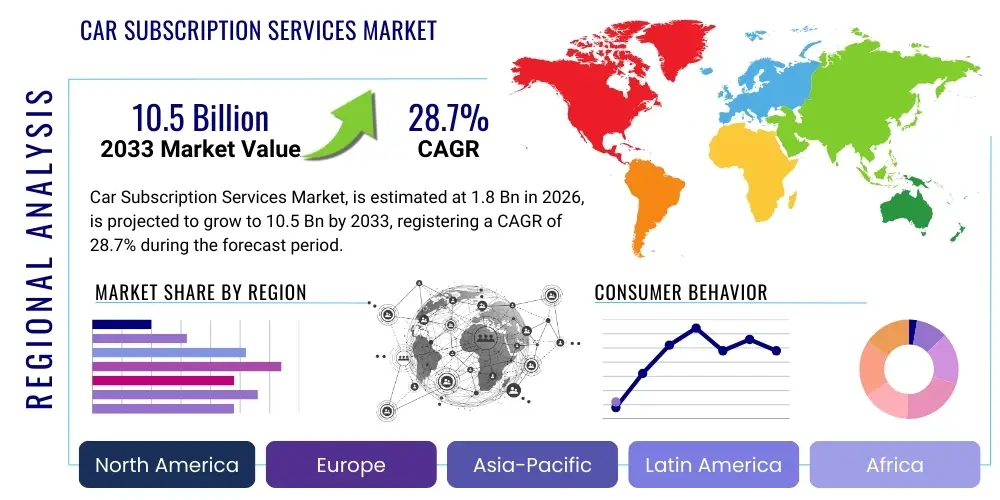

Car Subscription Services Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439753 | Date : Jan, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Car Subscription Services Market Size

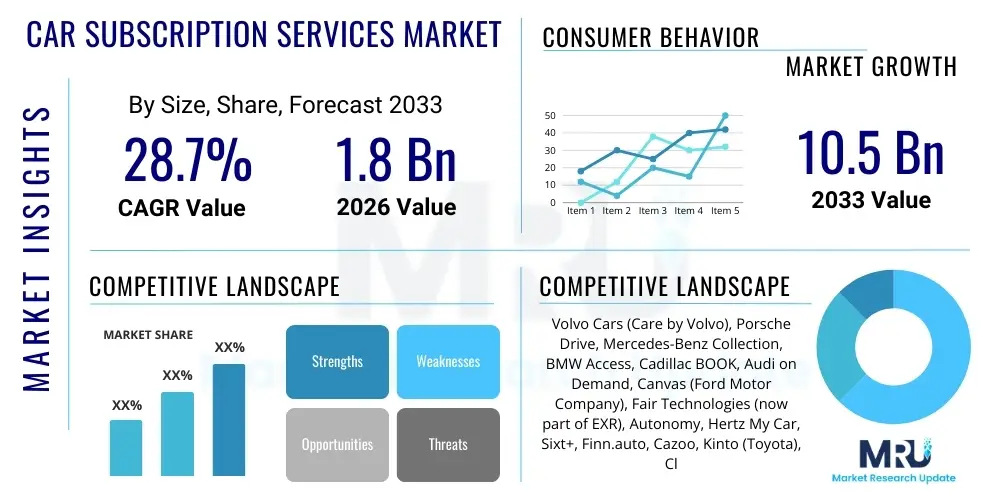

The Car Subscription Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.7% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 10.5 Billion by the end of the forecast period in 2033. This robust growth trajectory is fueled by evolving consumer preferences for flexible mobility solutions, a desire to avoid the burdens of car ownership, and the continuous innovation in digital platforms that underpin these services. The shift away from traditional vehicle acquisition models towards access-based consumption is a key driver, alongside the increasing integration of advanced telematics and personalized offerings that enhance user experience and service convenience, positioning car subscriptions as a compelling alternative in the future of urban and personal transportation landscapes.

Car Subscription Services Market introduction

The Car Subscription Services Market introduces a paradigm shift in personal mobility, moving away from traditional vehicle ownership or long-term leasing towards a flexible, all-inclusive access model. This service typically involves a recurring monthly fee that covers the vehicle, insurance, maintenance, roadside assistance, and often registration, providing users with the convenience of a personal vehicle without the associated hassles of ownership or fixed long-term commitments. The core product description emphasizes choice and adaptability, allowing subscribers to swap vehicles based on their evolving needs, such as switching from a sedan for daily commutes to an SUV for weekend trips, all within a simplified digital interface. This flexibility resonates strongly with modern consumers who prioritize convenience, variety, and predictable budgeting over asset ownership, particularly in rapidly urbanizing environments where car ownership can be a significant financial and logistical burden.

Major applications for car subscription services span a broad spectrum, catering to diverse end-users. Individuals seeking a temporary vehicle for a specific period, such as expatriates, project-based professionals, or those evaluating different car models before purchase, find these services highly beneficial. Furthermore, businesses utilize car subscriptions for flexible fleet management, providing employees with reliable transportation without the capital expenditure or depreciation risks associated with purchasing company cars. Tourists and infrequent drivers also leverage these services for short-term mobility solutions, bypassing traditional car rental complexities. The inherent adaptability makes it suitable for urban dwellers who might not need a car daily but require access for specific occasions, aligning perfectly with lifestyle-oriented consumption patterns prevalent in today's digital economy.

The myriad benefits of car subscription services are significant drivers of market growth. Foremost among these is the unparalleled flexibility offered, allowing subscribers to modify or cancel their service on shorter notice compared to leases or loans. The all-inclusive monthly payment simplifies budgeting by consolidating various vehicle-related expenses into a single, predictable charge, eliminating unexpected costs for maintenance or repairs. Subscribers also gain access to a wider range of vehicle types, enabling them to experience different brands or models without commitment. This model reduces the financial burden of depreciation, large down payments, and the administrative overhead of managing insurance and servicing schedules. These compelling advantages, coupled with the increasing digitalization of automotive services and a growing consumer preference for access over ownership, are powerful driving factors propelling the Car Subscription Services Market towards substantial expansion, fundamentally reshaping the automotive industry's future landscape.

Car Subscription Services Market Executive Summary

The Car Subscription Services Market is experiencing robust expansion, characterized by several key business trends. Original Equipment Manufacturers (OEMs) are increasingly entering the market, either independently or through partnerships, recognizing the strategic importance of direct consumer engagement and alternative revenue streams beyond traditional sales. This trend is fostering innovation in service offerings, digital platforms, and vehicle customization. Simultaneously, dedicated third-party subscription providers are scaling their operations, leveraging technology to optimize fleet utilization, customer acquisition, and service delivery. The market is also witnessing a surge in strategic alliances between automotive brands, technology firms, and insurance providers, aimed at creating seamless, integrated user experiences and expanding geographical reach. These collaborations are crucial for overcoming operational complexities and enhancing the value proposition for subscribers, driving competitive dynamics and market consolidation efforts.

Regional trends indicate a strong initial uptake in technologically advanced and urbanized economies. North America, particularly the United States, and Western Europe, including countries like Germany, the UK, and Sweden, have emerged as early adopters, driven by high disposable incomes, robust digital infrastructure, and a significant portion of consumers open to new mobility solutions. The Asia Pacific region, especially China and Japan, is rapidly accelerating its adoption, propelled by dense urban populations, government initiatives promoting electric vehicles, and a burgeoning middle class seeking premium and convenient services. Emerging markets in Latin America, the Middle East, and Africa are also beginning to show interest, albeit at a slower pace, as economic development and digital penetration improve. These regional variations underscore the need for localized strategies that address diverse consumer preferences, regulatory environments, and market readiness, influencing fleet composition, pricing models, and marketing approaches across different geographies.

Segmentation trends within the market highlight distinct areas of growth and evolving consumer preferences. The luxury and premium vehicle segments are particularly strong, with brands offering exclusive access to high-end models, catering to affluent consumers who value variety and status without the commitment of ownership. The electric vehicle (EV) segment is experiencing significant momentum within subscriptions, driven by increasing environmental consciousness, government incentives, and the desire for consumers to experiment with EVs before committing to a purchase. This allows subscribers to overcome range anxiety and charging infrastructure concerns without long-term financial risk. Furthermore, there's a growing demand for specialized services, such as corporate subscriptions for employee fleets or niche offerings targeting specific demographics like young professionals or families. The evolution of these segments underscores the market's adaptability and its potential to cater to an increasingly fragmented and discerning consumer base, promising further diversification in vehicle types, subscription periods, and service bundles.

AI Impact Analysis on Car Subscription Services Market

Users frequently inquire about how Artificial Intelligence (AI) will revolutionize the car subscription services market, focusing on themes such as enhanced personalization, operational efficiency, and the integration of autonomous technologies. Key concerns revolve around data privacy in personalized services, the reliability of AI-driven predictive maintenance, and the potential for AI to dramatically alter pricing models and vehicle availability. Expectations include seamless customer experiences, smarter vehicle allocation, and the eventual incorporation of self-driving capabilities to reduce operational costs and enhance convenience, ultimately aiming for a more intelligent, adaptive, and user-centric mobility ecosystem. There is a strong user anticipation that AI will optimize every facet of the subscription journey, from initial vehicle selection to end-of-service logistics, leading to a more efficient and personalized offering.

- AI-driven personalization algorithms enhance customer experience by recommending suitable vehicles and subscription plans based on usage patterns, preferences, and historical data.

- Predictive maintenance, powered by AI, optimizes vehicle uptime by anticipating and scheduling service needs, reducing breakdowns and improving fleet management efficiency.

- Dynamic pricing models leverage AI to adjust subscription costs in real-time, considering factors like demand, vehicle availability, seasonality, and subscriber loyalty, maximizing revenue and utilization.

- AI-enabled telematics and IoT integration provide real-time vehicle diagnostics, usage monitoring, and location services, crucial for fleet tracking, security, and usage-based insurance adjustments.

- Automated customer service chatbots and virtual assistants, driven by AI, offer instant support for inquiries, bookings, and troubleshooting, improving response times and reducing operational costs.

- Route optimization and traffic prediction tools, enhanced by AI, can assist subscribers with efficient navigation and fleet operators with vehicle repositioning for optimal service delivery.

- AI contributes to fraud detection and risk assessment by analyzing user behavior and transaction data, ensuring secure and reliable service provision for both providers and subscribers.

- The future integration of autonomous vehicles, managed by AI, holds the potential to reduce labor costs, enhance safety, and enable new service models within the subscription ecosystem.

DRO & Impact Forces Of Car Subscription Services Market

The Car Subscription Services Market is significantly shaped by a confluence of powerful drivers, inherent restraints, emerging opportunities, and dynamic impact forces. Drivers include the rising global demand for flexible and convenient mobility solutions, especially among urban populations seeking alternatives to traditional car ownership burdened by high costs, depreciation, maintenance, and parking challenges. The digital transformation of consumer behavior, characterized by a preference for subscription-based models across various sectors, further fuels this demand. Additionally, a growing environmental consciousness is pushing consumers towards electric vehicle (EV) adoption, and subscriptions offer a low-commitment pathway to experience EVs, mitigating initial purchase hesitations. The desire for variety in vehicles without the long-term financial commitment is also a powerful incentive, particularly for younger demographics and professionals seeking adaptable transportation options for work and leisure. These compelling factors collectively create a fertile ground for the sustained expansion of the car subscription ecosystem.

However, the market faces several notable restraints that could temper its growth. The limited availability of a diverse fleet, particularly for specialized or high-demand vehicles, can lead to customer dissatisfaction and hinder scalability for providers. Insurance complexities represent a significant challenge, as traditional insurance models are not always well-suited to the dynamic nature of car subscriptions, necessitating innovative, flexible coverage solutions. Establishing trust and educating consumers about the value proposition of subscriptions compared to ownership or leasing remains an ongoing hurdle, especially in markets deeply entrenched in traditional automotive paradigms. Furthermore, intense competition from well-established car rental companies, long-term leasing providers, and ride-sharing services requires car subscription providers to continuously innovate and differentiate their offerings to capture and retain market share. Regulatory uncertainties surrounding data privacy, vehicle usage, and subscription terms across different jurisdictions also pose operational challenges and necessitate careful compliance, potentially impacting profitability and market entry strategies.

Despite these restraints, the Car Subscription Services Market is ripe with substantial opportunities. The accelerating transition towards electric vehicles presents a significant avenue for growth, as subscriptions can facilitate easier EV adoption by reducing upfront costs and concerns about battery degradation or charging infrastructure. Expanding into new geographic markets, particularly in underserved urban areas and emerging economies with rising disposable incomes, offers untapped potential. Strategic partnerships with corporate entities, offering flexible fleet solutions for businesses, can unlock a large and consistent revenue stream. Moreover, the development of specialized subscription tiers catering to specific niche markets, such as luxury vehicle enthusiasts, families requiring larger vehicles occasionally, or individuals seeking short-term access for specific projects, can further diversify revenue streams and enhance market penetration. The continuous evolution of digital platforms, leveraging advanced analytics and artificial intelligence, will enable more personalized services, predictive maintenance, and optimized fleet management, creating significant operational efficiencies and superior customer experiences. These opportunities, when strategically leveraged, hold the key to overcoming existing challenges and driving robust, sustainable growth in the car subscription services market.

Segmentation Analysis

The Car Subscription Services Market is meticulously segmented to cater to the diverse and evolving needs of consumers and businesses, allowing providers to tailor their offerings and optimize market penetration. Segmentation helps in understanding specific demand patterns, competitive landscapes, and growth opportunities across various dimensions. Key segments typically revolve around the type of vehicle offered, the duration of the subscription period, the nature of the service provider, and the end-user demographic or industry. This granular approach ensures that services are relevant, accessible, and financially viable for a wide array of potential subscribers, from individuals seeking personal flexibility to large corporations requiring adaptable fleet solutions. By analyzing each segment, market players can identify lucrative niches, refine their product portfolios, and develop targeted marketing strategies that resonate with specific customer groups, thereby maximizing their market share and profitability within the dynamic mobility landscape. The detailed categorization also aids in forecasting future market trends and anticipating shifts in consumer preferences, allowing for proactive adjustments in service delivery and fleet acquisition.

- By Vehicle Type

- Internal Combustion Engine (ICE) Vehicles

- Electric Vehicles (EVs)

- Hybrid Vehicles

- Luxury Vehicles

- Standard/Economy Vehicles

- SUVs

- Sedans

- By Subscription Period

- Monthly

- Quarterly

- Half-Yearly

- Annually

- Flexible/Short-Term (e.g., 3-6 months)

- Long-Term (e.g., 6-12+ months)

- By Service Provider

- Original Equipment Manufacturers (OEMs)

- Third-Party Providers/Aggregators

- Dealerships

- Car Rental Companies (diversified into subscriptions)

- By End-User

- Individual/Personal

- Corporate/Business

- Tourism/Travel

- Expatriates

- Fleets (e.g., last-mile delivery, ridesharing services)

- By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Value Chain Analysis For Car Subscription Services Market

The value chain for the Car Subscription Services Market is complex, encompassing various stages from vehicle acquisition to end-user engagement and post-subscription services, highlighting the intricate network of activities required to deliver value. Upstream analysis primarily involves securing the fleet of vehicles. This critical stage includes direct procurement from Original Equipment Manufacturers (OEMs) or through authorized dealerships, which often entails negotiating favorable bulk purchase agreements, leasing arrangements, or strategic partnerships to ensure a steady supply of diverse and well-maintained vehicles. Financing plays a crucial role here, with providers often relying on specialized automotive financing solutions or establishing their own financial arms to manage vehicle acquisition costs. The efficiency and cost-effectiveness of this upstream process directly impact the profitability and scalability of the subscription service, requiring robust supply chain management and strategic relationships with automotive manufacturers.

Downstream analysis focuses on customer-facing operations and post-subscription support. This includes sophisticated customer acquisition strategies, leveraging digital marketing, online platforms, and partnerships to attract and onboard subscribers. Once a customer is acquired, platform management becomes central, involving user-friendly mobile applications and web interfaces for vehicle selection, booking, swaps, and account management. The continuous upkeep of vehicles is paramount, encompassing regular maintenance, servicing, and repairs, often managed through a network of approved service centers or in-house facilities. Furthermore, comprehensive insurance coverage is integrated into the subscription package, necessitating strong relationships with insurance providers to offer competitive and flexible policies. Roadside assistance and 24/7 customer support are also critical downstream elements, ensuring a seamless and worry-free experience for subscribers, directly contributing to customer satisfaction and retention.

The distribution channel for car subscription services is predominantly digital, with online platforms and mobile applications serving as the primary touchpoints for customers. These direct channels offer unparalleled convenience, allowing subscribers to browse available vehicles, customize their plans, sign contracts, and manage their subscriptions entirely online. This direct-to-consumer model enables providers to maintain closer relationships with their customers and gather valuable data for service optimization. Indirect channels, while less prevalent than in traditional car sales, include partnerships with aggregators, travel agencies, or corporate HR departments that might integrate subscription services into their employee benefits or relocation packages. The blend of direct digital interaction with strategic indirect collaborations helps expand market reach, enhance brand visibility, and streamline the customer journey, ensuring broad accessibility and operational efficiency throughout the entire value chain.

Car Subscription Services Market Potential Customers

The Car Subscription Services Market targets a diverse and expanding demographic of potential customers, essentially encompassing any individual or entity seeking flexible, convenient, and cost-predictable access to a vehicle without the traditional burdens of ownership. Urban dwellers, particularly those residing in densely populated cities with high costs of living and limited parking, represent a significant segment. These individuals often find car ownership impractical due to high acquisition costs, depreciation, maintenance expenses, and the logistical challenges of parking and traffic. Subscriptions offer them the freedom of mobility only when needed, without the long-term commitment. Furthermore, young professionals and millennials, who often prioritize experiences and flexibility over asset ownership, are natural fits for this model, aligning with their digital-first and on-demand lifestyles. This demographic values the ability to swap vehicles, manage everything via an app, and avoid large down payments or lengthy loan agreements, making subscriptions an attractive proposition that caters to their evolving mobility needs and financial considerations.

Another key segment of potential customers includes expatriates, individuals on temporary assignments, or those in transitional life stages who require reliable transportation for a specific, often undefined, period. For this group, traditional car purchases involve complex registration processes, insurance hurdles, and the eventual resale headache, while long-term leases might not offer sufficient flexibility. Car subscriptions provide an ideal solution, offering immediate access to a vehicle with all-inclusive costs and the option to terminate or adjust the service with relative ease. Similarly, tourists and frequent travelers who require a vehicle for extended visits, beyond typical car rental durations but shorter than a lease, find significant value in the flexible terms and comprehensive packages offered by subscription services. This group appreciates the predictability of costs and the convenience of having a vehicle ready for their use without administrative overhead, making their travel experiences smoother and more enjoyable, enhancing their overall satisfaction with the mobility solution.

Beyond individual consumers, the corporate sector represents a substantial and growing segment of potential customers for car subscription services. Businesses, ranging from small startups to large enterprises, are increasingly seeking agile and cost-effective solutions for their fleet management needs. Instead of purchasing or traditionally leasing vehicles, which ties up capital and incurs depreciation risks, corporations can leverage subscriptions to provide employee vehicles, manage project-specific transportation, or offer executive perks with unparalleled flexibility. This allows them to scale their fleet up or down based on operational demands, reduce administrative burdens related to vehicle maintenance and insurance, and enjoy predictable monthly expenditures. Additionally, specific industry verticals, such as real estate, consulting, and field services, where employees frequently travel or require diverse vehicle types, find subscriptions to be an efficient and financially prudent alternative to conventional fleet acquisition. The shift towards flexible work arrangements and project-based employment further reinforces the appeal of subscription models for corporate mobility, positioning them as a strategic tool for modern businesses.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 10.5 Billion |

| Growth Rate | 28.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Volvo Cars (Care by Volvo), Porsche Drive, Mercedes-Benz Collection, BMW Access, Cadillac BOOK, Audi on Demand, Canvas (Ford Motor Company), Fair Technologies (now part of EXR), Autonomy, Hertz My Car, Sixt+, Finn.auto, Cazoo, Kinto (Toyota), Clutch Technologies (Cox Automotive), Flexdrive (Cox Automotive), Drover (now part of Cazoo), Bipi (now part ofazoo), Lynk & Co, Free2move. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Car Subscription Services Market Key Technology Landscape

The Car Subscription Services Market is fundamentally underpinned by an advanced and evolving technology landscape, crucial for delivering seamless, efficient, and personalized mobility solutions. At its core, the ecosystem relies heavily on robust digital platforms, primarily composed of sophisticated mobile applications and web portals that serve as the primary interface for customer interaction. These platforms facilitate everything from vehicle browsing and subscription plan selection to contract signing, payment processing, vehicle booking, and management of vehicle swaps or service requests. The user experience is paramount, demanding intuitive design, secure data handling, and real-time functionality. Furthermore, these platforms are integrated with various backend systems for fleet management, inventory tracking, customer relationship management (CRM), and financial accounting, ensuring operational efficiency and data integrity across the entire service delivery chain.

Telematics and Internet of Things (IoT) devices are indispensable technologies that power the operational efficiency and data collection capabilities of car subscription services. Telematics systems, embedded within each vehicle, continuously transmit vital data such as GPS location, mileage, fuel levels, battery status (for EVs), driving behavior, and diagnostic information. This real-time data is critical for multiple functions: fleet tracking and optimization, ensuring vehicles are available where and when needed; usage-based insurance modeling, allowing for more precise risk assessment and personalized premiums; and proactive predictive maintenance scheduling, which anticipates potential vehicle issues before they lead to breakdowns, thereby maximizing vehicle uptime and minimizing operational costs. IoT sensors also enhance security, enabling remote locking/unlocking, geofencing, and anti-theft measures, all contributing to a more secure and responsive service environment for both providers and subscribers.

Artificial Intelligence (AI) and Machine Learning (ML) are increasingly pivotal in transforming car subscription services from reactive to proactive and highly personalized offerings. AI algorithms analyze vast datasets collected from telematics, customer interactions, and market trends to deliver intelligent insights. This includes personalized vehicle recommendations based on user preferences and past behavior, dynamic pricing models that adjust subscription fees according to demand and availability, and optimized fleet allocation strategies that predict future demand hotspots. Furthermore, AI-powered chatbots and virtual assistants enhance customer support, providing instant responses to inquiries and troubleshooting common issues, thereby improving customer satisfaction and reducing call center loads. Blockchain technology is also emerging as a potential game-changer, offering secure and transparent record-keeping for vehicle history, usage, and payments, building greater trust and efficiency within the ecosystem. The continuous integration and innovation of these advanced technologies are key to driving competitive differentiation, operational excellence, and sustained growth in the Car Subscription Services Market.

Regional Highlights

The global Car Subscription Services Market exhibits distinct characteristics and growth trajectories across different geographical regions, influenced by varying economic conditions, consumer preferences, regulatory frameworks, and technological adoption rates. Understanding these regional nuances is crucial for market players to formulate localized strategies, optimize service offerings, and identify high-potential expansion areas. While developed economies have largely led the initial adoption, emerging markets are rapidly catching up, indicating a strong global shift towards flexible mobility solutions. Each region presents a unique blend of opportunities and challenges, from regulatory hurdles to infrastructure development, that shapes the competitive landscape and consumer engagement with car subscription models. The strategic allocation of resources and tailoring of vehicle fleets to specific regional demands are paramount for achieving market leadership and sustainable growth in this dynamic sector.

- North America: This region, particularly the United States, is a dominant market for car subscription services, characterized by high disposable incomes, a strong car culture, and tech-savvy consumers open to new mobility solutions. Major OEMs and third-party providers have a significant presence, offering a diverse range of vehicles. Urbanization, congestion, and the high cost of ownership in metropolitan areas are key drivers. Canada also shows steady growth, mirroring US trends.

- Europe: Europe stands as another leading market, with countries like Germany, the UK, Sweden, and France at the forefront. Strong environmental regulations and a preference for sustainable mobility solutions drive EV subscriptions. Consumers value flexibility, convenience, and predictable costs. The presence of numerous luxury automotive brands and robust digital infrastructure further supports market expansion.

- Asia Pacific (APAC): The APAC region is experiencing rapid growth, fueled by dense urban populations, increasing disposable incomes, and government support for electric vehicles, particularly in China, Japan, South Korea, and Australia. India and Southeast Asian countries are emerging markets with vast potential, though infrastructure and regulatory challenges remain. Digital payment adoption and a young, tech-forward demographic contribute to its significant growth prospects.

- Latin America: This region is an emerging market for car subscription services, with growth primarily concentrated in larger economies such as Brazil, Mexico, and Chile. Economic fluctuations, varying regulatory environments, and consumer purchasing power influence adoption rates. However, increasing urbanization and a growing middle class are creating demand for flexible mobility, particularly in metropolitan centers.

- Middle East & Africa (MEA): The MEA region is in its nascent stages but shows promising potential, especially in the UAE, Saudi Arabia, and South Africa. High net-worth individuals and a large expatriate population contribute to the demand for premium and flexible vehicle access. Investment in digital infrastructure and diversification away from oil economies are fostering an environment conducive to new mobility services, though challenges like market awareness and robust digital ecosystems persist.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Car Subscription Services Market.- Volvo Cars (Care by Volvo)

- Porsche Drive

- Mercedes-Benz Collection

- BMW Access

- Cadillac BOOK

- Audi on Demand

- Canvas (Ford Motor Company)

- Autonomy

- Hertz My Car

- Sixt+

- Finn.auto

- Cazoo

- Kinto (Toyota)

- Clutch Technologies (Cox Automotive)

- Flexdrive (Cox Automotive)

- Lynk & Co

- Free2move

- DriveNow (BMW Group & Sixt)

- Fair Technologies

- Subscription One

Frequently Asked Questions

How do car subscription services work and what is their primary appeal?

Car subscription services provide access to a vehicle for a recurring monthly fee, which typically includes the car, insurance, maintenance, and roadside assistance, offering a hassle-free alternative to ownership or leasing. Their primary appeal lies in unparalleled flexibility, allowing subscribers to swap vehicles, cancel with shorter notice, and enjoy predictable costs without the burden of depreciation or long-term financial commitments. This model is particularly attractive to urban dwellers, young professionals, and businesses seeking adaptable mobility solutions that align with modern on-demand lifestyles.

What are the key benefits of opting for a car subscription over traditional car ownership or leasing?

The key benefits include significant flexibility in vehicle choice and subscription duration, allowing users to swap cars based on changing needs without penalty. It offers predictable budgeting through an all-inclusive monthly fee that covers most expenses, eliminating unexpected maintenance costs. Subscribers avoid the large down payments and depreciation risks associated with ownership. Furthermore, it simplifies administrative tasks like insurance and registration, providing a convenient, stress-free, and adaptable mobility experience tailored to individual or business requirements.

Is a car subscription more cost-effective than buying or leasing a vehicle?

Whether a car subscription is more cost-effective depends on individual usage patterns, desired flexibility, and market conditions. While monthly subscription fees can sometimes appear higher than traditional lease payments, they often include bundled costs like insurance, maintenance, and roadside assistance, which are typically separate expenses in ownership or leasing. For individuals who desire frequent vehicle swaps, avoid long-term commitments, or frequently incur unexpected car-related expenses, the predictable, all-inclusive nature of subscriptions can prove more economical and financially transparent in the long run, offering significant value beyond just the base vehicle cost.

What types of vehicles are typically available through car subscription services?

Car subscription services offer a diverse range of vehicles to cater to varied preferences and needs. This typically includes standard sedans and compact cars for daily commutes, larger SUVs for families or those needing more cargo space, luxury vehicles for premium experiences, and a growing selection of electric vehicles (EVs) and hybrids for environmentally conscious consumers. Many services also allow subscribers to swap between these different vehicle types, providing the ultimate flexibility to match a car to a specific occasion or evolving lifestyle requirements, enhancing the overall utility and appeal of the service for a broad customer base.

Who are the major players in the Car Subscription Services Market?

The Car Subscription Services Market features a mix of prominent players, including established Original Equipment Manufacturers (OEMs) and dedicated third-party providers. Major OEMs like Volvo (Care by Volvo), Porsche (Porsche Drive), Mercedes-Benz (Mercedes-Benz Collection), and BMW (BMW Access) have launched their own subscription programs. Alongside these, independent providers such as Autonomy, Hertz My Car, Sixt+, Finn.auto, and Cazoo are significant contributors, constantly innovating their service offerings and expanding their geographical reach. This competitive landscape drives continuous improvement in vehicle availability, service quality, and pricing models.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager