Cannabis Analyzer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432243 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Cannabis Analyzer Market Size

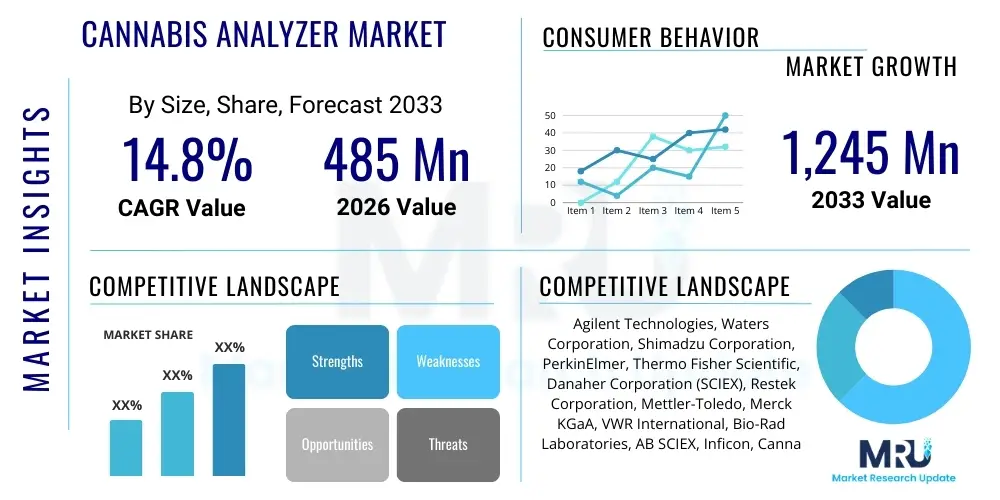

The Cannabis Analyzer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.8% between 2026 and 2033. The market is estimated at USD 485 Million in 2026 and is projected to reach USD 1,245 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the accelerating global legalization of cannabis for both medicinal and recreational purposes, necessitating rigorous quality control and safety testing across the supply chain. The growing requirement for precise measurement of cannabinoid potency, detection of contaminants such as pesticides and heavy metals, and mandatory compliance with evolving regulatory frameworks are the primary financial catalysts fueling this growth trajectory.

Cannabis Analyzer Market introduction

The Cannabis Analyzer Market encompasses analytical instrumentation and associated consumables used for quality assurance, safety testing, and research related to cannabis and its derived products. These sophisticated analytical tools, including High-Performance Liquid Chromatography (HPLC), Gas Chromatography (GC), Mass Spectrometry (MS), and various spectroscopic techniques, are indispensable for determining product efficacy and ensuring consumer safety. The primary applications range from measuring tetrahydrocannabinol (THC) and cannabidiol (CBD) potency and profiling terpene content, to screening for residual solvents, microbiological contaminants, and harmful heavy metals in flower, oils, edibles, and tinctures.

The core benefit of utilizing these advanced analyzers lies in establishing standardization and regulatory compliance, which are crucial for market maturation and consumer trust. Driving factors include the increasing therapeutic acceptance of cannabis, massive investments in state-of-the-art testing laboratories, and stringent government regulations mandating pre-market testing. Furthermore, continuous technological advancements leading to faster, more sensitive, and portable analytical devices are expanding the addressable market by making sophisticated testing more accessible to cultivators and small-scale processors, thereby ensuring traceability and consistency throughout the vertically integrated supply chain.

Cannabis Analyzer Market Executive Summary

The Cannabis Analyzer Market is currently characterized by intense technological innovation, driven by the demand for higher throughput and lower detection limits. Business trends show significant merger and acquisition activity among leading analytical instrument providers aiming to consolidate specialized testing capabilities and expand their geographical footprint, particularly into newly legalized jurisdictions. There is a notable shift toward integrated, automated systems that reduce manual handling and minimize variability, offering turn-key solutions for testing labs facing rising sample volumes and strict turnaround times. Strategic partnerships between instrument manufacturers and specialized cannabis testing labs are becoming central to product development and market penetration, ensuring that new devices meet stringent regulatory demands.

Regionally, North America, spearheaded by the United States and Canada, remains the largest and most mature market segment due to early and widespread legalization efforts and the establishment of robust testing infrastructure. However, Europe, particularly Germany and the United Kingdom, is emerging as a high-growth region, propelled by the expanding medicinal cannabis market and subsequent need for compliant testing capabilities. Asia Pacific is beginning to show nascent growth, largely concentrated in research and pharmaceutical applications, anticipating future regulatory changes. Segment trends indicate that Chromatography-Mass Spectrometry systems (LC-MS/MS and GC-MS) are dominating the market due to their unparalleled precision in contaminant screening, while potency testing remains the highest volume application.

The market outlook is highly positive, underpinned by the ongoing global legislative shift favoring cannabis utilization. Key challenges revolve around regulatory fragmentation across different states and countries, leading to complexity in standardizing analytical methods. Nevertheless, the underlying momentum created by consumer safety concerns and the commercial requirement for standardized products ensures sustained investment in analyzer technology. The market is expected to witness increasing competition from specialized start-ups offering modular and focused testing platforms, challenging the dominance of traditional analytical giants.

AI Impact Analysis on Cannabis Analyzer Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and the Cannabis Analyzer Market frequently center on how AI can enhance the efficiency, accuracy, and standardization of complex analytical processes. Common questions revolve around AI’s role in managing massive datasets generated by chromatography and mass spectrometry (e.g., spectral libraries), automating data interpretation to flag anomalies (such as unknown contaminants or unexpected potency variations), and optimizing laboratory workflow and instrument maintenance scheduling. Users are keen to understand if AI can accelerate the development of new testing methodologies, particularly for lesser-known cannabinoids and complex matrices, and if it can help standardize diverse international testing protocols. The key expectations are reduced human error, accelerated sample analysis time, and predictive quality control mechanisms that move beyond simple pass/fail reporting to provide deeper insights into product chemistry and genetic lineage.

AI is poised to revolutionize the throughput and data quality in cannabis testing laboratories. By applying machine learning algorithms to complex spectral data, AI systems can rapidly identify and quantify contaminants, reducing the subjectivity often present in manual data analysis. This automation is critical as sample volumes increase and laboratories strive for faster turnaround times while maintaining rigorous quality standards. Moreover, predictive maintenance driven by AI can monitor instrument performance in real-time, forecasting potential hardware failures or calibration drifts, thereby ensuring maximum uptime and data integrity—a necessity in a highly regulated industry where analytical reliability is paramount for both compliance and business continuity. The integration of AI tools, particularly in chemometrics and multivariate analysis, is enabling researchers and analysts to correlate chemical profiles with desired consumer effects or specific growing conditions, pushing the market beyond basic safety checks toward advanced product characterization and strain development.

- Enhanced Data Interpretation: AI algorithms process complex chromatographic and mass spectral data instantly, identifying subtle anomalies and contaminants missed by manual review, improving accuracy in pesticide and heavy metal screening.

- Automated Workflow Optimization: Machine learning schedules and optimizes sample runs, manages queue prioritization, and automates method validation, significantly increasing laboratory throughput and efficiency.

- Predictive Quality Control (QC): AI models predict potential issues in the growing or extraction process based on deviations in chemical profiles, enabling preemptive quality adjustments before the final testing stage.

- Standardization and Harmonization: AI tools assist in developing standardized protocols by identifying optimal analytical parameters across diverse regulatory environments, aiding global trade compliance.

- Accelerated R&D: AI rapidly correlates chemical composition (cannabinoids, terpenes) with genetic data and reported user effects, accelerating the development and classification of novel strains and products.

- Instrument Health Monitoring: Predictive maintenance utilizes sensor data to anticipate equipment malfunction or calibration drift, minimizing downtime and maintaining data integrity.

DRO & Impact Forces Of Cannabis Analyzer Market

The dynamics of the Cannabis Analyzer Market are shaped by a powerful confluence of regulatory mandates (Drivers), technological complexity and high initial investment costs (Restraints), the ongoing discovery of therapeutic applications (Opportunities), and the stringent nature of compliance frameworks (Impact Forces). The primary driving force is the global legislative momentum toward legalization, which inherently necessitates mandatory, verifiable testing protocols for consumer protection and taxation purposes. This legislative push ensures a continually expanding volume of mandatory testing. Conversely, the market is constrained by the relatively high capital expenditure required for purchasing and maintaining state-of-the-art analytical equipment (e.g., LC-MS/MS systems) and the scarcity of highly skilled labor capable of operating and validating complex analytical methods in a fast-paced environment. These restraints particularly affect smaller testing laboratories and new entrants in emerging markets.

Significant opportunities arise from the increasing recognition of minor cannabinoids and the need for comprehensive terpene profiling, which drives demand for more advanced separation and identification technologies. Furthermore, the development of rapid, on-site testing devices (point-of-use analyzers) presents a massive untapped market segment, allowing growers and processors to conduct immediate quality checks, reducing the reliance on centralized laboratories for preliminary screening. The impact forces are overwhelmingly characterized by regulatory fragmentation and consumer safety demands. The need to comply with multiple, sometimes conflicting, state or national regulations regarding acceptable limits for heavy metals or residual solvents forces instrument manufacturers to develop highly flexible and adaptable analytical platforms, placing significant pressure on standardization efforts and method validation procedures.

Ultimately, the market's trajectory is dependent on the balance between standardization efforts and the rapid expansion of legalized markets. While drivers create the fundamental demand, the complexity and cost associated with advanced technology act as a natural barrier to entry. However, the consistent opportunity presented by R&D into product efficacy and quality control ensures that investment in advanced analyzers will continue to accelerate. The competitive landscape is shaped by the requirement for speed, accuracy, and low-detection limits, pushing innovation towards automation and simplification of traditionally complex analytical processes.

Segmentation Analysis

The Cannabis Analyzer Market is comprehensively segmented based on the type of analytical instrument, the specific testing application, and the end-user profile. Analyzing these segments provides crucial insight into the areas experiencing the highest demand and technological investment. The segmentation by product type reveals a dominance of chromatography instruments due to their established accuracy and versatility in separating complex mixtures, while the application segmentation highlights that mandatory safety testing—especially for residual solvents and pesticides—is the fastest-growing area due to increasing regulatory strictness. The end-user segment is crucial, illustrating the shift from research-focused institutions to dedicated commercial testing laboratories, which are now the primary purchasers of high-throughput systems necessary to service the booming legal cannabis industry across various geographies.

- By Product Type:

- Chromatography Systems (High-Performance Liquid Chromatography (HPLC), Gas Chromatography (GC))

- Mass Spectrometry Systems (LC-MS/MS, GC-MS)

- Spectroscopy Systems (Atomic Absorption Spectroscopy (AAS), Inductively Coupled Plasma Mass Spectrometry (ICP-MS), Fourier-Transform Infrared Spectroscopy (FTIR))

- Consumables and Accessories (Columns, Standards, Solvents, Reagents)

- By Test Type:

- Potency Testing (THC, CBD, Minor Cannabinoids)

- Terpene Profiling

- Residual Solvent Testing

- Heavy Metal Testing

- Pesticide Screening

- Microbial Contaminant Testing

- Mycotoxin Testing

- By End-User:

- Cannabis Testing Laboratories (Independent and Third-Party)

- Pharmaceutical and Biotechnology Companies

- Research and Academic Institutions

- Growers and Cultivators (Point-of-Use Testing)

- By Region:

- North America (US, Canada)

- Europe (Germany, UK, Netherlands)

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Cannabis Analyzer Market

The value chain for the Cannabis Analyzer Market begins with the upstream suppliers, which include manufacturers of highly specialized components such as chromatography columns, high-purity solvents, detector lamps, and precision electronics necessary for building complex analytical instruments. Key players like Agilent and Waters integrate these components into complete systems. This upstream segment is highly specialized and features intense R&D focus on miniaturization and enhanced sensitivity, driven by the need for low-detection limits mandated by evolving regulatory standards.

Midstream activities involve the distribution channel, which utilizes both direct sales forces for major laboratory installations and indirect channels (distributors and third-party resellers) for consumables and routine maintenance supplies. Direct channels are crucial for high-value, complex instrumentation like LC-MS/MS, where technical support and application specialist training are mandatory. Downstream, the value is captured primarily by independent, accredited cannabis testing laboratories that utilize these analyzers to provide compliance testing services to growers, processors, and pharmaceutical entities. The direct channel ensures strong relationships between instrument manufacturers and large, dedicated testing labs, providing manufacturers valuable feedback for product improvement and method development. The indirect channel serves smaller academic labs and point-of-use customers, offering readily available consumables and maintenance services.

Cannabis Analyzer Market Potential Customers

The primary consumers and end-users of cannabis analyzer technology are the specialized, ISO-accredited cannabis testing laboratories, which form the bedrock of the market due to regulatory requirements mandating independent, third-party testing. These laboratories require high-throughput, automated systems capable of running hundreds of samples daily across multiple testing categories, from potency verification to complex contaminant screening. This segment is characterized by robust investment in capital equipment necessary to manage increasing regulatory demands and sample volumes across multiple jurisdictions.

Beyond centralized testing facilities, pharmaceutical and biotechnology companies represent a high-value customer segment, focusing on R&D for cannabinoid-based therapeutics. These customers prioritize highly sensitive and verifiable instrumentation for clinical trial work, stability testing, and formulation analysis. Finally, licensed cannabis growers and cultivators, especially large-scale operations, are increasingly adopting simplified, ruggedized, and often portable analyzers for internal quality checks at various stages of cultivation and processing. This allows them to optimize harvest timing and extraction parameters, reducing the risk of batch failure before expensive third-party compliance testing, thereby demonstrating a strong shift towards point-of-use analysis.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 485 Million |

| Market Forecast in 2033 | USD 1,245 Million |

| Growth Rate | 14.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Agilent Technologies, Waters Corporation, Shimadzu Corporation, PerkinElmer, Thermo Fisher Scientific, Danaher Corporation (SCIEX), Restek Corporation, Mettler-Toledo, Merck KGaA, VWR International, Bio-Rad Laboratories, AB SCIEX, Inficon, CannaSafe, Steep Hill Labs, Creso Pharma, MilliporeSigma, LGC Limited, Bruker Corporation, Heidolph Instruments. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cannabis Analyzer Market Key Technology Landscape

The technology landscape of the Cannabis Analyzer Market is dominated by advanced separation and detection techniques essential for ensuring product safety and quality. High-Performance Liquid Chromatography (HPLC) remains the gold standard for potency testing (cannabinoids like THC and CBD) because it preserves the molecular structure of thermally sensitive compounds. Conversely, Gas Chromatography (GC) is typically coupled with Mass Spectrometry (MS) for volatile compound analysis, such as residual solvents and terpenes, offering unparalleled sensitivity for these specific application niches. Both chromatographic techniques are witnessing strong evolutionary trends focused on Ultra-High-Performance Liquid Chromatography (UHPLC) and faster GC ovens, dramatically cutting down analysis time.

Mass Spectrometry, particularly tandem quadrupole systems (LC-MS/MS and GC-MS/MS), represents the pinnacle of contaminant screening technology. These systems are indispensable for meeting the extremely low regulatory limits set for pesticides, mycotoxins, and heavy metals, offering superior selectivity and sensitivity compared to standalone chromatography. Furthermore, the integration of Inductively Coupled Plasma Mass Spectrometry (ICP-MS) is crucial for accurate detection and quantification of toxic heavy metals (e.g., lead, arsenic) down to parts-per-billion levels. The ongoing technological development is focused on creating rugged, benchtop, and automated systems that integrate sample preparation steps, minimizing potential human error and maximizing laboratory efficiency.

A crucial emerging trend is the introduction of portable and handheld Near-Infrared (NIR) and Raman Spectroscopy devices. While not offering the regulatory-mandated accuracy of traditional chromatography for contaminant screening, these rapid, non-destructive technologies are ideal for point-of-use testing at cultivation sites, providing immediate feedback on potency and moisture content. This bifurcation of the market—between ultra-high accuracy lab equipment and rapid, accessible field devices—is shaping future investment, with manufacturers focusing on software solutions that provide seamless data comparison and compliance tracking across the entire supply chain, ensuring comprehensive quality assurance from harvest to retail.

Regional Highlights

- North America (USA and Canada): North America maintains the largest market share, primarily driven by early and expansive legalization for both medical and recreational use across numerous states and provinces. The US, with its fragmented but rapidly growing legal market, necessitates localized testing facilities adhering to varying state regulations (e.g., California’s strict contaminant testing standards). Canada serves as a mature, standardized national market with federally regulated testing requirements, ensuring consistent demand for high-throughput instrumentation and consumables. Innovation in North America is centered on automation and meeting fast turnaround times demanded by high-volume commercial production.

- Europe (Germany, UK, Netherlands): Europe is the fastest-growing market, fundamentally powered by the expansion of medicinal cannabis access, especially in Germany and the UK. European growth is strictly regulated, often adopting pharmaceutical-grade standards (Good Manufacturing Practice, GMP) for medical products, which necessitates the highest grade of analytical instrumentation (e.g., validated LC-MS/MS systems) for pharmaceutical compliance. The focus here is on quality, stability testing, and clinical research, contrasting with the high-throughput retail focus of North America.

- Asia Pacific (APAC): The APAC market is currently nascent but holds immense future potential. Growth is concentrated in scientific research and limited medical applications in countries like Australia and certain pharmaceutical-focused regions. Regulatory barriers remain high, but increasing R&D activity targeting drug discovery and the production of industrial hemp extracts is driving foundational demand for analytical equipment in academic and government laboratories. Any future legislative shifts toward legalization in major economies like Japan or South Korea would rapidly transform this region into a key growth center.

- Latin America (LATAM): Markets in Latin America, particularly those with established legal frameworks like Uruguay and emerging industries in Colombia, are experiencing significant growth. Colombia, a major producer for the global medical cannabis export market, requires international standard compliance, stimulating demand for sophisticated analytical equipment to meet European and North American import regulations. The market growth here is strongly tied to export volumes and the establishment of local compliance infrastructure.

- Middle East and Africa (MEA): The MEA region represents the smallest market share, with demand largely confined to academic research and limited medical pilot programs, particularly in South Africa and Israel. Israel, being a pioneer in cannabis research, maintains a high standard for analytical testing in its research facilities. Growth will be sporadic, dependent primarily on isolated governmental decisions regarding medical research liberalization.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cannabis Analyzer Market.- Agilent Technologies

- Waters Corporation

- Shimadzu Corporation

- PerkinElmer

- Thermo Fisher Scientific

- Danaher Corporation (SCIEX)

- Restek Corporation

- Mettler-Toledo

- Merck KGaA

- VWR International

- Bio-Rad Laboratories

- AB SCIEX

- Inficon

- CannaSafe

- Steep Hill Labs

- Creso Pharma

- MilliporeSigma

- LGC Limited

- Bruker Corporation

- Heidolph Instruments

Frequently Asked Questions

Analyze common user questions about the Cannabis Analyzer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the most commonly used analytical techniques for cannabis testing?

The most common and regulatory compliant techniques are High-Performance Liquid Chromatography (HPLC) for potency testing, and Gas Chromatography coupled with Mass Spectrometry (GC-MS) or Liquid Chromatography coupled with Tandem Mass Spectrometry (LC-MS/MS) for contaminant screening (pesticides, residual solvents, heavy metals).

How is regulatory fragmentation affecting the market for cannabis analyzers?

Regulatory fragmentation forces laboratories to maintain multiple validated methods and necessitates instrument flexibility to meet disparate contamination limits and testing standards across various state, provincial, and national jurisdictions, increasing operational complexity and capital investment costs.

What is the primary factor driving the demand for advanced analyzer technology?

The demand is primarily driven by increasingly stringent government regulations globally, particularly the requirement for low-detection limits (parts per billion) for contaminants like heavy metals and pesticides, which mandates the use of highly sensitive technologies like LC-MS/MS and ICP-MS.

Are portable or point-of-use analyzers reliable for compliance testing?

Portable analyzers (often using NIR or Raman spectroscopy) offer rapid, non-destructive preliminary screening for potency and moisture at cultivation sites. However, they are generally not yet sensitive enough to replace centralized, regulatory-mandated laboratory systems (HPLC, MS) for final contaminant compliance testing.

Which end-user segment contributes the most to the market revenue?

Independent, third-party Cannabis Testing Laboratories contribute the most significant revenue share, as they are legally required to process the bulk of all commercial product samples for potency verification and safety screening before market release across legalized jurisdictions.

What role does automation play in the future of cannabis analysis?

Automation, often enhanced by AI and robotics, is critical for managing the high throughput required by the rapidly growing industry. It reduces manual error, speeds up sample preparation, and ensures reproducibility, improving the overall efficiency and reliability of analytical results.

How do minor cannabinoids impact the demand for analytical instrumentation?

The growing commercial and therapeutic interest in minor cannabinoids (such as CBN, CBG, and THCV) necessitates analytical instruments with high resolution and sensitivity (e.g., advanced HPLC and LC-MS systems) capable of accurately separating and quantifying these low-concentration compounds from complex matrices.

What are the key technological restraints limiting market growth?

Key restraints include the high initial capital investment required for complex instrumentation, the ongoing cost of specialized consumables and certified reference standards, and the shortage of highly trained analytical chemists capable of validating and running sophisticated cannabis testing methods.

How does the pharmaceutical sector utilize cannabis analyzers?

The pharmaceutical sector uses high-grade analyzers for rigorous Quality Control (QC) and stability testing of cannabinoid-based drugs, ensuring purity, dosage consistency, and compliance with Good Manufacturing Practices (GMP) and regulatory submissions for clinical trials and commercialization.

Which region is expected to demonstrate the highest CAGR?

Europe is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to the rapid establishment of medicinal cannabis programs in key countries like Germany and the UK, which require pharmaceutical-level analytical testing infrastructure.

What are the challenges in standardizing testing methodologies globally?

Standardization is challenging due to varying acceptable limits for contaminants, differences in required matrices (flower vs. edible), and regulatory authorities in different jurisdictions mandating specific, non-harmonized analytical methods, complicating cross-border trade and method transfer.

How is the analysis of terpenes carried out in cannabis labs?

Terpene profiling is primarily conducted using Gas Chromatography (GC) coupled with Flame Ionization Detection (FID) or Mass Spectrometry (MS). GC’s heating capability is ideal for separating these volatile aromatic compounds, which are essential for product characterization.

What is the significance of the consumables segment in the market?

The consumables segment (HPLC columns, GC liners, solvents, reference standards) is crucial as it generates continuous, recurring revenue, offsetting the cyclical nature of large instrument sales, and demand is directly proportional to sample volume throughput in testing laboratories.

How do manufacturers cater to small-scale cultivators?

Manufacturers cater to small-scale cultivators by offering affordable, entry-level benchtop or rapid spectroscopic analyzers for basic, indicative potency and moisture checks, allowing cultivators to optimize processes before investing in expensive compliance testing.

What new technology is emerging to address heavy metal contamination?

Inductively Coupled Plasma Mass Spectrometry (ICP-MS) and Atomic Absorption Spectroscopy (AAS) are the established methods, but newer, faster models with enhanced interference removal capabilities are emerging to ensure reliable detection of heavy metals absorbed from cultivation media.

What is the expected long-term impact of AI on analytical labor requirements?

AI is expected to reduce the need for entry-level data interpretation staff by automating results validation and anomaly flagging, allowing senior analytical chemists to focus on complex method development and regulatory compliance tasks, increasing overall lab productivity.

Which test type is currently the highest volume application?

Potency testing, which measures primary cannabinoids (THC and CBD), remains the highest volume application globally because it is mandatory for virtually every single commercial cannabis and hemp product sold to verify labeling accuracy and dosage.

How does the value chain manage the distribution of complex instruments?

Complex and high-value instruments like LC-MS/MS are typically distributed via direct sales channels, ensuring that specialized technical support, installation, training, and ongoing service contracts are managed directly by the original equipment manufacturer (OEM).

Why is LC-MS/MS preferred over standalone HPLC for contaminant screening?

LC-MS/MS offers superior selectivity and sensitivity, allowing laboratories to reliably detect minute traces (parts per billion) of non-volatile contaminants like mycotoxins and pesticides, which is essential to meet extremely low regulatory thresholds where standalone HPLC often lacks sufficient detection power.

What is the primary concern for end-users when selecting an analyzer?

The primary concern is the instrument's ability to provide verifiable, reproducible results that meet or exceed specific local regulatory compliance standards, often prioritizing robustness, method validation support, and reliable service agreements.

How is the market addressing the need for faster turnaround times?

The market addresses faster turnaround times through the adoption of UHPLC systems, automated sample preparation modules (e.g., solid-phase extraction robotics), and AI-driven data processing, all designed to increase sample throughput without compromising regulatory compliance or accuracy.

What distinguishes pharmaceutical customers from commercial testing labs?

Pharmaceutical customers focus on R&D, drug stability studies, and GMP compliance, requiring extensive method validation documentation and high precision, while commercial testing labs focus on high throughput, cost-efficiency, and rapid screening of diverse product matrices for mandatory market release compliance.

What impact do mergers and acquisitions have on market concentration?

M&A activity, where large analytical giants acquire specialized testing companies or technology providers, leads to increased market concentration, allowing integrated companies to offer comprehensive, turn-key solutions and consolidate expertise across different test types and geographical regions.

Why is solvent testing critical in the cannabis extraction process?

Residual solvent testing is critical because solvents (like butane, ethanol, or propane) used in the extraction process must be removed below safe regulatory limits to prevent consumer toxicity, making GC-MS or GC-FID essential analytical tools for quality control.

How does the shift toward edibles influence analyzer technology requirements?

The shift toward complex matrices like edibles and beverages increases the challenge of sample preparation and matrix interference, driving demand for more sophisticated analytical techniques (e.g., advanced MS) that can effectively isolate and quantify analytes from difficult, high-sugar, or fatty samples.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager