Capital Program Management Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432021 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Capital Program Management Software Market Size

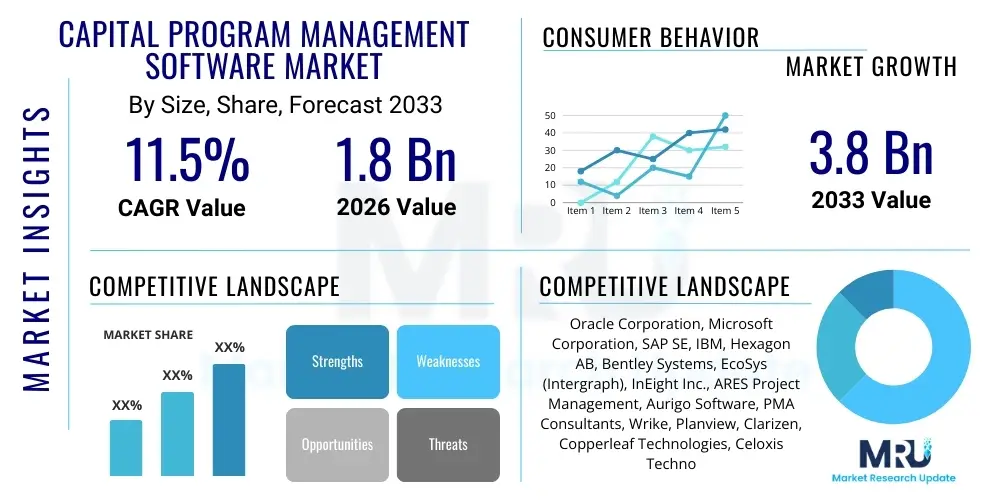

The Capital Program Management Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 3.8 Billion by the end of the forecast period in 2033.

The robust growth trajectory of the Capital Program Management (CPM) Software market is primarily fueled by the accelerating global infrastructure spending, particularly in developing economies, coupled with the need for better transparency and risk mitigation in large-scale projects. Enterprises managing vast portfolios of construction, energy, or public works projects are increasingly adopting specialized software tools to shift from manual tracking methods to integrated digital platforms. This transition is essential for enhancing operational efficiencies, standardizing project governance, and ensuring regulatory compliance across geographically dispersed capital assets. Furthermore, the complexity inherent in managing multi-year, multi-billion dollar programs necessitates sophisticated software capable of handling intricate resource allocation, financial modeling, and long-term planning.

Capital Program Management Software Market introduction

The Capital Program Management Software Market encompasses advanced digital solutions designed to help organizations centrally plan, execute, monitor, and control extensive portfolios of capital projects. These software platforms facilitate strategic alignment by ensuring that all ongoing projects contribute optimally to the organization's overarching financial and operational goals. Key functionalities include financial forecasting, strategic prioritization of investments, resource capacity planning, and integrated risk management across the entire program lifecycle. The primary application spans major industries such as construction, utilities, oil and gas, government, and transportation, where managing vast, complex, and high-value capital expenditures is critical.

The core benefits derived from adopting CPM software include enhanced decision-making through real-time data analytics, significant reductions in project overruns due to improved budgeting and scheduling accuracy, and elevated governance standards that minimize regulatory risk. Driving factors include the mandate for greater infrastructure spending worldwide, the necessity for digital transformation within traditionally manual industries, and the increasing organizational demand for predictive analytics to anticipate and mitigate potential program roadblocks. This market segment is crucial for entities seeking to maximize the return on their capital investments while maintaining rigorous accountability.

The software acts as a centralized repository for all program-related data, allowing senior management to gain a panoramic view of the program’s health, identify interdependencies between individual projects, and dynamically allocate capital funds based on performance metrics. This ability to integrate data from various sources—including project scheduling tools, financial systems, and enterprise resource planning (ERP) platforms—positions CPM software as an indispensable tool for strategic portfolio governance, moving beyond simple project management to comprehensive, strategic program oversight.

Capital Program Management Software Market Executive Summary

The Capital Program Management Software Market is experiencing rapid expansion driven by global economic recovery stimulating large-scale infrastructure and industrial development projects. Key business trends indicate a strong shift towards cloud-based Software-as-a-Service (SaaS) deployment models, offering scalability and reduced implementation costs, making advanced CPM accessible to a wider range of enterprise sizes. Furthermore, competitive pressure is forcing vendors to integrate artificial intelligence (AI) and machine learning (ML) capabilities for predictive scheduling, risk analysis, and automated compliance checks, enhancing the value proposition significantly. The integration of advanced analytics platforms is becoming standard, moving the software from a mere tracking tool to a proactive strategic asset management system.

Regionally, North America and Europe currently dominate the market due to established infrastructure and high levels of technological adoption, particularly within regulated industries like utilities and transportation. However, the Asia Pacific (APAC) region is poised for the fastest growth, fueled by massive government investments in smart cities, energy transition projects, and extensive manufacturing expansion in countries like India and China. Latin America and MEA are also showing steady adoption rates as organizations recognize the necessity of formalizing capital expenditure processes to attract foreign investment and manage complex cross-border programs efficiently.

In terms of segmentation, the market is seeing increased traction in specialized solutions tailored to specific vertical industries, such as heavy construction and public sector infrastructure, necessitating customization of risk models and regulatory reporting modules. Deployment models show cloud services gaining significant market share over on-premise solutions due to advantages in collaborative capabilities and real-time data access crucial for distributed teams. The large enterprise segment remains the largest consumer, though the mid-market segment is showing aggressive adoption rates, spurred by competitive, scalable SaaS offerings that were previously unaffordable or overly complex for smaller portfolios.

AI Impact Analysis on Capital Program Management Software Market

User queries regarding AI's impact on Capital Program Management Software overwhelmingly center on three core themes: predictive capabilities, automation efficiency, and ethical data usage. Users are keenly interested in how AI can move CPM beyond reactive monitoring to proactive forecasting, specifically asking about AI’s ability to predict project cost overruns, identify hidden resource bottlenecks before they materialize, and automatically generate optimized project schedules based on historical performance data. There is significant concern about data quality and the ethical implications of algorithmic decision-making replacing human expertise, particularly when prioritizing high-stakes capital investments. Expectations are high that AI will drastically reduce manual administrative tasks, streamline compliance reporting, and offer sophisticated risk simulation modeling, transforming the role of the program manager from data collector to strategic oversight specialist. The consensus suggests AI integration is not just a feature enhancement but a fundamental requirement for next-generation CPM platforms.

The immediate consequence of AI integration is a substantial improvement in the accuracy of long-term capital allocation forecasts. By analyzing thousands of historical projects—including variations in weather, supply chain delays, and team productivity—AI models can generate probabilistic schedules and budgets far superior to traditional critical path methods (CPM). This capability allows program offices to maintain contingency budgets more strategically and adjust funding across the portfolio dynamically. Moreover, AI-powered compliance tools automatically flag potential deviations from regulatory standards or internal governance rules, significantly reducing the administrative burden and legal exposure associated with massive capital programs, which are frequently subject to stringent governmental oversight.

Looking ahead, the evolution of CPM software will be defined by its embedded intelligence. Machine learning algorithms are now being trained on project managers’ qualitative feedback, integrating human expertise into the predictive models. This hybrid approach addresses user concerns about relying solely on quantitative data, creating a more robust and trusted decision support system. The increasing adoption of generative AI for synthesizing project reports, translating complex legal contracts into management summaries, and creating tailored communication plans for stakeholders further solidifies AI’s transformative role, making capital program management faster, smarter, and significantly less susceptible to human error inherent in manual data processing and analysis.

- Enhanced Predictive Analytics: AI enables accurate forecasting of schedules, costs, and resource utilization based on historical data patterns.

- Automated Risk Identification: ML algorithms scan program data to identify and quantify potential risks (e.g., supply chain volatility, regulatory changes) proactively.

- Intelligent Resource Optimization: AI dynamically allocates skilled labor and equipment across multiple projects to maximize utilization and minimize downtime.

- Streamlined Compliance Monitoring: Automated systems check adherence to local, state, and international regulatory standards in real-time.

- Generative Reporting: AI drafts complex performance reports and executive summaries, saving significant time for program management offices (PMOs).

- Improved Portfolio Prioritization: Algorithms score potential capital projects based on strategic fit, return on investment (ROI), and risk exposure.

DRO & Impact Forces Of Capital Program Management Software Market

The Capital Program Management Software market's dynamics are shaped by a confluence of powerful drivers related to regulatory mandates and digital transformation, juxtaposed against restraints concerning implementation complexities and data integration challenges, creating substantial opportunities for specialization and AI integration. The primary driver is the global increase in planned infrastructure spending and the stringent demand from stakeholders for transparency in how public and private capital is utilized. This demand necessitates robust software capable of audit trails and standardized reporting. However, a significant restraint is the high initial cost of implementation and the steep learning curve associated with migrating legacy data systems to modern CPM platforms, especially in public sector organizations often hindered by bureaucratic inertia. These forces collectively propel the market toward advanced cloud-native solutions that simplify deployment and offer superior data governance features.

Key drivers include the pervasive trend of digital transformation across all major capital-intensive industries, where the adoption of technologies like Building Information Modeling (BIM) and Internet of Things (IoT) sensors generates massive datasets that require sophisticated CPM tools for intelligent analysis. Furthermore, the increasing complexity of global supply chains and multi-party consortiums managing single capital programs makes integrated management software essential for maintaining unified control and communication. Conversely, a major constraint is the persistent challenge of integrating CPM software with diverse existing enterprise systems (ERP, finance, HR) that were often not designed for such deep interoperability. This integration hurdle frequently leads to delays and incomplete data synchronization, undermining the software's full potential.

Opportunities are vast, particularly in developing specialized vertical solutions catering to niche requirements, such as renewable energy capital programs or defense infrastructure. There is a strong market opening for vendors who can simplify the user interface (UI) and user experience (UX) to appeal to project managers who may not have advanced IT skills, focusing on mobile access and intuitive dashboards. The impact forces indicate that the imperative for financial accountability and risk mitigation will continue to override initial cost concerns, ensuring steady market growth. The competitive landscape is shifting toward platforms that can demonstrate immediate, measurable ROI through enhanced operational efficiency and reduced exposure to litigation or project failure.

Segmentation Analysis

The Capital Program Management Software market is meticulously segmented across key dimensions including deployment model, enterprise size, component, and application across various vertical industries. This segmentation reflects the diverse needs of organizations, ranging from small regional construction firms needing basic cloud services to multinational utilities requiring highly customized, on-premise solutions for managing complex regulatory environments. The application segmentation, spanning Infrastructure, Energy & Utilities, and Manufacturing, drives innovation by demanding specialized modules tailored to industry-specific risk profiles and compliance requirements. Understanding these segments is critical for vendors aiming to tailor their product offerings and marketing strategies effectively.

The component segmentation is focused on differentiating core functionalities, splitting the market into modules for Scheduling and Resource Optimization, Financial Management (Budgeting and Forecasting), and Risk and Compliance Management. Financial Management consistently holds a dominant market share due to the primary objective of CPM software being capital expenditure control. Simultaneously, the deployment model segment shows a clear migration preference toward the cloud, driven by the desire for rapid scalability, reduced IT overhead, and enhanced collaborative functionality necessary for managing globally distributed program teams. Enterprise size segmentation confirms that large enterprises remain the primary revenue generators, though the mid-market segment is growing quickly due to affordable SaaS solutions offering core CPM capabilities.

These segmentations highlight a maturing market moving towards specialization. While general-purpose platforms still exist, high-value contracts are increasingly awarded to vendors who offer deep domain expertise, such as specific compliance templates for public works projects or specialized risk models for large-scale energy transition programs. This trend necessitates flexible software architectures that support rapid customization and integration with industry-specific operational technologies (OT). The future market success hinges on the ability of software providers to move beyond generic project tracking and provide strategic, industry-aligned capital governance tools.

- By Component:

- Scheduling and Resource Optimization

- Financial Management (Budgeting, Cost Control, Forecasting)

- Risk and Compliance Management

- Document and Reporting Management

- By Deployment Model:

- On-Premise

- Cloud-Based (SaaS)

- By Enterprise Size:

- Large Enterprises (Over 1,000 employees)

- Small and Medium-sized Enterprises (SMEs)

- By Application/Industry Vertical:

- Infrastructure and Construction

- Energy and Utilities (Oil & Gas, Renewables)

- Government and Public Sector

- Manufacturing and Industrial

- Transportation and Logistics

Value Chain Analysis For Capital Program Management Software Market

The value chain for the Capital Program Management Software market begins with core upstream activities centered on software development, involving deep investment in R&D for predictive analytics, AI integration, and core platform architecture design. Key upstream suppliers include technology vendors providing cloud infrastructure (e.g., AWS, Azure), AI/ML libraries, and specialized data visualization tools. Success at this stage depends heavily on employing highly skilled software engineers and domain experts who understand the intricacies of capital expenditure management and industry-specific regulations. Strategic partnerships with leading technology providers ensure the CPM platform remains cutting-edge and scalable.

Mid-stream activities involve software customization, implementation, and integration services. This phase is characterized by intensive consultation, where vendors adapt the core software to meet the specific budgetary, organizational, and regulatory requirements of the end-user. Distribution channels are primarily direct sales models for large, complex deployments, which often require long sales cycles and high-touch customer support. However, indirect channels, including value-added resellers (VARs) and system integrators (SIs), play a crucial role in reaching SME clients and integrating the CPM solution seamlessly with existing enterprise systems like Oracle or SAP ERP platforms.

Downstream activities focus on post-deployment support, ongoing training, and platform maintenance. Since capital programs often span decades, long-term customer relationship management and continuous software updates are vital components of the value chain. Customer retention hinges on the vendor's ability to provide proactive technical support and timely regulatory compliance updates. The efficiency of the downstream segment, particularly through proactive customer success teams, significantly influences client satisfaction and recurring revenue streams in this subscription-heavy market, completing the cycle by feeding end-user feedback back into upstream R&D for continuous product improvement.

Capital Program Management Software Market Potential Customers

The primary end-users and buyers of Capital Program Management Software are organizations characterized by high capital intensity, long project lifecycles, and stringent regulatory oversight concerning asset investment. The most significant segment comprises large infrastructure owners, including governmental public works departments, metropolitan transportation authorities, and national defense agencies, all of whom manage multi-billion dollar programs requiring absolute financial transparency and rigorous schedule adherence. These entities seek CPM solutions to standardize processes, improve inter-departmental collaboration, and demonstrate accountability to taxpayers and political stakeholders across massive civil engineering initiatives.

Another major customer segment resides in the Energy and Utilities sector, encompassing oil and gas corporations, electric utilities, and renewable energy developers. These organizations utilize CPM software to manage the development and maintenance of vast, distributed asset portfolios—such as power plants, pipelines, and wind farms—where safety, regulatory compliance, and long-term asset performance tracking are paramount. The shift toward energy transition mandates significant capital reallocation, making robust forecasting and portfolio optimization tools essential for strategic survival and compliance with environmental, social, and governance (ESG) standards.

Finally, global manufacturing and large-scale industrial companies, particularly those in pharmaceuticals, automotive, and heavy machinery, represent critical potential customers. These firms require CPM to manage the construction and commissioning of new production facilities, complex plant maintenance shutdowns, and large-scale operational technology upgrades. For these customers, the software is crucial not only for budget control but also for minimizing disruption to operational throughput and accelerating time-to-market for new capacity, ensuring that capital investments yield maximum operational returns promptly.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 3.8 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Oracle Corporation, Microsoft Corporation, SAP SE, IBM, Hexagon AB, Bentley Systems, EcoSys (Intergraph), InEight Inc., ARES Project Management, Aurigo Software, PMA Consultants, Wrike, Planview, Clarizen, Copperleaf Technologies, Celoxis Technologies, Deltek, Inc., Procore Technologies, e-Builder (Trimble), PMWeb |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Capital Program Management Software Market Key Technology Landscape

The technology landscape of the Capital Program Management Software market is rapidly evolving, moving far beyond basic project scheduling tools to incorporate sophisticated analytical and collaborative technologies. Cloud computing remains the foundational technology, enabling scalable, accessible, and real-time data synchronization across vast, geographically dispersed project teams. The migration to public and private cloud environments addresses critical issues related to data security, disaster recovery, and software maintenance, positioning SaaS models as the industry standard. Furthermore, integration capabilities leveraging APIs (Application Programming Interfaces) are crucial, allowing CPM platforms to seamlessly exchange data with core enterprise systems (e.g., financial planning software, human resources databases) and specialized operational technologies like BIM software.

A significant technological shift involves the integration of advanced data science, primarily Artificial Intelligence (AI) and Machine Learning (ML). These capabilities are used to perform predictive risk modeling, automating the identification of potential program failures based on deviations from optimized performance benchmarks. ML algorithms analyze historical data from thousands of completed projects to refine forecasting models for resource needs and budget variances, moving CPM from descriptive reporting to prescriptive action. Furthermore, the increasing use of digital twin technology, especially in infrastructure and energy projects, requires CPM software to handle and visualize complex, large-scale data models, necessitating high-performance computing capabilities within the platform to simulate various capital expenditure scenarios.

The rise of mobility and connectivity, fueled by IoT deployment on construction sites and in industrial facilities, introduces a continuous stream of real-time operational data into the CPM ecosystem. This necessitates robust data ingestion and processing mechanisms, often relying on edge computing solutions to handle the volume and velocity of sensor data. Blockchain technology is also gaining nascent interest for enhancing transparency and auditability in multi-party contracts and payment processing within capital programs, ensuring immutable record-keeping of transactional activities. These technological advancements collectively aim to provide a single source of truth for all program data, drastically improving governance and minimizing information lag critical for time-sensitive, high-value decision-making.

Regional Highlights

- North America: This region holds the largest market share, driven by high technology adoption rates, extensive infrastructure renewal programs (particularly in the US and Canada), and stringent regulatory requirements that mandate formal capital governance. Key growth drivers include large-scale digitalization efforts within the utility and transportation sectors, leading to a constant demand for advanced, AI-enabled CPM solutions.

- Europe: Characterized by mature markets in the UK, Germany, and France, Europe demands CPM solutions that emphasize compliance with complex multi-national regulatory frameworks, such as those related to sustainability and environmental standards. The focus here is on integrating CPM with ESG reporting requirements and managing cross-border energy and transport infrastructure programs efficiently.

- Asia Pacific (APAC): Expected to exhibit the highest Compound Annual Growth Rate (CAGR) due to unprecedented investment in new infrastructure, smart city development, and manufacturing capacity expansion, particularly in China, India, and Southeast Asian nations. Market growth is spurred by government-led initiatives to improve public accountability and manage rapid urbanization projects, favoring scalable, cloud-based software models.

- Latin America (LATAM): Market adoption is steady, centered mainly in Brazil and Mexico, driven by foreign investment in mining, oil and gas, and regional energy projects. The focus is on establishing foundational capital program controls to mitigate project risk and combat historical inefficiencies often associated with large public sector endeavors.

- Middle East and Africa (MEA): Growth is primarily fueled by massive Giga-projects and economic diversification initiatives in the GCC states (Saudi Arabia, UAE). These nations require sophisticated CPM software to manage vast, complex, multi-billion dollar construction and tourism programs, emphasizing risk management, cost control, and adherence to aggressive delivery timelines.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Capital Program Management Software Market.- Oracle Corporation

- Microsoft Corporation

- SAP SE

- IBM

- Hexagon AB

- Bentley Systems

- EcoSys (Intergraph)

- InEight Inc.

- ARES Project Management

- Aurigo Software

- PMA Consultants

- Wrike

- Planview

- Clarizen

- Copperleaf Technologies

- Celoxis Technologies

- Deltek, Inc.

- Procore Technologies

- e-Builder (Trimble)

- PMWeb

Frequently Asked Questions

Analyze common user questions about the Capital Program Management Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Capital Program Management (CPM) and traditional Project Portfolio Management (PPM)?

CPM focuses specifically on managing massive, long-term, high-value capital expenditure programs, prioritizing financial strategy, long-term asset lifecycle planning, and stringent regulatory compliance across multiple interdependent projects. While PPM manages a broader mix of projects (including IT, R&D), CPM is narrowly focused on optimizing the return and control of physical asset creation and large infrastructure investments. CPM systems often integrate more deeply with asset management and ERP financial modules than typical PPM tools.

Which industries are the largest adopters of Capital Program Management Software?

The largest adopting industries are those with substantial capital expenditure budgets and complex, multi-year asset lifecycles. This includes Infrastructure and Construction (civil engineering, transport), Energy and Utilities (power generation, oil and gas, renewables), and the Government/Public Sector (defense and public works). These sectors require specialized software capabilities for cost control, governmental auditing, and managing external contractor dependencies efficiently.

How does Artificial Intelligence enhance the effectiveness of Capital Program Management software?

AI significantly enhances CPM effectiveness by providing predictive analytics for risk identification, cost forecasting, and resource optimization. AI algorithms analyze vast datasets, including historical performance and external variables, to anticipate potential project bottlenecks or budget overruns before they occur. This proactive capability allows program managers to implement mitigation strategies in real-time, greatly improving decision quality and financial accountability across the entire portfolio.

What are the typical deployment models for CPM software and which is growing faster?

The two main deployment models are On-Premise and Cloud-Based (SaaS). While large, highly regulated entities often utilize on-premise solutions for maximum control over sensitive data, the Cloud-Based (SaaS) model is experiencing significantly faster growth. SaaS offers superior benefits in terms of scalability, lower initial capital outlay, enhanced collaborative features crucial for distributed teams, and quicker deployment times, making it the preferred choice for new adopters and mid-sized enterprises.

What integration challenges must organizations overcome when implementing new CPM solutions?

Organizations frequently encounter significant integration hurdles, primarily connecting the new CPM platform with existing legacy Enterprise Resource Planning (ERP) systems, financial management software, and specialized operational tools like BIM (Building Information Modeling). Achieving seamless, two-way data flow requires robust API strategies and extensive data cleansing to ensure consistency and reliability, which is critical for accurate reporting and strategic decision-making within the central Program Management Office (PMO).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager