Car Wax Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437372 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Car Wax Market Size

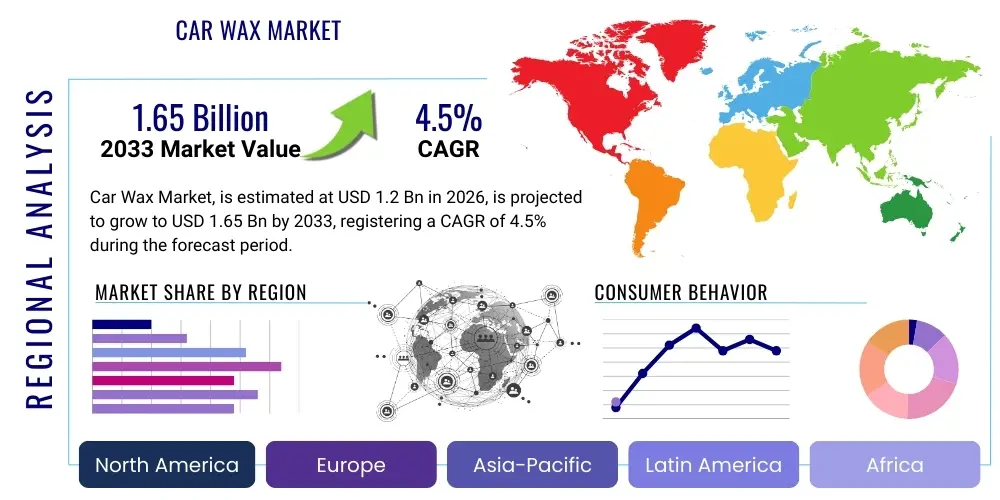

The Car Wax Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.65 Billion by the end of the forecast period in 2033. This growth trajectory is fueled by the accelerating proliferation of passenger and commercial vehicles globally, coupled with a heightened consumer focus on maintaining vehicle aesthetics and residual value. The integration of advanced synthetic polymer and ceramic technologies is reshaping traditional wax formulations, offering superior durability and protection, thereby appealing to both Do-It-Yourself (DIY) consumers and professional detailing services seeking high-performance solutions.

Car Wax Market introduction

The Car Wax Market encompasses products designed to protect, shine, and enhance the finish of automotive paintwork and other vehicle surfaces. These products typically form a hydrophobic layer, offering defense against environmental contaminants such as UV radiation, acid rain, bird droppings, and industrial fallout. Traditional car waxes, primarily based on natural substances like Carnauba, are increasingly supplemented or replaced by sophisticated synthetic alternatives, including polymer sealants and advanced ceramic (SiO2) coatings, which provide longer-lasting protection and superior gloss retention. The market is characterized by a wide spectrum of product formats, including liquid, paste, and spray applications, catering to various user preferences regarding ease of application and durability requirements.

Major applications of car wax extend beyond conventional passenger cars to include heavy-duty commercial vehicles, marine vessels, and aircraft, where surface protection against harsh operational environments is critical. The primary benefits derived from using car wax include improved paint lifespan, enhanced aesthetic appeal (deep gloss and reflection), and simplified subsequent cleaning processes due to hydrophobic properties. These protective properties directly contribute to maintaining the vehicle’s resale value, making regular waxing a routine maintenance activity for vehicle owners, particularly in developed economies with high vehicle ownership rates and stringent aesthetic standards.

Driving factors propelling market expansion include rising disposable incomes in emerging economies, leading to increased purchasing power for luxury and protective automotive care products. Furthermore, the rapid growth of the professional car detailing sector, which relies on high-volume, high-quality wax products, significantly contributes to demand. Manufacturers are continuously investing in research and development to create environmentally friendly and user-friendly products, such as waterless wash and wax formulas and easy-on/easy-off spray waxes, addressing consumer demands for convenience without compromising performance.

Car Wax Market Executive Summary

The global Car Wax Market is demonstrating robust growth, primarily driven by shifting consumer preferences towards durable, high-performance protective coatings, especially ceramic and hybrid wax formulations. Key business trends include aggressive vertical integration by major manufacturers aiming to control the supply chain of synthetic raw materials, and the increasing reliance on digital marketing and e-commerce platforms to reach the vast DIY consumer base globally. Strategic partnerships between wax producers and major automotive service centers are also prominent, ensuring consistent product off-take and brand exposure in the professional detailing segment. Innovation remains central, focusing on sustainability, faster cure times, and compatibility with modern clear coat technologies.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, propelled by rapidly expanding automotive sales, urbanization, and the nascent but accelerating adoption of professional vehicle maintenance services in countries like China and India. North America and Europe maintain dominance in terms of market value, characterized by mature consumer bases willing to invest in premium, high-cost specialty waxes and ceramic coatings. These regions also lead in the adoption of strict environmental regulations, influencing the shift toward water-based and biodegradable wax solutions, which presents both a challenge and an opportunity for product reformulation.

Segment trends reveal that synthetic wax, particularly ceramic-infused products, is rapidly capturing market share from traditional Carnauba wax due to superior longevity and chemical resistance. The application segment sees professional detailers driving demand for bulk and high-concentration formulas, while the DIY segment favors convenient spray and liquid wax formats. The market structure is highly competitive, with established multinational players leveraging extensive distribution networks and strong brand loyalty, while smaller, niche players focus on high-end, specialized formulations targeting automotive enthusiasts and premium detailing services.

AI Impact Analysis on Car Wax Market

Common user questions regarding AI's impact on the Car Wax Market frequently revolve around optimizing product formulation, enhancing quality control, and personalizing the consumer experience. Users are keen to understand how AI can reduce the time and effort required for wax application and maintenance. Key concerns include the potential for AI-driven manufacturing to standardize product quality, minimizing batch variations inherent in natural wax production, and the use of machine learning to predict the optimal chemical blend for specific vehicle paint types and regional climatic conditions. Expectations center on advanced customer support systems (chatbots and virtual assistants) that guide consumers through complex application processes for premium products like ceramic coatings, ensuring flawless, professional-grade results at home.

The deployment of Artificial Intelligence and Machine Learning (ML) algorithms is set to revolutionize the research and development pipeline for car wax. ML models can analyze vast datasets concerning chemical interactions, durability testing results under various environmental stressors, and consumer feedback on application ease. This capability allows manufacturers to rapidly prototype and refine new formulations, significantly cutting down the traditionally lengthy testing cycles. By identifying non-obvious correlations between raw material composition and performance metrics (such as gloss retention, water beading angle, and chemical resistance), AI facilitates the creation of next-generation protective coatings that are more effective, sustainable, and cost-efficient to produce.

Furthermore, AI-powered computer vision systems are becoming instrumental in quality assurance during the manufacturing process, detecting minute imperfections or inconsistencies in the wax mixture or packaging, ensuring only high-standard products reach the market. In the downstream segment, AI is integral to enhancing customer relationship management (CRM) systems and e-commerce platforms. AI analyzes user purchase history, geographic location, and vehicle type to offer hyper-personalized product recommendations—for instance, suggesting a specific polymer sealant suitable for clear coats in high-UV environments—thereby significantly improving conversion rates and customer satisfaction within the increasingly complex product landscape.

- AI-driven optimization of chemical formulation to enhance durability and environmental resistance.

- Machine learning models predict optimal raw material sourcing and blend ratios, particularly for synthetic waxes.

- Advanced computer vision systems for real-time quality control and defect detection during manufacturing.

- Personalized product recommendations and application guidance via AI-powered e-commerce assistants and chatbots.

- Predictive maintenance analytics using sensor data to recommend reapplication schedules based on vehicle usage and environmental exposure.

DRO & Impact Forces Of Car Wax Market

The Car Wax Market is significantly influenced by a confluence of driving forces, constraining factors, and opportunities that collectively determine its growth trajectory and competitive dynamics. A primary driver is the accelerating trend of vehicle aesthetic maintenance and preservation, driven by the desire to maintain high resale values, particularly for luxury and high-performance automobiles. This demand is intrinsically linked to rising global disposable income and the cultural shift towards vehicle detailing as a necessary form of preventative maintenance rather than merely a cosmetic endeavor. Simultaneously, continuous technological innovation in synthetic chemistry has led to the commercialization of highly durable, easy-to-apply ceramic and polymer coatings that offer superior performance compared to traditional waxes, attracting a broader consumer base.

Conversely, the market faces significant restraints, including the relatively high cost associated with premium, long-lasting protective solutions, such as professional-grade ceramic coatings, which can be prohibitive for budget-conscious consumers. Environmental regulations also pose a continuous challenge; increasing scrutiny on volatile organic compounds (VOCs) and specific silicones necessitates costly research and reformulation efforts to comply with global standards, particularly in stringent regions like Europe and certain US states. Moreover, the perceived complexity and time consumption involved in the proper multi-step application of traditional paste waxes and sealants can deter the average DIY consumer, leading them toward quicker, but often less durable, spray-and-wipe alternatives.

Opportunities for market expansion are vast, centering on the untapped potential in emerging economies where vehicle ownership is soaring and the professional detailing infrastructure is still developing. Manufacturers can capitalize on the burgeoning e-commerce sector to penetrate geographically distant markets and offer specialized niche products directly to consumers. Furthermore, the development of eco-friendly, bio-based waxes derived from sustainable sources presents a substantial opportunity to address environmental concerns and appeal to a growing segment of environmentally conscious consumers. The increasing integration of these protective solutions into factory-level or dealership-applied protection packages also represents a high-volume avenue for market growth and acceptance of advanced coating technologies.

Segmentation Analysis

The Car Wax Market segmentation is critical for understanding targeted consumer behavior, production strategies, and distribution channels. The market is primarily bifurcated based on the composition (natural versus synthetic), physical form (paste, liquid, spray), and application channel (DIY vs. professional). This granular analysis enables companies to tailor their product offerings, from high-concentration, bulk packaging for professional detailers requiring maximum coverage and depth, to convenient, ready-to-use spray formats designed for the time-constrained enthusiast seeking quick results. The ongoing segment shift emphasizes performance, longevity, and ease of use, with synthetic and hybrid formulations increasingly dominating sales volumes across all geographic regions due to their superior protective capabilities against modern environmental challenges.

The raw material segment highlights the contrast between traditional Carnauba wax, valued for its deep gloss and natural composition, and synthetic materials (polymers, resins, and ceramic compounds), which are prized for their extreme durability, UV resistance, and chemical stability. The ceramic wax sub-segment, incorporating Silicon Dioxide (SiO2) or Titanium Dioxide (TiO2), represents a high-growth area, blurring the line between traditional waxes and permanent paint protection films. Understanding the distinct user base for each raw material type—purists preferring natural waxes and performance seekers opting for synthetic coatings—is vital for effective product positioning and marketing campaigns that emphasize the unique benefits of each formulation.

The application method segmentation is also highly influential, separating the market into paste, liquid, and spray formats. Paste wax, though highly durable and generally offering the deepest shine, requires significant manual effort, appealing mainly to dedicated hobbyists and high-end detailers. Liquid wax provides a balance of ease of application and durability, making it a staple for the mid-range DIY market. In contrast, spray wax offers the fastest application, catering to the segment prioritizing speed and convenience for maintenance washes, driving volume growth but often sacrificing long-term protection characteristics. Strategic market entry requires careful consideration of this trade-off between convenience, price point, and longevity across all physical formats.

- By Product Type:

- Paste Wax

- Liquid Wax

- Spray Wax

- By Raw Material:

- Natural Wax (Carnauba, Montan, Beeswax)

- Synthetic Wax (Polymer Sealants, Resin-based, Ceramic/SiO2 Coatings)

- Hybrid Wax (Natural-Synthetic Blends)

- By Application Channel:

- DIY/Retail Consumers

- Professional Detailers and Service Centers

- Automotive Dealerships

- By Vehicle Type:

- Passenger Vehicles

- Commercial Vehicles

- Motorcycles

Value Chain Analysis For Car Wax Market

The Car Wax Market value chain commences with the upstream segment, dominated by the sourcing and refining of raw materials. This includes harvesting and processing natural resources such as Carnauba palm leaves (primarily from Brazil) and synthesizing complex chemical polymers, silicones, and ceramic precursors (SiO2/TiO2). Upstream activities are critical as the quality and stability of the final product are directly dependent on the purity and consistency of these input materials. Key challenges in this stage involve managing the volatile pricing of natural waxes and ensuring sustainable sourcing practices, while for synthetic materials, the focus is on achieving scalability and cost-effective chemical synthesis.

The midstream segment involves manufacturing, where refined raw materials are blended, emulsified, and packaged according to various proprietary formulations. This stage requires significant investment in specialized mixing equipment, strict quality control procedures, and compliance with packaging and safety standards (such as SDS requirements). Manufacturers often differentiate themselves here through innovative proprietary formulas and efficient scale economies. Direct distribution channels, such as selling directly to large professional detailing chains or original equipment manufacturers (OEMs) for factory application, bypass certain intermediaries, offering greater control over pricing and branding.

The downstream activities involve distribution and retail, covering both indirect channels (mass retailers, specialized auto parts stores, and increasingly, large e-commerce marketplaces) and direct channels (manufacturer websites). E-commerce has fundamentally reshaped the downstream, allowing smaller brands to compete globally and providing consumers with extensive product information and user reviews. The choice of distribution channel heavily influences market penetration and price realization, with specialized automotive retailers often handling premium, professional-grade products requiring dedicated sales support, while mass merchants focus on high-volume, general consumer liquid and spray waxes.

Car Wax Market Potential Customers

Potential customers for the Car Wax Market span a broad spectrum, ranging from individual car owners focused on routine vehicle upkeep to large-scale commercial entities requiring industrial-grade protective coatings. The largest volume segment comprises Do-It-Yourself (DIY) consumers, typically middle to high-income individuals who possess the time and inclination to personally maintain their vehicles, valuing ease of application and visible immediate results. This segment is highly responsive to spray waxes and liquid sealants marketed through retail and online channels, focusing on maintaining the vehicle’s aesthetic appeal and paint integrity against common environmental exposures.

The second major customer group consists of professional detailing services, auto repair shops, and car wash franchises. These professional users require bulk quantities, high concentration levels, and formulations optimized for rapid application and long-term durability, often preferring synthetic polymer or professional-grade ceramic coatings. Their purchasing decisions are driven by product performance metrics such as longevity, profitability (cost per vehicle application), and efficiency (quick cure times). This group acts as a crucial channel for testing and validating high-end, innovative wax technologies before they enter the general consumer market.

Finally, institutional and commercial buyers, including fleet management companies, public transport operators, marine maintenance yards, and automotive dealerships, represent specialized potential customers. Dealerships often offer premium ceramic protection packages as an added revenue stream during the vehicle sales process. Fleet managers require robust, industrial-grade protection that minimizes vehicle downtime and withstands frequent, high-pressure washing cycles. Targeting these institutional buyers necessitates specialized B2B sales strategies focused on volume discounts, technical support, and documentation proving compliance with relevant industry standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.65 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M, Turtle Wax, Meguiar's (ITW), Mothers, Simoniz, Chemical Guys, Malco Products, Sonax, Griot's Garage, Zymol, Farecla, P&S Detail Products, The Wax Shop, RBL Products, Autoglym, Shine Armor, Adam's Polishes, Poorboy's World. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Car Wax Market Key Technology Landscape

The technological landscape of the Car Wax Market is rapidly transitioning from traditional organic formulations to advanced synthetic chemistry, primarily focusing on the development and refinement of polymer sealants and ceramic coating technologies. Key innovations center around achieving higher solid content, improving the hydrophobic properties (measured by contact angle), and dramatically increasing the longevity of the protective layer. The integration of nano-technology is paramount, allowing for the creation of coatings that fill microscopic pores in the clear coat, offering deeper gloss and unparalleled resistance to chemical degradation and micro-scratching. Research efforts are heavily directed towards creating products that bond chemically with the vehicle's paint, offering protection measured in years rather than months.

Significant research is also being dedicated to formulation delivery methods. This includes developing highly advanced sprayable sealants and waxes that can be applied with minimal effort and buffing, often referred to as "sio2 infused waterless wash" or "ceramic boosters." This shift addresses the consumer demand for convenience and speed, allowing for maintenance applications that reinforce the base protective coating without requiring extensive surface preparation. Furthermore, manufacturers are investing in specialized emulsification technologies to create stable hybrid products that combine the deep, warm glow of natural Carnauba wax with the robust durability and slickness of synthetic polymers, offering a best-of-both-worlds solution to the consumer base.

Another crucial technological focus is on environmental sustainability. The landscape is witnessing a strong push toward water-based, solvent-free formulations that significantly reduce Volatile Organic Compound (VOC) emissions, aligning with stringent global environmental standards. Advances in bio-based raw materials, such as derivatives from sustainable agriculture, are also being explored as alternatives to petrochemical-derived ingredients. The technological innovation loop often involves close collaboration between chemical producers and application tool manufacturers, ensuring that the latest wax formulations are compatible with new microfiber cloths, specialized applicators, and automated car wash systems, maximizing performance and efficiency across all end-user segments.

Regional Highlights

The regional dynamics of the Car Wax Market reflect varying levels of vehicle ownership, consumer spending habits, and regulatory environments concerning chemical products. North America currently dominates the market in terms of value, characterized by a large population of automotive enthusiasts, high disposable income, and a mature professional detailing industry. Consumers in this region quickly adopt premium, high-performance synthetic and ceramic coating technologies, driving demand for specialized and high-margin products. The presence of major global market players and well-established distribution networks further solidifies North America's leading position, with strong growth projected for ceramic-infused spray wax alternatives catering to the large DIY consumer base.

Asia Pacific (APAC) is forecast to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid expansion is fundamentally linked to explosive growth in new vehicle sales, particularly in densely populated countries such as China, India, and Southeast Asia. As vehicle ownership rapidly increases, so does the demand for both basic and advanced vehicle maintenance products. Furthermore, the burgeoning middle class in these regions is increasingly prioritizing vehicle aesthetics and protective maintenance. The market in APAC is highly price-sensitive, initially favoring cost-effective liquid and paste waxes, but is quickly shifting toward accessible, medium-durability polymer sealants as consumers become educated on long-term vehicle care benefits.

Europe represents a stable and sophisticated market, driven by stringent environmental regulations that necessitate a strong focus on VOC compliance and sustainability in product formulation. European consumers show a preference for high-quality, professional-grade products, emphasizing longevity and eco-friendly ingredients. The demand here is steady, primarily fueled by the strong maintenance culture around vehicles and the high penetration of professional detailing services. Latin America and the Middle East & Africa (MEA) are emerging markets, where growth is highly dependent on economic stability and increasing automotive infrastructure development. MEA, in particular, shows strong demand for high-UV protection waxes due to extreme climatic conditions.

- North America: Market leader by value; high adoption of premium ceramic coatings; driven by professional detailers and automotive enthusiasts.

- Asia Pacific (APAC): Fastest-growing region; powered by rising vehicle sales and expanding middle-class spending on vehicle maintenance; strong growth potential for cost-effective synthetic waxes.

- Europe: Mature market; driven by strict environmental compliance and demand for sustainable, high-quality, professional-grade formulations.

- Latin America (LATAM): Emerging market; growth tied to economic recovery and increasing vehicle penetration; demand focused on balancing price and performance.

- Middle East & Africa (MEA): High demand for products offering superior UV and heat resistance due to harsh climatic conditions; focus on protective qualities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Car Wax Market.- 3M

- Turtle Wax

- Meguiar's (ITW)

- Mothers

- Simoniz

- Chemical Guys

- Malco Products

- Sonax

- Griot's Garage

- Zymol

- Farecla

- P&S Detail Products

- The Wax Shop

- RBL Products

- Autoglym

- Shine Armor

- Adam's Polishes

- Poorboy's World

- Soft99 Corporation

- The Valet Pro

Frequently Asked Questions

Analyze common user questions about the Car Wax market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Carnauba wax and ceramic coating?

Carnauba wax is a natural protectant known for providing a deep, warm gloss but offering shorter durability (weeks to months). Ceramic coating (typically SiO2-based) is a synthetic polymer sealant that chemically bonds to the paint, providing superior longevity (months to years), enhanced hardness, chemical resistance, and extreme hydrophobic properties. The primary difference lies in the chemical structure and protective lifespan.

How significant is the impact of environmental regulations, particularly regarding VOCs, on car wax formulation?

Environmental regulations, especially concerning Volatile Organic Compounds (VOCs), have a highly significant impact, forcing manufacturers to reformulate solvent-based waxes into water-based or low-VOC alternatives. This transition is essential for market access in regions like Europe and certain parts of North America, driving innovation towards safer, sustainable, yet equally effective, bio-based or synthetic chemistries.

Which segment of the Car Wax Market is projected to see the fastest growth?

The Synthetic Wax segment, specifically ceramic-infused spray and liquid coatings (SiO2 technology), is projected to see the fastest growth. This is driven by consumer demand for products that combine the ease of application of spray wax with the long-lasting durability and high chemical resistance typically associated with professional coatings, bridging the gap between DIY convenience and professional performance.

How does the shift towards e-commerce influence the Car Wax Market distribution?

The shift towards e-commerce significantly influences distribution by democratizing market access, allowing specialized smaller brands to reach global consumers without relying on traditional retail intermediaries. E-commerce platforms facilitate direct-to-consumer sales, offer detailed product reviews and application tutorials, and drive transparency, making it easier for niche or premium product lines to gain traction globally.

What are the key drivers for professional detailers adopting advanced polymer sealants over traditional paste wax?

Professional detailers are rapidly adopting advanced polymer sealants due to their superior efficiency, labor cost savings, and long-term performance guarantees. Polymer and ceramic coatings offer extended protection (often one to three years), reducing the need for frequent reapplication and allowing detailers to offer higher-margin, premium protection packages to clients.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager