Car Vacuum Pumps Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433801 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Car Vacuum Pumps Market Size

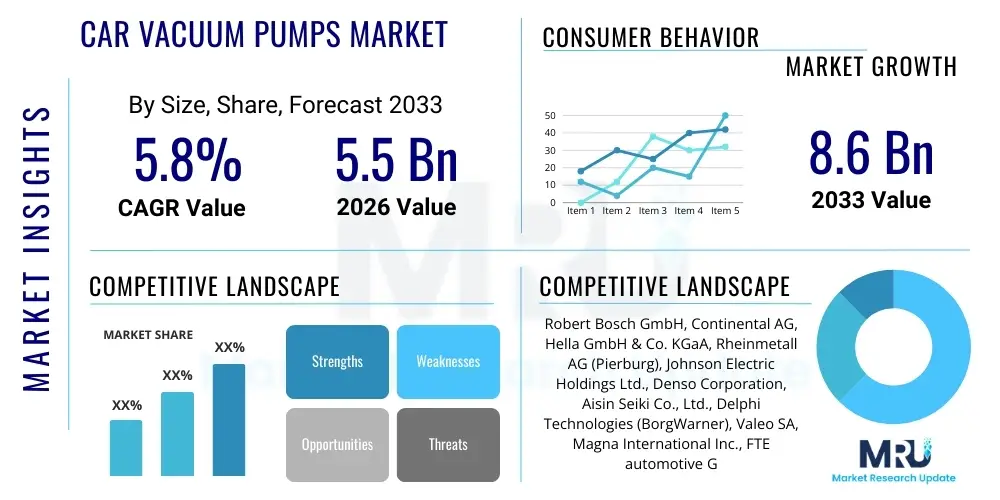

The Car Vacuum Pumps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 5.5 Billion in 2026 and is projected to reach USD 8.6 Billion by the end of the forecast period in 2033.

Car Vacuum Pumps Market introduction

The Car Vacuum Pumps Market encompasses the global production and distribution of mechanical or electrical devices crucial for generating the necessary vacuum pressure required by various automotive systems, primarily braking assistance (power brakes) and engine control components, especially in modern vehicles with turbochargers or downsized engines where natural engine vacuum is insufficient. These pumps are essential components ensuring vehicle safety, fuel efficiency, and optimal engine performance across both internal combustion engine (ICE) vehicles and rapidly expanding electric vehicle (EV) platforms. As emission standards tighten globally and the adoption of energy-efficient technologies accelerates, the reliance on independent vacuum generation mechanisms grows significantly.

Car vacuum pumps serve multiple critical functions within an automotive architecture. Their primary application involves providing vacuum assistance for the brake booster, which multiplies the driver's input force, enabling safe and effective braking. Furthermore, in ICE vehicles, they are increasingly utilized to operate various actuators, manage exhaust gas recirculation (EGR) valves, and control turbocharger wastegates. The increasing complexity of modern engine management systems, coupled with the miniaturization and efficiency enhancement of internal combustion engines—often resulting in low manifold vacuum—has cemented the vacuum pump's role as a standard, non-optional component, driving consistent demand across the automotive manufacturing supply chain.

The core benefits driving this market include enhanced vehicle safety through reliable braking assistance, improved engine efficiency by optimizing control systems, and adaptability across diverse powertrain configurations. Key driving factors accelerating market expansion include stringent global safety regulations mandating robust braking systems, the continuous rise in vehicle production volumes worldwide, and the structural shift toward electrification, where electric vacuum pumps (EVPs) are indispensable for providing consistent vacuum independent of the combustion engine. This transition underscores the necessity for lightweight, highly efficient, and electronically controlled pumping solutions tailored for the next generation of automobiles.

Car Vacuum Pumps Market Executive Summary

The Car Vacuum Pumps Market is undergoing transformative growth driven primarily by regulatory shifts favoring enhanced safety features and the rapid penetration of electric vehicle technology. Business trends indicate a strong move toward electrification, compelling traditional mechanical pump manufacturers to invest heavily in electric vacuum pump (EVP) technology, which offers superior energy efficiency, independent operation, and precise electronic control necessary for sophisticated EV braking systems. Component lightweighting and noise reduction are paramount manufacturing focuses, influencing material selection and design innovation across the industry. Furthermore, the market is characterized by strategic partnerships between Tier 1 suppliers and automotive OEMs to co-develop custom, integrated pumping solutions that meet evolving specific platform requirements.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by surging vehicle production in countries like China and India, coupled with increasing governmental mandates regarding vehicle safety standards and emission controls. North America and Europe demonstrate mature market characteristics but are defined by the swift adoption of advanced EV platforms and a strong emphasis on premium, high-performance pump systems. These regions are prioritizing technologies that integrate seamlessly with advanced driver-assistance systems (ADAS) and regenerative braking mechanisms, requiring reliable, instantaneous vacuum supply independent of traditional engine dynamics, thereby stimulating high-value demand.

In terms of segment trends, the Electric Vacuum Pumps segment is poised for the highest growth rate, overshadowing the traditional mechanical pumps, reflecting the global commitment to sustainable mobility. The application segment reveals strong demand stemming from Passenger Vehicles due to sheer volume, although Commercial Vehicles are also adopting advanced pumps to manage complex air systems and improve fuel economy. The Shift-on-Demand (SoD) technology within mechanical pumps continues to gain traction in conventional vehicles, allowing for operational efficiency gains by only activating the pump when vacuum pressure drops below a defined threshold, thus minimizing parasitic power loss on the engine.

AI Impact Analysis on Car Vacuum Pumps Market

Common user questions regarding AI's impact on the Car Vacuum Pumps Market frequently center on predictive maintenance capabilities, optimizing manufacturing processes, and how AI might influence the design and longevity of these critical safety components. Users are concerned about whether AI can reduce failure rates in highly stressed components like pumps and actuators. Key themes emerging from these inquiries include the expectation that AI-driven diagnostics will transition maintenance from reactive to predictive, the desire for AI to optimize pump power consumption in EVs, and the feasibility of using machine learning (ML) models to analyze operational data collected from integrated vehicle sensors to identify early signs of wear or impending mechanical failure, thereby enhancing reliability and vehicle uptime.

The integration of Artificial Intelligence and Machine Learning (ML) primarily revolutionizes the manufacturing pipeline for car vacuum pumps. AI-powered quality control systems utilize computer vision to inspect complex pump geometries and material finishes, ensuring zero-defect production at high volumes, surpassing the reliability of traditional human inspection. Furthermore, ML algorithms optimize material usage and production schedules, predicting equipment failure in manufacturing machinery before it impacts output, thus enhancing overall operational efficiency and reducing cost overheads associated with high-precision component production.

In the application phase, AI influences the performance and longevity of electric vacuum pumps (EVPs). Advanced control units embedded in modern vehicle architectures often employ ML models to dynamically regulate pump operation based on real-time driving conditions, brake pedal usage patterns, and system pressure fluctuations. This dynamic regulation optimizes energy consumption, a critical factor in EV range, ensuring the pump only runs precisely when necessary and at the minimum required power level, thereby extending both the pump's service life and the vehicle's driving range.

The future scope of AI in this market involves leveraging telemetry data collected from fleets. ML models analyze vast datasets pertaining to environmental conditions, duty cycles, and performance metrics to feed back into the design process. This predictive design refinement allows manufacturers to proactively adjust material specifications or mechanical tolerances to withstand specific, high-stress operational profiles identified by the AI, leading to the creation of more robust and reliable vacuum pump generations customized for varying global market demands and operational extremes.

- AI-driven Predictive Maintenance: Uses ML algorithms to analyze sensor data, predicting component failure probability, allowing for timely replacement and minimizing vehicle downtime.

- Optimized Manufacturing Quality: Implementation of AI-powered vision systems for high-speed, accurate defect detection during assembly, ensuring product integrity.

- Energy Management in EVs: ML models optimize the duty cycle and power draw of electric vacuum pumps, directly extending battery range and improving system efficiency.

- Supply Chain Optimization: AI predicts raw material demand and logistical bottlenecks, stabilizing the delivery of specialized components required for pump manufacturing.

- Design Refinement: Data-driven insights from AI analysis of field performance inform future design iterations, improving durability and operational robustness under stress.

DRO & Impact Forces Of Car Vacuum Pumps Market

The Car Vacuum Pumps Market is shaped by significant driving forces such as increasingly stringent global vehicle safety standards, the pervasive shift toward electric mobility necessitating independent vacuum sources, and the rising global production volumes of passenger vehicles. Conversely, the market faces restraints, primarily the cost sensitivity associated with high-precision components and the competitive proliferation of alternative braking technologies like electro-hydraulic braking (EHB) systems that reduce reliance on vacuum assistance. Opportunities abound in developing highly integrated, lightweight, and digitally controlled electric pumps, particularly those optimized for 800V EV architectures and autonomous vehicle applications, where fail-safe mechanisms are paramount. These factors collectively exert powerful impact forces on market dynamics, compelling manufacturers toward innovation in efficiency, redundancy, and electronic integration to maintain competitive advantage.

Drivers

One of the principal market drivers is the global enforcement of stringent vehicle safety regulations, particularly those concerning braking performance. Safety bodies worldwide continually update standards that require highly reliable and responsive brake assistance, making the vacuum pump an indispensable component, especially as vehicle weights increase due to complex features and battery packs in EVs. Furthermore, the trend of engine downsizing in conventional vehicles, aimed at achieving lower emissions and better fuel economy, inherently reduces the natural vacuum generated in the intake manifold. This structural limitation necessitates the mandatory integration of dedicated supplementary vacuum pumps across a vast array of new internal combustion engine models globally, thus stabilizing the mechanical pump segment while fueling the electrical pump segment.

A second major driver is the accelerating shift towards electric vehicles (EVs), hybrid electric vehicles (HEVs), and fuel cell vehicles (FCVs). These powertrains either generate zero manifold vacuum (in BEVs) or generate inconsistent vacuum (in HEVs). Therefore, to ensure constant, reliable, and high-performance braking, electric vacuum pumps (EVPs) are mandatory. The high growth trajectory predicted for the EV sector directly translates into exponential demand growth for advanced, high-efficiency, electronically controlled EVPs, which are often integral to regenerative braking systems, ensuring seamless transition between regenerative and friction braking for optimized energy recuperation.

Finally, the growing sophistication of powertrain systems, requiring precise control over various pneumatic actuators—such as EGR systems, variable geometry turbochargers (VGTs), and air suspension systems—further drives demand. Modern vehicles rely on vacuum stability for complex engine management functions beyond just braking. Manufacturers are opting for robust, high-flow vacuum pumps that can reliably support the increased pneumatic load demanded by these multiple systems, improving overall engine efficiency, reducing nitrogen oxide (NOx) emissions, and ensuring compliance with Euro 7 and equivalent future regulatory frameworks.

Restraints

Despite robust demand, the primary restraint challenging market growth is the high component cost associated with advanced vacuum pumps, particularly the electric variants, which require sophisticated motor controls, seals, and high-precision machining to ensure durability and minimal noise. This cost pressure is significant, especially in high-volume, cost-sensitive vehicle segments in developing markets. Furthermore, the integration of vacuum pumps, especially mechanical types, can introduce noise, vibration, and harshness (NVH) challenges, compelling manufacturers to spend additional resources on noise reduction techniques, which further increases the final cost and complexity of the installed system.

Another emerging restraint is the technological competition posed by non-vacuum dependent braking systems. The proliferation of advanced electronic braking systems, specifically electro-hydraulic braking (EHB) and ‘Brake-by-Wire’ systems, particularly in high-end electric and autonomous vehicles, fundamentally removes the need for a conventional vacuum brake booster. If these advanced EHB systems become standardized across mid-range vehicle segments—driven by reduced complexity and faster response times inherent in full-electronic control—the traditional demand foundation for vacuum pumps in braking applications could erode over the long term, necessitating market participants to pivot toward other vehicle pneumatic applications or focus heavily on replacement parts market.

A third restraint involves the engineering challenge of optimizing energy consumption. Mechanical vacuum pumps introduce parasitic loss on the engine, reducing overall fuel efficiency. While electric vacuum pumps eliminate parasitic drag from the engine, they draw substantial power from the battery, negatively impacting the EV's range if not managed perfectly. The continuous pressure on OEMs to maximize fuel economy and EV range necessitates components with extremely tight efficiency tolerances, making the development and mass production of pumps that meet these stringent efficiency targets both technically difficult and capital-intensive, slowing the pace of universal adoption across all vehicle classes.

Opportunities

The greatest opportunity lies in the development and widespread adoption of next-generation Electric Vacuum Pumps (EVPs) tailored for high-voltage EV architectures (400V and especially 800V). These pumps must offer ultra-high efficiency, enhanced reliability, and network connectivity for diagnostic purposes. Manufacturers who can supply lightweight, compact, and energy-dense EVPs capable of providing consistent high vacuum levels under rapid braking cycles will capture significant market share as the global EV fleet expands exponentially. This focus requires innovation in brushless DC motor design and acoustic dampening technologies to meet premium vehicle requirements.

Furthermore, the maintenance and replacement market presents a sustained opportunity. Vacuum pumps are wear-and-tear components subject to mechanical stress, thermal cycling, and continuous operation (especially in conventional engines). As the global vehicle parc ages and the average vehicle lifespan increases, the demand for high-quality, aftermarket replacement pumps, both mechanical and electric, will remain robust. Manufacturers who can establish strong distribution networks and leverage brand trust in durability within the aftermarket segment can realize stable revenue streams independent of new vehicle production cycles.

A specialized opportunity exists within the emerging sector of autonomous driving (AD) and heavy-duty commercial vehicles. AD systems require completely redundant and fail-safe braking mechanisms, potentially necessitating dual or integrated, ultra-reliable vacuum systems for emergency backup functionality, even if the primary system is hydraulic. For commercial vehicles, especially those utilizing advanced air brake systems, vacuum pumps are critical for various auxiliary functions, presenting a profitable niche for specialized, heavy-duty pump solutions that meet strict durability and performance requirements associated with fleet operations and higher GVWR categories.

Segmentation Analysis

The Car Vacuum Pumps Market is comprehensively segmented based on technology type, primary application, and the vehicle type in which they are installed, allowing for granular analysis of market demand drivers and technological shifts. The segmentation by Type—Mechanical vs. Electric—is paramount, reflecting the ongoing industry transition from traditional engine-driven systems to independently powered electric modules, a shift accelerated by EV adoption. Application segmentation, primarily between Braking Systems and Auxiliary Systems, highlights the pump’s foundational role in vehicle safety and its growing importance in optimizing complex engine peripherals.

The segmentation based on Vehicle Type—Passenger Vehicles (PV), Light Commercial Vehicles (LCV), and Heavy Commercial Vehicles (HCV)—illustrates the varying performance requirements across different vehicle classes. PVs drive the largest volume demand, focusing on low noise and high reliability. LCVs and HCVs, conversely, require pumps engineered for continuous heavy-duty use and resistance to extreme environmental conditions, often necessitating specialized, high-flow mechanical or robust electric pumps to manage larger brake boosters and multiple pneumatic accessories efficiently.

Analyzing these segments reveals critical trends: the electric pump segment is rapidly cannibalizing the market share of mechanical pumps in all new EV and high-end hybrid platforms, while the mechanical pump segment maintains strong residual demand in lower-cost ICE and replacement markets. The Application segmentation underscores that while braking remains the core demand driver, auxiliary applications are growing in complexity and frequency, ensuring that even non-braking systems contribute significantly to total market value, reinforcing the necessity for versatile and reliable vacuum supply across all modern vehicle designs.

- By Type:

- Mechanical Vacuum Pumps (Vane, Rotary Vane, Piston Type)

- Electric Vacuum Pumps (Diaphragm, Rotary, Piston Type, Brushless DC Motors)

- By Application:

- Braking Systems (Brake Booster Vacuum Assistance)

- Auxiliary Systems (EGR Valves, Turbocharger Control, Fuel Tank Ventilation, Climate Control Actuators)

- By Vehicle Type:

- Passenger Vehicles (PV)

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

- By Sales Channel:

- OEM (Original Equipment Manufacturer)

- Aftermarket

Value Chain Analysis For Car Vacuum Pumps Market

The value chain for the Car Vacuum Pumps Market begins with the upstream suppliers of raw materials and specialized components. Upstream activities involve the procurement of high-grade materials such as advanced aluminum alloys for housing (for lightweighting), specialized plastics (for certain pump types and noise reduction), high-precision seals (Viton or proprietary compounds for longevity), and sophisticated electronic control unit (ECU) components for electric pumps. Reliability in material supply, particularly semiconductors and rare earth magnets for high-efficiency electric motors, is crucial, placing significant emphasis on strong supplier relationships to mitigate supply chain risks and ensure quality consistency for mission-critical safety components.

The midstream phase focuses on the complex processes of manufacturing and assembly. This involves high-precision machining of rotors, vanes, and casings, followed by stringent quality control and assembly in highly automated environments, particularly for electric pumps requiring careful integration of the motor, controller, and pump mechanism. Tier 1 suppliers dominate this stage, utilizing advanced manufacturing techniques like CNC machining, cleanroom assembly, and sophisticated testing rigs to validate performance metrics such as vacuum recovery time, noise levels, and durability under various thermal and pressure conditions, ensuring compliance with stringent OEM specifications and global safety standards.

Downstream activities encompass distribution and sales, covering both the Original Equipment Manufacturer (OEM) channel and the global aftermarket. The OEM channel involves direct supply to automotive assembly lines, requiring Just-In-Time (JIT) delivery and adherence to long-term contract pricing. The aftermarket channel is managed through a complex network of authorized distributors, wholesalers, and independent repair shops, where demand is driven by vehicle age and component failure. The distribution strategy must differentiate between the high-volume, standardized requirements of the OEM segment and the geographically dispersed, product-specific demands of the highly profitable replacement parts market, often involving direct-to-mechanic sales strategies.

Car Vacuum Pumps Market Potential Customers

The primary and largest segment of potential customers for the Car Vacuum Pumps Market comprises Original Equipment Manufacturers (OEMs), encompassing global automotive manufacturers of passenger cars, SUVs, trucks, and buses. These customers require vacuum pumps in massive volumes, tailored to their specific vehicle platforms, necessitating close collaboration with Tier 1 suppliers during the design and validation stages. Their purchasing criteria are dominated by reliability, weight reduction, integration complexity, overall component cost, and the supplier's ability to maintain high quality control over extended production runs, especially crucial for EV manufacturers who rely solely on electric pumps for braking integrity.

A second crucial customer segment is the global network of Tier 1 and Tier 2 system integrators and specialized vehicle manufacturers. Tier 1 suppliers often purchase components or sub-assemblies of the pump (like specialized motors or controller boards) to integrate into proprietary brake booster assemblies or comprehensive powertrain management modules before supplying the final OEM. Specialized vehicle manufacturers, such as those producing armored vehicles, military transportation, or highly customized luxury coaches, represent a smaller volume but high-margin customer base, requiring bespoke, often heavy-duty or highly redundant pumping systems that can perform reliably under extreme conditions not typically faced by standard mass-market vehicles.

The third significant customer base is the Aftermarket Segment, which includes independent garages, franchised dealerships (for repairs), fleet operators (trucking and logistics companies), and retail parts distributors. These customers purchase vacuum pumps for replacement purposes, driven by the lifecycle failure of installed units. For fleet operators, durability and speed of replacement are key purchasing factors, as minimizing vehicle downtime is paramount. For the aftermarket, competitive pricing, broad vehicle coverage (SKU availability), and perceived brand quality often outweigh the advanced technological features prioritized by OEMs, leading to a vibrant and competitive secondary market focused on lifespan and cost-effectiveness.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.5 Billion |

| Market Forecast in 2033 | USD 8.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Continental AG, Hella GmbH & Co. KGaA, Rheinmetall AG (Pierburg), Johnson Electric Holdings Ltd., Denso Corporation, Aisin Seiki Co., Ltd., Delphi Technologies (BorgWarner), Valeo SA, Magna International Inc., FTE automotive GmbH, Mando Corporation, ZF Friedrichshafen AG, Hitachi Automotive Systems, KSPG Automotive, WABCO (ZF), Gentex Corporation, Electric Power Steering Co., Ltd., Schaeffler AG, Hanon Systems |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Car Vacuum Pumps Market Key Technology Landscape

The technology landscape of the Car Vacuum Pumps Market is undergoing a rapid transition, shifting from purely mechanical systems to highly sophisticated electromechanical and fully electronic control units. In the mechanical pump segment, the primary focus is on Shift-on-Demand (SoD) technology, which utilizes an integrated clutch or coupling mechanism to engage the pump only when the manifold vacuum drops below a predefined threshold, minimizing parasitic drag on the engine and improving fuel efficiency. This technological refinement maximizes the efficiency of traditional pumps, extending their relevance in the current fleet of internal combustion engine vehicles and minimizing their environmental impact by reducing unnecessary operation and wear. Optimization also centers on achieving superior noise isolation and weight reduction through advanced composite materials.

The most significant innovation trajectory lies within Electric Vacuum Pumps (EVPs). Modern EVPs are typically driven by highly efficient Brushless DC (BLDC) motors integrated with an Electronic Control Unit (ECU). The ECU allows for proportional control, meaning the pump speed is dynamically adjusted based on real-time vacuum requirements from the brake booster or auxiliary systems, rather than running at a fixed rate. This proportional control is critical for maintaining consistent braking feel and optimizing energy usage in battery electric vehicles (BEVs). Future development is focused on integrating these EVPs directly into the vehicle’s high-speed communication network (CAN bus) for advanced diagnostics and interaction with complex safety features like ADAS and stability control systems.

Emerging technology focuses on modularity and redundancy, particularly for autonomous driving applications (Level 4 and 5). This involves the development of dual-channel or fully redundant vacuum systems, ensuring that a primary system failure does not compromise vehicle safety. Furthermore, research is focused on integration with regenerative braking systems; the EVP must work in perfect synchronization with the electric motor's recuperation capabilities to maintain optimal pedal feel and ensure immediate friction braking engagement when required. This requires ultra-fast response times and high reliability, driving innovation in sensor technology, magnetic materials, and power electronics capable of handling high voltage demands (up to 800V) without compromising durability or thermal management.

Regional Highlights

The global Car Vacuum Pumps Market exhibits significant regional variations in demand, driven by differing regulatory environments, vehicle production volumes, and the pace of EV adoption. Asia Pacific (APAC) holds the largest market share and is projected to experience the fastest growth throughout the forecast period. This dominance is attributable to the massive automotive manufacturing base in China, which leads the world in vehicle production and is the largest market for electric vehicles, thereby creating explosive demand for high-volume, cost-effective electric vacuum pumps. Furthermore, increasing vehicle penetration and rising safety mandates in emerging economies like India and Southeast Asian countries bolster the regional market for both mechanical and electric pump solutions.

North America and Europe represent mature, high-value markets characterized by early adoption of advanced technologies and stringent emission standards. European demand is strongly influenced by sophisticated powertrain architectures requiring precise vacuum control for emission-reducing components, while the rapid transition toward electrification across both continents ensures sustained high demand for premium, highly efficient electric vacuum pumps. In North America, the shift towards larger light trucks and SUVs, which increasingly adopt engine downsizing strategies and require supplemental vacuum, maintains a strong foundational market. Both regions prioritize pump solutions that offer low Noise, Vibration, and Harshness (NVH) characteristics, supporting the luxury and performance segments.

The Latin America (LATAM) and Middle East & Africa (MEA) regions, while smaller in scale, offer growth opportunities primarily within the aftermarket segment and through increased standardization of safety features in newly produced vehicles. LATAM manufacturing centers, particularly Brazil and Mexico, are adapting to modern emission and safety requirements, leading to increased installation of vacuum assistance systems in domestically produced vehicles. MEA markets, often reliant on imported vehicles and high-mileage fleets, exhibit steady demand for durable replacement parts. Future growth in these regions will be contingent upon economic stability, local manufacturing investment, and the speed of regulatory harmonization with global safety standards, particularly the move away from basic, non-assisted braking systems.

- Asia Pacific (APAC): Market leader and fastest-growing region, driven by unparalleled EV manufacturing volume in China and expanding vehicle production in India and ASEAN countries. Focus on cost-efficient, mass-produced EVPs.

- Europe: High-value market focused on technical sophistication, stringent emission regulations, and rapid adoption of high-performance EV platforms. Strong demand for premium EVPs with low NVH characteristics.

- North America: Mature market sustained by robust light truck sales requiring supplemental vacuum and significant investment in next-generation EV platforms. Focus on integration with ADAS and vehicle safety technologies.

- Latin America (LATAM): Growth driven by increased safety regulation enforcement in key manufacturing hubs (Brazil, Mexico) and robust aftermarket demand for replacement parts.

- Middle East & Africa (MEA): Emerging market focused predominantly on imported vehicle fleets and sustained demand for durable, standard-specification pumps in the replacement market.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Car Vacuum Pumps Market.- Robert Bosch GmbH

- Continental AG

- Hella GmbH & Co. KGaA

- Rheinmetall AG (Pierburg)

- Johnson Electric Holdings Ltd.

- Denso Corporation

- Aisin Seiki Co., Ltd.

- Delphi Technologies (BorgWarner)

- Valeo SA

- Magna International Inc.

- FTE automotive GmbH

- Mando Corporation

- ZF Friedrichshafen AG

- Hitachi Automotive Systems

- KSPG Automotive

- WABCO (ZF)

- Gentex Corporation

- Electric Power Steering Co., Ltd.

- Schaeffler AG

- Hanon Systems

Frequently Asked Questions

Analyze common user questions about the Car Vacuum Pumps market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a car vacuum pump?

The primary function of a car vacuum pump is to generate and maintain sufficient vacuum pressure required for the brake booster, ensuring reliable and effective power assistance for the vehicle's braking system, especially in engines that do not naturally produce adequate manifold vacuum (e.g., turbo-charged or electric vehicles).

How does the shift to electric vehicles (EVs) impact the demand for vacuum pumps?

The shift to EVs significantly increases demand for Electric Vacuum Pumps (EVPs). Since electric motors do not generate manifold vacuum, EVs rely entirely on high-efficiency EVPs to power the brake booster. This makes the EVP an essential, high-growth component in all Battery Electric Vehicles (BEVs).

What is the difference between mechanical and electric vacuum pumps?

Mechanical vacuum pumps are driven by the engine (via the camshaft or belt) and are used primarily in internal combustion engine (ICE) vehicles. Electric vacuum pumps (EVPs) are independent, motor-driven units powered by the battery, offering precise electronic control and operation independent of the engine speed, making them necessary for EVs and high-performance hybrids.

Which region currently dominates the Car Vacuum Pumps Market?

The Asia Pacific (APAC) region currently dominates the market. This dominance is driven by the vast manufacturing base and high vehicle production volumes, particularly the world-leading production and adoption of electric vehicles in China, generating immense demand for electric vacuum pump technology.

What role does Shift-on-Demand (SoD) technology play in vacuum pumps?

Shift-on-Demand (SoD) technology is integrated into mechanical vacuum pumps, allowing the pump to engage and draw power from the engine only when the vacuum level drops below a set threshold. This minimizes parasitic power loss, thereby improving fuel efficiency and reducing wear compared to traditional, continuously running mechanical pumps.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager