Candy Toys Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433997 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Candy Toys Market Size

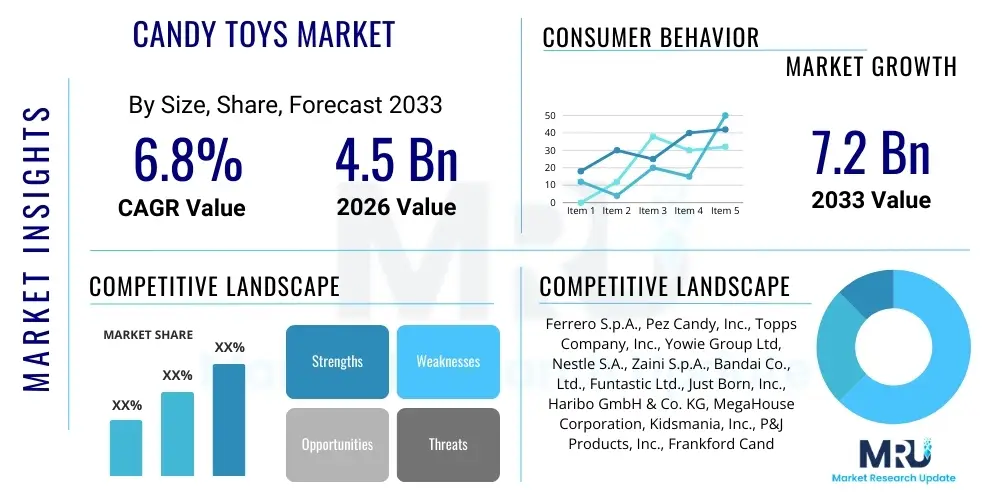

The Candy Toys Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 7.2 billion by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by increasing consumer spending on novelty confectionery, rising demand for licensed merchandise tied to popular culture franchises, and strategic innovations in packaging and product design that enhance the perceived value of the combined candy and toy offering. The market dynamic is highly sensitive to seasonal events, movie releases, and technological integration, which continuously refresh product lines and maintain consumer engagement across various demographic segments, particularly children and young collectors.

The valuation reflects the combined revenue generated from the sale of products where edible confectionery is packaged, bundled, or structurally integrated with a small, often collectible or functional toy. Key components driving this valuation include the expansion of distribution channels, such as specialty stores and online retail platforms, which make novel international products accessible to a global audience. Furthermore, market players are increasingly utilizing strategic partnerships with entertainment studios to leverage established Intellectual Property (IP), ensuring a steady pipeline of highly anticipated and collectible products that command premium pricing compared to standard confectionery items.

Geographically, high-density consumer markets in North America and Asia Pacific are significant contributors to the market size, driven by strong disposable incomes and a pervasive culture of collecting novelty items. The projected acceleration in CAGR post-2026 is linked to the adoption of advanced manufacturing technologies, enabling complex toy designs and safer candy formulations, thereby mitigating regulatory concerns and expanding the demographic reach beyond young children to include nostalgic adult collectors (kidults) seeking premium, limited-edition candy toy sets.

Candy Toys Market introduction

The Candy Toys Market encompasses products that strategically combine edible confectionery components with small, non-edible novelty items or toys, creating a unique dual-value proposition for consumers. This market segment is characterized by its emphasis on novelty, collectibility, and immersive entertainment, moving beyond mere nutritional consumption to offer a playful and interactive experience. Product designs range from simple lollipops with detachable bases and dispensers to complex surprise eggs containing encapsulated toys, often featuring characters from globally recognized media franchises, including animated movies, video games, and popular television series. The core objective of these products is to leverage the psychological appeal of unexpected rewards and limited-edition collecting to drive repeat purchases and foster brand loyalty among target demographics.

Major applications for candy toys extend beyond simple personal consumption, frequently serving as seasonal gifts, party favors, or impulse purchases at retail checkouts. The products are also utilized extensively in promotional campaigns for larger entertainment properties, acting as affordable entry points into a franchise's merchandise line. The inherent benefits of candy toys include enhanced consumer engagement due to the element of surprise, higher perceived value compared to standalone confectionery, and strong merchandising potential fueled by licensed characters. From a marketing perspective, these items offer exceptional shelf appeal and are essential components of cross-category promotional strategies, linking the food and beverage industry with the entertainment and novelty sector, thereby creating synergistic revenue streams.

Key driving factors propelling the growth of this market involve the sustained global rise in consumer disposable income, particularly in emerging economies, enabling greater expenditure on discretionary items like novelty treats. Crucially, the increasing commercialization and global reach of Intellectual Property (IP) through digital platforms ensure that licensed characters remain highly relevant and desirable across diverse international markets. Furthermore, aggressive product innovation, focusing on bio-degradable packaging, healthier candy formulations (e.g., natural colors and reduced sugar), and the integration of interactive digital elements (such as QR codes leading to online games), are sustaining consumer interest and driving market expansion. The demand is also significantly influenced by demographic shifts, especially the rise of the "kidult" segment—adults who purchase nostalgic or sophisticated collector versions of these childhood favorites.

Candy Toys Market Executive Summary

The Candy Toys Market is positioned for substantial growth through the forecast period, characterized by dynamic business trends centered on extensive cross-licensing and premiumization strategies. Major industry players are focusing on securing exclusive rights to high-profile IPs, maximizing the collectibility factor, and driving innovation in packaging mechanisms that facilitate the element of surprise while maintaining product safety standards. A significant business trend involves the increased investment in sustainable materials for both the toy components and the packaging, responding to escalating global consumer and regulatory demands for environmentally friendly products. Furthermore, digital integration, leveraging Augmented Reality (AR) experiences accessible via product packaging, is becoming a standard feature, effectively bridging the physical candy toy with the digital entertainment sphere, thereby enhancing replay value and consumer interaction beyond the initial purchase.

Regional trends indicate that the Asia Pacific (APAC) region, specifically countries like China, Japan, and South Korea, remains the epicenter of innovation and high consumption, driven by an established culture of collecting blind boxes and limited-edition novelty items. North America and Europe continue to demonstrate steady demand, fueled primarily by major movie launches and seasonal promotions, with a noticeable shift toward premium, health-conscious candy components. Emerging markets in Latin America and the Middle East & Africa (MEA) are showing accelerated growth, prompted by increasing penetration of global media franchises and the expanding retail infrastructure, making multinational brands readily available to new consumer bases. Regulatory environments regarding food safety and toy materials in these regions are also tightening, compelling manufacturers to adhere to stringent international quality standards, which inadvertently fosters greater consumer trust.

Segment trends reveal that the 'Surprise and Blind Box' segment is dominating the market, offering unparalleled excitement and driving viral marketing through unboxing content on social media platforms. In terms of product type, the combination of functional toys (e.g., writing instruments, small gadgets) with candy is gaining traction over purely decorative novelties, providing tangible utility alongside the treat. Licensing remains the most critical segmentation differentiator, where toys based on top-tier video game characters and animated series consistently outperform generic designs. Additionally, the increasing demand for "better-for-you" candy formulations, including those free from high fructose corn syrup and artificial dyes, indicates a growing segment focused on health-conscious parents and discerning consumers who do not wish to compromise on nutritional quality while enjoying novelty products.

AI Impact Analysis on Candy Toys Market

Common user questions regarding AI's impact on the Candy Toys Market frequently revolve around personalization capabilities, supply chain optimization, and the integration of smart features into the toys themselves. Consumers and industry stakeholders are concerned about how AI can predict fleeting consumer trends—especially concerning which licensed characters will be popular next—to minimize inventory risk associated with fads. Another key area of inquiry is the potential for AI-driven manufacturing to enhance safety and regulatory compliance by automatically inspecting both candy quality and toy structural integrity at high speeds. Expectations center on AI's ability to create hyper-personalized 'blind box' algorithms, ensuring collectors receive desired items more frequently, thereby increasing satisfaction and sustained spending. Furthermore, users anticipate AI will revolutionize customer service through sophisticated chatbots capable of identifying and resolving issues related to missing collectibles or specific product availability across vast retail networks, significantly improving the post-purchase experience and market responsiveness.

The application of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is set to revolutionize the Candy Toys market value chain, primarily by optimizing demand forecasting and accelerating product development cycles. AI models can analyze massive datasets encompassing social media trends, sales velocity across different regions, and entertainment release schedules to predict precisely which character licenses will peak in demand and when. This predictive capability significantly reduces the risk of overstocking unpopular items and understocking highly desirable, limited-edition runs, a critical challenge in the fast-paced, trend-driven novelty sector. Moreover, AI-driven design tools are being explored to quickly iterate on toy prototypes, optimizing them for rapid manufacturing and assembly while ensuring they meet stringent global safety standards concerning choking hazards and material compliance. This shift towards data-informed decision-making ensures that new product launches are timely, relevant, and accurately aligned with momentary consumer excitement, maximizing revenue generation during peak interest phases.

In addition to supply chain efficiency, AI is enhancing the consumer interaction layer by facilitating dynamic pricing strategies and personalized marketing campaigns. AI systems are capable of analyzing individual purchase histories and engagement data to recommend specific candy toy sets or collectible series, pushing highly targeted advertisements that dramatically improve conversion rates. Furthermore, AI-powered quality control systems using computer vision are increasingly deployed on production lines. These systems offer continuous, real-time monitoring of product consistency, detecting even minute flaws in the molding of the toy or the placement of the candy, thereby ensuring a consistently high standard of quality that builds brand trust and minimizes costly recalls. The future of candy toys may involve AI-enabled, app-connected toys that learn from user interactions, offering adaptive play patterns or unlocking personalized digital content based on recognized preferences, fully merging the physical product with a smart, digital ecosystem.

- AI-driven demand forecasting optimizes inventory levels for trend-sensitive licensed products.

- Machine Learning models analyze social media sentiment to identify emerging character popularity.

- AI improves manufacturing quality control via computer vision, ensuring candy and toy safety compliance.

- Personalized blind box algorithms enhance collector satisfaction and drive repeat purchases.

- AI facilitates dynamic pricing and hyper-targeted marketing campaigns based on consumer behavior data.

- Integration of AI-enhanced digital content (AR/games) via packaging QR codes boosts product interactivity.

DRO & Impact Forces Of Candy Toys Market

The dynamics of the Candy Toys Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively constituting the market's impact forces. A primary driver is the intense growth of the global entertainment industry, providing an endless supply of popular characters and franchises for licensing, which directly translates into novel and desirable candy toy products. This driver is counterbalanced by significant restraints, chiefly increasing regulatory scrutiny regarding child safety standards for toys, particularly concerning small parts, and growing public health concerns over sugar consumption, forcing manufacturers to reformulate products under tight margins. However, these challenges simultaneously open opportunities, particularly in developing premium, organic, or reduced-sugar confectionery components and investing in sustainable, non-toxic, bio-degradable toy materials. The impact forces indicate a market pushed toward innovation, where only companies capable of rapidly securing valuable IP, adhering to rigorous safety standards, and delivering high-quality, sustainable products will achieve sustained competitive advantage and market share expansion.

Drivers: The globalized expansion of licensed intellectual property (IP) is perhaps the strongest driver, ensuring that popular characters from movies, video games, and streaming content reach children and collectors worldwide almost instantaneously, creating high demand for associated merchandise. The "kidult" phenomenon, where young adults seek nostalgic or sophisticated collectibles, significantly expands the addressable market beyond traditional juvenile demographics, leading to higher average selling prices for premium collector sets. Furthermore, the rise of digital content platforms, especially YouTube and TikTok, has normalized the "unboxing" culture, where the element of surprise inherent in candy toys becomes a viral marketing tool, driving impulse purchases and creating massive, instantaneous demand spikes for new releases. These socio-cultural trends, coupled with continuous packaging and formulation innovation, maintain the market's high engagement level.

Restraints: The most pressing restraints involve stringent governmental regulations related to food safety and toy safety, demanding substantial investments in quality assurance and compliance testing, which can be costly and delay product launches. Public health campaigns targeting childhood obesity and excessive sugar intake pose a long-term threat to the core candy component of the product, pressuring companies toward costly R&D for natural sweeteners and low-calorie formulations. Moreover, the reliance on licensed IP introduces financial risk associated with royalty payments and the short lifespan of media-driven trends; if a franchise loses popularity quickly, manufacturers are left with obsolete inventory. The logistical challenges inherent in producing two fundamentally different products (food and toy) under a single package, requiring specialized manufacturing and handling, also act as a significant operational restraint.

Opportunities: Opportunities abound in exploiting the sustainability niche by developing eco-friendly plastic alternatives for toy components and packaging, appealing directly to environmentally conscious consumers. Geographic expansion into high-growth emerging economies, coupled with localized product offerings that feature regionally relevant characters or flavors, presents substantial revenue growth potential. The market can also capitalize on the integration of technology, moving beyond static toys to include Augmented Reality (AR) experiences accessible via smartphones, transforming the candy toy into an entry point for interactive digital play and increasing the perceived value dramatically. Furthermore, focused efforts on developing "premium" adult collector series, featuring higher-quality candy and more detailed, high-fidelity toy figures, allows manufacturers to capture higher price points and maintain relevance within the lucrative adult collector community.

Segmentation Analysis

The Candy Toys Market is meticulously segmented across multiple axes to capture the diverse demands of consumers and the varied product offerings. Segmentation by product type differentiates between surprise eggs, dispensing toys, functional candy kits (like buildable candy structures), and simple bundled items. Segmentation based on licensing status is crucial, distinguishing between proprietary branded toys and those leveraging external, third-party licensed characters, which usually command a premium. The market is also segmented by distribution channel, recognizing the importance of hypermarkets/supermarkets, convenience stores, and the burgeoning e-commerce channel which facilitates global access to niche collector items. End-user segmentation further divides the market into children (the largest segment) and adults (kidults), each requiring distinct product complexity, confectionery types, and associated IP themes.

Analyzing these segments allows stakeholders to understand specific consumer preferences and tailor their marketing and product development strategies effectively. The surprise egg segment, for instance, remains dominant globally due to the universal appeal of mystery and the high virality potential on social media. However, the functional toy segment is experiencing the fastest growth as parents seek products that offer educational or practical utility beyond immediate consumption. Licensed products consistently generate higher revenue due to pre-established emotional connection with the IP, necessitating robust licensing strategies. Geographical segmentation reveals diverse flavor profiles and packaging preferences; for example, Japanese markets prioritize intricate, multi-step crafting candy kits, while Western markets favor quick-consumption, high-novelty dispenser toys. This detailed segmentation is essential for accurate market forecasting and targeted resource allocation.

- By Product Type:

- Surprise Eggs

- Dispensing Toys (e.g., Pez, character dispensers)

- Functional/Assembly Toys (e.g., building block candy kits)

- Simple Bundled Candy and Toys (e.g., lollipops with integrated whistles)

- Gumball/Vending Machine Toys

- By Licensing Status:

- Licensed Products (IP-based, e.g., Disney, Marvel, Nintendo)

- Proprietary/Generic Products

- By Distribution Channel:

- Hypermarkets/Supermarkets

- Convenience Stores/Gas Stations

- Specialty Retail Stores (e.g., toy stores, comic book shops)

- Online Retail/E-commerce Platforms

- By End-User:

- Children (Ages 3-8)

- Pre-Teens (Ages 9-14)

- Adult Collectors (Kidults)

- By Confectionery Type:

- Gummies and Jellies

- Hard Candies and Lollipops

- Chocolate

- Pressed Powder Candy

Value Chain Analysis For Candy Toys Market

The value chain for the Candy Toys Market is uniquely complex as it integrates elements from both the food processing and toy manufacturing industries. Upstream activities involve the sourcing of raw materials, including bulk confectionery ingredients (sugar, flavorings, colorants) and specific non-toxic plastics and molding materials for the toys. This stage demands stringent quality control checks to ensure materials meet both food safety (FDA/EFSA) and toy safety (ASTM/EN71) standards simultaneously, often requiring specialized dual-certification suppliers. Midstream, manufacturing involves two parallel processes: high-speed, sterile candy production and precision injection molding/assembly for the toys. The critical convergence point is the automated packaging process, where the candy and the toy must be securely and hygienically combined, often within protective casings like plastic eggs or dispensing units, requiring advanced automation technologies to maintain high throughput and safety standards.

Downstream analysis focuses heavily on the distribution channel, which is crucial for market visibility and accessibility. Given the impulse-buy nature of candy toys, mass-market channels such as hypermarkets, convenience stores, and discount retailers are paramount for maximizing volume sales and product exposure, often featuring specialized displays near checkout lanes. The direct sales channel, facilitated by brand-specific e-commerce sites or targeted social media campaigns, is vital for selling premium, limited-edition collector sets specifically aimed at the adult collector segment. Indirect distribution utilizes brokers and specialized novelty distributors to penetrate niche markets, such as gift shops and amusement parks. The efficiency of the distribution system, particularly cold chain management for chocolate-based products, directly impacts product quality and regional market penetration, demanding robust logistics networks capable of handling sensitive consumer goods rapidly and effectively.

The interplay between direct and indirect distribution channels defines the market reach. Direct channels provide manufacturers with greater control over branding, pricing, and customer data, allowing for swift adjustments based on real-time sales feedback. Indirect channels, through established retailers and wholesalers, offer unparalleled market penetration and volume capabilities, essential for achieving economies of scale. Successful market players often employ a hybrid strategy, using indirect channels for high-volume, standard products, and leveraging direct-to-consumer platforms for high-margin, collectible, or exclusive releases. Furthermore, efficient licensing management, involving timely payments and proactive communication with IP holders, is a hidden but crucial element of the value chain that minimizes legal risks and ensures a continuous flow of highly desirable product designs, sustaining the entire ecosystem.

Candy Toys Market Potential Customers

The primary segment of potential customers for the Candy Toys Market remains children aged 3 to 14, driven by the inherent desire for novelty, sweet treats, and the excitement of collecting. Parents of young children constitute a significant secondary customer group, as they are the primary purchasers, often seeking affordable rewards, birthday party favors, or impulse distractions. Products targeted at this demographic prioritize bright colors, popular characters derived from animated features, and simple, safe toy components. The effectiveness of marketing to this segment relies heavily on appealing packaging, placement near checkout areas, and securing licenses tied to currently viral children's content, ensuring the product is instantly recognizable and desirable to the young consumer.

A rapidly expanding and highly lucrative segment comprises the "Kidults" or adult collectors, typically aged 25 to 45, who purchase candy toys for nostalgic reasons or as sophisticated collectibles. This demographic seeks limited-edition runs, intricate designs, higher-quality toy materials, and IP related to classic 80s, 90s, or contemporary video game and comic book franchises. Products aimed at adult collectors often feature minimal or premium confectionery components, focusing instead on the artistic merit and scarcity of the enclosed toy, supporting higher price points and driving the premiumization of the market. Marketing to this group emphasizes exclusivity, detailed product reveals, and targeted advertising within collector communities and specialized online forums.

In addition to core consumers, the market also serves institutional buyers, including event organizers, corporate marketers, and amusement park operators. These entities purchase candy toys in bulk for promotional giveaways, themed events, seasonal campaigns, and retail sale within their venues. These B2B customers prioritize consistency, bulk pricing, and the ability to customize products with specific branding or themes, viewing the candy toy as an effective, high-engagement marketing tool. Consequently, potential customers span a wide spectrum from individual impulse buyers to large commercial organizations leveraging the novelty factor for strategic engagement.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ferrero S.p.A., Pez Candy, Inc., Topps Company, Inc., Yowie Group Ltd, Nestle S.A., Zaini S.p.A., Bandai Co., Ltd., Funtastic Ltd., Just Born, Inc., Haribo GmbH & Co. KG, MegaHouse Corporation, Kidsmania, Inc., P&J Products, Inc., Frankford Candy LLC, Bluebird Group, Hasbro Inc., Mars, Incorporated, Hershey Company, CandyRific LLC, Mondo Toys. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Candy Toys Market Key Technology Landscape

The Candy Toys Market relies heavily on the integration of advanced manufacturing processes from both the food and plastics industries, with technology deployment focused on precision, speed, and safety. A core technological requirement is high-speed, multi-component injection molding, which allows for the mass production of complex, detailed toy figures and secure packaging shells (such as those used in surprise eggs) with minimal cycle times. Crucially, sophisticated automation technologies are necessary for the simultaneous production line management of perishable candy and non-food items, ensuring sterile separation until the final assembly and sealing stage. Furthermore, innovative packaging technologies, including tamper-evident seals and specialized foil wrappers optimized for extended shelf life and hygiene, are critical for maintaining product integrity across diverse climatic conditions and lengthy supply chains, especially when exporting products globally.

Beyond manufacturing, digital technologies are increasingly defining the consumer experience and operational efficiency. The widespread adoption of Augmented Reality (AR) technology, often accessed via QR codes printed directly onto packaging, transforms the static toy into an interactive digital asset. This technology allows consumers to scan the product using a smartphone to unlock games, filters, or virtual content related to the licensed characters, significantly extending the product's lifespan and encouraging repeat interaction. For manufacturers, data analytics and sophisticated supply chain management software are paramount. These tools enable real-time tracking of components and finished goods, optimizing logistics, and providing crucial data feedback on regional sales velocity and consumer preferences, which directly feeds into the next cycle of product development and inventory allocation.

Looking ahead, advancements in material science are a key technological focus. Manufacturers are investing heavily in developing bio-plastics and compostable polymers derived from plant sources to replace traditional petrochemical-based plastics used in toys and packaging, addressing environmental concerns. Similarly, in confectionery production, technologies enabling the use of natural colorants, alternative sweeteners (like stevia or monk fruit), and high-pressure processing techniques to ensure microbial safety while reducing the reliance on chemical preservatives are becoming standard. These technological shifts are not merely cost-saving measures but are strategic investments aimed at future-proofing the industry by meeting evolving consumer demands for healthier, safer, and more sustainable products, ultimately driving greater market acceptance and premium positioning.

Regional Highlights

The Candy Toys Market exhibits distinct consumption patterns and growth dynamics across major global regions, influenced by cultural factors, disposable income levels, and the penetration rate of international media franchises.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market, primarily driven by countries such as Japan, China, and South Korea, which possess deeply rooted "gachapon" (capsule toy) and blind box collecting cultures. This region is characterized by high levels of innovation, particularly in intricate, DIY candy kits and advanced, high-fidelity licensed figurines. The strong economic growth and high population density contribute significantly to volume sales, while the rapid adoption of digital platforms facilitates the viral spread of new trends and collectible series, sustaining continuous market demand and innovation.

- North America (NA): North America holds a substantial market share, defined by strong purchasing power and heavy reliance on seasonal marketing and major licensed IPs, especially those originating from Hollywood cinema, US television, and major video game publishers. Demand is steady, characterized by high volume during holidays (Halloween, Easter) and major movie release windows. The region is witnessing a noticeable trend towards healthier candy options, pushing manufacturers to introduce low-sugar or organic confectionery integrated into the novelty products.

- Europe: Europe is a mature market, governed by strict regulations, particularly the EU’s Toy Safety Directive and robust food standards, making compliance a prerequisite for entry. Western European countries, including Germany, the UK, and France, are key consumers. The market features a strong presence of traditional European confectionery brands integrating toys, with a growing emphasis on sustainability, evidenced by the push for plastic-free or bio-degradable packaging solutions and locally sourced ingredients.

- Latin America (LATAM): LATAM is an emerging high-growth region, benefiting from increasing disposable incomes and greater access to global entertainment media. Brazil and Mexico are leading markets, where affordable pricing and high visibility in traditional retail outlets are crucial for market penetration. The adoption of international IP is accelerating, driving consumer interest, though market expansion often faces challenges related to complex import tariffs and fragmented distribution networks.

- Middle East and Africa (MEA): This region is characterized by concentrated demand in urban centers and high-income Gulf Cooperation Council (GCC) countries. Consumption is driven by luxury and premium imported brands, particularly those associated with global children's franchises. Regulatory harmonization concerning food and toy safety is gradually improving, paving the way for easier market entry for international players, with holiday gifting customs significantly influencing purchasing patterns.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Candy Toys Market.- Ferrero S.p.A.

- Pez Candy, Inc.

- Topps Company, Inc.

- Yowie Group Ltd

- Nestle S.A.

- Zaini S.p.A.

- Bandai Co., Ltd.

- Funtastic Ltd.

- Just Born, Inc.

- Haribo GmbH & Co. KG

- MegaHouse Corporation

- Kidsmania, Inc.

- P&J Products, Inc.

- Frankford Candy LLC

- Bluebird Group

- Hasbro Inc.

- Mars, Incorporated

- Hershey Company

- CandyRific LLC

- Mondo Toys

Frequently Asked Questions

Analyze common user questions about the Candy Toys market and generate a concise list of summarized FAQs reflecting key topics and concerns.What major trends are currently driving the growth of the Candy Toys Market?

The market is primarily driven by the increasing global demand for licensed entertainment merchandise (IP), the cultural phenomenon of "unboxing" and collecting (especially blind box formats), and the expansion of the "kidult" demographic seeking high-quality, nostalgic, and sophisticated collectible candy toy sets. Technological integration, particularly Augmented Reality (AR) experiences, also enhances product engagement and perceived value.

How significant is the role of licensed intellectual property (IP) in market success?

Licensed IP is critical, often determining a product's success. Licensing agreements with major studios (Disney, Nintendo, Marvel) provide immediate brand recognition, emotional connection, and high consumer trust, allowing these products to command premium prices and ensuring higher sales volume compared to generic or proprietary designs.

What are the key regulatory challenges facing candy toy manufacturers?

The most significant challenges involve strict dual regulatory requirements: adhering to stringent global food safety standards for the candy components (e.g., ingredient sourcing, nutritional labeling) and simultaneously meeting international toy safety directives (e.g., EN71, ASTM F963) regarding material toxicity, small parts, and choking hazard prevention, which necessitates extensive testing and compliance protocols.

Which regional market offers the highest growth potential for candy toys?

The Asia Pacific (APAC) region, spearheaded by countries like China and Japan, offers the highest growth potential. This growth is fueled by deeply entrenched collecting cultures, rapid economic development, high consumer propensity for novelty items, and continuous innovation in product design and packaging formats, such as complex DIY candy kits.

How is the industry addressing concerns regarding environmental sustainability and plastic waste?

Manufacturers are increasingly focusing on sustainability by investing in R&D for eco-friendly materials, specifically utilizing bio-degradable or compostable plastics derived from plant sources for toy components and packaging. Many companies are also adopting design principles that minimize packaging volume and eliminate non-recyclable materials to meet escalating consumer and regulatory pressures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager