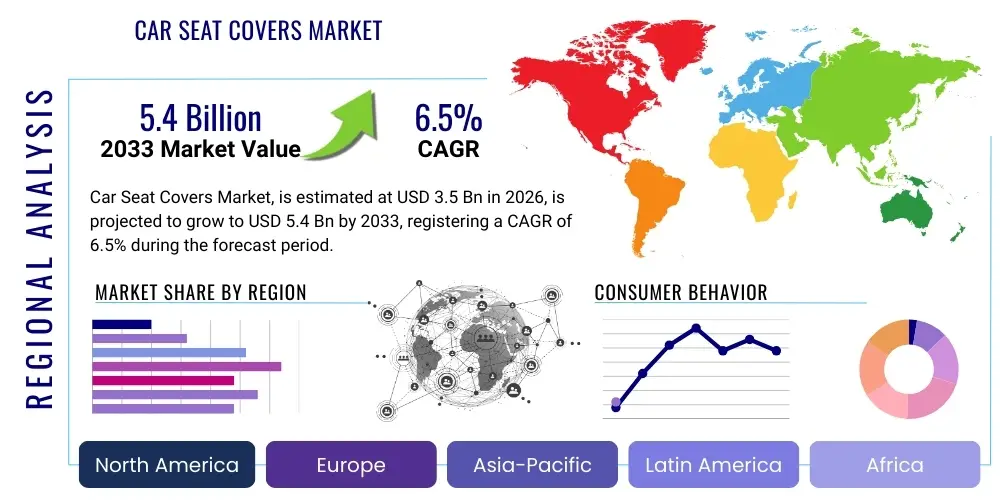

Car Seat Covers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437437 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Car Seat Covers Market Size

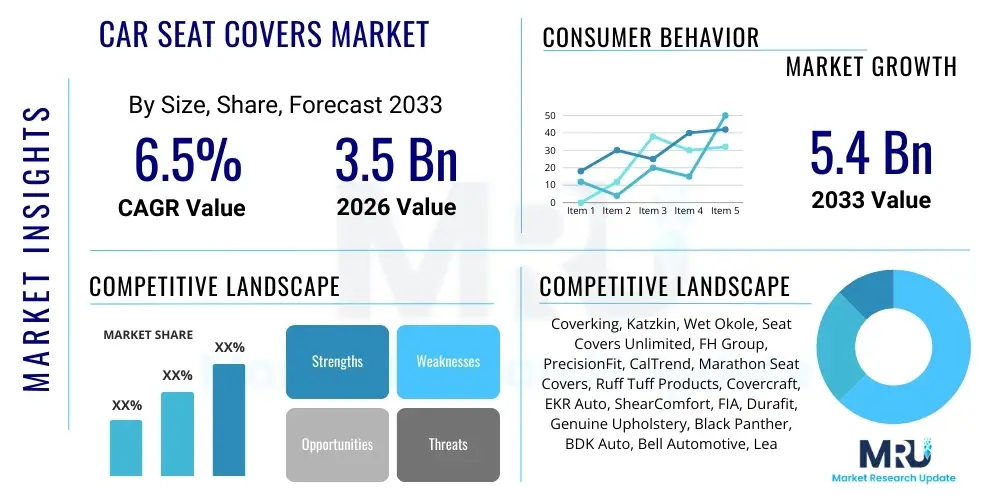

The Car Seat Covers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $3.5 Billion in 2026 and is projected to reach $5.4 Billion by the end of the forecast period in 2033.

Car Seat Covers Market introduction

The Car Seat Covers Market encompasses the manufacturing, distribution, and sale of protective and decorative layers designed to fit over automotive seats. These products serve dual purposes: enhancing the aesthetic appeal of the vehicle interior through customization and safeguarding the original upholstery from wear, tear, stains, and UV damage, thereby preserving the vehicle's resale value. The demand spectrum ranges from highly durable, water-resistant covers used in commercial fleets or utility vehicles to luxurious, custom-fit leather options sought by high-end passenger vehicle owners looking for personalization and comfort enhancements. The proliferation of the automotive aftermarket industry, coupled with increased consumer awareness regarding vehicle maintenance and customization, fundamentally underpins the market's robust growth trajectory.

Products available in this market are highly differentiated based on material composition, including genuine leather, synthetic leather (vinyl/PU), neoprene, ballistic nylon, and various specialized fabrics such as jacquard and microsuede. Major applications span across passenger vehicles (sedans, SUVs, trucks) and commercial vehicles (vans, taxis, heavy trucks). Key benefits derived from seat cover adoption include improved sanitation, enhanced comfort through padding or temperature regulation features (breathable materials), and protection against pet damage or occupational wear. Furthermore, the modern market emphasizes sustainability, with a growing segment dedicated to eco-friendly and recycled material usage, appealing to environmentally conscious consumers.

Driving factors primarily revolve around the surge in global vehicle production and sales, particularly in emerging economies where personal vehicle ownership is increasing rapidly. The trend towards vehicle personalization, where owners view their vehicles as extensions of their personal style, significantly fuels the aftermarket segment. Additionally, the necessity for maintaining hygiene and interior longevity, especially in ride-sharing and rental fleet operations, provides a persistent demand base. Technological advancements focusing on fire-retardant properties, airbag compatibility, and integration with heated/cooled seats are further broadening the product portfolio and ensuring continued relevance in modern automotive design.

Car Seat Covers Market Executive Summary

The global Car Seat Covers Market is demonstrating dynamic business trends characterized by strong consumer preference shifts towards custom-fit, OEM-grade materials in the aftermarket segment, driven by aesthetic improvement and durability requirements. Market competitiveness is intensifying, focusing on rapid product innovation, including materials with antimicrobial properties and integrated heating/cooling functionality. Manufacturers are leveraging advanced 3D scanning and computer-aided design (CAD) to ensure precision fit, mimicking original factory specifications. Supply chain resilience and digitalization of distribution channels, especially e-commerce platforms, are critical competitive differentiators, allowing smaller specialized firms to reach global audiences effectively and challenge established players. Strategic partnerships between material science companies and seat cover manufacturers are key to developing next-generation protective textiles tailored for extreme conditions, such as those found in off-road or industrial usage vehicles, pushing the boundaries of material performance and longevity.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by the massive automotive bases in China and India, coupled with rising disposable incomes leading to higher customization spending. North America and Europe, while mature markets, continue to contribute significantly through high average selling prices driven by demand for premium materials like genuine leather and high-performance synthetic options tailored for luxury and sports utility vehicles. Trends in North America specifically focus on heavy-duty, utility-focused covers for trucks and SUVs, emphasizing ruggedness and ease of cleaning. Conversely, regulatory landscapes in Europe concerning materials compliance (e.g., REACH regulations, flammability standards) influence product development, pushing manufacturers toward certified, safer components. The Middle East and Africa (MEA) are emerging due to increasing new vehicle registrations and the requirement for UV and heat-resistant materials tailored to harsh desert climates.

Segmentation analysis reveals that the Material segment is dominated by synthetic leather and vinyl due to their cost-effectiveness and versatile performance characteristics, though the premium Leather segment commands the highest revenue per unit. By Vehicle Type, Passenger Vehicles, particularly SUVs and pickup trucks, hold the largest market share, reflecting global consumer preference shifts towards larger vehicles that often experience more frequent use. The Distribution Channel segment sees robust growth in the Aftermarket category, particularly through online sales, which provide consumers with extensive customization options, detailed fitment guides, and competitive pricing, challenging the traditional dominance of the OEM channel for replacement and primary protection needs. Future segmentation trends point towards increasing differentiation based on functional properties, such as water resistance ratings, pet friendliness, and specialized ergonomic support features integrated into the cover design.

AI Impact Analysis on Car Seat Covers Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and the Car Seat Covers Market typically center on how technology can enhance customization accuracy, optimize manufacturing processes, and improve the durability and functionality of the final product. Common questions explore AI’s role in predicting material wear patterns, designing custom patterns based on complex vehicle models efficiently, and personalizing the buying experience through recommendation engines. Users are keenly interested in predictive maintenance—whether AI can analyze driving habits or environmental factors to recommend the optimal replacement time or material type. Concerns often relate to the cost implications of implementing AI-driven manufacturing and whether these advanced features will be accessible across all price points, or if they will remain exclusive to the premium segment. The core expectation is that AI will streamline the highly complex customization process inherent in seat covers, reducing human error, accelerating design cycles, and ultimately delivering a more perfect fit and functional cover optimized for the specific end-user environment.

- AI-driven Predictive Analytics: Analyzing usage data (e.g., climate, cleaning frequency, occupancy load) to predict material degradation and inform material selection for specific fleets or regions, maximizing cover lifespan and utility.

- Customization and Fitment Optimization: Utilizing machine learning algorithms to process high-resolution 3D scans of car interiors, ensuring highly accurate digital templates for custom-fit covers, minimizing waste and errors during cutting and stitching.

- Automated Manufacturing and Quality Control: Implementing AI-powered vision systems in production lines for real-time defect detection in stitching, pattern alignment, and material flaws, significantly enhancing overall product quality before market entry.

- Enhanced E-commerce Experience: Deploying AI recommendation engines on online retail platforms to guide consumers through complex material, color, and fit options based on vehicle specifications, budget, and stated needs (e.g., pet protection, heavy-duty use).

- Supply Chain Efficiency: Using AI algorithms to forecast material demand fluctuations based on vehicle sales forecasts and seasonal trends, optimizing inventory levels of core materials like leather hides and specialized synthetic fabrics, improving lead times.

DRO & Impact Forces Of Car Seat Covers Market

The dynamics of the Car Seat Covers Market are heavily influenced by a confluence of driving factors centered on consumer behavior and increasing vehicle longevity, regulatory restraints pertaining to safety standards, and burgeoning opportunities in material science and digital commerce. Drivers include the global upward trend in vehicle ownership and the corresponding need for interior preservation, coupled with a strong cultural inclination towards vehicle customization and personalization, treating the car interior as an extension of personal style. The restraint landscape is primarily dictated by the high initial investment required for premium custom-fit leather options, which limits mass adoption, and the stringent regulatory requirements concerning airbag safety compatibility, which necessitates complex testing and design integration for aftermarket products. These conflicting forces create a nuanced environment where market participants must balance quality, affordability, and regulatory compliance to remain competitive and capture varied consumer segments effectively.

Opportunities are largely concentrated in the development and integration of novel, high-performance materials, such as antibacterial fabrics essential for ride-sharing fleets and specialized synthetic polymers offering unparalleled durability and stain resistance for the utility vehicle segment. Furthermore, the expansion of e-commerce platforms provides a significant avenue for specialized niche manufacturers to bypass traditional retail limitations and offer highly tailored, made-to-order products directly to global consumers, effectively capitalizing on the demand for highly personalized solutions. The market is also heavily influenced by impact forces such as material costs volatility—particularly petroleum-derived synthetics and genuine leather—and the rapid pace of automotive interior design changes, which requires continuous investment in 3D scanning and template updates to ensure product relevance and fitment accuracy across new vehicle models. The overall technological environment surrounding textile engineering and digital manufacturing acts as a powerful accelerating force on market growth.

The inherent conflict between consumer demand for low-cost, universal-fit solutions and the superior performance and aesthetic value of high-cost, custom-fit options dictates pricing strategies and segment differentiation. Overcoming the restraint of complex installation, often associated with high-quality custom covers, through innovative quick-release or modular design mechanisms presents a crucial opportunity for market differentiation. The long-term driver of sustainability is becoming increasingly pronounced, compelling manufacturers to invest in environmentally friendly materials and production methods. Failure to adapt to strict regional regulations regarding material safety (e.g., fire resistance standards required in many European and North American markets) remains a persistent restraint, while the growth of the electric vehicle (EV) segment, requiring unique materials and designs compatible with specialized seating structures, presents a fertile and high-value opportunity area for future revenue generation.

Segmentation Analysis

The Car Seat Covers Market is systematically segmented primarily based on the Material used, the Vehicle Type they are applied to, and the Distribution Channel through which they are sold. This granular breakdown allows for a precise understanding of consumer preferences and market profitability across different product categories. Material segmentation is crucial, differentiating between high-end, durability-focused products like genuine leather and high-performance synthetics (Neoprene, Ballistic Nylon) and more budget-conscious, protective options (Fabric/Cloth, Vinyl). The Vehicle Type segmentation highlights the dominant revenue generation from the Passenger Vehicle segment, specifically SUVs and light trucks, which require robust and often customized protective solutions due to their frequent, multi-purpose use. The Distribution Channel split underscores the rising importance of the Aftermarket—particularly online sales—which offers expansive product catalogs and customization tools far exceeding the standard options available through OEM channels.

- Material

- Leather (Genuine)

- Synthetic Leather (Vinyl, PU)

- Neoprene

- Fabric/Cloth (Twill, Canvas, Jacquard)

- Others (Ballistic Nylon, Sheepskin)

- Vehicle Type

- Passenger Vehicles (Sedans, Hatchbacks, SUVs, Trucks)

- Commercial Vehicles (Taxis, Vans, Buses, Heavy Trucks)

- Distribution Channel

- OEM (Original Equipment Manufacturer)

- Aftermarket

- Retail Stores (Automotive Specialty Stores, Hypermarkets)

- Online Sales (E-commerce Platforms, Company Websites)

Value Chain Analysis For Car Seat Covers Market

The value chain for the Car Seat Covers Market begins with upstream activities focused on the procurement and processing of raw materials. This includes sourcing natural fibers, synthetic polymers (for neoprene and vinyl), and high-grade leather hides. Key upstream players involve chemical companies producing synthetic textiles and tanneries preparing leather, where material quality, consistency, and compliance with environmental standards are critical cost drivers. This stage determines the foundational properties of the final product, such as durability, fire resistance, and tactile feel. Manufacturers must manage price volatility in raw materials and ensure long-term supply agreements, especially for specialized performance fabrics used in high-wear applications, requiring deep integration with upstream suppliers to maintain product margin and quality control.

Midstream processes involve core manufacturing activities, including computer-aided design (CAD) template creation, precision cutting (often using laser or automated CNC machines), intricate stitching, and assembly. This is where proprietary technology related to achieving a perfect 'factory fit' is developed and utilized. Companies often invest heavily in robotic and automated stitching systems to handle complex shapes and maintain high throughput for mass-market products, while custom-fit luxury covers still require highly skilled manual craftsmanship. Quality assurance, ensuring compatibility with seat functions (e.g., side airbags, heated elements), is an essential step before packaging.

Downstream activities focus on product distribution and end-user engagement. Distribution channels are bifurcated between direct sales to OEMs for factory-installed or branded accessory options and the robust Aftermarket. The Aftermarket is primarily segmented into indirect channels—specialty automotive retailers, general hypermarkets, and installer networks—and direct-to-consumer online sales. Online platforms have emerged as a powerful indirect channel, offering superior visual configuration tools and fitment guidance, dramatically reducing reliance on traditional physical retail footprints. The final step involves installation, which can be professional (via aftermarket service centers) or DIY, with manufacturers increasingly providing extensive video tutorials and streamlined designs to facilitate easy self-installation, enhancing the overall customer experience and reducing post-sale service requirements.

Car Seat Covers Market Potential Customers

Potential customers for the Car Seat Covers Market are diverse, ranging from individual vehicle owners seeking personalized aesthetics and protection to large commercial entities requiring durable, standardized interior solutions. The largest segment comprises individual consumers who fall into two main categories: those purchasing covers immediately after buying a new vehicle to preserve the pristine original upholstery and maximize resale value, and owners of older vehicles looking to refurbish or conceal existing damage affordably. Specific sub-segments within the private consumer market include pet owners who need specialized, heavy-duty, waterproof covers and outdoor enthusiasts (hunters, fishermen, off-road drivers) who require ballistic nylon or neoprene to protect against mud, water, and debris exposure, emphasizing ruggedness and ease of cleaning over luxury aesthetics.

The commercial sector represents a highly valuable B2B customer base. This includes fleet operators such as taxi and ride-sharing companies (e.g., Uber, Lyft fleets), rental car agencies, and government/municipal vehicle fleets (police cars, fire trucks). These commercial buyers prioritize hygiene, extreme durability, fire retardancy, and simple maintenance schedules, often purchasing covers in bulk with standardized specifications and minimal aesthetic variance. The commercial segment drives demand for materials that withstand frequent, intense use and cleaning cycles, making synthetic leather and heavy-duty vinyl preferred choices due to their resilience and cost-efficiency. Furthermore, OEMs (Original Equipment Manufacturers) act as potential customers, either purchasing covers for their genuine accessories catalog or contracting manufacturers to supply seat materials for specific trim levels or limited edition vehicles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $3.5 Billion |

| Market Forecast in 2033 | $5.4 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Coverking, Katzkin, Wet Okole, Seat Covers Unlimited, FH Group, PrecisionFit, CalTrend, Marathon Seat Covers, Ruff Tuff Products, Covercraft, EKR Auto, ShearComfort, FIA, Durafit, Genuine Upholstery, Black Panther, BDK Auto, Bell Automotive, Leader Accessories, Saddleman. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Car Seat Covers Market Key Technology Landscape

The technology landscape in the Car Seat Covers Market is predominantly characterized by advancements in material science and digital manufacturing processes, moving the industry toward precision, durability, and multi-functionality. A core technological reliance is placed on sophisticated 3D scanning and Computer-Aided Design (CAD) software. This technology is essential for accurately capturing the highly complex contours of modern vehicle seats, which feature integrated components like side airbags, seat sensors, and specialized bolstering. This precise digital templating ensures that custom-fit covers integrate flawlessly with vehicle safety systems and operational features, a requirement that cannot be met by older, generic manufacturing methods. Furthermore, the incorporation of fire-retardant chemical treatments and specialized UV-resistant coatings into materials like synthetic leather is a key area of ongoing technological investment, ensuring compliance with global automotive safety standards and enhancing longevity in sun-exposed environments.

The integration of Smart Textiles is an emerging but rapidly growing area. While currently niche, manufacturers are exploring fabrics that can interact with the user or the vehicle environment. This includes antimicrobial and self-cleaning fibers essential for high-use commercial applications and phase change materials (PCMs) integrated into the fabric structure to provide localized temperature regulation, enhancing comfort without relying solely on the vehicle's HVAC system. Another critical technological development involves advanced stitching and cutting machinery, specifically automated CNC fabric cutters and robotic stitching arms. These machines improve production speed, reduce material waste, and ensure uniformity across large batches, making the mass production of complex patterns economically viable and accelerating time-to-market for new designs corresponding to recent vehicle model releases.

In terms of distribution, technology drives the customer interface. E-commerce platforms now utilize advanced visualization tools, including Augmented Reality (AR) integration and highly interactive configurators, allowing customers to visualize how different materials and colors will look in their specific vehicle model before purchase. This digital technology minimizes fitment errors and improves customer confidence in custom orders, which traditionally carried high risks of dissatisfaction. Lastly, the development of specialized quick-release installation systems and modular cover designs represents product technology focused on simplifying the end-user experience, thereby mitigating a significant restraint related to the perceived difficulty of installing high-quality, custom-fit covers. These innovations rely on precise engineering and specialized fastener mechanisms designed for robust, long-term use while maintaining ease of removal.

Regional Highlights

- Asia Pacific (APAC): This region dominates the market due to the high volume of new vehicle production and sales, particularly in major automotive hubs like China, India, and Japan. Rising disposable incomes across Southeast Asia are driving an increasing demand for aftermarket accessories, with a strong focus on affordable, durable, and aesthetically appealing options. The sheer size of the vehicle population and the high usage rates of vehicles in densely populated urban areas necessitate protective covers to maintain interior hygiene and resale value. The growth is fueled by both the OEM supply chain, catering to mass-market vehicles, and a rapidly evolving aftermarket supported by localized manufacturing capabilities.

- North America: Characterized by high average selling prices and a strong preference for large vehicles (SUVs and Pickup Trucks), the North American market focuses heavily on premium and highly specialized covers. Demand is driven by consumers seeking rugged, heavy-duty materials (like ballistic nylon or specialized tactical covers) for recreational and utility use, alongside the significant market for luxury, custom-fit genuine leather installations. The robust aftermarket distribution network, coupled with high consumer spending power on personalization, makes this a critical region for high-value revenue generation and product innovation, particularly concerning safety integration with advanced seat technology.

- Europe: This market is mature, characterized by stringent regulatory requirements, especially concerning flammability and material toxicity (e.g., adherence to REACH regulations). Demand is stable, primarily driven by replacement needs and the luxury vehicle segment, where precise, OEM-grade synthetic and genuine leather covers are favored. The proliferation of smaller, fuel-efficient vehicles dictates a different product portfolio compared to North America, focusing on comfort, ergonomic support, and certified material safety. Germany, the UK, and France are key countries, exhibiting steady growth in personalized interior solutions.

- Latin America (LATAM): Growth in LATAM is attributed to the increasing penetration of private vehicle ownership and the expansion of automotive manufacturing bases in countries like Brazil and Mexico. The market generally favors cost-effective, high-durability synthetic covers capable of withstanding varied climate conditions. The region presents significant opportunity for mid-range aftermarket players focusing on localized distribution and materials tailored to high humidity and temperature environments.

- Middle East and Africa (MEA): This region is emerging, driven by increasing vehicle sales and unique climatic requirements. High temperatures and intense UV exposure necessitate materials with superior heat reflection and UV resistance properties. The demand structure includes a niche for luxury customization driven by wealth in the Gulf Cooperation Council (GCC) countries and a parallel need for durable, easily cleanable covers for commercial and heavy-duty vehicles operating in harsh terrain.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Car Seat Covers Market.- Coverking

- Katzkin

- Wet Okole

- Seat Covers Unlimited

- FH Group

- PrecisionFit

- CalTrend

- Marathon Seat Covers

- Ruff Tuff Products

- Covercraft

- EKR Auto

- ShearComfort

- FIA

- Durafit

- Genuine Upholstery

- Black Panther

- BDK Auto

- Bell Automotive

- Leader Accessories

- Saddleman

Frequently Asked Questions

Analyze common user questions about the Car Seat Covers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What materials offer the best protection against stains and water damage for car seats?

Neoprene and heavy-duty vinyl (synthetic leather) offer superior protection against stains, spills, and water damage. Neoprene is popular for its waterproof and comfortable nature, often favored by surfers and outdoor enthusiasts, while high-grade vinyl provides excellent resilience and mimics the look of genuine leather.

Are custom-fit car seat covers necessary for vehicles with side airbags?

Yes, custom-fit car seat covers are highly recommended and often necessary for vehicles equipped with side-impact airbags integrated into the seats. Reputable manufacturers design these covers with specialized, break-away stitching or certified openings to ensure the airbag can deploy safely and unimpeded upon impact, maintaining crucial safety standards.

How does the aftermarket distribution channel compare to OEM in terms of customization?

The aftermarket channel, particularly online retailers, offers significantly higher levels of customization compared to OEM options. Aftermarket providers allow consumers to choose from a vast array of materials, colors, piping options, and personalized patterns that are typically unavailable through the standardized accessory packages offered by Original Equipment Manufacturers.

What factors primarily drive the high cost of genuine leather car seat covers?

The high cost of genuine leather covers is primarily driven by the raw material procurement (high-quality hides), the intensive multi-step tanning and finishing processes, and the skilled craftsmanship required for precision cutting and stitching, which is essential to achieve a luxurious, wrinkle-free, custom fit.

Is the Car Seat Covers Market influenced by the shift toward Electric Vehicles (EVs)?

Yes, the EV shift influences the market by requiring new material focus and design considerations. EV interiors often prioritize sustainable or recycled materials, and their seats may integrate more complex sensing and heating technologies, necessitating specialized cover designs that ensure full compatibility and non-interference with underlying electronic components.

What is the role of 3D scanning technology in modern car seat cover manufacturing?

3D scanning is crucial for modern manufacturing, enabling the creation of extremely precise digital templates of vehicle seats. This technology ensures the production of custom-fit covers that hug the contours of complex modern seats exactly, guaranteeing airbag compatibility and a factory-like aesthetic appearance, significantly reducing design time and material waste.

How are manufacturers addressing sustainability concerns in the market?

Manufacturers are addressing sustainability by increasing the use of recycled materials, such as post-consumer recycled plastic incorporated into synthetic fabrics and utilizing eco-friendly leather tanning processes (chrome-free). They are also focusing on optimizing production to reduce scrap material and minimize volatile organic compound (VOC) emissions during manufacturing.

Which regional market shows the fastest growth potential for seat covers?

The Asia Pacific (APAC) region exhibits the fastest growth potential, driven by rapid urbanization, substantial increases in new vehicle sales, and rising disposable incomes that are fueling strong demand for both protective and aesthetic aftermarket automotive accessories across major economies like China and India.

What are the primary restraints hindering mass adoption of premium car seat covers?

The primary restraints include the high price point of custom, premium materials (like genuine leather or high-performance synthetics), which limits accessibility for budget-conscious consumers, and the complexity associated with the installation process for high-quality, snug-fitting covers, often requiring professional assistance.

How do ride-sharing services impact the demand for specific types of car seat covers?

Ride-sharing and taxi fleets significantly increase demand for highly durable, antibacterial, and easily cleanable covers (typically vinyl or robust synthetic fabrics). These operators prioritize hygiene, longevity under constant use, and rapid turnover cleaning cycles to maintain professional standards and minimize interior replacement costs over the vehicle's service life.

What material is generally preferred for severe weather conditions like extreme cold or heat?

For severe weather, neoprene and heavy-duty synthetic materials are often preferred. Neoprene resists cracking in cold weather and is water-resistant, while specialized synthetic fabrics are treated to resist extreme UV degradation and heat absorption, maintaining comfort and structural integrity longer than standard cloth or lower-grade vinyl.

Is the integration of heating and cooling features into seat covers a viable technology?

Yes, while usually built into OEM seats, aftermarket manufacturers are beginning to integrate localized heating elements and utilizing materials like phase change fabrics or highly breathable textiles to enhance thermal comfort. However, full active cooling systems remain complex for aftermarket integration and are less common.

What is the typical lifespan expected from a high-quality, custom-fit synthetic seat cover?

A high-quality, custom-fit synthetic cover, such as those made from robust vinyl or ballistic nylon, can typically last between 5 to 10 years, depending on the frequency of use, environmental exposure, and adherence to proper cleaning and maintenance guidelines provided by the manufacturer.

How do regulatory standards affect car seat cover design in Europe?

European regulatory standards, such as those governed by the European Union (REACH), heavily influence design by mandating strict material safety, toxicity limits, and flammability standards. Manufacturers must ensure their materials are certified to these high standards, often requiring investment in advanced fire-retardant treatments and sustainable material sourcing.

What future opportunities exist for smart technology integration in this market?

Future opportunities lie in integrating sensors for posture correction feedback, utilizing AI for predictive wear analysis, and incorporating smart textiles that manage moisture or provide subtle ergonomic support based on the driver's profile, moving the product from simple protection to active comfort enhancement.

In the value chain, where is the highest profit margin typically realized?

The highest profit margins are typically realized in the downstream Aftermarket segment, particularly through direct-to-consumer online sales of premium, highly customized products, where manufacturers capture the full retail markup by bypassing intermediaries like traditional brick-and-mortar retailers.

What is the primary factor driving commercial fleet operators to purchase seat covers?

The primary factor driving commercial fleet operators is interior preservation and sanitation. Seat covers significantly reduce wear and tear on expensive original upholstery, maximize the vehicle's resale value, and facilitate quick, deep cleaning required for high-occupancy vehicles like taxis and rental cars.

How has the rise of SUV and truck sales influenced material choices?

The rise of SUV and truck sales has significantly increased demand for heavy-duty, rugged materials like Ballistic Nylon and Neoprene, as these vehicles are frequently used for activities involving mud, dirt, and heavy gear, requiring materials designed for extreme protection and simple hose-off cleaning capability.

What design considerations must be made for bench seats versus bucket seats?

Bench seats require simpler, less complex patterns but often necessitate highly robust materials due to uniform load distribution. Bucket seats, conversely, require intricate, three-dimensional patterns that accommodate complex bolstering and headrest configurations, making their custom covers much more challenging and costly to manufacture accurately.

Do DIY installation challenges act as a significant market restraint?

Yes, the perceived difficulty and time commitment required for the proper installation of snug-fitting, high-quality custom covers deter many consumers. This challenge acts as a restraint, prompting manufacturers to invest in innovative quick-release mechanisms and extensive digital installation guides to simplify the process.

What are the key benefits of using Neoprene material for car seat covers?

Neoprene is highly valued for its exceptional water resistance, making it ideal for protecting against sweat and spills. It also provides good cushioning, excellent durability, and a comfortable, stretchable fit, making it a popular choice for active lifestyle users and those living in wet or humid climates.

How does the demand for seat covers vary between new car owners and used car owners?

New car owners primarily demand seat covers for prophylactic protection, aiming to maintain the vehicle’s mint condition and resale value, often opting for premium custom materials. Used car owners frequently purchase covers for restorative purposes—to conceal existing damage or wear—and generally favor more cost-effective, durable materials.

What impact does the volatility of raw material prices have on market stability?

Volatility in raw material prices, particularly leather hides and petroleum-based synthetic fibers, directly impacts the profit margins of manufacturers. This necessitates strong hedging strategies and flexible pricing models, especially in the competitive mass-market segment where small cost changes can significantly affect retail price sensitivity.

How are companies ensuring compatibility with integrated seat heaters and coolers?

Manufacturers ensure compatibility by using highly breathable materials and specialized testing. They design covers to be thin enough not to impede the transfer of heat or cold, and they use non-metallic fasteners in critical areas to prevent electrical interference or localized hot spots, rigorously testing thermal performance.

What is the difference between universal-fit and custom-fit seat covers in terms of market value?

Custom-fit covers command a significantly higher market value and price premium because they offer superior aesthetic integration, enhanced safety due to precise airbag compatibility, and much greater material durability due to their tailored construction, compared to low-cost, one-size-fits-all universal alternatives.

What specific challenges does the production of synthetic leather seat covers face?

Production challenges for synthetic leather include achieving the desired luxury look and feel while maintaining breathability and minimizing the use of environmentally harmful plasticizers. Manufacturers must also continuously improve synthetic formulations to resist peeling, cracking, and excessive heat absorption in hot climates.

How is the market leveraging digital platforms to enhance product configuration?

Digital platforms utilize advanced product configurators and high-resolution imaging, sometimes including 3D or AR visualizations. These tools allow customers to select specific material types, colors, stitching patterns, and logos, instantly previewing the results on their exact vehicle model, thereby streamlining complex custom orders.

Which segments of the commercial vehicle market show the greatest demand?

The taxi/ride-sharing and fleet rental segments show the greatest current demand, followed closely by the industrial and construction heavy-truck segment. The former prioritizes hygiene and ease of cleaning, while the latter focuses purely on maximum durability and resistance to harsh occupational contaminants.

What is the current trend regarding the use of sheepskin in the market?

Sheepskin remains a niche luxury segment, primarily valued for its natural temperature regulation and exceptional comfort in colder climates. While not a volume leader, it commands the highest price per unit and caters to consumers prioritizing opulent comfort over maximum ruggedness or technological integration.

How do technological advancements in stitching affect overall product quality?

Technological advancements, such as automated CNC stitching and laser-guided assembly, drastically improve product quality by ensuring perfect seam alignment, uniform tension, and robust construction. This precision is essential for guaranteeing airbag compatibility and enhancing the overall fit and longevity of the finished seat cover.

What is the significance of the "Base Year" 2025 in the market report structure?

The Base Year 2025 represents the established starting point and reference data against which all future forecasts and compounded annual growth rates (CAGR) are calculated. It provides the most recent, fully analyzed market size and structure before the start of the defined forecast period (2026–2033).

Which segment, Material or Distribution Channel, experiences faster innovation cycles?

The Material segment generally experiences faster innovation cycles driven by continuous advancements in textile science, focusing on integrating properties like antimicrobial treatments, specialized UV stabilizers, and improved breathability into new synthetic compounds to meet evolving consumer and commercial needs.

How do manufacturers ensure their covers do not interfere with integrated seat electronics?

Manufacturers ensure non-interference by rigorous testing and design. They use non-conductive, non-metallic fastening systems near electronic components, strategically placing attachment points to avoid pressure on sensors, and ensuring materials are thin enough not to obstruct the operation of heating or cooling elements.

What are the typical lifespan expectations for genuine leather covers compared to high-end synthetics?

Genuine leather, if properly maintained, can last the entire life of the vehicle (10+ years), often improving in appearance over time. High-end synthetic covers typically offer longevity of 5 to 10 years, depending on the material quality and usage intensity, but usually require less maintenance than natural leather.

What are the main risks associated with purchasing universal-fit seat covers?

The main risks associated with universal-fit covers include poor fitment that leads to bunching and movement, potential interference with seat functionality (like folding or reclining), and critically, an inability to guarantee safe deployment of side airbags, posing a significant safety hazard.

How does the demand for customization differ between Europe and North America?

In North America, customization is often focused on utility, ruggedness, and aggressive aesthetics (trucks/SUVs). In Europe, customization tends towards aesthetic refinement, focusing on precision stitching, luxurious materials, and color matching that closely mimics high-end factory upholstery, emphasizing sophistication over ruggedness.

What defines the upstream analysis within the Car Seat Covers Value Chain?

Upstream analysis focuses on the initial stages of material supply and preparation, including sourcing raw materials (hides, polymers, fibers), primary processing (tanning, chemical treatment), and managing the cost and quality control of these foundational inputs before they reach the manufacturing facility.

How does the aftermarket segment capitalize on older vehicle models?

The aftermarket capitalizes on older models by providing replacement covers that are often unavailable through the OEM (Original Equipment Manufacturer) once the vehicle is out of production. They serve the restoration and refurbishment market, extending the usable life and improving the appearance of aging vehicle interiors affordably.

What role does branding and licensing play in the competitive landscape?

Branding and official licensing (e.g., specific vehicle models or major sports teams) play a significant role by building consumer trust, guaranteeing fitment quality, and allowing manufacturers to command a price premium over generic alternatives, enhancing their competitive positioning and market visibility.

What technological trends are expected to revolutionize the market by 2033?

Revolutionary trends expected by 2033 include the widespread commercial application of smart textiles for integrated health monitoring or temperature control, AI-powered fully autonomous design and fitting processes, and the transition to closed-loop recycling and 100% sustainable materials across the industry.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager