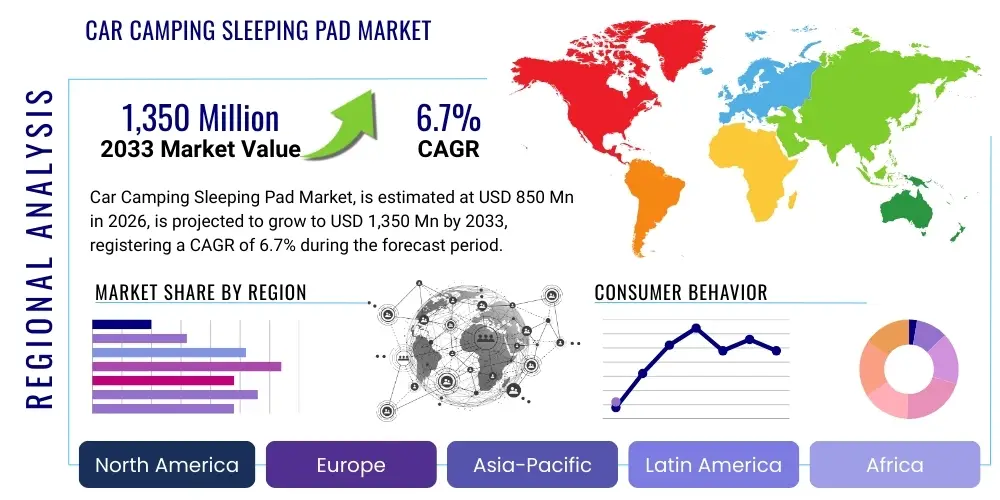

Car Camping Sleeping Pad Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435964 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Car Camping Sleeping Pad Market Size

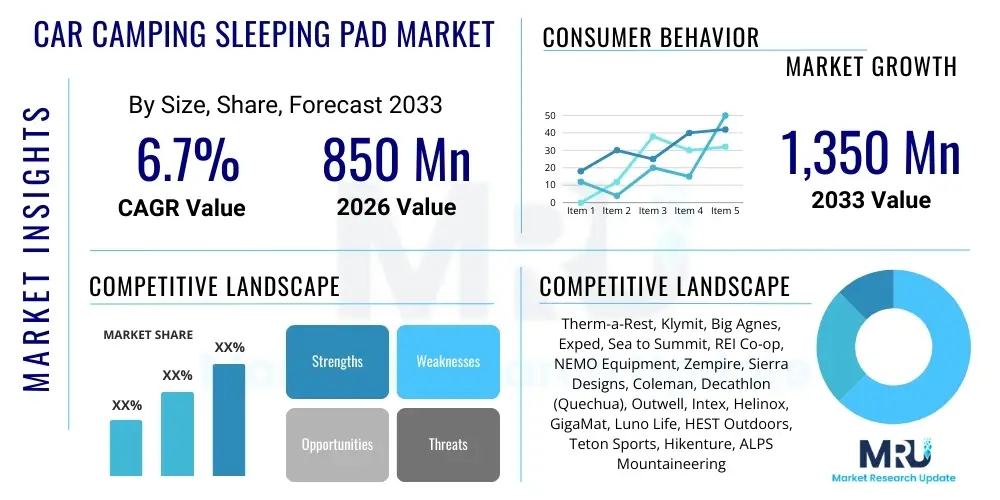

The Car Camping Sleeping Pad Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,350 Million by the end of the forecast period in 2033.

Car Camping Sleeping Pad Market introduction

The Car Camping Sleeping Pad Market encompasses specialized inflatable or foam insulation mattresses designed for comfort and thermal regulation during vehicle-based outdoor adventures. These pads are distinct from traditional backpacking pads primarily due to their emphasis on thickness, durability, and luxury features, sacrificing minimal weight savings for superior comfort. Key product features include high R-values (thermal resistance), advanced self-inflating mechanisms, and robust, puncture-resistant outer materials like heavy-denier polyester or nylon. The primary goal of these products is to replicate the comfort of a home mattress within the confines of a car, van, or rooftop tent setup, catering specifically to the booming overlanding and "van life" segments.

Major applications for car camping sleeping pads span recreational vehicle travel, family camping trips where bulkiness is not a constraint, and specialized overlanding expeditions requiring reliable insulation against varied ground temperatures. The burgeoning popularity of outdoor recreation coupled with technological advancements in foam lamination and valve design drives market expansion. Consumers increasingly seek hybrid designs that combine the packability of air pads with the insulation properties of open-cell foam, ensuring maximum sleeping quality in diverse environments, from deserts to high-altitude campsites.

The core benefits derived from utilizing these products include enhanced thermal insulation, crucial for maintaining body heat and preventing energy loss, and superior pressure distribution, significantly improving sleep quality compared to thinner alternatives. Driving factors include rising disposable incomes in developed nations, the societal shift towards experiential travel (e.g., glamping and car-based exploration), and intense product innovation focused on sustainability, ease of use, and improved ergonomic design. The market is highly competitive, focusing on differentiating features such as integrated pillows, multi-chamber air systems, and rapid deflation technology.

Car Camping Sleeping Pad Market Executive Summary

The Car Camping Sleeping Pad Market is characterized by robust growth, primarily fueled by shifting consumer preferences towards high-comfort outdoor accommodation solutions and the exponential expansion of the overlanding and recreational vehicle (RV) market segments globally. Business trends highlight a strong focus on premiumization, with manufacturers investing heavily in materials science to develop lighter yet more durable fabrics and higher R-value insulation without increasing product volume significantly. Strategic partnerships between sleeping pad manufacturers and rooftop tent producers are becoming commonplace, leading to integrated and proprietary solutions optimized for specific vehicle setups. The supply chain is increasingly facing pressure to adopt sustainable manufacturing processes, responding to consumer demand for eco-friendly products, often featuring recycled or bio-based polymer components.

Regionally, North America and Europe dominate the market, driven by high rates of outdoor participation, mature infrastructure for car camping, and significant consumer spending power allocated to high-end recreational equipment. However, the Asia Pacific (APAC) region is demonstrating the fastest growth trajectory, propelled by rising middle-class income in countries like China and India, coupled with government initiatives promoting domestic tourism and the establishment of dedicated recreational vehicle parks. Segment trends show a clear preference shift toward self-inflating and hybrid pads (combining air and foam), particularly those achieving an R-value of 4.0 or higher, indicating that insulation performance is a crucial decision-making factor for the core user base who frequently camp in shoulder seasons or varying climates.

In terms of distribution, e-commerce channels continue to gain dominance, offering consumers vast product selection, detailed technical specifications, and comparative reviews crucial for high-involvement purchases like sleeping pads. Specialty outdoor retail stores maintain relevance by offering experiential purchasing opportunities, allowing customers to test pads before purchase. Furthermore, the market is seeing innovation in specialized pad shapes designed specifically to fit the contours of various vehicle interiors (e.g., tailored pads for specific SUV or van models), addressing niche market demands and reducing the reliance on generic rectangular designs. The emphasis remains on delivering residential-level sleep comfort in rugged environments.

AI Impact Analysis on Car Camping Sleeping Pad Market

User queries regarding the impact of Artificial Intelligence (AI) on the Car Camping Sleeping Pad Market center around three core themes: personalized product recommendation systems, supply chain optimization, and the integration of smart features into the pads themselves. Consumers are highly interested in how AI can analyze their sleeping patterns, body metrics, typical camping locations, and historical purchase data to recommend the optimal pad R-value, thickness, and material composition, moving beyond generic categorization. Supply chain concerns focus on AI’s potential to predict material demands (especially premium foams and high-tech fabrics), optimize inventory management to reduce warehousing costs, and manage complex global logistics efficiently, thus lowering the final consumer price. A prominent expectation is the development of "smart pads" where embedded sensors utilize AI algorithms to adjust inflation pressure or temperature zones automatically based on real-time body temperature fluctuations and microclimate changes within the tent or vehicle, significantly enhancing thermal efficiency and user comfort, potentially redefining the premium segment of the market.

- AI-driven personalized recommendation engines optimize product matching based on user biometrics, typical use conditions, and desired R-value.

- Predictive demand forecasting and inventory management powered by AI algorithms reduce overstocking of seasonal or specialized pad models.

- AI integration into smart sleeping pads enables real-time monitoring and autonomous adjustment of firmness and internal temperature regulation zones.

- Machine learning algorithms analyze material stress points during simulated use, informing the design phase for enhanced durability and lifespan.

- Automated quality control systems use computer vision to detect minor manufacturing defects in seams, welding, and material consistency with high precision.

- Natural Language Processing (NLP) tools analyze vast amounts of customer feedback and warranty claims, swiftly identifying persistent product design flaws for immediate R&D attention.

- Optimized logistics planning via AI minimizes shipping distances and fuel consumption, supporting sustainability claims and reducing operational costs.

DRO & Impact Forces Of Car Camping Sleeping Pad Market

The Car Camping Sleeping Pad Market is significantly influenced by a dynamic interplay of growth drivers, structural restraints, compelling opportunities, and powerful external impact forces. A primary driver is the widespread adoption of the "van life" movement and overlanding culture, which prioritize extended comfort and reliable equipment capable of handling diverse environmental conditions and frequent setup/teardown cycles. This cultural shift translates directly into heightened demand for thick, high-R-value sleeping pads. Concurrently, continuous advancements in material science, particularly the development of lightweight, high-density foams and durable, recycled polyester fabrics, enable manufacturers to offer superior products at competitive weights, enhancing consumer value proposition. Furthermore, the increased focus on health and wellness encourages consumers to invest in better sleep solutions, even in outdoor settings, moving away from cheaper, less supportive alternatives.

Restraints primarily revolve around the initial high cost associated with premium, technical sleeping pads, which can deter budget-conscious consumers, particularly in emerging markets. Technical complexities, such as the potential for puncture and insulation degradation over time, necessitate careful maintenance, which acts as a minor deterrent. Additionally, the bulkiness of some ultra-comfortable car camping pads, while acceptable for vehicle transport, still limits storage space within smaller vehicles or multi-person setups, posing a logistical challenge for some users. This trade-off between luxurious comfort and practical pack size often forces consumers to compromise, which restricts the potential market size for the largest and thickest pads available.

Opportunities abound, centering on the innovation of smart textile integration, allowing pads to regulate temperature actively or self-repair minor punctures autonomously. The expansion into niche markets, such as specialized ergonomic pads for side sleepers or pads designed for extreme cold environments (R-value 8+), presents avenues for premium pricing and differentiation. Impact forces include stringent environmental regulations requiring the use of non-PFC (Perfluorinated compound) coatings and sustainable supply chain certifications, pushing manufacturers toward more environmentally friendly but potentially costlier production methods. Economic uncertainty can temporarily dampen discretionary spending on high-end outdoor gear, although the fundamental shift towards experiential travel mitigates severe market retraction.

Segmentation Analysis

The Car Camping Sleeping Pad Market is comprehensively segmented based on product type, R-value (thermal resistance), material composition, distribution channel, and end-user application. Analyzing these segments provides critical insights into market dynamics and consumer preferences. The dominance of self-inflating pads is a key feature in the product type segmentation, as they offer the best balance of comfort, insulation, and ease of use, appealing especially to mainstream family campers and older demographics. R-value segmentation is becoming increasingly crucial, with pads rated 4.0 and above commanding a premium, reflecting the growing understanding among consumers that effective insulation is paramount for restful sleep in varying weather conditions. Materials segmentation highlights the shift from basic PVC towards durable, lightweight thermoplastic polyurethane (TPU) laminated nylon and polyester, preferred for its reduced weight and improved environmental profile.

- By Product Type:

- Self-Inflating Pads

- Air Pads (Inflatable)

- Closed-Cell Foam Pads (CCF)

- Hybrid Pads (Air and Foam Combination)

- By R-Value (Thermal Resistance):

- R-Value Less Than 2.0 (Summer Use)

- R-Value 2.0 to 4.0 (3-Season Use)

- R-Value 4.0 and Above (All-Season/Winter Use)

- By Material:

- Nylon Fabric

- Polyester Fabric

- Other Fabrics (e.g., TPU coated)

- By Thickness:

- Below 3 Inches

- 3 to 6 Inches

- Above 6 Inches (Luxury Pads)

- By Distribution Channel:

- Online Retail (E-commerce Platforms, Brand Websites)

- Offline Retail (Specialty Outdoor Stores, Department Stores, Hypermarkets)

- By End-User:

- Individual Campers

- Family Campers

- Overlanders and RV Users

Value Chain Analysis For Car Camping Sleeping Pad Market

The value chain for the Car Camping Sleeping Pad Market begins with upstream activities, focusing heavily on raw material sourcing and specialized component manufacturing. This stage involves procuring high-quality polymer materials such as Nylon and Polyester fabric, chemical components for TPU laminations, and specialized open-cell foam components necessary for self-inflating models. Key considerations at this upstream level include ensuring sustainable sourcing practices and maintaining consistent quality standards for R-value performance. Manufacturers must maintain robust relationships with specialized textile mills and chemical suppliers capable of delivering materials meeting stringent durability and insulation specifications. The initial design and prototyping phase, where ergonomics and thermal efficiency are calculated, is heavily dependent on this upstream input, defining the final product cost structure and overall performance metrics.

The midstream phase involves manufacturing, including precise cutting, lamination, high-frequency welding of seams, and valve integration. This is where innovation in automation and quality control is critical to minimize leak rates and ensure product longevity. After manufacturing, the products enter the downstream phase, primarily concerned with distribution and sales. The distribution channel is bifurcated into direct sales (brand websites) and indirect sales (retailers and e-commerce platforms). Direct-to-Consumer (D2C) models allow manufacturers higher margin control and direct customer feedback capture but require significant investment in logistics infrastructure. Indirect channels leverage the established reach and customer trust of major outdoor retailers and large e-commerce marketplaces like Amazon or specialized platforms, offering broader market penetration but involving margin sharing.

The final phase involves end-user sales, after-sales service, warranty management, and ultimately, consumer disposal or recycling. Customer engagement, driven by product reviews and digital marketing campaigns focused on lifestyle benefits and technical superiority (like R-value and comfort), is paramount for conversion. Effective distribution hinges on optimizing freight costs, managing warehousing efficiently, and providing accurate inventory levels across both online and offline touchpoints. The preference among technical buyers for specialty stores allows these locations to act as crucial advisory points, while the mass market favors the convenience and pricing advantages of large online retailers, making a truly omnichannel strategy essential for market leadership.

Car Camping Sleeping Pad Market Potential Customers

The primary potential customers for the Car Camping Sleeping Pad Market are distinctly segmented into two main groups: dedicated outdoor recreationists seeking premium comfort and the rapidly growing demographic associated with lifestyle travel movements such as overlanding and van life. Dedicated recreationists typically include family campers who prioritize spaciousness and durability over ultra-lightweight design, often purchasing thicker, high-R-value pads (6 inches or more) to ensure sleep comfort for multiple nights in a row. This segment views the purchase as a long-term investment in their leisure quality, often choosing well-established brands known for reliability and robust warranty policies. These buyers are generally less price-sensitive and more focused on achieving residential-level comfort standards in an outdoor environment, often integrating pads with larger tents or specialized vehicle platforms.

The second major group, Overlanders and Van Life enthusiasts, represent a sophisticated and frequently nomadic customer base. These individuals require pads that offer extreme durability, excellent insulation for year-round living (high R-values), and specialized sizing to integrate seamlessly into vehicle conversions (often requiring tapered or custom-sized solutions). They typically conduct exhaustive research on materials, valve systems, and pack size, as the pad is used daily. They value pads that are repairable and feature superior internal construction, such as baffled air chambers or high-resilience foam, designed to withstand continuous use and variable climates. A significant subset of this demographic also includes renters and users of recreational vehicle (RV) rental services who seek portable, superior aftermarket sleeping solutions to supplement standard RV mattresses.

Additionally, secondary potential customer groups include adventure motorcyclists who utilize cars as base camps for larger expeditions, specialized outdoor educators, and institutions running outdoor programs that require durable, standardized equipment for temporary lodging. These institutional buyers focus heavily on longevity, ease of cleaning, and compliance with safety standards. They typically purchase in bulk and prioritize wholesale pricing, representing a stable, high-volume segment that values reliability and simplified inventory management over novel aesthetic features.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,350 Million |

| Growth Rate | 6.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Therm-a-Rest, Klymit, Big Agnes, Exped, Sea to Summit, REI Co-op, NEMO Equipment, Zempire, Sierra Designs, Coleman, Decathlon (Quechua), Outwell, Intex, Helinox, GigaMat, Luno Life, HEST Outdoors, Teton Sports, Hikenture, ALPS Mountaineering |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Car Camping Sleeping Pad Market Key Technology Landscape

The technological landscape of the Car Camping Sleeping Pad Market is primarily defined by advancements in insulation methods, material science, and valve engineering designed to maximize R-value while minimizing weight and bulk. A central technology is the use of high-density, vertically cored open-cell foam, laminated with durable, airtight fabrics (often using TPU lamination) to create self-inflating pads that offer superior ground insulation and structural integrity. Manufacturers are continually refining the core patterns (e.g., delta coring, horizontal baffles) to optimize the foam-to-air ratio, thereby increasing the effective R-value without adding excessive weight or significantly impacting the ability of the pad to roll up tightly. Furthermore, proprietary reflective layers, often integrated within the air chambers, utilize radiant heat technology to reflect body warmth back to the user, a non-lofted method that dramatically boosts thermal performance in high-end pads.

In the air pad segment, key innovations center on baffle construction and multi-chamber systems. Horizontal and vertical baffle structures are meticulously designed to prevent air movement and cold spots, ensuring stable and comfortable support. The introduction of proprietary internal fabrics or synthetic fill insulation (such as Primaloft or similar hollow fiber fills) within air chambers prevents convective heat loss, enabling lightweight pads to achieve high R-values suitable for four-season car camping. Valve technology is also undergoing transformation, with high-flow, single-piece flat valves replacing traditional screw-cap designs, allowing for rapid, one-way inflation using integrated pumps or specialized pump sacks, dramatically simplifying setup and teardown for the end-user, enhancing the overall convenience proposition.

The emerging technological frontier involves incorporating smart features, utilizing micro-sensors to monitor internal temperature and pressure. While still niche, these advancements hint at future products capable of dynamic adjustments. Manufacturers are also heavily focused on achieving superior bonding techniques, particularly high-frequency welding, which creates incredibly durable and leak-proof seams, crucial for longevity in demanding environments. Finally, the growing use of sustainable technology, including recycled nylon and polyester fabric that is post-consumer sourced, often treated with environmentally friendly DWR (Durable Water Repellent) finishes instead of traditional PFCs, showcases a commitment to both performance and ecological responsibility, aligning with modern consumer values.

Regional Highlights

- North America (NA): Dominates the global market due to the well-established culture of camping, RV travel, and overlanding, coupled with high consumer purchasing power. The US market, in particular, exhibits high demand for large, thick, luxury self-inflating pads (R-value 5.0+) tailored for SUV and van applications. Innovation in specialized vehicle-specific sleeping solutions is a key regional trend.

- Europe: Represents a mature market characterized by strong demand across Western European nations (Germany, France, UK) driven by dense populations engaging in weekend getaways and organized campsite holidays. The region shows a strong preference for pads incorporating sustainable materials and lightweight construction, even in car camping, due to varied climate zones and focus on eco-tourism.

- Asia Pacific (APAC): Expected to register the highest CAGR, primarily fueled by rising disposable incomes, expanding middle-class interest in domestic tourism, and significant government investment in outdoor recreational infrastructure in countries like China, Japan, and Australia. The market here is highly price-sensitive but shows rapid adoption of mid-range self-inflating pads as awareness of outdoor gear quality increases.

- Latin America (LATAM): A growing market, particularly in countries with extensive road networks suitable for overlanding (e.g., Argentina, Chile). Demand focuses on durable, mid-to-high R-value products that can withstand variable temperatures and rugged terrain, although distribution networks can pose logistical challenges.

- Middle East and Africa (MEA): Represents the smallest but emerging market segment. Demand is concentrated in regions with suitable climates for camping and tourism, often focusing on highly durable pads designed to cope with extreme heat fluctuations and abrasive desert environments. Luxury glamping operations drive niche demand for high-end comfort pads.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Car Camping Sleeping Pad Market.- Therm-a-Rest

- Klymit

- Big Agnes

- Exped

- Sea to Summit

- REI Co-op

- NEMO Equipment

- Zempire

- Sierra Designs

- Coleman

- Decathlon (Quechua)

- Outwell

- Intex

- Helinox

- GigaMat

- Luno Life

- HEST Outdoors

- Teton Sports

- Hikenture

- ALPS Mountaineering

Frequently Asked Questions

Analyze common user questions about the Car Camping Sleeping Pad market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most crucial factor when selecting a car camping sleeping pad?

The most crucial factor is the R-Value, which measures thermal resistance. For year-round car camping, an R-Value of 4.0 or higher is recommended to ensure adequate insulation from cold ground temperatures, maximizing sleep quality and safety.

Are self-inflating sleeping pads truly better than manual air pads for car camping?

For car camping, self-inflating pads are generally superior as they combine the high comfort of foam and air, offering excellent stability and insulation with minimal setup effort, unlike basic manual air pads which rely solely on air and require more physical effort to inflate.

How does the thickness of a sleeping pad affect car camping comfort?

Thickness directly correlates with comfort and shock absorption. Car camping pads typically range from 3 to 6 inches, with thicker options (above 4 inches) providing better cushioning for side sleepers and those seeking a residential mattress feel, as bulkiness is less restricted by transportation limits.

What are the current trends regarding sustainable materials in sleeping pads?

The market is increasingly trending towards sustainability, utilizing recycled polyester or nylon fabrics (post-consumer recycled content), and employing TPU laminations free of harmful PVC or PFC chemicals. Consumers prioritize durability and repairability to extend product lifespan.

Which distribution channel dominates sales in the Car Camping Sleeping Pad Market?

While specialty outdoor retailers remain important for high-touch sales, the Online Retail segment, including major e-commerce platforms and brand-direct websites, dominates due to competitive pricing, vast product comparisons, and convenient home delivery of bulky items.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager