Car Active Subwoofer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438401 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Car Active Subwoofer Market Size

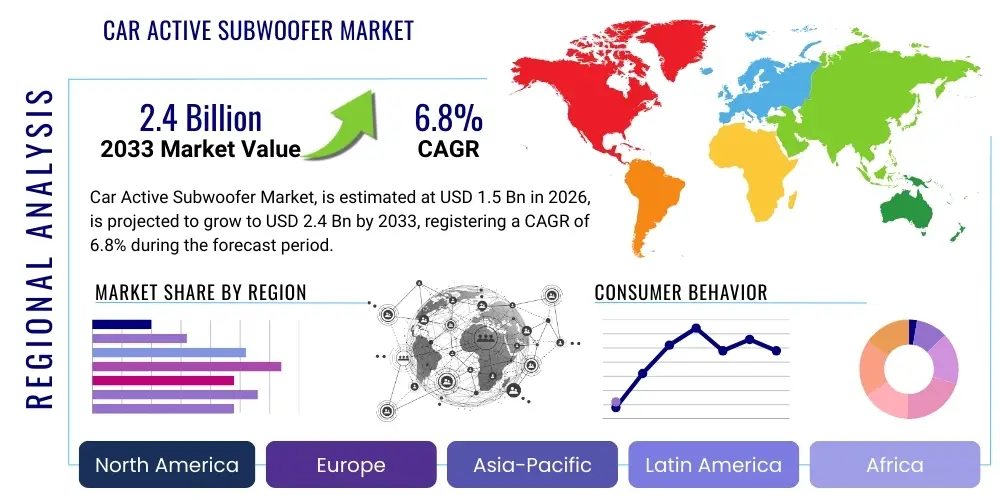

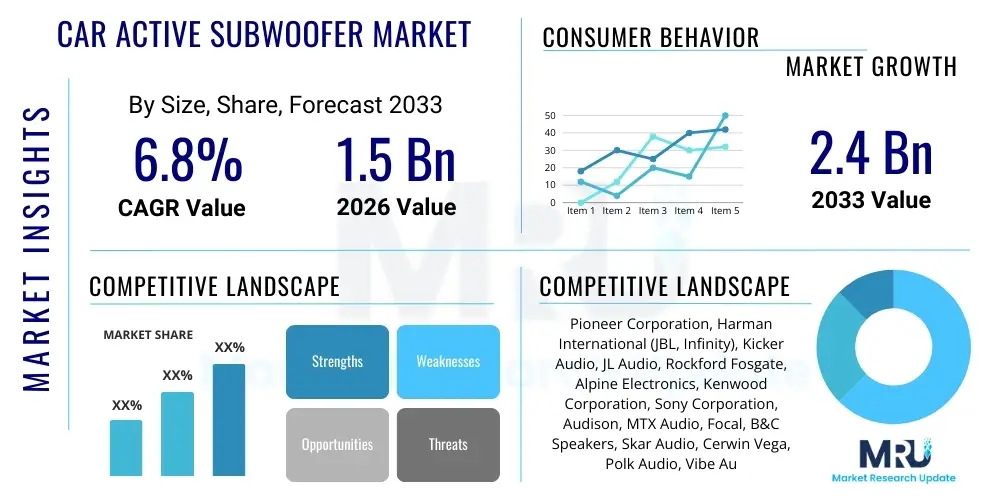

The Car Active Subwoofer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.4 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by the increasing consumer demand for superior in-car audio experiences, coupled with technological advancements leading to more compact, powerful, and integrated active subwoofer systems. The shift towards premium audio packages, particularly in the Original Equipment Manufacturer (OEM) segment, acts as a significant catalyst for market valuation growth over the next decade.

Car Active Subwoofer Market introduction

The Car Active Subwoofer Market encompasses self-contained audio systems designed to reproduce low-frequency sound (bass) within automobiles. Unlike passive subwoofers which require external amplification, active subwoofers integrate the speaker driver, enclosure, and dedicated amplifier into a single unit, simplifying installation and ensuring optimal power matching. These systems are crucial for enhancing the overall acoustic quality of vehicle sound systems, providing depth and richness that standard factory speakers often lack. The primary goal of an active subwoofer is to deliver impactful, distortion-free bass reproduction across various vehicle platforms, ranging from compact sedans to large SUVs and commercial vehicles. Key product differentiators in the market include compact design (such as under-seat options), material science improvements in cones, and digital signal processing (DSP) capabilities for precise sound tuning.

Major applications for active subwoofers span across both the Original Equipment Manufacturer (OEM) sector, where they are increasingly included as standard or optional high-end audio features, and the aftermarket segment, where consumers seek upgrades to personalize their audio environments. The benefits of active subwoofers include ease of installation, space efficiency—especially for models designed to fit under seats or in side panels—and system compatibility due to their self-powered nature. Furthermore, the integrated amplifier is optimized specifically for the speaker’s characteristics, leading to superior efficiency and sound quality compared to generic external amplifiers.

Driving factors propelling market growth include the rising disposable income in developing economies, leading to higher adoption rates of personal vehicles and subsequent expenditure on premium accessories. Moreover, global automakers are prioritizing infotainment and audio quality as critical distinguishing features in competitive vehicle markets. Regulatory shifts favoring quiet cabins and the widespread availability of high-resolution digital audio formats necessitate powerful bass response systems. The ongoing miniaturization of components and improvements in Class D amplifier technology allow manufacturers to produce powerful subwoofers that require minimal space, effectively resolving the historical trade-off between bass performance and trunk space utility, thus making them highly attractive to modern consumers.

Car Active Subwoofer Market Executive Summary

The Car Active Subwoofer Market is characterized by vigorous innovation, shifting from bulky systems to highly optimized, compact units tailored for specific vehicle acoustics. Business trends indicate a strong move toward OEM integration, driven by collaborations between leading audio specialists and automotive manufacturers, focusing on factory-installed premium audio packages. Concurrently, the aftermarket segment remains vital, capitalizing on DIY installation trends and providing customized solutions for older vehicles or budget-conscious consumers seeking quality upgrades. Key technological investments are centered on advanced heat management, power efficiency improvements using Class D architecture, and incorporating sophisticated Digital Signal Processing (DSP) capabilities to allow drivers real-time acoustic adjustments based on music genre and cabin noise. The competitive landscape is consolidating, with major players leveraging global distribution networks and brand recognition to capture market share, especially in fast-growing Asian economies.

Regionally, Asia Pacific (APAC) is emerging as the fastest-growing market, primarily due to the rapid expansion of the automotive manufacturing sector in countries like China, India, and Japan, coupled with a large, young, and tech-savvy consumer base eager for entertainment upgrades. North America and Europe, while mature, maintain dominance in terms of technological adoption and high average selling prices (ASPs), driven by high consumer expectations for luxury features and sophisticated acoustic performance in premium vehicles. Growth in Latin America and the Middle East & Africa (MEA) is accelerating, supported by increasing vehicle penetration rates and urbanization, leading to higher spending on convenience and luxury vehicle features.

Segment trends reveal that the Aftermarket channel currently holds a larger share but the OEM segment is witnessing the most rapid growth, reflecting automakers’ commitment to enhancing factory audio. Based on product type, the compact, under-seat active subwoofers are gaining significant traction due to their discreet integration and minimal impact on vehicle utility space, contrasting with traditional box enclosures. The Passenger Car segment dominates consumption, although the Commercial Vehicle segment is also showing steady uptake as professional drivers seek improved comfort and entertainment during long routes, necessitating durable and powerful audio solutions.

AI Impact Analysis on Car Active Subwoofer Market

User queries regarding AI's influence on the Car Active Subwoofer market often center on whether AI can personalize sound, optimize bass output in real-time, and manage power consumption more efficiently within the constrained automotive electrical systems. Consumers are keen to understand how AI-driven algorithms can move beyond simple equalization to provide dynamic, context-aware audio tuning that adapts instantaneously to changes in road noise, vehicle speed, and passenger load. Key concerns include data privacy related to in-car monitoring necessary for personalization and the perceived complexity of configuring AI-enhanced systems. The expectation is that AI will transform subwoofers from static components into intelligent audio delivery platforms capable of optimizing acoustic performance autonomously. This leads to increased demand for components that can interface seamlessly with sophisticated vehicle operating systems and handle complex computational tasks necessary for advanced DSP.

The integration of Artificial Intelligence primarily affects the Digital Signal Processing (DSP) component of active subwoofers. AI algorithms can analyze ambient noise levels and frequency patterns within the vehicle cabin (acoustic fingerprinting) and automatically adjust subwoofer crossover points, phase correction, and gain settings to maintain optimal bass performance regardless of external variables. This predictive and adaptive tuning vastly improves sound quality consistency and reduces the need for manual adjustment by the user. Furthermore, AI contributes to predictive maintenance by monitoring amplifier temperature and power draw, alerting the user to potential failure modes before they occur, thereby extending product lifespan and enhancing reliability, which is crucial in the harsh automotive environment.

AI's role extends into product development and manufacturing processes. Machine learning is being utilized in the design phase to simulate acoustic performance within diverse vehicle geometries, accelerating the iteration cycle for designing optimal enclosure shapes and driver materials. This allows manufacturers to produce vehicle-specific active subwoofers that perform exceptionally well straight out of the box. From a consumer perspective, the primary benefit is an effortless, optimized listening experience, where the bass response is not only powerful but also seamlessly integrated with the mid-range and high frequencies, eliminating common audio issues like boominess or delayed response often associated with poorly calibrated systems. This focus on intelligent optimization differentiates premium active subwoofer offerings.

- AI-driven real-time acoustic optimization (RTAO) adapts bass output based on vehicle speed, cabin noise, and music genre.

- Predictive equalization algorithms manage acoustic reflections and standing waves within the vehicle cabin for precise sound staging.

- Integration of machine learning models for personalized user profiles and automated sound preset selection.

- AI aids in optimizing power management (Class D amplifiers) to maximize efficiency and minimize heat generation.

- Enhanced reliability through diagnostic AI monitoring amplifier health and component degradation.

DRO & Impact Forces Of Car Active Subwoofer Market

The market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO). Major drivers include the increasing consumer preference for sophisticated in-vehicle entertainment, driven by longer commute times and the proliferation of digital high-fidelity audio sources, which demand powerful bass reproduction. Simultaneously, the relentless pursuit of technological miniaturization allows active subwoofers to fit into previously unusable spaces, significantly broadening their applicability across vehicle types. Restraints primarily involve the inherent complexity and high cost associated with integrating high-power electrical components into the vehicle's electrical system, particularly for battery electric vehicles (BEVs) where power efficiency is paramount. Additionally, the lack of standardized installation protocols in the aftermarket segment can lead to performance variance and customer dissatisfaction. Opportunities lie in developing ultra-efficient, lightweight materials and exploiting the rapid growth of the electric vehicle (EV) sector, which requires specialized, low-power-draw audio solutions that can communicate via vehicle network buses (like CAN bus) for seamless control and diagnostic reporting.

Impact forces in this market are high, driven by rapidly evolving consumer electronics standards and stiff global competition. The primary impact force is the substitution threat posed by alternative audio technologies, such as advanced in-car noise cancellation systems which can electronically synthesize low frequencies, although these are currently less potent than dedicated subwoofer systems. Supplier power is moderate; while component suppliers for specialized transducers and integrated circuits hold some leverage, standardized components like amplifiers are widely available. Buyer power is high, especially in the aftermarket, where consumers have access to vast product choices and pricing transparency online, forcing manufacturers to continuously innovate on price and features. Regulatory forces related to vehicle noise emissions and electrical safety also exert a strong influence on product design and testing, particularly in high-growth regions like the EU and North America.

The industry is also highly impacted by the lifecycle of vehicles and the increasing focus on sustainable manufacturing. Manufacturers are pressured to use recyclable materials and develop energy-saving designs. The long-term success of market participants hinges on their ability to offer systems that are not only acoustically superior but also easy to integrate, energy-efficient, and aesthetically discreet. The shift towards autonomous driving also creates an opportunity for immersive audio environments, positioning the active subwoofer as a key component in creating a personalized "acoustic bubble" for passengers, further cementing its role as a high-value automotive accessory. Successfully navigating the high initial capital investment required for R&D in digital processing and power management remains a critical barrier to entry for smaller players.

Segmentation Analysis

The Car Active Subwoofer Market is primarily segmented based on Type, Vehicle Type, and Sales Channel, reflecting diverse consumer preferences and market application landscapes. Understanding these segments is crucial for strategic planning, as the requirements for an OEM-installed system in a luxury SUV differ significantly from an aftermarket purchase for a compact hatchback. The segmentation strategy allows market players to tailor product design, pricing, and distribution channels to maximize reach and profitability. For instance, the demand for compact, under-seat subwoofers is highly concentrated in urban markets where space utilization is critical, while large enclosure subwoofers remain popular in the enthusiast-driven aftermarket segment in North America, catering to maximum SPL (Sound Pressure Level) demands.

Segmentation by Sales Channel, specifically the division between OEM and Aftermarket, reveals divergent growth trajectories. While the Aftermarket segment benefits from a higher volume of product variety and price points, catering to budget upgrades and high-performance customizations, the OEM segment is driven by integration, reliability, and guaranteed compatibility. The OEM trend suggests that premium audio integration is becoming a standardized offering, impacting vehicle purchase decisions directly. Manufacturers investing in OEM relationships must prioritize long-term component durability and complex acoustic modeling suitable for mass production and specific vehicle architecture compliance.

Furthermore, segmentation by Vehicle Type—Passenger Cars versus Commercial Vehicles—highlights distinct design requirements. Passenger car subwoofers focus heavily on aesthetic integration and acoustic fidelity suitable for varied musical tastes. In contrast, commercial vehicle applications often prioritize ruggedness, resistance to vibration and temperature extremes, and simpler, maintenance-friendly designs, as these vehicles endure high usage hours. Analysis of these segments confirms that future growth will be concentrated in systems that offer superior power-to-size ratios, utilizing advancements in materials science to reduce weight without compromising output fidelity, thereby appealing to the broadest base of automotive consumers globally.

- Type:

- Under Seat Subwoofer (Compact, space-saving design, high-growth segment)

- Box Subwoofer (Traditional enclosure, higher output potential, dominates aftermarket SPL)

- Spare Wheel Subwoofer (Stealth installation, focuses on utility preservation)

- Vehicle Type:

- Passenger Cars (Sedans, SUVs, Hatchbacks)

- Commercial Vehicles (Trucks, Vans, Buses)

- Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

- Power Output:

- Low Power (Below 200W RMS)

- Medium Power (200W – 500W RMS)

- High Power (Above 500W RMS)

Value Chain Analysis For Car Active Subwoofer Market

The value chain for the Car Active Subwoofer Market begins with upstream activities involving the sourcing of highly specialized materials and components. This includes rare earth metals for magnetic assemblies (Neodymium), specialized polymer and composite materials for speaker cones (e.g., carbon fiber, Kevlar), and sophisticated semiconductor integrated circuits (ICs) for amplifier modules and Digital Signal Processors (DSP). Key upstream suppliers are those specializing in high-performance power electronics (Class D amplifier ICs) and transducer manufacturing, dictating the component quality and innovation pace. The active subwoofer manufacturer then performs design, precision assembly, and rigorous testing, focusing heavily on thermal management and enclosure tuning to ensure maximum acoustic efficiency within the defined physical constraints. Efficiency and cost control at this stage are paramount, particularly for high-volume OEM contracts where margins are tightly controlled.

Midstream activities involve the core manufacturing and integration processes. This includes enclosure fabrication (often high-density fiberboard or molded plastic), driver assembly, and the complex integration of the amplifier and DSP board within the active unit. Distribution channels then move the finished goods to the final consumers. Direct channels are becoming increasingly important, especially through dedicated manufacturer websites and direct-to-consumer platforms, offering greater control over pricing and customer interaction. However, indirect channels—comprising a vast network of authorized distributors, regional wholesalers, and specialized automotive electronics retailers—still handle the bulk of transactions, particularly in the fragmented aftermarket segment, providing installation services and localized support.

Downstream activities center on sales, marketing, installation, and after-sales support. For the OEM channel, the active subwoofer is integrated directly into the vehicle assembly line, forming part of a complete audio package. For the aftermarket, specialized installation professionals and automotive workshops play a critical role in ensuring optimal system integration and tuning, especially regarding wiring into the vehicle's electrical system and acoustic calibration. Customer service and warranty provision are essential downstream factors influencing brand loyalty and market reputation. The proliferation of online content (tutorials, reviews) also influences downstream demand, helping consumers select the right product and even perform DIY installations, which puts pressure on packaging and user documentation quality.

Car Active Subwoofer Market Potential Customers

The primary potential customers and end-users of car active subwoofers fall into two distinct groups: vehicle manufacturers (OEMs) and private vehicle owners (Aftermarket consumers). OEMs, particularly those focusing on premium, luxury, and technologically advanced vehicle segments, purchase active subwoofers in large volumes as integral components of factory-installed audio packages. These customers prioritize reliability, precise acoustic integration (requiring extensive joint R&D), longevity, and strict compliance with automotive electrical and safety standards (e.g., EMC). Their purchasing decisions are driven by long-term supply agreements and the ability of the supplier to scale production while maintaining zero defects, aiming to use the audio system as a key selling point for the final vehicle.

Aftermarket consumers are highly diversified and can be segmented further into audio enthusiasts, everyday commuters, and professional drivers. Audio enthusiasts seek high-performance, high-power systems, prioritizing maximum sound pressure levels (SPL) and sound fidelity, often favoring the traditional box subwoofers or highly customizable options. Everyday commuters, representing the largest segment, are increasingly seeking compact, space-saving solutions like under-seat models that offer a significant acoustic upgrade over stock audio without sacrificing trunk space or complex installation, prioritizing ease of integration and affordability. Professional drivers (e.g., truck drivers, ride-share operators) constitute a niche but growing segment, valuing durable, high-quality audio that enhances comfort during prolonged driving hours.

In both the OEM and Aftermarket segments, purchasing behavior is highly influenced by technical specifications such as power rating (RMS), frequency response, physical dimensions, and brand reputation for quality and performance. The growing trend of customization, coupled with increased consumer knowledge due to online research, means that end-users are becoming more discerning regarding acoustic technology (e.g., passive radiators, ported vs. sealed enclosures) and amplifier efficiency (Class D). As vehicle connectivity increases, customers are also beginning to prioritize subwoofers that offer advanced connectivity features and compatibility with digital sound control apps, enabling personalized tuning directly from a smartphone interface.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.4 Billion |

| Growth Rate | Insert CAGR 6.8% ( Include CAGR Word with % Value ) |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pioneer Corporation, Harman International (JBL, Infinity), Kicker Audio, JL Audio, Rockford Fosgate, Alpine Electronics, Kenwood Corporation, Sony Corporation, Audison, MTX Audio, Focal, B&C Speakers, Skar Audio, Cerwin Vega, Polk Audio, Vibe Audio, Earthquake Sound, BOSS Audio Systems, AudioControl, Soundstream, Gladen Audio, Hifonics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Car Active Subwoofer Market Key Technology Landscape

The technological evolution of the Car Active Subwoofer Market is centered around three core areas: amplification efficiency, driver design, and digital integration. Class D amplification represents the most significant technological shift, replacing less efficient Class AB amplifiers. Class D technology offers energy efficiency exceeding 90%, significantly reducing power consumption and heat generation, which is crucial for modern vehicle electrical systems and vital for battery preservation in electric vehicles. This efficiency allows manufacturers to pack higher power output (RMS) into physically smaller chassis, directly enabling the popularization of compact designs like under-seat and spare wheel subwoofers. Furthermore, advancements in heat sink materials and passive cooling techniques ensure sustained performance even under strenuous use, addressing a historical reliability issue associated with powerful compact audio systems.

In driver design, innovation is focused on achieving maximum excursion and stiffness with minimum mass. Manufacturers are heavily investing in proprietary cone materials, such as layered carbon fiber and treated paper pulps, to maintain structural integrity and minimize distortion (THD) at high volumes. Crucially, the move towards shallow-mount designs demands specialized motor structures, often utilizing powerful Neodymium magnets and unique voice coil designs (e.g., dual voice coils) to deliver deep bass response from enclosures less than four inches deep. The integration of passive radiators is also becoming common, allowing smaller active enclosures to achieve acoustic performance comparable to larger, ported systems by utilizing air pressure to enhance low-frequency output without requiring extra electrical power.

Digital integration, particularly sophisticated Digital Signal Processing (DSP), forms the intelligent backbone of modern active subwoofers. DSP allows for highly precise electronic adjustments, including adjustable phase, variable crossover points, subsonic filters, and parametric equalization. This digital control is essential for correcting the complex acoustic anomalies inherent in vehicle cabins and ensuring seamless blending between the subwoofer and the main speaker system. Modern active subwoofers increasingly incorporate dedicated DSP chips capable of high-resolution audio processing and feature control via mobile applications, aligning the market with the broader trend of vehicle connectivity and smart electronics. Future developments will further integrate advanced DSP with vehicle telemetry data (via CAN bus) to create adaptive sound systems capable of real-time environmental compensation and acoustic personalization.

Regional Highlights

The global Car Active Subwoofer Market exhibits varied growth patterns influenced by regional economic conditions, automotive production volumes, and consumer spending habits on vehicle customization. North America currently represents a mature market characterized by high consumer awareness, strong aftermarket presence, and demand for high-output, premium brand systems. Consumers in the US and Canada often prioritize maximum bass pressure (SPL) and performance, leading to sustained demand for high-power box subwoofers, although the trend towards integrated OEM premium audio is rapidly growing. Regulatory requirements regarding installation and electrical safety are stringent here, driving high standards in product certification and quality assurance, particularly regarding power handling and thermal stability.

Asia Pacific (APAC) stands out as the engine of market expansion, showing the highest projected CAGR. This surge is fueled by massive growth in automobile manufacturing, especially in China and India, coupled with rising disposable incomes that enable consumers to purchase both new vehicles and subsequently invest in personalized audio upgrades. The APAC market shows a strong preference for space-saving active subwoofers (under-seat models) due to the dominance of compact car segments in major metropolitan areas. The competitive landscape in APAC is intensifying, with both global audio giants and strong local manufacturers competing aggressively on price, size, and OEM supply contracts. Japan and South Korea lead in adopting advanced integrated digital technology within their active subwoofer offerings.

Europe presents a market that balances performance and discretion. European consumers emphasize sound fidelity, aesthetic integration, and adherence to noise regulations. The OEM channel is highly dominant, with European automakers frequently partnering with high-end audio specialists (e.g., Harman, Focal, Audison) to offer integrated audio systems that are subtly engineered into the vehicle architecture. The environmental consciousness of the region also drives demand for high-efficiency Class D amplifiers that minimize energy usage. Latin America and the Middle East & Africa (MEA) are emerging markets offering significant long-term potential. Growth here is primarily driven by increasing vehicle ownership and a growing aftermarket sector that seeks durable, reasonably priced active subwoofers capable of withstanding varied environmental conditions, suggesting a high demand for ruggedized and reliable products in the coming years.

- North America: Dominant aftermarket sales, high ASP, strong demand for high-power systems and brand recognition.

- Asia Pacific (APAC): Fastest growth region due to burgeoning automotive production and preference for compact, efficient designs (under-seat subwoofers).

- Europe: High OEM integration rates, focus on energy efficiency, sound fidelity, and premium, discreet designs.

- Latin America: Emerging market characterized by increasing vehicle ownership and growing affordability of mid-range aftermarket products.

- Middle East & Africa (MEA): Growth driven by vehicle population increase and demand for durable audio accessories resistant to extreme climates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Car Active Subwoofer Market.- Pioneer Corporation

- Harman International (JBL, Infinity)

- Kicker Audio

- JL Audio

- Rockford Fosgate

- Alpine Electronics

- Kenwood Corporation

- Sony Corporation

- Audison

- MTX Audio

- Focal

- B&C Speakers

- Skar Audio

- Cerwin Vega

- Polk Audio

- Vibe Audio

- Earthquake Sound

- BOSS Audio Systems

- AudioControl

- Soundstream

Frequently Asked Questions

Analyze common user questions about the Car Active Subwoofer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between an active and a passive car subwoofer?

An active subwoofer is an all-in-one system that includes the speaker, the enclosure, and a matched, built-in amplifier, simplifying installation and ensuring optimal power delivery. A passive subwoofer only includes the speaker and enclosure, requiring a separate external amplifier to operate.

Are under-seat active subwoofers powerful enough for modern vehicles?

Yes, modern under-seat active subwoofers utilize highly efficient Class D amplifiers and shallow-mount driver technology to provide surprisingly deep and powerful bass, significantly improving the stock audio experience without sacrificing valuable cabin or trunk space, making them ideal for SUVs and compact cars.

Which sales channel is experiencing faster growth in the Car Active Subwoofer Market?

While the Aftermarket currently holds a larger total volume, the Original Equipment Manufacturer (OEM) sales channel is demonstrating the faster growth rate. This accelerated growth is driven by automakers incorporating premium, factory-integrated active audio systems into higher trim levels of new vehicle models globally.

How does Digital Signal Processing (DSP) enhance active subwoofer performance?

DSP is crucial for enhancing active subwoofer performance by allowing precise electronic tuning, including phase correction, variable crossover management, and specialized equalization (EQ). This ensures the bass integrates seamlessly with the rest of the car's speakers and corrects acoustic irregularities inherent in the vehicle cabin, delivering cleaner, more consistent sound.

What technological advancements are driving the efficiency of active subwoofers?

The primary technological driver is the widespread adoption of Class D amplification, which significantly increases power efficiency (over 90%) while minimizing heat generation and power draw. Furthermore, advancements in specialized cone materials and motor structures allow for high excursion and output from compact, shallow-mount designs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager