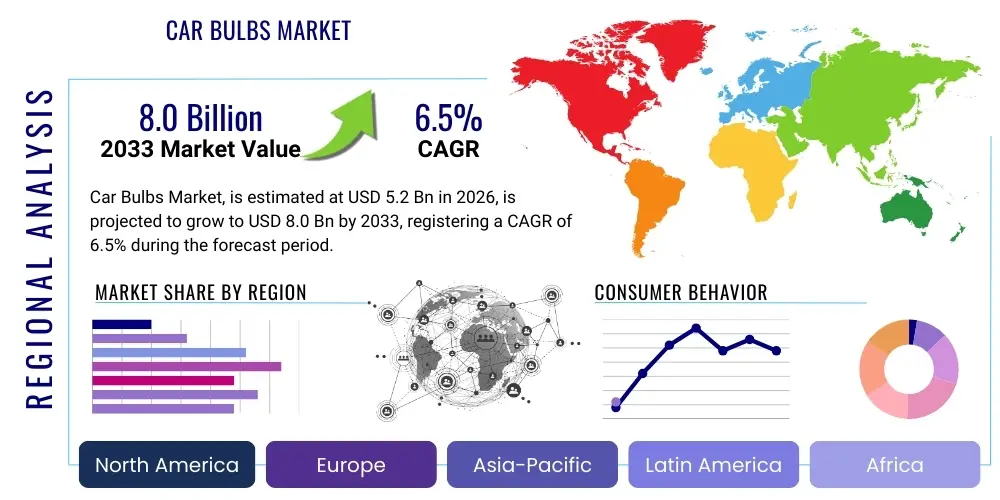

Car Bulbs Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439168 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Car Bulbs Market Size

The Car Bulbs Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $5.2 Billion in 2026 and is projected to reach $8.0 Billion by the end of the forecast period in 2033.

Car Bulbs Market introduction

The Car Bulbs Market encompasses the manufacturing, distribution, and sale of various lighting sources—including traditional halogen, modern Light Emitting Diodes (LEDs), and high-intensity discharge (HID) or Xenon lamps—specifically designed for automotive applications. These components are critical for both external lighting (headlights, tail lights, fog lights, turn signals) ensuring safety and visibility, and internal lighting (dashboard, cabin illumination). The product range has seen a significant evolutionary shift, moving from simple filament-based technology to complex, highly efficient semiconductor solutions, driven primarily by stringent global safety regulations requiring better road illumination and the aesthetic demands of modern vehicle design.

Major applications of car bulbs extend across passenger vehicles, commercial vehicles, and heavy-duty trucks, servicing both the Original Equipment Manufacturer (OEM) segment during new vehicle production and the vast aftermarket segment for replacement and upgrade purposes. The transition towards solid-state lighting (LED) has provided substantial benefits, including enhanced energy efficiency, significantly longer lifespan, and greater design flexibility for automakers. Furthermore, advanced features like adaptive headlights and matrix LED systems are becoming standard in premium and mid-range vehicles, pushing the average unit price and total market valuation upwards.

Key driving factors for market expansion include the continuous increase in global vehicle production, particularly in emerging economies, coupled with rigorous government mandates regarding vehicle lighting performance and pedestrian safety standards. The necessity for routine replacement of traditional halogen bulbs in the existing fleet continues to fuel the aftermarket, while the rising adoption of electric vehicles (EVs) favors energy-saving LED technology, further accelerating the market's technological evolution and growth trajectory over the forecast period.

Car Bulbs Market Executive Summary

The Car Bulbs Market is undergoing a rapid technological transformation, shifting decisively away from legacy lighting technologies toward advanced semiconductor-based solutions, particularly LEDs. Current business trends indicate a strong focus on strategic partnerships between lighting manufacturers and high-volume automotive OEMs to integrate complex, smart lighting systems early in the design phase, thus securing lucrative long-term contracts. The aftermarket remains robust, driven by the replacement cycle of the global vehicle parc, though competitive pricing pressure is intense among traditional suppliers. Furthermore, sustainability mandates and the push for reduced power consumption are dictating R&D investment, favoring companies that can deliver highly efficient, durable lighting modules tailored for electric vehicle architectures.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by burgeoning automotive manufacturing hubs in China, India, and Southeast Asia, and escalating vehicle ownership rates. While Europe and North America represent mature markets, growth here is dominated by the premium segment, focusing on high-end features like Adaptive Driving Beam (ADB) technology and aesthetic customization, coupled with stringent regulatory updates like the phasing out of inefficient light sources. Latin America and the Middle East and Africa (MEA) present expanding aftermarket opportunities, necessitated by challenging road conditions and higher rates of component wear and tear, though infrastructure limitations sometimes hinder rapid adoption of the newest, most sophisticated lighting systems.

Segment trends confirm the dominant position of the LED segment, which is expected to capture the highest market share by the end of the forecast period, replacing halogen and Xenon bulbs across most vehicle classes due to superior performance characteristics and cost optimization realized through mass production. The OEM segment is outpacing the aftermarket in terms of value growth, driven by the integration of complex modules and smart lighting features into new vehicles, requiring higher value-per-unit sales. This segmentation shift reflects the broader automotive industry move towards digitalization and enhanced safety features, positioning lighting as an integral component of vehicle intelligence rather than just a basic functional requirement.

AI Impact Analysis on Car Bulbs Market

User inquiries regarding AI's impact on car bulbs predominantly center on how Artificial Intelligence facilitates advanced functionality, specifically concerning safety, visibility optimization, and predictive maintenance. Common questions analyze the integration of AI with sensors for adaptive lighting (how AI determines beam patterns based on real-time traffic and weather), the role of machine learning in optimizing bulb longevity and efficiency, and the potential for AI-driven fault detection within complex lighting systems. Users are keen to understand if AI will lead to entirely personalized or predictive illumination experiences, moving beyond current automatic high-beam features. The overarching theme is the expectation that AI will transform car bulbs from simple components into sophisticated, reactive safety features, potentially leading to increased complexity and higher replacement costs, simultaneously demanding greater supply chain efficiency and reliability from manufacturers.

- AI enhances Adaptive Driving Beam (ADB) systems by processing multi-sensor data (camera, radar) in real-time to precisely shape the light beam, maximizing visibility without dazzling oncoming drivers.

- Machine learning algorithms are being used in manufacturing to optimize LED chip performance, predict failure points based on thermal stress data, and improve quality control during assembly.

- Predictive maintenance platforms integrate AI to monitor the health of high-value lighting modules, alerting drivers or fleet managers before potential bulb or component failure occurs, reducing unexpected downtime.

- AI-driven optimization contributes to energy management, ensuring that lighting systems in electric vehicles utilize minimal power consumption while maintaining regulatory brightness standards, thus extending battery range.

- Artificial Intelligence facilitates dynamic lighting aesthetics (car-to-car communication) through complex, customizable light signatures that require sophisticated computational control over individual LED pixels or arrays.

DRO & Impact Forces Of Car Bulbs Market

The market dynamics are governed by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and associated impact forces that shape investment and strategic decisions. Primary drivers include increasingly stringent global safety standards, particularly mandates in regions like the EU and North America requiring superior illumination performance to mitigate nighttime accidents, forcing OEMs to adopt advanced LED and matrix lighting systems. Furthermore, the global proliferation of electric vehicles (EVs) acts as a significant driver, as EVs require highly energy-efficient lighting solutions (LEDs) to conserve battery life, cementing the transition away from power-intensive halogen technology. The continuous need for replacement parts due to the natural lifespan expiration of installed bulbs ensures steady volume demand in the aftermarket segment, regardless of new vehicle sales cycles.

Conversely, the market faces significant restraints. The high initial cost of advanced lighting technologies, such as complex matrix LED systems, presents a barrier to entry for budget or entry-level vehicle segments, limiting overall penetration rates. Furthermore, the complexity of integrating these smart lighting systems, which often require sophisticated electronic control units (ECUs) and software, increases maintenance costs and complexity for mechanics, slowing adoption in the independent aftermarket. Additionally, regulatory fragmentation across major global markets regarding specific lighting intensity and beam pattern rules (e.g., historical restrictions on ADB use in the US) can impede product standardization and global supply chain efficiency for manufacturers.

Opportunities for growth are abundant, particularly in the development of next-generation solid-state lighting, including Organic LEDs (OLEDs) and Micro-LEDs, which offer unprecedented design freedom and energy efficiency for futuristic vehicle architectures. The emerging trend of vehicle personalization and customization, where lighting is used as a critical aesthetic and branding element, provides lucrative avenues for premium lighting suppliers targeting the luxury and high-performance segments. Impact forces are strong and multifaceted, primarily exerted by technological shifts (LED dominance), governmental regulatory bodies (safety mandates), and evolving consumer expectations (demand for enhanced visibility and aesthetic appeal). The rapid speed of innovation in semiconductors necessitates continuous R&D investment, pressuring smaller manufacturers while benefiting large, technologically advanced market leaders capable of handling the convergence of hardware, software, and optics.

Segmentation Analysis

The Car Bulbs Market is predominantly segmented based on Product Type, Application, Technology, Sales Channel, and Vehicle Type. Product type segmentation distinguishes between exterior and interior lighting elements, where exterior lighting—critical for safety—commands the majority of the market value. Application analysis separates the market into headlights, tail lights, fog lights, and interior dome lights, with headlight units being the highest revenue generator due to the complexity and high-tech integration required. The technological division, arguably the most critical segmenting factor, highlights the shift from traditional Halogen to increasingly dominant LED and niche Xenon/HID categories, directly reflecting the market's technological maturity and future trajectory.

- Product Type:

- Exterior Lighting (Headlights, Tail Lights, Fog Lights, Indicators)

- Interior Lighting (Dashboard Lights, Dome Lights, Ambient Lighting)

- Technology:

- Halogen Bulbs

- Light Emitting Diodes (LED)

- High-Intensity Discharge (HID) / Xenon Bulbs

- Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Replacement and Upgrade)

- Vehicle Type:

- Passenger Vehicles (PC)

- Commercial Vehicles (CV)

- Electric Vehicles (EV)

Value Chain Analysis For Car Bulbs Market

The value chain of the Car Bulbs Market begins with upstream activities focused on raw material procurement, which primarily involves specialized components such as tungsten filaments (for halogen), quartz glass, rare earth metals, semiconductor chips (LED dies), and optical plastics/lenses. Upstream analysis highlights the dependence on a few specialized suppliers for high-quality semiconductor components and LED drivers, subjecting manufacturers to input cost fluctuations and supply bottlenecks, particularly in the semiconductor sector. Innovation at this stage focuses on enhancing luminous efficacy and minimizing heat dissipation for LEDs, which requires significant R&D investment in material science and thermal management solutions.

Midstream activities encompass the core manufacturing and assembly processes, where key players convert raw materials into finished lighting units and modules, including the integration of bulbs with housings and electronic control systems for smart lighting features. Due to the high precision required for optimal light beam output and adherence to safety standards, manufacturing facilities are often highly automated and regulated. The competitive landscape in the midstream is intense, with global leaders leveraging scale and proprietary optical engineering expertise to maintain efficiency and quality across diverse product lines, catering specifically to OEM specifications for new vehicle platforms.

Downstream analysis focuses on distribution channels, including direct sales to OEMs and sales through independent distributors, wholesalers, and retailers for the aftermarket. Direct distribution to OEMs is characterized by long-term contracts and strict quality compliance, whereas aftermarket distribution relies heavily on efficient logistics networks, brand recognition, and competitive pricing. The rise of e-commerce has significantly altered indirect channels, allowing specialized and performance lighting brands to reach end-consumers directly. Effective supply chain management is crucial at this stage to ensure timely delivery of high-volume, low-margin replacement products, as well as the specialized, high-margin, complex lighting modules required by OEMs.

Car Bulbs Market Potential Customers

The primary customer base for the Car Bulbs Market can be segmented into two distinct but overlapping categories: the Original Equipment Manufacturers (OEMs) and the End-Users/Consumers procuring products through the Aftermarket. OEMs constitute the highest value customer segment, purchasing large volumes of sophisticated lighting modules directly for integration into new vehicle production lines. These customers demand highly specific technical compliance, exceptional reliability, multi-year supply contracts, and often require tailored R&D collaboration for unique vehicle designs and advanced features like dynamic signal lighting and adaptive front-lighting systems (AFS). Their purchasing decisions are driven by safety regulations, vehicle platform costs, and aesthetic differentiation.

The Aftermarket potential customers include independent garages, service centers, specialty repair shops, automotive parts retailers (both physical and online), and individual vehicle owners. This segment focuses primarily on replacement bulbs and upgrade kits. For replacement purposes, consumers prioritize longevity, ease of installation, and cost-effectiveness, particularly for standard halogen and basic LED units. For upgrade kits, customers seek performance enhancements (brighter light output, specific color temperatures) and aesthetic improvements, driving demand for premium LED and performance halogen products. Fleet operators and commercial vehicle companies also represent a significant customer group within the aftermarket, prioritizing durability and low total cost of ownership (TCO) to minimize vehicle downtime.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.2 Billion |

| Market Forecast in 2033 | $8.0 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | OSRAM GmbH (AMS OSRAM), Philips Lighting (Signify N.V.), Hella GmbH & Co. KGaA, Koito Manufacturing Co., Ltd., Stanley Electric Co., Ltd., Magneti Marelli S.p.A. (Marelli), Valeo S.A., SL Corporation, Ichikoh Industries, General Electric Company (GE Lighting), PIAA Corporation, Phoenix Lighting, Bosch GmbH, Zizala Lichtsysteme GmbH, Federal-Mogul LLC, Candex Lighting, Sammoon Lighting Co. Ltd., Xingyu Automotive Lighting Systems Co., Ltd., Grupo Antolin, L&W Light Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Car Bulbs Market Key Technology Landscape

The technological landscape of the Car Bulbs Market is currently dominated by the accelerated adoption of Light Emitting Diode (LED) technology, which has fundamentally redefined automotive lighting performance and design flexibility. LEDs offer unparalleled advantages over conventional halogen and Xenon bulbs, primarily through superior energy efficiency, which is vital for the increasing fleet of electric and hybrid vehicles, and significantly extended operational lifespan, reducing maintenance burdens. Furthermore, the compact size and modular nature of LEDs enable sophisticated applications such as matrix lighting and digital light processing (DLP) systems, allowing for precise control over individual light pixels to create highly adaptive and glare-free high beams, a key innovation driving premium segment growth and mandatory safety enhancements.

Beyond standard LED implementation, the frontier of innovation lies in Smart Lighting Systems and Advanced Driver-Assistance Systems (ADAS) integration. Smart lighting utilizes integrated sensors, cameras, and software algorithms (often AI-enhanced) to automatically adjust beam patterns and intensity based on driving conditions, speed, surrounding traffic, and geographical data. Technologies like Adaptive Driving Beam (ADB) are rapidly maturing, moving from high-end models to mass-market vehicles, increasing the value complexity of the component. This shift transforms the car bulb component from a passive light source into an active safety feature, requiring robust communication protocols and integration with the vehicle's central electronics architecture.

Emerging technologies, while not yet mass-market, promise further disruption. Organic Light Emitting Diodes (OLEDs) are gaining traction, particularly in rear lighting applications, due to their ultra-thin profile, uniform light distribution, and ability to create dynamic, three-dimensional light signatures, offering superior styling opportunities. Micro-LEDs, still largely in the research phase for automotive exterior lighting, hold the potential to deliver even greater resolution, efficiency, and brightness for future high-definition headlamp systems. Thermal management remains a critical technological challenge for high-power LED arrays; continuous improvements in heat dissipation materials and designs are essential to ensure the longevity and stable performance of sophisticated lighting modules under diverse operating conditions.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, primarily driven by massive vehicle production volumes in China, which serves both domestic demand and export markets, and the rapid expansion of automotive manufacturing in India, South Korea, and Japan. The demand in APAC is bifurcated: high-volume, cost-sensitive replacement demand in emerging economies, alongside a booming luxury segment in countries like Japan and China that drives early adoption of advanced LED and matrix lighting systems. Strict implementation of new vehicle safety standards, particularly concerning pedestrian visibility in densely populated urban centers, further accelerates the adoption of high-performance lighting solutions across the region.

- Europe: Europe is characterized by a strong regulatory push for high-end safety features and low-energy consumption, making it a mature market highly focused on LED technology, ADB, and sophisticated lighting aesthetics. Regulatory milestones, such as revisions to the UN Regulation No. 48 and the phasing out of inefficient bulbs, underpin consistent OEM demand for advanced solutions. The region acts as a hub for premium and luxury vehicle manufacturing, sustaining high average selling prices (ASPs) for advanced lighting modules, and leading global trends in aesthetic automotive lighting design.

- North America (NA): North America has historically maintained a unique regulatory environment, though recent changes (like the NHTSA allowing ADB technology) are expected to unlock significant growth potential for smart lighting integration in the OEM segment. The market is defined by a strong consumer preference for durability and performance, especially in the aftermarket, where robust replacement demand exists, driven by long driving distances and diverse climatic conditions. The rapid shift toward electric vehicles in the US and Canada is a major accelerator for energy-efficient LED technology adoption.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions represent significant growth opportunities for the aftermarket, driven by the replacement needs of an aging vehicle fleet and challenging road infrastructure that necessitates reliable and durable lighting. While initial adoption of cutting-edge OEM technologies is slower due to cost considerations, steady urbanization and increasing disposable incomes are gradually facilitating the shift toward higher quality, non-halogen replacement options. MEA, particularly the Gulf Cooperation Council (GCC) states, shows high potential due to demand for high-end European and Japanese vehicles that come equipped with standard advanced lighting systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Car Bulbs Market.- OSRAM GmbH (AMS OSRAM)

- Philips Lighting (Signify N.V.)

- Hella GmbH & Co. KGaA

- Koito Manufacturing Co., Ltd.

- Stanley Electric Co., Ltd.

- Magneti Marelli S.p.A. (Marelli)

- Valeo S.A.

- SL Corporation

- Ichikoh Industries

- General Electric Company (GE Lighting)

- PIAA Corporation

- Phoenix Lighting

- Bosch GmbH

- Zizala Lichtsysteme GmbH

- Federal-Mogul LLC

- Candex Lighting

- Sammoon Lighting Co. Ltd.

- Xingyu Automotive Lighting Systems Co., Ltd.

- Grupo Antolin

- L&W Light Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Car Bulbs market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift from Halogen to LED technology in the automotive industry?

The shift is primarily driven by superior efficiency, enhanced longevity, and stringent regulatory safety requirements. LEDs consume significantly less power, crucial for electric vehicles, and offer greater luminous efficacy (brightness per watt), directly improving driver visibility and adherence to high-performance lighting standards mandated globally. Furthermore, the compact size of LEDs allows for greater design freedom for sophisticated, modern vehicle aesthetics.

How do global regulations impact the design and sale of advanced car bulbs?

Global regulations, particularly those established by UNECE and NHTSA (in the U.S.), directly dictate light intensity, beam pattern, and component quality. These regulations compel manufacturers to invest heavily in complex technologies like Adaptive Driving Beams (ADB) to meet improved visibility targets while ensuring minimum glare for oncoming traffic. Regulatory alignment, such as the recent US adoption of ADB standards, is a critical factor influencing product marketability and standardization.

Which market segment, OEM or Aftermarket, offers the highest growth potential for car bulb manufacturers?

While the Aftermarket provides consistent volume growth through necessary replacement cycles, the OEM segment offers higher value growth. This is because OEM transactions involve complex, integrated, and high-margin lighting modules (like matrix LEDs and full headlight assemblies) mandated for new vehicle platforms, driving up the average revenue per unit significantly more than simple replacement bulbs sold through the aftermarket.

What role does the adoption of electric vehicles (EVs) play in the Car Bulbs Market?

EV adoption is a major catalyst for the LED segment. Since lighting systems in EVs must minimize power drain to maximize driving range, energy-intensive lighting sources like Halogen are rapidly being phased out. LEDs are the standard choice for EVs due to their superior efficiency, ensuring that the lighting system has a minimal detrimental impact on the vehicle's critical battery performance metrics.

What are the primary challenges faced by manufacturers in producing advanced smart lighting systems?

The main challenges involve managing the complexity of integration, ensuring thermal management, and mitigating high component costs. Advanced systems require seamless integration with sophisticated Electronic Control Units (ECUs) and vehicle software, demanding cross-disciplinary expertise. Moreover, high-power LEDs generate significant heat, requiring complex thermal solutions to maintain performance and lifespan, adding to the manufacturing complexity and overall unit cost.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager