Canvas Fabric Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432467 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Canvas Fabric Market Size

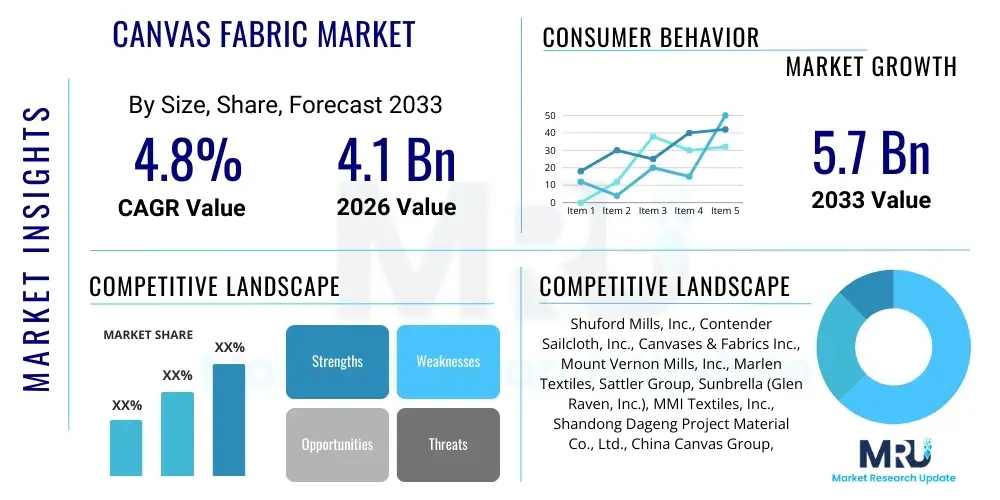

The Canvas Fabric Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 5.7 Billion by the end of the forecast period in 2033.

Canvas Fabric Market introduction

The Canvas Fabric Market encompasses a wide range of heavy-duty, plain-woven textiles, historically made from cotton or hemp, but increasingly utilizing synthetic fibers like polyester and nylon for enhanced durability and specific functional properties. Canvas is characterized by its robust structure, resistance to tearing, and suitability for applications requiring resilience against environmental factors, including water resistance and UV degradation. Modern canvas production involves sophisticated finishing techniques such as waxing, coating with polyvinyl chloride (PVC), or treating with fire-retardant chemicals, expanding its utility far beyond traditional sailcloth and tents. The product range includes duck canvas, numbered canvas, and various treated specialty fabrics designed for specific industrial, consumer, and artistic applications, driving demand across diverse end-use sectors globally.

Major applications of canvas fabric are predominantly found in industrial textiles, defense, transportation, and consumer goods. In the industrial sphere, canvas is crucial for conveyor belts, filtration media, and heavy-duty protective covers. In transportation, it is widely utilized for truck tarpaulins, marine coverings, and automotive upholstery due to its strength and weather resistance. The consumer sector leverages canvas for high-quality footwear, durable bags, outdoor furniture, and awnings. Furthermore, the burgeoning demand for sustainable materials has boosted the market for organic cotton and natural fiber canvas, especially in fashion and homeware. The fundamental benefits of canvas fabric—including its longevity, tensile strength, and versatility in accepting various treatments and dyes—continue to solidify its position as a staple textile in both mature and developing economies.

Driving factors for the sustained growth of the canvas fabric market include rapid urbanization and increasing construction activities, particularly in Asia Pacific, which necessitate robust protective and temporary structural materials like industrial tents and tarps. The global trend towards outdoor recreation and adventure tourism directly increases the demand for high-performance camping gear, backpacks, and durable apparel made from technical canvas varieties. Moreover, the emphasis on material durability and lifecycle extension in industrial operations, where canvas offers cost-effective, long-lasting solutions for covering equipment and products, contributes significantly to market expansion. Technological advancements in weaving and coating processes are also enabling the creation of lightweight yet stronger synthetic canvas variants, opening up new specialized application avenues.

Canvas Fabric Market Executive Summary

The global canvas fabric market is experiencing dynamic growth, propelled by robust expansion in the construction and transportation sectors, particularly in emerging Asian markets. Key business trends indicate a strong shift toward sustainable and recycled canvas alternatives, addressing mounting environmental regulations and consumer preference for eco-friendly products. Manufacturers are increasingly investing in proprietary coating technologies to enhance functional attributes such as breathability, microbial resistance, and flame retardancy, moving away from commoditized plain-woven fabrics toward high-value, technical textiles. Strategic collaborations between textile manufacturers and specialized chemical suppliers are becoming common, aimed at optimizing material performance for demanding applications like military equipment and industrial safety gear. Supply chain resilience, following post-pandemic disruptions, remains a focal point, driving efforts toward localized production and digitalization of inventory management.

Regionally, Asia Pacific maintains market dominance due to its large-scale manufacturing base for consumer goods, booming infrastructural development, and substantial automotive production. North America and Europe, while representing mature markets, are leading the adoption of technical canvas and sustainable variants, driven by strict quality standards and high disposable income allocated to outdoor recreational equipment. Latin America and the Middle East & Africa are demonstrating promising growth, primarily fueled by investments in oil & gas infrastructure (requiring heavy-duty industrial covers) and rapid urbanization, which spurs demand for architectural and protective canvas. Political stability and trade agreements significantly influence raw material sourcing and finished product distribution across these geopolitical zones, necessitating adaptive market strategies for global players.

Segmentation trends highlight the increasing prominence of synthetic canvas fabrics, such as polyester and PVC-coated materials, over traditional cotton canvas in industrial and heavy-duty applications, attributed to their superior resistance to moisture, mildew, and chemicals. Conversely, the cotton canvas segment retains strong market share in artistic supplies, fashion, and high-end consumer goods, benefiting from the growing premiumization trend favoring natural aesthetics and breathability. By application, the Industrial & Protective Use segment is projected to hold the largest market share due to continuous demand from sectors like mining, agriculture, and warehousing. Within the weight class, heavy-duty canvas (>16 oz) sees robust demand in transportation and marine sectors, whereas lighter-weight materials (<10 oz) are favored in apparel and filtration systems, indicating a polarization in functional requirements driving product development.

AI Impact Analysis on Canvas Fabric Market

Common user questions regarding AI's impact on the canvas fabric market frequently center on how machine learning can optimize textile quality, predict demand fluctuations for specific canvas types (e.g., duck vs. marine canvas), and streamline complex global supply chains. Users are particularly keen on understanding AI's role in detecting microscopic defects during weaving, customizing fabric coating formulations based on real-time environmental data, and automating pattern cutting to minimize material waste, thereby boosting sustainability and reducing production costs. Key themes emerging from these inquiries include predictive maintenance for large-scale looms, AI-driven raw material (cotton, polyester) price forecasting, and the use of computer vision systems to ensure precise color matching and weave density, leading to expectations of significant operational efficiency gains and improved product consistency within the canvas manufacturing domain.

- AI-driven Predictive Maintenance: Utilizing sensor data on weaving machines and coating lines to forecast equipment failures, minimizing unexpected downtime and maximizing operational uptime, essential for maintaining high-volume canvas production schedules.

- Supply Chain Optimization: Machine learning algorithms analyze global raw material availability, shipping logistics, and geopolitical risks to recommend optimal procurement and distribution routes, enhancing resilience against supply shocks for cotton and synthetic fibers.

- Quality Control and Defect Detection: Implementing AI-powered computer vision systems on inspection lines to instantly identify subtle weaving imperfections, thread breaks, and coating inconsistencies, ensuring canvas batches meet stringent quality specifications (e.g., military-grade canvas).

- Demand Forecasting and Inventory Management: Sophisticated models analyze historical sales data, seasonal trends (e.g., camping season for tent canvas), and macro-economic indicators to accurately predict demand for various canvas types, reducing overstocking and material obsolescence.

- Sustainable Design and Waste Reduction: AI algorithms optimize cutting layouts for complex canvas products (like tents, bags, or tarpaulins), minimizing fabric remnants and contributing significantly to the sustainability goals of manufacturers.

- Personalized Product Customization: Using AI to quickly translate customer-specific requirements (e.g., specialized color, waterproofing level, weight) into manufacturing parameters, facilitating efficient production of small, high-value customized canvas orders.

DRO & Impact Forces Of Canvas Fabric Market

The canvas fabric market is characterized by a complex interplay of drivers (D), restraints (R), and opportunities (O), which collectively shape its trajectory and impact forces. Major drivers include the robust growth in end-use industries such such as construction, marine, and outdoor recreation, where the inherent durability and weather resistance of canvas are indispensable. The increasing global focus on sustainable and natural textiles also drives demand for organic and recycled cotton canvas, providing a growth corridor. However, the market faces significant restraints, notably the volatile pricing of raw materials, particularly cotton, which is subject to unpredictable climate patterns and agricultural output. Furthermore, intense competition from lighter, highly specialized synthetic alternatives like advanced technical composites in certain high-performance applications poses a structural challenge. Opportunities lie in developing advanced technical canvas fabrics with integrated smart features (e.g., embedded sensors or self-cleaning surfaces) and expanding market penetration in specialized industrial filtration and protective gear sectors, which command high margins.

The key driving force is the expanding global population and subsequent demand for robust infrastructure and reliable transportation, both requiring extensive use of canvas for protective coverings and industrial applications. The burgeoning popularity of durable, stylish canvas bags, backpacks, and footwear, driven by fashion trends favoring rugged aesthetics, further contributes to market momentum. Manufacturers are capitalizing on product innovation, introducing hybrid fabrics that blend natural fibers with synthetic polymers to achieve optimal balance between breathability, strength, and cost-effectiveness. This innovation cycle is essential for maintaining relevance against competing materials.

Conversely, regulatory scrutiny concerning the environmental impact of traditional canvas treatments, such as certain waterproofing chemicals and dyes, acts as a significant restraint. This forces manufacturers to invest heavily in R&D to find eco-friendly substitutes, adding to operational costs. The primary impact forces influencing market dynamics include the rapidly shifting consumer preference toward sustainable products, the intense competition leading to price compression in commoditized segments, and the influence of macro-economic stability on construction and industrial investment, which directly affects bulk canvas orders. Ultimately, technological leaps in material science defining specialized fabric performance and the effectiveness of supply chain management in mitigating cost volatility are the dominant forces dictating market success.

Segmentation Analysis

The Canvas Fabric Market segmentation is structured based on Material Type, Application, and Weight Class, providing a comprehensive view of product diversity and end-user requirements. Material type primarily differentiates between Natural Canvas (cotton, hemp, flax) and Synthetic Canvas (polyester, nylon, blended), reflecting varying properties like breathability, tensile strength, and water resistance required for specific uses. The Application segment defines end-user industries, ranging from Industrial and Protective to Marine, Tents & Awnings, and Consumer Goods, highlighting the market's broad reliance on this versatile textile. Weight Class segmentation (light, medium, heavy) determines the suitability of the fabric for different duties, with heavy canvas being crucial for high-stress industrial covers and medium weight ideal for fashion and decorative items. These segments allow market participants to tailor their production, marketing, and distribution strategies to meet specialized needs across the value chain, from raw fiber sourcing to final product assembly.

- By Material Type:

- Natural Canvas (Cotton, Hemp, Flax)

- Synthetic Canvas (Polyester, Nylon, Poly-Cotton Blends)

- By Treatment Type:

- Waterproof/Water-Resistant Canvas

- Fire-Retardant Canvas

- Coated Canvas (PVC, Waxed)

- Untreated Canvas

- By Weight Class:

- Lightweight (<10 oz)

- Medium Weight (10 oz - 16 oz)

- Heavy-Duty (>16 oz)

- By Application:

- Industrial & Protective Uses (Tarpaulins, Equipment Covers, Filtration)

- Tents, Awnings, & Shelters

- Marine & Sporting Goods (Sailcloth, Boat Covers)

- Footwear & Accessories (Bags, Backpacks, Shoes)

- Artistic & Decorative Uses (Canvas Art, Upholstery)

- By End-User Industry:

- Construction

- Transportation & Logistics

- Military & Defense

- Outdoor Recreation

- Fashion & Apparel

Value Chain Analysis For Canvas Fabric Market

The canvas fabric value chain begins with the sourcing of raw materials, primarily cotton fibers (for natural canvas) and petrochemical derivatives for synthetic fibers (polyester, nylon). Upstream analysis involves raw material cultivation and harvesting (cotton farming) or chemical polymerization (synthetic fiber production). Key upstream players include agricultural conglomerates and major chemical/polymer manufacturers whose efficiency and price stability significantly dictate the cost structure of the final canvas product. Fiber processing, including ginning, spinning, and preparation, transforms raw materials into yarns suitable for weaving. Optimization at this stage focuses heavily on fiber quality assessment and minimizing input costs through vertical integration or long-term procurement contracts, ensuring a steady supply of consistent quality yarn required for heavy-duty weaving processes.

The midstream segment involves the core manufacturing processes: weaving, knitting (less common for traditional canvas), and finishing. Weaving mills utilize specialized looms designed to handle the heavy gauge of canvas yarn, producing the woven greige fabric. Following weaving, the finishing stage is critical, encompassing dyeing, chemical treatments (waterproofing, mildew resistance, fire retardancy), and coating (PVC, polyurethane). This stage adds the specialized functionality required for end-use applications like marine or industrial covers, transforming the commodity fabric into a high-value product. Efficient processing and adherence to quality standards (e.g., UV resistance testing) are pivotal here, defining the performance and marketability of the canvas.

Downstream analysis covers distribution channels and end-user consumption. Distribution occurs through direct sales to large industrial users (e.g., military, large construction firms), specialized textile distributors supplying smaller manufacturers, and retail channels for consumer products (e.g., hobby stores for art canvas, outdoor gear retailers). Direct distribution ensures quality control and customized orders, while indirect channels provide market breadth. Potential customers include major manufacturers in automotive and logistics for tarpaulins, tent and shelter manufacturers, designers of high-end consumer goods, and the defense sector. The final impact on the value chain is determined by the speed of technology adoption in finishing processes and the effectiveness of logistics in delivering bulky rolls of canvas fabric efficiently to global processing hubs.

Canvas Fabric Market Potential Customers

The potential customer base for the canvas fabric market is extremely diverse, spanning heavy industrial sectors, consumer goods manufacturers, military and governmental agencies, and specialized trade professionals. End-users requiring material durability, weather resistance, and high tensile strength constitute the primary demand drivers. Key institutional buyers include major logistics and trucking companies that require high volumes of heavy-duty, PVC-coated canvas for truck tarpaulins and cargo covers to protect goods during transport. Construction companies purchase robust canvas for temporary shelters, site covers, and safety netting, prioritizing fire retardancy and structural integrity. The military and defense sectors represent significant buyers, demanding highly specific, treated canvas for tents, vehicle covers, and protective gear, where material specifications are non-negotiable and governed by strict standards.

In the consumer sphere, manufacturers of outdoor recreational equipment form a major customer group. This includes companies specializing in high-performance camping tents, large family tents, specialized backpacks, and marine supply companies utilizing canvas for boat sails, biminis, and protective marine covers. These customers seek canvas that balances weight, UV resistance, and waterproofing capabilities. Furthermore, the fashion and footwear industries increasingly utilize canvas, particularly natural and high-quality dyed varieties, for durable sneakers, tote bags, and luggage, driven by consumer trends that emphasize longevity and sustainable aesthetics. The demand here often focuses on feel, color fastness, and ethical sourcing.

Specialized industrial segments also constitute vital niche markets. This includes manufacturers of industrial filtration systems that use technical canvas for dust collection bags and liquid filtering media, where porosity and chemical resistance are paramount. Additionally, artists and art suppliers are consistent buyers of untreated, prepared canvas (often cotton or linen blend) for painting surfaces. These end-users typically purchase through specialized distributors but their demand for consistent texture and archival quality material is constant. The overall trend indicates a strong demand concentration among business-to-business (B2B) customers in the industrial and protective application spaces, driving bulk orders and sustained market volumes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 5.7 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shuford Mills, Inc., Contender Sailcloth, Inc., Canvases & Fabrics Inc., Mount Vernon Mills, Inc., Marlen Textiles, Sattler Group, Sunbrella (Glen Raven, Inc.), MMI Textiles, Inc., Shandong Dageng Project Material Co., Ltd., China Canvas Group, Twitchell Technical Fabrics, Picanol Group, Forbo International AG, Heytex Bramsche GmbH, Sioen Industries NV, Ferrari S.A., Goyard St. Honoré, Kosa Textile, Artex Mill, G & R Wovens. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Canvas Fabric Market Key Technology Landscape

The technological landscape of the canvas fabric market is centered around optimizing weaving efficiency, enhancing fabric performance through advanced finishing treatments, and ensuring sustainable production practices. Weaving technology has seen significant evolution, particularly with the introduction of high-speed air-jet and rapier looms capable of handling heavy, thick yarns while maintaining uniform weave density and minimizing defects. These modern looms integrate sensor technology for real-time monitoring of thread tension and breakage, drastically improving output quality and consistency, which is crucial for technical canvas used in high-stress environments like large industrial tents or safety barriers. Furthermore, digital printing technologies are increasingly applied to canvas, particularly in decorative and advertising applications, allowing for high-resolution, durable graphics that resist fading and weathering, opening new avenues in architectural textiles.

The most transformative technologies relate to chemical finishing and coating applications. Specialized polymer coatings, such as advanced fluoropolymers and PVC alternatives, are being developed to offer superior water, oil, and stain repellency without compromising breathability or flexibility. UV stabilizers are incorporated into these coatings, extending the lifespan of outdoor canvas materials significantly, which is vital for marine and awning applications. Additionally, nanotechnology is emerging, enabling the creation of 'smart canvas' textiles with integrated functions, such as self-cleaning surfaces achieved through photocatalytic coatings or enhanced microbial resistance, making the fabric suitable for demanding medical and food-grade protective coverings. These technological enhancements are driving the premiumization of canvas products.

Sustainability technologies are also highly influential. Manufacturers are investing in closed-loop water treatment systems and energy-efficient drying processes to minimize the environmental footprint of dyeing and finishing. The adoption of recycled synthetic yarns (rPET) derived from plastic bottles is a major trend, allowing the production of strong, durable synthetic canvas with a lower ecological impact. Furthermore, blockchain technology is being piloted to provide transparent sourcing documentation for organic and sustainable cotton canvas, assuring end-users and regulators of ethical and traceable supply chains. These material and processing innovations are essential for meeting stringent international environmental regulations and capitalizing on the growing consumer demand for responsible manufacturing.

Regional Highlights

- Asia Pacific (APAC) stands as the largest and fastest-growing market for canvas fabric, propelled by extensive manufacturing capabilities, particularly in China and India, which serve as global hubs for textile production and processing. The region's rapid urbanization, massive infrastructure projects (roads, ports, housing), and thriving domestic demand for vehicles and consumer goods directly fuel the need for protective canvas, tarpaulins, and functional textiles.

- North America represents a mature, high-value market, characterized by high adoption rates of technical and specialized canvas fabrics, particularly in the marine, defense, and high-end outdoor recreational sectors. Strict quality and fire safety regulations drive the demand for premium, certified materials, leading to significant market contribution from specialized, branded products like marine-grade acrylic canvas.

- Europe maintains strong demand, primarily driven by the automotive industry (for interior and exterior covers), architectural textiles (awnings, shading systems), and a deep cultural focus on sustainability, boosting the market for organic cotton and recycled canvas. Germany, France, and Italy lead in the production and consumption of technical canvas used in advanced industrial filtration and protective clothing.

- Latin America is emerging as a critical market due to increasing investments in mining, agriculture, and logistics infrastructure, creating a substantial need for heavy-duty industrial tarpaulins and equipment covers. Economic stabilization and increasing trade activities are unlocking latent demand for durable textile solutions.

- Middle East and Africa (MEA) growth is linked to large-scale oil & gas projects, which require robust flame-retardant and high-temperature resistant canvas for safety shelters and equipment protection. Significant governmental spending on defense and military applications further contributes to the specialized canvas segment in this region, alongside growing needs for shade and architectural coverings in hot climates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Canvas Fabric Market.- Shuford Mills, Inc.

- Contender Sailcloth, Inc.

- Canvases & Fabrics Inc.

- Mount Vernon Mills, Inc.

- Marlen Textiles

- Sattler Group

- Sunbrella (Glen Raven, Inc.)

- MMI Textiles, Inc.

- Shandong Dageng Project Material Co., Ltd.

- China Canvas Group

- Twitchell Technical Fabrics

- Picanol Group (Focusing on weaving machinery for canvas)

- Forbo International AG

- Heytex Bramsche GmbH

- Sioen Industries NV

- Ferrari S.A.

- Goyard St. Honoré (High-end coated canvas manufacturer)

- Kosa Textile

- Artex Mill

- G & R Wovens

Frequently Asked Questions

Analyze common user questions about the Canvas Fabric market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between duck canvas and regular canvas?

Duck canvas is woven with two yarns twisted together in the warp and a single yarn in the weft, resulting in a tighter, stronger, and smoother weave than standard canvas. This dense structure makes duck canvas superior for applications requiring high wear resistance, such as heavy-duty bags, tents, and industrial uses.

Which material type of canvas is leading the market segmentation?

The Synthetic Canvas segment, particularly polyester-based canvas and poly-cotton blends, currently dominates the market share by volume due to its superior durability, lower cost, and enhanced resistance to moisture and mildew compared to 100% natural cotton canvas, especially in industrial and protective applications.

How is the canvas fabric market incorporating sustainability?

Sustainability is addressed through the increased adoption of organic cotton and recycled polyester (rPET) fibers. Manufacturers are also implementing advanced, eco-friendly coating processes and minimizing water and chemical usage during dyeing and finishing to reduce the overall environmental footprint of production.

What are the main applications of technical canvas in the industrial sector?

Technical canvas is predominantly used in the industrial sector for truck tarpaulins (coated for weather resistance), filtration systems (engineered porosity), conveyor belting, safety barriers, and heavy equipment covers. These applications demand high tensile strength, chemical resistance, and long-term durability.

What factors are driving the growth of the marine canvas segment?

Growth in the marine segment is driven by the increasing global popularity of recreational boating and the demand for high-performance, UV-resistant, and water-repellent canvas materials (like acrylic or specialty treated polyester) used for boat covers, sails, biminis, and exterior upholstery, ensuring protection against harsh salt and sun exposure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager