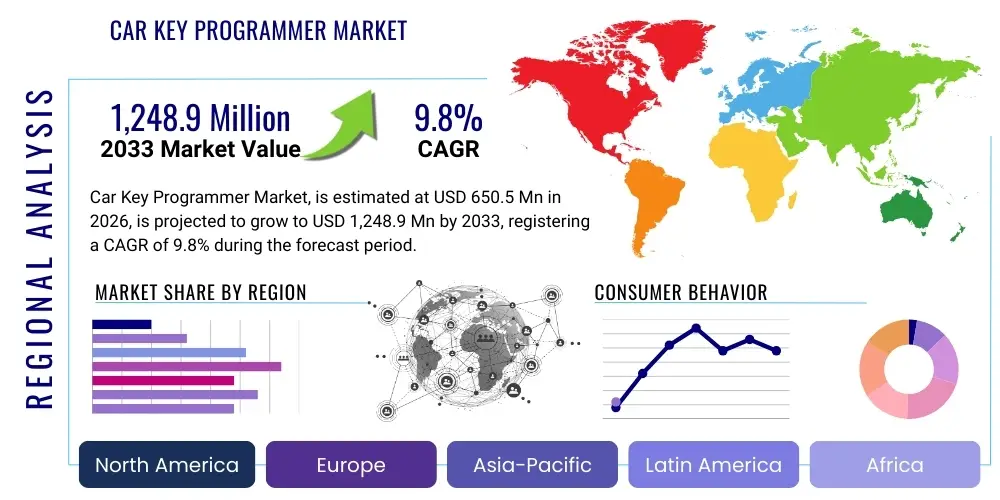

Car Key Programmer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437758 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Car Key Programmer Market Size

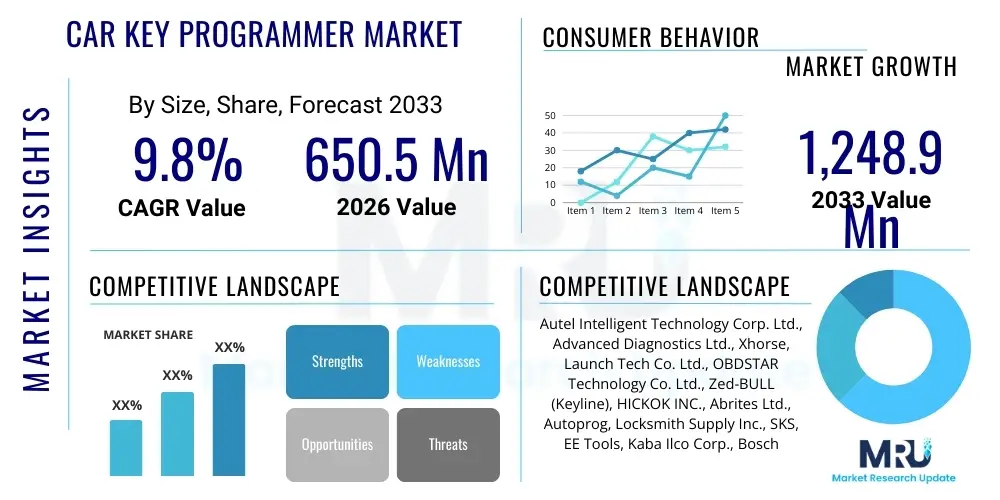

The Car Key Programmer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 650.5 Million in 2026 and is projected to reach USD 1,248.9 Million by the end of the forecast period in 2033.

Car Key Programmer Market introduction

The Car Key Programmer Market encompasses specialized electronic devices and software solutions designed for automotive professionals, locksmiths, and security services to program, duplicate, or erase transponder chips and remote functions integrated within modern vehicle keys. These systems are crucial in the automotive aftermarket for addressing key loss, replacement, or malfunction, particularly as vehicles increasingly adopt sophisticated immobilizer systems, keyless entry (Passive Keyless Entry/PKE), and push-button start functionalities that rely on complex encrypted communication protocols between the key fob and the vehicle's Engine Control Unit (ECU) or Body Control Module (BCM). The core function of these programmers is to securely interface with the vehicle’s On-Board Diagnostics (OBD-II) port or directly with chip components to establish a recognized cryptographic handshake, allowing the new key or fob to be accepted by the vehicle’s security system, ensuring both theft deterrence and operational convenience for the owner.

The necessity for robust car key programming tools stems from the continuously evolving complexity of automotive security. Original Equipment Manufacturers (OEMs) consistently upgrade their encryption standards, leading to a perpetual demand for programmers that are frequently updated to support the latest vehicle models, diverse communication standards (like CAN, LIN, FlexRay), and specialized immobilizer protocols (e.g., those utilizing rolling codes or challenge-response authentication). Major applications span across independent repair workshops, dedicated automotive locksmiths, franchised dealerships needing backup solutions, and fleet management companies managing large pools of vehicles. The versatility of advanced programmers—often incorporating features like EEPROM reading, mileage correction, and module resetting—extends their utility far beyond simple key duplication, transforming them into vital diagnostic and security maintenance tools within the automotive service sector.

The primary benefits driving the adoption of advanced car key programmers include rapid service turnaround, which minimizes customer inconvenience during key replacement, and significant cost savings compared to mandated dealer-only solutions, especially in the aftermarket. Furthermore, these tools empower independent businesses to handle highly technical tasks previously restricted to OEMs, fostering market competition and accessibility. Key driving factors include the global increase in vehicle parc, the rising complexity of vehicle security systems requiring specialized tools for maintenance, the continuous expansion of the used car market necessitating reprogramming services, and growing concerns over vehicle theft, which mandates high-security, reliable programming procedures. The transition towards smart keys and digital key technology further propels the need for future-proof programming hardware capable of handling digital certificates and over-the-air (OTA) updates, positioning the market for sustained growth rooted in technological necessity and operational efficiency.

Car Key Programmer Market Executive Summary

The Car Key Programmer Market is experiencing robust expansion, fundamentally driven by the escalating integration of advanced electronic security systems, such as sophisticated immobilizers and passive entry systems, across all vehicle classes globally. Current business trends indicate a critical shift towards software-as-a-service (SaaS) models and subscription-based updates for programming devices, ensuring that automotive professionals have immediate access to the latest security protocols and vehicle coverage required for modern diagnostics and servicing. Key players are heavily investing in developing multi-brand, universal programming tools that minimize the need for proprietary hardware, thereby increasing accessibility and efficiency for independent repair shops and locksmiths. Furthermore, the market is characterized by a strong emphasis on cybersecurity and regulatory compliance, particularly concerning unauthorized access to vehicle electronic control units (ECUs), prompting manufacturers to implement enhanced security features like secure boot and enhanced data encryption within the programming hardware itself.

Regionally, North America and Europe currently dominate the market, primarily due to the large presence of highly complex vehicle fleets and stringent automotive security standards mandated by regulatory bodies. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by rapidly expanding vehicle production, increasing disposable incomes leading to greater adoption of technologically advanced vehicles, and the proliferation of independent automotive service networks in countries like China and India. The regional dynamics are heavily influenced by local automotive regulations regarding key encryption standards and the prevalence of different key types (e.g., mechanical keys with transponders vs. full smart keys). Infrastructure development for advanced diagnostics and the professionalization of the locksmith industry are key determinants of market maturation in developing economies, driving the demand for affordable, yet reliable, programming solutions capable of handling diverse vehicle models.

Segmentation trends highlight the increasing dominance of the OBD-based programmer segment due to its non-intrusive nature and ease of use, though specialized solutions targeting EEPROM/MCU manipulation remain essential for addressing complex scenarios, such as lost all keys (LAK) situations or module replacement. By application, the Aftermarket segment, comprising independent workshops and automotive locksmiths, holds the largest market share, directly benefiting from the continuous need for key replacement and reprogramming services across the aging vehicle parc. Technology specialization is also fragmenting the market, with dedicated tools for specific brands or vehicle types (e.g., high-security luxury vehicles) commanding premium pricing. The overarching trend across all segments is the movement toward connectivity—integrating cloud computing for automatic updates, remote technical support, and data logging, ensuring the programming tools remain relevant and accurate amidst rapid technological evolution within the automotive industry.

AI Impact Analysis on Car Key Programmer Market

User queries regarding the impact of Artificial Intelligence (AI) on the Car Key Programmer Market frequently center around two primary themes: the potential for AI to automate complex diagnostic procedures and the capacity of AI-driven systems to circumvent sophisticated OEM security protocols. Users are primarily concerned about whether AI can accelerate the process of identifying unknown or proprietary security algorithms, thereby allowing faster development of programming solutions, or conversely, if OEMs will leverage AI/Machine Learning (ML) to create dynamic, perpetually evolving encryption methods that render current programming tools obsolete quicker. Expectations focus on AI enhancing the accuracy of key learning processes, predicting required security parameters based on VIN inputs, and providing proactive troubleshooting assistance by analyzing vast datasets of successful and failed programming attempts across diverse vehicle models, ultimately streamlining the service workflow and reducing technician reliance on specialized, trial-and-error procedures. There is also significant interest in AI supporting predictive maintenance for key fobs and transponders, alerting users to potential battery failure or signal degradation before complete operational loss.

- AI-driven automated protocol identification: AI algorithms analyze communication patterns during key registration to rapidly identify proprietary encryption and handshake protocols, accelerating the development time for new programmer support.

- Enhanced predictive diagnostics: AI analyzes real-time vehicle ECU data and historical success rates to predict necessary security settings or potential communication errors before starting the key programming procedure, minimizing failures.

- Adaptive security countermeasures: OEMs increasingly use AI/ML to detect unauthorized programming attempts and dynamically alter security parameters (e.g., rolling code generation patterns), creating a continuous arms race in the key programmer market.

- Streamlined user interfaces: AI assists in creating intuitive, step-by-step programming workflows tailored specifically to the technician's skill level and the vehicle model, optimizing task efficiency and reducing training time requirements.

- Remote technical assistance via AI: Machine Learning models analyze diagnostic logs uploaded from the programmer to provide instantaneous, highly specific troubleshooting advice, often eliminating the need for human technical support intervention.

- Fraud detection and anti-tampering: AI monitors the programming process for anomalies that suggest attempted illegal manipulation of mileage or security modules, enhancing the overall integrity of the service operation.

DRO & Impact Forces Of Car Key Programmer Market

The Car Key Programmer Market is significantly influenced by a complex interplay of Drivers, Restraints, and Opportunities, which collectively dictate the market’s growth trajectory and inherent volatility. The primary drivers include the exponential increase in the number of vehicles equipped with transponder-based immobilizers and advanced RKE/PKE systems globally, mandating specialized electronic tools for maintenance and replacement. Regulatory mandates in several regions promoting 'Right to Repair' legislation are also opening up access to security-relevant information previously restricted to OEM dealerships, thus fueling the independent aftermarket. Furthermore, the high rate of key loss and the inherent vulnerability of electronic keys to damage or battery failure ensure a constant demand for replacement and reprogramming services. These drivers create a foundational market need that is technologically entrenched, ensuring sustained revenue generation for key programmer manufacturers who can maintain broad vehicle coverage.

Conversely, the market faces significant restraints, most notably the continuous enhancement of vehicle cybersecurity by OEMs, which involves highly complex, proprietary algorithms and the integration of secure gateways (SGWs) that severely restrict unauthorized access to the vehicle's diagnostic bus. This ongoing security escalation necessitates frequent, costly research and development investments by programmer manufacturers to maintain compatibility, often creating a significant time lag between new vehicle release and corresponding programmer support. Furthermore, the proliferation of low-quality, unauthorized programming tools (clones) presents challenges regarding data security, reliability, and market pricing integrity. Legislative ambiguity concerning intellectual property rights related to vehicle security protocols also creates operational hurdles, limiting the speed at which generic aftermarket solutions can be legally developed and deployed, thereby dampening immediate market potential in certain sophisticated segments.

Opportunities within the market center on the shift towards developing cloud-based, subscription services that offer real-time updates and remote diagnostics, ensuring tool longevity and continuous support for the latest vehicle models, maximizing return on investment for end-users. The rising adoption of telematics and V2X (Vehicle-to-Everything) communication also opens new avenues for specialized programming tools that can integrate with digital identity management and security protocols, especially for fleet operators and shared mobility services. Impact forces, such as the digital transformation of automotive retail and service, push for integration, requiring key programmers to function seamlessly with broader diagnostic ecosystems. Technological disruption from the proliferation of specialized MCU/EEPROM programming techniques and the potential integration of blockchain for verifiable security log maintenance are also influential, compelling manufacturers to innovate continually to overcome security barriers and capitalize on emerging operational efficiencies across the global automotive service sector.

Segmentation Analysis

The Car Key Programmer Market is comprehensively segmented based on technology, connectivity, application, and distribution channel, providing a granular view of market dynamics and specialized user needs. Segmentation by technology delineates between non-intrusive OBD-based solutions, which are preferred for routine programming and diagnostics due to their ease of use, and advanced bench programming techniques (EEPROM/MCU programming) required for complex tasks like "all keys lost" scenarios or security module bypass, which demand higher technical proficiency but offer greater control. The differentiation between hardware and software components highlights the critical trend towards software-defined devices, where the value resides increasingly in the intellectual property and continuous updates rather than the physical hardware itself. Understanding these segments is vital for manufacturers aiming to align product offerings with specific service provider capabilities and regulatory requirements.

By application, the market is broadly divided into OEM services (primarily dealerships) and the aftermarket (independent repair shops, locksmiths, and specialized garages). The aftermarket segment dominates in volume due to the necessity of affordable, comprehensive solutions for maintaining an expanding and diverse fleet of used vehicles globally. Connectivity segmentation is rapidly gaining importance, with wired (USB, dedicated cables) and wireless (Bluetooth, Wi-Fi) solutions competing on factors like data transfer speed, convenience, and security. Wireless connectivity, particularly when linked to cloud services, is becoming the standard for modern, subscription-based devices. Lastly, segmentation by key type—covering transponder keys, remote keyless entry (RKE) fobs, and advanced passive keyless entry (PKE) smart keys—reflects the varying levels of complexity and security encryption required, directly impacting the design and cost structure of the programming tool.

- By Technology Type:

- OBD (On-Board Diagnostics) Programmers

- EEPROM/MCU Programmers (Bench/Chip Programming)

- Transponder Chip Readers/Writers

- By Key Type:

- Transponder Keys

- Remote Keyless Entry (RKE) Fobs

- Passive Keyless Entry (PKE) Smart Keys

- By Application:

- Automotive Aftermarket (Independent Workshops, Locksmiths)

- OEM Service Centers (Dealerships)

- Fleet Management Services

- By Connectivity:

- Wired Programmers (USB, Dedicated)

- Wireless Programmers (Bluetooth, Wi-Fi, Cellular)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Car Key Programmer Market

The Value Chain for the Car Key Programmer Market begins with specialized raw material procurement, focusing on high-integrity electronic components such as microcontrollers (MCUs), EEPROM chips, secure communication modules, and high-durability enclosures necessary for professional diagnostic equipment. This upstream segment is highly dependent on specialized semiconductor suppliers and requires stringent quality control due to the sensitive nature of automotive security programming. The subsequent crucial phase involves Research and Development (R&D) and software algorithm development, where manufacturers invest heavily in reverse engineering proprietary OEM security protocols, developing cryptographic libraries, and creating user-friendly, multilingual interfaces. This R&D function constitutes the highest value-add activity, as the intellectual property associated with decoding vehicle security determines the commercial viability and market reach of the final product.

Midstream activities involve the highly specialized manufacturing and assembly of the hardware interface devices, followed by rigorous quality assurance and testing to ensure compatibility across a broad spectrum of vehicle platforms (e.g., various CAN bus iterations, J1850 protocols, etc.). The distribution channel is bifurcated into direct sales to large OEM dealerships or certified automotive training institutions, and indirect sales, which primarily rely on a network of authorized distributors, online e-commerce platforms, and specialized automotive tool suppliers targeting the vast aftermarket. Direct channels ensure tight control over pricing and customer support, crucial for high-end, brand-specific tools, while indirect channels maximize market penetration, especially in geographically dispersed regions serving independent locksmiths and general repair shops.

The downstream segment focuses heavily on post-sale services, which include providing continuous, mandatory software updates (often through subscription models) to maintain compatibility with new vehicle models and address evolving security countermeasures. Technical support and training are critical components, given the complexity of modern vehicle security systems, where poor programming execution can lead to vehicle immobilization. End-users (automotive locksmiths, technicians) represent the final link, relying on the programmer’s reliability and comprehensive vehicle coverage to deliver prompt, professional services. The efficiency of the distribution network and the robustness of the post-sale update system directly impact end-user satisfaction and the overall perceived value of the programming equipment, emphasizing that the value chain in this market extends significantly beyond the initial hardware sale and is deeply intertwined with continuous software support.

Car Key Programmer Market Potential Customers

The potential customer base for the Car Key Programmer Market is diverse yet highly specialized, primarily comprising entities that require authorized, secure access to vehicle immobilizer and security systems for maintenance, repair, or replacement operations. The largest segment consists of independent automotive locksmiths, who rely on versatile, multi-brand programming devices as their core business tool for services ranging from emergency key retrieval to complete key fabrication and transponder synchronization, particularly when all original keys have been lost (LAK). This segment values broad vehicle compatibility, portability, and competitive pricing combined with robust, frequently updated software libraries. They operate under high pressure to deliver quick, reliable solutions outside the traditional dealership environment, making tool efficiency and reliability paramount purchasing criteria.

Another significant customer segment includes independent automotive repair workshops and specialized garages that perform module replacement (such as ECU, BCM, or immobilizer module swapping), diagnostics, and advanced electrical system repairs. For these customers, the key programmer is often integrated into a broader diagnostic tool suite, serving as a critical accessory for post-repair testing and calibration, ensuring the vehicle’s security system is fully functional before handover. Dealerships and OEM service centers also constitute a key market segment, although they often utilize proprietary tools mandated by the manufacturer; however, they require aftermarket solutions as backups or for servicing older, non-warrantied vehicles. These institutional customers prioritize guaranteed reliability, stringent security compliance, and often require bulk purchase agreements for standardized regional implementation.

Emerging potential customers include large fleet management companies and rental car agencies that need efficient, in-house capabilities for quickly decommissioning keys or programming new ones across hundreds or thousands of vehicles to minimize downtime and manage asset security. Furthermore, automotive training institutions and vocational schools represent a steady demand for educational versions of programmers, ensuring the next generation of technicians is proficient in modern vehicle security protocols and programming techniques. The fundamental commonality across all potential customers is the mandatory requirement for the tools to operate securely and effectively, navigating the continuously increasing complexity of vehicle electronics while minimizing the risk of accidental vehicle immobilization or security breach, making professional support and certified hardware key differentiators in the purchasing decision process.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650.5 Million |

| Market Forecast in 2033 | USD 1,248.9 Million |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Autel Intelligent Technology Corp. Ltd., Advanced Diagnostics Ltd., Xhorse, Launch Tech Co. Ltd., OBDSTAR Technology Co. Ltd., Zed-BULL (Keyline), HICKOK INC., Abrites Ltd., Autoprog, Locksmith Supply Inc., SKS, EE Tools, Kaba Ilco Corp., Bosch Diagnostics, Drew Technologies (Opus IVS), JDIAG, ChipTuningKit, Car Keys Express, ADT Smart Car Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Car Key Programmer Market Key Technology Landscape

The technological landscape of the Car Key Programmer Market is characterized by intense innovation centered around overcoming stringent OEM security measures and accommodating next-generation vehicle architectures. A fundamental component of this landscape is the continuous evolution of transponder technology, moving from basic fixed-code transponders (like the early Texas Instruments types) to sophisticated rolling-code and cryptographic transponders that utilize high-security algorithms (e.g., Megamos Crypto, Hitag Pro). Programmers must integrate advanced hardware capable of interpreting and generating these encrypted signals, often requiring powerful microprocessors and specialized secure elements within the programming device itself to securely store cryptographic keys and operational data, preventing unauthorized firmware manipulation or data leakage, thereby adhering to strict cyber hygiene standards in automotive service.

The shift towards cloud-enabled programming is another pivotal technological advancement. Modern programmers function less as isolated physical tools and more as intelligent interfaces to remote, powerful server infrastructure. This allows for Over-the-Air (OTA) software updates, enabling immediate support for newly released vehicle models or updated OEM security patches without physical intervention. Furthermore, complex, processor-intensive decryption or token generation processes can be offloaded to the cloud, significantly reducing the hardware requirements and cost of the physical device while enhancing the speed and reliability of the programming process. This connectivity facilitates crucial features like VIN-specific code generation and remote technical support, which are essential for maintaining competitiveness against dealer proprietary systems and ensuring the operational viability of independent repairers.

A critical emerging technology involves the necessity to interface with Secure Gateways (SGWs), increasingly implemented by manufacturers like FCA, VW Group, and others to protect the CAN bus from unauthorized diagnostic requests. Key programmers must now incorporate dedicated diagnostic licenses and compliant protocols to securely authenticate and access the vehicle's network layer before any key programming or module manipulation can commence. This often involves standardized protocols like UDS (Unified Diagnostic Services) and proprietary OEM access methods, requiring programmer manufacturers to forge strategic partnerships or utilize legally available access routes to maintain their device utility. Concurrently, technological advancement in non-invasive EEPROM and MCU reading techniques, such as using specialized adapters that avoid the need for physical desoldering of chips, is accelerating, making complex 'all keys lost' scenarios faster and less risky for high-end automotive technicians, solidifying the professional segment's reliance on highly advanced, multi-function programming platforms that incorporate both OBD and bench capabilities seamlessly.

Regional Highlights

- North America: This region holds a significant market share, characterized by a high concentration of technologically advanced vehicle fleets, widespread adoption of high-security passive entry systems, and a mature aftermarket infrastructure supported by well-established locksmith associations and large franchise repair networks. Regulatory frameworks, particularly the push toward standardizing access to vehicle data, influence the rapid technological uptake of sophisticated programming tools. The US and Canada are key markets where demand is consistently high due to complex vehicles, high rates of key loss, and a robust consumer willingness to pay for rapid, specialized services outside of dealership environments, driving market demand for comprehensive, multi-brand OBD programmers and specialized diagnostic tool integration.

- Europe: Europe is a highly competitive and fragmented market, driven by stringent security regulations (such as those tied to vehicle type approval) and a significant presence of premium, high-security European automotive brands (Germany, UK, France). The demand here leans towards sophisticated bench programming tools capable of handling complex immobilizer systems and microcontrollers, especially in the secondary market dealing with import and export of vehicles requiring compliance adjustments. The EU's commitment to "Right to Repair" strongly supports the independent aftermarket segment, pushing programmer manufacturers to ensure their tools comply with standardized security access mechanisms across various member states, emphasizing frequent, localized software updates and multi-language support.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by burgeoning automotive manufacturing bases in China, India, and Southeast Asia, leading to rapid expansion of the vehicle parc and a proportionate increase in key programming requirements. The market is characterized by a strong demand for cost-effective, high-coverage programming solutions that can handle a diverse mix of domestic, Japanese, and European vehicle models. While hardware costs are highly sensitive, the massive volume potential drives manufacturers to focus on scalable, high-volume production models, often prioritizing wireless and cloud-connected programmers to efficiently distribute software updates across vast geographical areas and burgeoning independent service networks.

- Latin America (LATAM): The LATAM market, while smaller in absolute value, exhibits a growing demand for robust, reliable key programming solutions primarily driven by increasing urbanization, rising concerns over vehicle theft requiring better security measures, and the expansion of professional automotive service infrastructure. Challenges include volatile economic conditions and varying degrees of enforcement regarding authorized software use, leading to a complex landscape where both genuine tools and low-cost alternatives coexist. Brazil and Mexico are leading markets, driven by their large domestic automotive industries and the need for localized technical support and device affordability.

- Middle East and Africa (MEA): This region shows stable growth, concentrated predominantly in the Gulf Cooperation Council (GCC) countries where high-end luxury vehicle imports are substantial, necessitating high-capability, complex key programming for premium brands. The African market, however, is often characterized by older vehicle models and a high need for basic, durable, and highly accessible transponder programming solutions. Market development is strongly linked to the pace of professionalization within the automotive service sector and the growth of formal distribution channels capable of handling specialized electronic equipment and software licensing agreements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Car Key Programmer Market.- Autel Intelligent Technology Corp. Ltd.

- Advanced Diagnostics Ltd.

- Xhorse

- Launch Tech Co. Ltd.

- OBDSTAR Technology Co. Ltd.

- Zed-BULL (Keyline)

- HICKOK INC.

- Abrites Ltd.

- Autoprog

- Locksmith Supply Inc.

- SKS

- EE Tools

- Kaba Ilco Corp.

- Bosch Diagnostics

- Drew Technologies (Opus IVS)

- JDIAG

- ChipTuningKit

- Car Keys Express

- ADT Smart Car Systems

- Shenzhen Fcar Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Car Key Programmer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What distinguishes OBD-based car key programmers from EEPROM programmers?

OBD-based programmers utilize the vehicle's standard diagnostic port (OBD-II) to communicate directly with the ECU/immobilizer module, offering a non-intrusive method suitable for standard key additions or simple replacements. EEPROM programmers require direct physical access, often involving the removal or desoldering of memory chips from the vehicle's security modules, to read and write data manually, a process reserved for complex scenarios like 'all keys lost' situations or when standard OBD access is restricted by high-level security protocols.

How do OEM security measures, such as Secure Gateways, affect the aftermarket key programmer market?

Secure Gateways (SGWs) act as firewalls, blocking unauthorized diagnostic commands via the OBD port, requiring aftermarket programmers to possess specific, often licensed or proprietary, access tokens and authentication protocols to bypass these security barriers. This escalation in OEM security significantly increases the research and development investment needed by programmer manufacturers, often leading to mandatory software subscriptions to maintain compatibility and ensuring continuous compliance with vehicle manufacturers' rotating security standards.

Is the Car Key Programmer Market shifting towards subscription or software-as-a-service (SaaS) models?

Yes, the market is rapidly moving towards subscription-based models. Due to the continuous release of new vehicle models and the corresponding updates to proprietary security algorithms, manufacturers are transitioning away from one-time sales. SaaS models ensure users receive essential, timely software updates, cryptographic libraries, and technical support access, guaranteeing tool longevity and continuous operational relevance for automotive locksmiths and repair professionals who rely on the latest vehicle coverage.

What is the primary role of AI and Machine Learning in modern key programming tools?

AI and Machine Learning are primarily used to enhance diagnostic efficiency and overcome complexity. They help in automatically identifying unknown or proprietary security protocols (Auto-ID), streamlining programming workflows by predicting required steps based on VIN and system status, and offering instantaneous, highly precise troubleshooting support by analyzing complex, real-time diagnostic data logs, thereby reducing programming errors and improving service reliability.

Which regional market is expected to show the highest growth rate for car key programmers?

The Asia Pacific (APAC) region is projected to exhibit the highest growth rate. This is driven by massive growth in vehicle production and sales, the rapid expansion of the independent aftermarket, and increasing consumer adoption of vehicles equipped with advanced electronic security features, creating a surging demand for accessible and comprehensive key programming solutions across markets like China, India, and Southeast Asia.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager