Car Security Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433838 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Car Security Systems Market Size

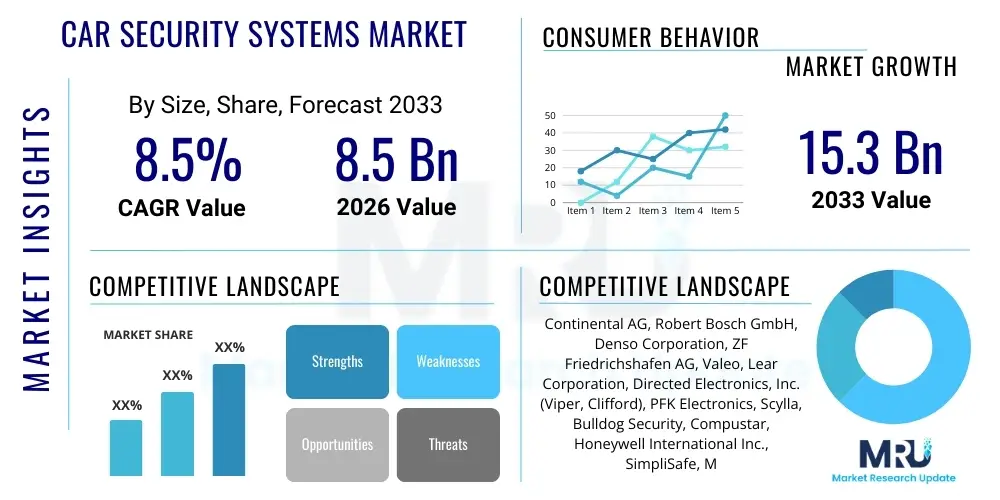

The Car Security Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $8.5 Billion in 2026 and is projected to reach $15.3 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by the escalating demand for advanced vehicle protection solutions, propelled by increasing rates of vehicle theft, the widespread integration of connected car technologies, and stringent regulatory mandates requiring sophisticated anti-theft and tracking mechanisms across key global regions. The shift from traditional alarms to complex, multi-layered security ecosystems featuring telematics and biometric authentication is a significant accelerator of market valuation, ensuring sustained growth throughout the forecast horizon.

Car Security Systems Market introduction

The Car Security Systems Market encompasses the design, manufacture, and deployment of specialized electronic and mechanical components aimed at preventing unauthorized access, deterring theft, and safeguarding vehicles and their contents. Products range from foundational devices, such as passive immobilizers and audible alarms, to highly sophisticated, networked systems, including GPS/GSM tracking devices, remote monitoring telematics, and biometric authentication modules integrated directly into the vehicle’s electronic architecture. These systems are crucial for minimizing financial losses for owners and insurance providers, enhancing personal safety, and ensuring compliance with evolving vehicle safety standards globally. The fundamental objective is to provide proactive defense against malicious activities, whether physical intrusion or digital compromise.

Major applications for car security systems span passenger vehicles, commercial fleets, and high-value logistics operations, where real-time monitoring and geo-fencing capabilities are essential for operational security and efficiency. The immediate benefits derived from these advanced systems include significant reductions in insurance premiums, enhanced recovery rates for stolen vehicles due to precise tracking capabilities, and unparalleled peace of mind for vehicle owners. Furthermore, modern security systems are increasingly leveraged as part of a broader vehicle health and maintenance framework, providing diagnostic data alongside security alerts, thereby transforming the vehicle from a static asset into a dynamically monitored, connected endpoint.

Key driving factors underpinning the expansion of this market include the global proliferation of high-end and luxury vehicles, which are prime targets for sophisticated theft rings, thereby necessitating robust anti-theft measures. Concurrently, the rise of the Internet of Things (IoT) in automotive manufacturing has facilitated the seamless integration of sophisticated sensors and communication modules, making advanced security features more accessible and effective. Furthermore, regulatory bodies in regions like Europe and North America continue to introduce mandates promoting or requiring certain levels of security technology, such as mandatory tracking systems for new commercial vehicles, ensuring a steady baseline demand for these critical security solutions.

Car Security Systems Market Executive Summary

The Car Security Systems Market is currently undergoing a transformative period marked by the convergence of automotive security with broader cybersecurity protocols, driven largely by the proliferation of connected vehicles. Business trends indicate a clear shift away from standalone security hardware towards subscription-based telematics and software-defined security services that offer continuous updates and remote diagnostics. Key manufacturers are aggressively pursuing strategic partnerships with semiconductor producers and specialized software developers to embed tamper-proof security at the microchip level, addressing the significant threat posed by CAN bus hacking and other digital vulnerabilities. This emphasis on cybersecurity assurance is the cornerstone of modern market growth, influencing both OEM integration strategies and aftermarket consumer choices.

Regional trends reveal that North America and Europe remain the principal revenue generators, characterized by high disposable incomes, significant adoption rates for advanced vehicle technologies, and strict data privacy and security regulations (such as GDPR). However, the Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate, fueled by massive increases in vehicle production, particularly in China and India, alongside the rapidly developing middle-class segments that prioritize vehicle protection. This regional growth dynamic compels global suppliers to adapt their product portfolios to meet diverse local regulatory requirements and pricing sensitivities, often necessitating simplified yet effective solutions for emerging mass-market segments.

In terms of segment trends, the market is overwhelmingly leaning toward the Remote Tracking and Telematics segment, moving beyond basic GPS location services to incorporate advanced driver behavior analysis, crash detection, and secure remote engine disablement. The increasing integration of these telematics solutions into the Original Equipment Manufacturer (OEM) assembly line is cannibalizing portions of the traditional aftermarket hardware segment, forcing aftermarket providers to innovate rapidly, often focusing on highly specialized features such as advanced biometrics or vehicle-specific security overlays. The shift towards software and service revenue models ensures more stable long-term growth and higher profitability margins compared to solely relying on one-time hardware sales.

AI Impact Analysis on Car Security Systems Market

User queries regarding AI in car security frequently revolve around three core themes: the reduction of false alarms through intelligent detection, the deployment of predictive analytics for theft prevention, and the integration of advanced biometric and behavioral authentication methods. Consumers are deeply concerned about the efficacy of current systems in high-density environments, often asking how AI distinguishes genuine threats from environmental interference (e.g., wind, construction noise). Furthermore, questions focus on AI's role in securing the growing number of connected components against sophisticated remote exploits, expecting AI to establish behavioral baseline models for both the driver and the vehicle’s operational status to detect anomalies instantly, thereby moving security from reactive response to proactive intervention.

The implementation of Artificial Intelligence, particularly Machine Learning (ML) algorithms, is fundamentally reshaping the capabilities and reliability of car security systems. AI facilitates sophisticated pattern recognition, allowing systems to learn the typical operating environment and driver habits, drastically reducing the instances of false positive alerts that have historically plagued traditional ultrasonic and shock sensors. By processing multiple inputs—including accelerometer data, audio patterns, geolocation velocity, and door lock status—AI models can synthesize contextual information to determine the likelihood of a genuine threat with high accuracy, thereby significantly enhancing user trust and minimizing resource wastage for authorities and system owners. This intelligent filtering capacity is essential for modern security architectures.

Beyond noise reduction, AI is crucial for developing predictive security measures. ML models analyze historical data points relating to theft location, timing, vehicle type, and attack vectors to generate risk maps and proactively alert owners or fleet managers when a vehicle enters a high-risk zone or exhibits anomalous behavior indicative of preparation for theft. For autonomous and semi-autonomous vehicles, AI plays a pivotal role in internal cybersecurity, continuously monitoring the integrity of the vehicle’s Electronic Control Units (ECUs) and communication pathways (such as the CAN bus and Ethernet backbone) to detect and neutralize unauthorized firmware changes or injected malicious code, thereby safeguarding vehicle functionality and occupant safety against digital attacks.

- AI-driven pattern recognition significantly reduces false alarm rates by analyzing contextual environmental and behavioral data.

- Machine learning enables predictive theft modeling based on geolocation history and observed anomalies in vehicle usage.

- Behavioral biometrics (e.g., driving style, seating position) utilize AI for personalized authentication and unauthorized driver detection.

- AI algorithms facilitate real-time anomaly detection in vehicle network traffic (CAN bus monitoring) to prevent cyber intrusions.

- Intelligent sensor fusion optimizes the effectiveness of perimeter sensors, adapting sensitivity based on environmental conditions.

DRO & Impact Forces Of Car Security Systems Market

The Car Security Systems Market is propelled by mandatory regulatory requirements and the rapid advancement of automotive technology, while simultaneously being constrained by high implementation costs and increasing complexity related to cybersecurity vulnerabilities. Opportunities arise from integrating these security mechanisms with vehicle-to-everything (V2X) communication infrastructure and the development of tamper-proof, blockchain-based data logging solutions. The interplay of these forces dictates market trajectory: high-tech drivers push innovation, but cost and complexity restraints limit mass-market penetration, making strategic policy intervention and technological simplification critical for sustained long-term growth across all geographic and demographic segments.

The primary drivers include the escalating global vehicle theft statistics, which pressure consumers and insurance companies to adopt stronger countermeasures, and the accelerating integration of IoT connectivity into all vehicle classes, necessitating robust digital security measures. Furthermore, governments worldwide are enacting stricter anti-theft legislation, often making immobilizers or basic tracking units mandatory features for new vehicles, guaranteeing a baseline level of market demand. However, the market faces significant restraints, notably the relatively high initial cost of installing advanced security systems, especially biometric and telematics solutions, which can deter price-sensitive buyers. A critical restraint is the technical challenge posed by the increasing sophistication of car theft techniques, including relay attacks and advanced digital hacking, which constantly forces manufacturers into an expensive and rapid innovation cycle.

Significant opportunities exist in two key areas: firstly, the expansion of the commercial and fleet management segment, where advanced tracking, diagnostics, and secure asset management justify higher investment in security infrastructure. Secondly, the market has immense potential in developing truly integrated V2X security protocols. As vehicles begin to communicate reliably with infrastructure and other vehicles, the security system must evolve beyond protecting the individual car to securing the entire network ecosystem, potentially utilizing decentralized identity management and encryption. Impact forces, such as changing consumer preferences for seamless, keyless access and the intensifying competition among telematics providers, further shape product development toward highly integrated, user-friendly, and digitally resilient security solutions.

Segmentation Analysis

The Car Security Systems Market is extensively segmented across multiple dimensions, including system type, technology employed, vehicle class application, and sales channel. This detailed segmentation reflects the diverse needs of end-users, ranging from basic protection requirements for older vehicles to comprehensive, integrated digital and physical security for high-value modern cars and large commercial fleets. The overarching trend within segmentation is the hybridization of traditional alarm systems with cutting-edge digital technologies, particularly within the OEM channel, where security is no longer an add-on but an intrinsic part of the vehicle's electronic architecture. Understanding these segment dynamics is crucial for manufacturers tailoring solutions for specific geographical and economic contexts.

Segmentation by technology highlights the shift from conventional mechanical and basic electronic immobilizers toward sophisticated GPS/GSM modules and advanced sensor technology. The GPS/GSM segment dominates revenue generation due to its dual function of security monitoring and fleet management capabilities, offering actionable data that justifies the investment for commercial operators. Meanwhile, the emergence of advanced protocols like Ultra-Wideband (UWB) and refined CAN bus intrusion detection systems is defining the high-security niche. Vehicle type segmentation clearly delineates the demand for sophisticated security in premium passenger cars and commercial vehicles, contrasting with the more basic security requirements typically found in economy passenger car markets.

The Sales Channel split between OEM and Aftermarket dictates product design and pricing. OEM integration focuses on deep system compatibility and cybersecurity assurance, often leveraging vehicle data bus access for seamless operation. The Aftermarket, conversely, thrives on providing specialized features, high performance, and competitive pricing for vehicles that lack factory-installed advanced security. As OEMs continue to integrate more features standard, the Aftermarket must pivot toward highly specialized, feature-rich supplemental systems, such as advanced biometric locks or tailored fleet management platforms, to maintain relevance and market share against the increasingly comprehensive factory offerings.

- By Type:

- Alarm Systems (Audible, Silent/Pagers)

- Immobilizers (Passive, Transponder-based, Integrated)

- Remote Tracking and Telematics Systems (GPS/GSM, Lojack)

- Biometric Access Systems (Fingerprint, Voice Recognition, Facial Recognition)

- Advanced Driver Assistance System (ADAS) Integration

- By Technology:

- GPS/GSM Connectivity

- Ultrasonic and Microwave Sensors

- Radio Frequency Identification (RFID)

- Controller Area Network (CAN) Bus Security

- Ultra-Wideband (UWB) Keyless Technology

- By Vehicle Type:

- Passenger Vehicles (Economy, Mid-Range, Luxury)

- Commercial Vehicles (Light, Heavy Duty, Buses)

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

Value Chain Analysis For Car Security Systems Market

The value chain for the Car Security Systems Market is highly integrated and complex, spanning raw material provision, high-technology component manufacturing, system integration, distribution, and ultimately, installation and maintenance services. The upstream segment is dominated by specialized semiconductor manufacturers, sensor providers (accelerometers, gyroscopes, proximity sensors), and communication module developers (GPS, GSM, UWB chips). These suppliers, primarily based in Asia Pacific and North America, provide the essential technological backbone, requiring high precision and compliance with automotive safety integrity levels (ASIL) given the critical nature of the components. Control over the supply of highly specialized microchips and secure communication hardware is a major point of leverage in this part of the chain.

Midstream activities involve the security system integrators, Tier 1 automotive suppliers (like Bosch, Continental, Denso), and specialized security hardware companies (like Directed, Compustar). These entities consolidate the upstream components, develop proprietary software, and integrate the security features into cohesive modules compatible with vehicle ECUs and specific CAN bus architectures. For the OEM channel, these Tier 1 suppliers collaborate closely with vehicle manufacturers during the design phase to ensure deep system integration. For the aftermarket, manufacturers focus on creating modular systems that are compatible with a wide range of vehicle models and can be retrofitted efficiently.

The downstream component is crucial and involves direct and indirect distribution channels. The direct channel largely constitutes OEM sales, where the security system is factory-installed and bundled into the final vehicle price, providing guaranteed volume for suppliers. The indirect channel relies on networks of independent distributors, authorized dealers, vehicle dealerships, and specialized aftermarket installation shops. Specialized installers play a vital role, especially for complex telematics or biometric systems, as improper installation can negate the security benefits or, worse, introduce vulnerabilities. Ongoing maintenance, subscription services for telematics, and software updates form the long-tail revenue stream, reinforcing the service aspect of the downstream value chain.

Car Security Systems Market Potential Customers

The primary customers of car security systems can be broadly categorized into three distinct segments: Automotive Original Equipment Manufacturers (OEMs), Commercial Fleet Operators and Logistics Companies, and Individual Vehicle Owners, particularly those in the premium and luxury segments. OEMs represent the largest customer base in terms of unit volume, as they incorporate security systems, from basic immobilizers to advanced telematics, directly into their vehicle models during the production phase to meet regulatory standards and enhance brand perceived value. Their purchasing criteria are centered on reliability, integration compatibility, and compliance with stringent quality and safety standards (e.g., ISO 26262).

Commercial Fleet Operators, including trucking companies, ride-sharing services, and delivery logistics providers, constitute a high-growth customer segment focusing heavily on advanced telematics and remote monitoring solutions. These buyers utilize security systems not just for theft prevention, but crucially for asset tracking, optimization of operational efficiency, managing driver behavior, geo-fencing, and complying with insurance requirements for high-value cargo transport. For fleets, the security system must offer robust real-time data reporting and scalable platform integration, justifying the cost through lower operational expenses and better risk management.

The final crucial customer segment comprises individual vehicle owners who typically access security systems through the aftermarket channel or by opting for premium factory-installed features. This group is driven primarily by concerns over personal property loss, insurance requirements, and safety. Owners of luxury vehicles, performance cars, and classic cars are particularly willing to invest in advanced, multi-layered systems, including biometric access and specialized anti-jamming telematics, to protect their valuable assets. The aftermarket customer often seeks customization, advanced functionality (like remote start integration), and enhanced theft recovery capabilities beyond standard factory offerings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $8.5 Billion |

| Market Forecast in 2033 | $15.3 Billion |

| Growth Rate | CAGR 8.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Continental AG, Robert Bosch GmbH, Denso Corporation, ZF Friedrichshafen AG, Valeo, Lear Corporation, Directed Electronics, Inc. (Viper, Clifford), PFK Electronics, Scylla, Bulldog Security, Compustar, Honeywell International Inc., SimpliSafe, Mitsubishi Electric, Aptiv PLC, NXP Semiconductors, Infineon Technologies AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Car Security Systems Market Key Technology Landscape

The technology landscape in the Car Security Systems Market is rapidly evolving, driven by the need to combat increasingly sophisticated digital theft methods, particularly those targeting keyless entry systems and onboard diagnostics ports. A critical technological shift involves moving from traditional radio frequency (RF) authentication to Ultra-Wideband (UWB) technology for keyless entry and proximity sensing. UWB offers precise distance measurement, effectively neutralizing relay attacks, which exploit the time delay of RF signals to trick the car into believing the key fob is nearby. This enhanced spatial awareness provides a fundamentally stronger layer of physical access security, which is being rapidly adopted by premium vehicle manufacturers globally.

Furthermore, the integration of advanced cybersecurity technologies is paramount. This includes implementing Hardware Security Modules (HSMs) directly within Electronic Control Units (ECUs) to establish a root of trust and secure the vehicle’s communication infrastructure. These HSMs manage cryptographic keys, ensuring that software updates are authenticated and that unauthorized access attempts to the CAN bus are detected and blocked instantaneously. Specialized intrusion detection and prevention systems (IDPS) are being developed using machine learning to monitor the internal network traffic, establishing behavioral baselines, and flagging deviations that signify malicious activity, thus securing the critical vehicle functions from remote compromise.

Another area of intense technological focus is the utilization of blockchain and distributed ledger technologies (DLT) for secure data logging and supply chain integrity. Blockchain can be employed to create an immutable record of component authentication, software versioning, and vehicle ownership history, making it virtually impossible for illicit parties to tamper with the vehicle’s identity or operational logs. Coupled with sophisticated biometric authentication methods—including fingerprint scanners and facial recognition integrated into the infotainment system or steering wheel—these technologies provide multiple, mutually reinforcing layers of physical and digital defense, significantly raising the barrier to entry for potential thieves and ensuring data integrity across the vehicle’s lifecycle.

Regional Highlights

- North America: This region is characterized by high consumer demand for advanced, feature-rich security systems, particularly those integrated with telematics for location tracking and insurance premium reduction. The US and Canada represent a mature market with significant aftermarket activity, but the OEM share is rapidly growing as connected services become standard. High rates of luxury vehicle ownership and a strong regulatory environment favoring data security drive substantial investment in anti-jamming technologies and sophisticated digital defenses.

- Europe: Europe is defined by stringent safety and environmental regulations, which indirectly influence security system design. Mandatory requirements for eCall systems (which often utilize core telematics hardware) and impending cybersecurity standards for connected vehicles are key market drivers. Germany, the UK, and France are leaders in adopting sophisticated immobilizers and V2X security protocols, focusing heavily on robust data protection compliant with GDPR, making secure data handling a competitive necessity.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, driven primarily by the massive scale of automotive manufacturing in China, Japan, South Korea, and India, coupled with rapid urbanization and rising wealth. While cost-sensitivity remains high in certain mass-market segments, the proliferation of technology and increasing vehicle theft rates push demand for affordable yet reliable GPS tracking and alarm systems. Japan and South Korea lead in adopting advanced OEM technologies, whereas China dominates in volume and the rapid implementation of domestic telematics solutions linked to regional infrastructure.

- Latin America (LATAM): The LATAM region, particularly Brazil and Mexico, exhibits very high demand for vehicle security due to persistent high rates of vehicular theft and hijacking. The market is heavily skewed towards high-efficacy theft recovery systems, primarily GPS/GSM tracking units, often mandated by insurance providers. Aftermarket solutions thrive here, focusing on durability and reliable communication under varying infrastructure conditions.

- Middle East and Africa (MEA): This region shows varied market maturity, with the GCC countries (UAE, Saudi Arabia) rapidly adopting high-end integrated security systems for their predominantly luxury and premium vehicle fleets. In contrast, emerging African markets prioritize cost-effective immobilization and basic tracking solutions. The growth is intrinsically linked to infrastructure development and the regulation of mobile communication networks necessary for telematics functionality.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Car Security Systems Market.- Continental AG

- Robert Bosch GmbH

- Denso Corporation

- ZF Friedrichshafen AG

- Valeo

- Lear Corporation

- Directed Electronics, Inc. (Viper, Clifford)

- PFK Electronics

- Scylla

- Compustar (Firstech, LLC)

- Honeywell International Inc.

- Infineon Technologies AG (Component Provider)

- NXP Semiconductors N.V. (Component Provider)

- Mitsubishi Electric Corporation

- Aptiv PLC

- Harman International (Samsung subsidiary)

- Technisat Digital GmbH

- Xroadmedia GmbH

- Garmin Ltd.

- Sober Steering

Frequently Asked Questions

Analyze common user questions about the Car Security Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between an immobilizer and a car alarm system?

An immobilizer prevents the engine from starting without the correct key or code, acting as a direct mechanical and electronic barrier to operation. A car alarm system is primarily a deterrent, designed to alert the owner and surrounding public using audible signals or remote notifications (telematics) when unauthorized entry or intrusion is detected.

How does AI contribute to reducing false alarms in car security?

AI utilizes Machine Learning (ML) algorithms to analyze multiple sensor inputs (shock, tilt, audio, context) and learns typical environmental patterns. By distinguishing genuine malicious activities from harmless noise (like passing trucks or thunder), AI significantly reduces the incidence of false positive alerts, enhancing system reliability.

Are current keyless entry systems vulnerable to relay attacks, and how is the industry responding?

Standard Passive Keyless Entry (PKE) systems using traditional Radio Frequency (RF) are highly susceptible to relay attacks. The industry is responding by rapidly adopting Ultra-Wideband (UWB) technology, which precisely measures the time-of-flight of the signal, preventing the amplification or relaying trickery used by thieves.

What role does the CAN bus play in modern vehicle security?

The Controller Area Network (CAN) bus is the vehicle’s internal communication network, connecting all critical ECUs (engine, brakes, steering). Securing the CAN bus is vital because compromising it allows hackers to disable safety features, unlock doors, or steal vehicle data. Modern systems use intrusion detection software to monitor CAN traffic for anomalies.

Which segment of the Car Security Market is projected to experience the fastest growth?

The Remote Tracking and Telematics segment is projected to experience the fastest growth. This is due to the increasing integration of Internet of Things (IoT) capabilities in vehicles, the demand from commercial fleet operators for advanced diagnostics and asset management, and the rising consumer preference for subscription-based real-time monitoring services.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Passenger Car Security Systems Market Size Report By Type (Immobilizer, Remote Keyless Entry (RKE), Passive Keyless Entry (PKE), Passive Keyless Go (PKG)), By Application (OEM, Aftermarket), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Car Security Systems Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Immobilizer system, Remote Central Locking System, Alarm System), By Application (Economic Cars, Mid-Range Cars, Premium Cars), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Car Security Systems Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Central Locking System, Global Positioning System, Immobilizers, Others), By Application (Passenger Car, Commercial Vehicles), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Passenger Car Security Systems Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Immobilizer, Remote keyless entry (RKE), Passive keyless entry (PKE), Passive keyless go (PKG)), By Application (OEM, Aftermarket), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager