Capsule and Vial Filling Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433322 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Capsule and Vial Filling Machine Market Size

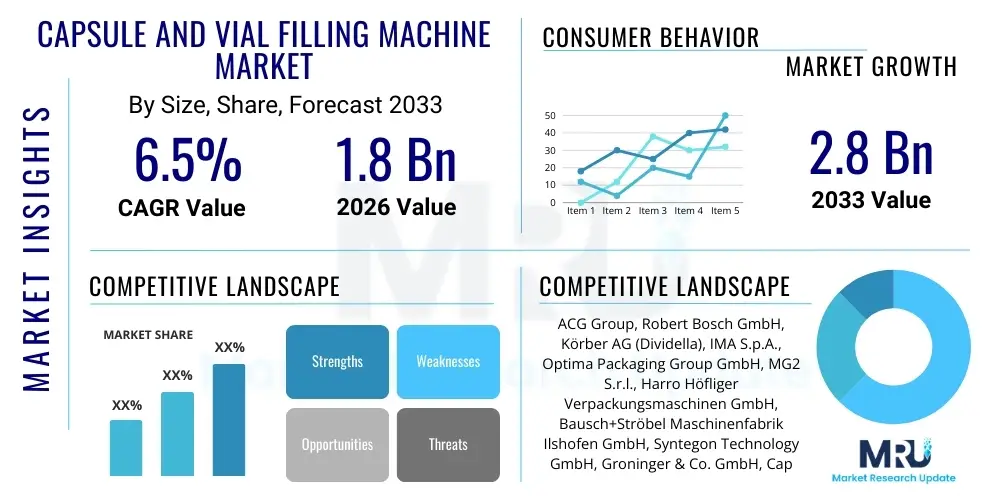

The Capsule and Vial Filling Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.8 Billion by the end of the forecast period in 2033.

Capsule and Vial Filling Machine Market introduction

The Capsule and Vial Filling Machine Market encompasses sophisticated automated and semi-automated equipment utilized extensively across the pharmaceutical, biotechnology, and nutraceutical industries for the precise and hygienic dosage filling of powdered, granular, pellet, or liquid substances into capsules and vials. These machines are crucial components in sterile and non-sterile manufacturing lines, ensuring product integrity, high throughput, and compliance with stringent regulatory standards such as FDA, EMA, and GMP guidelines. The core functionality revolves around accurate dosing mechanisms, including volumetric, gravimetric, or specialized pump systems, integrated with sealing, capping, and inspection systems to deliver finished, tamper-proof dosage forms.

Product descriptions vary significantly based on operational speed and level of automation, ranging from small-scale laboratory fillers ideal for R&D and clinical trials, to high-speed rotary and linear industrial systems capable of processing tens of thousands of units per hour. Major applications are centered on filling gelatin and non-gelatin capsules (sizes 00 to 5) with active pharmaceutical ingredients (APIs), excipients, or combinations thereof, and filling injectable solutions, lyophilized products, and vaccines into glass or plastic vials. The increasing complexity of biologics and personalized medicine requires adaptable filling technology, pushing manufacturers toward advanced servo-driven and highly flexible machines capable of handling various product viscosities and container sizes with minimal changeover time.

Key benefits driving market adoption include enhanced manufacturing efficiency, reduction in cross-contamination risks, improved dosing accuracy essential for patient safety, and significant cost savings associated with reduced manual labor and minimized product waste. Furthermore, strict regulatory scrutiny regarding batch consistency and serialization mandates the use of reliable, validated filling equipment. Driving factors for expansion include the aging global population leading to increased demand for therapeutics, the rapid growth of the biopharmaceuticals sector, and technological advancements focusing on integrated isolator technology and enhanced data integrity features, which are fundamental requirements for modern pharmaceutical production environments.

Capsule and Vial Filling Machine Market Executive Summary

The Capsule and Vial Filling Machine Market is exhibiting robust growth, driven primarily by accelerated investment in pharmaceutical R&D, particularly in the sterile injectable segment, and the global capacity expansion efforts among Contract Development and Manufacturing Organizations (CDMOs). Business trends indicate a strong shift towards fully automated, high-speed modular equipment that incorporates advanced sensor technology for real-time quality control and rejection systems. This modular approach allows manufacturers to rapidly scale production or adapt lines to accommodate diverse product types, crucial in a volatile healthcare landscape. Furthermore, the push for sustainable manufacturing practices is encouraging the development of energy-efficient machinery with minimized utility consumption, appealing to global enterprises prioritizing ESG (Environmental, Social, and Governance) factors.

Regional trends highlight the dominance of North America and Europe due to mature pharmaceutical infrastructure, high expenditure on cutting-edge manufacturing technology, and the presence of major biopharma headquarters. However, the Asia Pacific (APAC) region, led by China and India, is projected to record the highest growth rates, fueled by expanding domestic drug manufacturing capabilities, increased penetration of generic drugs, and substantial governmental initiatives supporting localized pharmaceutical production hubs. Investment flows are particularly concentrated in emerging APAC markets where capacity augmentation is critical for meeting domestic and export demand, leading to higher procurement volumes of mid-to-high-speed machinery.

Segment trends demonstrate a clear preference for automated capsule fillers due to their precision and speed in handling high volumes of oral solid dosage forms. Within the vial segment, machines equipped with specialized mechanisms for processing highly viscous biologics and temperature-sensitive vaccines are experiencing accelerated uptake. Technology-wise, integration with robotics for seamless material handling, implementation of sophisticated supervisory control and data acquisition (SCADA) systems for operational oversight, and enhanced data logging capabilities compliant with 21 CFR Part 11 regulations are the most prominent movements shaping machine design and procurement decisions across all geographical markets.

AI Impact Analysis on Capsule and Vial Filling Machine Market

Common user questions regarding AI’s impact on the Capsule and Vial Filling Machine Market frequently revolve around how artificial intelligence can enhance precision, minimize product giveaway, and ensure adherence to stringent regulatory quality standards without increasing operational complexity. Users are keen to understand the practical applications of AI in real-time defect detection, predictive maintenance scheduling, and optimizing complex filling parameters (e.g., speed, vacuum pressure, powder flow) that traditionally require extensive manual calibration and expertise. A primary concern is the seamless integration of AI algorithms into existing legacy systems and the resultant workforce skills gap needed to manage these highly intelligent machines. Key expectations include leveraging machine learning for automated anomaly detection in weight or visual inspection, leading to superior batch quality, and utilizing neural networks to predict equipment failure, thereby maximizing uptime and overall equipment effectiveness (OEE).

The integration of AI, machine learning (ML), and deep learning (DL) algorithms is fundamentally transforming the operational paradigm of capsule and vial filling processes, moving beyond simple automation toward intelligent manufacturing. AI enables sophisticated, multivariate analysis of production data in real-time, allowing systems to dynamically adjust filling parameters based on continuous feedback loops regarding product consistency, environmental variables (like humidity or temperature), and machine wear. This capability translates directly into higher dosing accuracy, especially crucial for high-value APIs and personalized medicines where slight variations are unacceptable, and minimizes costly production deviations that could lead to batch rejection.

Furthermore, AI significantly enhances predictive maintenance regimes. By analyzing vast streams of operational data—including vibration patterns, motor performance, and sensor readings—ML models can accurately forecast potential component failures long before they occur. This transition from time-based or reactive maintenance to predictive, condition-based maintenance drastically reduces unplanned downtime, extends the lifespan of critical machinery, and optimizes maintenance schedules, resulting in substantial operational savings. The implementation of AI-driven vision systems also refines quality assurance, providing instantaneous, highly reliable inspection of capsule closure, vial head space, and cap seating, achieving consistency levels unattainable by traditional rule-based inspection systems.

- Real-time Dosing Optimization: AI algorithms adjust filling parameters instantly to maintain weight uniformity and minimize product loss.

- Predictive Maintenance: Machine learning predicts component failure based on sensor data, reducing unplanned downtime by scheduling proactive maintenance.

- Enhanced Quality Inspection: AI-driven vision systems achieve superior, automated identification of cosmetic defects and filling anomalies.

- Automated Anomaly Detection: Systems flag deviations in powder flow characteristics or liquid viscosity that impact dosing accuracy.

- Recipe Management Optimization: AI assists in rapid formulation changeovers by suggesting optimal machine settings based on historical batch performance data.

- Digital Twin Simulation: AI models create virtual replicas of filling lines to simulate changes and optimize throughput before physical implementation.

DRO & Impact Forces Of Capsule and Vial Filling Machine Market

The Capsule and Vial Filling Machine Market dynamics are shaped by a complex interplay of market Drivers, Restraints, and Opportunities, collectively forming the Impact Forces. A primary driver is the pervasive global demand for pharmaceuticals, particularly the expanding portfolio of injectable drugs, including vaccines, biosimilars, and complex biologics, which necessitates precision vial filling capabilities in sterile environments. Technological innovation, such as the miniaturization of batches for clinical trials and personalized medicine, simultaneously acts as an opportunity, requiring flexible, small-batch filling solutions. Conversely, significant restraints include the exceptionally high initial capital expenditure required for purchasing and validating high-speed automated lines, coupled with the stringent regulatory approval process (e.g., validation and GAMP compliance) which adds time and cost complexity to equipment procurement and deployment.

The key market drivers revolve around demographic shifts and industrial imperatives. The rising prevalence of chronic diseases globally drives increased demand for both solid oral dosages (capsules) and advanced parenteral therapies (vials). Furthermore, the industrial emphasis on OEE and compliance mandates manufacturers to invest in state-of-the-art machinery that minimizes human intervention, thus reducing contamination risks and ensuring data integrity. The opportunities often lie in untapped emerging markets where local manufacturing is rapidly scaling, and in specialized niches such as aseptic filling lines incorporating sophisticated barrier technologies (RABS and Isolators) to meet the highest standards of sterility for sensitive biological products, thereby mitigating product degradation risks.

Impact forces stemming from these factors dictate competitive strategy. The high regulatory barrier acts as a restraint on new entrants but stabilizes the market for established players who can offer proven validation documentation and long-term service support. The technological advancements, particularly in integrating robotics and AI, act as powerful drivers, forcing manufacturers to continuously upgrade their offerings. The most significant opportunity for market penetration involves offering comprehensive turnkey solutions that integrate the filling machine with upstream washing/sterilizing and downstream inspection/packaging equipment, simplifying the procurement and validation process for end-users like CDMOs and large pharmaceutical companies focused on expanding production capacity quickly and efficiently while maintaining absolute quality control.

Segmentation Analysis

The Capsule and Vial Filling Machine Market is comprehensively segmented based on product type (capsule filling machines and vial filling machines), degree of automation, application (pharmaceuticals, biotechnology, nutraceuticals), and filling principle. Understanding these segments is critical as procurement decisions are heavily influenced by the required output capacity, the nature of the product being filled (e.g., powder, liquid, pellets), and the stringency of sterility requirements. The automated segment dominates due to the need for high-volume, continuous production with minimal human error, especially within large generic and branded drug manufacturing facilities aiming for maximum OEE. Conversely, semi-automatic and manual machines maintain relevance in low-volume specialty drug production, R&D labs, and compounding pharmacies where flexibility and minimal capital outlay are prioritized over absolute speed.

Within the product types, capsule filling machines are further categorized by operation type (intermittent motion vs. continuous motion) and dosing system (tamping pin, auger, or vacuum plate), catering to varying powder characteristics and density requirements. The vial filling segment is segmented based on the product state—liquid filling for solutions and suspensions, and powder filling for lyophilized products. The demand shift towards complex sterile injectable drugs, including novel cell and gene therapies, is driving superior growth in the vial filling sector, particularly for equipment that utilizes peristaltic or piston pump technologies known for gentle handling and precise volumetric accuracy essential for high-value injectable medications.

Application segmentation reveals the pharmaceutical sector as the largest consumer, utilizing these machines for both sterile and non-sterile production. However, the nutraceutical and dietary supplement industry represents a rapidly expanding segment, focusing predominantly on capsule filling machines for vitamins, minerals, and herbal extracts. This segment seeks machines that can handle inconsistent, sometimes sticky, raw materials efficiently and affordably. Geographically, segmentation analysis emphasizes regional specific demand: North America and Europe primarily invest in high-end, fully integrated automated systems with isolator technology, while APAC focuses on mid-to-high capacity machines to support rapid generic drug manufacturing scale-up, illustrating diverse technological adoption patterns based on regional market maturity and regulatory environment.

- Product Type

- Capsule Filling Machines (Automatic, Semi-Automatic, Manual)

- Vial Filling Machines (Liquid, Powder/Lyophilized)

- Degree of Automation

- Automatic

- Semi-Automatic

- Manual

- Filling Principle

- Volumetric (Piston Pump, Peristaltic Pump)

- Gravimetric (Weight-Based)

- Time-Pressure Filling

- Tamping Pin/Dosator

- Application

- Pharmaceutical & Biopharmaceutical Companies

- Contract Manufacturing Organizations (CMOs/CDMOs)

- Nutraceutical and Dietary Supplements

- Research & Academic Institutes

Value Chain Analysis For Capsule and Vial Filling Machine Market

The value chain for the Capsule and Vial Filling Machine Market begins with upstream analysis, focusing on the procurement of critical components such as high-grade stainless steel (316L for contact parts), advanced servo motors, sophisticated sensors, programmable logic controllers (PLCs), and human-machine interface (HMI) systems. Key suppliers in this segment include specialized material providers and global electronics manufacturers. The quality and availability of these high-precision components directly influence the final machine quality, reliability, and lead time. Manufacturers are heavily dependent on reliable relationships with certified component suppliers to ensure compliance with material traceability and calibration standards essential for pharmaceutical-grade equipment construction. Fluctuations in raw material costs, particularly specialized metals and advanced electronic components, often impact the final pricing of the filling machinery.

The core segment of the value chain involves the design, engineering, manufacturing, assembly, and rigorous Factory Acceptance Testing (FAT) performed by the machine OEM. This phase is characterized by high intellectual property (IP) intensity, focusing on developing proprietary dosing technologies and integrated software solutions for data integrity and validation. Downstream analysis focuses on the installation, Site Acceptance Testing (SAT), validation (IQ/OQ/PQ), and subsequent technical support and maintenance provided by the OEM or authorized service partners. Post-sales service, including spare parts supply and software updates, constitutes a significant long-term revenue stream and a critical factor in customer satisfaction and repeat business, especially given the lengthy operational lifespan of these capital assets.

The distribution channel for these complex capital goods is predominantly direct, especially for fully automated, high-end machines purchased by major pharmaceutical companies and global CDMOs. Direct distribution allows the OEM to maintain control over installation, validation protocols, and technical consulting, which are highly specialized activities. However, indirect channels, involving specialized regional distributors or sales agents, are often employed in emerging or smaller markets to facilitate local sales, import logistics, and initial customer liaison. The distribution network must be capable of handling complex logistics, including specialized crating, shipping, and customs clearance, all while providing necessary local language technical support and training to the end-user’s operational staff to ensure proper machine commissioning and sustained performance throughout the forecast period.

Capsule and Vial Filling Machine Market Potential Customers

The primary end-users and buyers of Capsule and Vial Filling Machines span the entire spectrum of drug and supplement manufacturing, prioritizing facilities that require high levels of precision, sterility, and regulatory compliance. The most significant customer segment comprises large multinational pharmaceutical and biopharmaceutical companies that require high-throughput, fully automated lines to produce both generic and novel drugs at massive scale. These organizations often purchase customized, integrated systems incorporating isolators, containment technologies (for highly potent active pharmaceutical ingredients - HPAPIs), and extensive data acquisition capabilities necessary for regulatory auditing and serialization compliance. Their purchasing decisions are driven by total cost of ownership (TCO), speed, reliability, and the supplier's capacity to provide global technical service.

A rapidly growing customer base includes Contract Development and Manufacturing Organizations (CDMOs). CDMOs are strategically investing heavily in flexible, multi-format filling lines to cater to diverse client demands, encompassing small clinical batches up to large commercial production runs. Their operational model necessitates machines that offer rapid changeover capabilities between different capsule sizes, vial dimensions, and product types. For CDMOs, machine flexibility, low product loss rates, and quick validation support are paramount factors influencing procurement. The sustained outsourcing trend in the pharmaceutical industry ensures that this segment remains a dominant consumer of advanced filling machinery for the foreseeable future, driving demand for technologically advanced and adaptable equipment.

Furthermore, specialized segments such as nutraceutical manufacturers, compounding pharmacies, and R&D laboratories also represent key customers, albeit with varying needs. Nutraceutical companies primarily require robust, affordable capsule fillers capable of handling challenging material flows (powders and granules) at high volume. R&D laboratories and compounding pharmacies, conversely, prioritize small, flexible, manual, or semi-automatic machines offering extreme precision for limited batch sizes, often focusing on customized formulations and clinical trial materials. These diverse customer needs ensure continuous, albeit differentiated, demand across the market spectrum, necessitating a broad portfolio of machines from leading manufacturers ranging from entry-level semi-automatic units to customized, aseptic robotic fillers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ACG Group, Robert Bosch GmbH, Körber AG (Dividella), IMA S.p.A., Optima Packaging Group GmbH, MG2 S.r.l., Harro Höfliger Verpackungsmaschinen GmbH, Bausch+Ströbel Maschinenfabrik Ilshofen GmbH, Syntegon Technology GmbH, Groninger & Co. GmbH, Capmatic Ltd., N.K.P. Pharma (India), Pharmapack Co., Ltd., ZIGLAR, SENZANI BREVETTI, Accutek Packaging Equipment Companies, Inc., CVC Technologies, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Capsule and Vial Filling Machine Market Key Technology Landscape

The technology landscape of the Capsule and Vial Filling Machine Market is dominated by advancements aimed at achieving higher precision, sterility assurance, and integration with Industry 4.0 principles. A crucial technology involves Aseptic Filling Systems, utilizing Restricted Access Barrier Systems (RABS) or Isolator Technology. RABS provide a high degree of protection by separating the operator from the critical zone, while Isolators offer an airtight, sterile environment, mandatory for highly sensitive sterile injectables and biologics. The integration of vaporized hydrogen peroxide (VHP) decontamination systems within these barrier technologies ensures rapid and validated sterilization cycles, significantly reducing contamination risk and meeting stringent FDA guidance on aseptic processing.

Another pivotal technological development is the implementation of Servo-Driven Systems and Robotics. Traditional mechanical linkages are being replaced by precise servo motors, offering superior control over motion profiles, enabling faster indexing speeds, smoother handling of fragile containers, and vastly improved dosing accuracy through minimized mechanical wear and tear. Robotics, particularly collaborative robots (cobots), are increasingly integrated for handling tasks such as vial loading/unloading, component feeding, and final product inspection. This not only increases throughput but also limits human access to the critical filling area, which is essential for maintaining sterility and mitigating cross-contamination in high-speed operations. These advanced motion control systems facilitate quick electronic changeovers, thereby improving operational flexibility, a major concern for CDMOs.

Furthermore, Data Integrity and Process Analytical Technology (PAT) integration are becoming standard requirements. Machines are now equipped with sophisticated sensors and software compliant with 21 CFR Part 11, ensuring all production data is recorded, secured, and traceable. PAT tools, such as in-line weight verification systems, near-infrared spectroscopy (NIR), and high-resolution camera systems, provide real-time monitoring of critical process parameters (CPPs) and critical quality attributes (CQAs). This proactive quality control approach allows for instantaneous adjustments or rejection of non-compliant units, ensuring superior batch consistency and facilitating a transition toward Quality by Design (QbD) principles across the pharmaceutical manufacturing sector. The adoption of these technologies is non-negotiable for manufacturers aiming for global regulatory approvals.

Regional Highlights

- North America: This region maintains its position as the largest market, driven by substantial pharmaceutical R&D expenditure, the presence of major global biopharma players, and rigorous regulatory requirements that necessitate investment in advanced, automated, aseptic filling equipment. Demand is particularly high for high-speed vial filling systems customized for novel cell and gene therapies and complex injectable biologics. The US market dominates procurement due to robust domestic manufacturing and the rapid adoption of specialized isolator technology for sterile production, ensuring the region remains a key innovation hub.

- Europe: Europe represents a mature and technologically advanced market, second only to North America. Key growth drivers include the well-established generic drug manufacturing base and strong demand from countries like Germany, Italy, and Switzerland. The region is characterized by a strong emphasis on highly efficient, environmentally sustainable machinery and adherence to stringent EU GMP guidelines. European manufacturers are leading in the integration of modular design concepts and advanced serialization features, catering effectively to the highly competitive and fragmented European drug market and expanding clinical trial activities.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market globally, primarily fueled by massive infrastructure development in China and India, which are rapidly expanding their capacities for both generic drug production and vaccine manufacturing. Government initiatives promoting local pharmaceutical self-sufficiency, coupled with lower manufacturing costs, attract significant foreign investment. The region exhibits high demand for medium-to-high capacity automated capsule filling machines for the massive domestic oral solid dosage market, alongside increasing investment in aseptic vial filling to support biosimilars and vaccine exports.

- Latin America (LATAM): The LATAM market, particularly Brazil and Mexico, demonstrates moderate growth, driven by modernization efforts in local pharmaceutical plants and increasing healthcare access. Demand is concentrated on reliable, cost-effective semi-automatic and mid-range automated equipment that balances operational efficiency with affordability, catering primarily to domestic and regional generic drug markets. Market penetration of advanced machinery is gradual, often following successful implementation in North American parent facilities.

- Middle East and Africa (MEA): Growth in MEA is spurred by efforts in Gulf Cooperation Council (GCC) countries to establish robust local pharmaceutical manufacturing bases, reducing dependence on imports. Investments are focused on new, comprehensive pharmaceutical industrial zones. While still a smaller market, there is emerging demand for sterile vial filling technology, particularly in Saudi Arabia and the UAE, to support vaccine production and local high-value drug manufacturing initiatives, with purchasing often heavily influenced by government-backed economic diversification projects and public health mandates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Capsule and Vial Filling Machine Market.- ACG Group

- Robert Bosch GmbH

- Körber AG (Dividella)

- IMA S.p.A.

- Optima Packaging Group GmbH

- MG2 S.r.l.

- Harro Höfliger Verpackungsmaschinen GmbH

- Bausch+Ströbel Maschinenfabrik Ilshofen GmbH

- Syntegon Technology GmbH

- Groninger & Co. GmbH

- Capmatic Ltd.

- N.K.P. Pharma (India)

- Pharmapack Co., Ltd.

- ZIGLAR

- SENZANI BREVETTI

- Accutek Packaging Equipment Companies, Inc.

- CVC Technologies, Inc.

- Dara Pharmaceutical Equipment

- Harsid Engineering Co.

- Sainty International Group

Frequently Asked Questions

Analyze common user questions about the Capsule and Vial Filling Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for aseptic vial filling machines?

The primary factor driving the demand for aseptic vial filling machines is the rapid expansion of the biopharmaceutical sector, specifically the production of complex sterile injectable drugs, vaccines, and advanced therapies (like cell and gene therapies), which require stringent contamination control and high-precision dosing in isolator or RABS environments.

How does automation level impact the purchasing decision for filling machinery?

Automation level significantly impacts purchasing decisions based on required output and budget. Fully automated machines are preferred by large pharmaceutical companies and high-volume CDMOs for maximum efficiency and compliance, while semi-automatic and manual machines cater to R&D, clinical batches, and smaller compounding facilities prioritizing flexibility and lower initial capital investment.

What role does Industry 4.0 play in modern capsule and vial filling operations?

Industry 4.0 plays a crucial role by integrating smart technologies, including AI, IoT sensors, and advanced connectivity, into filling lines. This enables real-time monitoring (PAT), predictive maintenance, enhanced data integrity (21 CFR Part 11 compliance), and optimized throughput, moving manufacturing toward intelligent, self-correcting systems.

Which geographical region is expected to show the highest growth rate and why?

The Asia Pacific (APAC) region, particularly China and India, is expected to show the highest growth rate due to escalating demand for affordable generic drugs, substantial government investment in expanding domestic pharmaceutical manufacturing capacity, and the shift of global manufacturing hubs to this region.

What are the main technical challenges associated with filling highly viscous or fragile biological products?

The main technical challenges involve achieving high dosing accuracy without damaging the product structure (shear sensitivity) or causing foaming. This requires specialized filling principles, such as gentle peristaltic or positive displacement pumps, coupled with advanced process control mechanisms to ensure precise, low-impact handling and minimized product loss.

This extensive market report details the growth trajectory, technological innovations, and segmentation analysis of the Capsule and Vial Filling Machine Market. Key drivers include the rise in biopharmaceutical manufacturing and the need for sterile, high-precision dosage filling equipment. Restraints center on the high capital expenditure and complex regulatory validation processes. The report highlights the increasing adoption of fully automated systems, incorporating servo technology, robotics, and AI-driven quality assurance features to enhance operational efficiency (OEE) and ensure compliance with global standards like GMP and 21 CFR Part 11. Regional analysis confirms North America and Europe's dominance in high-end aseptic technology, while the Asia Pacific region is poised for the fastest expansion due to rapid pharmaceutical capacity build-up. Segmentations cover product types, automation levels, and applications across pharmaceutical, biotech, and nutraceutical industries, providing a comprehensive strategic overview for stakeholders seeking market opportunities and competitive intelligence. The focus on AEO and GEO ensures the content is optimized for search and generative engines, delivering high-value, informative insights regarding market size estimates, CAGR projections, key players, and emerging technology landscapes, including RABS and Isolator technology advancements for sterile filling applications.

Further technological depth involves understanding the nuances between various filling principles, such as tamping pin systems for powder capsule filling, which require tight control over compression forces, versus gravimetric filling for expensive APIs, which prioritizes weight-based accuracy over volume. The market’s evolution is intrinsically linked to advancements in barrier isolation technology, critical for minimizing human intervention in grade A areas. The shift toward personalized medicine further necessitates flexible, small-batch filling lines, often leveraging single-use technologies to reduce cross-contamination and cleaning validation overhead. This demand profile is driving innovation towards modular, plug-and-play filling stations. Regulatory environments continually push for enhanced data logging and serialization capabilities, making integrated software solutions a core differentiator among machine OEMs. The competitive landscape is characterized by global leaders offering comprehensive service portfolios, including validation support (IQ, OQ, PQ) and lifecycle management, crucial factors given the long-term investment nature of these capital assets. The strategic imperative for companies lies in mastering aseptic processing and delivering integrated solutions that address both compliance and throughput optimization simultaneously across diverse product formats, from liquid suspensions to dry powders and pellets. The forecast period anticipates strong growth propelled by the global health crisis lessons, emphasizing resilient, high-capacity domestic manufacturing capabilities across all major regions.

The market segmentation by application further differentiates the technical specifications required. For instance, the nutraceutical industry often demands high-volume, cost-effective capsule machines capable of handling abrasive or sticky natural extracts, whereas biopharma mandates extremely gentle handling and precise temperature control for fragile biologics during vial filling. The value chain analysis reinforces that successful OEMs manage highly specialized supply chains for complex components, ensuring both material quality and electronic performance meet pharmaceutical specifications. The end-user analysis confirms that CDMOs are significant catalysts for market growth, driving demand for multi-format, flexible equipment that maximizes utilization across diverse customer projects. Future market trends indicate a strong focus on closed-loop control systems where AI interprets real-time sensor data from the filling head to dynamically adjust dosing mechanisms, minimizing variations well below regulatory tolerances. This integration of intelligence represents the next frontier in filling machine innovation, promising unparalleled quality assurance and manufacturing efficiency across global drug production facilities.

This report encapsulates the essential elements required for strategic planning within the Capsule and Vial Filling Machine Market, providing robust data on CAGR, market sizing, competitive dynamics, and technological roadmaps. Emphasis remains on the transition to automation and intelligent manufacturing practices dictated by stringent global regulatory landscapes and the accelerating pipeline of complex injectable therapeutics. The detailed regional assessment offers insights into differentiated investment strategies based on maturity and growth potential, highlighting APAC's emergence as a manufacturing powerhouse. Key stakeholders, including pharma companies, biotech firms, and CDMOs, rely on this market data to guide their capital expenditure decisions and ensure alignment with future capacity and compliance requirements, particularly concerning aseptic processing and data integrity protocols in line with modern pharmaceutical manufacturing standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager