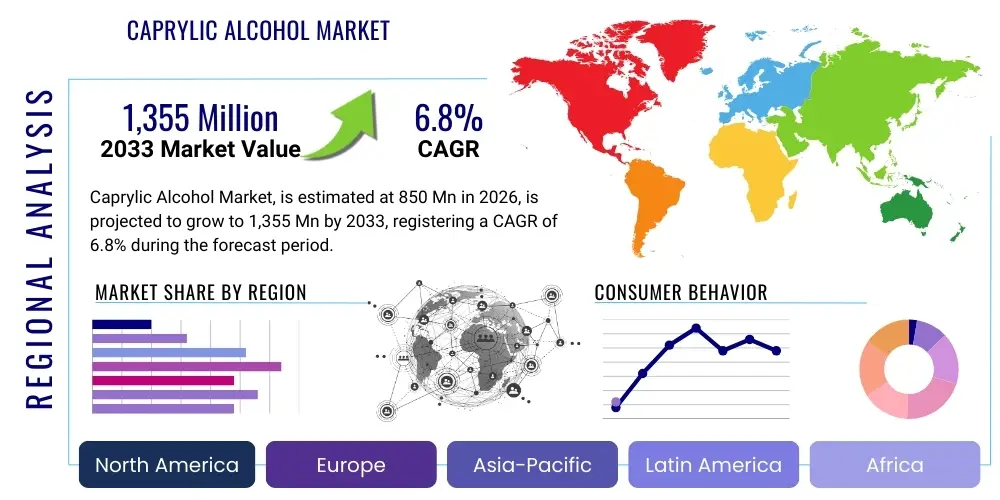

Caprylic Alcohol Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439949 | Date : Jan, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Caprylic Alcohol Market Size

The Caprylic Alcohol Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,355 Million by the end of the forecast period in 2033. This robust growth is primarily driven by increasing demand across diverse end-use industries, particularly within the burgeoning personal care and cosmetics sector, alongside consistent expansion in pharmaceutical and flavor and fragrance applications. The market's valuation reflects a steady upward trajectory, underpinned by evolving consumer preferences for naturally derived ingredients and advancements in sustainable production methodologies.

Caprylic Alcohol Market introduction

Caprylic alcohol, chemically known as 1-octanol, is a saturated fatty alcohol with an eight-carbon chain. It is a colorless liquid with a characteristic fatty odor, insoluble in water but soluble in organic solvents. Predominantly sourced from natural origins such as coconut oil and palm kernel oil through processes like hydrolysis, hydrogenation, and fractional distillation, it can also be synthetically produced from petroleum derivatives, though the market trend increasingly favors bio-based alternatives due to environmental and consumer-driven demands. Its unique amphiphilic nature and versatility make it a valuable compound across a spectrum of industrial applications.

Major applications of caprylic alcohol span a multitude of sectors. In the cosmetics and personal care industry, it functions as an emollient, emulsifier, solvent, and viscosity modifier in products ranging from lotions, creams, and sunscreens to deodorants and hair care formulations, imparting a smooth feel and enhancing product stability. For the flavor and fragrance industry, it serves as a crucial building block and enhancer, contributing to fruity, citrusy, or floral notes in various compositions. Pharmaceuticals utilize caprylic alcohol as a solvent in drug formulations, an intermediate in synthesizing active pharmaceutical ingredients, and as an antimicrobial agent. Furthermore, it finds use as a defoamer, a wetting agent, and a chemical intermediate in the production of esters, plasticizers, and surfactants for industrial applications, demonstrating its broad utility.

The benefits derived from caprylic alcohol are manifold, contributing significantly to its market appeal. As an excellent emollient, it helps improve skin hydration and texture without leaving a greasy residue, a highly sought-after characteristic in personal care products. Its role as a solvent for a wide range of active ingredients and fragrances enhances formulation efficacy and stability. Moreover, its mild antimicrobial properties contribute to product preservation. The market is primarily driven by the escalating demand for natural and bio-based ingredients in personal care, increasing consumer awareness regarding product safety and efficacy, and continuous innovation in cosmetic and pharmaceutical formulations that leverage its versatile properties. The expansion of the global chemical industry, coupled with growth in emerging economies, further propels its adoption across diverse industrial processes.

Caprylic Alcohol Market Executive Summary

The Caprylic Alcohol Market is experiencing dynamic shifts, characterized by several key business, regional, and segmental trends that collectively shape its growth trajectory and competitive landscape. From a business perspective, there is a pronounced move towards sustainable sourcing and production methods, with companies investing in bio-based technologies to meet the rising consumer and regulatory demand for eco-friendly ingredients. Strategic alliances, mergers, and acquisitions are also prevalent, aimed at consolidating market share, expanding geographical reach, and enhancing product portfolios, particularly in specialized grades of caprylic alcohol. Research and development efforts are intensifying, focusing on creating novel derivatives with enhanced functionalities and exploring cost-effective synthesis routes, driving innovation and differentiation within the market. Furthermore, manufacturers are increasingly emphasizing supply chain resilience and transparency, in response to global disruptions and increasing scrutiny over raw material origins and ethical procurement practices.

Regionally, the Asia Pacific (APAC) market stands out as the primary growth engine for caprylic alcohol, fueled by rapid industrialization, burgeoning personal care and pharmaceutical sectors, and increasing disposable incomes in countries like China, India, and Southeast Asian nations. This region also benefits from the availability of raw materials such as palm kernel oil. North America and Europe, while mature markets, continue to demonstrate consistent demand, driven by stringent regulatory frameworks promoting high-quality ingredients, robust innovation in product formulations, and a strong emphasis on premium and organic cosmetic products. Latin America and the Middle East & Africa (MEA) are emerging as promising markets, exhibiting nascent but accelerating growth, particularly in personal care consumption and industrial applications, as these regions experience economic development and urbanization, leading to greater adoption of various end products containing caprylic alcohol. Each region presents unique opportunities and challenges influenced by local economic conditions, regulatory landscapes, and consumer preferences, necessitating tailored market entry and growth strategies for key players.

Segment-wise, the personal care and cosmetics application segment remains the largest and fastest-growing consumer of caprylic alcohol, driven by its versatile role as an emollient, solvent, and fragrance ingredient. Within this segment, there is a distinct trend towards natural and organic certifications, prompting manufacturers to prioritize bio-based caprylic alcohol. The flavor and fragrance segment also exhibits significant growth, with caprylic alcohol being a vital component in developing complex aroma profiles for various consumer goods. The pharmaceutical sector is showing steady expansion, leveraging caprylic alcohol's utility as a solvent and intermediate in drug synthesis, with a focus on high-purity grades. The industrial solvents and chemical intermediate segments, while more mature, continue to provide a stable base demand, driven by ongoing manufacturing processes and the production of downstream derivatives. The interplay of these trends highlights a market that is evolving to meet diverse industrial needs while simultaneously adapting to shifting consumer preferences and global sustainability imperatives.

AI Impact Analysis on Caprylic Alcohol Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) technologies is poised to significantly transform various facets of the Caprylic Alcohol Market, addressing common user questions about operational efficiency, R&D acceleration, supply chain optimization, and market forecasting. Users are keenly interested in how AI can streamline complex chemical processes, predict market fluctuations more accurately, and facilitate the development of novel applications or more sustainable production methods for caprylic alcohol. The overarching theme revolves around leveraging AI to enhance productivity, reduce costs, improve product quality, and build more resilient and responsive market strategies in an increasingly data-driven global economy, ultimately aiming for smarter, more efficient, and environmentally friendly operations throughout the entire value chain of caprylic alcohol.

- Optimized Production Processes: AI algorithms can analyze real-time data from production facilities, including temperature, pressure, and catalyst performance, to optimize reaction conditions for caprylic alcohol synthesis. This leads to higher yields, reduced energy consumption, and minimized waste by precisely controlling parameters, detecting anomalies, and predicting equipment failures before they occur, ensuring consistent product quality and operational uptime.

- Enhanced Quality Control: Machine learning models can be trained on extensive datasets of caprylic alcohol purity metrics, spectroscopic data, and chromatographic profiles to accurately predict and detect impurities or deviations from quality standards. This enables faster, more reliable quality assurance checks, significantly reducing batch rejections and ensuring that only high-grade caprylic alcohol reaches the market, which is critical for sensitive applications like pharmaceuticals and cosmetics.

- Predictive Demand Forecasting: AI-powered analytics can process vast amounts of market data, including historical sales, consumer trends, economic indicators, and seasonal variations, to generate highly accurate predictions for caprylic alcohol demand across different segments and regions. This capability allows manufacturers to optimize production schedules, manage inventory levels more effectively, and respond proactively to market shifts, minimizing both overproduction and stockouts.

- Supply Chain Optimization and Resilience: AI can analyze global supply chain data, identifying potential bottlenecks, supplier risks, and logistical inefficiencies related to raw materials (e.g., palm kernel oil) and distribution of finished caprylic alcohol. By predicting disruptions and suggesting alternative routes or suppliers, AI enhances supply chain visibility, improves planning, and builds greater resilience against geopolitical events or natural disasters, ensuring a stable and cost-effective supply.

- Accelerated Research and Development: AI and computational chemistry tools can significantly accelerate the discovery and optimization of new caprylic alcohol derivatives or novel synthesis pathways, especially for bio-based production. By simulating molecular interactions and predicting properties, AI reduces the need for extensive physical experimentation, shortens development cycles, and uncovers innovative applications or more sustainable alternatives for caprylic alcohol, fostering rapid market expansion.

- Sustainability and Green Chemistry: AI can be employed to design more energy-efficient and environmentally friendly production processes for caprylic alcohol, optimizing catalyst selection, reaction conditions, and waste treatment methods. This includes identifying opportunities for circular economy principles, reducing carbon footprints, and promoting the use of renewable raw materials, aligning with global sustainability goals and consumer preferences for green chemicals.

- Personalized Product Formulation: In the cosmetics and personal care sectors, AI can analyze consumer preferences and ingredient interactions to recommend optimal formulations that include caprylic alcohol. This leads to the development of highly customized products with desired textures, efficacy, and sensory profiles, shortening time-to-market for new products and better meeting specific niche demands.

DRO & Impact Forces Of Caprylic Alcohol Market

The Caprylic Alcohol Market is influenced by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the 'DRO & Impact Forces' that define its growth trajectory and competitive landscape. The primary drivers include the escalating demand from the personal care and cosmetics industry, where caprylic alcohol serves as a crucial emollient, solvent, and fragrance component, driven by rising consumer spending and an increasing focus on product efficacy and natural ingredients. The expansion of the pharmaceutical sector, utilizing caprylic alcohol as a solvent and intermediate for drug synthesis, further contributes to market growth. Additionally, the flourishing flavor and fragrance industry consistently demands high-quality caprylic alcohol for formulating various aroma profiles. Furthermore, the growing adoption of bio-based chemicals and green chemistry principles across industries positions naturally derived caprylic alcohol as a preferred choice, aligning with global sustainability trends and consumer preferences for eco-friendly products.

However, the market also faces significant restraints. The volatility of raw material prices, particularly for natural sources like palm kernel oil and coconut oil, poses a considerable challenge, leading to fluctuating production costs and impacting profit margins for manufacturers. Geopolitical tensions, adverse weather conditions, and supply chain disruptions can exacerbate this price instability. Stringent regulatory frameworks governing the use of chemicals in personal care, food, and pharmaceuticals, especially in developed regions, necessitate rigorous compliance and can increase production complexities and costs. Moreover, the availability of substitute fatty alcohols and other solvents, though sometimes less effective or sustainable, creates a competitive pressure that can limit the pricing power and market share of caprylic alcohol, requiring continuous innovation to maintain its competitive edge.

Despite these challenges, numerous opportunities are emerging that are set to catalyze future market expansion. The increasing focus on bio-based and sustainable chemical production offers a substantial avenue for growth, with ongoing research into advanced fermentation and enzymatic processes for caprylic alcohol synthesis potentially reducing reliance on traditional agricultural raw materials and petrochemicals. Emerging economies in Asia Pacific, Latin America, and Africa present untapped market potential, characterized by rapidly growing middle-class populations, increasing disposable incomes, and expanding industrial bases, leading to higher consumption of personal care products, pharmaceuticals, and industrial chemicals. Innovation in caprylic alcohol derivatives, tailored for specific high-performance applications in niche markets, further represents a significant opportunity. Additionally, the development of integrated biorefinery concepts that yield caprylic alcohol alongside other valuable co-products can enhance economic viability and resource efficiency, reinforcing the long-term sustainability and growth prospects of the market.

The impact forces influencing the caprylic alcohol market can be analyzed through a framework that considers various competitive pressures. The bargaining power of buyers is moderate to high, particularly for large-scale cosmetic and pharmaceutical manufacturers who often purchase in bulk and can negotiate favorable terms, pushing for competitive pricing and stringent quality standards. Conversely, the bargaining power of suppliers, especially for natural raw materials, is also significant due to commodity price volatility and supply chain concentration, impacting production costs. The threat of new entrants is relatively low for large-scale production due to high capital investment requirements, established intellectual property, and regulatory hurdles, but niche players focusing on specialized grades or sustainable processes can emerge. The threat of substitutes is moderate, as other fatty alcohols or alternative solvents can sometimes fulfill similar functions, although caprylic alcohol often offers superior performance attributes for specific applications. Finally, the intensity of competitive rivalry among existing players is high, driven by product differentiation, technological advancements, strategic pricing, and global reach, pushing companies to innovate and optimize operations continuously.

Segmentation Analysis

The Caprylic Alcohol Market is comprehensively segmented to provide granular insights into its diverse dynamics, categorizing the market primarily by application, grade, and source. This segmentation allows for a detailed understanding of consumer preferences, industrial requirements, and supply chain considerations across various end-use sectors. Analyzing these segments is crucial for market participants to identify growth pockets, tailor product offerings, and devise effective strategies for market penetration and expansion. Each segment reflects distinct demand drivers and competitive landscapes, from the highly quality-sensitive pharmaceutical segment to the volume-driven industrial applications, and the increasingly sustainability-focused personal care segment. Understanding these delineations helps in predicting future market shifts and resource allocation, highlighting the multifaceted nature of the caprylic alcohol industry and its dependency on specific industry requirements and sourcing trends globally.

- By Application:

- Cosmetics & Personal Care: This segment is the largest consumer, driven by caprylic alcohol's efficacy as an emollient, solvent, and viscosity modifier in products like lotions, creams, sunscreens, and deodorants, enhancing texture and stability.

- Flavors & Fragrances: Utilized as a crucial intermediate and enhancer to impart fruity, citrusy, and floral notes in various perfumes, food flavorings, and aroma chemicals.

- Pharmaceuticals: Employed as a solvent in drug formulations, an intermediate in the synthesis of active pharmaceutical ingredients (APIs), and sometimes for its antimicrobial properties in certain medical applications.

- Food & Beverages: Used sparingly as a food additive and flavoring agent, primarily for its role in contributing to specific taste profiles in certain food and beverage products, adhering to strict regulatory guidelines.

- Industrial Solvents: Acts as a versatile solvent in various industrial processes, including coatings, inks, and resins, due to its favorable solvency properties and relatively low toxicity.

- Chemical Intermediates: Serves as a fundamental building block for the synthesis of other specialty chemicals, such as esters, plasticizers, surfactants, and fatty alcohol sulfates, which find applications across a wide array of industries.

- Others: Includes minor applications such as defoamers, wetting agents, and components in lubricant formulations, demonstrating the broad utility of caprylic alcohol in specialized industrial processes.

- By Grade:

- Cosmetic Grade: Characterized by high purity, low odor, and specific regulatory compliance for use in skin care, hair care, and other personal hygiene products, meeting stringent safety and quality standards.

- Industrial Grade: Designed for large-volume industrial applications where purity requirements are less stringent than cosmetic or pharmaceutical grades but still demand consistent performance for use in solvents, detergents, and chemical synthesis.

- Pharmaceutical Grade: Demands the highest level of purity and adherence to strict pharmaceutical standards (e.g., USP, EP), free from impurities that could affect drug stability or efficacy, essential for medical formulations.

- By Source:

- Natural (Bio-based): Derived from renewable plant oils such as coconut oil and palm kernel oil through hydrolysis, hydrogenation, and distillation. This segment is growing due to increasing demand for sustainable and biodegradable ingredients.

- Synthetic (Petrochemical-based): Produced from petroleum-derived raw materials. While offering cost-effectiveness, its market share is gradually declining in favor of natural alternatives due to environmental concerns and consumer preferences.

Value Chain Analysis For Caprylic Alcohol Market

The value chain for the Caprylic Alcohol Market is a multi-stage process, beginning with the sourcing of raw materials and culminating in the delivery of finished products to diverse end-use industries. At the upstream analysis stage, the value chain initiates with the procurement of primary feedstocks. For naturally derived caprylic alcohol, this primarily involves the cultivation and harvesting of oil palm and coconut trees, followed by the extraction of palm kernel oil and coconut oil, respectively. This stage is highly susceptible to commodity price fluctuations, climatic conditions, and geopolitical factors, which can significantly impact the cost and availability of raw materials. For synthetic caprylic alcohol, the upstream involves the extraction and processing of petrochemicals, typically crude oil and natural gas, which are then refined into intermediates like ethylene. Sustainable sourcing practices and certifications (e.g., RSPO for palm oil) are increasingly critical at this stage, influencing brand reputation and market access, particularly in regions with strong environmental consciousness.

Moving downstream, the raw materials undergo chemical processing to yield caprylic alcohol. This involves complex manufacturing processes such as hydrolysis of oils to produce fatty acids, followed by hydrogenation to convert fatty acids into fatty alcohols, and subsequent fractional distillation for purification and separation of 1-octanol (caprylic alcohol) from other fatty alcohols. Manufacturers in this segment, often large chemical companies, invest heavily in R&D to optimize these processes for higher yields, purity, and energy efficiency. Post-production, the caprylic alcohol is further processed and formulated, often by specialized ingredient suppliers, into various grades (cosmetic, industrial, pharmaceutical) to meet specific application requirements. This stage can also involve the synthesis of derivatives such as caprylic esters, which broaden the application scope of the base chemical. Quality control and assurance are paramount throughout this manufacturing segment to ensure compliance with industry standards and regulatory mandates, especially for sensitive applications like personal care and pharmaceuticals.

The distribution channel plays a critical role in connecting manufacturers with end-users. This typically involves a mix of direct sales and indirect channels. Large-volume buyers, such as multinational cosmetic or pharmaceutical companies, often engage in direct procurement agreements with major caprylic alcohol producers, facilitating bulk purchases and long-term contracts. This direct approach offers greater control over quality, pricing, and supply logistics. Conversely, indirect channels, involving a network of distributors, agents, and specialty chemical suppliers, cater to smaller manufacturers or those with more diverse ingredient needs. These distributors often provide value-added services such as warehousing, smaller packaging sizes, technical support, and local market expertise, enabling broader market reach for producers and efficient access for varied customers. The choice of distribution strategy depends on factors like market maturity, logistical complexity, customer base size, and the need for specialized technical support. The effectiveness of this distribution network is crucial for ensuring timely and cost-efficient delivery, maintaining market presence, and responding to regional demands, ultimately impacting the accessibility and competitive positioning of caprylic alcohol in the global market.

Caprylic Alcohol Market Potential Customers

The potential customers for Caprylic Alcohol are diverse, spanning a wide array of industries that leverage its unique chemical properties as an emollient, solvent, fragrance component, or chemical intermediate. The largest segment of end-users comprises manufacturers within the cosmetics and personal care industry. These companies, ranging from global beauty conglomerates to niche organic brands, incorporate caprylic alcohol into formulations for skin creams, lotions, sunscreens, shampoos, conditioners, deodorants, and makeup products. Their demand is driven by the need for ingredients that provide excellent sensory properties, improve product spreadability, enhance skin feel, stabilize emulsions, and act as effective solvents for active ingredients and fragrances, all while meeting increasingly stringent consumer expectations for safety and natural origin. The continued innovation in beauty product development and the global expansion of the personal care market ensure a sustained and growing customer base in this sector.

Another significant customer segment includes companies in the flavor and fragrance industry. These customers, including large fragrance houses and specialized flavor manufacturers, utilize caprylic alcohol as a key building block and modifier in creating a vast spectrum of aromatic compositions for perfumes, colognes, air fresheners, detergents, and food flavorings. Its ability to contribute specific notes and act as a fixative makes it invaluable for formulators seeking to develop complex and stable scent profiles. The pharmaceutical industry also represents a critical customer base, with drug manufacturers and API (Active Pharmaceutical Ingredient) producers using caprylic alcohol as a solvent for specific active ingredients, an excipient in various drug delivery systems, or as a chemical intermediate in the synthesis of more complex drug molecules. The demand from this sector is characterized by a strong emphasis on high-purity grades, stringent regulatory compliance, and consistent quality, underscoring its role in ensuring drug efficacy and safety.

Beyond these prominent sectors, caprylic alcohol finds customers in the broader industrial chemical sector. This includes manufacturers of specialty chemicals, surfactants, plasticizers, and lubricants, where caprylic alcohol serves as a fundamental intermediate for synthesizing various derivatives that impart specific functionalities to their end products. Additionally, companies involved in industrial cleaning, paints and coatings, and agricultural chemicals may also procure caprylic alcohol for its solvent properties or as a component in their formulations. The food and beverage industry, though a smaller segment, includes customers who use it sparingly as a food additive or flavoring agent, under strict regulatory guidelines. These diverse customer groups highlight caprylic alcohol's versatile utility, making it an indispensable ingredient across a wide spectrum of industrial and consumer-facing applications, with each sector's specific demands influencing market trends and product development strategies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,355 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, The Dow Chemical Company, Croda International Plc, Kao Corporation, Sasol Limited, KLK Oleo, Emery Oleochemicals, Godrej Industries Limited, PT Musim Mas, VVF LLC, Wilmar International Limited, Berg + Schmidt GmbH & Co. KG, Oleon NV, Evonik Industries AG, P&G Chemicals, Archer Daniels Midland Company (ADM), Stepan Company, Alzo International Inc., Kensing LLC, Sabic |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Caprylic Alcohol Market Key Technology Landscape

The technology landscape for the Caprylic Alcohol Market is characterized by continuous advancements aimed at improving production efficiency, purity, and sustainability, while also exploring novel synthesis routes. Traditionally, the production of natural caprylic alcohol relies on the hydrolysis of plant-based oils, such as palm kernel oil or coconut oil, to yield fatty acids. This is followed by a catalytic hydrogenation process to convert the fatty acids into a mixture of fatty alcohols, from which 1-octanol is then separated and purified through advanced fractional distillation techniques. These conventional methods are well-established but face ongoing refinement to enhance yields, reduce energy consumption, and minimize environmental impact. Innovations in catalyst design, for instance, are crucial for achieving higher selectivity and efficiency during the hydrogenation step, leading to purer products and fewer by-products.

A significant area of technological focus and investment is in bio-based production methods, particularly leveraging fermentation processes. Research and development efforts are increasingly directed towards microbial fermentation using genetically engineered microorganisms (e.g., yeast or bacteria) to directly produce caprylic alcohol from renewable feedstocks such as sugars or agricultural waste. This approach aligns with green chemistry principles by reducing reliance on petrochemicals and minimizing the environmental footprint of production. Advances in metabolic engineering, synthetic biology, and bioreactor design are critical to making these fermentation routes economically viable and scalable. The goal is to achieve high titers and yields of caprylic alcohol, along with efficient downstream separation and purification technologies tailored for bio-based mixtures, ensuring the final product meets the stringent purity requirements for various end applications.

Furthermore, the broader technological landscape includes the development of more efficient and environmentally friendly chemical synthesis routes for synthetic caprylic alcohol, although the market trend leans towards bio-based alternatives. This involves exploring new catalytic systems for olefin hydroformylation and subsequent hydrogenation, aiming for milder reaction conditions and reduced energy input. Process intensification techniques, such as continuous flow chemistry and microreactor technology, are also being investigated to improve reaction control, safety, and overall process economics. Analytical technologies, including advanced chromatography and spectroscopy, play a vital role across all production methods, ensuring rigorous quality control, impurity detection, and process monitoring, thereby guaranteeing the consistent delivery of high-purity caprylic alcohol to demanding industries like pharmaceuticals and cosmetics. The integration of process analytical technology (PAT) and automation further contributes to optimizing real-time manufacturing processes and maintaining product specifications.

Regional Highlights

- North America: The Caprylic Alcohol Market in North America is characterized by a mature industrial base and a strong emphasis on high-quality and specialty chemical ingredients. The region demonstrates consistent demand from a well-established personal care and cosmetics industry, which prioritizes premium, naturally derived, and sustainably sourced ingredients. Regulatory frameworks, such as those from the FDA, impose stringent quality and safety standards, driving manufacturers towards high-purity caprylic alcohol. Innovation in new product development, particularly in pharmaceutical applications and advanced cosmetic formulations, remains a key driver, alongside a growing consumer preference for transparent and eco-friendly ingredient sourcing.

- Europe: Europe represents a significant market for caprylic alcohol, distinguished by its robust regulatory environment, epitomized by REACH, which places a strong focus on chemical safety and environmental protection. This pushes the market towards sustainable production methods and bio-based caprylic alcohol. The region's advanced personal care and fragrance industries are key consumers, with a high demand for specialty ingredients that meet stringent aesthetic, performance, and ethical standards. Germany, France, and the UK are prominent contributors to this market, showcasing a strong inclination towards premium cosmetic formulations, natural products, and a growing pharmaceutical sector that requires high-purity solvents and intermediates.

- Asia Pacific (APAC): The Asia Pacific region is projected to be the fastest-growing market for caprylic alcohol, driven by rapid industrialization, expanding economies, and increasing disposable incomes in countries like China, India, Japan, and Southeast Asian nations. The region benefits from abundant availability of natural raw materials, particularly palm kernel oil, which supports local production of bio-based caprylic alcohol. The burgeoning personal care and cosmetics industry, coupled with significant growth in the pharmaceutical and industrial chemical sectors, fuels escalating demand. This region is also witnessing a surge in manufacturing activities and a rising consumer awareness regarding quality ingredients, making it a pivotal growth hub for the global caprylic alcohol market.

- Latin America: The Caprylic Alcohol Market in Latin America is experiencing emerging growth, primarily driven by increasing urbanization, rising disposable incomes, and the consequent expansion of the personal care and cosmetics industry in countries such as Brazil, Mexico, and Argentina. While still developing compared to more mature markets, the region offers significant untapped potential. Local manufacturers are increasingly adopting advanced ingredients to cater to evolving consumer preferences and international beauty trends. Furthermore, industrial growth and a nascent but expanding pharmaceutical sector contribute to the demand for caprylic alcohol as a solvent and chemical intermediate, indicating a steady upward trajectory for the market in this region.

- Middle East and Africa (MEA): The Middle East and Africa region currently holds a smaller share of the global caprylic alcohol market but is poised for gradual growth. This growth is predominantly supported by ongoing industrialization initiatives, particularly in the chemical and manufacturing sectors in countries like Saudi Arabia, UAE, and South Africa. The expanding personal care market, influenced by Western trends and increasing consumer sophistication, also contributes to demand. While challenges such as economic volatility and limited access to advanced manufacturing technologies persist, investments in infrastructure and diversification away from oil economies are expected to stimulate the market for specialty chemicals, including caprylic alcohol, in the long term, creating niche opportunities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Caprylic Alcohol Market.- BASF SE

- The Dow Chemical Company

- Croda International Plc

- Kao Corporation

- Sasol Limited

- KLK Oleo

- Emery Oleochemicals

- Godrej Industries Limited

- PT Musim Mas

- VVF LLC

- Wilmar International Limited

- Berg + Schmidt GmbH & Co. KG

- Oleon NV

- Evonik Industries AG

- P&G Chemicals

- Archer Daniels Midland Company (ADM)

- Stepan Company

- Alzo International Inc.

- Kensing LLC

- Sabic

Frequently Asked Questions

What is Caprylic Alcohol primarily used for?

Caprylic alcohol, or 1-octanol, is primarily used as an emollient, solvent, and fragrance ingredient in the cosmetics and personal care industry. It also serves as a crucial intermediate in the synthesis of flavors, fragrances, pharmaceuticals, and various industrial chemicals, valued for its versatile properties and compatibility with diverse formulations. Its application enhances product texture, stability, and sensory appeal across a broad range of consumer and industrial goods.

Is Caprylic Alcohol considered a natural or synthetic ingredient?

Caprylic alcohol can be both natural and synthetic. Naturally, it is derived from renewable plant sources like coconut oil and palm kernel oil through processes such as hydrolysis and hydrogenation. Synthetically, it can be produced from petrochemical raw materials. The market trend shows a growing preference for natural, bio-based caprylic alcohol due to increasing consumer demand for sustainable and eco-friendly ingredients in various end-use applications, particularly in personal care.

What factors are driving the growth of the Caprylic Alcohol Market?

The Caprylic Alcohol Market's growth is primarily driven by the escalating demand from the personal care and cosmetics industry, fueled by rising consumer spending and focus on high-quality ingredients. Additionally, expansion in the pharmaceutical sector for its solvent and intermediate applications, and consistent demand from the flavor and fragrance industry, are significant drivers. The increasing adoption of bio-based chemicals and green chemistry principles further propels the market towards sustainable caprylic alcohol solutions.

What are the key challenges faced by the Caprylic Alcohol Market?

Key challenges for the Caprylic Alcohol Market include the volatility of raw material prices, particularly for natural sources like palm kernel and coconut oil, which can impact production costs and profit margins. Stringent regulatory frameworks in various end-use industries necessitate complex compliance. Furthermore, competition from substitute fatty alcohols and alternative solvents poses a threat, requiring continuous innovation to maintain caprylic alcohol's competitive edge and market share.

How does sustainability impact the Caprylic Alcohol Market?

Sustainability significantly impacts the Caprylic Alcohol Market by driving a strong shift towards bio-based and naturally derived sources, reducing reliance on petrochemicals. Consumers and regulations increasingly demand eco-friendly ingredients and transparent supply chains. This pushes manufacturers to invest in sustainable sourcing, green chemistry production methods, and certifications (e.g., RSPO), enhancing the market for caprylic alcohol produced through environmentally responsible processes and improving brand reputation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager