Car Ramp Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435862 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Car Ramp Market Size

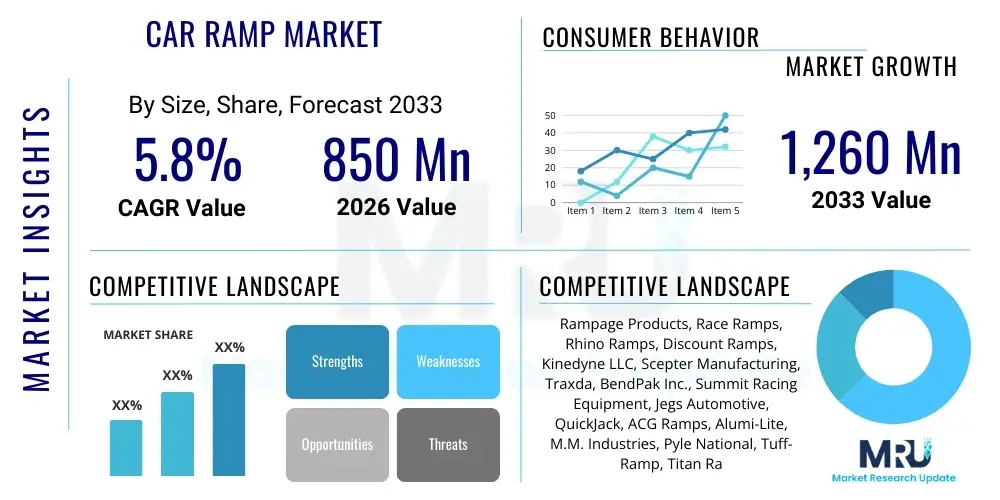

The Car Ramp Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,260 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the expanding automotive repair and maintenance sector globally, coupled with the increasing consumer focus on DIY vehicle upkeep, particularly in developed economies. The demand for reliable, lightweight, and high-capacity ramps designed to service lower-profile modern vehicles is a significant accelerator of market valuation.

The valuation reflects robust demand across several key end-user segments, including professional automotive workshops, home garages, and specialty off-road modification shops. While traditional steel and heavy-duty plastic ramps maintain a significant market share, the emerging popularity of composite and aluminum ramps, which offer superior strength-to-weight ratios, contributes significantly to average selling prices and overall revenue expansion. Furthermore, stringent safety regulations governing vehicle maintenance equipment mandate continuous product innovation, pushing manufacturers towards higher quality, certified ramp solutions, thereby enhancing market value over the forecast period.

Car Ramp Market introduction

The Car Ramp Market encompasses various tools and equipment designed to elevate vehicles for inspection, maintenance, or repair tasks, spanning from simple oil changes to complex undercarriage work. These ramps are critical infrastructure components for the automotive aftermarket, enabling technicians and consumers to safely access the underside of cars, trucks, and SUVs. Products range widely, including low-profile ramps, standard service ramps, two-piece ramps, and specialized trailer ramps used for loading vehicles onto transportation decks. The essential product characteristic is load capacity, with models supporting passenger vehicles up to light commercial trucks, manufactured predominantly from materials such as steel, aluminum, and high-density polyurethane (HDPE).

Major applications for car ramps are centered around routine vehicle servicing, such as fluid draining, exhaust system inspection, and suspension component replacement. In the consumer segment, the benefit of using ramps over traditional jacks lies in enhanced stability, reduced risk of vehicle slippage, and simultaneous access to both front or rear wheels. This stability factor drives adoption in environments where safety and efficiency are paramount. For professional workshops, modular and adjustable ramps are increasingly utilized to supplement existing hydraulic lifts, offering cost-effective solutions for quick service bay turnaround and specialized modifications, particularly those related to performance tuning or off-roading enhancements.

The market is primarily driven by the expanding global vehicle parc—the total number of vehicles in use—which necessitates consistent maintenance services. Key driving factors include the proliferation of personalized garage spaces, the rising trend of vehicle customization (especially lift kits and low-rider modifications that require specific ramp profiles), and regulatory emphasis on worker safety in automotive repair environments. Conversely, the market faces constraints from the high initial cost of specialized, certified ramps and competition from advanced hydraulic lifting systems. However, ongoing material science innovations focused on making ramps lighter, more durable, and intrinsically safer present significant future opportunities for sustained market expansion.

Car Ramp Market Executive Summary

The Car Ramp Market demonstrates significant buoyancy, underpinned by robust business trends focusing on material science advancements and customization capabilities. Regionally, North America and Europe lead in revenue share due to high levels of vehicle ownership and established DIY cultures, while the Asia Pacific (APAC) region is emerging as the fastest-growing market, driven by rapid motorization and the formalization of vehicle service centers. Segmentation trends highlight a critical shift toward portable and high-performance material ramps (like aluminum and composites) within the consumer segment, juxtaposed with consistent demand for heavy-duty, certified steel ramps in the professional service sector. Safety and compliance remain central themes, influencing product design across all segments.

Key business trends involve strategic partnerships between ramp manufacturers and large retail chains focusing on automotive parts, ensuring broad consumer access to certified products. Furthermore, manufacturers are increasingly integrating safety features such as non-skid bases, extended approach lengths for low-profile vehicles, and load-spreading designs to manage the weight of modern electric vehicles (EVs), which are heavier due to battery packs. This focus on EV compatibility represents a crucial competitive advantage. Investment in automated manufacturing processes is also observed, aimed at reducing production costs and improving dimensional consistency and overall product quality to meet rigorous international safety standards.

From a regional perspective, the expansion of the organized aftermarket in countries like China and India fuels demand for professional-grade equipment, shifting the regional focus from basic, uncertified ramps to higher-quality import substitutes. In established markets like Germany and the US, the market is characterized by replacement demand and upgrades to ergonomically superior and safety-compliant models. Segment trends clearly show that the Material segment favors aluminum due to its lightweight properties, which appeal strongly to mobile mechanics and consumers requiring easy storage. Meanwhile, the Application segment sees increasing specialization, with specific ramps being developed solely for tasks like alignment checks or tire access, diverging from general-purpose utility.

AI Impact Analysis on Car Ramp Market

User queries regarding the impact of Artificial Intelligence (AI) on the Car Ramp market primarily revolve around three central themes: the integration of smart diagnostics with physical elevation equipment, safety enhancement through predictive failure analysis, and the automation potential in manufacturing and deployment logistics. Users are keen to understand if AI-driven systems could monitor the structural integrity of ramps in real-time or if robotics, guided by AI, could automate the placement and adjustment of ramps in high-throughput workshops. Key concerns focus on the necessity and cost-effectiveness of integrating expensive AI sensors into a traditionally low-tech, static piece of equipment, and whether regulatory frameworks will keep pace with these innovations to certify 'smart ramps' for safety. The overarching expectation is that AI will predominantly influence the supporting ecosystem—diagnostics and logistics—rather than the fundamental physical function of the ramp itself, which is to provide stable elevation.

While AI does not directly change the physical function of elevation, its indirect impact promises substantial operational efficiencies and safety improvements. AI systems are increasingly utilized in the design phase, employing generative design algorithms to optimize ramp structure, material use, and load-bearing capacity, reducing weight while maintaining strength. Furthermore, AI-powered predictive maintenance models, which monitor usage cycles and stress points on heavy-duty ramps used in commercial settings, can flag potential structural failures before they occur, significantly enhancing workplace safety. This integration is less about "smart ramps" and more about optimizing the lifecycle and deployment of robust, reliable physical tools, ensuring maintenance schedules are based on actual usage strain rather than fixed time intervals, thereby maximizing asset utilization and minimizing downtime risk in professional garages.

- AI optimizes ramp design via generative algorithms, reducing material consumption and weight while maximizing load capacity.

- Predictive maintenance analytics, powered by AI, monitor high-usage professional ramps for structural fatigue, preempting catastrophic failures.

- AI-driven inventory management systems optimize ramp stock levels and distribution, responding dynamically to regional spikes in demand for specific types (e.g., low-profile ramps).

- Computer vision and machine learning enhance quality control during manufacturing, automatically identifying microscopic flaws or structural inconsistencies in materials.

- AI assists in developing highly accurate simulation models for testing ramp failure under diverse and extreme load scenarios before physical prototyping.

DRO & Impact Forces Of Car Ramp Market

The Car Ramp Market is shaped by a confluence of influential factors: Drivers stemming from the increasing vehicle complexity and the corresponding need for specialized access; Restraints posed by viable alternative lifting technologies like hydraulic lifts and jacks; Opportunities found in the burgeoning electric vehicle (EV) segment requiring unique ramp specifications; and Impact Forces primarily driven by stringent global safety standards and continuous material innovation. These elements combine to define the competitive landscape, emphasizing the need for manufacturers to prioritize safety, durability, and compatibility with diverse modern vehicle architectures to ensure market relevance and sustained growth throughout the forecast period. The dynamic balance between cost efficiency and safety compliance is a defining challenge for all industry participants.

Key drivers include the global expansion of the vehicle aftermarket, fueled by rising average vehicle age, which necessitates more frequent maintenance and repair tasks accessible only via vehicle elevation. The increasing trend of vehicle customization, especially among hobbyists and professional racers who require rapid, reliable undercarriage access, further stimulates demand for specialized, performance-oriented ramps. However, the market faces significant restraints, notably the high initial investment required for certified, heavy-duty ramps, making cheaper, uncertified alternatives attractive in developing markets, albeit at the expense of safety. Furthermore, the availability and ease of use of sophisticated mobile hydraulic jacks and compact scissor lifts, which offer variable height adjustments, compete directly with traditional static ramp solutions, limiting ceiling growth for basic ramp designs.

Opportunities are significant, particularly in addressing the specific needs of the burgeoning EV sector. Since EVs possess significantly lower ground clearance and heavier battery weight distribution, traditional ramps are often unsuitable. Manufacturers designing high-capacity, low-angle approach ramps with wide platforms tailored for EV dimensions can tap into a rapidly expanding, high-value niche. The primary impact forces influencing the market are regulatory mandates (such as OSHA and ANSI standards in North America and CE certifications in Europe) that enforce stricter load testing and material quality requirements. These forces compel continuous innovation in anti-slip coatings, interlocking designs, and robust material selection (e.g., aerospace-grade aluminum alloys) to ensure that products meet or exceed the highest benchmarks for safety and reliability in both professional and consumer settings.

Segmentation Analysis

The Car Ramp Market is comprehensively segmented based on Material, Application, Capacity, and End-User, providing granular insights into demand patterns and competitive positioning. Material segmentation (Steel, Aluminum, Plastic/Polymer) dictates the ramp's weight, portability, and maximum load capacity, directly influencing pricing and end-user suitability. Application segmentation distinguishes between service and maintenance ramps versus specialty loading ramps (for trailers or transportation). Capacity segmentation is critical, ranging from light-duty (under 5,000 lbs) for passenger vehicles to heavy-duty (over 15,000 lbs) for light commercial trucks or large SUVs. Analyzing these segments helps stakeholders understand where technological investment (e.g., lightweighting materials) yields the highest return and which customer groups possess the strongest willingness to pay for premium features like adjustable angles or built-in safety chocks.

End-user analysis further refines the market view, broadly splitting demand between Professional Workshops and Consumer/DIY segments. Professional entities prioritize durability, certification, and multi-use capabilities, often opting for heavy-duty steel or modular ramp systems that can withstand high-frequency use and rigorous regulatory scrutiny. In contrast, the Consumer segment places higher value on ease of storage, lightweight construction (favoring aluminum or specialized plastic), and affordability for occasional use, such as oil changes or undercarriage washing. The rise of the mobile mechanic service segment creates a specialized demand subset within the Professional category, driving requirements for highly portable, rapidly deployable ramps that maintain certified load capacity without the bulk associated with traditional workshop equipment.

- Material

- Steel Ramps (High durability, high weight, cost-effective)

- Aluminum Ramps (Lightweight, corrosion-resistant, high cost)

- Plastic/Polymer Ramps (Low profile, chemical resistant, consumer focused)

- Application

- Service and Maintenance Ramps (Routine repairs, oil changes)

- Loading Ramps (Trailer loading, transport)

- Specialty Ramps (Alignment, display/show ramps)

- Capacity (Weight Bearing)

- Light-Duty (Up to 5,000 lbs)

- Medium-Duty (5,000 lbs to 10,000 lbs)

- Heavy-Duty (Above 10,000 lbs)

- End-User

- Professional Workshops and Garages

- Independent Service Centers

- Consumer/DIY Users

- Mobile Mechanics

Value Chain Analysis For Car Ramp Market

The value chain for the Car Ramp Market begins with upstream activities focused on raw material procurement, encompassing steel (hot-rolled and cold-rolled), aluminum alloys, and high-density polymer compounds. Manufacturers often engage in direct sourcing contracts, negotiating bulk prices to manage commodity volatility, which significantly impacts the final product cost. Key upstream challenges involve maintaining consistency in material quality, especially for structural components, and ensuring sustainable and ethical sourcing, particularly concerning the energy-intensive production of aluminum. Precision engineering and welding services are then integrated into the manufacturing process, transforming raw materials into standardized, load-bearing units, emphasizing regulatory compliance and quality assurance checks at every stage.

The midstream stage involves the core manufacturing process, including cutting, bending, welding (for metal ramps), and injection molding (for plastic ramps), followed by critical processes such as powder coating or surface treatments to enhance corrosion resistance and grip. Assembly, testing, and packaging form the final steps before distribution. Downstream activities involve getting the finished product to the end-user through a multifaceted distribution channel. Direct sales may occur via manufacturer e-commerce platforms targeting professional shops and fleets, offering personalized consultation and bulk discounts. Indirect sales rely heavily on traditional retail networks, including large automotive parts retailers, hardware stores, and specialized industrial equipment distributors, who provide crucial geographical reach and customer support for the consumer segment.

The selection of distribution channels heavily influences brand perception and market penetration. High-quality, certified ramps often utilize specialized industrial distributors who can provide technical training and maintenance services to professional garages, thereby justifying a higher price point. Conversely, mass-market plastic and basic steel ramps are efficiently distributed through high-volume, low-margin retail chains and large online marketplaces. Optimization of logistics—managing the bulk and weight of the ramps—is a critical factor in maintaining competitive pricing across all distribution channels, highlighting the advantage of manufacturers who utilize regional warehousing or localized production facilities to minimize freight costs and lead times to both direct and indirect buyers.

Car Ramp Market Potential Customers

The primary potential customers for the Car Ramp Market fall into two distinct yet overlapping categories: professional entities requiring frequent, high-capacity lifting solutions and private individuals engaged in vehicle hobbyism or basic home maintenance. Professional customers include franchised automotive dealerships' service departments, independent local repair shops, tire and brake specialists, and specialized customization garages focusing on performance tuning or off-road modifications. These commercial users prioritize products with high load ratings, certified safety standards (e.g., OSHA compliance), and designs that minimize bay congestion and maximize efficiency, demanding ramps that can handle the full spectrum of passenger vehicles and light commercial trucks, including modern, heavy battery electric vehicles (BEVs).

The second major customer group comprises Do-It-Yourself (DIY) enthusiasts and private vehicle owners. This demographic requires reliable, safe, and relatively low-cost elevation solutions for routine tasks like oil changes, fluid checks, or minor component replacements. They are highly motivated by ease of storage, portability, and simple, intuitive setup. For this segment, the rise of specialized low-profile ramps that accommodate sports cars and modern sedans with minimal ground clearance represents a strong purchasing driver. E-commerce platforms are the preferred procurement channel for DIY customers, placing a premium on clear product descriptions, safety ratings, and positive user reviews regarding setup and stability.

A rapidly growing niche customer base includes mobile mechanics and professional racing teams. Mobile mechanics require ultra-lightweight, durable, and easily transportable ramps that can be deployed quickly and safely in diverse environments outside a traditional garage setting. Racing teams often use specialized drive-on alignment ramps or quick-lift systems for rapid trackside adjustments and inspections, valuing precision, quick release mechanisms, and robustness under demanding, time-critical conditions. Addressing the specific portability and performance needs of these niche segments is crucial for manufacturers seeking differentiation and sustained high-margin growth outside the heavily competed standard workshop and consumer markets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,260 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rampage Products, Race Ramps, Rhino Ramps, Discount Ramps, Kinedyne LLC, Scepter Manufacturing, Traxda, BendPak Inc., Summit Racing Equipment, Jegs Automotive, QuickJack, ACG Ramps, Alumi-Lite, M.M. Industries, Pyle National, Tuff-Ramp, Titan Ramps, Harbor Freight Tools, Northern Tool + Equipment, Snap-on Incorporated |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Car Ramp Market Key Technology Landscape

The technology landscape of the Car Ramp Market, while seemingly mature, is undergoing subtle yet significant transformation driven by material science and safety engineering. Key technological advancements center on developing advanced composite materials, primarily high-density structural foams coated with durable polymers, which offer superior strength-to-weight ratios compared to traditional steel. This allows for the creation of lightweight, stackable ramps, such as those made from high-density expanded polypropylene (EPP), that can safely bear heavy loads, including modern trucks and EVs, while remaining portable enough for consumer use or mobile mechanic services. The shift toward composite materials addresses critical end-user needs: reducing logistical costs for manufacturers and enhancing ease of use and storage for consumers, thereby boosting adoption rates in the DIY segment.

Another crucial technological focus is the application of advanced finite element analysis (FEA) and computational fluid dynamics (CFD) in the design process. Manufacturers utilize these tools to simulate stress distribution across ramp surfaces and structural members under maximum load conditions, leading to optimized geometry that eliminates potential failure points and ensures compliance with stringent safety standards. This predictive engineering allows for precise material allocation, preventing over-engineering and reducing overall production costs. Furthermore, surface technology, specifically the integration of specialized anti-slip elastomers and aggressive tread patterns, is essential for maintaining wheel grip, especially in environments exposed to oil, grease, or water, significantly mitigating the primary risk associated with ramp use: vehicle slippage.

The integration of modular and adjustable mechanisms also represents a technical advancement, particularly catering to the diverse needs of modern vehicle types. Two-piece interlocking ramp designs, adjustable approach angles, and integrated wheel chocks that automatically engage upon vehicle placement enhance versatility and safety. For the premium market, certain high-end professional ramps are incorporating smart safety features, such as integrated load sensors that confirm the weight distribution is within safe parameters, or RFID tags for asset management in large commercial fleets. While these technologies increase the complexity and cost, they provide superior reliability and compliance tracking, aligning with the rising professional demand for audited, fail-safe equipment management systems in regulated automotive environments.

Regional Highlights

- North America (USA and Canada): North America holds the largest market share, predominantly driven by a robust automotive aftermarket sector and a deeply ingrained DIY vehicle maintenance culture. The region features high vehicle ownership rates and a strong consumer preference for large SUVs and trucks, necessitating high-capacity, heavy-duty ramps. Market growth is further stimulated by the presence of large professional workshop chains and stringent safety regulations (OSHA, ANSI) that enforce replacement cycles for aging, non-compliant equipment. The increasing adoption of performance tuning and vehicle customization, particularly in the US, sustains strong demand for specialized, low-approach and modular ramp systems, especially those made from high-strength aluminum alloys. The region is a major early adopter of EV-compatible ramp technologies.

- Europe (Germany, UK, France): The European market is characterized by a strong emphasis on product quality, material sustainability, and strict EU-wide certifications (CE marking). Germany, with its large domestic automotive manufacturing base and high concentration of specialized repair workshops, is a key revenue generator. The demand here leans towards precision-engineered steel ramps and advanced composite systems that guarantee long service life and high safety margins. While the DIY market is present, professional adoption is higher, driven by strict occupational safety requirements that mandate the use of certified equipment. The proliferation of compact vehicles necessitates the development of specialized, space-saving, and often foldable ramp designs suitable for smaller urban garages.

- Asia Pacific (APAC) (China, India, Japan): APAC is projected to exhibit the highest CAGR during the forecast period. This accelerated growth is attributed to the rapid motorization of the massive populations in China and India, the expansion of the middle class, and the consequential increase in the vehicle parc. While affordability drives demand for basic steel ramps in developing APAC markets, there is a parallel surge in demand for high-quality, professional-grade equipment as international automotive brands expand their service networks. Japan and South Korea represent mature markets focusing on technology integration and compact design, while the burgeoning logistics sector across the region fuels exceptional demand for heavy-duty loading ramps for commercial transport applications.

- Latin America (Brazil, Mexico): The Latin American market exhibits steady growth, influenced primarily by fluctuating economic conditions and varying levels of regulatory enforcement. Demand is concentrated in urban centers with high vehicle density. Brazil and Mexico are the largest consumers, where both official service centers and a vast network of informal mechanics drive the market. Price sensitivity remains high, leading to strong sales of cost-effective steel ramps. However, improving safety standards and increasing foreign investment in organized repair chains are gradually raising the required quality benchmark, pushing manufacturers to offer locally sourced, standardized products that adhere to international safety specifications.

- Middle East and Africa (MEA): Growth in the MEA region is fragmented, primarily dependent on oil revenue stability and infrastructure development. The GCC countries (Saudi Arabia, UAE) showcase demand for high-end, heavy-duty ramps, driven by extensive fleet operations and luxury vehicle servicing, often importing premium certified products from Europe and North America. Conversely, the African market, particularly South Africa, demonstrates strong localized manufacturing capabilities and a high need for durable, simple-to-maintain ramps that can withstand challenging environmental conditions. Long-term market development hinges on regulatory harmonization and investment in formal vocational training for mechanics, which increases the demand for reliable, professional equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Car Ramp Market.- Rampage Products

- Race Ramps

- Rhino Ramps

- Discount Ramps

- Kinedyne LLC

- Scepter Manufacturing

- Traxda

- BendPak Inc.

- Summit Racing Equipment

- Jegs Automotive

- QuickJack

- ACG Ramps

- Alumi-Lite

- M.M. Industries

- Pyle National

- Tuff-Ramp

- Titan Ramps

- Harbor Freight Tools

- Northern Tool + Equipment

- Snap-on Incorporated

Frequently Asked Questions

Analyze common user questions about the Car Ramp market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary safety considerations when purchasing car ramps for heavy vehicles?

The primary safety considerations are the certified load capacity, which must exceed the vehicle's heaviest axle weight; the ramp's construction material (steel or aluminum for durability); and the presence of safety features like anti-slip surfaces and integrated wheel stops or chocks. Always ensure the ramps possess relevant safety certifications (e.g., ANSI, CE) and are designed with a gentle approach angle to prevent scraping low-profile undercarriages.

How do aluminum ramps compare to plastic (polymer) ramps in terms of durability and application?

Aluminum ramps offer superior long-term durability, high load capacity, and excellent corrosion resistance, making them suitable for frequent professional use and heavy vehicles, often at a higher cost. Plastic or polymer ramps are significantly lighter, less expensive, and ideal for consumer DIY use or basic maintenance tasks on lighter passenger cars, prioritizing portability and storage ease over maximum load bearing and professional resilience.

Is the Car Ramp Market being impacted by the rise of electric vehicles (EVs)?

Yes, the rise of EVs significantly impacts the market by necessitating new ramp designs. EVs are typically heavier due to large battery packs, requiring ramps with higher certified capacities and wider wheel tracks. Additionally, their often lower ground clearance mandates ramps with extended, shallower approach angles to prevent damage to the underbody battery enclosures, driving innovation in specialized EV-compatible products.

What is the difference between service ramps and loading ramps, and can they be used interchangeably?

Service ramps are designed to elevate a vehicle safely and stably for maintenance tasks, featuring level platforms at the top. Loading ramps are designed for transitioning a vehicle onto a trailer or transport deck and are not intended to maintain a static, stable working height for repairs. They should generally not be used interchangeably, as loading ramps lack the required safety features and structural stability needed for undercarriage work.

What material is currently driving innovation in the professional segment of the market?

Advanced aluminum alloys and high-density structural composites are driving innovation in the professional segment. These materials enable manufacturers to produce ramps that are substantially lighter for easier maneuverability within a workshop, while simultaneously increasing the ultimate load-bearing capacity and fatigue life, meeting the rigorous demands of high-throughput service centers and mobile mechanic operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager