Car Auction Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433717 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Car Auction Market Size

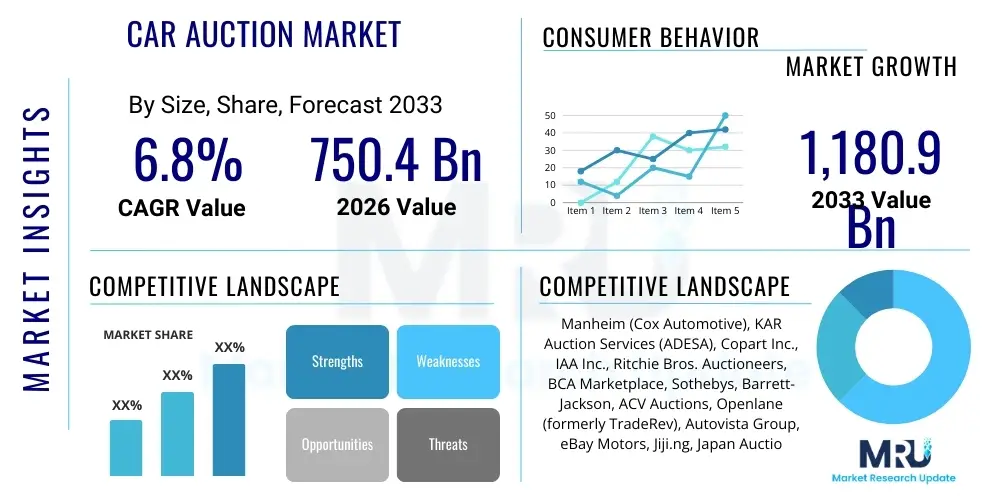

The Car Auction Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $750.4 Billion USD in 2026 and is projected to reach $1,180.9 Billion USD by the end of the forecast period in 2033.

Car Auction Market introduction

The Car Auction Market encompasses the structured sale of pre-owned and new vehicles through competitive bidding processes, primarily targeting wholesale transactions between sellers (such as fleet operators, financial institutions, and dealerships) and professional buyers (dealers and dismantlers). This market acts as a vital liquidity conduit for the automotive ecosystem, efficiently handling high volumes of used inventory, including vehicles acquired through trade-ins, off-lease returns, repossessions, and salvage claims. The operational landscape has undergone radical transformation, shifting from predominantly physical, in-lane auctions to sophisticated digital platforms offering hybrid or fully online experiences, significantly reducing geographical barriers and enhancing transactional transparency and speed. Key product offerings include whole-car auctions, which focus on ready-to-retail vehicles, and salvage auctions, which handle total loss or damaged vehicles for parts and reconstruction.

Major applications of the car auction structure revolve around inventory management and wholesale redistribution for large organizations. Dealerships leverage auctions both to dispose of unwanted trade-ins quickly (reducing holding costs) and to source specific inventory required for their retail lots, balancing supply and demand efficiently. Financial institutions, particularly banks and leasing companies, rely heavily on auctions to liquidate assets from defaulted loans or expired lease agreements, utilizing standardized processes to maximize recovery value. Furthermore, insurance companies employ salvage auctions as the primary method for disposing of vehicles deemed total losses, providing an essential service for managing claims and mitigating costs associated with extensive vehicle damage. The scalability and regulated nature of these environments make them indispensable for high-volume, standardized automotive transactions globally.

The principal benefits driving the continued expansion of the car auction market include robust price discovery mechanisms, operational efficiency, and enhanced market reach. Competitive bidding ensures that vehicles are transacted at fair market value based on real-time supply and demand dynamics, offering transparency that traditional private sales often lack. Driving factors fueling the current growth trajectory are dominated by the increasing digitization of wholesale operations, which allows for detailed vehicle condition reporting (CR), sophisticated digital inspection tools, and seamless cross-border transactions. The sustained global scarcity and high retail cost of new vehicles have concurrently intensified demand for high-quality used cars, further solidifying the auction channel as a crucial source of inventory for the retail sector. Regulatory frameworks facilitating electronic titling and secure payment processing also contribute significantly to the market's streamlined efficiency and sustained growth outlook.

Car Auction Market Executive Summary

The Car Auction Market is characterized by accelerating digitalization and consolidation, driving significant shifts in business trends across key geographical regions and segments. Business trends indicate a definitive move toward platform centralization, where major auction houses invest heavily in creating integrated, omni-channel environments that blend physical services (like inspection and logistics) with superior online bidding functionalities. This integration is crucial for maximizing bidder participation and transactional velocity. Furthermore, there is a pronounced focus on ancillary services such as inventory financing, transportation logistics, and title management, transforming auction houses from simple marketplaces into comprehensive automotive remarketing service providers. Geographically, mature markets like North America and Europe are focusing on technological optimization and regulatory compliance refinement, while the Asia Pacific region, particularly countries with rapidly growing middle-class populations and increasing motorization rates, exhibits the highest growth potential for both physical and online auction formats, driven by expanding used vehicle sales volumes and increasing sophistication of local dealer networks.

Regional trends reveal diversification in auction adoption rates and operational maturity. North America continues to lead in market size, characterized by a well-established infrastructure of both large physical auction sites and highly advanced digital platforms catering extensively to institutional sellers (OEMs, fleet/lease companies). European trends are marked by fragmentation and a strong regulatory environment, promoting the use of cross-border platforms to handle the diverse national markets and specifications, often emphasizing specialized auctions for high-value or luxury vehicles. Conversely, the market in emerging economies, notably Latin America and certain parts of APAC, is rapidly professionalizing. These regions are seeing accelerated adoption of auction systems to replace fragmented, less transparent wholesale methods, with initial growth often concentrated in business-to-business (B2B) segments before expanding into consumer-to-business (C2B) models supported by technological trust-building mechanisms like standardized vehicle grading.

Segmentation trends highlight the increasing dominance of the B2B segment, specifically dealer-to-dealer transactions and institutional sales, which benefit most directly from the efficiency and scale of auction platforms. Within the channel segmentation, online auctions are rapidly gaining market share over physical auctions, driven by lower operational costs, 24/7 accessibility, and the capacity to host specialized, niche sales events efficiently. The growth of the C2B model, facilitated by digital platforms that allow consumers to easily sell their vehicles directly to dealers through a managed auction environment, represents a crucial emerging segment trend, offering dealers alternative sourcing channels outside traditional trade-in processes. Furthermore, there is a specialized segment trend toward high-frequency, short-duration auctions, known as flash sales, designed specifically for rapid inventory liquidation, further optimizing transactional efficiency for professional sellers managing large fleets.

AI Impact Analysis on Car Auction Market

User queries regarding the impact of Artificial Intelligence (AI) on the Car Auction Market consistently focus on three core areas: the automation of pricing and valuation processes, the enhancement of trust and fraud detection, and the personalization of the bidding experience. Users frequently ask how AI can predict the final hammer price of a vehicle with greater accuracy than traditional appraisal methods, driven by the need for maximized profitability and reduced risk exposure. A secondary, critical concern revolves around the integrity of the auction process; users seek reassurance that AI-powered image recognition and Natural Language Processing (NLP) systems can detect inconsistencies in vehicle condition reports (CR) or identify subtle forms of digital fraud. Finally, professional bidders inquire about AI's role in optimizing their bidding strategy, such as providing real-time competitive analysis or suggesting optimal exit points during rapid-fire online auctions, highlighting a desire for data-driven strategic advantages.

The analysis of these themes reveals that key expectations center on AI transitioning the car auction market from an expertise-driven environment to a data science-driven ecosystem. The summary of user expectations indicates a strong demand for AI tools that integrate vast datasets—including historical transaction prices, external market supply changes, macroeconomic indicators, and detailed vehicle specifics (mileage, optionality, damage severity)—to generate highly precise residual value and dynamic auction pricing recommendations. This shift minimizes human bias and accelerates decision-making. Furthermore, the expectation is high that AI will significantly bolster transparency, a traditionally challenging aspect of wholesale transactions, by providing verifiable, objective assessments of vehicle wear and tear through advanced computer vision models applied to inspection photos and videos, thereby building buyer confidence and expanding cross-border trade potential.

Consequently, market development is heavily focused on deploying sophisticated machine learning models to handle complex variability inherent in used vehicle pricing. These technologies are not only used for predictive pricing but are also foundational to improving operational efficiency across the entire value chain, from automated vehicle listing generation to intelligent logistics routing after a sale. The transformative effect of AI promises to unlock substantial value by ensuring vehicles are listed at optimal reserve prices, minimizing the risk of ‘buying back’ inventory due to low bids, and concurrently providing buyers with confidence in the fairness and accuracy of the listed vehicle descriptions. This technological integration is essential for auction platforms seeking AEO and GEO advantages, ensuring their systems are recognized by search and generative engines as authoritative sources for vehicle valuation and auction intelligence.

- Dynamic Pricing Algorithms: AI utilizes vast historical transaction data, depreciation curves, and real-time market signals to set optimal reserve prices and predict final hammer prices, maximizing seller returns.

- Condition Report (CR) Validation: Computer vision and machine learning analyze inspection photos and videos to automatically detect discrepancies or undeclared damage, significantly reducing fraud risk and enhancing buyer trust.

- Personalized Bidding Strategies: AI algorithms offer real-time insights to professional bidders, suggesting optimal bid increments, tracking competitor behavior, and calculating maximum acceptable price based on dealer margins.

- Automated Digital Listing: NLP and generative AI streamline the creation of accurate, standardized vehicle descriptions and marketing copy directly from inspection data, accelerating time-to-market.

- Fraud and Risk Detection: Machine learning models monitor bidding patterns and user behavior to identify suspicious activities or potential collusion, ensuring a fair auction environment.

- Predictive Logistics Optimization: Post-sale, AI algorithms optimize transportation routes and timing based on vehicle location, buyer destination, and logistics network capacity, lowering delivery costs and time.

- Customer Service Automation: AI-powered chatbots and virtual assistants handle routine inquiries regarding vehicle availability, inspection schedules, and payment processing, improving operational scale.

DRO & Impact Forces Of Car Auction Market

The Car Auction Market is significantly shaped by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces dictating market trajectory and competitive intensity. A primary driver is the accelerating shift towards digitalization, transforming traditionally manual, localized auctions into scalable, transparent online global marketplaces. This technological pivot enhances access to liquidity for sellers and drastically expands inventory selection for buyers, transcending geographical limitations. Simultaneously, the sustained global increase in used vehicle demand, fueled by macroeconomic pressures favoring affordable alternatives over expensive new cars, ensures a consistently high volume of vehicles entering the remarketing channel. These drivers are bolstered by the institutional need for efficient asset disposition mechanisms among leasing companies, banks, and large corporate fleets, making the auction house a non-negotiable component of their asset recovery strategy. The aggregate force of these drivers pushes the market toward higher volumes, faster transactional speeds, and greater overall market value creation.

Conversely, the market faces significant restraints that temper growth, primarily centered around trust, logistics, and regulatory complexity. Historically, buyer confidence in vehicle condition reports remains a major hurdle, particularly in fully online sales where buyers cannot physically inspect the asset. While AI is mitigating this, concerns about non-disclosure or latent defects persist. Furthermore, managing the complex logistics of cross-country or international vehicle transport, including the associated costs, administrative burdens, and potential for transit damage, restrains the ease of global market integration. Regulatory hurdles, particularly varying national and state laws regarding titling, emissions standards, and consumer protection in different jurisdictions, necessitate significant operational customization and often restrict the seamless flow of inventory, increasing the operational friction for multinational auction platforms and impacting the profitability of certain cross-border segments.

The principal opportunities lie in harnessing advanced technology and exploiting untapped inventory sources. The development and implementation of blockchain technology offer a massive opportunity to create immutable, transparent vehicle history records, potentially resolving the industry's pervasive trust deficit and revolutionizing Condition Report accuracy. Opportunities also exist in expanding auction services into adjacent financial technologies (FinTech), providing integrated floor-plan financing and instant payment services directly within the auction platform, capturing additional revenue streams. The potential for growth in the salvage and total-loss segment, driven by increasingly complex and costly vehicle repairs, presents another opportunity, requiring specialized auction formats and buyer networks. The cumulative Impact Forces emphasize efficiency, technology adoption (specifically AI/GEO compliance), and regulatory navigation as the key competitive differentiators, favoring platforms that can offer end-to-end, trustworthy, and logistically optimized remarketing solutions.

Segmentation Analysis

The Car Auction Market is rigorously segmented based on key operational and market characteristics to provide granular insights into consumer behavior, technology adoption, and growth trajectories. The primary segmentation divides the market based on the Transaction Channel (Physical vs. Online/Digital), Buyer Type (B2B, B2C, C2B), and Vehicle Type (Used vs. Salvage). This structure allows market participants, from financial analysts to operational managers, to accurately target specific needs and tailor service offerings. The fastest-growing segments typically involve digital transactions, reflecting the industry's adaptation to remote sales capabilities, enhanced data transparency, and the professional buyer's need for inventory sourcing efficiency that transcends local geography. Understanding these segments is critical for strategizing investment in platform technology, optimizing logistical networks, and developing targeted marketing campaigns aimed at institutional sellers or wholesale dealership networks seeking volume throughput.

Further granularity in segmentation involves distinguishing between the types of sellers (e.g., Fleet/Lease companies, Financial Institutions, Independent Dealers, Government Agencies) and the nature of the auction (e.g., Open Auctions vs. Closed Dealer-Only Sales). Dealer-only auctions, characterized by high-volume, standardized inventory and strict membership criteria, remain a core revenue driver for large auction houses, ensuring a professional trading environment. The segmentation by geography also plays a pivotal role, acknowledging the vast differences in regulatory environments, consumer preferences, and vehicle specifications across regions like North America, which has highly standardized auction practices, versus Asia Pacific, where market structures are rapidly evolving and increasingly favoring mobile-enabled transactions. This multi-dimensional segmentation provides a robust framework for assessing market risk and identifying high-potential niches, such as the growing demand for specialty vehicle auctions (e.g., classic cars or heavy-duty trucks) which often utilize hybrid physical and online formats to attract a global buyer base.

- By Channel:

- Physical Auctions (In-Lane)

- Online Auctions (Digital/Virtual)

- Hybrid Auctions (Simulcast)

- By Vehicle Type:

- Used Vehicles (Whole Car)

- Salvage Vehicles (Total Loss)

- Specialty Vehicles (Classic, Heavy Duty, Motorcycles)

- By Buyer Type:

- Business-to-Business (B2B): Dealer, Dismantler, Exporter

- Business-to-Consumer (B2C)

- Consumer-to-Business (C2B)

- Institutional Buyers (Insurance, Fleet, Government)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Car Auction Market

The value chain of the Car Auction Market is an intricate process designed for high-efficiency asset monetization, starting with upstream activities focused on vehicle sourcing and preparation. Upstream analysis involves sellers—primarily fleet companies, financial institutions, and dealers—deciding on the remarketing channel. Key activities here include vehicle recovery (in the case of repossession), initial inspection, and scheduling for auction. The core value addition at this stage is the creation of a comprehensive and accurate vehicle condition report (CR), which requires detailed physical inspections, standardized digital documentation, and title verification. The efficiency and credibility of the upstream CR process are foundational, as they directly impact buyer trust and the ultimate realized auction price, emphasizing the importance of independent, third-party inspection services or highly standardized in-house procedures leveraging advanced imaging technology.

The midstream phase focuses on the auction platform operation itself, representing the core value exchange mechanism. This involves platform management, marketing the vehicles to a qualified buyer base, managing the bidding process (either physically in-lane or digitally), and executing the sale. Critical value drivers in the midstream include the robustness and speed of the online bidding platform, the quality of digital imagery and virtual inspection tools, and the effective management of reserve prices and auction formats (e.g., timed auctions, sealed bids). Distribution channels are primarily bifurcated into direct sales via the auction platform (facilitated by major entities like Manheim or IAA) and indirect channels utilizing smaller regional auction houses or specialized software providers that white-label auction technology to financial institutions. The effectiveness of this phase is measured by conversion rates and the efficiency of price discovery.

Downstream analysis encompasses post-sale activities essential for completing the transaction and delivering the asset to the buyer. This includes managing payment processing, handling regulatory paperwork (such as title transfer and registration), and organizing logistics and transportation. Downstream value creation is significantly enhanced by offering integrated services such as floor-plan financing for dealers, insuring the vehicle during transit, and providing multi-modal logistics options (rail, truck, or port delivery). The direct channel, through integrated auction providers, offers seamless post-sale workflow management, where payment, title, and logistics are coordinated through a single platform. The indirect channel often requires buyers to manage these services separately or through third-party providers, introducing greater friction. Optimizing these downstream services is critical for customer retention and overall market competitiveness, especially as efficiency in delivery time becomes a major differentiating factor.

Car Auction Market Potential Customers

The primary consumers of the Car Auction Market are highly diversified professional entities, ranging from small independent used car dealerships to large, multi-national franchise groups and institutional dismantlers. These potential customers leverage the auction environment as their principal, high-volume inventory sourcing mechanism. For dealers, the auction provides a crucial pipeline of vehicles that cannot be easily sourced through trade-ins or local purchases, allowing them to precisely fill specific gaps in their retail inventory based on geographic demand, vehicle segment, and pricing strategy. The B2B nature of the market ensures a consistent, regulated supply that is essential for maintaining retail floor consistency, making the independent dealer segment one of the most frequent and transactionally intensive customer bases for auction houses globally. Their focus is overwhelmingly on whole-car, retail-ready units with clear titles and accurate condition reports.

Another significant group of potential customers includes institutional buyers, comprising salvage yards, remanufacturers, parts exporters, and specialized rebuilders. This segment predominantly utilizes salvage auctions, purchasing vehicles that have been deemed total losses by insurance companies. Their buying decisions are driven by the value of the components, specific structural damage, or regulatory compliance for export, rather than retail readiness. For example, large dismantling operations utilize online platforms to source geographically dispersed salvage vehicles efficiently, stripping them for reusable parts or recycling materials. This customer base is highly price-sensitive and requires transparent information regarding the extent of damage and specific component integrity. They represent a stable, high-volume segment crucial for insurance companies needing to liquidate damaged assets quickly and efficiently to close out claim liabilities.

Finally, fleet operators and large rental companies frequently participate as both sellers and buyers, representing an important bi-directional customer relationship. While they primarily utilize auctions to dispose of vehicles at the end of their service life, they also occasionally use auction platforms to acquire short-term inventory for specific operational needs or to source specialty vehicles. Emerging customer segments include digital-first retailers (like Carvana or Vroom), who use auction systems, often through private exchange formats, to source large volumes of inventory for their centralized reconditioning centers, requiring high levels of integration between the auction platform’s inspection data and their proprietary inventory management systems. This segment demands transactional speed, scalable logistics, and guaranteed data integrity, representing the future of high-tech auction customer requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $750.4 Billion USD |

| Market Forecast in 2033 | $1,180.9 Billion USD |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Manheim (Cox Automotive), KAR Auction Services (ADESA), Copart Inc., IAA Inc., Ritchie Bros. Auctioneers, BCA Marketplace, Sothebys, Barrett-Jackson, ACV Auctions, Openlane (formerly TradeRev), Autovista Group, eBay Motors, Jiji.ng, Japan Auction System (JAS), Pickles Auctions, Auction Technology Group, Cars & Bids, Hemmings Auctions, Wilsons Auctions, Europcar Mobility Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Car Auction Market Key Technology Landscape

The technological landscape of the Car Auction Market is dominated by advancements aimed at replicating and enhancing the physical inspection and bidding experience within a digital framework, fundamentally driven by the need for scalability and data fidelity. Key technologies include high-fidelity imaging systems, often leveraging 360-degree photography and integrated video clips, to provide buyers with a virtual walk-around experience that minimizes the perceived risk of remote purchasing. Crucially, sophisticated Condition Report (CR) generation software, frequently integrated with AI and machine learning tools, automatically annotates and grades vehicle damage, standardizing reporting across disparate inventory sources. Mobile applications are also pivotal, providing professional buyers with the ability to participate in high-frequency, real-time auctions remotely, receive personalized notifications, and manage their watch lists and bids efficiently, transforming the procurement process from a location-dependent activity to an on-the-go workflow.

Furthermore, data analytics and predictive modeling form the backbone of modern auction operations, moving beyond simple listing services to offering high-value advisory tools. Platforms utilize Big Data processing capabilities to aggregate millions of transactional records, external market data, and proprietary inspection scores to feed into advanced AI pricing engines. These engines dynamically adjust reserve prices and provide sellers with actionable insights regarding optimal time-to-market, ensuring maximized recovery value. For buyers, similar analytical tools offer competitive intelligence, calculating expected hammer prices and providing real-time assessments of competitive bidding pressure. The integration of robust cybersecurity measures, including multi-factor authentication and blockchain-based title verification, is equally critical to protect high-value transactions and maintain institutional trust, particularly as cross-border electronic commerce accelerates and the risks associated with cyber threats increase across the financial technology sector.

Emerging technologies, while still maturing, are set to significantly reshape the next generation of car auctions. The implementation of Augmented Reality (AR) and Virtual Reality (VR) is beginning to offer immersive inspection environments, allowing buyers to virtually ‘step inside’ a vehicle and inspect defects in 3D space, which is expected to drastically improve confidence in expensive, high-spec vehicles. Blockchain technology is also being piloted for securing vehicle ownership history and maintenance records, promising an immutable and universally verifiable record that eliminates concerns about mileage tampering and hidden damage, a critical factor for wholesale buyers. Additionally, specialized telematics data integration allows auction houses to offer real-time health and usage data on vehicles, particularly for fleet returns, providing an unprecedented level of transparency and accurate assessment of mechanical condition far superior to traditional physical inspection methods.

Regional Highlights

- North America (United States & Canada): Dominates the global market in terms of transactional value and technological maturity. Characterized by a highly institutionalized auction system, major players like Manheim and KAR Auctions maintain vast physical infrastructures complemented by leading digital platforms. The market here is driven by high volumes of lease returns and fleet turnover, demanding rapid, highly efficient digital remarketing solutions, and leading the global adoption of AI-driven pricing and digital condition reporting standards. The B2B segment is overwhelmingly dominant, supported by robust financing and logistics networks.

- Europe (Germany, UK, France): Characterized by market fragmentation due to varied national regulations, language barriers, and highly diverse vehicle specifications. European auctions are increasingly focused on cross-border transactions, facilitated by digital platforms that streamline documentation and compliance across the EU. The UK remains a key hub, particularly for used vehicle exports. There is a strong emphasis on high-value, closed dealer-only sales, and the market shows a rapid shift toward fully online sales channels, reducing the reliance on centralized physical mega-sites.

- Asia Pacific (APAC - China, Japan, Australia): Represents the fastest-growing region, driven by the explosive growth in used vehicle sales, particularly in emerging markets like China and India, where formal wholesale channels are rapidly replacing informal trade. Japan and Australia maintain mature, high-volume auction systems (e.g., USS in Japan) known for strict grading standards. The APAC region is experiencing significant mobile-first adoption in bidding and inspection, targeting the high number of buyers who access the internet primarily via smartphones. Investment in localized physical auction capacity is also expanding to handle increased used car inventory.

- Latin America (LATAM - Brazil, Mexico): An emerging market for formal car auctions, transitioning from highly fragmented, opaque trade practices to standardized, transparent auction models. Growth is primarily concentrated in major metropolitan areas, focused on managing repossessed vehicles for financial institutions. The market is highly sensitive to macroeconomic stability but presents massive untapped potential for digitalization and institutional adoption of auction best practices to improve transactional security.

- Middle East and Africa (MEA): This region is crucial for vehicle export markets, driving demand for both whole cars and salvage vehicles, particularly from North American and European sources. Auctions in the MEA, particularly in the UAE (a key trade hub), focus on serving international buyers and often specialize in high-spec, luxury, or large 4x4 vehicles. The domestic market in large countries like South Africa is also developing localized, formal auction structures to handle insurance claims and corporate fleet sales efficiently.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Car Auction Market.- Manheim (Cox Automotive)

- KAR Auction Services (ADESA)

- Copart Inc.

- IAA Inc.

- Ritchie Bros. Auctioneers

- BCA Marketplace

- Sothebys

- Barrett-Jackson

- ACV Auctions

- Openlane (formerly TradeRev)

- Autovista Group

- eBay Motors

- Jiji.ng

- Japan Auction System (JAS)

- Pickles Auctions

- Auction Technology Group

- Cars & Bids

- Hemmings Auctions

- Wilsons Auctions

- Europcar Mobility Group

- Hertz Global Holdings (Fleet Disposition Services)

- Hyundai Glovis

- Apac Auction

- Motorway

- Vauto (Cox Automotive)

- Trade Me Motors

- Autorola Group

Frequently Asked Questions

Analyze common user questions about the Car Auction market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between physical and online car auctions?

Physical auctions (in-lane) facilitate direct inspection and immediate negotiation, often favoring local dealers. Online auctions offer global access, higher transactional volume capacity, 24/7 availability, and utilize advanced digital tools like AI condition reporting, appealing to remote and high-frequency institutional buyers focused on logistics efficiency and lower overhead costs. The shift to digital is accelerating due to superior data integration and market reach.

How does AI technology impact vehicle pricing accuracy in auction settings?

AI significantly enhances pricing accuracy by deploying predictive models that analyze historical sales data, real-time market supply, geographical demand, and detailed vehicle specifications (e.g., trim level, damage severity). This dynamic pricing capability helps sellers optimize reserve prices to maximize profit realization and ensures buyers are bidding on a vehicle valued accurately against current market conditions, reducing risk associated with traditional subjective appraisals.

Who are the major institutional sellers utilizing car auction platforms?

Major institutional sellers include large financial institutions, captive finance companies, and leasing firms disposing of off-lease or repossessed vehicles; major rental car agencies managing fleet turnover; insurance companies liquidating salvaged or total-loss vehicles; and large OEM manufacturers remarketing program cars. These entities require the regulatory compliance and high-volume capacity offered by established auction houses.

What role does the Condition Report (CR) play in digital car auctions?

The Condition Report is the most critical element in digital auctions, serving as the buyer’s primary source of information regarding the vehicle’s mechanical, cosmetic, and structural integrity since physical inspection is often impossible. An accurate, standardized CR, often validated using computer vision AI, is essential for establishing buyer trust, mitigating transactional disputes, and supporting cross-border sales where physical viewing is impractical, thereby unlocking greater liquidity.

What are the key growth drivers for the Car Auction Market in the Asia Pacific (APAC) region?

The primary growth drivers in APAC are the rapid formalization of the used car wholesale segment, driven by increasing vehicle ownership rates and a growing middle class, leading to higher volumes of trade-in and used inventory. Accelerated adoption of mobile-based auction platforms and the professionalization of local dealer networks also contribute significantly, as sophisticated digital tools improve transparency and trust, stimulating both domestic and intra-regional wholesale trade.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager