Car Spray Waxes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437445 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Car Spray Waxes Market Size

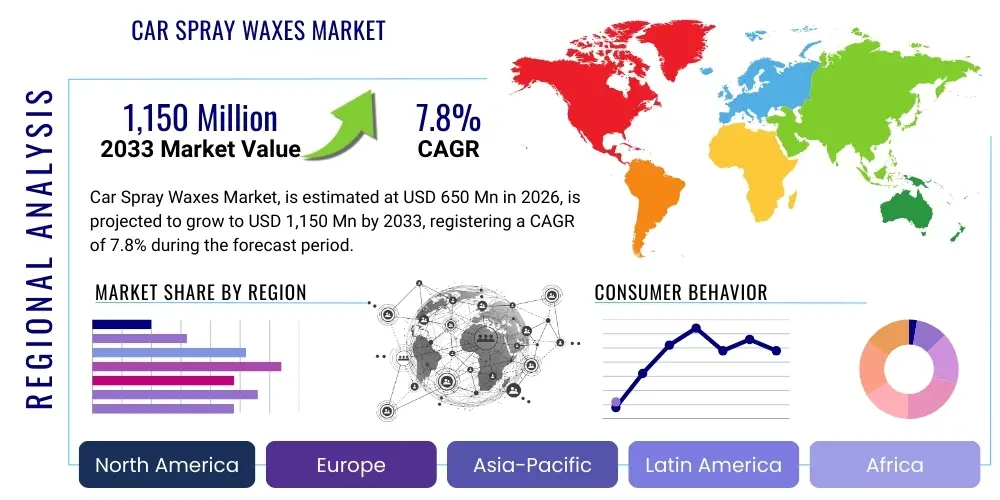

The Car Spray Waxes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 1,150 Million by the end of the forecast period in 2033.

Car Spray Waxes Market introduction

The Car Spray Waxes Market encompasses the manufacturing, distribution, and sale of liquid wax products applied through a spray mechanism designed to protect and enhance the aesthetic appeal of automotive exterior surfaces. These products offer a convenient, rapid alternative to traditional paste or liquid waxes, significantly reducing application time while providing substantial hydrophobic properties, UV protection, and deep gloss finishes. The core demand driver stems from increasing consumer interest in Do-It-Yourself (DIY) car care and maintenance, coupled with advancements in chemical formulations that enhance durability and ease of use.

The product portfolio within this market is diversifying, moving beyond traditional Carnauba-based sprays to advanced synthetic polymers and ceramic-infused (SiC/SiO2) formulas. Major applications include routine vehicle maintenance for personal consumers, professional detailing services seeking efficiency, and high-volume commercial car wash operations. The inherent benefits, such as minimal effort required, streak-free application, and effective surface protection against environmental contaminants (e.g., acid rain, bird droppings, road salt), solidify the market's trajectory. Furthermore, the growing global vehicle parc and rising disposable incomes across developing economies continue to propel market expansion.

Driving factors for sustained growth involve continual product innovation, particularly the integration of nanotechnology and ceramic protective layers into spray formats. This technological evolution allows consumers to achieve near-professional results quickly. Increased awareness regarding the importance of vehicle paint preservation, especially in regions experiencing harsh weather conditions or high levels of environmental pollution, further stimulates adoption. The convenience factor remains paramount, positioning spray waxes as essential detailing products for the modern, time-conscious vehicle owner.

Car Spray Waxes Market Executive Summary

The Car Spray Waxes Market is characterized by robust growth fueled by shifting consumer preferences towards time-saving, high-performance detailing solutions and intense competition driving innovation in material science. Business trends indicate a strong move toward e-commerce platforms and direct-to-consumer models, enabling niche brands focused on specialized formulations (e.g., graphene, pure Si02) to capture significant market share alongside established automotive giants. Sustainability is emerging as a critical competitive factor, with increasing demand for eco-friendly, biodegradable wax formulations and recyclable packaging, influencing supply chain strategies and product development cycles globally.

Regionally, North America maintains market dominance due to high vehicle ownership rates, a deeply ingrained DIY culture, and early adoption of premium, advanced ceramic spray wax technologies. However, the Asia Pacific (APAC) region is projected to register the highest growth rate, driven by expanding middle-class populations, rapid urbanization leading to increased vehicle purchases, and the development of organized retail channels for automotive accessories, notably in China and India. European growth is steady, emphasizing regulatory compliance regarding chemical safety and favoring high-quality, professional-grade products.

Segment trends highlight the exceptional performance of the Ceramic Spray Wax segment, which commands a premium price point and shows accelerating adoption across both professional and consumer applications due to superior durability and extreme hydrophobicity. The application segment sees substantial growth in professional detailing centers that leverage the speed of spray waxes to enhance service throughput. Distribution trends show that dedicated automotive specialty stores and online marketplaces are the preferred channels, offering consumers detailed product information and extensive comparative reviews.

AI Impact Analysis on Car Spray Waxes Market

Common user questions regarding AI's impact on the Car Spray Waxes Market center on several key themes: how AI influences formulation efficiency and R&D speed; the role of AI in optimizing supply chain logistics and inventory management for volatile consumer demand; and, crucially, how machine learning and computer vision could integrate into automated car wash systems to personalize wax application based on vehicle surface condition. Users are generally concerned with whether AI will enable personalized product recommendations for complex paint finishes, reduce manufacturing costs (thereby lowering consumer prices), and whether AI-driven quality control can standardize the performance of specialized spray wax batches. The overarching expectation is that AI will primarily enhance back-end operations (R&D, manufacturing, logistics) and potentially revolutionize the customer experience through predictive maintenance and personalized product matching in the retail environment.

- AI-Driven Formulation Optimization: Machine learning algorithms accelerate the discovery of new chemical compositions, testing millions of combinations virtually to find optimal durability, gloss, and hydrophobic properties, significantly reducing traditional R&D cycles.

- Predictive Inventory Management: AI tools analyze real-time sales data, seasonality, and promotional impacts to accurately forecast demand for specific wax types (e.g., Carnauba vs. Ceramic), ensuring efficient inventory levels across global distribution networks.

- Automated Quality Control: Computer vision systems and AI analytics monitor manufacturing lines, detecting minute inconsistencies in spray wax texture, consistency, and packaging, thus ensuring high product quality and batch consistency.

- Personalized Recommendation Engines: E-commerce platforms utilize AI to suggest specific spray waxes based on the user's vehicle type, paint color, climate zone, and historical purchase behavior, enhancing customer satisfaction and conversion rates.

- Robotics Integration in Application: AI-powered robotic arms in professional detailing and automated car washes use sensors to map vehicle contours and apply spray wax with precision and uniformity, minimizing waste and maximizing coverage.

- Supply Chain Efficiency: AI optimizes logistics routes and warehouse placement, minimizing transportation costs and ensuring rapid delivery of time-sensitive chemical components and finished goods.

DRO & Impact Forces Of Car Spray Waxes Market

The market dynamics are primarily shaped by robust consumer demand for convenience (Driver) and the challenge of high raw material costs (Restraint), while sustainability concerns present a significant potential avenue for growth (Opportunity). The primary drivers include the escalating global vehicle population, the growing influence of the DIY detailing community popularized through social media and instructional content, and ongoing innovation leading to superior, longer-lasting products, particularly in the ceramic hybrid space. These factors collectively push market volume and value upwards, supported by the premium pricing achieved by advanced formulations.

Conversely, the market faces constraints related to the volatility and high cost of specialized polymers, silicon dioxides, and other proprietary chemical ingredients essential for high-performance waxes. Regulatory complexities surrounding VOC (Volatile Organic Compounds) limits, particularly in North America and Europe, necessitate continuous, costly reformulation efforts. Furthermore, the inherent perception among some traditionalists that spray waxes cannot match the durability of paste waxes acts as a psychological barrier to widespread professional adoption, although this perception is rapidly diminishing with new product generations.

Opportunities for expansion lie significantly in tapping into emerging markets, where rapid motorization is occurring, and in the development of highly specialized, functional coatings beyond mere gloss, such as anti-microbial or anti-icing spray waxes. A major impact force is the power of substitution; while traditional waxes are substitutes, the rise of fully comprehensive paint protection films (PPF) and professional ceramic coatings (installed by certified detailers) provides high-end alternatives that threaten the premium spray wax segment. Supplier bargaining power is moderate due to the proprietary nature of certain chemical precursors, while buyer bargaining power is high due to intense brand competition and the ease of comparing products online.

- Drivers:

- Growing global vehicle ownership and rising disposable incomes.

- Increased demand for time-saving, easy-to-apply detailing products.

- Technological advancements in ceramic and polymer spray wax formulations offering enhanced durability.

- Strong influence of DIY detailing culture and social media demonstrating ease of use.

- Restraints:

- Volatile pricing and high dependency on specialized raw materials (e.g., silicone, specialized polymers).

- Stringent regulatory standards concerning VOC content and environmental impact.

- Consumer perception that traditional paste waxes offer superior, long-term protection compared to sprays.

- Opportunity:

- Expansion into untapped emerging economies, especially in APAC and MEA.

- Focus on developing eco-friendly, biodegradable, and sustainable product lines.

- Integration of additional protective functionalities, such as anti-scratch resistance and enhanced chemical resistance.

- Impact Forces (Porter’s Five Forces Analysis Summary):

- Threat of New Entrants: Moderate (High capital requirement for R&D and proprietary chemistry, but low barrier to entry for private label/repackers).

- Bargaining Power of Buyers: High (Numerous competitors, easy product comparison, and strong brand loyalty discounts).

- Bargaining Power of Suppliers: Moderate to High (Proprietary nature of performance raw materials gives leverage).

- Threat of Substitutes: High (Availability of traditional waxes, liquid sealants, professional ceramic coatings, and PPF).

- Competitive Rivalry: Extremely High (Fragmented market with intense price and innovation-based competition).

Segmentation Analysis

The Car Spray Waxes Market is fundamentally segmented based on the composition or type of wax utilized, the specific end-use application, and the channel through which the product is distributed to the end consumer. Type segmentation is the most dynamic, differentiating products based on their core chemistry and performance metrics, ranging from natural Carnauba blends to high-tech synthetic sealants and advanced ceramic polymers. These segmentations are critical for manufacturers to tailor marketing efforts and R&D investment toward high-growth areas, particularly the premium ceramic segment which offers distinct advantages in longevity and hydrophobic performance.

Application segmentation distinguishes between high-volume commercial users, such as professional detailing garages and automatic car washes, and the vast individual consumer market engaged in DIY maintenance. While commercial users prioritize speed, consistency, and bulk pricing, personal users often focus on ease of application and the quality of the finish achieved. The convergence of these needs has driven manufacturers to create 'hybrid' products suitable for both environments. Understanding this split is crucial for effective packaging, pricing, and technical support strategies.

Distribution Channel analysis tracks how the product reaches the final buyer. The rise of e-commerce has decentralized sales, allowing smaller, specialized brands to compete effectively globally. However, traditional brick-and-mortar automotive parts retailers and hypermarkets maintain strong relevance, especially for mainstream brands, due to immediate availability and in-person purchase advice. Successful market players employ an omnichannel strategy, optimizing logistics across both digital and physical touchpoints to ensure maximum market penetration and product visibility.

- By Type:

- Carnauba Spray Wax (Natural wax-based, focused on deep gloss)

- Synthetic Polymer Spray Wax (Utilizes synthetic sealants for durability and UV protection)

- Hybrid Spray Wax (Blend of natural waxes and synthetic polymers)

- Ceramic (SiC/SiO2) Spray Wax (Advanced segment offering maximum longevity and hydrophobicity)

- Graphene-Infused Spray Wax (Emerging segment promising enhanced slickness and durability)

- By Application:

- Personal/DIY Use (Individual vehicle owners)

- Commercial Use

- Professional Detailing Shops

- Automated Car Wash Facilities

- Fleet Maintenance Services

- By Distribution Channel:

- Offline Retail

- Automotive Specialty Stores

- Supermarkets and Hypermarkets

- Independent Distributors

- Online Retail

- Company Websites (Direct-to-Consumer)

- E-commerce Marketplaces (Amazon, eBay, etc.)

- Offline Retail

Value Chain Analysis For Car Spray Waxes Market

The value chain for the Car Spray Waxes Market begins with the upstream sourcing of raw materials, which is highly specialized. This involves procuring refined petrochemical derivatives, silicon compounds (for ceramics), specialized synthetic polymers, and natural waxes like Carnauba. The procurement phase is highly sensitive to geopolitical factors and commodity pricing, directly influencing manufacturing costs. Key activities in this stage include R&D focused on novel chemical synthesis and ensuring the consistent quality of inputs before they move to the formulation and compounding phase, where proprietary blends are created and scaled.

The core manufacturing process involves blending, testing, quality control, and packaging. Due to the need for precise chemical ratios and complex emulsification processes, manufacturing requires significant capital investment in specialized mixing equipment and regulatory compliance expertise. Once packaged, the product moves into the distribution network. This segment utilizes both direct and indirect channels. Direct distribution (DTC via manufacturer websites) allows higher margins and direct consumer feedback, crucial for niche, premium brands.

Indirect channels involve extensive networks, including domestic and international distributors, wholesalers, and specialized logistics providers that handle the transportation and inventory management required to supply large retailers, auto parts stores, and detailing suppliers globally. Downstream activities involve aggressive marketing, shelf placement optimization in physical retail, digital marketing for online sales, and finally, reaching the professional detailers, car wash operators, and end-user consumers who perform the final application. The effectiveness of the marketing phase significantly dictates consumer choice in this competitive, brand-sensitive market.

Car Spray Waxes Market Potential Customers

The primary target demographic for Car Spray Waxes is broadly segmented into two key user groups: the automotive enthusiast and DIY consumer, and professional commercial entities. The DIY consumer, often characterized by owning newer or high-value vehicles, seeks convenience and quality results without the professional cost or time commitment associated with traditional detailing methods. This group values ease of use, hydrophobic performance, and brand reputation heavily, relying on peer reviews and online tutorials for purchasing decisions. They are the largest volume buyers in terms of transaction count.

The professional segment includes high-volume commercial operators, suchably professional detailing salons, mobile detailers, and large fleet operators. These buyers prioritize efficiency, bulk packaging, product reliability, and cost-effectiveness per application. For detailing shops, the speed of application offered by spray waxes is critical for increasing throughput and profit margins. Automated car washes specifically seek formulas that work effectively when applied by automated machinery and rinse off cleanly without leaving residue on glass or plastic trim.

Furthermore, specialized end-users, such as classic car collectors or owners of high-end luxury vehicles, represent a lucrative niche. While they may utilize professional services, they often mandate the use of premium, specialized spray waxes (like pure Carnauba blends or high-end ceramics) as an interim protective measure between full professional coatings. These customers demand the absolute highest quality finish and protection, irrespective of the premium price point.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 1,150 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Meguiar's, Chemical Guys, Turtle Wax, Griot's Garage, Adam's Polishes, Mothers, 3M, Sonax, P&G (Car Care Division), WABCO, Zymöl, Poorboy's World, Malco Products, Jay Leno's Garage Advanced Vehicle Care, The Last Coat, Ethos Car Care, Shine Armor, Aero Cosmetics, Simoniz, Farecla. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Car Spray Waxes Market Key Technology Landscape

The technological landscape of the Car Spray Waxes Market is rapidly evolving, moving away from simple solvent-based systems towards complex, water-based emulsions incorporating advanced chemical compounds. A primary technological focus is nanotechnology, specifically the integration of Silicon Dioxide (SiO2) and Silicon Carbide (SiC) particles, which, when engineered at the nano level, bond effectively to the clear coat. This results in the highly coveted "ceramic" spray wax, offering superior hardness, chemical resistance, and the characteristic extreme hydrophobic effect (beading and sheeting) that lasts significantly longer than traditional wax. The development challenge lies in ensuring these compounds remain stable and easily sprayable while retaining high concentration levels for maximum performance.

Another major technological advancement involves the use of advanced synthetic polymers, often referred to as paint sealants, that utilize cross-linking chemistry. These polymers create a highly durable, sacrificial layer that protects the paint from environmental etching and UV degradation. Continuous R&D is focused on creating hybrid formulas that combine the deep, rich gloss appearance associated with natural Carnauba wax with the long-lasting protection of synthetic or ceramic polymers. The most recent frontier is the introduction of Graphene Oxide derivatives, which are being marketed for their potential to enhance slickness and thermal resistance even further than current ceramic formulations.

Beyond the core formulation chemistry, technological advancements also apply to the delivery mechanism and eco-friendliness. Manufacturers are investing in high-precision spray nozzles and aerosol alternatives that minimize overspray and maximize product utilization, catering to both consumer ease of use and professional efficiency. Furthermore, green chemistry principles are driving research into highly effective, biodegradable surfactants and solvents to meet increasingly stringent global environmental regulations, specifically targeting the reduction or elimination of Volatile Organic Compounds (VOCs) without compromising product performance or shelf stability.

Regional Highlights

- North America (Dominant Market Share): North America, particularly the United States, commands the largest share of the Car Spray Waxes Market value. This dominance is attributable to high per-capita vehicle ownership, a mature and competitive automotive aftermarket, and robust consumer willingness to pay a premium for technologically advanced detailing products, especially ceramic and graphene sprays. The region benefits from early adoption of specialized detailing tools and a highly sophisticated retail infrastructure supporting both specialty and online sales channels.

- Europe (Steady Growth and Regulatory Focus): The European market shows steady, incremental growth, with a strong emphasis on high-quality, professional-grade products. Regulations regarding VOC content and sustainability are exceptionally stringent here, pushing manufacturers toward developing water-based, environmentally compliant formulations. Germany, the UK, and France are the key markets, driven by a strong luxury and premium vehicle segment where paint preservation is highly valued.

- Asia Pacific (APAC - Highest Growth Rate): APAC is projected to be the fastest-growing region globally. This explosive growth is fueled by rapid motorization, rising disposable incomes in economies like China and India, and the increasing establishment of professional car care and detailing industries. While price sensitivity remains a factor, there is growing demand for affordable, high-performance synthetic spray waxes that offer better durability than traditional coatings in the often harsh, humid climates prevalent in Southeast Asia.

- Latin America (Emerging Opportunities): The market in Latin America, while smaller, presents significant growth potential, driven by urbanization and an increasing middle class prioritizing vehicle appearance and maintenance. Brazil and Mexico are the primary centers of demand. The market here is sensitive to economic fluctuations but shows a growing inclination toward imported, quality brands offering convenience and protection against harsh sun exposure.

- Middle East and Africa (MEA - Niche Demand for Extreme Protection): The MEA region exhibits distinct demand characteristics focused on products that offer extreme protection against intense heat, sand abrasion, and dust. High-end detailing services cater to a wealthy clientele, driving demand for premium ceramic spray waxes. Infrastructure development and increasing consumer awareness of vehicle maintenance contribute to gradual, specialized market expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Car Spray Waxes Market.- Meguiar's (3M Company)

- Chemical Guys

- Turtle Wax

- Griot's Garage

- Adam's Polishes

- Mothers

- 3M

- Sonax GmbH

- P&G (Car Care Division)

- WABCO Holdings Inc.

- Zymöl

- Poorboy's World

- Malco Products, Inc.

- Jay Leno's Garage Advanced Vehicle Care

- The Last Coat

- Ethos Car Care

- Shine Armor

- Aero Cosmetics

- Simoniz USA

- Farecla Products Ltd.

Frequently Asked Questions

Analyze common user questions about the Car Spray Waxes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between ceramic spray wax and traditional Carnauba spray wax?

The primary difference lies in the base chemistry and durability. Traditional Carnauba spray wax offers a deep, warm gloss but provides protection lasting only weeks. Ceramic (SiO2/SiC) spray wax uses engineered silicon polymers that chemically bond to the paint, offering significantly enhanced durability (often months), superior chemical resistance, and extreme hydrophobic properties (water beading).

Are spray waxes as effective as traditional paste or liquid waxes for long-term protection?

Historically, paste waxes offered superior long-term durability. However, modern synthetic and ceramic spray waxes, particularly advanced hybrid formulations, now rival or even surpass the protection and longevity of traditional liquid waxes, due to nanotechnology and polymer cross-linking capabilities, while retaining the convenience of a spray application.

Which distribution channel dominates sales in the Car Spray Waxes Market?

While traditional automotive specialty stores remain vital for brand visibility and immediate purchases, the online retail channel, encompassing large e-commerce marketplaces and direct-to-consumer websites, is rapidly gaining dominance. Online platforms offer competitive pricing, extensive product reviews, and direct access to niche, high-performance brands.

How do environmental regulations, such as VOC limits, affect the development of new spray wax products?

VOC regulations significantly challenge product development by forcing manufacturers to transition from traditional solvent-based formulas to complex, highly effective water-based emulsions and high-solids formulations. This shift requires substantial R&D investment to maintain or enhance performance while adhering to strict environmental standards, particularly in North America and Europe.

What is Graphene's role in the emerging spray wax technology landscape?

Graphene is being utilized as an additive (often Graphene Oxide) in advanced spray wax and ceramic formulations. Its inclusion is purported to enhance the coating's structural integrity, improve slickness, offer better UV and heat dissipation properties, and further increase the lifespan of the protective layer beyond standard ceramic options.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager