Cap Applicators Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435723 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Cap Applicators Market Size

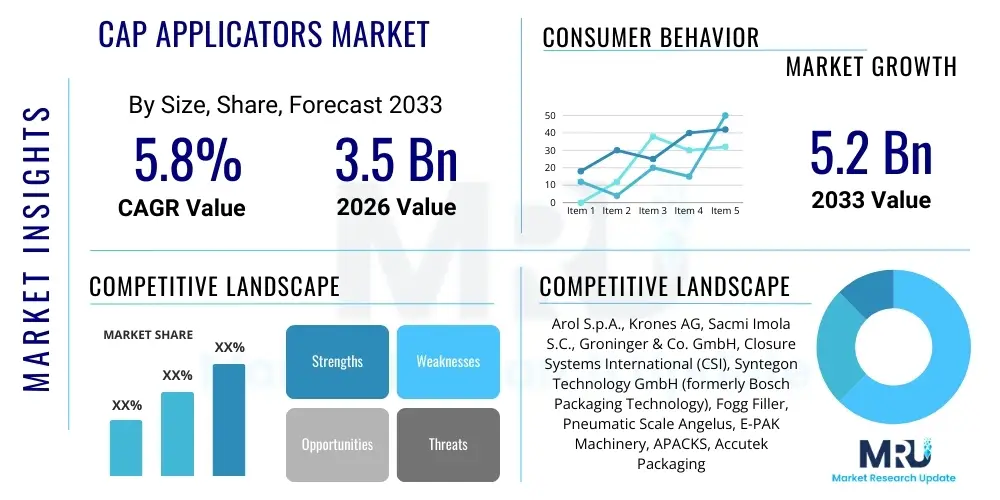

The Cap Applicators Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.5 billion in 2026 and is projected to reach USD 5.2 billion by the end of the forecast period in 2033.

Cap Applicators Market introduction

The Cap Applicators Market encompasses machinery designed to precisely apply, tighten, or seal various closure types onto containers, including bottles, jars, and vials, across a multitude of industries. These systems range from simple manual devices to highly sophisticated, high-speed rotary machines integrated into fully automated packaging lines. Cap applicators, often referred to as capping machines or cappers, are essential for ensuring product integrity, preventing leakage, and maintaining tamper-evidence, which is critical in sectors dealing with consumer safety and regulatory compliance. The primary function involves orienting the caps, placing them onto the container opening, and then securing them using torque, pressure, or heat sealing, depending on the closure mechanism required.

Product descriptions within this market cover diverse technological mechanisms, including rotary chuck cappers known for high throughput and precision, inline cappers ideal for flexibility across different container shapes, and specialized systems like Roll-On Pilfer Proof (ROPP) cappers used extensively in the beverage and pharmaceutical sectors for hermetic sealing. Major applications span food and beverage (bottled water, soda, dairy), pharmaceuticals (syrups, vials, tablets), cosmetics (lotions, shampoos), and chemicals (solvents, lubricants). The consistent demand for efficient, sterile, and high-speed packaging solutions is the cornerstone of market vitality.

Key benefits derived from implementing advanced cap applicators include enhanced production efficiency, significant reduction in manual labor costs, improved sealing consistency which minimizes product spoilage, and adherence to stringent industry standards such as FDA regulations and ISO quality controls. The market is primarily driven by the escalating global consumption of packaged goods, particularly in emerging economies, the continuous need for flexibility in handling diverse cap and bottle formats, and ongoing technological advancements focused on increasing machine speed, precision, and integration capabilities (Industry 4.0 readiness). The growing emphasis on sustainable packaging materials and lightweight closures also necessitates continuous innovation in applicator design.

Cap Applicators Market Executive Summary

The Cap Applicators Market is characterized by robust growth driven by the expansion of the global packaging industry and the stringent regulatory requirements governing sealing integrity across critical sectors like pharmaceuticals and food and beverage. Business trends indicate a strong pivot towards automated and high-speed rotary capping systems, offering superior throughput and reliability, alongside increasing adoption of modular designs that allow for rapid changeovers between different product lines. Key market players are heavily investing in integrating advanced sensor technology and sophisticated vision systems to verify cap placement and torque application, thereby minimizing defects and enhancing overall equipment effectiveness (OEE). Sustainability is a prevailing theme, with manufacturers demanding machines capable of handling lighter-weight caps and environmentally friendly materials efficiently.

Regional trends demonstrate that Asia Pacific (APAC) remains the fastest-growing market, primarily fueled by rapid urbanization, substantial population growth, and booming domestic consumption of packaged foods and beverages in countries like China and India. North America and Europe, representing mature markets, exhibit steady growth driven by replacement cycles, modernization efforts focused on integrating Industry 4.0 principles, and high demand for specialized applications such as child-resistant and tamper-evident closures. The competitive landscape in these regions emphasizes precision engineering and service excellence, with manufacturers focusing on reducing total cost of ownership (TCO) through energy-efficient operation and minimal maintenance requirements.

Segment trends highlight the dominance of the Automatic segment due to pervasive automation in high-volume production environments. In terms of capping methods, Rotary Chuck Capping continues to hold the largest market share owing to its speed and consistency, while the demand for ROPP cappers is surging, especially in alcoholic and non-alcoholic beverage industries requiring secure, hermetic seals. The Food & Beverage sector remains the largest end-user, though the Pharmaceutical industry is poised for significant growth, demanding extremely high precision and sterile capping solutions to comply with Good Manufacturing Practices (GMP). This trend reinforces the necessity for vendors to offer bespoke solutions catering to specific regulatory and sanitary prerequisites of each end-user segment.

AI Impact Analysis on Cap Applicators Market

Common user inquiries regarding the influence of Artificial Intelligence (AI) and Machine Learning (ML) on the Cap Applicators Market frequently center on predictive maintenance capabilities, optimization of operational parameters, and the role of AI in quality control. Users are keen to understand how AI algorithms can forecast component failure, thereby minimizing unplanned downtime, and how ML can dynamically adjust capping torque or speed based on real-time sensory data (e.g., changes in ambient temperature or material viscosity) to ensure optimal sealing consistency. Furthermore, there is significant interest in using AI-powered vision systems for instantaneous defect detection, moving beyond simple presence/absence checks to complex anomaly detection in cap application, orientation, and seal integrity. The summarized expectation is that AI integration will fundamentally shift capping operations from reactive maintenance models to proactive, highly efficient, and adaptive manufacturing processes, significantly improving OEE and product safety compliance.

- AI-driven Predictive Maintenance: Algorithms analyze sensor data (vibration, heat, current draw) to forecast equipment failure, scheduling maintenance preemptively and drastically reducing unplanned downtime.

- Real-time Parameter Optimization: Machine Learning models dynamically adjust capping parameters (torque, speed, stroke depth) to compensate for variations in container or cap material consistency, ensuring consistent seal integrity.

- Enhanced Quality Control (QC): AI vision systems utilize deep learning to identify subtle cosmetic and functional defects in cap placement and alignment at high line speeds, exceeding human inspection capabilities.

- Supply Chain Integration: AI analyzes historical production data to optimize raw material inventory (caps and closures), aligning stock levels precisely with fluctuating production schedules.

- Energy Efficiency Management: ML algorithms optimize motor usage and system cycling, contributing to lower operational energy consumption in high-volume production lines.

DRO & Impact Forces Of Cap Applicators Market

The Cap Applicators Market is influenced by a dynamic interplay of factors encompassing strong demand drivers, operational restraints, technological opportunities, and significant external impact forces. Key drivers include the robust expansion of the global beverage industry, particularly the demand for specialized closure formats like sports caps and lightweight water bottle caps, coupled with stringent regulatory pressure from bodies like the FDA and EMA demanding enhanced sealing integrity and tamper-proofing in pharmaceutical packaging. These forces compel manufacturers to invest in high-precision, validated capping equipment capable of meeting these demanding specifications consistently. The overall shift towards automation across all manufacturing sectors, fueled by rising labor costs and the need for higher throughput, further accelerates market growth.

Restraints primarily revolve around the high initial capital investment required for automated, high-speed rotary capping systems, which can be prohibitive for small and medium-sized enterprises (SMEs), particularly in developing regions. Furthermore, the complexity of integrating highly specialized machines into existing legacy packaging lines, requiring extensive customization and validation, often presents technological hurdles. Another significant restraint is the increasing diversity in cap materials, shapes, and container designs, necessitating complex and frequent changeover procedures, which temporarily reduces operational efficiency and demands highly skilled maintenance personnel.

Opportunities in the market are abundant, centered largely on technological innovation, specifically the development of flexible, modular systems utilizing robotics and advanced vision systems that can handle multiple cap types (e.g., screw caps, snap caps, pumps, triggers) on the same platform with minimal mechanical adjustments. The growing focus on sustainable packaging materials, such as bio-plastics and recycled content, creates opportunities for manufacturers to develop applicators optimized for these lighter and often less rigid closures. Impact forces, driven by global events and societal shifts, include fluctuating raw material prices (steel, aluminum, specialized plastics for machine components), geopolitical instability affecting supply chains, and evolving consumer preferences for personalized and single-serving packaging formats, which increases the complexity and volume of capping operations globally.

Segmentation Analysis

The Cap Applicators Market segmentation provides a detailed structural breakdown based on criteria such as operational technology (Type), the mechanical process used to secure the closure (Capping Method), and the primary industrial application (End-Use Industry). Understanding these segments is crucial for strategic market planning, as each category exhibits unique growth drivers, technological requirements, and consumer expenditure patterns. The complexity of modern closures, ranging from standard continuous thread caps to sophisticated child-resistant and dispensing closures, necessitates a highly specialized product offering within each segment. This structure allows market participants to tailor machinery solutions, targeting specific operational needs—from the high-volume standardization required by the beverage industry to the stringent validation demands of the pharmaceutical sector.

- By Type:

- Semi-automatic Cap Applicators

- Automatic Cap Applicators

- Manual Cap Applicators

- By Capping Method:

- Rotary Chuck Capping (High Speed)

- Inline Capping (Friction Wheel/Belt)

- Snap Capping

- ROPP (Roll-On Pilfer Proof) Capping

- Press-on Capping

- Crimping

- By End-Use Industry:

- Food & Beverage (largest segment)

- Pharmaceuticals & Biotechnology (highest growth potential)

- Cosmetics & Personal Care

- Chemical & Petroleum

- Others (Nutraceuticals, Household Products)

Value Chain Analysis For Cap Applicators Market

The value chain for the Cap Applicators Market begins with the upstream procurement of specialized raw materials and components, including high-grade stainless steel, specialized alloys for wear resistance, precision electronic components (PLCs, servo motors, sensors), and vision systems. Upstream analysis focuses on managing supplier relationships to ensure the consistent quality and timely delivery of components critical for machine performance, particularly the intricate capping heads and change parts. Manufacturers often source these high-precision elements from specialized global suppliers. Price volatility in base metals and the lead times for custom-engineered electrical components significantly impact the upstream segment of the value chain, requiring robust inventory management and multi-sourcing strategies by major market players.

The core manufacturing stage involves the design, fabrication, assembly, and rigorous testing of the capping machinery. This stage requires significant intellectual capital, focusing on mechanical engineering excellence, software integration, and compliance with global safety standards (e.g., CE marking). Downstream analysis focuses on how these complex machines reach the end-users. The primary distribution channel involves a combination of direct sales for large, customized, high-end systems (especially within pharmaceutical and major beverage corporations) and indirect channels utilizing regional distributors and system integrators for standard or semi-automatic models. System integrators play a vital role in integrating the cap applicator into a complete packaging line, often alongside fillers, labelers, and conveyors.

The indirect channel, employing specialized local agents, is essential for providing immediate local support, spare parts inventory, and necessary training, particularly in geographically diverse markets like Asia Pacific and Latin America. Direct sales are preferred when highly specialized application engineering support or comprehensive factory acceptance testing (FAT) is required, ensuring maximum control over installation and validation processes critical for regulated industries. Post-sale services, including maintenance contracts, spare parts supply, and software upgrades, represent a significant revenue stream and a crucial differentiator for competitors, solidifying the long-term relationship between the equipment provider and the end-user.

Cap Applicators Market Potential Customers

Potential customers for Cap Applicators are primarily large-scale manufacturers and contract packagers operating within the fast-moving consumer goods (FMCG) industries, where high-volume and high-speed packaging is essential for competitiveness. The Food & Beverage sector represents the largest consumer base, encompassing bottled water companies, carbonated soft drink manufacturers, dairy processors, and breweries, all requiring reliable sealing to prevent spoilage and maintain carbonation or sterility. These clients typically demand highly reliable rotary cappers with rapid changeover capabilities to handle diverse bottle shapes and closure types efficiently.

The Pharmaceutical and Biotechnology sectors constitute a highly lucrative customer segment, characterized by extremely stringent requirements for precision, sterility, validation (e.g., 21 CFR Part 11 compliance), and specialized sealing methods for vials, syringes, and ophthalmic preparations. Their demand is focused on customized, small-batch, high-precision capping systems, often requiring laminar flow environments or isolator technology integration. Cosmetics and Personal Care manufacturers, including producers of shampoos, lotions, and perfumes, are another key segment, demanding flexibility to handle visually complex closures, pump dispensers, and trigger sprayers, often requiring specialized torque control systems to protect packaging aesthetics.

Finally, the Chemical & Petroleum industry, involved in packaging lubricants, solvents, and agrochemicals, represents end-users requiring durable machines capable of handling corrosive materials and large format containers, often utilizing specialized cap types like induction seals and tamper-evident ratchet closures. Contract packagers (co-packers) represent a critical growth area, as they cater to multiple brands and product types, driving demand for flexible, modular cap applicators capable of accommodating frequent product switching with minimal downtime.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 billion |

| Market Forecast in 2033 | USD 5.2 billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Arol S.p.A., Krones AG, Sacmi Imola S.C., Groninger & Co. GmbH, Closure Systems International (CSI), Syntegon Technology GmbH (formerly Bosch Packaging Technology), Fogg Filler, Pneumatic Scale Angelus, E-PAK Machinery, APACKS, Accutek Packaging Equipment, Liquid Packaging Solutions, Gebo Cermex, M.C.S. S.p.A., IMA Group, MG2, Federal Mfg. Co., Tecnocap S.p.A., Marchesini Group S.p.A., IC Filling Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cap Applicators Market Key Technology Landscape

The technology landscape of the Cap Applicators Market is rapidly evolving, driven by the need for increased speed, precision, flexibility, and connectivity. Traditional mechanical cappers are being supplanted by systems incorporating advanced servo-motor technology, which allows for highly accurate, electronically controlled torque application. Servo systems provide superior precision compared to conventional clutch-based systems, reducing the likelihood of loose or overtightened caps and minimizing container damage. This high level of control is essential for modern lightweight containers and specialized closures, ensuring seal integrity without material stress. Furthermore, the integration of quick-change change parts and automated height adjustments, managed through the Human-Machine Interface (HMI), significantly reduces changeover time, directly boosting OEE metrics across complex production schedules.

Industry 4.0 and the Internet of Things (IoT) are major technological focuses. Modern cap applicators are equipped with integrated sensors that monitor vibration, temperature, and torque in real-time, feeding data into centralized Manufacturing Execution Systems (MES). This connectivity facilitates remote monitoring, diagnostics, and predictive maintenance protocols, drastically improving machine uptime and enabling efficient inventory management for spare parts. Vision inspection systems, utilizing high-resolution cameras and advanced image processing software, are becoming standard features, ensuring 100% verification of cap presence, alignment, orientation, and tamper-band integrity at speeds exceeding 60,000 bottles per hour, a capability critical for quality assurance.

Robotic Capping Solutions represent the cutting edge of flexibility. Collaborative robots (cobots) are increasingly utilized for intricate or low-volume capping tasks, such as applying complex pump sprayers or customized cosmetic closures. These robotic systems offer unprecedented adaptability, handling non-standard container shapes and closure designs that fixed machinery struggles with. Another critical technology is the development of magnetic clutch systems and vacuum cap placement techniques, particularly for sensitive materials like glass, minimizing product spillage and container breakage during high-speed operation. The push for hygienic design (washdown capabilities and reduced contamination zones) continues to drive innovation, especially in the dairy and pharmaceutical sub-sectors, ensuring regulatory compliance and product safety.

Regional Highlights

Regional dynamics play a crucial role in shaping the Cap Applicators Market, reflecting varying levels of automation adoption, regulatory strictness, and consumer market size. Developed economies in North America and Europe emphasize precision, efficiency, and compliance with high safety and validation standards, driving demand for specialized ROPP and servo-driven rotary cappers for premium and regulated products.

- Asia Pacific (APAC): Dominant growth engine driven by population increase, expansion of the middle class, and massive infrastructure investment in the food and beverage industry. Countries like China, India, and Southeast Asian nations are experiencing rapid shifts from manual/semi-automatic operations to fully automated, high-speed lines, offering vast market potential for entry-level and mid-range automatic applicators.

- North America: Characterized by early adoption of advanced technology, including AI integration for predictive maintenance and specialized capping solutions for pharmaceutical and nutraceutical products. The focus remains on machine flexibility, reducing total cost of ownership (TCO), and implementing complex child-resistant and dispensing closures.

- Europe: A mature market focusing heavily on sustainability and adherence to rigorous European Union (EU) directives. Demand is high for cap applicators capable of handling lightweight packaging materials and recycling-friendly closures, alongside stringent requirements for hygienic design and high validation protocols, particularly in Germany and Italy, key manufacturing hubs.

- Latin America (LATAM): Exhibiting steady growth, primarily fueled by the beverage and beer industries. The market is price-sensitive, balancing the need for automation with capital constraints. Growth is concentrated in Brazil and Mexico, focusing on upgrading existing semi-automatic lines to automatic systems to increase efficiency and volume throughput.

- Middle East and Africa (MEA): Emerging market potential driven by expanding domestic production capabilities in the food, dairy, and bottling sectors, particularly in the Gulf Cooperation Council (GCC) countries and South Africa. Initial adoption focuses on robust, reliable systems suitable for challenging operational environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cap Applicators Market.- Arol S.p.A.

- Krones AG

- Sacmi Imola S.C.

- Groninger & Co. GmbH

- Closure Systems International (CSI)

- Syntegon Technology GmbH (formerly Bosch Packaging Technology)

- Fogg Filler

- Pneumatic Scale Angelus

- E-PAK Machinery

- APACKS

- Accutek Packaging Equipment

- Liquid Packaging Solutions

- Gebo Cermex (Sidel Group)

- M.C.S. S.p.A.

- IMA Group

- MG2

- Federal Mfg. Co.

- Tecnocap S.p.A.

- Marchesini Group S.p.A.

- IC Filling Systems

Frequently Asked Questions

Analyze common user questions about the Cap Applicators market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected CAGR for the Cap Applicators Market between 2026 and 2033?

The Cap Applicators Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period from 2026 to 2033, driven primarily by automation demands and expansion in the food and beverage sector.

Which technology is crucial for achieving high precision in modern capping operations?

The integration of servo-motor technology is crucial for high precision, allowing electronically controlled and adjustable torque application, which minimizes container damage and ensures consistent sealing integrity across diverse container and cap materials, a key aspect of AEO.

Which segment holds the largest share in the Cap Applicators Market by end-use industry?

The Food & Beverage industry holds the largest market share due to the immense global volume of bottled water, soft drinks, and dairy products requiring reliable, high-speed sealing, although Pharmaceuticals are expected to show the highest growth rate due to regulatory demands.

How does AI impact the operational efficiency of cap applicators?

AI significantly enhances operational efficiency by enabling predictive maintenance through sensor data analysis, real-time optimization of capping parameters for consistency, and advanced vision systems for instantaneous quality control and defect detection.

What are the primary restraints affecting the growth of the Cap Applicators Market?

Primary restraints include the high initial capital investment required for sophisticated automated systems and the complex engineering challenges associated with designing machines capable of handling the increasing diversity and lightweight nature of modern sustainable closure types efficiently.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager