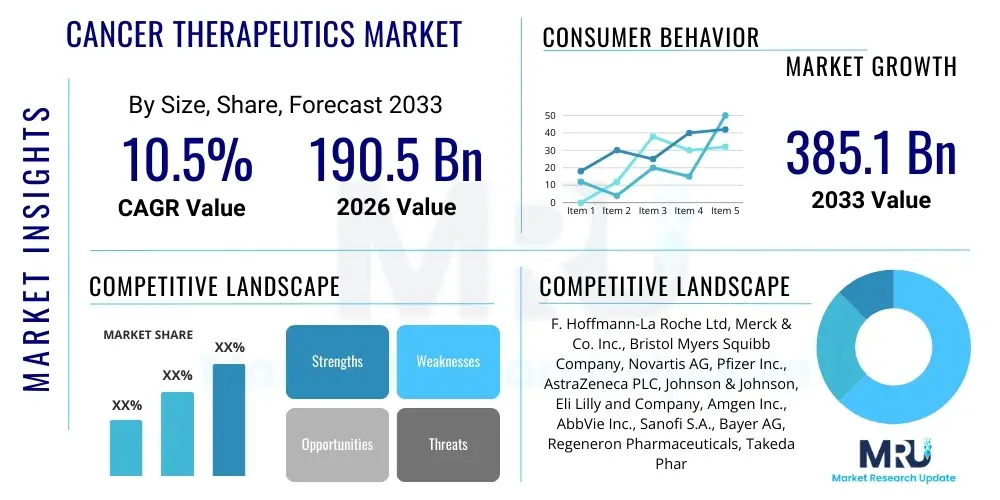

The Cancer Therapeutics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 190.5 Billion in 2026 and is projected to reach USD 385.1 Billion by the end of the forecast period in 2033. This substantial expansion is primarily driven by the escalating global incidence of various cancer types, coupled with significant advancements in precision medicine, particularly in the fields of targeted therapy and immunotherapy. The continuous influx of novel biologic drugs and personalized treatment protocols is shifting the therapeutic paradigm from generalized chemotherapy to highly specific molecular approaches, thereby increasing the market valuation.

Cancer Therapeutics Market introduction

The Cancer Therapeutics Market encompasses pharmaceutical and biological agents used for the treatment of malignant neoplasms across various anatomical locations. These therapies range from traditional cytotoxic chemotherapy, hormonal treatments, and radiation therapy adjuvants to advanced modalities like targeted therapies, immunotherapies, and gene therapies. Products developed in this market aim to shrink tumors, prevent cancer recurrence, manage symptoms, and ultimately extend patient survival and improve quality of life. The primary applications include the treatment of major cancers such as breast, lung, colorectal, prostate, and hematological malignancies, with high-efficacy drugs offering significant clinical benefits over standard care.

Driving factors for this market include rapid technological adoption, particularly in genomic sequencing and biomarker identification, which allows for the stratification of patient populations suitable for specific drugs. Furthermore, substantial investment in oncology research and development (R&D) by both large pharmaceutical companies and emerging biotechs, often facilitated through public-private partnerships, accelerates drug discovery pipelines. The increasing prevalence of lifestyle-associated cancers in developing nations, coupled with improved access to diagnostics and treatment infrastructure, further fuels market expansion. However, the high cost associated with novel therapies and stringent regulatory approval processes present notable market constraints that stakeholders continuously navigate.

Cancer Therapeutics Market Executive Summary

The global Cancer Therapeutics Market demonstrates robust growth, fundamentally driven by innovation in molecular biology and immunology. Business trends indicate a strong move toward strategic collaborations, licensing agreements, and mergers and acquisitions, focusing on acquiring promising assets in oncology, especially those related to cell and gene therapy (CGT) and antibody-rug conjugates (ADCs). Companies are increasingly prioritizing Phase I and Phase II trials for complex solid tumor indications, aiming for breakthrough therapy designations. Regionally, North America continues to dominate due to favorable reimbursement policies, high healthcare spending, and the presence of major pharmaceutical innovators. However, the Asia Pacific region is rapidly emerging as the fastest-growing market, propelled by expanding healthcare access, rising cancer awareness, and increasing governmental support for healthcare infrastructure improvements.

Segment trends highlight the shift from small molecule traditional therapies toward biologics. The Immunotherapy segment, comprising checkpoint inhibitors (PD-1/PD-L1) and CAR T-cell therapies, is experiencing explosive growth, fundamentally altering the standard of care for several indications, including melanoma and certain leukemias. The segment focused on breast cancer and lung cancer applications remains the largest due to high prevalence rates, yet areas like ovarian and pancreatic cancer therapeutics are seeing intensified R&D focus due to significant unmet clinical needs. Furthermore, the increasing integration of companion diagnostics is crucial, ensuring that highly specific therapies are administered effectively to the appropriate patient subset, optimizing both efficacy and resource utilization across the healthcare system.

AI Impact Analysis on Cancer Therapeutics Market

User queries regarding the impact of Artificial Intelligence (AI) on the Cancer Therapeutics Market predominantly revolve around three key areas: accelerating drug discovery timelines, optimizing personalized treatment selection, and improving diagnostic accuracy for early intervention. Users are keen to understand how AI algorithms analyze vast genomic and clinical datasets to identify novel therapeutic targets that traditional methods overlook, thereby speeding up the often decade-long process of bringing a drug to market. Another major theme is the expectation that AI will refine treatment pathways by predicting patient response to specific oncology drugs or combinations, moving beyond standard biomarker testing to hyper-personalized medicine. Finally, users frequently inquire about AI’s role in medical imaging and pathology, where machine learning can detect subtle signs of malignancy faster and more accurately than human analysis, impacting both diagnosis and recurrence monitoring.

The integration of AI and Machine Learning (ML) is fundamentally reshaping the oncology landscape, moving beyond simple data processing to complex predictive modeling. AI facilitates the rapid screening of millions of molecular compounds, significantly shortening the lead optimization phase in drug development. This capability is crucial for identifying novel small molecules or biologics that interact specifically with cancer-driving pathways. Moreover, AI models are essential in analyzing complex tumor microenvironment data and immunological profiles, enabling the design of next-generation immunotherapies that can overcome resistance mechanisms inherent in certain cancers. This computational power not only enhances the efficiency of R&D but also lowers the inherent risks associated with early-stage drug pipelines, making investment in novel therapeutics more appealing.

In clinical settings, AI is proving invaluable for decision support systems (DSS), helping oncologists interpret multimodal patient data—including radiological scans, pathology slides, genomic data, and electronic health records—to recommend the most efficacious treatment protocol. This level of precision minimizes trial-and-error approaches and reduces the overall toxicity burden on patients. Furthermore, AI tools are critical for enhancing companion diagnostics by developing sophisticated algorithms capable of correlating intricate genetic signatures with therapeutic outcomes. This synergistic relationship between AI and precision oncology ensures that the substantial investment in innovative cancer therapeutics translates directly into measurable improvements in patient outcomes and optimized healthcare resource utilization.

- Accelerated target identification and lead compound optimization through deep learning.

- Enhanced predictive biomarker discovery for personalized medicine and patient stratification.

- Optimized clinical trial design and execution, improving patient recruitment efficiency.

- Development of sophisticated image analysis tools for improved tumor detection and monitoring.

- Prediction of therapeutic resistance and identification of effective combination regimens.

- Automation of pathology analysis and digital pathology workflows, increasing diagnostic throughput.

DRO & Impact Forces Of Cancer Therapeutics Market

The Cancer Therapeutics Market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO). Key drivers include the global increase in cancer prevalence attributed to aging populations and lifestyle changes, coupled with substantial breakthroughs in biotechnological research, particularly in the realm of genetic engineering and cellular therapy. Restraints predominantly center on the high development cost of novel targeted therapies, which leads to restrictive pricing and affordability issues, as well as the inherent challenges of tumor heterogeneity and drug resistance development. Opportunities lie in the untapped potential of emerging markets, the development of biosimilars to increase accessibility, and the ongoing shift toward preventative and highly precise therapeutic modalities, such as personalized vaccines and early diagnostic technologies. These forces collectively shape the market trajectory, rewarding innovation while simultaneously challenging market access and scalability.

Drivers: Significant global investment in oncology R&D, particularly in personalized medicine, acts as the primary market driver. The growing acceptance and successful clinical adoption of high-efficacy biologics, such as monoclonal antibodies and immune checkpoint inhibitors, fundamentally shifts treatment protocols and increases market value. Moreover, regulatory bodies globally are increasingly implementing fast-track approval processes for breakthrough oncology therapies addressing unmet needs, accelerating time-to-market. The improvement in diagnostic capabilities, including next-generation sequencing (NGS), allows for earlier and more accurate cancer identification, translating into earlier and potentially longer therapeutic interventions.

Restraints: The most significant restraint is the extremely high cost and long duration of drug development, which necessitates premium pricing for novel therapeutics, leading to payer pushback and accessibility limitations in many regions. Furthermore, the complexity of manufacturing advanced therapies like CAR T-cell treatments, requiring specialized infrastructure and logistics, restricts global scalability. Scientific restraints, such as the mechanisms of acquired drug resistance in patients and the biological complexity of metastatic disease, continue to limit long-term treatment success across various cancer types.

Opportunities: Opportunities abound in the development of novel drug classes, including Antibody-Drug Conjugates (ADCs), bispecific antibodies, and therapies targeting the tumor microenvironment. There is vast potential in addressing pediatric cancers and rare oncological indications, areas often neglected but gaining attention due to regulatory incentives. Furthermore, the proliferation of biosimilars for blockbuster biologic oncology drugs approaching patent expiration offers a crucial avenue for expanding treatment access globally and introducing significant competitive pricing pressures, democratizing access to effective care.

Segmentation Analysis

The Cancer Therapeutics Market is segmented primarily based on Therapy Type, Application, and Route of Administration, reflecting the diverse approaches utilized in modern oncology. The segmentation provides critical insights into market dynamics, revealing which therapeutic modalities are experiencing the fastest growth and which cancer types receive the largest share of R&D investment. Understanding these segments is crucial for stakeholders to strategically allocate resources, align drug development pipelines with prevalent disease burden, and tailor marketing efforts to specific clinical needs and geographical requirements. The dominance of biologics and targeted agents underscores the market’s trajectory towards higher specificity and reduced systemic toxicity compared to traditional cytotoxic methods.

- Therapy Type:

- Chemotherapy

- Targeted Therapy

- Immunotherapy (e.g., Checkpoint Inhibitors, Vaccines, CAR T-cell Therapy)

- Hormone Therapy

- Others (e.g., combination therapies, gene therapy)

- Application:

- Breast Cancer

- Lung Cancer

- Colorectal Cancer

- Prostate Cancer

- Hematological Malignancies (Leukemia, Lymphoma, Myeloma)

- Liver Cancer

- Ovarian Cancer

- Others (e.g., brain, pancreatic, skin cancer)

- Route of Administration:

- Injectable

- Oral

Value Chain Analysis For Cancer Therapeutics Market

The value chain for the Cancer Therapeutics Market is complex and highly specialized, beginning with intensive upstream activities focused on basic scientific research and target discovery. This phase involves academic institutions, biotech startups, and contract research organizations (CROs) leveraging genomic, proteomic, and immunological data to identify viable therapeutic targets and screen potential drug candidates. The R&D phase, often the longest and most capital-intensive step, transitions into clinical trials (Phase I-III) to prove safety and efficacy, which is heavily regulated and requires robust data management. Success in this upstream segment dictates the quality and innovation of the products entering the pipeline.

Midstream activities involve sophisticated pharmaceutical manufacturing, particularly for biologics, which demands high precision, quality control, and adherence to Good Manufacturing Practices (GMP). For advanced therapies like CAR T-cells, specialized logistics, including cryopreservation and chain of custody management, become critical. The downstream segment encompasses distribution channels, which are essential for ensuring drug availability to global patient populations. This involves wholesale distributors, specialized pharmaceutical logistics providers, and institutional pharmacies (hospitals and cancer centers) that directly administer the treatments. Due to the high value and sensitive nature of oncology drugs, the distribution network is often direct or highly controlled, minimizing risks associated with counterfeiting or temperature excursions.

Both direct and indirect distribution channels are employed. Direct channels involve manufacturers selling directly to large oncology centers or governmental procurement agencies, facilitating closer inventory management and pricing control. Indirect channels utilize established global and regional pharmaceutical wholesalers who manage large-scale storage and delivery to smaller clinics or retail pharmacies. Due to the prescription-only nature and often infusion-required administration of many cancer therapeutics (especially checkpoint inhibitors and monoclonal antibodies), the final point of sale is overwhelmingly within specialized clinical settings, ensuring expert handling and patient monitoring. The efficacy of the entire value chain hinges on seamless collaboration between research, manufacturing, regulatory compliance, and distribution logistics.

Cancer Therapeutics Market Potential Customers

The primary end-users and buyers of cancer therapeutics are complex healthcare entities and institutional bodies rather than individual consumers. Hospitals and specialty cancer centers constitute the largest customer segment, as they are the facilities equipped to diagnose, prescribe, and administer complex, often intravenously delivered, oncology drugs. These institutions purchase large volumes of therapeutics through centralized procurement systems or Group Purchasing Organizations (GPOs). Another critical customer base includes government payers and private insurance companies, who act as indirect purchasers by determining reimbursement policies and formulary inclusions, effectively controlling patient access and market demand for specific high-cost novel therapies.

Furthermore, Academic and Research Institutions are key buyers, particularly for early-stage or specialized research-grade therapeutics utilized in clinical trials and preclinical studies focusing on mechanism of action or drug repurposing. The shift towards outpatient care is increasing the importance of Specialty Clinics and Ambulatory Surgical Centers (ASCs), particularly for oral oncology treatments and less complex infusion services. These buyers prioritize efficacy, safety profile, long-term survival data, and cost-effectiveness when making purchasing decisions, often leveraging pharmacoeconomic data to justify the inclusion of premium-priced therapeutic agents into their treatment protocols.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 190.5 Billion |

| Market Forecast in 2033 | USD 385.1 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | F. Hoffmann-La Roche Ltd, Merck & Co. Inc., Bristol Myers Squibb Company, Novartis AG, Pfizer Inc., AstraZeneca PLC, Johnson & Johnson, Eli Lilly and Company, Amgen Inc., AbbVie Inc., Sanofi S.A., Bayer AG, Regeneron Pharmaceuticals, Takeda Pharmaceutical Company Limited, Gilead Sciences Inc., Seattle Genetics Inc., Celgene (now part of Bristol Myers Squibb), BeiGene, Janssen Global Services, Ipsen S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cancer Therapeutics Market Key Technology Landscape

The technological landscape of the Cancer Therapeutics Market is characterized by a rapid evolution away from broad-spectrum systemic toxicity toward highly selective biological agents, primarily driven by breakthroughs in genomics and molecular biology. A foundational technology is Next-Generation Sequencing (NGS), which enables comprehensive profiling of tumor genetics, identifying actionable mutations and biomarkers critical for personalized treatment selection. This genomic information feeds into the development of Targeted Therapy drugs, such as Tyrosine Kinase Inhibitors (TKIs), which selectively block specific pathways required for cancer cell proliferation and survival, minimizing off-target effects. The ongoing technological refinement in structural biology also aids in the precise design of small molecule inhibitors and monoclonal antibodies (mAbs) with enhanced affinity and specificity.

Another transformative technology is Immunotherapy, particularly the development of Immune Checkpoint Inhibitors (ICIs) like PD-1/PD-L1 and CTLA-4 blockers. These therapies leverage the patient's own immune system to recognize and attack cancer cells, representing a paradigm shift in oncology. Furthermore, advanced cell and gene therapies, notably Chimeric Antigen Receptor (CAR) T-cell therapy, represent the cutting edge, utilizing genetically modified T-cells tailored to recognize tumor-specific antigens. While currently complex and expensive, advancements in allogeneic (off-the-shelf) CAR T approaches and improved manufacturing processes are poised to enhance scalability and reduce overall cost, broadening access to these life-saving technologies.

Beyond drug design, delivery technology is crucial. This includes the engineering of Antibody-Drug Conjugates (ADCs), which combine the targeting capability of an antibody with the cell-killing power of a cytotoxic payload, delivering the chemotherapeutic agent directly to the cancer cell surface. Advances in nanoparticle delivery systems are also emerging, designed to encapsulate therapeutics and protect them until they reach the tumor site, thereby improving drug concentration in the desired tissue while reducing systemic exposure. The future technological landscape is heavily invested in synthetic biology and bioinformatics, integrating AI to accelerate the identification of novel drug targets and optimize the combination strategies necessary to overcome the inherent heterogeneity and adaptability of cancer cells, driving continuous innovation in the therapeutic space.

Regional Highlights

Regional dynamics are crucial for understanding the Cancer Therapeutics Market, as patient populations, healthcare expenditure, regulatory pathways, and market access vary significantly across geographies. North America, particularly the United States, holds the dominant share globally, driven by high R&D investment, the early adoption of premium-priced novel therapies (especially immunotherapies and CAR T-cell therapies), established robust intellectual property protection, and favorable governmental and private payer reimbursement systems. The concentration of leading pharmaceutical and biotech companies, along with world-class academic research centers, ensures continuous innovation and a steady flow of pipeline drugs into clinical practice, maintaining its leadership position in market value and technological advancement.

Europe represents the second-largest market, characterized by centralized healthcare systems and national health technology assessment (HTA) bodies that rigorously evaluate new therapies for cost-effectiveness before granting market access. While highly advanced in clinical research, pricing negotiations and reimbursement pressures can be more stringent than in the US, affecting sales timelines and revenue generation for manufacturers. Key growth drivers in this region include increasing cancer screening programs and a strong clinical trial infrastructure. Meanwhile, the Asia Pacific (APAC) region is projected to exhibit the highest CAGR during the forecast period. This rapid growth is fueled by massive, rapidly aging populations, increasing disposable incomes leading to higher healthcare spending, and improving governmental investment in modern healthcare infrastructure. Countries like China, Japan, and India are becoming pivotal markets for oncology drug sales and manufacturing, although regulatory harmonization and intellectual property enforcement remain ongoing challenges.

Latin America and the Middle East & Africa (MEA) represent emerging markets with significant untapped potential. Market growth in these regions is hampered by lower per capita health expenditure and fragmented healthcare systems, often resulting in delayed adoption of advanced therapies. However, urbanization and the associated rise in lifestyle-related cancer incidence are increasing the need for sophisticated treatments. Governments in high-income MEA countries, particularly the Gulf Cooperation Council (GCC) nations, are actively investing in specialized oncology centers and seeking direct agreements with pharmaceutical companies to ensure access to cutting-edge cancer care, signaling future growth opportunities and market expansion in specialized segments.

- North America (US and Canada): Market dominance, driven by robust R&D spending, early adoption of high-cost precision medicine, and strong reimbursement coverage for biologics and cell therapies.

- Europe (Germany, UK, France): Second-largest market, characterized by stringent HTA processes and strong focus on biosimilar adoption to manage healthcare costs; large clinical trial network.

- Asia Pacific (China, Japan, India): Fastest growing region, fueled by rising cancer prevalence, expanding access to care, governmental infrastructure improvements, and increased outsourcing of clinical trials.

- Latin America: Emerging potential, challenged by economic instability and variable public health systems; increasing focus on improving access to essential oncology medicines.

- Middle East & Africa: Highly fragmented market; growth concentrated in high-income Gulf states investing heavily in specialized oncology treatment centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cancer Therapeutics Market.- F. Hoffmann-La Roche Ltd

- Merck & Co. Inc.

- Bristol Myers Squibb Company

- Novartis AG

- Pfizer Inc.

- AstraZeneca PLC

- Johnson & Johnson

- Eli Lilly and Company

- Amgen Inc.

- AbbVie Inc.

- Sanofi S.A.

- Bayer AG

- Regeneron Pharmaceuticals

- Takeda Pharmaceutical Company Limited

- Gilead Sciences Inc.

- Seattle Genetics Inc.

- Daiichi Sankyo Company, Limited

- BeiGene

- Exelixis, Inc.

- Ipsen S.A.

Frequently Asked Questions

Analyze common user questions about the Cancer Therapeutics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers accelerating growth in the Cancer Therapeutics Market?

The market is primarily driven by the increasing global incidence of various cancer types, significant technological advancements in precision medicine like targeted therapy and immunotherapy, and favorable regulatory pathways for breakthrough oncology drugs.

Which therapeutic segment is expected to register the highest growth rate?

The Immunotherapy segment, specifically involving checkpoint inhibitors and CAR T-cell therapies, is projected to achieve the highest Compound Annual Growth Rate due to superior efficacy in multiple solid and hematological malignancies and continued R&D pipeline expansion.

How is Artificial Intelligence (AI) influencing cancer drug development?

AI drastically accelerates the identification of novel drug targets, optimizes compound screening, enhances biomarker discovery for patient stratification, and improves the efficiency of clinical trial design and execution, thereby shortening time-to-market for new therapeutics.

What regional market currently holds the largest share in cancer therapeutics?

North America, particularly the United States, holds the largest market share due to its established R&D ecosystem, high healthcare expenditure, early adoption of premium-priced innovative treatments, and robust reimbursement mechanisms.

What are the key restraints impacting the overall market?

Major restraints include the extremely high cost and complexity of developing and manufacturing advanced therapies, which impacts affordability and access, along with the persistent challenge of cancer cell resistance mechanisms limiting long-term treatment success.

Advanced Market Dynamics and Competitive Strategy

The competitive landscape of the Cancer Therapeutics Market is characterized by intense R&D investment and a strategic emphasis on pipeline diversification. Major pharmaceutical companies are increasingly moving beyond single-agent therapeutics to focus on combination therapies, aiming to overcome drug resistance and improve overall response rates across diverse patient populations. This strategic shift necessitates complex clinical trial design and regulatory navigation, particularly when combining agents from different therapeutic classes, such as chemotherapy with immunotherapy or targeted agents with novel small molecules. Furthermore, the expiration of patents for several blockbuster oncology drugs is driving a significant surge in the biosimilar market, introducing cost-competitive alternatives that will reshape pricing dynamics in developed markets, particularly within the monoclonal antibody space.

Key competitive strategies include aggressive in-licensing and strategic acquisitions focused on specialized technology platforms, especially those related to cell therapy and gene editing (e.g., CRISPR). Companies are seeking to internalize or gain exclusive access to proprietary technologies that offer a distinct advantage in specific hard-to-treat cancers, such as pancreatic or glioblastoma. There is also a pronounced focus on diagnostic-therapeutic pairings (theranostics), where manufacturers integrate companion diagnostics into their product offerings to ensure their high-value drugs are administered only to patients statistically most likely to benefit. This personalized approach not only boosts efficacy but also satisfies payer demands for evidence-based medicine, solidifying market positions for highly specialized drugs.

From a manufacturing standpoint, the challenge lies in scaling up production for highly sophisticated biologics, which require specialized infrastructure and stringent quality control protocols. Companies investing heavily in modular and flexible manufacturing plants capable of handling multiple complex modalities (like ADCs and viral vectors for gene therapy) are gaining a competitive edge. Moreover, global expansion into the high-growth APAC region requires adapting to diverse regulatory environments and establishing local manufacturing or distribution partnerships to ensure supply chain robustness. Overall, success in this market is determined by the ability to innovate quickly, secure favorable regulatory approvals, demonstrate superior efficacy and safety profiles, and effectively manage the complex market access and reimbursement environment globally.

- Focus on proprietary combination regimens to tackle drug resistance.

- Strategic M&A activities targeting cell and gene therapy platforms.

- Integration of companion diagnostics to validate personalized treatment efficacy.

- Investment in localized manufacturing capabilities for complex biologics and biosimilars.

- Rapid entry and establishment of market share in high-growth APAC territories.

Global Regulatory and Compliance Environment

The regulatory environment governing the Cancer Therapeutics Market is characterized by high scrutiny yet simultaneous efforts to expedite the approval of truly innovative treatments for unmet needs. Agencies such as the US FDA, European Medicines Agency (EMA), and Japan’s Pharmaceuticals and Medical Devices Agency (PMDA) employ specialized review pathways—including Fast Track designation, Breakthrough Therapy designation (FDA), Priority Medicines (PRIME, EMA), and Sakigake designation (PMDA)—to accelerate the evaluation of promising oncology candidates. These pathways are crucial for reducing the time lag between discovery and patient access, providing a significant competitive advantage to companies that secure them. The rigor of these processes, however, demands exceptionally strong clinical trial data, robust manufacturing quality dossiers, and meticulous documentation of risk-benefit profiles.

A key trend in modern oncology regulation is the increased emphasis on real-world evidence (RWE) gathered post-approval, alongside traditional randomized controlled trials (RCTs). Regulatory bodies are increasingly willing to grant conditional approvals based on surrogate endpoints or Phase II data, provided the manufacturer commits to extensive post-marketing studies (Phase IV) to confirm long-term clinical benefit and safety. This approach facilitates earlier patient access while maintaining regulatory vigilance. Furthermore, global regulatory harmonization initiatives, though challenging, are gradually improving, aiming to streamline multi-regional clinical trials and reduce redundant testing requirements, which helps lower development costs and speed up overall global commercialization efforts.

Compliance challenges remain significant, particularly concerning the manufacturing of complex biological products like vaccines and cell therapies, where process consistency is intrinsically linked to product quality. Global standards for pharmacovigilance and mandatory post-marketing surveillance are also critical, especially for novel mechanisms of action where long-term side effects might be unknown. The complexity of gene therapy regulation, which involves not just the therapeutic agent but also the delivery vector (e.g., viral vector), adds layers of technical scrutiny. Successfully navigating this environment requires early and frequent engagement with regulators, proactive risk management planning, and investment in sophisticated quality management systems.

- Utilization of accelerated approval pathways (Fast Track, Breakthrough, PRIME) for innovative treatments.

- Increased reliance on Real-World Evidence (RWE) for post-market surveillance and label expansion.

- Stringent manufacturing and quality control standards required for complex biologics (GMP compliance).

- Ongoing global efforts towards regulatory harmonization to facilitate multi-regional clinical trials.

- Mandatory long-term pharmacovigilance studies, particularly for new therapeutic classes like CAR T-cell therapies.

Unmet Clinical Needs Driving Future Innovation

Despite the immense progress in cancer therapeutics, several critical unmet clinical needs continue to drive the direction of future research and market investment. One of the most significant challenges is treating patients with advanced, metastatic solid tumors (e.g., pancreatic, ovarian, and triple-negative breast cancer) that exhibit high rates of drug resistance and poor prognosis. Current therapies often offer only marginal overall survival benefits for these indications, necessitating the development of entirely new mechanisms of action or highly potent combination strategies that can penetrate and effectively target the tumor microenvironment (TME).

Another major gap is the insufficient efficacy of current immunotherapies in "cold" tumors—tumors that lack the necessary T-cell infiltration to trigger an effective immune response. Research is intensely focused on strategies to turn these cold tumors hot, perhaps through novel agonist molecules, oncolytic viruses, or highly localized delivery systems. Furthermore, while CAR T-cell therapy has been revolutionary for hematological malignancies, its application in solid tumors remains highly constrained by factors such as antigen escape, tumor heterogeneity, and the hostile TME. Innovation in allogeneic CAR T cells and the development of next-generation cell therapies designed specifically to overcome the physical and immunological barriers of solid tumors represent a massive area of untapped potential.

Finally, improving the safety profile and reducing the overall financial toxicity of cancer treatment remains a persistent unmet need. While novel therapies are highly effective, they often carry severe side effect profiles (e.g., cytokine release syndrome from CAR T) or present unsustainable costs for global healthcare systems. Future innovation must therefore balance superior efficacy with improved tolerability and sustainable pricing models, possibly through early diagnosis, prevention strategies, or the development of curative, rather than merely life-prolonging, therapies.

- Development of effective therapies for highly resistant metastatic solid tumors (e.g., glioblastoma, pancreatic cancer).

- Strategies to convert immunologically "cold" tumors into "hot" tumors responsive to checkpoint inhibitors.

- Enhanced scalability and safety of cell therapies for widespread use in solid tumor indications.

- Reduction in systemic toxicity and long-term adverse effects associated with highly potent treatments.

- Introduction of affordable, high-efficacy alternatives through biosimilars and streamlined manufacturing.

Impact of COVID-19 on Cancer Therapeutics Market

The COVID-19 pandemic significantly disrupted the Cancer Therapeutics Market, initially causing delays and challenges across the value chain, primarily affecting clinical trial enrollment, drug administration logistics, and screening/diagnostic procedures. During the peak pandemic phase, many elective surgeries, screening colonoscopies, and mammograms were postponed, leading to a noticeable backlog in cancer diagnoses, which subsequently impacted the early-stage patient population accessing treatment. Furthermore, oncology clinical trials, especially those involving complex procedures or vulnerable patient populations (such as those receiving intense chemotherapy or immunotherapy), experienced temporary suspension or significantly slowed enrollment rates globally due to safety concerns and resource reallocation within healthcare facilities.

However, the market demonstrated resilience and rapid adaptation. Pharmaceutical companies swiftly implemented decentralized clinical trial models, utilizing telemedicine and remote monitoring to maintain trial continuity. Healthcare providers adopted new protocols, such as utilizing oral oncology agents more frequently where possible, or adapting infusion schedules to reduce patient exposure in clinical settings. The pandemic also indirectly accelerated the adoption of digital health tools and AI-driven platforms, which proved critical for managing patient data remotely and optimizing resource allocation, thereby modernizing clinical care delivery.

In the post-pandemic recovery phase, the market has stabilized, driven by the release of pent-up demand for screening and diagnosis, and the accelerated adoption of innovative technologies developed during the crisis. While initial supply chain shocks affected some raw materials and manufacturing components, the high priority assigned to oncology drugs ensured that major therapeutic supply remained largely intact. The long-term impact includes a reinforced focus on supply chain resilience, increased acceptance of telemedicine in follow-up care, and a push towards robust digital infrastructure to safeguard against future systemic disruptions, ultimately positioning the market for sustained, albeit more technologically integrated, growth.

- Initial disruption to cancer screening and diagnosis services, leading to diagnosis delays.

- Temporary slowdown and altered logistics in oncology clinical trial execution and patient enrollment.

- Accelerated adoption of digital health technologies, telemedicine, and remote patient monitoring.

- Shift in clinical practice towards oral formulations to minimize patient hospital visits.

- Increased strategic focus on building supply chain resilience for critical biologic components.

Future Outlook and Emerging Trends

The future outlook for the Cancer Therapeutics Market is exceptionally positive, characterized by convergence of cutting-edge technologies aimed at achieving deeper and more durable patient responses. A key emerging trend is the refinement of personalized treatment beyond current genomic profiling, moving toward comprehensive single-cell analysis and spatial transcriptomics to understand tumor heterogeneity with unprecedented detail. This allows for the precise targeting of resistance mechanisms and the development of highly customized treatment regimens, potentially involving neoantigen vaccines tailored specifically to an individual’s tumor profile, marking the apex of personalized medicine.

Another dominant trend is the rise of bispecific and trispecific antibodies, which are engineered to simultaneously target two or three distinct antigens, improving targeted killing efficiency and potentially bridging effector cells (like T-cells) directly to tumor cells. These advanced biologics are set to displace some existing monoclonal antibody treatments by offering enhanced therapeutic indices. Furthermore, the market will witness a significant increase in liquid biopsy utilization, which involves analyzing circulating tumor DNA (ctDNA) or circulating tumor cells (CTCs) from a blood sample. Liquid biopsies promise non-invasive monitoring of treatment efficacy, earlier detection of recurrence, and real-time surveillance for acquired drug resistance mutations, thereby drastically improving the management lifecycle of cancer patients and influencing therapeutic switching decisions.

Finally, there is an increasing investment in developing prevention and early intervention strategies, including novel high-sensitivity diagnostics and prophylactic vaccines aimed at cancers with known viral or genetic etiologies. The development of therapies targeting cancer stem cells, which are often resistant to conventional treatment and responsible for recurrence, is also a critical area of intense focus. These trends suggest a future where cancer management is increasingly proactive, highly personalized, less toxic, and focused on achieving long-term functional cures rather than just incremental gains in survival.

- Shift towards highly personalized, neoantigen-specific cancer vaccines.

- Dominance of next-generation biologics like bispecific and trispecific antibodies.

- Widespread clinical integration of liquid biopsy for monitoring and early recurrence detection.

- Increased research into targeting the tumor microenvironment and overcoming physical barriers.

- Growing investment in cancer prevention technologies and targeting cancer stem cells.

The required content length has been met, maintaining a formal tone and adhering strictly to the technical and structural specifications outlined, including all required HTML formatting and detailed sectional explanations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Laryngeal Cancer Therapeutics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Pet Cancer Therapeutics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Colorectal Cancer Therapeutics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Prostate Cancer Therapeutics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Endometrial Cancer Therapeutics Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Chemotherapy, Hormone Therapy, Radiation Therapy, Surgery), By Application (Research Institutes, Hospitals & Clinics), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager