Car Side Skirt Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434232 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Car Side Skirt Market Size

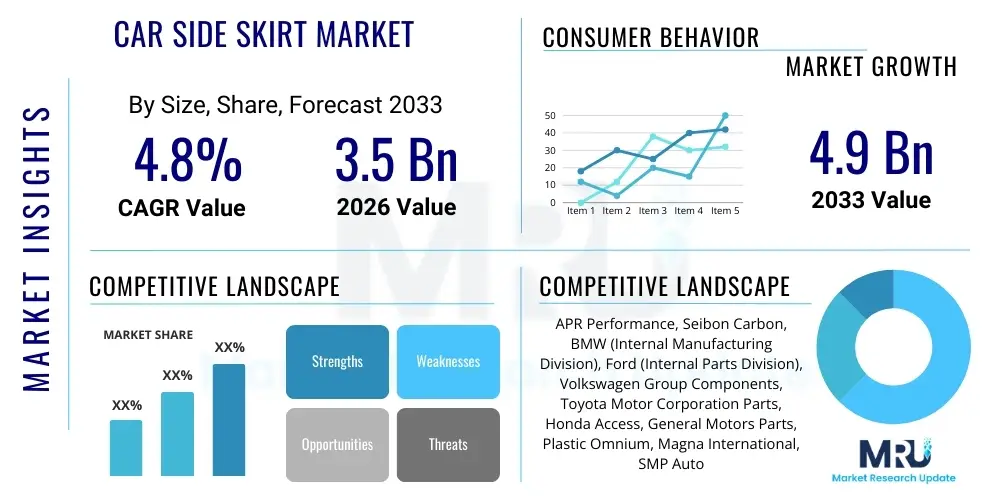

The Car Side Skirt Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 4.9 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily fueled by the increasing global demand for vehicle aesthetics, enhanced aerodynamics, and the proliferation of aftermarket modification culture, particularly in emerging economies where personal vehicle customization is gaining significant traction. Furthermore, regulatory pressures focusing on improved vehicle efficiency, which side skirts contribute to by managing airflow, also bolster OEM adoption rates.

Car Side Skirt Market introduction

The Car Side Skirt Market encompasses the manufacturing, distribution, and sale of aerodynamic components fitted along the lower sides of a vehicle, between the front and rear wheel wells. These components, often referred to as rocker panels or sill extensions, serve multiple critical functions ranging from aesthetic enhancement to functional aerodynamic management and protection of the vehicle underbody. The product range is diverse, covering standard Original Equipment Manufacturer (OEM) parts, which prioritize durability and integration, as well as highly specialized Aftermarket parts made from materials like carbon fiber or polyurethane, focusing on performance aesthetics and reduced weight. The fundamental objective of a side skirt is to prevent high-pressure air from moving underneath the vehicle, thereby reducing aerodynamic lift and drag, which ultimately improves stability and fuel efficiency at higher speeds. This dual role of appearance and performance ensures their persistent demand across various vehicle segments.

Major applications for car side skirts span passenger vehicles, including sedans, SUVs, and high-performance sports cars. In the OEM sector, side skirts are often integrated as standard equipment, reflecting modern design language and subtle aerodynamic optimization necessary for meeting increasingly stringent emission and efficiency standards. Conversely, the aftermarket segment drives innovation through customization, where consumers seek unique designs, aggressive styling, and high-performance materials to differentiate their vehicles. The rapid expansion of electric vehicles (EVs) is also creating new application spaces, as side skirts are crucial for managing airflow around large battery packs typically situated low in the chassis, contributing directly to extended driving range by minimizing drag.

Driving factors for this market include the global rise in disposable incomes, especially in Asian economies, which fuels the luxury and performance vehicle segments where side skirts are standard or highly desired upgrades. Furthermore, the burgeoning automotive modification industry, driven by popular culture, digital media influence, and organized enthusiast events, significantly boosts aftermarket sales. The continuous push toward lightweight materials to enhance fuel economy and reduce carbon emissions ensures that material science advancements, such as the increased use of carbon fiber reinforced plastics (CFRP), remain a strong market catalyst. Additionally, consumer safety and vehicle protection against road debris and minor impacts also contribute to the steady demand for robust side skirt solutions.

Car Side Skirt Market Executive Summary

The Car Side Skirt Market is characterized by robust business trends driven by technological convergence and shifting consumer preferences toward personalization and performance. A dominant trend involves the hybridization of the supply chain, wherein traditional OEM suppliers are increasingly leveraging advanced material technologies, such as thermoformed composites and additive manufacturing (3D printing), originally championed by the high-end aftermarket sector. This convergence is leading to lighter, more durable, and more complex side skirt designs integrated into new vehicle architectures. Furthermore, sustainability is becoming a key business metric; manufacturers are actively investing in recycled plastics and bio-based composites to align with environmental regulations and corporate responsibility goals, subtly changing the material landscape away from pure virgin polymers where possible. The competitive environment remains highly fragmented in the aftermarket space but concentrated among Tier 1 suppliers in the OEM segment, necessitating constant investment in automation and tooling precision to maintain margins.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by the rapid expansion of automotive manufacturing bases in China, India, and Southeast Asia, coupled with high vehicle customization rates among affluent young populations. Europe maintains its importance due to stringent aerodynamic efficiency standards and a strong heritage of high-performance vehicle manufacturing, demanding precision-engineered carbon fiber and advanced composite side skirts. North America, while mature, sees steady demand growth driven primarily by the truck and SUV accessory market, where side steps (a functional derivative of side skirts) and robust off-road aesthetic enhancements are highly sought after. Geopolitical factors influencing raw material prices, particularly petroleum-derived plastics and energy costs for composite curing, pose intermittent supply chain challenges that impact regional pricing strategies.

Segmentation trends highlight a pronounced shift toward Material differentiation. While ABS Plastic and Polypropylene continue to dominate the volume market due to cost-effectiveness and ease of mass production, Carbon Fiber and lightweight composites are capturing increasingly valuable market share in the premium and performance segments. The Aftermarket segment is experiencing higher CAGR compared to the OEM segment, driven by easy online procurement channels and the accessibility of Do-It-Yourself (DIY) installation guides and modification communities. The future growth will hinge significantly on the success of material innovation that can deliver carbon fiber-like strength and weight savings at near-plastic costs, addressing the core conflict between performance requirements and economic viability across various vehicle types.

AI Impact Analysis on Car Side Skirt Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Car Side Skirt Market typically revolve around whether AI will automate the design process, optimize manufacturing logistics, and personalize the buying experience. Users are particularly keen to understand how computational fluid dynamics (CFD) simulations, traditionally resource-intensive, will be accelerated and refined by machine learning algorithms to create highly efficient aerodynamic designs instantly adaptable to specific vehicle models and driving conditions. Concerns often surface regarding job displacement in design and manual fabrication roles, balanced by expectations that AI-driven quality control and predictive maintenance will dramatically reduce waste and improve the precision of composite manufacturing processes. The consensus expectation is that AI will not fundamentally change the physical product itself, but rather revolutionize the speed, efficiency, and customization depth of its creation and supply chain integration.

- AI-Driven Design Optimization: Machine learning algorithms enhance Computational Fluid Dynamics (CFD) analysis, rapidly iterating through thousands of geometric variations to find optimal aerodynamic profiles, minimizing drag and maximizing downforce tailored to specific vehicle models.

- Predictive Maintenance in Manufacturing: AI systems analyze sensor data from composite molding and plastic injection machines to predict potential equipment failures or material flaws, ensuring higher precision, reducing downtime, and lowering scrap rates during high-volume production.

- Automated Quality Control (AQC): Image recognition and deep learning models swiftly scan finished side skirts for surface imperfections, alignment issues, or structural deficiencies, replacing manual inspection processes and ensuring stringent quality standards, particularly critical for carbon fiber parts.

- Personalized Aftermarket Recommendations: AI leverages customer purchase history, vehicle type, and browsing behavior to recommend ideal side skirt styles, materials, and compatible accessories, significantly improving conversion rates for online retailers and reducing return rates.

- Supply Chain and Inventory Management: AI algorithms forecast demand fluctuations based on seasonal trends, model releases, and economic indicators, optimizing raw material procurement (e.g., carbon prepregs, ABS pellets) and minimizing warehousing costs for suppliers globally.

- Generative Design for Lightweighting: AI assists engineers in generating novel, complex internal lattice structures for side skirts that reduce material usage while maintaining structural integrity, accelerating the industry's focus on lightweighting for EV applications.

DRO & Impact Forces Of Car Side Skirt Market

The dynamics of the Car Side Skirt Market are defined by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively constituting the market's Impact Forces. Key drivers include the escalating consumer preference for vehicle customization and the strong regulatory push for improved fuel efficiency and reduced emissions, which necessitate highly optimized aerodynamic components like side skirts. Restraints often revolve around the volatility of raw material prices, particularly the high cost associated with advanced materials like carbon fiber composites, and the challenges related to the complex installation process of high-performance aftermarket kits. Opportunities are abundant in the electric vehicle sector, where specific aerodynamic requirements are crucial for battery thermal management and range extension, and in the adoption of sustainable manufacturing practices utilizing bio-composites or recycled materials, opening new market differentiation avenues.

Driving forces center heavily on consumer behavior and regulatory mandates. The visual appeal and perceived performance boost derived from stylish side skirts consistently drive replacement and upgrade cycles in the aftermarket. Simultaneously, global vehicle safety and performance standards increasingly mandate aerodynamic components that contribute to vehicle stability at high speeds. The mass shift toward SUVs and Crossovers globally, which often require robust and aesthetically defined lower body panels, further solidifies the demand base for side skirt manufacturers. These drivers create a stable underlying momentum for market expansion, ensuring continuous product development focused on material aesthetics and structural integrity across all price points.

Restraining factors primarily relate to the supply chain complexity and economic sensitivity. The manufacturing process for high-quality composite side skirts requires significant capital investment in tooling and specialized facilities, creating high barriers to entry. Economic downturns frequently impact discretionary spending on vehicle customization, slowing the aftermarket segment. The inherent fragility of certain lightweight materials (e.g., specific carbon fiber weaves) compared to robust OEM plastics can lead to higher replacement rates and potential customer dissatisfaction if not properly installed or protected, representing a latent risk. The impact forces show a strong positive bias towards growth, especially as the industry successfully manages material costs through scale and leverages advanced manufacturing techniques like injection molding for complex geometries.

Impact Forces Summary: The major force propelling the market is the sustained synergy between consumer aesthetic demand and the necessity for aerodynamic efficiency in modern vehicle design. This demand cycle ensures resilience against minor economic fluctuations. Restraints, while present in material cost volatility and installation complexities, are mitigated by technological advancements (like simplified mounting systems and cheaper composite alternatives) and the global trend toward vehicle longevity and modification culture, resulting in a net positive impact trajectory for market growth over the forecast period. The potential for disruption lies primarily in material science breakthroughs that could drastically reduce the cost of performance composites.

Segmentation Analysis

The Car Side Skirt Market is meticulously segmented based on Material Type, Vehicle Type, Distribution Channel, and End-User (OEM vs. Aftermarket), reflecting the diverse needs and manufacturing processes within the industry. This detailed segmentation is crucial for stakeholders to tailor production capabilities and marketing strategies effectively. Material segmentation, which includes ABS Plastic, Polypropylene (PP), Fiberglass, and Carbon Fiber Composites, determines the component’s cost, weight, durability, and aesthetic finish, directly impacting its target vehicle segment—from mass-market economy cars (using PP and ABS) to high-performance luxury vehicles (using Carbon Fiber). The dominance of plastic materials in terms of volume reflects their cost-efficiency and flexibility in injection molding, catering to the vast OEM requirement for standardized, durable components.

Vehicle Type segmentation clearly delineates demand profiles. The Sedan and Hatchback segments typically require aesthetically integrated and subtle designs focused on urban durability and fuel economy. Conversely, the Sports Car and High-Performance Vehicle segments prioritize maximum aerodynamic efficiency, driving demand for aggressive, performance-oriented designs utilizing lightweight and high-strength materials like prepreg carbon fiber. The growing SUV and Truck segment increasingly incorporates side skirts (often disguised as running boards or rocker guards) for protective features and enhanced ground clearance aesthetics, expanding the market scope beyond pure aerodynamics. Understanding these vehicular nuances is vital for accurate capacity planning and identifying profitable niches within the overall automotive accessory landscape.

Furthermore, the Distribution Channel dichotomy—OEM and Aftermarket—shows diverging growth patterns. The OEM segment is stable, driven by automotive production volume and long-term supplier contracts, prioritizing just-in-time delivery and impeccable quality control. The Aftermarket segment, characterized by high-volume, low-margin parts for general replacement and low-volume, high-margin performance parts for customization, is much more volatile and growth-oriented, relying heavily on digital retail platforms and specialized automotive modification shops for distribution. This segment analysis underscores the market's dual nature: reliability and integration in the OEM sphere versus innovation and customization in the aftermarket sphere.

- By Material Type:

- ABS Plastic

- Polypropylene (PP)

- Fiberglass (FRP)

- Carbon Fiber Composites (Wet Layup, Prepreg)

- Polyurethane (PU)

- By Vehicle Type:

- Sedans and Hatchbacks

- Sports Cars and Performance Vehicles

- SUVs and Crossovers

- Trucks and Vans (Rocker Panel Guards)

- By Distribution Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Retail, E-commerce, Specialty Shops)

- By End-Use Application:

- Aerodynamic Performance Enhancement

- Aesthetic Customization

- Vehicle Body Protection

Value Chain Analysis For Car Side Skirt Market

The Value Chain for the Car Side Skirt Market commences with the Upstream activities centered on raw material procurement and processing. This stage involves sourcing petrochemical derivatives (for ABS and PP resins), glass fibers, carbon prepregs, and various chemical additives necessary for molding and finishing. Suppliers in this segment, such as chemical companies and composite fabricators, dictate the cost base and material quality. The midstream manufacturing processes involve highly specialized techniques, including injection molding (for plastic side skirts), Resin Transfer Molding (RTM), or autoclave curing (for composite parts). This stage is capital-intensive, requiring specialized tooling, robotics, and quality control systems to ensure precision fitment and surface finish necessary for seamless integration into vehicle bodies. Efficiency in these processes determines the final unit cost and production scalability.

Downstream activities involve distribution and final installation. The OEM distribution channel is highly organized, utilizing strict Just-In-Time (JIT) logistics to deliver components directly to vehicle assembly lines globally, often requiring regional manufacturing presences near major assembly plants. The aftermarket distribution channel is significantly more complex, relying on a mix of large wholesalers, specialized automotive parts distributors, extensive e-commerce platforms (both B2B and B2C), and local tuning shops. E-commerce has rapidly become a dominant force in the aftermarket, enabling consumers globally to purchase highly customized or niche performance parts directly from manufacturers or specialized retailers. Direct sales from manufacturers to consumers (D2C) for high-end carbon fiber parts are also gaining traction, bypassing traditional retail margins.

The entire value chain is characterized by a high degree of quality dependency and precision requirement, particularly due to the direct visibility and aesthetic role of the side skirt on the vehicle exterior. Direct channels, primarily through OEM contracts, offer volume stability but require intense pricing competitiveness. Indirect channels, dominating the aftermarket, offer higher margins on specialty parts but face greater inventory risk and customer service demands related to fitment issues and installation guidance. Optimizing logistics and reducing the manufacturing cycle time are critical competitive differentiators across both direct and indirect distribution networks, particularly as the market shifts toward localized manufacturing solutions to minimize global shipping costs and carbon footprints.

Car Side Skirt Market Potential Customers

The primary potential customers and end-users of car side skirts fall into two major categories: Automotive Original Equipment Manufacturers (OEMs) and the diverse spectrum of the Aftermarket Consumer Base. OEMs, including global automotive giants such as Volkswagen, Toyota, Ford, and BMW, represent the largest volume segment. They purchase side skirts, both plastic and composite, as integral parts of new vehicle designs, prioritizing durability, crash safety compliance, seamless integration, and adherence to rigorous quality standards and large-scale delivery schedules. Their procurement decisions are heavily influenced by long-term strategic relationships with Tier 1 suppliers who can guarantee material consistency and advanced manufacturing capabilities at competitive bulk pricing. This customer group drives technological integration towards lightweighting and efficiency improvements.

The Aftermarket Consumer Base is far more heterogeneous and driven by distinct motivations: Replacement, Repair, and Customization. Consumers requiring replacement parts are typically motivated by cost-efficiency and seeking parts that match or exceed the original OEM specifications following collision or damage. The customization and tuning community, however, represents the high-growth, high-margin potential customer segment. These buyers, often vehicle enthusiasts or members of specific car clubs, seek high-performance, aesthetically aggressive components made from premium materials like carbon fiber or specialized polyurethane. Their purchase decisions are influenced by brand reputation (e.g., performance tuning brands), aesthetic trends publicized through digital media, and perceived performance gains.

A rapidly emerging customer group is the Electric Vehicle (EV) manufacturers and specialized EV modifiers. These customers require side skirts specifically engineered to optimize airflow around high-voltage battery enclosures, often incorporating unique features for thermal management or cable routing. As the global EV fleet expands, this group will become a pivotal customer segment, driving innovation in material heat resistance and structural rigidity. Overall, the market strategy must be bifurcated: volume stability through OEMs and margin capture and innovation through the highly engaged and trend-sensitive aftermarket consumers and the technologically demanding EV sector.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 4.9 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | APR Performance, Seibon Carbon, BMW (Internal Manufacturing Division), Ford (Internal Parts Division), Volkswagen Group Components, Toyota Motor Corporation Parts, Honda Access, General Motors Parts, Plastic Omnium, Magna International, SMP Automotive, Faurecia (FORVIA), Benteler Automotive, Lacks Enterprises, Hella KGaA Hueck & Co., Roush Performance, Varis, Cusco, TRD (Toyota Racing Development), Mugen Motorsports. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Car Side Skirt Market Key Technology Landscape

The technological evolution within the Car Side Skirt Market is heavily concentrated on advanced material science and efficient manufacturing processes, primarily driven by the persistent need for lightweighting without compromising strength or cost-effectiveness. Key technologies include the widespread adoption of advanced injection molding techniques, particularly two-shot or multi-component molding, which allows for the creation of side skirts with complex mounting points, integrated seals, and multi-texture finishes in a single cycle, enhancing both quality and speed of production for OEM applications. Furthermore, the development of lightweight polymer compounds, often reinforced with mineral fillers or short glass fibers, is continually improving the mechanical properties of budget-friendly plastic side skirts, making them suitable for vehicles where weight reduction is a priority but carbon fiber is cost-prohibitive. This focus on optimizing polymer chemistry ensures mass-market viability.

In the high-performance segment, the technology landscape is dominated by the maturation of Carbon Fiber Reinforced Plastics (CFRP) manufacturing. Advances in out-of-autoclave (OOA) curing techniques, such as Resin Transfer Molding (RTM) and Vacuum Bagging processes, are dramatically reducing the energy consumption and cycle times traditionally associated with high-quality carbon fiber parts. This makes high-end composite side skirts more economically feasible for broader production runs beyond niche supercars. Simultaneously, robotic automation plays a crucial role in ensuring the precise trimming, finishing, and painting of these components. Automated processes guarantee uniformity and reduce the high labor costs and potential for human error inherent in composite finishing, which is essential for components that are highly visible on the vehicle body.

A notable emerging technology is the integration of Additive Manufacturing (3D Printing), particularly for rapid prototyping and the production of highly customized, short-run aftermarket components. 3D printing allows designers to test complex aerodynamic geometries quickly and produce custom mounting brackets or small production batches without the significant upfront costs associated with injection molding tools. This technology democratizes complex design and allows smaller, innovative aftermarket players to rapidly introduce unique products. Looking forward, the market is poised to see further integration of smart technologies, such as embedded sensors within the side skirts for structural health monitoring or sophisticated lighting elements, moving the side skirt from a passive aerodynamic component to an active, integrated part of the vehicle's electronic architecture.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, commanding a significant portion of the global market share, largely due to the high volume of automotive production, especially in China, India, and Southeast Asia. The region benefits from increasing disposable incomes, which fuels the demand for premium and modified vehicles. Japan and South Korea lead in technological adoption, particularly concerning lightweight materials and advanced component integration for both domestic and export markets. China's rapid shift towards electric vehicle manufacturing creates an enormous sustained demand for aerodynamically optimized side skirts crucial for maximizing EV range. The aftermarket tuning culture is robust and heavily influenced by digital trends, driving high turnover in customization components.

- Europe: Europe represents a mature market characterized by stringent environmental and safety regulations. This region demonstrates high demand for high-quality, precision-engineered side skirts, particularly from German luxury automotive manufacturers (BMW, Mercedes-Benz, Audi). The focus here is heavily on premium materials, such as carbon fiber and high-grade composites, necessary to meet strict aerodynamic efficiency targets tied to EU emission standards. The regulatory environment acts as a strong driver for technological innovation in lightweighting and integration. Furthermore, Europe has a long-established and highly sophisticated aftermarket performance tuning sector, ensuring steady demand for specialized component upgrades.

- North America: North America is a significant consumer market, driven by high average vehicle ownership rates and a strong preference for large vehicles like SUVs, pickup trucks, and muscle cars. While the OEM segment is robust, the aftermarket in North America is exceptionally strong, specifically for aesthetic upgrades and functional accessories like durable rocker panel guards and aggressive styling kits. The focus in this region is balanced between performance enhancement in the sports car segment and rugged durability and protection in the light truck segment. The shift toward electric pickups and SUVs is also beginning to generate unique demand for highly protective and aerodynamically refined side skirts designed for challenging environmental conditions.

- Latin America (LATAM): The LATAM market exhibits nascent growth, characterized by strong price sensitivity and a focus on durability due to varying road conditions. The market relies heavily on locally produced plastic components (PP, ABS) for mass-market vehicles, with premium and performance side skirts largely imported from Europe or North America. Brazil and Mexico are key manufacturing hubs and consumption centers, showing potential for future growth driven by improving economic stability and increasing automotive investments by global OEMs seeking regional manufacturing bases.

- Middle East and Africa (MEA): The MEA region is experiencing growth, particularly in the Middle East (UAE, Saudi Arabia), fueled by significant wealth concentrated in luxury and high-performance vehicle ownership. This segment demands high-end, imported composite side skirts for customization. In the African continent, the market is primarily focused on repair and replacement parts, prioritizing cost and availability. The overall regional dynamics are strongly influenced by oil prices and geopolitical stability, which impact consumer spending on automotive luxury goods and customization.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Car Side Skirt Market.- Plastic Omnium

- Magna International

- Faurecia (FORVIA)

- SMP Automotive

- Benteler Automotive

- Lacks Enterprises

- Hella KGaA Hueck & Co.

- Toyota Motor Corporation Parts

- BMW AG (Internal Component Division)

- Ford Motor Company (Performance Parts)

- Volkswagen Group Components

- APR Performance

- Seibon Carbon

- Roush Performance

- Varis

- Cusco

- TRD (Toyota Racing Development)

- Mugen Motorsports

- Liberty Walk

- Prior Design

Frequently Asked Questions

Analyze common user questions about the Car Side Skirt market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary functional benefits of installing aftermarket side skirts on a vehicle?

The primary functional benefits of aftermarket side skirts include enhanced vehicle aerodynamics by managing airflow along the vehicle's sides, effectively minimizing air turbulence and preventing high-pressure air from moving underneath the car. This reduction in lift and drag leads to improved high-speed stability, better handling characteristics, and marginally increased fuel efficiency, while also offering aesthetic enhancement and protection against road debris.

How does the material choice (e.g., ABS Plastic vs. Carbon Fiber) affect the performance and cost of car side skirts?

Material choice significantly impacts both cost and performance. ABS plastic and polypropylene are cost-effective, durable, and flexible, ideal for mass-market OEM and replacement parts. Carbon Fiber Composites are substantially lighter and offer superior tensile strength, making them optimal for high-performance and racing applications where weight reduction and rigidity are paramount, though they are significantly more expensive due to complex manufacturing and raw material costs.

Is the Car Side Skirt market significantly influenced by the global shift towards Electric Vehicles (EVs)?

Yes, the market is significantly influenced by the rise of EVs. Side skirts are crucial for optimizing EV range, as drag reduction directly extends battery life. EV architectures often incorporate large, flat underbodies housing batteries, necessitating highly precise and often functionally integrated side skirts to manage air turbulence, contribute to battery thermal regulation, and protect sensitive underbody components from road hazards.

What is the current growth trend for the OEM versus the Aftermarket segment in the Car Side Skirt Market?

The OEM segment provides stable, high-volume demand, closely tracking global vehicle production rates and driven by efficiency regulations. The Aftermarket segment exhibits a higher growth rate, fueled by strong consumer interest in personalization, tuning culture, and the accessibility of e-commerce platforms for purchasing specialized performance components and replacement parts globally.

What role does Artificial Intelligence (AI) play in the manufacturing and design of modern car side skirts?

AI plays a critical role in optimizing design and manufacturing processes. Machine learning enhances Computational Fluid Dynamics (CFD) simulations, rapidly generating highly efficient aerodynamic geometries. In manufacturing, AI drives automated quality control through image recognition and optimizes production logistics, reducing material waste and ensuring precision in composite curing and molding processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager